Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

In This Issue:

The High Price Bias

Bitcoin Thoughts And Analysis

Legacy Markets

Bitwise Files For Aptos ETF

BioNexus Adopts Ethereum Treasury Strategy

Ethereum Pectra Upgrade Goes Live On Testnet

World Liberty Financial Goes On Shopping Spree

Bitcoin Chaos & Insane Swings – Where Is Crypto Headed Next?!

The High Price Bias

In the early 1970s, two visionary friends, Amos Tversky and Daniel Kahneman, reshaped our understanding of human cognition by introducing the concept of cognitive bias—the systematic errors in thinking that influence our decisions. Today, more than 180 cognitive biases have been identified, with new ones constantly being added—a testament to the many ways our minds trick us.

I may not have studied all 180+, but I do know one thing: investors are walking case studies in flawed reasoning. There’s probably already a bias that captures what I’m about to discuss, but for the sake of originality, let’s introduce what I call the High Price Bias.

The High Price Bias is the cognitive trap that makes investors believe an asset is valuable only after it has reached a certain high price. Ever met someone who refuses to buy Bitcoin until it soars? That’s the High Price Bias in action.

This faulty logic usually stems from a few core assumptions:

If Bitcoin is trading higher, it must be of higher quality.

If Bitcoin is trading higher, it has “proven itself.”

While sometimes driven by FOMO, this bias often masquerades as rationality—when in reality, it’s just an emotional shortcut disguised as logic.

But the High Price Bias doesn’t just apply to “high” prices—it has an equally damaging inverse. There’s also the Low Price Bias, which causes investors to lose faith when Bitcoin drops. The thinking goes:

If Bitcoin is trading lower, something must be wrong with it.

If Bitcoin is trading lower, it must not be as valuable as people claim.

This bias affects both non-investors and Bitcoin holders alike. A non-investor who operates purely on this bias is like someone standing on a sinking ship, waiting for a miracle. Meanwhile, an investor who constantly questions Bitcoin's value when it dips is clinging to a life raft with one hand, unsure whether to let go or climb aboard.

Price is undeniably important—it’s a key metric in valuing an asset. But it should never be the sole metric. On its own, price is a distraction, pulling focus away from fundamentals, network effects, and long-term value. However, when paired with thorough research, compelling narratives, and on-chain analytics, price becomes a powerful signal—one that ties everything together.

Don’t fall victim to the High Price Bias. And if you know someone who has, send them this newsletter. If it weren’t for this bias, Bitcoin’s value would likely be far higher. But because it exists, the opportunity is still there for those who recognize it.

At the end of the day, it’s human biases that create inefficiencies in the market—and for those who spot them early, those inefficiencies can be incredibly profitable.

Bitcoin Thoughts And Analysis

Bitcoin's daily chart continues to recover after testing the 200-day moving average, which acted as strong support. $91,271 is currently acting as resistance.

Volume remains elevated following the massive rebound from $85,010, showing clear demand at lower levels. The next major hurdle is at $94,990, where sellers previously stepped in. A daily close above this level would confirm a breakout toward $99,860.

The 50-day moving average is still trending downward, and Bitcoin remains below it, so there is still work to do to fully regain bullish momentum. However, the structure has improved significantly, and the market is showing strength after a period of heavy selling.

If $91,271 fails to hold, Bitcoin could revisit the $85,000 region, but as long as price closes above that level, the trend remains in recovery mode.

Legacy Markets

Stock futures signaled a weaker open for Wall Street as tech stocks took a hit from disappointing earnings and fresh AI competition from China. Nasdaq 100 futures fell 1.4%, while S&P 500 futures dropped 1%. Marvell Technology plunged 15% after its revenue forecast disappointed investors, while CrowdStrike and MongoDB also declined sharply.

Alibaba’s new Qwen platform, touted as an AI model rivaling DeepSeek with significantly less data, added to pressure on US chip stocks, raising concerns about the dominance of American firms in AI.

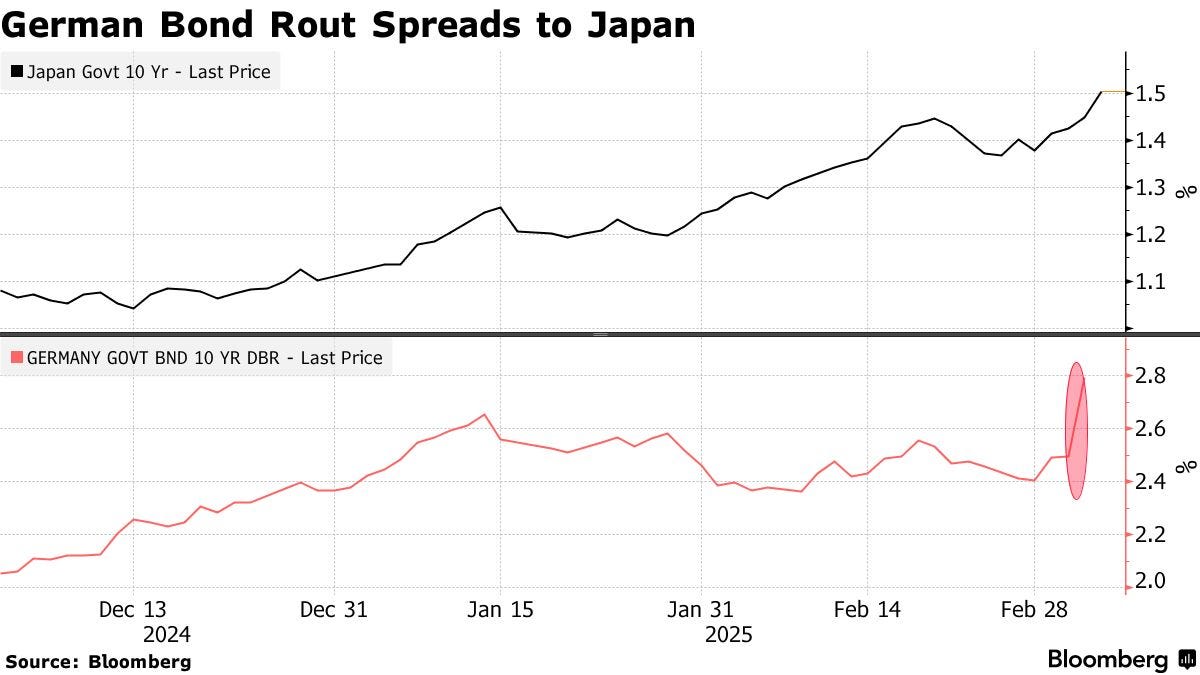

European markets struggled as bond yields surged following Germany’s massive spending plans. The Stoxx 600 fell 0.6%, while Bunds extended their historic selloff from Wednesday. The bond rout rippled globally, with Japanese 10-year yields hitting a decade high and US Treasury yields climbing three basis points.

Investors are now focused on the European Central Bank’s meeting, where a 25 basis-point rate cut is expected. Meanwhile, the euro hovered near four-month highs as the dollar steadied following Wednesday’s sharp decline.

Key events this week:

Eurozone retail sales, ECB rate decision, Thursday

US trade, initial jobless claims, wholesale inventories, Thursday

US Treasury Secretary Scott Bessent speaks, Thursday

Fed’s Christopher Waller and Raphael Bostic speak, Thursday

Eurozone GDP, Friday

US jobs report, Friday

Fed Chair Jerome Powell gives keynote speech at an event in New York hosted by University of Chicago Booth School of Business, Friday

Fed’s John Williams, Michelle Bowman and Adriana Kugler speak, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures fell 1% as of 6:37 a.m. New York time

Nasdaq 100 futures fell 1.3%

Futures on the Dow Jones Industrial Average fell 1%

The Stoxx Europe 600 fell 0.5%

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0795

The British pound fell 0.1% to $1.2880

The Japanese yen rose 0.7% to 147.90 per dollar

Cryptocurrencies

Bitcoin rose 1.1% to $91,361.9

Ether rose 2.7% to $2,296.33

Bonds

The yield on 10-year Treasuries advanced two basis points to 4.30%

Germany’s 10-year yield advanced five basis points to 2.85%

Britain’s 10-year yield advanced three basis points to 4.71%

Commodities

West Texas Intermediate crude rose 0.2% to $66.45 a barrel

Spot gold fell 0.5% to $2,905.71 an ounce

Bitwise Files For Aptos ETF

Bitwise Asset Management has filed an S-1 registration statement with the U.S. Securities and Exchange Commission (SEC) to list a spot Aptos (APT) exchange-traded fund (ETF). Aptos, a layer-1 blockchain developed by former Facebook employees, launched in October 2022 and is currently the 36th largest cryptocurrency by market capitalization. The proposed ETF aims to provide investors with direct exposure to APT without including staking features. Coinbase Custody is listed as the proposed custodian, but details such as the listing exchange, ticker symbol, and management fees have yet to be specified. This filing adds to Bitwise's recent efforts to expand its crypto ETF offerings, including filings for Solana (SOL), XRP (XRP), and Dogecoin (DOGE) ETFs.

BioNexus Adopts Ethereum Treasury Strategy

BioNexus Gene Lab Corp. (NASDAQ: BGLC) has announced an Ethereum-focused treasury strategy, claiming to be the first Nasdaq-listed company to do so. The company emphasizes Ethereum's staking capabilities and institutional credibility as key factors in this decision. Following the announcement, BioNexus shares surged significantly, reflecting investor confidence in the company's innovative approach.

Ethereum Pectra Upgrade Goes Live On Testnet

Ethereum’s Pectra upgrade went live on the Sepolia testnet but faces potential mainnet delays after issues arose during Holesky activation. The upgrade introduces key improvements in staking flexibility and scalability, with developers set to discuss next steps in an upcoming Ethereum core dev call.

World Liberty Financial Goes On Shopping Spree

World Liberty Financial (WLFI), a decentralized finance venture associated with President Donald Trump and his family, has expanded its cryptocurrency holdings by acquiring $21.5 million worth of assets. The purchases include 4,468 Ether (ETH) at approximately $2,238 each, totaling $10 million; 110.6 Wrapped Bitcoin (WBTC) at $90,415 each, also amounting to $10 million; and 3.42 million MOVE tokens at $0.438 apiece, equating to $1.5 million. These acquisitions come just days before the scheduled White House Crypto Summit on March 7, where President Trump is expected to meet with prominent figures in the cryptocurrency industry.

Bitcoin Chaos & Insane Swings – Where Is Crypto Headed Next?!

What's happening in crypto and global macro? Bitcoin's wild volatility is back, and the markets are going crazy. I'm joined by top macro and Bitcoin expert Noelle Acheson to break it all down for you!

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.