The Wolf Den #1140 - Bitcoin Treasury Vs. Bitcoin Balance Sheet

I am advising a company on the latter.

Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

In This Issue:

Bull Market Behavior

Bitcoin Treasury Vs. Bitcoin Balance Sheet

Legacy Markets

Peter Thiel Invests In Tom Lee’s ETH Company

Is Trump Attempting To Fire Jerome Powell

An Update On US Bitcoin Holdings

Will The USA Blow Its Chance With Bitcoin? Unpacking Crypto Week

Bitcoin Treasury Vs. Bitcoin Balance Sheet

It’s not every day I get to quote myself – but once in a while, a story drops and I can’t resist pulling a few highlights.

Here’s what I said in that article:

“Red Light Holland's pivot to Bitcoin after banking challenges is pure grit and vision. This isn't just about smart investments; it's about building a decentralized future where people hold the power. I'm fired up to lead their Bitcoin strategy and help make Red Light Holland a beacon in both psychedelics and crypto.”

As promised in yesterday’s newsletter, here’s more detail on the news that I’m now advising a company on its Bitcoin position. Red Light Holland is adding Bitcoin to its balance sheet – but not the way some so-called Bitcoin treasury companies have done by raising capital, cutting deals with early BTC whales, or piling on questionable debt to financially engineer a position.

Red Light Holland isn’t playing that game. A key part of my role is to make sure their Bitcoin acquisition is sustainable, transparent, and aligned with the long-term health of the business. I’m not here to help them chase headlines – I’m here to help them build a strategy that survives market chaos. That means accumulating responsibly and being able to HODL through thick and thin.

A bit of backstory: I’ve known the CEO, Todd Shapiro, for a few years now – and full disclosure, we’re friends. Below is a podcast episode we recorded nearly five years ago.

One of the reasons Todd became so fascinated by Bitcoin is because his company – which sells psilocybin truffles – was debanked by a tier 1 financial institution. He knows firsthand how difficult it is to run a legitimate, compliant business without reliable access to traditional banking. That experience naturally pushed him to explore Bitcoin as an alternative. And that’s where our paths aligned.

Most companies dipping their toes into Bitcoin treasury strategies are completely in the dark. That’s especially true here: Todd and his team aren’t crypto-native – they’re focused on running a successful business, not scanning X for daily updates or keeping tabs on shifting market dynamics. They don’t have deep industry relationships, they’re new to custody options and security best practices, and they’ve never been through a full market cycle. And let’s be honest – when you’re a company, not an individual, there are smarter, more efficient ways to buy than just punching an order into a retail app. That’s where I come in.

Red Light Holland knows I’m not a licensed financial advisor – and honestly, if they had hired one, that person would probably advise against buying Bitcoin at all and wouldn’t have a clue how to do it properly anyway. What I bring to the table is transparency, experience, and a no-nonsense approach to helping them make informed, strategic decisions. I’m also making sure they understand how unsustainable many corporate Bitcoin acquisition strategies really are – while helping them build something far more thoughtful and resilient.

As the company announced: “Red Light Holland is going to allocate up to around $1.5 million (CAD 2 million) to Bitcoin and related assets. It is exploring the cryptocurrency as a ‘decentralized solution’ to bolster financial resilience.

The company's new balance sheet strategy includes investing up to around $182,000 (CAD 250,000) per tranche. Its initial investment of around $153,000 (CAD 210,000) in a Bitcoin ETF on June 23 has already delivered an impressive return, it said.”

I’ve been outspoken about my concerns with many Bitcoin treasury companies. Yes, some of their activity props up Bitcoin’s price in the short term – but the long-term winners will be companies with strong underlying businesses, solid balance sheets, and responsible strategies. Think Strategy, a few of the leaner public companies that didn’t overextend themselves – and now, Red Light Holland. Because they’re doing it right: accumulating Bitcoin quietly and responsibly while continuing to focus on what they do best.

Also, just to be clear – I didn’t earn anything from sharing this news here. I’m doing it because A) I’m genuinely excited to be part of what I believe is the responsible side of this movement, and B) I want you to clearly see the distinction between Bitcoin treasury companies and businesses that are simply adding Bitcoin to their balance sheet. That distinction is going to matter – especially when the next bear market hits. Trust me, I don’t want to see any of you stuck holding stocks that collapse when the tide inevitably goes out.

If you want to read more on this, click HERE or HERE.

Second on my agenda to cover is this:

Every hour yesterday brought a new headline that seemed to contradict the last.

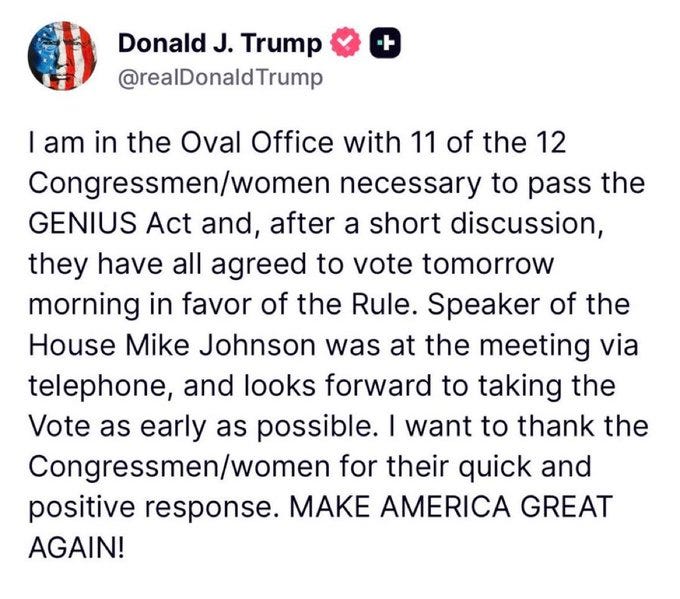

Two days ago was a shit show. Yesterday, the circus started to get its act together. Hopefully, today, everything finally goes according to plan. There’s a lot I could say about what’s unfolded, but I want to focus on one thing: Trump has said – and continues to say – a lot of positive things about this space. That’s become the norm. But the fact that he’s now pulling his party together at a critical moment and getting them on board with crypto? That’s another level of commitment. Honestly, we couldn’t ask for stronger support than this.

Obviously, part of the tension here is that Democrats are opposing the GENIUS Act largely because Trump is going all in on crypto – there’s a clear political conflict of interest. Add to that some Republican resistance over CBDC provisions, and you’ve got a recipe for gridlock. Yet despite all this, it’s remarkable to see the president this aligned with the crypto movement – literally in the trenches, pushing to get these bills passed.

I’ve said all along that passing these bills would be good for alts – but what we’re seeing now in price action goes well beyond a simple Congressional reaction. At this point, we’re in the midst of a full-blown mini alt-season. The outcome in Congress now feels more like it’ll act as a tailwind or headwind, rather than being the main driver of this move.

Also, I know some of you are feeling jittery about ETH’s price action right now – but keep in mind, we’ve barely scratched the surface of a true recovery, especially considering how much pain and stagnation the asset has endured. That’s not to say ETH has to rip immediately, but it could easily charge toward $4,000 or higher in a short span. For context, Bitcoin’s previous all-time high before this bull cycle was $69,000 – ETH’s was around $4,800. There’s still plenty of runway ahead.

There’s been a lot of news lately, which is why my intros have felt a bit chaotic – but that’s the norm in a bull market, and I’m committed to delivering everything that matters to you. All three stories below are juicy, so don’t close out of this newsletter just yet.

Bitcoin Thoughts And Analysis

Bitcoin is consolidating just below $120,000 after Tuesday’s sharp pullback – which came on the highest daily volume since the $74,000 bottom in March – mostly driven by selling. Despite the pressure, price held support cleanly at $117,582 and continues to range tightly, suggesting healthy consolidation after a strong breakout above $112,000. As long as $117,582 holds, the structure remains bullish. A close above $120,000 could ignite the next leg higher.

Markets Rebound As Powell Drama Fades And Dollar Surges

Stocks rose Thursday as fears over Jerome Powell’s job security eased and the U.S. dollar rebounded sharply, gaining 0.4%. Markets were rattled Wednesday by speculation that Trump might replace the Fed Chair, but those concerns subsided after Trump downplayed the idea. Treasury yields ticked higher as traders scaled back expectations for rate cuts in 2025 – now pricing in fewer than two quarter-point cuts.

Meanwhile, strong earnings and guidance from Taiwan Semiconductor boosted confidence in AI-driven growth, lifting sentiment in both European and Asian equities. Corporate resilience is proving to be a stabilizing force, with banks and major firms reporting solid results. PepsiCo beat sales expectations, and GE raised its financial guidance on aviation strength. On the other hand, United Airlines, Elevance Health, and Swatch Group issued downbeat outlooks.

Trump also softened his tone toward China, signaling interest in a summit with Xi Jinping and plans to notify 150 countries of potential 10–15% tariff rates. While the macro backdrop remains supportive, strategists warn inflation remains the key risk ahead.

Stocks

S&P 500 futures were little changed as of 7:04 a.m. New York time

Nasdaq 100 futures were little changed

Futures on the Dow Jones Industrial Average fell 0.1%

The Stoxx Europe 600 rose 0.6%

The MSCI World Index rose 0.1%

Currencies

The Bloomberg Dollar Spot Index rose 0.4%

The euro fell 0.4% to $1.1589

The British pound fell 0.1% to $1.3402

The Japanese yen fell 0.5% to 148.62 per dollar

Cryptocurrencies

Bitcoin fell 1.4% to $118,261.98

Ether rose 2% to $3,450.61

Bonds

The yield on 10-year Treasuries was little changed at 4.46%

Germany’s 10-year yield was little changed at 2.69%

Britain’s 10-year yield advanced two basis points to 4.66%

Commodities

West Texas Intermediate crude rose 0.6% to $66.80 a barrel

Spot gold fell 0.6% to $3,326.23 an ounce

Peter Thiel Invests In Tom Lee’s ETH Company

Legendary investor Peter Thiel – best known for co-founding PayPal and making early bets on Facebook and Palantir – has deepened his involvement in crypto, this time with a clear focus on Ethereum. Entities tied to Thiel have acquired a 9.1% stake in Bitmine Immersion, the publicly traded company I’ve been covering for its bold pivot from Bitcoin mining to building a massive Ethereum treasury. According to a recent SEC filing, Thiel-linked funds now own over 5 million shares.

Bitmine Immersion, which now holds nearly $500 million worth of ETH, is modeling its strategy after Michael Saylor’s Bitcoin-heavy approach at Strategy. Under the leadership of Fundstrat’s Tom Lee, who serves as acting chairman, the company adopted this Ethereum-focused treasury model in June – and its stock price has already jumped 400%. Bitmine argues that accumulating ETH not only boosts shareholder value but also supports the Ethereum network by shrinking the available supply.

Ethereum investors couldn’t have asked for a better endorsement. Following the news of Thiel’s involvement, shares of Bitmine Immersion (BMNR) surged more than 27% in pre-market trading.

Is Trump Attempting To Fire Jerome Powell?

President Trump cannot directly fire Jerome Powell from his role as Chair of the Federal Reserve simply over policy disagreements. Powell, like all Fed Chairs, is appointed to a four-year term and can only be removed “for cause” – meaning serious misconduct or incapacity, not for refusing to cut interest rates on command. I’m no legal expert, but those who are seem to agree: attempting to fire a Fed Chair without cause would likely spark a major constitutional and legal showdown, and could severely undermine the perceived independence of the central bank.

Trump is within his rights to put pressure on Jerome Powell – while some view it as a breach of long-standing norms around Fed independence, others might argue that Powell’s refusal to cut rates is equally irresponsible. Legally, there’s nothing preventing a president from publicly urging the Fed Chair to take action. It’s not illegal – just highly controversial and politically charged.

An Update On US Bitcoin Holdings

Follow along with me, it started with the post above.

This one is blurry, but it will make sense in a moment.

Here’s the response:

There’s more shared on X, so I will summarize here:

When people say the U.S. government is ‘selling their Bitcoin,’ it’s important to understand there’s a key difference between seized assets and forfeited assets.

Seized assets are coins temporarily held by law enforcement agencies (like the FBI or DEA) after being taken during investigations, but they’re not yet officially owned by the government.

Forfeited assets are coins that have legally become government property after court decisions.

The U.S. Marshals Service (USMS) mainly handles forfeited assets - Bitcoin that the government officially owns and can sell. But other agencies might hold seized Bitcoin that isn’t yet government property and therefore can’t be sold.

So, when you see lists or trackers showing government-held Bitcoin, they often mix seized and forfeited coins without making the distinction clear. That means just because Bitcoin is held by government agencies doesn’t mean the government has sold any of it yet. Basically, most of the trackers that are out there are incomplete or wrong, it’s a messy picture and we are still learning about what Bitcoin is where and held under what rules.

Ideally, the U.S. government would conduct a proper audit to clarify the situation - but realistically, that’s probably asking too much. It turns out though, the U.S. barely has any BTC.

On the bright side - and maybe this is just wishful thinking - but if the U.S. actually holds less BTC than we thought, it could mean they’ll need to buy more than they originally planned. I’m disappointed, but also bullish, as the U.S. can make this right.

Will The USA Blow Its Chance With Bitcoin? Unpacking Crypto Week

Eleanor Terrett joins me to break down what just happened on Capitol Hill as Congress fumbles the biggest crypto legislation in years. After the House failed to move forward on the GENIUS and CLARITY Acts, Trump claims the votes are coming, but time is running out. Meanwhile, Bitcoin ETFs see another $403 million in inflows and major banks like JPMorgan and Citi inch closer to launching stablecoins.

Chris Inks will join us in the second part to share some interesting trades in crypto and beyond.

My Platforms And Sponsors

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

The Wolf Pack - My new Telegram group where I share daily updates on everything I'm watching and chat directly with all of you. Completely free to join.

The Crypto Advisor - My weekly newsletter for registered investment advisors, combining macro trends, Wall Street insights, and crypto – all in one place..

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis!

Blofin - Blofin is offering our Telegram members a $30 Bonus + 50% Spot Discount when they sign up for The Wolf Pack.

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Peoples Reserve - Use Bitcoin as pristine collateral with Peoples Reserve - where wealth is built smarter through Bitcoin-powered finance.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.