Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Use my link HERE.

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 400 trading pairs, minimal fees, peer to peer trading, derivatives, up to 100x leverage.

In This Issue:

Saylor

Bitcoin Thoughts And Analysis

Legacy Markets

We Now Know How Bybit Was Hacked

Bank of America Is Ready To Issue A Stablecoin

Ondo Teams Up With Mastercard

Pump.fun’s X Account Was Hacked

Bitcoin Bounce Or Bull Trap? Has The Crypto Sell-Off Ended?

Saylor

On November 10, 2021, Bitcoin hit an all-time high of ~$69,000.

At the time, nearly everyone believed Bitcoin was on the brink of reaching $100,000, fulfilling the prophecy of the 2017 bull market. It was supposed to happen last cycle.

Bitcoin had other plans.

Over the next year, it endured a relentless storm of bad news, global criticism, and existential crises—testing believers to their core while giving skeptics their moment of validation. By November 21, 2022, Bitcoin had cratered to ~$15,500.

Many of you reading this held strong through that brutal year—I’ve heard your stories. But nobody did what Saylor did. That’s the story I want to share today.

Before we dive into the numbers, keep in mind that MSTR has undergone three stock splits historically. Don’t let that throw you off - just focus on the bigger picture.

On November 10, 2021, the day Bitcoin peaked, MicroStrategy was trading at $88 per share. By December 29, 2022, it had plunged to a low of $13.38. This was two years and two months after the company embarked on its relentless Bitcoin buying spree, amassing 132,500 BTC, all while facing the very real possibility of Bitcoin sinking into five-figure territory.

People often forget what was forged in the pits and laugh at decisions made at the tops. Some details of this period are mind-blowing.

In July 2022, during a MicroStrategy earnings call, the CFO publicly revealed the company’s “oh shit” floor. He explained that Bitcoin would need to drop another 50% from $42,000 to around $21,000 to trigger a margin call—something he confidently claimed was unlikely. The entire crypto space latched onto this statement, fueling panic and ironically increasing the likelihood of that exact scenario playing out.

“As far as where Bitcoin needs to fall, we took out the loan at a 25% LTV, the margin call occurs at 50% LTV. So essentially, Bitcoin needs to cut in half, or around $21,000, before we’d have a margin call. That said, before it gets to 50%, we could contribute more Bitcoin to the collateral package, so it never gets there.

So, I think we’re in a pretty comfortable place where we are right now.”

This was during a time when liquidation levels of major firms were repeatedly targeted by whales, so openly discussing a critical price threshold was not the best idea.

Yet Saylor remained unfazed. He even went as far as posting on X that he was prepared for Bitcoin to drop below $3,562, a staggering 90% decline from its then price of $30,300. This was after Bitcoin had already fallen 56% from its previous high. That level of conviction is almost unheard of.

And then, Bitcoin just kept falling.

June 1, 2022: $31,000

July 1, 2022: $19,000

August 1, 2022: $22,000

September 1, 2022: $20,000

October 1, 2022: $19,000

November 1, 2022: $20,000

December 1, 2022: $17,000

By December 28, 2022, with Bitcoin scraping $16,552, Saylor placed his 24th Bitcoin order—buying at a lower price than he had on his third-ever purchase back in December 2020. There’s no way that felt good. But he did it.

Saylor never wavered, never second-guessed. He had a plan, executed it, and committed to it. His conviction was absolute.

And to be fair, conviction is expected from a CEO. Alex Mashinsky fought until Celsius collapsed. Do Kwon held onto LUNA until it literally hit zero. Su Zhu and Kyle Davies of 3AC went down swinging—and are still posting on X to this day.

But where Saylor differed was that his conviction wasn’t built on deception or greed. His vision for Bitcoin wasn’t a get-rich-quick scheme; it was a bet on a better future. And unlike the others, his story didn’t end in catastrophe.

While many wanted MicroStrategy to succeed, there were whales actively trying to break him. They wanted to force a liquidation. But he outlasted them all.

Now, Bitcoin is down 20% from its all-time high, and panic is creeping back into the space. But for Saylor? This isn’t even a trial—it’s insulting to call it one. Even if Bitcoin dips to $80,000, $70,000, or lower, it’s nowhere near the fires he’s walked through. MSTR is currently down over 50%, and I promise you, he’s sleeping just fine.

Bitcoin, unlike any other asset, rewards those who simply hold. Sure, it will round-trip you more than once, but if history is any guide, it will eventually rise so far beyond your cost basis that selling will never cross your mind.

Saylor and long-term Bitcoin holders are seeing this play out right now.

If you’re holding crypto without Bitcoin, you’re doing it wrong.

Be like Saylor: stay brave, remain transparent, stick to your plan, and be stoic. Your portfolio depends on it. But more importantly, your conviction does.

Bitcoin is the future, and right now, it’s on sale.

The bottom isn’t far, and quality alts will have their time too.

I’m right here with you.

Bitcoin Thoughts And Analysis

Bitcoin has seen a sharp sell-off over the past few days, breaking key support levels and testing the 200-day moving average, which has acted as a strong support level historically. The long lower wick from yesterday’s candle suggests that buyers stepped in aggressively around the 200 MA, leading to a relief bounce. However, the recovery remains weak, and price is still trading below previous key levels, indicating that the market structure remains bearish for now.

Volume has spiked significantly, confirming strong participation in the recent move, but Bitcoin will need to reclaim higher levels, particularly around 90,000, to regain momentum. If the 200 MA fails to hold, further downside into the mid-80,000s remains a possibility. Bulls need a strong continuation above today’s high to confirm a more meaningful reversal.

The 4-hour Bitcoin chart is showing a strong signal of potential bottoming with an oversold bullish divergence. While price made a lower low, the RSI made a higher low, indicating that bearish momentum is weakening. This type of divergence often precedes a reversal or at least a relief bounce.

However, it is important to remain cautious of potential hidden bearish divergence forming on lower timeframes. If price makes a lower high while RSI makes a higher high, it could signal a continuation of the downtrend. Confirmation above local resistance levels would be needed to invalidate further downside risk. For now, the bullish divergence suggests that the worst of the sell-off might be over, but price action needs to hold and push higher to confirm a stronger reversal.

When zooming into the 4-hour chart from the daily, an important detail emerges—while there was heavy volume during the sell-off, the strongest volume candles were actually buy-side, not sell-side. This suggests that buyers aggressively stepped in at the lows, supporting the idea that the oversold bullish divergence could mark a local bottom.

Legacy Markets

US stock futures rose as traders digested economic data and Nvidia’s earnings reassured investors about AI demand. Nvidia gained 2.2% in premarket trading, lifting other tech giants like Meta, Tesla, and Amazon, as its fourth-quarter results largely met expectations despite ongoing US-China semiconductor tensions.

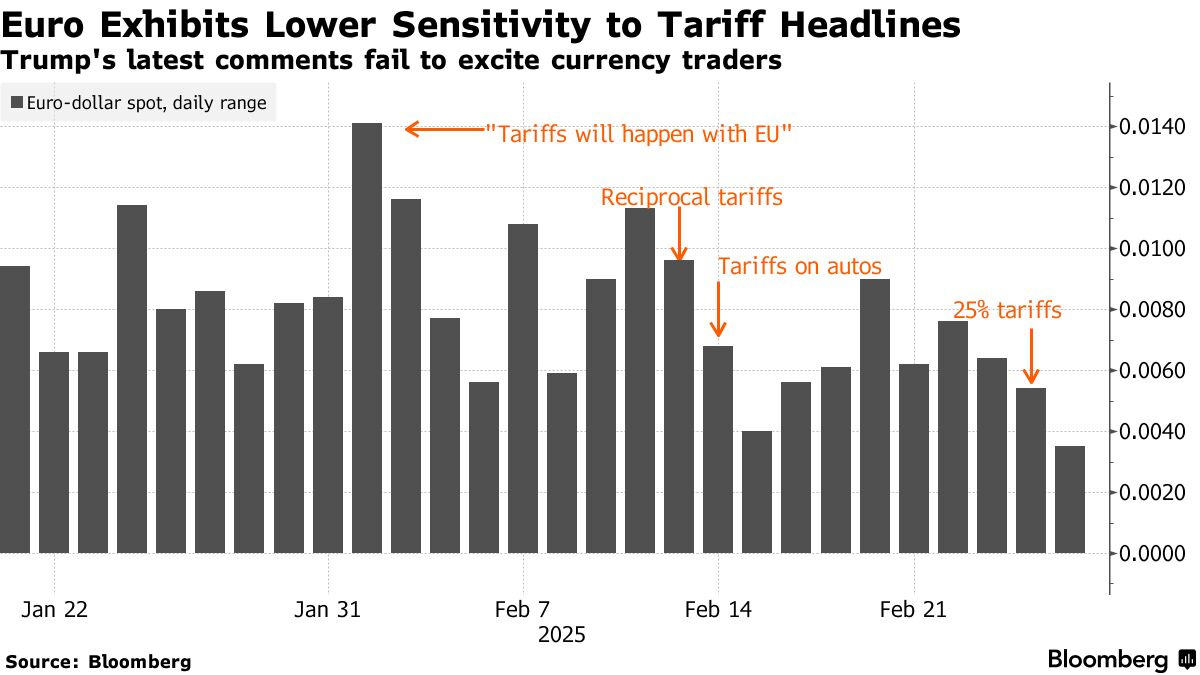

Meanwhile, traders remain cautious about the evolving US trade policy, with Trump’s administration threatening 25% tariffs on EU imports. The uncertainty weighed on European stocks, particularly the auto sector, while the Stoxx 600 index fell 0.4%. Markets are awaiting clarity on whether the tariffs will be broad-based or sector-specific, with the US still set to impose levies on Mexico and Canada.

Economic data will be closely watched today, including initial jobless claims and revised Q4 GDP figures. Soft PMI and housing data earlier this week signaled a slowing economy, reinforcing expectations for Fed rate cuts this year. The 10-year Treasury yield remains on track for a seventh straight weekly decline, the longest streak since 2019.

Among corporate moves, Salesforce slipped in premarket trading after offering a conservative outlook, while Snowflake surged on stronger-than-expected AI-driven revenue projections. Rolls-Royce reinstated its dividend and announced a buyback, boosting its shares.

Despite near-term uncertainty, JPMorgan strategists predict stocks will struggle in early March due to weaker economic data before rebounding later in the spring.

Key events this week:

US GDP, durable goods, initial jobless claims, Thursday

Fed’s Jeff Schmid, Beth Hammack, Patrick Harker, Michael Barr, Michelle Bowman speak, Thursday

Japan Tokyo CPI, industrial production, retail sales, Friday

US PCE inflation, income and spending, Friday

Fed’s Austan Goolsbee speaks, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.7% as of 7:04 a.m. New York time

Nasdaq 100 futures rose 0.7%

Futures on the Dow Jones Industrial Average rose 0.3%

The Stoxx Europe 600 fell 0.3%

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index rose 0.1%

The euro was little changed at $1.0478

The British pound was little changed at $1.2675

The Japanese yen fell 0.4% to 149.74 per dollar

Cryptocurrencies

Bitcoin rose 2.5% to $86,618.82

Ether rose 0.5% to $2,351.58

Bonds

The yield on 10-year Treasuries advanced four basis points to 4.30%

Germany’s 10-year yield advanced one basis point to 2.45%

Britain’s 10-year yield advanced one basis point to 4.52%

Commodities

West Texas Intermediate crude rose 0.9% to $69.24 a barrel

Spot gold fell 1.1% to $2,883.84 an ounce

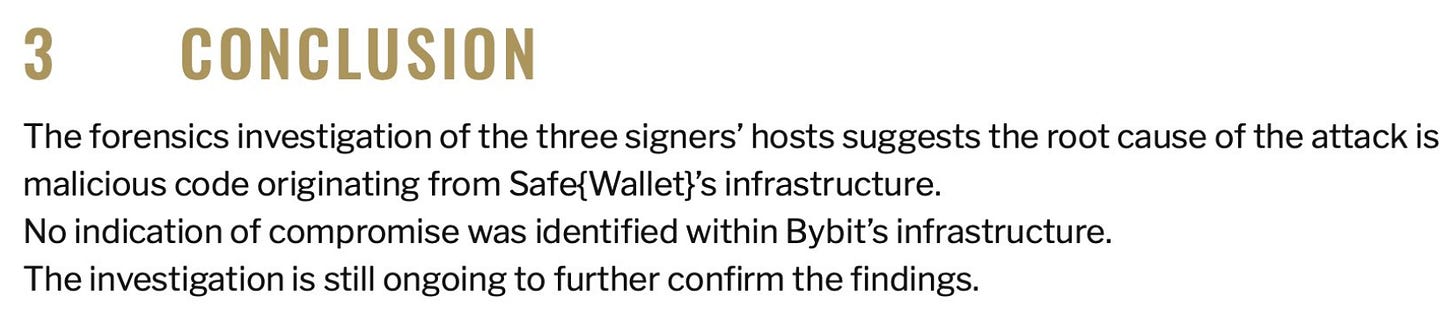

We Now Know How Bybit Was Hacked

We now have a clear understanding of how the Bybit hack occurred. I’m not claiming to be an expert on this, but I can summarize what has been shared. Bybit isn’t the only party at fault—Safe Wallet, a smart contract multisig wallet, contained the malicious code that allowed the Lazarus Group to infiltrate Bybit’s Ethereum wallet.

It has been confirmed that Bybit’s infrastructure was not compromised.

This raises the question of how much responsibility falls on Bybit and now Safe Wallet.

Bank of America Is Ready To Issue A Stablecoin

Bank of America is poised to launch a stablecoin if regulations permit, according to CEO Brian Moynihan in a recent interview at the Economic Club of Washington. Moynihan made several bullish comments on the market, emphasizing the bank’s focus on three key areas: stablecoins, blockchain technology, and Bitcoin and crypto. As he spoke, he seemed to convince himself of the inevitability, noting that the bank already moves $3 trillion digitally today.

“It’s pretty clear there’s going to be a stablecoin that is fully dollar-backed. If they make that legal, we’ll go into that business. You’ll have a Bank of America coin and a US dollar deposit, and we’ll be able to move them back and forth. Because now it hasn’t been legal for us to do it. It’s no different than a money market fund with check access… no different than a bank account.”

While banks may find efficiencies and operational improvements through their own stablecoins, the fundamental issues of fragmentation and centralization remain. A bank-issued stablecoin would likely be little more than a software upgrade rather than a true step toward financial decentralization.

Ondo Teams Up With Mastercard

Ondo Finance is teaming up with Mastercard to integrate its tokenized asset technology into Mastercard’s Multi-Token Network (MTN). This partnership will provide businesses with access to tokenized short-term U.S. government bonds, allowing them to manage assets more efficiently—without relying on stablecoins or traditional banking settlement windows.

The integration enables 24/7 subscriptions and redemptions, daily yield distribution, and a seamless connection between private payment networks and tokenized assets on public blockchains, enhancing liquidity and capital management.

While the broader crypto market may be in turmoil, developments like this continue to emerge daily. I remain bullish.

Pump.fun’s X Account Was Hacked

It’s ironic that the very platform responsible for spawning countless scams ended up getting scammed itself. Pump.fun’s X account was hacked yesterday, leading to the launch of a fake ‘governance token’ called $PUMP, which skyrocketed 517,000,000% before crashing 99.9% within minutes.

The platform’s 23-year-old pseudonymous COO, Alon Cohen, confirmed the breach and warned users not to engage. The compromised account falsely promoted $PUMP as the “OFFICIAL pump.fun GOVERNANCE token,” claiming, “Democracy has never been this degen.”

Bitcoin Bounce Or Bull Trap? Has The Crypto Sell-Off Ended?

I’m joined by Matt Hougan, CIO of Bitwise, to dive into the latest in crypto—including the massive news of Bitwise’s $70 million funding round!

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.