Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Trading Alpha Released An Exciting Product!

One of the partners of this newsletter, Trading Alpha, my trusted indicator and trading community, has launched their proprietary Indicator Search Engine for All Markets. This custom Indicator Screener scans crypto, stocks, and forex markets for Trading Alpha indicator setups, eliminating the need for time-consuming manual analysis. It can simultaneously screen for multiple indicators, enhancing confluence and providing advanced analysis capabilities across different markets. This is cutting-edge technology for serious traders.

Make sure to use my link HERE if you plan on giving it a try.

In This Issue:

Where Legends (And Cowards) Are Made

Bitcoin Thoughts And Analysis

Legacy Markets

The Ethereum Foundation Is Making Leadership Changes

Is GameStop The Next Strategy?

Eric Trump Remains Bullish

Bybit Launches A Bounty Website

Bitcoin Crashing! Crypto Nightmare! Is the Worst Yet To Come?

Where Legends (And Cowards) Are Made

I guess we have to talk about the market.

Bitcoin is doing what it always does in every bull market—taking one of its usual 10% to 30% pullbacks while altcoins get obliterated. That’s the story right now.

Bitcoin, currently trading at $87,300, is down about 20.2% from its all-time high of ~$109,400. Ethereum, at $2,415, is down roughly 50.6% from its peak of ~$4,891.

Solana, sitting at $143, has dropped about 51.3% from its high of ~$294.

The market dynamics this cycle are undeniably different. Historically, when Bitcoin took a large correction, altcoins crashed even harder. This time, however, alts have been front-running Bitcoin’s dips, absorbing the pain early and reacting more mildly when Bitcoin finally moves down.

On the flip side, when Bitcoin’s price historically surged, altcoins typically outperformed. Yet this cycle, very few alts have managed to outpace Bitcoin, and those that did saw their temporary gains wiped away just as quickly. The only investors sitting comfortably are Bitcoin holders and a handful of traders who timed their moves well.

These unexpected dynamics have burned anyone who thought they had the market "figured out" and hurt long-term investors who bet heavily outside of Bitcoin. None of this means alts won’t eventually outperform, but it does raise serious questions about their current value proposition and whether the classic four-year cycle is still intact.

Veteran investors know that Bitcoin bull markets are filled with pullbacks—necessary corrections that reset leverage and allow the price to climb higher. I dug through the charts, and here’s what I found:

After the 2013 bottom, there were 12 pullbacks of more than 20%.

After the 2015 bottom, there were 17 pullbacks over 20%.

After the 2018 bottom, there were 2 pullbacks before the 2019 top.

After the 2020 bottom, there were 7 pullbacks before the April 2021 top.

Since the 2022 bottom, we’ve already seen 8 pullbacks over 20%—and counting.

A 20% Bitcoin pullback is completely normal. What would be abnormal is if it never happened. Bitcoin could even dip further, and it would still be par for the course. What is unusual, however, is how major altcoins have absorbed all the pain without any of the upside. The only narrative that really made an impact this cycle was the most extractive one yet—memecoins.

Speaking of the meme collapse—which wiped out the hot ball of money fueling alts—the crypto news cycle has remained overwhelmingly positive. In the past week alone, we’ve learned that the SEC is dropping its lawsuit against Coinbase and closing investigations into Robinhood, OpenSea, and now Uniswap, which was just announced yesterday.

There has never been a moment in history when the macro backdrop for crypto has been this strong. In the U.S., we now have a pro-crypto president, SEC chairman, Treasury Secretary, Secretary of Commerce, and Congress + Senate, along with presidential instructions to explore the creation of a national digital asset stockpile.

On the state level, Bitcoin adoption is accelerating through aggressive legislation. Lawmakers are drafting stablecoin and market structure bills, retail and institutional investors are pouring into ETFs, and U.S. companies are actively exploring real-world tokenization.

Outside the U.S., sovereign wealth funds and entire nations are stepping up their Bitcoin acquisitions. El Salvador and the Central African Republic have already adopted Bitcoin as legal tender. Meanwhile, previously resistant governments like India, China, Russia, and Brazil are softening their stance, while progressive financial hubs like Portugal, the Czech Republic, Switzerland, and Singapore are making major advancements.

Meanwhile, the stablecoin market cap has hit an all-time high of $230 billion, a 50% increase in just a year. Tokenization is becoming a major priority for financial giants. Just yesterday, Robinhood CEO Vlad Tenev made an interesting comment that, while not explicitly about tokenization, fits perfectly into the conversation:

Interviewer: "What is your ultimate vision here? Is this going to be a place where people can buy and sell real estate one day?"

Vlad Tenev: "I think so. Whatever a customer wants to invest in—and there actually is an overlap with real estate between assets that you utilize and those that are also investments. A lot of our customers are interested in that. So yeah, every asset that’s investable, and even some assets you’d like to hold in physical form, are within the scope of the vision."

And in case anyone has forgotten, there’s a timeline attached to Trump’s crypto executive order, which includes the "digital asset stockpile" initiative:

Within 30 days (by February 22), agencies must identify all regulations impacting the digital asset sector.

Within 60 days (by March 23), agencies will submit recommendations on which regulations should be rescinded or modified.

Within 180 days (by July 22), the working group will submit a full report with proposed regulatory and legislative changes.

That order was signed just 34 days ago. If you’re feeling panicked, step away, take a breather, and check back in a few months. The collapse of memes this cycle is nothing compared to China’s 2021 mining ban, which massively disrupted the last bull run. If anything, swinging the pendulum this far from utility should generate enough momentum to swing it back hard in the right direction—toward real, lasting adoption.

At least for now, we can set aside tribalism between competing protocols and focus on solving real-world problems. Bitcoiners already know the drill—they’ve been through this cycle countless times and continue pushing forward, regardless of price action. My advice for those looking beyond Bitcoin: only invest in projects that are carving their own path. This cycle has made one thing clear—not all boats will rise with Bitcoin’s tide.

And if you’re waiting for the perfect entry, here’s my hard advice: if you’ve got the conviction, what are you waiting for? There’s no meaningful difference between buying Bitcoin at $88,000 or $80,000 if it’s going to $1 million. A discount is a discount, and the same applies to high-quality altcoins. Nothing is without risk, so do your own research and take responsibility for your decisions.

Shoutout to Bitcoin Magazine—this couldn’t be more accurate right now.

Keep reading this newsletter every day, but check the prices in a few months—you’re going to be fine.

Bitcoin Thoughts And Analysis

Bitcoin has broken down aggressively, losing key support levels and extending the recent sell-off. The price is now testing the lower boundary of the previous demand zone around 88,700, with a significant volume spike indicating strong selling pressure. Yesterday's long lower wick suggests that buyers attempted to step in, but the daily close remains weak, indicating continued bearish momentum. The 50-day moving average is now well above the price, confirming the shift in market structure. Bulls need a strong recovery above ~90,000 to regain momentum, while failure to hold the current support zone could open the door for deeper corrections. The next major downside level to watch is around 85,000 if this support fails.

Legacy Markets

Global stocks advanced ahead of Nvidia’s crucial earnings report, which could determine the near-term direction of the AI-driven market rally. Nvidia rose 3% in premarket trading, while contracts on the Nasdaq 100 and S&P 500 signaled a recovery from Tuesday’s pullback, driven by weaker-than-expected consumer confidence data.

The stakes are high for Nvidia’s results, with options data implying a potential 8.5% swing in either direction. Given Nvidia’s role in powering AI computing, the report will be closely watched for both revenue growth and forward guidance. A disappointment could further pressure the technology sector, where the “Magnificent Seven” stocks recently entered correction territory.

Among other notable movers, Super Micro Computer jumped 25% after meeting a key Nasdaq listing deadline, while Workday rallied on strong earnings. Mining stocks gained globally, with Freeport-McMoRan rising as President Trump’s latest tariff threats lifted copper prices.

In Europe, the Stoxx 600 index hit a record high, led by resource companies and upbeat earnings from Anheuser-Busch InBev, Banco Santander, and Fresenius. Bond markets also reflected shifting sentiment, with 10-year U.S. Treasury yields hitting their lowest since mid-December as traders increased bets on Fed rate cuts.

Meanwhile, in Asia, Hong Kong stocks surged after China’s AI platform DeepSeek reopened its core programming interface, fueling optimism about the country’s tech sector. Copper and gold also remained strong, with gold trading near its all-time high.

Key events this week:

US new home sales, Wednesday

Nvidia earnings, Wednesday

Fed’s Raphael Bostic speaks, Wednesday

Eurozone consumer confidence, Thursday

US GDP, durable goods, initial jobless claims, Thursday

Fed’s Jeff Schmid, Beth Hammack, Patrick Harker, Michael Barr, Michelle Bowman speak, Thursday

Japan Tokyo CPI, industrial production, retail sales, Friday

US PCE inflation, income and spending, Friday

Fed’s Austan Goolsbee speaks, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.5% as of 5:56 a.m. New York time

Nasdaq 100 futures rose 0.8%

Futures on the Dow Jones Industrial Average rose 0.3%

The Stoxx Europe 600 rose 0.7%

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index rose 0.2%

The euro fell 0.1% to $1.0499

The British pound fell 0.2% to $1.2646

The Japanese yen fell 0.3% to 149.47 per dollar

Cryptocurrencies

Bitcoin rose 0.5% to $89,151.7

Ether fell 0.8% to $2,491.22

Bonds

The yield on 10-year Treasuries advanced two basis points to 4.31%

Germany’s 10-year yield declined two basis points to 2.44%

Britain’s 10-year yield declined two basis points to 4.49%

Commodities

West Texas Intermediate crude was little changed

Spot gold fell 0.1% to $2,911.99 an ounce

The Ethereum Foundation Is Making Leadership Changes

Aya Miyaguchi, formerly the executive director of the Ethereum Foundation, has been promoted to president, expanding her role and responsibilities within the organization. While this might seem like a natural progression, the Ethereum community isn’t exactly thrilled. Many have been calling for her removal, citing her controversial political views and, more specifically, her stance on competition and winning.

Aya’s most infamous quote, “I’m training people to say no to the culture of competition and winning,” has resurfaced, fueling criticism that the Ethereum Foundation is moving in the wrong direction.

In the official announcement, she elaborated on her vision for Ethereum’s future:

"However, we must avoid evolving like a traditional corporation, because our goal isn't for EF to ‘win’ – it is for Ethereum to win over the long term while staying true to its core values. As the ecosystem's needs evolve, our focus shifts from simply asking, ‘How can EF execute this?’ to ‘How can Ethereum accomplish this, and what role should EF play?’ This doesn’t mean stepping back; rather, we step forward with purpose, strategy, and intention, always guided by our mission to preserve the integrity and values of Ethereum.”

My take? If Ethereum were outperforming, no one would care about the politics of any one person at the Ethereum Foundation.

Is GameStop The Next Strategy?

Matt Cole, CEO of Strive Asset Management, has urged GameStop to adopt Bitcoin as a reserve asset. In a letter to GameStop CEO Ryan Cohen on February 24, Cole pointed to the company's nearly $5 billion cash reserve as a unique opportunity, stating, “We believe GameStop has an incredible opportunity to transform its financial future by becoming the premier bitcoin treasury company in the gaming sector.”

Strive, which holds GME shares through its ETFs, has a vested interest in the company’s success. The letter comes amid reports that GameStop is exploring alternative investments, including Bitcoin.

You can read the letter below:

Eric Trump Remains Bullish

It’s still hard to wrap my head around the fact that the son of the President of the United States is on X, posting statements like, “₿uy the dips!!!” All I have to say is—he’s right. Use this opportunity to buy quality assets at a discount. Be cautious when piling into higher-risk assets—they can drop much further and may not recover as strongly. Bitcoin remains my top choice to buy at a discount, followed by ETH and SOL. Beyond that, I’m not looking too far.

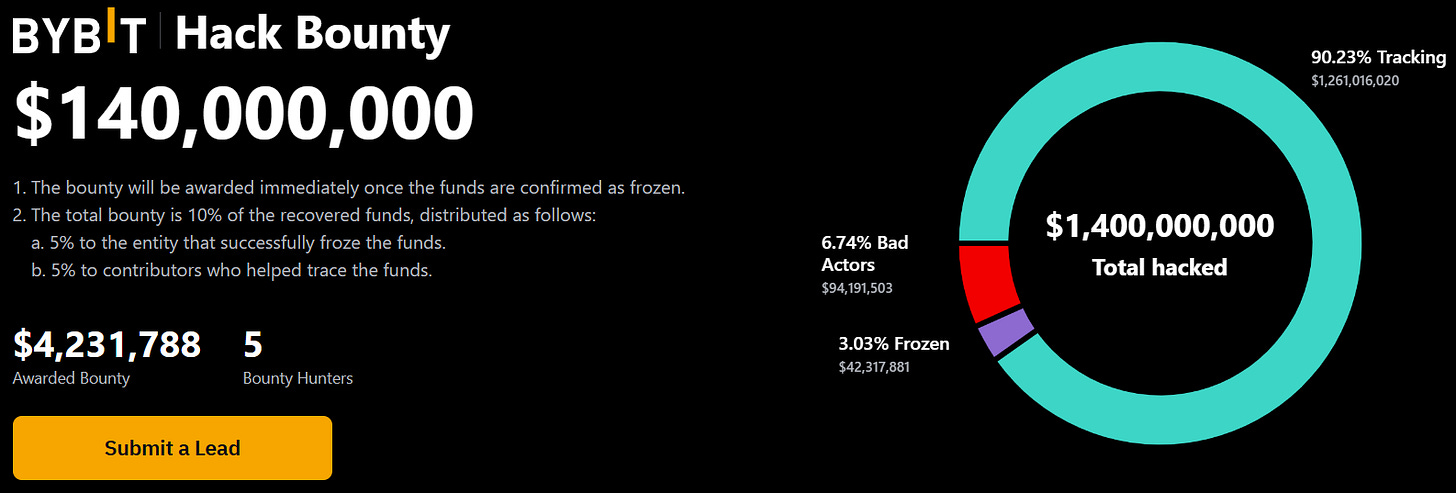

Bybit Launches A Bounty Website

Bybit is seeking public support to track down, freeze, and recover the funds stolen last week. Bounty hunters will be rewarded based on the amount successfully frozen or recovered:

- Total bounty: 10% of the recovered funds, distributed as follows:

5% to the entity that successfully freezes the funds.

5% to contributors who assist in tracing the funds.

Bitcoin Crashing! Crypto Nightmare! Is the Worst Yet To Come?

Bitcoin and the entire crypto market are crashing—what is going on?! I'm breaking down this unprecedented crypto nightmare with my friends from Arch Public, Andrew Parish and Tillman Holloway. Plus, they’ll provide an update on the $10K algorithmic portfolio. Don't miss it!

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.