Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

The Bitcoin Algorithm Arbitrage Strategy crushed it over the weekend. 2X Long bias, accumulate $BTC, create cash yield.

The chart is noted below, but here are the ‘Arb’ transactions that occurred referenced below.

Buy $91K

Buy $87K

Buy $85.5K

Buy $79K

Sell $85K

Sell $95K

This (and our $ETH and $SOL algos) are free for use up to $10K annually. Arbitrage, Accumulate, Apex (sell) strategies. Run all of them at different time intervals and different capital commitments. Front run Citadel with our Bitcoin Algorithm!

Remarkable execution for four days, in the face of whiplash volatility!! And it’s free!!

In This Issue:

Trump Controls The Cards

Bitcoin Thoughts And Analysis

Legacy Markets

Massive Token Unlocks To Watch

The Kraken Case Has Been Dismissed

Standard Chartered Reaffirms Its Bullish Predictions

Coinbase Is Going Scorched Earth On The SEC

Trump Pumps Bitcoin: Is The Crypto Strategic Reserve Finally Coming? | Macro Monday

Trump Controls The Cards

The crypto space is broken—seriously, try making sense of this.

Bitcoin keeps grinding sideways, showing weakness, while altcoins continue to bleed—despite the strongest industry tailwinds we’ve ever seen. Then, the President of the United States drops what might be the most bullish set of posts in crypto history. The market reacts accordingly with a bounce, only to collapse even harder the next day.

Because, of course. Why not crank up the confusion and make this market as irrational and unpredictable as possible?

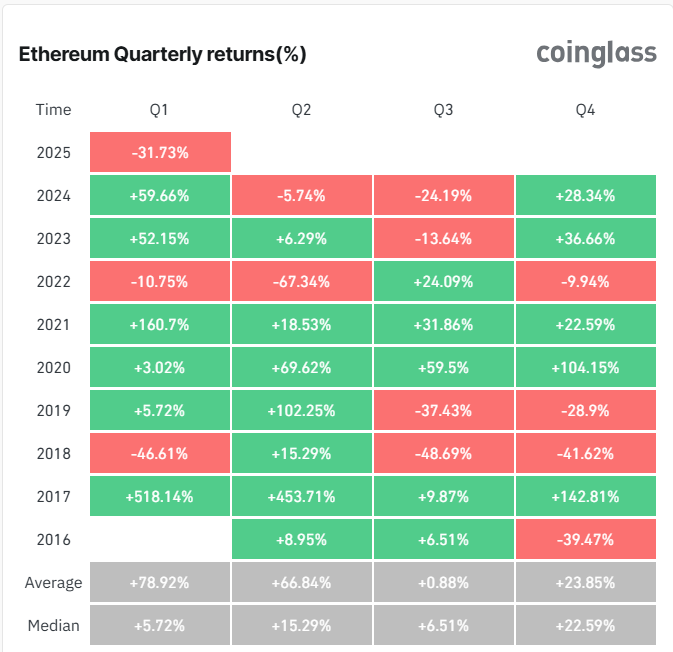

Our designated crypto Czar, David Sacks, explicitly stated we’d get more details on Trump’s plan this Friday—not in two months, not in two weeks, just a few days. Yet, the market still tanks. Ethereum is now down 31.73% since January 1st. Yikes.

If Sacks had said we’d have to wait 60 days, I’d get why the market might shrug it off and keep selling. But that’s not the situation. What we’re witnessing is peak frustration—a classic prelude to maximum pain. There’s no certainty we have to hit that level, but at this rate, I’d be anything but surprised.

If you’ve been following me, you know I leaned on historical quarterly returns last year because Bitcoin and alts were actually playing along. Now? That playbook might as well be thrown out the window.

The silver lining here is that if Q1 turns out to be a dud for Bitcoin, it could break the usual cycle of weaker Q2 and Q3 performances, forcing us to rethink expectations. And let’s be real—the longer this bull market stretches, the higher prices inevitably climb. That’s not just a trend; it’s market gravity.

In yesterday’s newsletter, I doubled down on my belief that the crypto market is at Trump’s mercy. It’s undeniable—he holds all the cards (see what I did there?). With a single post, he can send prices soaring through sheer influence over a strategic reserve. But he also has the power to frustrate the space and steer us down a precarious path—one that might be great for investors but not necessarily in the best interest of the country. And that’s exactly the tightrope we’re walking right now.

Trump is leading us down a path that raises far more questions than answers—something I touched on yesterday. The biggest one: Would Congress actually approve adding altcoins to a national reserve? I’m not convinced. But beyond that, I can’t shake the feeling that something else is driving this brutal altcoin sell-off. My long-time readers know I’m not one for conspiracy theories, but let’s be real—do alts simply need a full-scale reevaluation against Bitcoin, or are powerful players strategically suppressing them to scoop them up on the cheap? Bitcoin, after all, isn’t nearly as easy to manipulate or quietly accumulate at a discount.

Maybe the reality is simpler: the best these whales can do is push Bitcoin down 20%, and in the process, altcoins get absolutely wrecked as collateral damage.

We do now that an unnamed whale has been playing the news perfectly - longing and shorting Bitcoin in Ethereum in eye watering size, just ahead of announcements. I will leave that there.

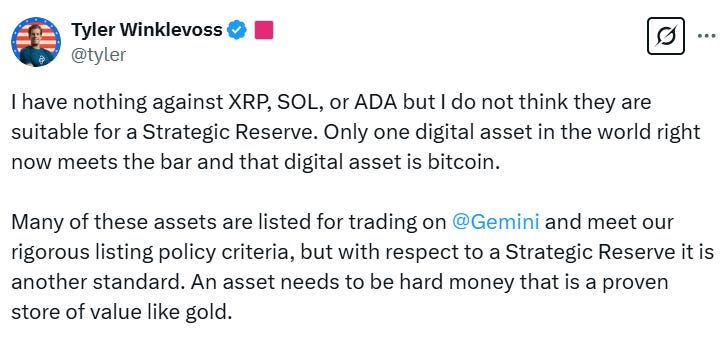

What’s interesting is that even die-hard Trump supporters who are all-in on crypto seem uneasy about including altcoins in the reserve. And you can bet Trump’s team is paying attention.

Tyler nails it. The concern isn’t about XRP, SOL, or ADA specifically—you could swap in any altcoin, and the debate would still hold. Even Ethereum, despite its stronger track record, isn’t an obvious fit for the nation’s balance sheet. I’d need a lot more convincing.

Instead, I’d much rather see tech-driven corporations take the lead in acquiring these assets—companies like Strategy, where the alignment of ethos makes sense, and the process isn’t muddied by lobbying, political favors, or fiat-driven incentives. Let the free market decide before the government tries to play venture capitalist.

Something tells me another big day is right around the corner—all it takes is the right mix of news dropping on Friday. Of course, the wrong mix could just as easily push the market into deeper frustration, maybe even forcing a true bottom. Fingers crossed we don’t see yet another round of multi-million-dollar longs or shorts with absurd leverage popping up just hours before an announcement, magically positioned for the perfect trade.

I’m not sure my life is any better today, but I’ll HOLD—so thanks, Eric, I guess.

The market feels like it’s in limbo. Trump’s favoritism toward altcoins doesn’t seem entirely organic, and if there’s one thing we should have learned by now, it’s that trusting anyone too much rarely ends as expected. Bitcoin remains the only true hedge against human error.

During Trump’s first presidency, the opposition threw everything at him in an attempt to take him down. He was impeached twice—first in 2019 for abuse of power and obstruction of Congress over Ukraine, and again in 2021 for incitement of insurrection after January 6th. Both times, the Senate acquitted him. Right now, Trump has the Senate on his side, but the last thing this market needs is another wave of investigations and impeachment hearings—especially with crypto at the center of it all.

I can already picture the headlines:

“Department of Justice Investigating Trump Family’s Crypto Involvement”

“Trump Facing Impeachment Charges Over Crypto Fraud and Scams”

That would not play out well for prices.

To reiterate what I said yesterday—Trump has already done more for crypto than the previous administration, and that’s worth recognizing. But that doesn’t mean every move he makes is without risk. We’re walking a tightrope right now, one that could just as easily lead to an ideal outcome as it could take everything straight to Hades.

Trump has proven he can surround himself with the right people. Now, the question is whether he can resist being swayed by bad actors pushing their own self-interests over the country’s well-being. At the same time, the market—especially altcoins—desperately needs a narrative shift. It can’t keep relying on Trump, memes, and scams to drive momentum. A new catalyst needs to emerge, something that pulls focus away from Trump and lets the noise settle. You would have thought that altcoins being added to a strategic reserve would have done that, but here we are.

I’m not convinced Trump is the only narrative for the rest of the cycle—if the ‘4-year cycle’ even still exists—but for now, it’s the only game in town. Friday will be a major test. Until then, stay patient. Holders should ignore the charts, check back then, and see where we stand. Godspeed.

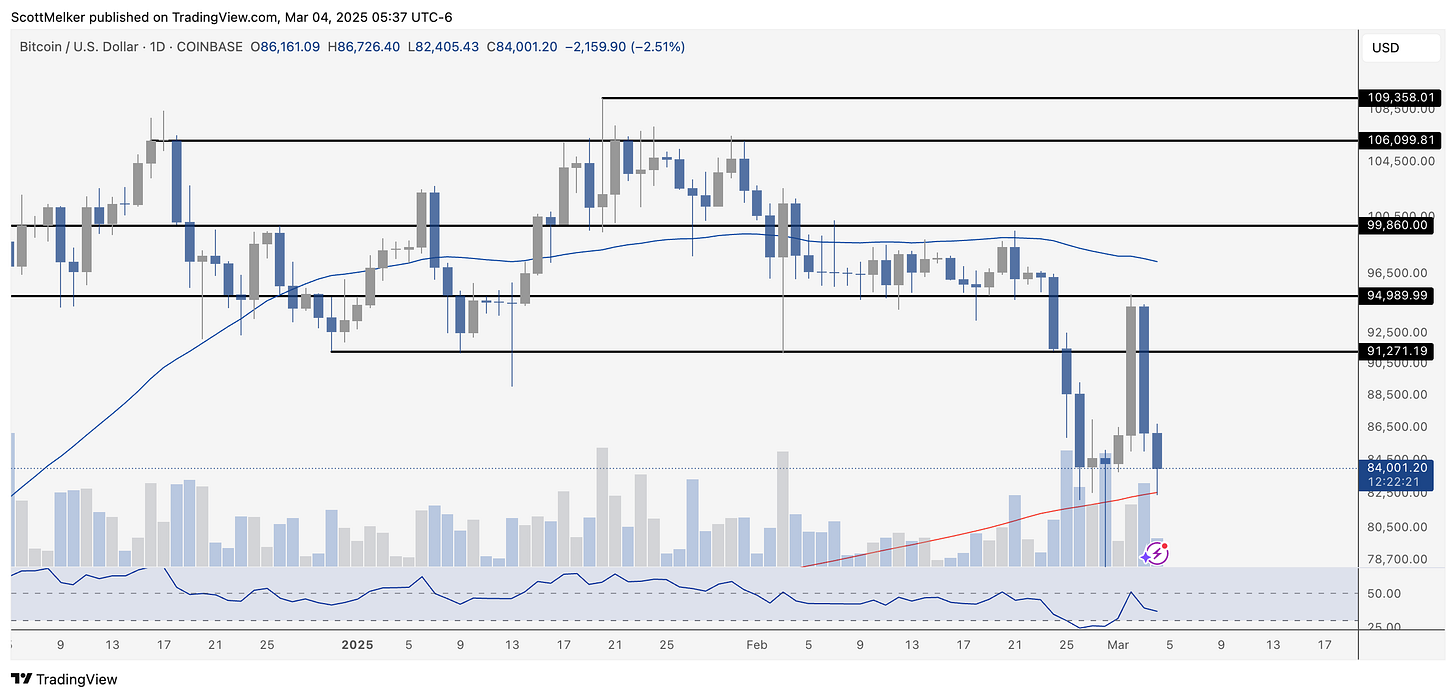

Bitcoin Thoughts And Analysis

Bitcoin's daily chart is showing potential bullish divergence, a key signal for a possible reversal. We still need a clear upward elbow on RSI with a higher low and for price to close at a lower low to fully confirm the divergence.

The 200-day moving average was tested and is currently acting as support, reinforcing its importance as a key level. The recent rejection at $94,990 confirms this as a strong resistance zone.

The failure to hold above $91,270 suggests that Bitcoin still has work to do before confirming a full recovery.

For bulls, the next key objective is reclaiming $91,270 and flipping it back into support, which would strengthen the case for another retest of $94,990. If Bitcoin fails to hold the 200-day MA, another major dip is likely.

Overall, bullish divergence is forming, but confirmation is needed. The 200-day MA is critical, and price action over the next few days will determine if Bitcoin can resume its uptrend or if further downside is in store.

Legacy Markets

European stocks and oil declined as President Trump’s new tariffs on Mexico, Canada, and China took effect, raising concerns that Europe could be next. The Stoxx 600 dropped 1.2%, with automakers and energy stocks leading losses. S&P 500 futures pointed to a flat open as investors awaited Trump’s address to Congress for further trade policy direction.

The euro gained 0.3% after the EU proposed a €150 billion defense loan package, while the Mexican peso weakened 0.9%. Oil fell further as trade tensions weighed on demand prospects, with Brent crude nearing $70 a barrel.

Trump also announced new tariffs on “external” agricultural products set to begin April 2, though details were unclear. Meanwhile, he paused all military aid to Ukraine, increasing pressure on Zelenskiy following recent tensions.

European defense stocks outperformed, with Thales SA surging 8% and Hensoldt AG jumping 18%, as investors bet on increased EU military spending. Cryptocurrencies remained volatile, with Bitcoin extending losses after Trump reiterated his support for a strategic digital asset reserve.

Global markets are now focused on Trump’s address and potential European trade retaliation. Chinese stocks edged lower as Beijing’s tariff response remained measured, while India’s Nifty 50 extended its record losing streak amid investor concerns over economic growth.

Key events this week:

Eurozone unemployment, Tuesday

President Donald Trump’s speech to a joint session of Congress, Tuesday

China Caixin services PMI, Wednesday

Eurozone HCOB services PMI, PPI, Wednesday

US ADP employment, ISM services index, factory orders, Wednesday

Fed’s Beige Book, Wednesday

Eurozone retail sales, ECB rate decision, Thursday

US trade, initial jobless claims, wholesale inventories, Thursday

US Treasury Secretary Scott Bessent speaks, Thursday

Fed’s Christopher Waller and Raphael Bostic speak, Thursday

Eurozone GDP, Friday

US jobs report, Friday

Fed Chair Jerome Powell gives keynote speech at an event in New York hosted by University of Chicago Booth School of Business, Friday

Fed’s John Williams, Michelle Bowman and Adriana Kugler speak, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures were little changed as of 6 a.m. New York time

Nasdaq 100 futures were little changed

Futures on the Dow Jones Industrial Average were little changed

The Stoxx Europe 600 fell 1.2%

The MSCI World Index fell 0.2%

Currencies

The Bloomberg Dollar Spot Index fell 0.2%

The euro rose 0.2% to $1.0510

The British pound rose 0.2% to $1.2723

The Japanese yen rose 0.5% to 148.79 per dollar

Cryptocurrencies

Bitcoin fell 1.7% to $83,895.79

Ether fell 0.6% to $2,097.61

Bonds

The yield on 10-year Treasuries advanced one basis point to 4.16%

Germany’s 10-year yield declined two basis points to 2.47%

Britain’s 10-year yield declined four basis points to 4.51%

Commodities

West Texas Intermediate crude fell 0.9% to $67.75 a barrel

Spot gold rose 0.8% to $2,914.77 an ounce

Massive Token Unlocks To Watch

A wave of major token unlocks is set to hit the market this week, with approximately $1 billion worth of altcoins scheduled for release between March 3 and March 10, 2025, according to Tokenomist.

Leading the charge, Ethena will unlock 2.07 billion ENA tokens worth $855.75 million on March 5—the largest unlock since April 2024. Other notable releases include Movement’s 50 million MOVE tokens ($23.82 million) on March 9, Staika’s 1.57 million STIK ($8.32 million) on March 4, and Kaspa’s 162.35 million KAS ($13.87 million) on March 7.

Meanwhile, Solana, fresh off a massive $1.8 billion SOL unlock, will see another $76 million worth of SOL gradually released. Worldcoin is set to unlock 37.23 million WLD ($45.1 million), Celestia will release 6.99 million TIA ($27 million), Dogecoin will unlock 96.52 million DOGE ($21.1 million), and MANTRA will distribute 2.65 million OM ($20 million) over the coming week.

If you click on the image above, you can track these unlocks. Staying informed is key, as they can trigger stronger selloffs in an already weak market.

The Kraken Case Has Been Dismissed

The SEC has officially dropped its lawsuit against Kraken, marking the end of a high-profile legal battle and adding another major name to the growing list of dismissed cases. Notably, the case was dismissed with prejudice, meaning it cannot be refiled. Kraken walks away without paying fines, making business changes, or admitting any wrongdoing.

The list of dropped cases now includes: Coinbase, Uniswap, OpenSea, Robinhood, the Tron Foundation, Gemini, Consensys, and Kraken.

Add Yuga Labs to the list. Boom.

Standard Chartered Reaffirms Its Bullish Predictions

Following Trump’s Truth Social post about the U.S. purchasing BTC, ETH, XRP, SOL, and ADA for a Crypto Strategic Reserve, Standard Chartered’s Geoff Kendrick reaffirmed his $500,000 Bitcoin target. In an investor note, he emphasized Bitcoin’s increasing role as a stable portfolio asset and a hedge against traditional financial risks, citing expanded investor access as a key driver of long-term price appreciation.

Regarding Trump’s announcement, Kendrick wrote, “Given these developments, which align with our previous expectations, we continue to target Bitcoin to reach $200,000 by year-end 2025. Thereafter, we expect Bitcoin to reach $300,000 by the end of 2026, $400,000 by the end of 2027, and $500,000 by the end of 2028, where it will likely remain until the end of 2029.”

Coinbase Is Going Scorched Earth On The SEC

Coinbase isn’t just satisfied with the SEC dismissing its case—it wants answers. The exchange is now demanding to know exactly how much taxpayer money was spent attacking it. Whether this fuels its broader mission or sets the stage for recouping losses, it’s a bold move. Given the Freedom of Information Act, there's a good chance we’ll get an answer.

From Paul Grewal on X, “We know the previous SEC’s regulation-by-enforcement approach cost Americans innovation, global leadership, and jobs, but how much did it cost in taxpayer dollars? Today, Coinbase submitted a FOIA request asking the SEC to explain how much its war on crypto cost taxpayers. What do we hope to find out? How many investigations and enforcement actions were brought – and how much they cost; how many employees worked on these investigations/enforcement actions – and how much they cost; how many third-party contractors were used in these.”

The American taxpayer should be outraged that the SEC used public funds to target a company and system designed to benefit them. If Coinbase uncovers the true cost of this legal attack, they should make sure the world knows exactly how much was wasted.

Trump Pumps Bitcoin: Is The Crypto Strategic Reserve Finally Coming? | Macro Monday

Join Dave Weisberger, Mike McGlone, and James Lavish as we break down what's happening in macro and crypto!

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.