Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

In This Issue:

Is Thomas Lee Ethereum's Michael Saylor?

Aptos Weekly Review

Bitcoin Thoughts And Analysis

Altcoin Charts

Stocks Climb As Strong US Data And Earnings Boost Market Confidence

Coinbase Rebrands Its Wallet

The White House Is Considering Tax Exemptions On Crypto

This Is What A Bubble Looks Like

Altcoins Pump Hard - Will Trump Make Crypto History This Week? | Mark Yusko

Is Thomas Lee Ethereum's Michael Saylor?

Ethereum’s prayers have been answered.

Outside of Satoshi Nakamoto, no one commands more reverence in the Bitcoin community than Michael Saylor. He headlines every event he attends, draws massive crowds, earns the respect of lawmakers, and has become the embodiment of BTC conviction. Strategy hasn’t just accumulated nearly 3% of Bitcoin’s total 21 million supply – it set the industry standard, inspired millions, and quite literally carried two bull runs on its back.

Ethereum has never had a Saylor – or anyone even close. Vitalik is a brilliant technical mind, but he’s not built to lead a charge. Even he admits his shortcomings, often citing his commitment to keeping Ethereum decentralized and leaderless by design. The lead developers don’t speak Wall Street’s language, and the Ethereum Foundation has long felt fragmented and, at times, incompetent. Over time, the community gradually lost sight of its mission. Combine that with the complexity of the tech and constantly shifting narratives, and it’s clear: Ethereum has lacked a clear, unifying voice.

All of that changed three weeks ago.

Ethereum has found its Michael Saylor – and his name is Thomas Lee.

When the news first broke, the reaction was simple: “this is big.” But few grasped just how monumental it truly was.

Meet Thomas Lee – Ethereum’s answer to Michael Saylor.

Tom Lee isn’t just another Wall Street analyst – he’s one of the most respected macro strategists in the game, with a loyal institutional following. As Co-Founder and Head of Research at FS Insight (a division of Fundstrat), Tom built his reputation by not only talking the Wall Street talk – but consistently walking it.

He’s known for calling major trends early – from digital assets and AI to tech and demographic shifts – and his research regularly shapes how big-money investors think. Before founding Fundstrat, Tom spent over a decade as Chief Equity Strategist at J.P. Morgan. He’s also a CNBC favorite – a regular guest whose insights dominate clips circulating across financial media.

In short: he’s the real deal – everything Ethereum has lacked, and then some.

Ethereum has been missing a unifying voice, a steady hand, and a face that Wall Street trusts. Out of nowhere, Tom Lee filled that void. And while it would be unfair to call him Ethereum’s sole savior – this surge of momentum is clearly the result of a broader movement, including figures like Joseph Lubin of Consensys, the renewed energy of SharpLink, and a more public-facing effort by Vitalik, the Foundation, and core developers – it’s Tom who has the potential to send ETH multiples higher.

Because if there’s anyone in this lineup who can do for Ethereum what Michael Saylor did for Bitcoin, it’s Tom Lee. And let’s be honest – the man can bull post with the best of them.

Look at this:

“At BitMine, we have surpassed $1 billion in Ethereum holdings, just seven days after closing on the initial $250 million private placement. We are well on our way to achieving our goal of acquiring and staking 5% of the overall ETH supply.”

The current ETH supply stands at 120.7 million. To control 5% of that, BitMine would need to acquire and stake around 6 million ETH – an ambitious goal that would instantly make it the second-largest validator in the ecosystem. For context, Lido leads with 9.1 million ETH staked, while Binance is next with 2.9 million. Hitting this scale would give BitMine real influence over Ethereum’s future direction.

Any guesses on how much ETH BitMine has right now?

They hold 300,657 at $3,461.89 per ETH.

They’d need to buy roughly 20 times more ETH than they currently hold to reach that 6 million mark. Let that sink in for a moment.

It’s going to take some serious fire power to pull off that kind of growth.

And then this news dropped:

Tom Lee has been on the public ETH train for just three weeks – and somehow, some way, he’s already captured legendary investor Peter Thiel. Holy cow. I get that Saylor looked crazy when he started – and Tom Lee does too – but Ethereum remains largely untapped when it comes to companies buying up its supply. There’s no MicroStrategy here that’s a hundred miles ahead. This is a competition, folks.

Tom Lee and Joseph Lubin are neck-and-neck at the moment and headlines continue to roll in…

We’ve had years to witness the glory of Saylor evangelizing Bitcoin – and we’re only three weeks into what could be Tom Lee doing the same and more for Ethereum. The community seems to like it, the price seems to love it, and Wall Street finally seems to be on board.

(Not to be a party pooper, but ETH treasury companies raising debt to buy ETH and pulling financial engineering stunts are no better than BTC treasury companies doing the same. I’m thrilled ETH is back on track, but let’s be honest – this is classic bubble behavior. What applies to BTC also applies to ETH, SOL, and every other asset. Still, my gut says it’s all a worthy trade-off.)

What’s fair is fair. (I’ll never not share my opinion.)

And speaking of fair – I can’t talk about Ethereum without calling out the massive inflows the ETF has seen over the past few days and weeks:

This is what Matt Hougan said in response to that post:

“We're 11 trading days into the half and ETH ETFs have already picked up $2.3 billion in flows. This prediction was way out-of-consensus 10 days ago. Now it looks bearish.”

ETH decided to make up for years’ worth of bad news in one day.

If you’re an ETH holder, congrats – you’ve endured the hardships, and you’ve earned these gains. Tom Lee is a force to be reckoned with, and any coin can only hope to find an advocate with that level of conviction and dedication. The ripple effects Saylor created for Bitcoin over the years are about to play out once again – this time, on an entirely different coin that’s 18% the size, in the middle of the bull market.

That’s a statement I know the crypto space doesn’t yet grasp – and pure alpha for those who made it all the way to the end.

Hope you all had a killer week. If you’re a long-term holder, put down your phone, close your portfolio, and go touch some grass. This thing is just getting started – and I know it would serve you all well to step back and take a breather.

Aptos Weekly Review

For those that don’t know, Aptos - one of the most exciting layer 1 blockchain competing with Solana and Ethereum - is an official sponsor of this newsletter! Over the past few months, I’ve had the chance to get to know the Aptos team, create content with them, and watch this project accomplish incredible things.

Each week, I provide an Aptos review, showcasing all the exciting announcements and milestones the network is achieving. This week, I want to start with a research report put together by Blockworks on Aptos.

Read how bullish this is:

“Since the publication of our prior report on Aptos in September 2024, Aptos has demonstrated notable growth in ecosystem traction in combination with continued improvements on its technical infrastructure… Additionally, the introduction of Zaptos and Shardines offer continued architectural improvements through parallelization and pipelining, allowing Aptos to maximize resource utilization, improve bandwidth, and reduce end-to-end latency. These technical improvements position the chain to offer best-in-class infrastructure for high-volume financial activity, forming the foundation for a global trading engine.”

That’s high praise.

Here’s a few snapshots of Aptos’s ecosystem activity:

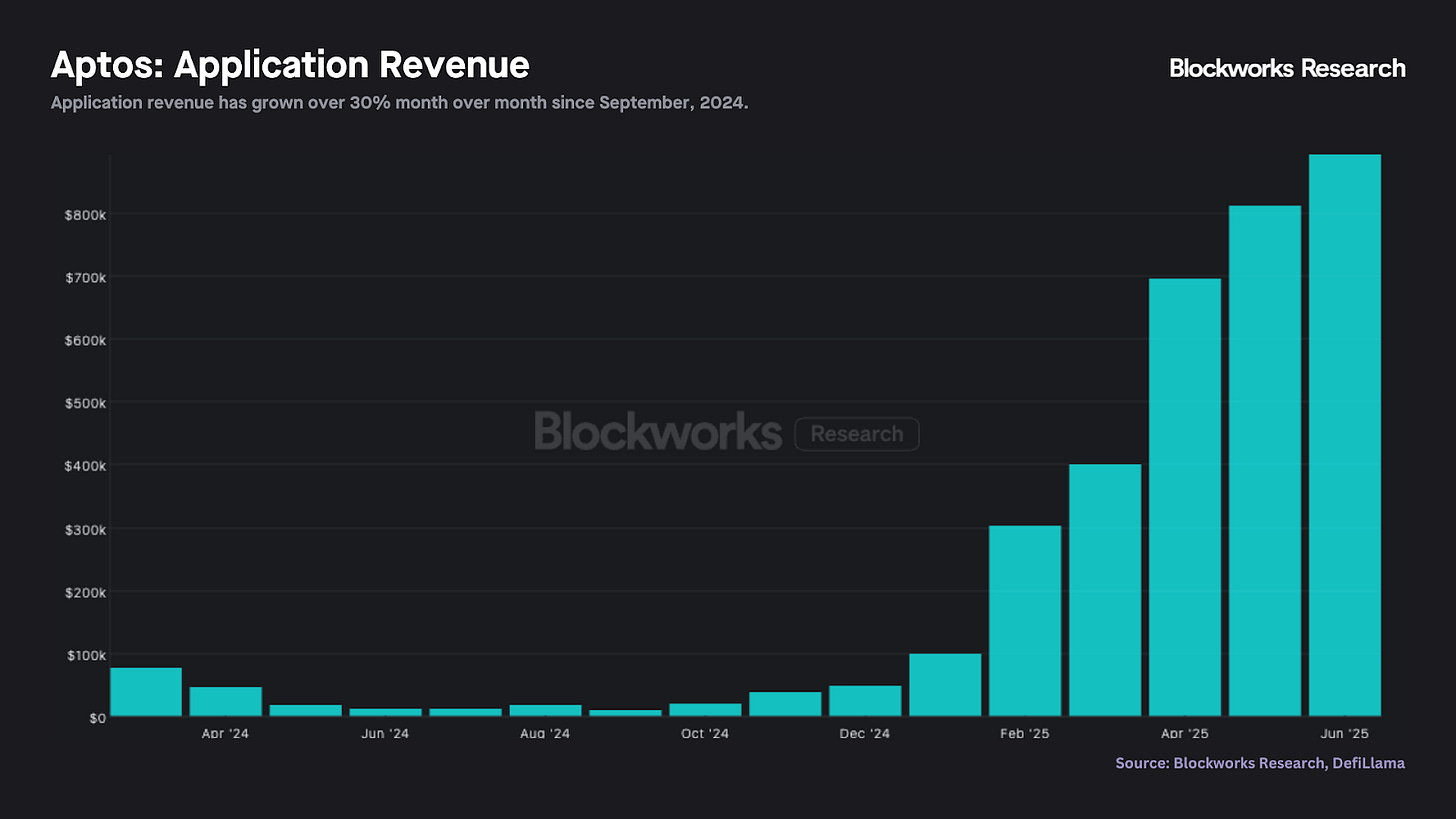

“Aptos exhibits increasing utilization of its high performance environment, evidenced by DEX volumes and application revenue growing notably month over month and each having reached new all-time highs in June. While green shoots abound, utilization on the network remains far below its theoretical capacity. Aptos is further positioning its technical stack as best-in-class amongst high-performance L1s to settle high-volume financial use cases. At large, technical upgrades, growing DEX volumes, and an increasing supply of stablecoins, BTC, and RWAs on the chain further position it to grow into the global trading engine it has set out to become.”

Anyways, that is all for this week, make sure to show Aptos some love - they’re a huge reason this newsletter remains free!

Bitcoin Thoughts And Analysis

Bitcoin is consolidating and altcoins are having fun. Enjoy the ride.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

Stocks Climb As Strong US Data And Earnings Boost Market Confidence

Global stocks extended gains Friday, buoyed by optimism around the U.S. economy’s strength and better-than-expected earnings. European shares rose 0.4%, while S&P 500 and Nasdaq 100 futures edged 0.1% higher after both indexes posted record closes. Crypto markets also surged past a $4 trillion market cap, powered by altcoin momentum and pro-crypto legislation.

The dollar slipped 0.2% after Fed Governor Christopher Waller supported a potential July rate cut, though markets remained skeptical. Treasury yields dipped slightly, with the 10-year at 4.44%. Investors shook off midweek volatility over fears Trump might fire Fed Chair Jerome Powell, focusing instead on resilient data and earnings.

S&P 500 companies are projected to see Q2 earnings rise 3.2%, ahead of estimates. Netflix exceeded expectations across the board and raised its full-year guidance, while American Express and 3M were set to report. Despite bullish sentiment, Bank of America flagged a possible bubble if stocks continue rising amid high yields and inflation.

Analysts expect risk assets to stay strong through July, with potential softness in employment data next month. Key corporate highlights included a disappointing FDA panel outcome for GSK, an $18% drop in Sarepta after a gene therapy death, and Reckitt’s $4.8B homecare divestiture.

Stocks

The Stoxx Europe 600 rose 0.4% as of 10:52 a.m. London time

S&P 500 futures rose 0.1%

Nasdaq 100 futures rose 0.1%

Futures on the Dow Jones Industrial Average rose 0.1%

The MSCI Asia Pacific Index rose 0.5%

The MSCI Emerging Markets Index rose 0.7%

Currencies

The Bloomberg Dollar Spot Index fell 0.2%

The euro rose 0.3% to $1.1634

The Japanese yen was little changed at 148.71 per dollar

The offshore yuan was little changed at 7.1820 per dollar

The British pound rose 0.2% to $1.3438

Cryptocurrencies

Bitcoin fell 0.4% to $118,999.08

Ether rose 5.8% to $3,621.66

Bonds

The yield on 10-year Treasuries was little changed at 4.44%

Germany’s 10-year yield advanced two basis points to 2.70%

Britain’s 10-year yield advanced two basis points to 4.67%

Commodities

Brent crude rose 1.2% to $70.37 a barrel

Spot gold rose 0.4% to $3,353.13 an ounce

Coinbase Rebrands Its Wallet

Coinbase has officially launched the Base App, rebranding its Coinbase Wallet into an ambitious all-in-one “everything app” that fuses social media, payments, trading, and mini-apps. Introduced during its “A New Day One” event, the Base App completes the trifecta of Coinbase’s Base ecosystem: Base Chain (an Ethereum Layer 2), Base Build (developer infrastructure), and now Base App (a consumer gateway).

Currently in beta for waitlisted users, the app packs features like tokenized social posts, live trading feeds, embedded mini-apps, encrypted messaging, and tap-to-pay USDC payments. It also debuts Base Pay, enabling fast USDC checkouts—starting with Shopify integrations—and smart wallets designed to work across apps and blockchains.

Coinbase’s vision is to make onchain activity intuitive and seamless, letting users post, earn, and transact from one unified platform. A broader release is expected after the beta period.

The White House Is Considering Tax Exemptions On Crypto

This news was overshadowed by everything else going on yesterday, but that doesn’t make it any less important. Here’s the quote:

“The president did signal his support for de minimis exemption for crypto and the administration continues to be in support of that. We are definitely receptive to it, to make crypto payments easier and more efficient for those who seek to use crypto. As simple as buying a cup of coffee. Of course, right now, that cannot happen, but with the de minimis exemption, perhaps it can in the future and we will continue to explore legislative solutions to accomplish that.”

This would be huge for the entire industry - advancing the most basic use case for these assets: simply using them for payments.

This Is What A Bubble Looks Like

Just when it seemed like the treasury bubble might’ve topped out with Bitcoin, Ethereum, Solana, BNB, and maybe XRP – crypto found a way to outdo itself.

Bit Origin Ltd (NASDAQ: BTOG) has revealed plans to raise up to $500 million through share sales and convertible debt to launch a Dogecoin treasury strategy. The goal? Become one of the largest publicly traded holders of DOGE. The company cites fast settlement, a loyal community, and the potential for integration into platforms like Elon Musk’s X Money as key drivers of the move.

CEO Jinghai Jiang says this marks Bit Origin’s pivot from mining to full-on engagement with digital asset ecosystems – with Doge leading the way. He views Dogecoin as a symbol of cultural optimism and decentralized utility. The company has already raised $15 million to begin accumulation, and future plans include DOGE-focused services like miner tools and payment infrastructure.

Altcoins Pump Hard - Will Trump Make Crypto History This Week? | Mark Yusko

Altcoins are ripping and “Crypto Week” is officially back on after the House broke a 10-hour standoff to advance the biggest crypto bills in years. The GENIUS Act heads to a floor vote today, and momentum is surging across the market. Ethereum ETFs just posted record inflows, Bitcoin hit a new all-time high, and Trump memecoins are unlocking with a $100M windfall.

I’m joined at 9 am EST by Mark Yusko and Edan Yago to break down what this means for regulation, markets, and the next crypto supercycle.

In the second part of the show, Dan from The Chart Guys will share his market analysis and some trades.

My Platforms And Sponsors

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

The Wolf Pack - My new Telegram group where I share daily updates on everything I'm watching and chat directly with all of you. Completely free to join.

The Crypto Advisor - My weekly newsletter for registered investment advisors, combining macro trends, Wall Street insights, and crypto – all in one place..

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis!

Blofin - Blofin is offering our Telegram members a $30 Bonus + 50% Spot Discount when they sign up for The Wolf Pack.

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Peoples Reserve - Use Bitcoin as pristine collateral with Peoples Reserve - where wealth is built smarter through Bitcoin-powered finance.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.