Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Use my link HERE.

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 400 trading pairs, minimal fees, peer to peer trading, derivatives, up to 100x leverage.

In This Issue:

We Are Entering The Golden Age

Bitcoin Thoughts And Analysis

Legacy Markets

Elon Musk Is Attempting To Audit Fort Knox

Argentina’s Stock Market Plummets

Public State Funds Are Buying Strategy

An ETH Whale Made A Bizarre Statement On-Chain

Crypto Bulls Are Giving Up, Is Bitcoin In Danger? | Macro Monday

We Are Entering The Golden Age

Seasoned crypto investors have a sixth sense for who can and can’t be trusted. For newcomers, though, it’s like playing a game of Guess Who.

I can’t imagine what the average retail bro sees day-to-day.

Oh wait, they see this…

Presidents are literally exploiting retail investors, ‘trench leaders’ are feigning trustworthiness while withholding insider info, and bag holders, presenting as experts or analysts have their own bags to sell. On top of that, genuine research is often behind a paywall, hard to find, and even harder to understand.

There’s the pessimistic side of me who thinks the number of individuals once seen as neutral or reliable in this space have severely diminished, but on the other hand, the space is growing in many positive ways with solid actors at the helm. That said, I can't recall a time with this level of legal confusion; the once narrow grey area is now swallowing what used to be clear-cut black and white.

Despite all the nonsense, I’m not giving up on providing education, quality opinions, research, and facts from those we can still trust. On that note, Coinbase just had a killer quarterly earnings report, and today, I want to give the spotlight to Brian Armstrong, the CEO of America’s leading and most trustworthy exchange. There’s no debate here—Coinbase has proven itself to be a force for good, and Brian has as well.

Coinbase literally launched the Stand With Crypto Alliance to tip the scales of the presidential election and other key races in favor of pro-crypto officials and candidates. Today, I’m going to share Coinbase’s “Fourth Quarter and Full Year 2024 Earnings Call” to unpack what Brian is saying about the space and the state of the company, which should give us a good read on where we’re headed for 2025.

Let’s begin:

“Crypto's voice was heard loud and clear in this recent U.S. election, and it's the dawn of a new era for crypto. President Trump is moving fast to fulfill his promise of making the U.S. the crypto capital of the planet.”

“And the most pro-crypto congress we've ever seen is now leading the charge on stablecoin and market structure legislation. Given the U.S.' leadership here, the rest of the world is taking notice and will be under pressure to embrace crypto adoption. So it's hard to overstate the significance of this change that's happened in the last few months. We have a number of new opportunities in front of us now to go build in 2025.”

Armstrong is making it very clear the landscape has changed, ultimately giving way for Coinbase to continue pushing forward. Very briefly, I am going to cover the numbers of the company, it’s a side point, not the main point of today.

Coinbase reported earnings per share of $4.68, more than double the expected $2.11, and $2.27 billion in revenue, surpassing estimates of $1.84 billion. This marks a significant increase from last year’s Q4, when the company posted $1.04 in EPS and $954 million in revenue. Robinhood also had a stellar Q4, seeing an eight-fold increase in transaction-based revenue from crypto trading. As a result, the company’s stock jumped nearly 14% in early Thursday trading, adding about $6 billion to its market value.

Let’s continue.

“I'm very, very optimistic on this next few years…We've got a repeatable playbook now that we can launch in these new markets and get them to contribution margin positive. And so we're going to keep doing that in more markets.”

Coinbase is signaling plans for continued expansion. Already serving over 100 countries, the next logical step is bringing its full suite of products to new territories.

“And we like to say that onchain is the new online. It's a little bit like the early 2000s when every company had to figure out how to adapt to the Internet. Up to 10% of global GDP could be running on crypto rails by the end of this decade and Coinbase is going to be the preferred partner to come in and build this for many of the companies out there because we have the most trusted and scalable infrastructure with the longest track record.”

The global GDP is currently estimated to be a little over $100 trillion, potentially around $115 trillion. That would mean $15 trillion running on crypto over the next few years.

“So, 2025 is going to be about growing revenue with our existing products. It's going to be about driving utility in these new categories where crypto is getting to scale. And it's going to be about building the foundations to power this next decade of growth.”

Coinbase is in part referring to Base and Ethereum among other things.

“We also have a stretch goal to make USDC the number one dollar stablecoin. We're very bullish on stablecoins. We think USDC has a network effect behind it and the compliant approach that they've taken is, I think, going to be really defensible long term.”

USDC is currently just over a third of the size of USDT. While the gap has narrowed somewhat, it's still significant, and Tether continues to grow rapidly.

“And we're also solidifying Base as the number one chain for building — for start-ups to build on chain and large companies.”

Base earning some recognition.

“We're going to continue to support StandWithCrypto.org, hopefully get that to 4 million advocates by the 2026 midterms.”

This initiative will have lasting impacts for years to come. This will directly play into states buying Bitcoin and passing their own crypto-friendly laws.

“I mean we're really entering a golden age for crypto here. The opportunity in front of us is unprecedented to update the financial system and increase economic freedom around the world. The regulatory overhang is lifting. Governments are leaning in, and we're shaping the next chapter of crypto from trading to payments to consumer apps and beyond. 2025 is going to be a very good year.”

To succeed long-term in this market, you need to A) stay optimistic and B) listen to the right voices. Brian Armstrong’s statement that we are entering a golden age should be all the evidence needed to show that we are in fact on the brink of a major shift, despite all the current noise in the market. Armstrong’s confidence, coupled with Coinbase's steady growth, signals that the crypto space is healthy and evolving into something more stable and mainstream.

Here a few other memorable moments within the transcript:

“I’m also pretty interested in tokenized securities and equities, the traditional securities and equities out there. I think that it offers a lot of promise to consumers around being able to trade 24/7. People internationally who maybe don't have easy access to this being able to trade and trading fractions of a share. The clearing and settlement could happen real time. A number of kind of fee takers in the middle could be — it could be the whole thing could be simplified and optimized if it was happening onchain because crypto is a way to update the financial system…And tokenizing real-world assets or traditional securities. I mean eventually, real estate, the debt markets like private credit, everything should come onchain.”

Brian Armstrong wouldn't mention his interest in tokenization unless he and his team were actively exploring it. I fully expect to see COIN tokenized, along with other equities, as this trend evolves over time.

“Today, only about half of 1% of global GDP is running on crypto rails, but we think that that could expand dramatically by the end of the decade. And that starts—where things start to get really exciting as this is a foundational account you might have for your participation in the global economy.”

This helps clarify the earlier point about GDP. Essentially, Coinbase is predicting a roughly 10x increase in the portion of global GDP running on crypto rails. You could argue that the CEO of the largest and most trusted exchange in the U.S. is biased, or you could believe he simply understands the market better than anyone else. The choice is yours. Despite the uncertainty in the market, with the memes and scams to go along with it, I'm staying optimistic for 2025 and will continue to focus on the voices I trust, which I’ll keep highlighting here.

Bitcoin Thoughts And Analysis

Bitcoin has been the same price for two weeks. Nothing to do but wait.

Legacy Markets

Global stocks climbed as U.S. and Russian officials met in Saudi Arabia to negotiate an end to the three-year war in Ukraine. The S&P 500 and Nasdaq 100 futures rose, while Europe’s Stoxx 600 hovered near record highs, driven by gains in defense stocks such as Rheinmetall AG and Dassault Aviation SA. Emerging-market equities also hit a three-month high.

Despite optimism over peace talks, European bond yields continued to rise, with German 10-year bund yields reaching their highest levels in over two weeks due to expectations of increased defense spending. In the U.S., 10-year Treasury yields also climbed as markets reopened after Monday’s holiday.

Investor sentiment remained bullish, with a Bank of America survey showing that global stocks are the most popular asset class among fund managers, while cash levels dropped to their lowest since 2010.

In premarket moves, Intel shares gained following reports that TSMC and Broadcom are considering deals that could reshape the U.S. chip giant. Meanwhile, Delta Air Lines fell after one of its jets flipped upon landing in Toronto, and InterContinental Hotels Group declined after disappointing results.

Markets are now shifting focus to the Federal Reserve’s rate path, with Governor Christopher Waller signaling that rates may remain on hold until inflation shows more progress. The dollar strengthened against G-10 currencies following his comments.

Gold extended gains, trading near $2,910 an ounce after Goldman Sachs raised its year-end target to $3,100. The metal has surged nearly 11% this year as investors seek safety amid economic and geopolitical uncertainties.

Some of the key events this week:

Canada CPI, Tuesday

New Zealand rate decision, Wednesday

UK CPI, Wednesday

US FOMC minutes, housing starts, Wednesday

China loan prime rates, Thursday

Eurozone consumer confidence, Thursday

G-20 foreign ministers meet in South Africa, Thursday - Friday

Reserve Bank of Australia Governor Michele Bullock and officials testify to parliamentary committee, Friday

Japan CPI, Friday

Eurozone HCOB manufacturing & services PMI, Friday

UK S&P Global manufacturing & services PMI, Friday

US S&P Global manufacturing & services PMI, Friday

Bank of Canada Governor Tiff Macklem speaks, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.3% as of 6:44 a.m. New York time

Nasdaq 100 futures rose 0.3%

Futures on the Dow Jones Industrial Average rose 0.1%

The Stoxx Europe 600 rose 0.1%

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index rose 0.1%

The euro fell 0.2% to $1.0463

The British pound fell 0.2% to $1.2601

The Japanese yen fell 0.1% to 151.72 per dollar

Cryptocurrencies

Bitcoin fell 0.8% to $95,599.51

Ether fell 3.3% to $2,684.59

Bonds

The yield on 10-year Treasuries advanced three basis points to 4.51%

Germany’s 10-year yield advanced two basis points to 2.51%

Britain’s 10-year yield advanced three basis points to 4.55%

Commodities

West Texas Intermediate crude rose 1.2% to $71.56 a barrel

Spot gold rose 0.5% to $2,912.05 an ounce

Elon Musk Is Attempting To Audit Fort Knox

First, if Elon does manage to secure clearance to audit Fort Knox, I hope every ounce of gold is accounted for—because if any is missing, it would guaranteed rattle markets in the short term. Second, the fact that an audit is even necessary, regardless of the outcome, only reinforces the case for Bitcoin. Unlike gold, Bitcoin’s supply is fully transparent and verifiable on the blockchain by anyone, anywhere, 24/7. According to the World Gold Council, the United States held the largest gold reserves in the world at the end of 2024, with over 8,100 tonnes valued at $425 billion. Sen. Rand Paul, R-Ky., who first suggested the idea to Elon, has been trying to audit the gold for over a decade without success. American people deserve transparency.

Argentina’s Stock Market Plummets

It’s no surprise that Argentina’s stock market is rattled, given the concerns over criminal investigations into Javier Milei and the possibility of impeachment. In other news, Bubble Maps, a popular account that visualizes blockchain data, has claimed with high confidence that the same team behind Melania Coin was also behind Libra. This is just the beginning, as there are other high-profile meme coins, connected to the same group, that appear to be scams, with insiders profiting at the expense of retail investors.

Public State Funds Are Buying Strategy

Several U.S. state funds have significantly increased their holdings in Strategy, signaling growing demand for Bitcoin exposure. SEC filings from Q4 2024 show at least 12 states, including California, Florida, and Texas, collectively hold $330.5 million in Strategy shares. California’s State Teacher’s Retirement System and Florida’s State Board of Administration are among the largest holders. This surge in investment aligns with Strategy’s continued Bitcoin accumulation, which reached 478,952 BTC—now worth over $46 billion.

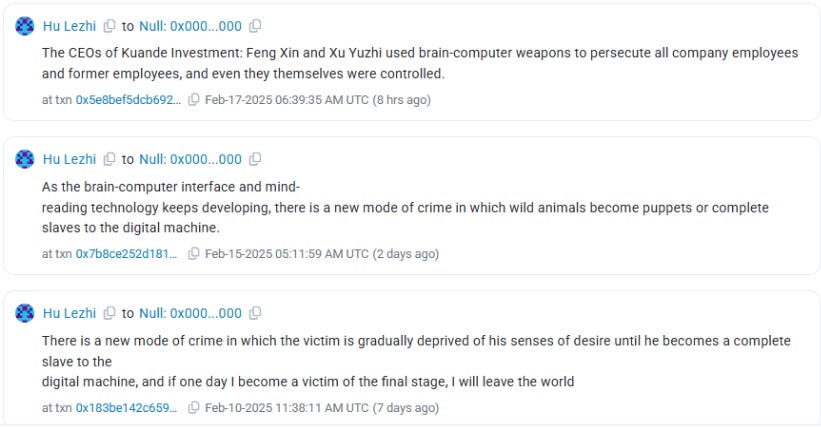

An ETH Whale Made A Bizarre Statement On-Chain

Hu Lezhi, a Chinese programmer, burned 603 ETH ($1.65M) via a burn address and donated 1,950 ETH ($5.35M) to Wikileaks and Ukraine while making allegations against Kuande Investment CEOs Feng Xin and Xu Yuzhi. In on-chain messages, he accused them of using “brain-computer weapons” on employees and former employees. Also known as WizardQuant, Kuande Investment is a hedge fund focused on quantitative trading. I’m not a doctor, but I’d venture to say this individual likely needs a mental evaluation at the very least.

Crypto Bulls Are Giving Up, Is Bitcoin In Danger? | Macro Monday

Join Noelle Acheson, Lawrence Lepard, Dave Weisberger, and Mike McGlone, as we break down what's happening in macro and crypto!

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.