Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Use my link HERE.

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 400 trading pairs, minimal fees, peer to peer trading, derivatives, up to 100x leverage.

In This Issue:

Bybit Hacked: The Biggest Crypto Heist in History!

Bitcoin Thoughts And Analysis

Legacy Markets

Coinbase Has Effectively Won

VanEck Argues An SBR Will Offset National Debt

Saylor Keeps Buying Bitcoin

Crypto Sponsorships Are On The Rise

The Next FTX-Level Disaster Is Already Brewing… On WALL STREET | Caitlin Long

Bybit Hacked: The Biggest Crypto Heist in History!

Until this weekend, the crypto industry had never seen a billion-dollar hack. The previous record was set in 2022 when the Ronin Network was exploited for approximately $625 million in ETH and USDC. The second-largest was the Poly Network hack, which exceeded $600 million, followed by Binance’s BNB Bridge attack at $569 million.

For perspective, the total amount stolen across all platforms and exchanges in 2023 was estimated at $1.7 billion. The recent Bybit hack alone has nearly matched an entire year’s worth of crypto theft in a single incident, surpassing the combined total of the two largest previous hacks.

The damage? $1.46 billion. Entirely in ETH and staked ETH. Go figure.

To be clear, this wasn’t an Ethereum issue. It could have just as easily been Bitcoin, Solana, stablecoins, or any other asset. The incident this past weekend had nothing to do with Ethereum itself—it was purely an exchange security failure.

The exact timing of the hack and its finer details haven’t been made public yet, likely for security and investigative reasons. However, what we do know is that the incident took place on Friday, February 21st.

Here’s where it all began:

Following the breach announcement, Bybit moved quickly, launching a bounty program and providing regular updates on social media. While details about their security practices remain limited, their response to the incident has been strong.

On-chain analysts quickly traced the hack back to Lazarus Group, the infamous North Korean cybercrime organization responsible for some of the largest cyber heists in history. Their track record includes the Sony Pictures hack, the Bangladesh Bank heist, the WannaCry ransomware attack, and the Axie Infinity hack—and now, the largest crypto hack to date.

The last thing this bull market needs is another exchange insolvency. Thankfully, it seems lessons have been learned from the last cycle, and Bybit appears to have the funds to back its claims.

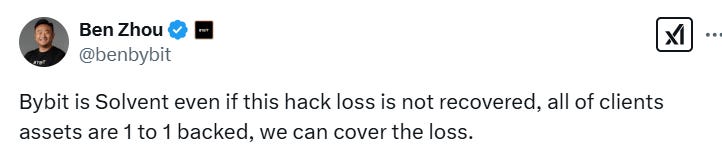

To put the scale of the hack into perspective, Bybit CEO Ben Zhou revealed that "the security breach saw the hackers make off with roughly 70% of their clients’ ether." Following the attack, users rushed to withdraw funds, adding even more outflow pressure. Despite credible recommendations to pause withdrawals, Bybit never halted them. Kudos to them.

Total assets on the exchange are currently falling off a cliff…

So far, over six billion dollars has flowed out of Bybit, with total assets plunging from $16.94 billion to $10.63 billion—and likely even lower by the time you read this. Now that the initial shock has settled, two key questions remain: What does this mean for Ethereum’s price action? And should the chain consider a rollback?

To tackle the first question, Ethereum saw only a 4% drop following the hack—an incredibly resilient response given the circumstances. This also reinforces the fact that Ethereum itself wasn’t the issue here; it just happened to be the asset caught in the crossfire.

The hack sets up a few possible outcomes. If the Lazarus Group successfully sells the stolen ETH, it could be disastrous for price action. However, if they hold onto it, about 0.4% of the total ETH supply would effectively be locked out of circulation—a surprisingly bullish outcome. While they’ve already managed to offload a small portion, liquidating the entire stash will be extremely difficult under the intense scrutiny of on-chain analysts and the ability of entities like Tether and Circle to freeze funds instantly.

Additionally, Bybit’s loss of ETH means one thing: they have to replace it. The exchange has already started purchasing ETH over-the-counter, which won’t immediately impact spot prices but will still add some upward pressure. Bybit will obviously try to acquire ETH as cheaply as possible to minimize losses, but this demand will inevitably push the price higher.

Ultimately, the overall impact of the hack will depend on two forces: how the Lazarus Group moves its stolen funds and how Bybit executes its ETH repurchase. The market is now watching both closely.

At this point, Lazarus hasn’t made any major moves with the stolen funds, likely because they understand that any misstep comes with massive risks. However, there are signs that they’ve started exploring Pump.fun, which suggests they may be testing the waters—probing ways to move, launder, or utilize the stolen assets without completely losing access to them.

Maybe there’s a blessing in disguise here for ETH, but I’m not holding my breath.

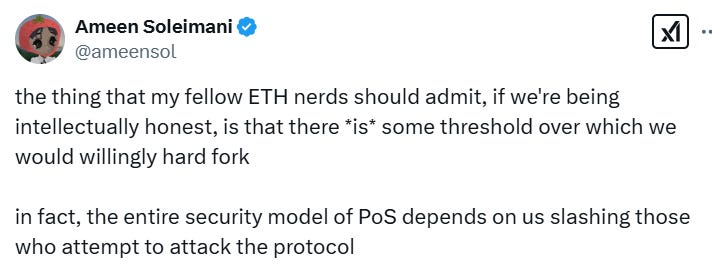

Now for the harder question: rolling back the chain. Every time a major incident involves ETH, this debate resurfaces. I’m not going to pretend to be an expert on whether Ethereum should roll back the chain, but I’ll share some perspectives and known facts.

What I do know is that Ethereum has only ever had one instance where the chain was effectively “rolled back”—the DAO hack in 2016. I say “rolled back” in quotes because, technically, it wasn’t a traditional rollback but rather a state transition via a hard fork. This fork reversed the effects of the hack and returned stolen funds to investors. While many refer to it as a rollback, the decision to alter Ethereum’s history through a hard fork made it a far more nuanced and controversial move.

“I wish we could roll back for the Bybit hack; I’m not against the idea. But the DAO hack was 15% of ETH with a clean recovery path. Today, a rollback would break bridges, stablecoins, L2s, RWAs, and so much more. The ETH ecosystem is just too interconnected now for a clean solution like 2016.” — Gautham Santhosh, co-founder of Polynomial.fi

For anyone who’s seen claims that Vitalik and the Ethereum Foundation are planning a vote on whether to roll back the chain—that’s fake news. Vitalik hasn’t made any statements regarding the hack, and at this point, a rollback seems highly unlikely. With every passing minute, the chances of that happening shrink even further.

The past month has been a whirlwind. If anything, we’ve had just the right amount of bad news to balance out the highs we rode into the new year.

When the bull market picks up again, good news will start rolling in just as frequently as the bad—if not faster. While altcoins have taken a hit, they’re holding up relatively well, and Bitcoin’s resilience speaks for itself. The market’s underlying strength hasn’t gone anywhere—don’t let the headlines make you forget that.

Bitcoin Thoughts And Analysis

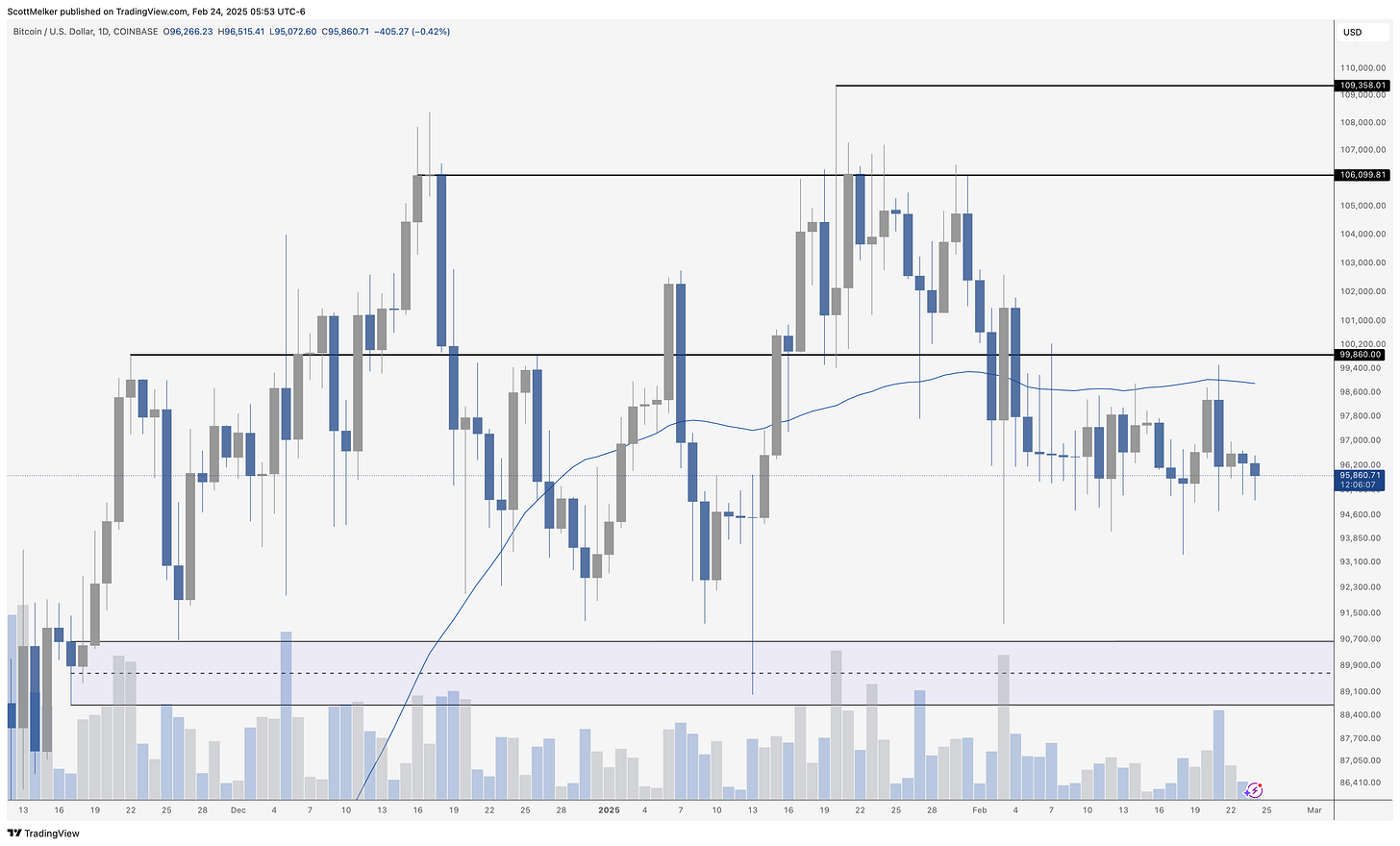

Bitcoin's daily chart remains in a sideways consolidation, with price hovering below the key resistance at 99,860 and struggling to reclaim the 50-day moving average. Momentum has clearly stalled, with low volatility and declining volume, indicating a lack of strong conviction from both bulls and bears. Price continues to hold above the mid-range of recent price action, but failure to break back above key resistance zones could lead to a further grind lower. If support around 95,000 fails, a deeper retracement toward the demand zone around 90,000 may come into play. Bulls need a decisive push above resistance to shift the structure back toward a bullish bias.

Legacy Markets

Key events this week:

Eurozone CPI, Monday

Israel rate decision, Monday

South Korea rate decision, Tuesday

US consumer confidence, Tuesday

Richmond Fed President Tom Barkin speaks, Tuesday

Thailand rate decision, Wednesday

Nvidia earnings, Wednesday

G-20 finance ministers and central bank governors meet in Cape Town though Feb. 27

Atlanta Fed President Raphael Bostic speaks, Wednesday

Germany CPI, unemployment, Friday

India GDP, Friday

Japan Tokyo CPI, industrial production, retail sales, Friday

US PCE inflation, income and spending, Friday

Chicago Fed President Austan Goolsbee speaks, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.5% as of 6:09 a.m. New York time

Nasdaq 100 futures rose 0.4%

Futures on the Dow Jones Industrial Average rose 0.7%

The Stoxx Europe 600 rose 0.1%

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro rose 0.2% to $1.0474

The British pound was little changed at $1.2643

The Japanese yen fell 0.3% to 149.74 per dollar

Cryptocurrencies

Bitcoin fell 0.2% to $95,553.14

Ether fell 4.7% to $2,676.2

Bonds

The yield on 10-year Treasuries was little changed at 4.44%

Germany’s 10-year yield advanced two basis points to 2.49%

Britain’s 10-year yield was little changed at 4.58%

Commodities

West Texas Intermediate crude rose 0.2% to $70.53 a barrel

Spot gold was little changed

U.S. stock futures pointed to a rebound after Friday’s selloff, with Nvidia gaining ahead of its key earnings report on Wednesday. S&P 500 futures rose 0.5%, while Nasdaq 100 contracts climbed 0.4%. Berkshire Hathaway shares were up after strong insurance underwriting results, while Apple declined following news of a $500 billion domestic investment plan for AI expansion. Nvidia rose 1.5% in early trading as investors anticipate blockbuster earnings to reaffirm its AI leadership against emerging competition from China's DeepSeek.

Investors are in "wait-and-see" mode as Nvidia's earnings could be a pivotal moment for megacap stocks and the AI sector, according to Nuveen’s Laura Cooper. The S&P 500 has lagged global markets in 2025 due to uncertainty around President Trump’s tariff policies and their inflationary impact, but some strategists believe U.S. stocks will regain their strength as growth remains robust.

In Europe, the Stoxx 600 fluctuated, while German stocks initially rose after Friedrich Merz’s conservative bloc won the country’s election. However, the euro pared its earlier gains as concerns grew over the new government's ability to push through economic reforms. Siemens Energy, ABB, and Schneider Electric fell amid concerns about data center spending following reports that Microsoft has canceled leases for large-scale data center capacity.

With markets shifting focus from inflation fears to potential economic growth under Trump’s policies, analysts are watching upcoming economic data and earnings closely for further direction.

Coinbase Has Effectively Won

From Brian Armstrong: “Today is a really good day because we just heard from the SEC staff that they plan to withdraw their litigation against Coinbase. This still needs to be approved by the SEC commissioners, but we’re hopeful it will happen next week. If it goes through, it’s a huge deal, not just for us, but for the entire crypto industry, the 50 million Americans who own crypto, and the rest of the world. It’s an important signal about where things are headed.”

It isn’t official until the SEC announces it, but this would be a massive development for the industry. Coinbase has spent over $50 million fighting the SEC on several fronts, including the classification of major tokens, operating as an unregistered securities broker, staking services, and other DeFi-related activities. While the ongoing battles with Binance, which is broader in scope, and Kraken continue, a favorable outcome for Coinbase would send a powerful and positive message to the other exchanges under litigation in the space. It signals that they are likely either on the winning side or mostly on the winning side of crypto history.

VanEck Argues An SBR Will Offset National Debt

VanEck created a pretty neat, free-to-use calculator that lets you calculate the impact an SBR could have on offsetting the U.S. debt. The calculator allows you to adjust variables like the debt growth rate, BTC acquisition prices, the amount of Bitcoin purchased, and its growth rate.

Saylor Keeps Buying Bitcoin

I’m not sure exactly what Saylor “got done” last week, but it sounds like a major purchase is either in the works or already underway. At times, it feels like Saylor is singlehandedly driving this bull market forward. As a Bitcoin holder, I am looking forward to the day when he faces competition from an SBR or a sovereign wealth fund in the U.S. buying Bitcoin. While this will ultimately be a positive for Bitcoin’s value, it could slow down Saylor's purchasing pace. But in the end, every Bitcoin holder stands to benefit.

It seems the Bitcoin community is anticipating around $2 billion in Bitcoin purchases.

Crypto Sponsorships Are On The Rise

Crypto company sponsorships of sports teams are on the rise, from F1 and football to MMA and snooker

Despite the lack of crypto ads at Super Bowl LIX, crypto companies are still investing heavily in sports partnerships. So far in 2025, 22 deals worth an average of $4.3M have been signed, up from 18 deals averaging $2.6M last year. Notable deals include Tether’s $50M stake in Juventus, Coinbase’s stablecoin-funded partnership with Aston Martin’s F1 team, and Gate.io’s deal with Red Bull Racing. XBO.com is now Argentina’s national football team sponsor, while Sportsbet.io and Cloudbet have secured deals in snooker and MMA, respectively. Crypto’s presence in sports remains strong.

The Next FTX-Level Disaster Is Already Brewing… On WALL STREET | Caitlin Long

The Wolf Of All Streets is back with an explosive conversation with Caitlin Long, CEO of Custodia Bank, diving deep into the shocking truths behind Operation Chokepoint 2.0. We expose how the crypto industry was systematically debanked, the political power plays happening behind the scenes, and what’s next for Bitcoin-friendly policies under the new administration. Don’t miss this eye-opening discussion on what it means for crypto, stablecoins, and the future of financial freedom!

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.