The Wolf Den #1138 - Ignorance Is a Strategy (Sometimes)

Why knowing your exact entry price can hurt more than it helps.

Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Unprecedented precision. That’s what Arch Public is known for; algorithmic tools that produce incredible results. The charts, entries and exits, and total return speak for themselves. Our partnerships with Gemini and Kraken speak for themselves.

Here is one data point for you: over the past five years our Bitcoin Algorithm Arbitrage Strategy has returned 247% annually. Talk to us, we know what we’re doing.

In This Issue:

Ignorance Is a Strategy (Sometimes)

Bitcoin Thoughts And Analysis

Nvidia Boosts Markets As CPI, Earnings Loom

Different Opinions Are Healthy

Grayscale Is Planning To Go Public

Federal Regulators Issue Joint Statement Confirming Banks Can Custody BTC

BofA Praises ETH While It Flips It In Marketcap

$123,000 Bitcoin🔥! Will The Fed Turn The Printer On 🖨💴? | Macro Monday

Ignorance Is a Strategy (Sometimes)

Most crypto investors don’t know their cost basis.

And believe it or not, that’s probably a blessing.

Let’s be honest – tracking your cost basis in crypto is a nightmare. You've likely traded across multiple platforms, maybe holding spot BTC on Coinbase, some ETF exposure in your IRA, and a nice chunk chilling on a Ledger. Sound familiar? It gets worse.

Remember when Binance forced U.S. users to manually transfer funds to Binance U.S.? No purchase history carried over. Poof. GDAX? Same thing – good luck digging that up. If you've ever used more than one tax calculator, your data trail is already broken. And if you’re rotating alts to stack more BTC – swapping in and out hundreds of times – forget it. Most tax tools can’t keep up.

Then there’s the issue of wallet-to-exchange transfers. Your receiving platform just assumes the market price at time of deposit is your cost basis – which is obviously false. The IRS? They toss the responsibility in your lap and wait to audit you. Helpful.

Add in forgotten wallets, misplaced transfers, or obscure token swaps (what even is 127,857,611 XYZ at $0.00027?) – and you need a damn forensic accountant to figure out if you’re up or down.

But maybe that chaos is a gift.

Sure, in a perfect world, knowing your cost basis sounds empowering. You could make clean, logical decisions about when to sell, right? Not exactly.

That number – your cost basis – it’s not just a stat. It’s a story. And stories are dangerous.

If your Bitcoin cost average is $50,000, selling at $100K feels like victory. A tidy 2x. But should that actually be your signal? Or what about $150K – triple your money – sounds even better. But suddenly, you’re not thinking about the market anymore. You’re thinking about that number. That 2x. That 3x. That emotional high of being “right.”

Your cost basis becomes an anchor. One that can drag your portfolio down.

You might sell too early because it feels like the “rational” thing to do. You might hold too long because you’re convinced it’ll keep running. Worst of all, you might abandon the plan you made when you were calm and focused – all because a green number lit up on your screen and hijacked your brain.

And what if you got that number wrong?

Imagine a trader who's been at it for years – rotating, stacking, chasing narratives – and after all that, they sit down and finally calculate their Bitcoin cost basis: $50K. They feel disappointed. Underwhelmed. Maybe even embarrassed.

Then they realize they made a mistake. Their real basis? $10K.

Instant confidence boost. Suddenly they’re a genius. Same holdings. Same account. Just a new number on a spreadsheet. And yet everything about their mindset changes.

That’s the trap.

So if you don’t know your cost basis – don’t stress. You’re not broken. You’re free.

Start with a clean slate. Reevaluate your holdings the same way a pro would: ignore the past, assess the present, and make moves based on your actual goals – not your emotional baggage.

Your cost basis doesn’t tell you when to sell. It tells you how you feel.

And that’s the part that needs mastering.

Don’t let a spreadsheet dictate your destiny.

I hope this helped - my goal is to deliver a creative edge to you every day. If you know someone who’d benefit from these ideas, forward them this newsletter. And if you haven’t already, join my brand new Telegram group. I know 99% of you aren’t in there yet, and you’re missing the chance to chat directly with me and my team.

Bitcoin Thoughts And Analysis

Bitcoin’s daily chart is flashing caution after a sharp reversal candle on Monday was followed by downside continuation today. Yesterday’s session printed an unmistakably ugly candle – a long upper wick signaling rejection at the highs near $120K, with a close well off the top of the range. Crucially, that candle came on elevated volume, adding weight to the move and suggesting a possible blow-off top in the short term.

Today’s follow-through confirms that sellers are taking the reins, at least for now. Price is currently sitting around $116,800 after dropping over 2.5%, with the next major support zone near $112,000 – a level that previously capped price throughout early June before the breakout. If that fails, the 50-day MA and horizontal support around $105,800 should act as the next line of defense.

Volume has remained elevated, showing that this pullback has real participation – not just apathy or a lack of buyers. Bulls need to see price stabilize above $112K and reclaim lost ground quickly, or risk a deeper retrace after such an aggressive upside move.

For now, momentum has clearly stalled, and the risk of a more meaningful correction is on the table.

Nvidia Boosts Markets As CPI, Earnings Loom

Stocks climbed to start the week after Nvidia received approval from U.S. officials to resume exports of certain AI chips to China – easing trade tensions and boosting investor confidence. Nasdaq 100 futures rose 0.5% and the S&P 500 gained 0.3%, with Nvidia jumping 4.5% in early trading. European stocks also edged up, led by tech, while U.S. Treasury yields slipped and the dollar dipped ahead of Tuesday’s key inflation data.

Nvidia’s H20 chip export approval is seen as a positive signal for both the company’s bottom line and broader U.S.–China trade dynamics. The move comes just as Wall Street braces for the latest CPI report and the unofficial start of earnings season – led by JPMorgan and other major banks.

Despite recent record highs, investors remain cautious. Bitcoin pulled back slightly after a massive run, and the options market is pricing in a 0.6% swing for the S&P 500 post-CPI. Traders are also watching for fallout from escalating tariff tensions – Europe has finalized a retaliatory list targeting $84 billion worth of U.S. goods, including Boeing aircraft and bourbon.

In corporate news, Ericsson beat profit estimates on strong U.S. 5G demand, and Thames Water hinted at possible nationalization due to ongoing financial troubles. Rio Tinto named Simon Trott its new CEO, and Sumitomo Mitsui is eyeing another $1.1 billion investment in India’s Yes Bank.

The backdrop is busy, but the tone is upbeat – for now. CPI will test the market’s resilience, and earnings could reset expectations. For the moment, Nvidia has given bulls a reason to cheer.

Key events this week:

Tuesday, July 15

– June CPI Report (8:30 AM ET): Arguably the most important release of the week. Expected: +0.3% MoM headline, +3.1% YoY. A hotter-than-expected number could push back expected Fed rate cuts.

– Bank Earnings Continue: Bank of America, Wells Fargo, and Morgan Stanley report earnings pre-market. Focus will be on loan loss provisions and net interest margins.

– BlackRock & Pepsi Earnings: Institutional and consumer trends intersect. BlackRock commentary may include digital asset growth.

Wednesday, July 16

– June Retail Sales Report: A key read on consumer spending. Expected to rise +0.1%. Stronger-than-expected data would reinforce Fed hawkishness.

– Goldman Sachs, PNC, US Bancorp Earnings: Attention will be on investment banking rebound and credit quality trends.

– Tech Watch Begins: ASML (a key semiconductor equipment provider) reports earnings—providing a forward-looking signal for AI demand.

Thursday, July 17

– Jobless Claims: Weekly unemployment claims could add nuance to Fed policy outlook.

– Netflix Earnings (After Market Close): Projected to show 45% YoY earnings growth driven by ad-supported subscriptions. One of the most closely watched reports of the season.

– TSMC Earnings (Before Market Open): Semiconductor bellwether. Results will reflect AI hardware demand and broader chip market dynamics.

Friday, July 18

– No Major Economic Reports: Expect follow-through from earnings and CPI implications to dominate market sentiment.

– Key Earnings: Johnson & Johnson, Novartis, State Street – final reads on healthcare and financials to wrap the week.

– Crypto Week Legislative Movement: Possible Congressional developments on the CLARITY Act, Anti-CBDC Act, and GENIUS Act.

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 rose 0.2% as of 10:02 a.m. London time

S&P 500 futures rose 0.3%

Nasdaq 100 futures rose 0.5%

Futures on the Dow Jones Industrial Average fell 0.1%

The MSCI Asia Pacific Index rose 0.8%

The MSCI Emerging Markets Index rose 1%

Currencies

The Bloomberg Dollar Spot Index fell 0.2%

The euro rose 0.2% to $1.1687

The Japanese yen was little changed at 147.65 per dollar

The offshore yuan was little changed at 7.1761 per dollar

The British pound rose 0.2% to $1.3449

Cryptocurrencies

Bitcoin fell 2.8% to $116,799.67

Ether fell 0.9% to $2,976.91

Bonds

The yield on 10-year Treasuries declined two basis points to 4.41%

Germany’s 10-year yield declined four basis points to 2.69%

Britain’s 10-year yield declined three basis points to 4.57%

Commodities

Brent crude fell 0.4% to $68.90 a barrel

Spot gold rose 0.5% to $3,361.80 an ounce

Different Opinions Are Healthy

I’m sharing this post from Udi - not because I agree with everything he says, but because it presents a sharp, well-structured argument about some of the broader trends playing out in the space. It’s important to entertain the possibility that we might be wrong about our assumptions. Maybe Udi’s right. Or maybe the counterpoints he presents will either challenge or reinforce our conviction.

Yes, ETH has had a tough stretch. But Udi raises an interesting point about the difference in OG presence between Bitcoin and Ethereum - a contrast worth thinking through.

Also worth noting: I skimmed over most of the article’s deep dive into DOGE price history, but it told a compelling story. A lot of early DOGE holders - people who bought at $0.008 or even $0.08 - completely missed the $0.70 run because they either sold too early or got complacent. That context matters. It suggests that Bitcoin could be gearing up for its own generational move higher - not despite the fact that many OGs have sold, but because of it. A new wave of investors may be ready to send it to new multiples.

Bitcoin doing a 50x-100x, “in a relatively short time period,” is hopium. This is the exact line of thinking that creates bag holders at the top.

Grayscale Is Planning To Go Public

Grayscale Investments has confidentially filed for an IPO with the SEC, meaning key details - like valuation, share count, and timeline - remain under wraps for now. For those unfamiliar, Grayscale is a heavyweight in the crypto world. Founded in 2013 and operating as a subsidiary of Digital Currency Group, it’s one of the largest crypto asset managers and ETF issuers in the space.

The IPO move makes perfect sense given the firm’s success, particularly through its flagship ETFs and broad lineup of crypto investment products tailored to institutional investors. In just the past 18 months, Grayscale converted both its Bitcoin and Ethereum trusts into ETFs, pushing its assets under management above $30 billion.

If completed, the IPO would mark a major milestone - not just for Grayscale, but for the broader trend of crypto firms eyeing public markets amid a more favorable, pro-crypto climate in the U.S. It joins the likes of Circle (now public), as well as Gemini, Bullish, Ripple, and Kraken - companies that are actively preparing for or considering their own public listings.

Federal Regulators Issue Joint Statement Confirming Banks Can Custody BTC

The Federal Reserve has officially cleared the way for U.S. banks to offer custody services for Bitcoin and other crypto assets.

In a joint announcement with the OCC and FDIC, regulators confirmed that traditional banks are now allowed to securely hold digital assets on behalf of their customers - something they previously avoided due to regulatory uncertainty.

This shift opens the door for banks to compete with crypto-native custodians, giving institutions more trusted, regulated options as demand for crypto exposure grows.

However, banks must still meet strict requirements around risk management, cybersecurity, AML/KYC compliance, and oversight of any third-party providers they use.

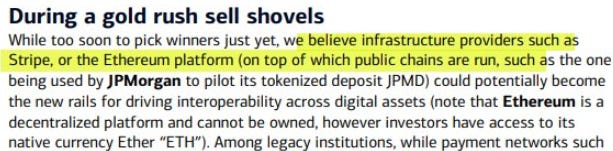

BofA Praises ETH While It Flips It In Marketcap

This segment is short - just read the highlighted section. Bank of America is bullish on ETH, and the irony is that ETH just flipped BofA in market cap and now sits two spots above it.

$123,000 Bitcoin🔥! Will The Fed Turn The Printer On 🖨💴? | Macro Monday

Bitcoin just became the world’s fifth-largest asset, smashing through $123,000 as institutional inflows hit $3.7 billion in a single week. With the money printer revving, ETFs exploding, and policy turning pro-crypto, this rally is being fueled by serious macro momentum. I’m joined by Dave Weisberger, Mike McGlone, and James Lavish on Macro Monday to break down what’s next for Bitcoin, ETFs, and the Fed.

My Platforms And Sponsors

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

The Wolf Pack - My new Telegram group where I share daily updates on everything I'm watching and chat directly with all of you. Completely free to join.

The Crypto Advisor - My weekly newsletter for registered investment advisors, combining macro trends, Wall Street insights, and crypto – all in one place..

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis!

Blofin - Blofin is offering our Telegram members a $30 Bonus + 50% Spot Discount when they sign up for The Wolf Pack.

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Peoples Reserve - Use Bitcoin as pristine collateral with Peoples Reserve - where wealth is built smarter through Bitcoin-powered finance.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.