Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

The Bitcoin Algorithm Arbitrage Strategy remains extraordinarily powerful. How powerful you might ask:

247% annualized returns.

10-20% annual cash flow.

You’re reading that correctly. FREE! Our Bitcoin Algorithm Arbitrage Strategy will generate cash flow, while also producing exceptional annual returns that are 4.5X buy and hold Bitcoin returns.

Most of you reading this believe in Bitcoin, and so do we. Employing a strategy that generates cash flow, protects downside risk, and aggressively buys dips (completely hands free!) is available to you; for FREE!

In This Issue:

Do You Have Cash?

Aptos Weekly Review

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

The SEC Ends Investigation Into Gemini

Democrats Don’t Like Government Meme Coins

Pakistan Joins Growing List Of Pro-Crypto Countries

Trump’s Next Move Could CRASH Bitcoin to $70K!

Do You Have Cash?

For those of you waiting for a specific price to buy the dip in Bitcoin, Ethereum, Solana, or any other coin, does this thought cross your mind?

The market is in a decline, I’m expecting further falls, and cash serves as my safety net.

If it does, chances are this thought has also crossed your mind:

The market is on an upswing, prices are too high and will eventually correct, cash is my safety net.

Bitcoin is currently priced at $84,500, the same as it was on November 10, 2024, 110 days ago. If you’ve been holding cash since then, you’ve likely experienced the effects of inflation, though it's been minimal and probably not something you've truly felt. You’ve also missed out on Bitcoin nearly reaching $110,000, though we’re now back at square one (November prices).

If you’ve been holding cash longer and aren’t exposed to Bitcoin, you’ve missed a significant opportunity. Sure, there’s still a chance Bitcoin could dip to $80,000 or lower, but at some point, staying on the sidelines will no longer be a wise choice—you’ll risk being left behind as the market moves forward. The question is: what will you do now?

To answer this question, we probably have to go back to the italicized statements above: take a moment with them and honestly assess if and how they have ever applied to you.

The market is in a decline, I’m expecting further falls, and cash serves as my safety net.

or

The market is on an upswing, prices are too high and will eventually correct, cash is my safety net.

My gut tells me that A LOT of investors subscribe to either of the statements above when it’s most convenient, and confirmation bias reinforces the logic. To clarify, there are times when both of these ways of thinking can save someone a substantial amount of money—right now is one of those instances, particularly in altcoins. However, when it comes to Bitcoin and markets in general, these statements tend to be the exception rather than the rule.

Most people labeled as ‘investors’ who are addicted to cash struggle to casually take positions; these habits often persist for years.

Here are the four reasons cash addicted investors inevitably fail:

Immense Timing Pressure

Obsession With Diversification

Overthinking the Tax Implications

Overemphasis on Liquidity

Holding a large cash position creates pressure to make the right timing decisions. As the cash pile grows, the anxiety intensifies, making it harder to commit to investments. This can lead to overthinking potential opportunities, which brings me to my next point.

If an investor manages to break through the paralysis, they may fall into an unhealthy obsession with diversification. While diversification can be beneficial, it can reach a point where it wastes time, energy, and capital. This fixation can prevent the investor from making clear, strategic decisions.

A cash-addicted investor often overanalyzes potential tax liabilities and implications. Focusing too much on timing investments for a more favorable tax year can become counterproductive, ultimately impacting returns. The missed opportunities and potential growth from holding cash usually outweighs the perceived tax benefits.

Tax implications should be considered year-round, but they shouldn’t drive your decisions or cause inaction. Over-focusing on taxes can lead to more short-term capital gains implications, which ultimately cost more. On the flip side, it’s better to pay short-term taxes than miss out on gains or let the market run away from you.

Lastly, an overemphasis on liquidity occurs when an investor prioritizes immediate access to funds, focusing too much on security and flexibility. While this approach can feel safe and isn’t technically a cash position, it often sacrifices potentially lucrative long-term gains. In today’s market, an investor who solely sticks to short-duration bonds and misses out on better-performing assets belongs in the same group as the cash hoarder.

There becomes a point where hoarding cash resembles an addiction. You've likely begun to identify some unmistakable and overlapping signs of the addiction, such as apprehension, hubris, and pessimism. The positive aspect is that once the problem is recognized and addressed, it can be quickly rectified.

While I am not a licensed financial analyst or therapist, as a friend, I recommend seeking the assistance of a professional, automating your investments, and doing all you can to ignore your portfolio at times right now when you're probably down. If you have sat on cash up until the point, pat yourself on the back and realize the window you’re in right now won’t last forever.

Rarely will cash take you where you hope it will. Keep what you need for a year or so, store some under your mattress if you have to, have a bit for dip buying and put the rest of it to work. I will always be clear with all of you when I do substantially move towards cash, but right now, I am doing the exact opposite, deploying what I can. You own your cash; it doesn’t own you.

The bottom is getting closer in terms of price. Don’t get too caught up in the charts this weekend—low liquidity can wreak havoc on long and short traders. Get outside, spend time with family, and put your phone down. Step away for a couple of months—you’ll be much better off.

Aptos Weekly Review

For those that don’t know, Aptos—one of the most exciting layer 1 blockchain competing with Solana and Ethereum—is an official sponsor of this newsletter! Over the past few months, I’ve had the chance to get to know the Aptos team, create content with them, and watch this project accomplish incredible things.

Each week, I’ll provide an Aptos review, showcasing all the exciting announcements and milestones the network is achieving. This week let’s start with this announcement that Bitwise, one of the leading crypto ETF issuers has registered for an Aptos ETF in Delaware!

Technically, nothing is official until Aptos or Bitwise makes a public statement, but we've seen this story unfold countless times before.

By the end of 2025, a wide range of ETFs will be available, and Aptos is well-positioned to earn its place among them. I also expect Aptos to be included in indexes tracking leading digital assets.

In other news, last week, I covered how Aptos Labs had joined members of the Blockchain Association in signing a letter urging Congress to overturn the DeFi broker rule, which poses a threat to the future of DeFi in the U.S and that Aptos is committed to working with the Blockchain Association and lawmakers to help shape the future of Web3.

Following up on that, there’s this:

Slow and steady, D.C. is going to rewrite the wrong from the previous administration and it’s nice to see Aptos contributing to this process.

The last story I want to touch on is a report Aptos did in collaboration with The Block, titled, “Aptos Unpacked: Scaling Beyond Limits”

Below are the highlights:

“Aptos introduces Zaptos and Shardines, two innovations that reduce latency and boost throughput.”

“Zaptos reduces end-to-end transaction latency by 40% with optimistic operations, including optimistically executing transactions before their order is finalized.”

“Shardines applies sharding to Aptos’ execution engine, leveraging intelligent partitioning, micro-batching, and pipelining to surpass 1 million tps while minimizing cross-shard communication and efficiently handling conflicting transactions.”

With Zaptos and Shardines driving its scalability, Aptos stands at the forefront of blockchain parallelism. Its ability to deliver high throughput and low latency lays the foundation for widespread adoption of decentralized applications and services, enabling seamless handling of large transaction volumes with minimal delays.

That is all for this week, make sure to show Aptos some love—they’re a huge reason this newsletter remains free!

Bitcoin Thoughts And Analysis

I have been AGGRESSIVELY bull posting on twitter, because I have high conviction that my favorite assets are on sale at the moment and that this is an opportunity to plug your nose and buy assets you like for the long term. That does not mean the bottom is definitely in. It just means that I like a sale.

That said, there are quite a few bottoming signals. Of course, my favorite is bullish divergence with oversold RSI, which has built beautifully on the 4-hour chart for Bitcoin, likely on the 12 hour and lower, and potentially on the daily if we get a higher close today.

You can see that we had a bullish divergence, then hidden bearish divergence in the middle, then more bullish divergence. I love when they build like this. This is, quite literally, my favorite signal for a bottom, or at least a bounce. It fails, but far less than it succeeds. No signal is perfect.

On the daily chart, you can see that price is currently testing, but below, the 200 MA. This is SERIOUS mean reversion.

$73,835 is looming below, the March all time high that was never tested as support. That said, what happens when everyone is watching a specific line? Either price bounces above and leaves most people behind, or it nukes through and rekts everyone - before bouncing.

And, of course, we have the CME gap that the world has been talking about.

It remains technically unfilled, but VERY close, Enough? Maybe.

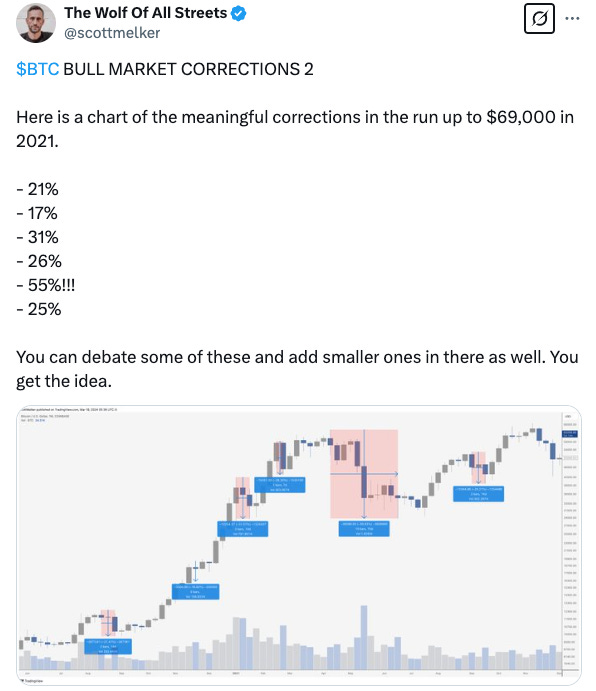

While we are at it, here are a few important reminders of what bull market corrections have looked like in the past. Here is 2017.

Here is 2021.

The current correction, from top to bottom, is about 28%.

Normal.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

Market thoughts for TRADERS. If you are looking for short term bounces that could be potential bottoms, I see oversold RSI with bullish divergences on the 4-hour chart on almost EVERY SINGLE chart I have opened. Bitcoin. Ethereum. Other altcoins. High conviction in a bounce. For full transparency:

Ethereu just swept a key low. Clear buy zone for those looking for a longer term entry, if we see a close above $2,093. Scary, I know. Printing bullish divergence with oversold RSI on the 4-hour (not shown).

And how about Solana?

A beautiful tap of the demand and support zone, wildly oversold, printing bullish divergence on the 4-hour (not shown).

Almost every coin looks like this.

Legacy Markets

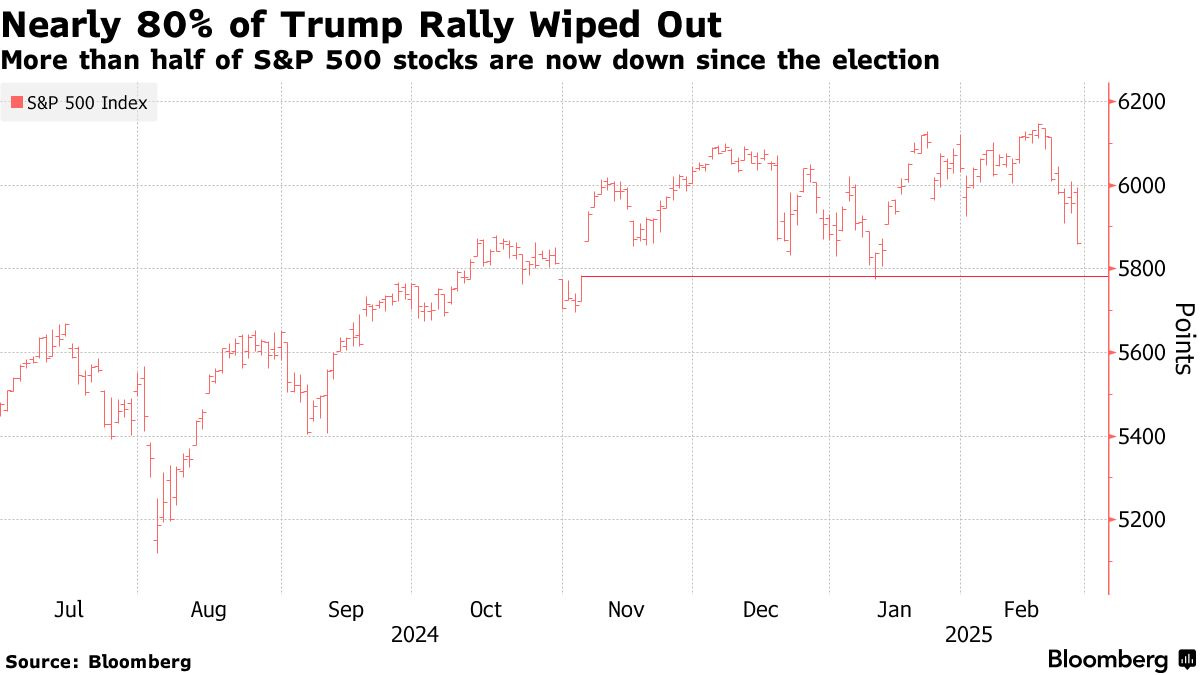

US stock futures rose ahead of the core PCE inflation report, the Federal Reserve’s preferred inflation gauge, while Bitcoin’s sell-off deepened amid Trump’s latest trade tariff threats. The S&P 500 gained 0.4% in premarket trading, with Nvidia up 1% after an 8.5% post-earnings slump. However, crypto-linked stocks fell as Bitcoin extended its losses, now down over 25% from its January peak.

Investors are closely watching the PCE index, expected to show a 2.6% annual increase, down from 2.8% in December. A hotter-than-expected reading could dampen hopes for Fed rate cuts, while tariffs on Canada, Mexico, and China threaten to push inflation higher and slow economic growth.

The S&P 500 has dropped nearly 3% in February amid concerns that Trump’s tariffs could ignite a global trade war. Treasuries rallied, with the 10-year yield hitting December lows, while the dollar edged higher. Analysts suggest market sentiment hinges on the upcoming March 4 tariff enforcement deadline, with some expecting Trump to intervene if markets react negatively.

Key events this week:

US PCE inflation, income and spending, Friday

Fed’s Austan Goolsbee speaks, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.4% as of 6:40 a.m. New York time

Nasdaq 100 futures rose 0.3%

Futures on the Dow Jones Industrial Average rose 0.3%

The Stoxx Europe 600 fell 0.3%

The MSCI World Index fell 0.3%

Currencies

The Bloomberg Dollar Spot Index rose 0.1%

The euro was little changed at $1.0396

The British pound fell 0.1% to $1.2588

The Japanese yen fell 0.4% to 150.46 per dollar

Cryptocurrencies

Bitcoin fell 4.4% to $80,545.93

Ether fell 6.5% to $2,131.94

Bonds

The yield on 10-year Treasuries was little changed at 4.26%

Germany’s 10-year yield declined two basis points to 2.39%

Britain’s 10-year yield declined three basis points to 4.48%

Commodities

West Texas Intermediate crude fell 1.4% to $69.35 a barrel

Spot gold fell 0.6% to $2,861.51 an ounce

The SEC Ends Investigation Into Gemini

Under new leadership, the SEC is taking a more pragmatic approach, prioritizing efficient use of its time and resources by shutting down investigations initiated under Gary Gensler. We've now seen cases and investigations against Coinbase, Uniswap, OpenSea, Robinhood, the Tron Foundation, Gemini and Consensys now come to a close. While it's unlikely these companies will recoup their legal expenses, the real restitution should come in the form of long-overdue regulatory clarity and legislation that fosters innovation rather than stifling it.

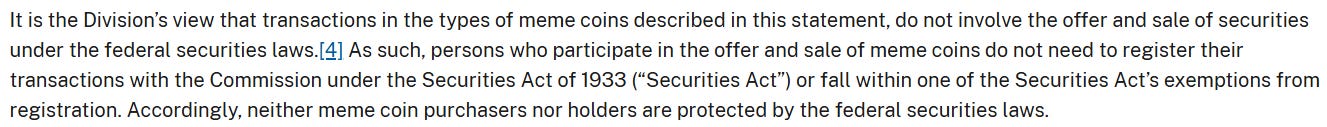

Once the SEC’s plate is fully cleared, then it can really start initiating the pro-crypto rulings and decisions this space needs. A perfect example happened just yesterday; the SEC ruled meme coins are NOT securities.

This also happened yesterday:

The market might not have the strength to react positively right now, but this is huge. The chains are off, and Coinbase is free to build. With the SEC no longer standing in the way, I’m expecting big announcements that push the envelope from the exchange this year.

Democrats Don’t Like Government Meme Coins

Never in a million years did I expect to see the President of the United States launch a meme coin—only for the Democratic Party to respond with proposed legislation against it. Rep. Sam Liccardo is introducing the Modern Emoluments and Malfeasance Enforcement (MEME) Act to prohibit top government officials and their families from profiting off personal meme coins. The bill would ban the issuance, sponsorship, or endorsement of digital assets and impose criminal and civil penalties for violations. It includes a retroactive provision that could impact the TRUMP coin. Liccardo argues the legislation is necessary to prevent officials from exploiting their positions for financial gain.

Chances are, this bill doesn’t get very far because Congress is Republican-controlled, but it’s an interesting response that may foreshadow what’s to come further down the road.

Pakistan Joins Growing List Of Pro-Crypto Countries

Pakistan's Finance Ministry is considering establishing a “National Crypto Council” to explore the legalization of cryptocurrencies. This decision follows a meeting between Finance Minister Muhammad Aurangzeb and a foreign delegation, including advisers to former U.S. President Donald Trump. The council will consist of government officials, regulatory authorities, and industry experts, aiming to develop policies, tackle regulatory challenges, and ensure the growth of a secure crypto ecosystem. Despite having over 20 million crypto users, Pakistan faces issues like high transaction fees. Aurangzeb has directed stakeholders to create a framework that ensures economic viability, regulatory compliance, and protection against financial crimes. By no means is Pakistan a large domino, but it’s still a country, and its involvement will undoubtedly encourage others to follow.

Trump’s Next Move Could CRASH Bitcoin to $70K!

Join Pete Rizzo, The Bitcoin Historian, and Edan Yago, Core Contributor of BitcoinOS, as we discuss the latest news in Bitcoin and Crypto.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.