Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Arch Public Algorithms absolutely CRUSH the markets. Over the past 90 days here is the performance of our Nasdaq Algorithms:

NQ: +47%

MNQ: +41%

Our algos are out of the market nearly 90% of the time, meaning our returns are strategic and risk averse. Liquid, hands free, and stop loss protections.

Try Arch Public now! You can even demo the platform, for free, to learn more.

In This Issue:

Don't Cry For Me, Argentina

Bitcoin Thoughts And Analysis

Legacy Markets

This Middle Eastern Sovereign Wealth Fund Bought Bitcoin

Coinbase Smashes Successful Earnings

This California Pension Fund Is Buying MSTR

New Crypto Laws & CBDCs: What It Means for Bitcoin’s Future | Chris & Luke Giancarlo

Don't Cry For Me, Argentina

What we’re witnessing right now is the proliferation of blatant scams on an unprecedented scale—scams that have nothing to do with memes, decentralization, or any real innovation. This is pure opportunism at its worst, exploiting hype, speculation, and ignorance at the expense of retail investors.

On Friday evening, at 5:01 pm ET, Javier Milei, the president of Argentina—the third most populous country in South America—posted the following (translated from Spanish):

As insane as this post was, it turned out to be real. Reputable Argentine politicians shared it as well, and the link directed users to a seemingly legitimate website—which is still live, as I’ll show below.

The website is nothing more than a collection of vague statements encouraging small projects, entrepreneurs, and local businesses to apply for funding.

The only clickable element on the entire page? A Google Docs form.

The token distribution provided appears to be put together by a fourth grader.

Crypto Twitter sleuths quickly uncovered that the website was thrown together just hours before launch, registered for only a year, with no public ownership information and multiple restricted domain statuses.

What makes this scam especially insidious is that it didn’t just wipe out retail investors—it likely misled countless Argentinians into believing they were applying for real government support.

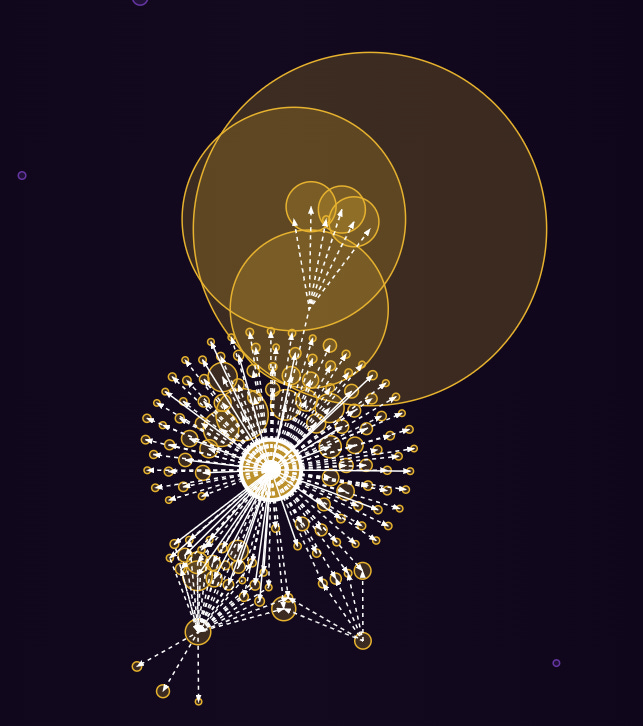

It took less than three hours for $LIBRA insiders to start dumping. Unlike Trump’s coin, which had at least some transparency around token holders and supply distribution, $LIBRA had none. According to Bubble Maps, a popular tool for analyzing token distribution, 82% of the supply was concentrated in a single cluster—a textbook setup for a massive rug pull.

You can verify this for yourself HERE.

During these first three hours, $87.4 MILLION of the token was sold, causing the token to drop 90% from a $4.6 billion market cap. It was such a blatant scam, with such an immense amount of backlash, that is caused Javier Milei to post the following a few hours later.

I did the math, and in this response, there is zero accountability, zero remorse, and zero f**ks given from me.

That said, this is where things start to get murky. I won’t name names, but if you dig around on X, you’ll find at least a handful of so-called experts—traders who claim to be deep in the trenches—either admitting or being called out for knowing about $LIBRA weeks in advance. Ironically, I think many of them lost money on $LIBRA themselves because they didn’t realize they were getting rugged right alongside retail.

Here’s how it played out: they sat on the information, waited for $LIBRA to drop, promoted it to their followers when it did, and then—after getting burned—made videos about what they supposedly lost and learned.

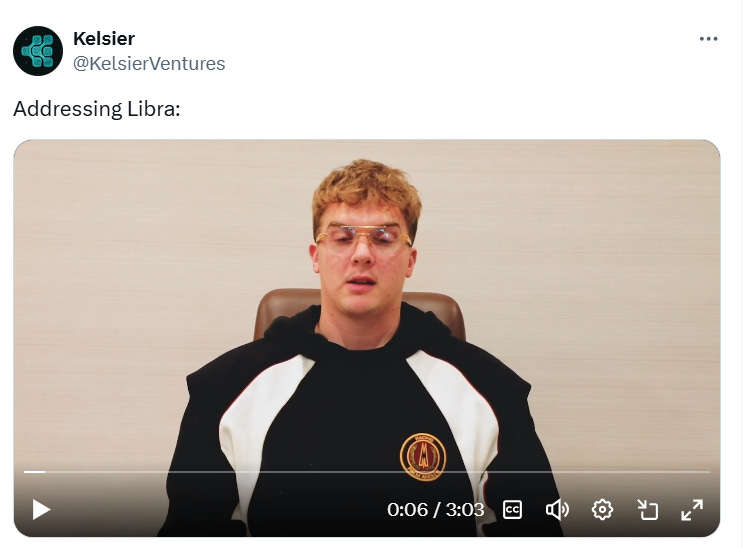

One name I will mention is Hayden Davis, who came forward with a video explaining some of what happened with $LIBRA. In it, he openly admitted that his plan is to take the funds collected from the launch and put them back into $LIBRA. He even encouraged wallets and exchanges to do the same, claiming it would turn the token into “a success story.” Yeah, sure.

What’s even more unbelievable is that Hayden’s statement blames the president for pulling out of Libra, causing a “wave of panic selling.” Neither of the responsible parties wants to take responsibility.

I've invited another one of the culprits, Julian to share more—let's see if he takes me up on it.

The backlash, as you can imagine, has been immense, and now criminal investigations are fully underway—as they should be. That said, I’m not so hopeful everyone that should be held accountable will be.

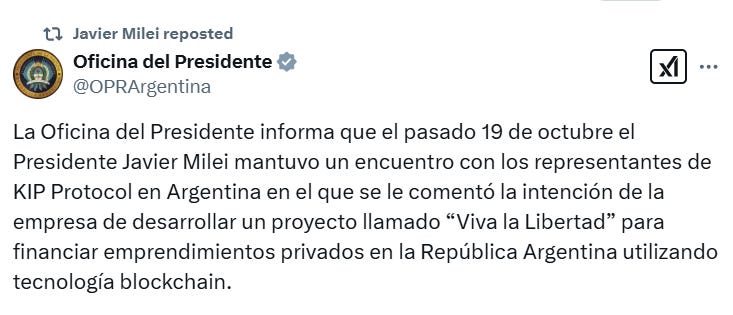

Essentially, the Argentine equivalent of the White House released a lengthy statement confirming that an investigation is underway. It reads:

"The Office of the President reports that on October 19, President Javier Milei held a meeting with representatives of KIP Protocol in Argentina, where he was informed of the company's intention to develop a project called ‘Viva la Libertad’ to finance private ventures in the Argentine Republic using blockchain technology.”

For those worried that justice may not be served in Argentina, there’s something else brewing beyond its borders…

A Reuters article made the case that the opposition party is threatening impeachment.

Here’s how I see it: retail got screwed by their trusted KOLs, who got screwed by the insiders behind the scam, who are now getting screwed for trying to screw over the president—who was willing to screw his own people. Got it?

I’m sure there’s more to come on this story, but I’ll leave it at that for now. What we can all agree on is that this is an undeniably bad look for crypto. While there may be debate over whether Trump’s coin is good or bad, the Libra case leaves no room for argument—everyone can objectively agree it’s a disaster.

The biggest issue with Trump’s coin is that it’s opened Pandora’s box, inspiring bad actors to exploit this new vertical and steal from retail in a more convenient way. Unfortunately, this will keep happening for one simple reason—memecoins still attract massive attention, even when the optics are awful.

It’s also a shame for Solana, which, by becoming the de facto chain for memes, has also become the de facto chain for outright scams. But blaming Solana wouldn’t be fair—at the end of the day, it’s just technology. We didn’t blame Tornado Cash, so we can’t blame Solana. Solana will be fine, but if this situation bothers you, maybe stick to Bitcoin or Ethereum to avoid the drama for now. The wave of politicians and celebrities launching memecoins will eventually run its course, but for now, it’s still scam season.

History won’t look fondly on 99% of those who launch coins. If this is what it takes to learn the hard way, then so be it—but I’ll be avoiding the trenches like the plague. The only way to “win” in this space right now seems to be by stealing from your neighbor. Stick to buying assets with a sound purpose—ones that solve real-world problems and will still be valuable five or ten years from now.

Also, credit to Dave Portnoy for recognizing the situation and doing the right thing. He’s had a wild ride in this space—I’ve covered it since day one—but I have to give him props for handling a bad situation the right way.

“I can't accept coins if you don't f**king let me say you gave me coins, and I'm part of the project. So, I literally sent the coins back. This is all going on before any of this shit — before I knew this was a disaster.”

Portnoy was given six million coins by the founder to promote Libra—but instead, he returned them all. We’re clearly in a very different time than just a few months ago, but it’s not a free-for-all—there are still laws and consequences.

Bitcoin Thoughts And Analysis

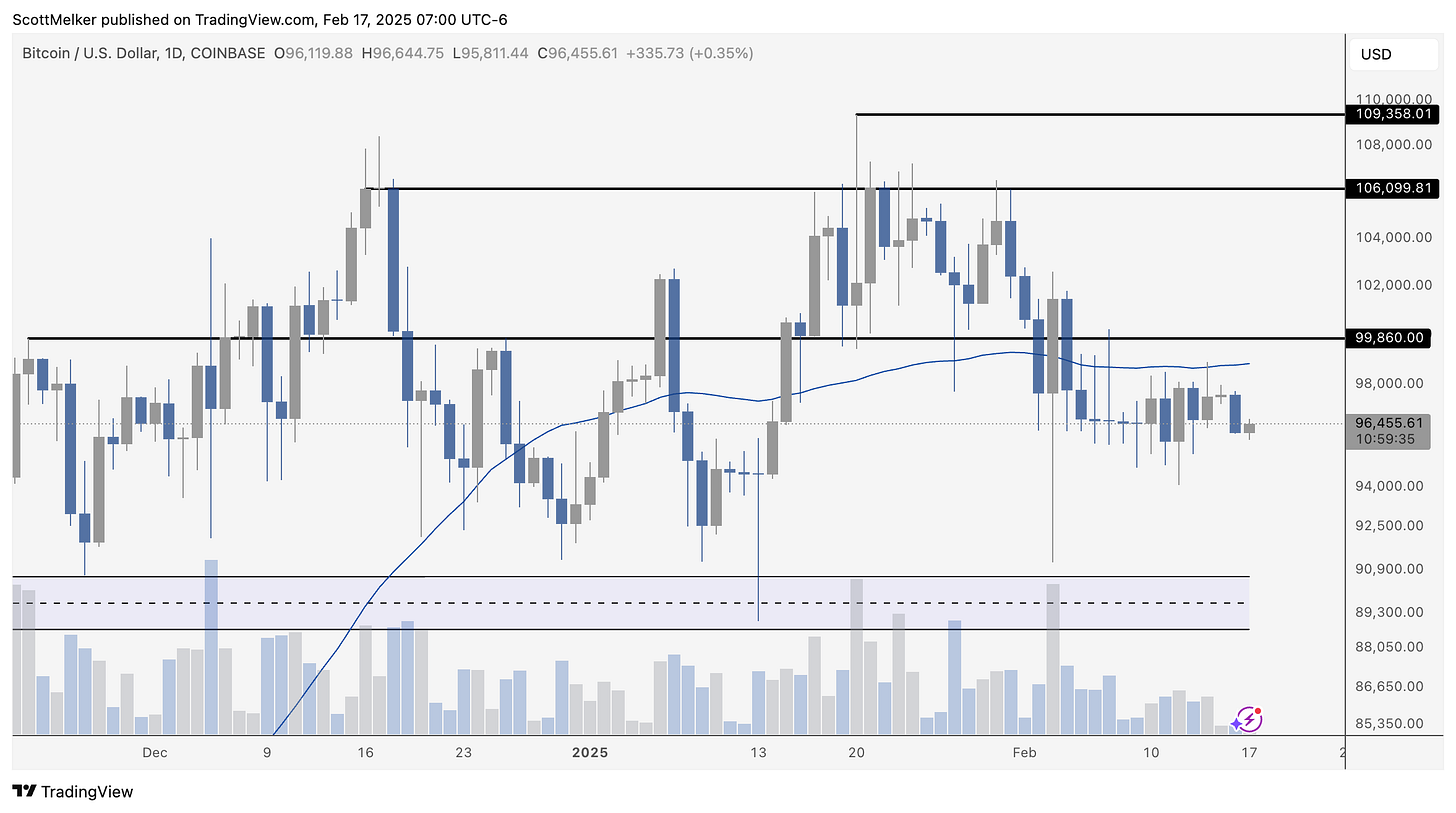

DAILY CHART

Boring and sideways. Go touch grass.

Legacy Markets

European stocks climbed, led by defense companies, as investors bet on increased military spending amid growing geopolitical tensions. Rheinmetall AG and Saab AB surged, pushing a Goldman Sachs index of European defense shares to a record high. Meanwhile, European bond yields rose as expectations grew that governments would need to ramp up borrowing to fund military upgrades and support Ukraine.

German, French, and Italian bonds slipped, with 10-year bund yields reaching their highest levels in over two weeks. EU leaders are working on a major defense package as the bloc realizes it may need to rely less on U.S. military support. Bloomberg Economics estimates that upgrading defense and protecting Ukraine could cost Europe’s major powers $3.1 trillion over the next decade.

Market sentiment also improved on optimism over China, where a meeting between President Xi Jinping and key business figures, including Jack Ma, raised hopes that Beijing’s crackdown on the private sector may be easing.

In currency markets, the yen strengthened against all G-10 peers after Japan’s economy grew faster than expected, reinforcing expectations of rate hikes from the Bank of Japan. Meanwhile, the Bloomberg Dollar Index held steady after two days of losses.

Some of the key events this week:

Presidents Day holiday in the US; bond and stock markets are closed, Monday

Australia rate decision, Tuesday

UK jobless claims, unemployment, Tuesday

Bank of England Governor Andrew Bailey speaks, Tuesday

Canada CPI, Tuesday

New Zealand rate decision, Wednesday

Indonesia rate decision, Wednesday

UK CPI, Wednesday

South Africa CPI, retail sales, Wednesday

US FOMC minutes, housing starts, Wednesday

Australia unemployment, Thursday

China loan prime rates, Thursday

Eurozone consumer confidence, Thursday

G-20 foreign ministers meet in South Africa, Thursday - Friday

Reserve Bank of Australia Governor Michele Bullock and officials testify to parliamentary committee, Friday

Japan CPI, Friday

Eurozone HCOB manufacturing & services PMI, Friday

UK S&P Global manufacturing & services PMI, Friday

US S&P Global manufacturing & services PMI, Friday

Bank of Canada Governor Tiff Macklem speaks, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 rose 0.4% as of 12:04 p.m. London time

S&P 500 futures rose 0.2%

Nasdaq 100 futures rose 0.2%

Futures on the Dow Jones Industrial Average rose 0.1%

The MSCI Asia Pacific Index rose 0.6%

The MSCI Emerging Markets Index rose 0.4%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro fell 0.1% to $1.0479

The Japanese yen rose 0.5% to 151.53 per dollar

The offshore yuan was little changed at 7.2629 per dollar

The British pound rose 0.1% to $1.2599

Cryptocurrencies

Bitcoin fell 1.1% to $96,158.36

Ether rose 2.7% to $2,760.26

Bonds

The yield on 10-year Treasuries was little changed at 4.48%

Germany’s 10-year yield advanced six basis points to 2.49%

Britain’s 10-year yield advanced five basis points to 4.55%

Commodities

Brent crude fell 0.2% to $74.61 a barrel

Spot gold rose 0.6% to $2,900.13 an ounce

This Middle Eastern Sovereign Wealth Fund Bought Bitcoin

What would have been the intro for today was quickly drowned out by news of Abu Dhabi’s sovereign wealth fund, Mubadala Investment Company, disclosing a $437 million stake in BlackRock’s iShares Bitcoin Trust ETF, representing 0.14% of its $302 billion portfolio. The significance of this development lies in the fact that several similar sovereign wealth funds in the region collectively manage $1.6 trillion. Imagine the impact on Bitcoin’s price if Mubadala increases its position to 1%, 3%, or even 5%, with other nearby funds potentially following suit. This move underscores the growing involvement of Gulf nations in Bitcoin investment and marks a pivotal step in the ‘nation-state Bitcoin adoption race.’

Imagine what happens when the 0.14% becomes 1%, then 3%, and then +5%.

Coinbase Smashes Earnings

Donald Trump’s return to the White House has been a boost for Coinbase, helping the company exceed analysts’ Q4 expectations. Coinbase reported earnings per share of $4.68, more than double the $2.11 anticipated, and $2.27 billion in revenue, beating estimates of $1.84 billion. This is a significant jump from the previous year's Q4, where the company reported $1.04 in EPS and $954 million in revenue. Although Coinbase shares dipped 0.9% in premarket trading, they surged 8.4% on Thursday after Robinhood reported a 700% increase in crypto revenue. Investors frustrated or confused by COIN’s price action need to zoom out. The company is thriving, but it’s also facing competition from Robinhood. Both COIN and HOOD will continue to perform well as long as the crypto market trends up.

This California Pension Fund Is Buying Bitcoin

California may not be on the Bitcoin map, which highlights states that have proposed Bitcoin bills in orange, but the second-largest pension fund in the U.S., based in California, has purchased MicroStrategy—and the position has doubled in value.

Here’s a list of all the pension funds in the world:

The number 10 position is held by none other than California State Teachers.

New Crypto Laws & CBDCs: What It Means for Bitcoin’s Future | Chris & Luke Giancarlo

Are we witnessing the biggest financial revolution of our time? In this episode of The Wolf Of All Streets, we dive deep into the future of crypto, blockchain, and financial innovation with former CFTC Chairman Chris Giancarlo and fintech expert Luke Giancarlo. From the impact of central bank digital currencies (CBDCs) to the rise of tokenization, this conversation will challenge everything you think you know about the next phase of money. If you care about the future of finance, you don’t want to miss this one!

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.