Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Trading Alpha Released A Super Cool Product!

One of the partners of this newsletter, Trading Alpha, my trusted indicator and trading community, has launched their proprietary Indicator Search Engine for All Markets. This custom Indicator Screener scans crypto, stocks, and forex markets for Trading Alpha indicator setups, eliminating the need for time-consuming manual analysis. It can simultaneously screen for multiple indicators, enhancing confluence and providing advanced analysis capabilities across different markets. This is cutting-edge technology for serious traders.

Make sure to use my link HERE if you plan on giving it a try. Use code '10OFF' for a 10% discount.

In This Issue:

Bubble Watch

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Take A Look At These Historical Returns

Ondo May Be Partnering With World Liberty Financial

More World Liberty Financial News

The Legal Battle Between The SEC And Binance Is Put On Pause

Lummis Presses Powell On Crypto Oversight Failures

Bitcoin Frenzy: Buy Before It Skyrockets Or End Up Digging Through The Trash!

Bubble Watch

“One of the first great investment adages I learned in the early 1970s is that ‘being too far ahead of your time is indistinguishable from being wrong.’” — Howard Marks.

That quote applies to us—crypto investors—more than perhaps any other group. It’s not just relevant to obvious sectors like NFTs, DeFi, and RWAs but to Bitcoin itself. Those who called for Bitcoin to hit $100,000 in 2017 had to wait until the end of 2024 to be proven right. Along the way, there were plenty of gains—but also years of waiting, corrections, and outright crashes.

Stepping back for a moment, the crypto market has been eerily quiet the past couple of weeks. After the executive order drama, news flow has slowed alongside Bitcoin’s price action, so I’ve taken the opportunity to dig into some more thought-provoking material. Howard Marks, one of my favorite value investors, recently published a memo titled “On Bubble Watch,” marking the 25th anniversary of the first memo he ever wrote that actually received a response.

It’s refreshing to feel like less of an old-timer in this space when covering a milestone like that. While the memo isn’t about Bitcoin, its insights couldn’t be more relevant. Marks only mentions Bitcoin once, using it as an example to reinforce his core argument: “A bubble or crash is more a state of mind than a quantitative calculation.”

So here’s my challenge to you: take a step back and assess where we stand—not just in crypto, but across equities and every major asset class. Are we in that place right now?

Howard Marks explains “there’s no price too high” by saying, “When you can’t imagine any flaws in the argument and are terrified that your officemate/golf partner/brother-in-law/competitor will own the asset in question and you won’t, it’s hard to conclude there’s a price at which you shouldn’t buy.”

For us in crypto, it’s often the opposite—we already hold Bitcoin, while it’s our co-worker, barber, uncle, or nephew whose sudden curiosity turns into panic once they realize they have no exposure. A diligent investor needs to recognize which side of the equation they’re on and act accordingly.

“Bubbles are marked by bubble thinking. Perhaps for working purposes we should say that bubbles and crashes are times when extreme events cause people to lose their objectivity and view the world through highly skewed psychology—either too positive or too negative.”

Are we bubble thinking right now?

“When a whole market or a group of securities is blasting off and a specious idea is making its adherents rich, few people will risk calling it out.”

Marks then reflects on his early career, dating back to 1969, during the rise of the Nifty Fifty—a group of high-growth companies deemed invincible, with no price too high for their stocks. Fueled by a booming post-WWII economy, innovation, and the rising dominance of growth investing, these companies became the centerpiece of the first major stock market bubble in 40 years.

But Marks saw the reality unfold firsthand. When the bubble burst in 1973-74, those who clung to the belief that these stocks could only go higher watched over 90% of their investment vanish as prices collapsed from their sky-high P/E ratios.

"When people assume – and price in – an expectation that things can only get better, the damage done by negative surprises is profound." We just saw this play out with Trump’s tariffs.

"When something is new, the competitors and disruptive technologies have yet to arrive. The merit may be there, but if it’s overestimated, it can be overpriced, only to evaporate when reality sets in." This almost perfectly describes DeepSeek.

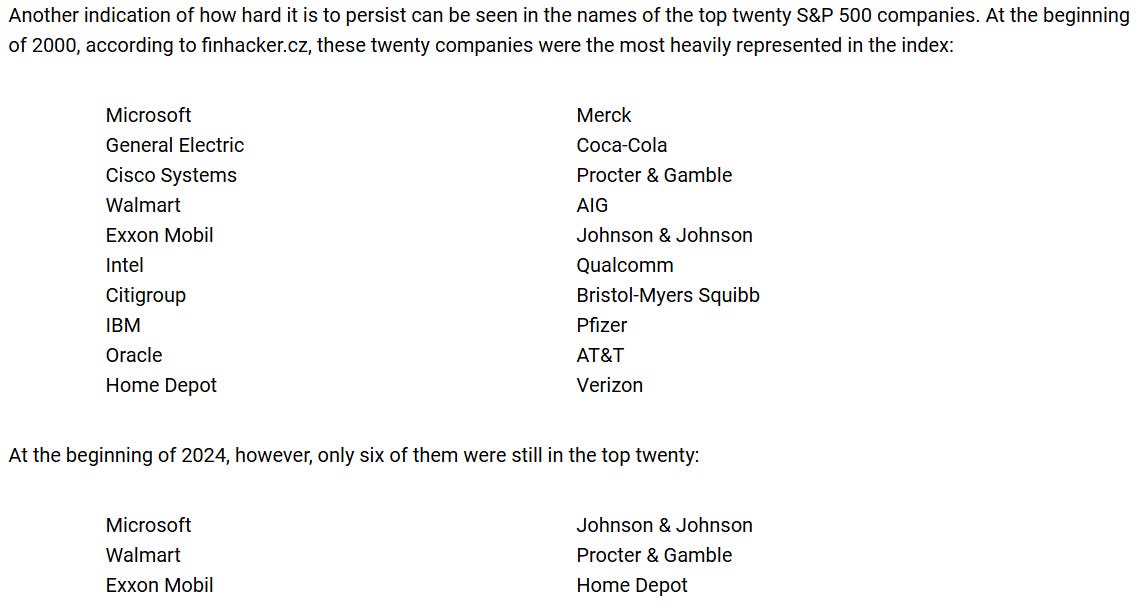

My favorite point in the entire memo comes next. Marks compares NVDA’s P/E ratio (in the low 30s) to the Nifty Fifty’s average (60 to 90 times) and examines the persistence of companies over long periods. He highlights a list of stocks that once traded at valuations signaling long-term dominance but ultimately fell far short of those expectations decades later.

“In bubbles, investors treat the leading companies – and pay for their stocks – as though the firms are sure to remain leaders for decades. Some do and some don’t, but change seems to be more the rule than persistence.”

This is interesting: “There were only four times in the history of the S&P 500 when it returned 20% or more for two years in a row. In three of those four instances (a small sample, mind you), the index declined in the subsequent two-year period. (The exception was 1995-98, when the powerful TMT bubble caused the decline to be delayed until 2000, but then the index lost almost 40% in three years.)”

Did you know the S&P 500 has now recorded back-to-back gains of 20% or more five times in history? The most recent example came in 2023 and 2024, with the index rising 26% in 2023 and another 25% in 2024. This marks its best two-year stretch since 1997-98.

This is where Marks briefly mentions Bitcoin: “Finally, while I’m at it, although it’s not directly related to stocks, I have to mention Bitcoin. Regardless of its merit, the fact that its price rose 465% in the last two years doesn’t suggest an overabundance of caution.”

Since merit is on our side, this argument holds even more weight—Bitcoin isn’t in a bubble. And if it does enter bubble territory due to a psychological shift and FOMO, it will, as always, shed the excess and return to its natural growth trajectory.

There’s no P/E ratio for Bitcoin, but we can analyze other key metrics like the MVRV score and Stock-to-Flow model to gauge whether Bitcoin is over or undervalued relative to its "fair value" and to help project potential price movements.

And right now? Things are looking good!

Neither of these charts look concerning.

This tells me one of two things: either our existing models are broken—which I don’t believe—or we’re simply not in bubble territory. And to build on Howard Marks’ argument, price and metrics alone aren’t the ultimate indicators. There’s no excess froth in Bitcoin right now (not to say it can’t dip), and altcoins are even further from it.

If Bitcoin had surged to $150,000 or $200,000 on the executive order news, I’d be preaching caution—especially since we’re still just in the research phase of an SBR or digital asset stockpile. But that didn’t happen, so the only real risk I see is for those who remain underexposed to the asset class.

Investing in this space is hard, especially right now, but the good news is we’re nowhere near froth. There’s still no widespread consensus that Bitcoin’s success is inevitable, inexperienced investors aren’t scrambling to buy, plenty of people have no hesitation calling for lower prices, and most importantly—there’s no bubble thinking.

Meanwhile, the president is calling on select pro-Bitcoin leaders to “evaluate the potential creation and maintenance of a national digital asset stockpile.” The market may be dull at the moment, but that’s often the perfect setup for a major move.

Whether up or down in the short term, the long-term trend is clear.

We are going much higher.

Bitcoin Thoughts And Analysis

DAILY CHART

Bitcoin is doing absolutely nothing - but I expect some volatility today with CPI.

Legacy Markets

US stock futures traded in a narrow range as investors awaited key inflation data that could shape expectations for Federal Reserve rate cuts. S&P 500 futures dipped 0.1%, while Treasury yields edged higher, with the 10-year yield rising to 4.55%. The dollar gained, reflecting market caution ahead of the Consumer Price Index (CPI) release.

The CPI report is expected to show core inflation rising 0.3% in January, up from 0.2% in December. A higher-than-expected reading could drive bond yields higher, push stocks lower, and reinforce the Fed’s cautious stance on rate cuts. JPMorgan’s trading desk estimates a 2% drop in the S&P 500 if inflation exceeds forecasts at 0.4% or higher. Fed Chair Jerome Powell, in his testimony to Congress, reiterated that the central bank is in no rush to adjust rates, further adding to uncertainty.

In corporate news, Heineken surged 13% after announcing a buyback and strong beer sales in Brazil and Mexico. ABN Amro Bank jumped 8.9% on robust earnings, while CVS Health issued weaker-than-expected profit guidance. Lyft shares fell after a disappointing outlook, while Super Micro Computer and DoorDash both gained on optimistic forecasts. Meanwhile, Japan urged President Trump to exempt its companies from newly announced tariffs, as trade tensions remain a key market overhang.

With inflation data, Powell’s testimony, and ongoing trade uncertainties, markets remain in a holding pattern, awaiting clarity on the economic trajectory.

Key events this week:

US CPI, Wednesday

Fed Chair Jerome Powell testifies to House Financial Services panel, Wednesday

Fed’s Raphael Bostic and Christopher Waller speak, Wednesday

Eurozone industrial production, Thursday

US initial jobless claims, PPI, Thursday

Eurozone GDP, Friday

US retail sales, industrial production, business inventories, Friday

Fed’s Lorie Logan speaks, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures were little changed as of 7:35 a.m. New York time

Nasdaq 100 futures rose 0.1%

Futures on the Dow Jones Industrial Average fell 0.1%

The Stoxx Europe 600 rose 0.1%

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro rose 0.1% to $1.0376

The British pound was little changed at $1.2456

The Japanese yen fell 0.7% to 153.60 per dollar

Cryptocurrencies

Bitcoin fell 0.2% to $96,180.86

Ether rose 0.3% to $2,630.32

Bonds

The yield on 10-year Treasuries advanced one basis point to 4.55%

Germany’s 10-year yield advanced two basis points to 2.45%

Britain’s 10-year yield advanced two basis points to 4.53%

Commodities

West Texas Intermediate crude fell 1.1% to $72.49 a barrel

Spot gold fell 0.5% to $2,882.31 an ounce

Take A Look At These Historical Returns

The image above is just a small preview of what this link offers. Dating back to 1928, it tracks the growth of a $100 investment over time across the S&P 500, U.S. Small Cap, Treasury bills, gold, and more. It also highlights inflation rates and annual returns.

For example, a $100 investment in the S&P 500 (including dividends) in 1928 would be worth $982,817.82 in 2024. Meanwhile, gold would have grown to $12,649.47, and U.S. Small Cap stocks would have reached $4,744,891.59.

It’s an interesting table to explore, especially for anyone who enjoys seeing the long-term impact of compounding and market performance.

Ondo May Be Partnering With World Liberty Financial

Ondo’s partnership with World Liberty Financial is not confirmed. Yesterday morning, Ondo announced the news but quickly removed it, suggesting it may have been released prematurely. Based on the leaked images, the partnership appears to be focused on advancing the adoption of tokenized real-world assets. It would be pretty amusing if World Liberty Financial kept accumulating Ondo tokens while waiting for the official announcement. Regardless, the partnership would make sense given that World Liberty Financial holds 342,000 ONDO, and Eric Trump recently spoke at Ondo’s NYC summit.

More World Liberty Financial News

We now have an official statement from WLFI addressing the purpose behind their aggressive token acquisitions, which they’re calling their “Macro Strategy.” There wasn’t a whole lot behind the announcement other than a lot of generalizations such as, “invest in innovative projects, support ecosystem development, and seize emerging opportunities within the DeFi landscape.” It was also announced that coming soon, there will be a “comprehensive proposal detailing the Macro Strategy” which will be available on the governance forum shortly.

The Legal Battle Between The SEC And Binance Is Put On Pause

The SEC and Binance have jointly requested a 60-day stay in their legal case to allow for potential regulatory developments, particularly the formation of the SEC’s new Crypto Task Force under Acting Chairman Mark T. Uyeda. The SEC originally sued Binance in June 2023, alleging it operated as an unregistered exchange and misled investors—claims Binance denies. Both parties believe pausing the case could lead to a more efficient resolution.

After 60 days, they will submit a status report to determine whether to resume proceedings or extend the pause. Ideally, the same happens for Coinbase soon.

To me, this is a clear signal that crypto is winning and that the SEC’s outdated enforcement tactics are running out of steam. The new leadership seems to be recognizing that these cases are built on shaky ground and that continuing to push them would be a losing battle.

Lummis Presses Powell On Crypto Oversight Failures

I have the transcript from yesterday's hearing between Senator Cynthia Lummis and Fed Chair Jerome Powell. Not included in this excerpt is Powell’s confirmation that there will not be a CBDC, which is also good news.

Lummis: “Just look at the mess the Fed made with SVB. I contend that there is a lack of understanding that is deliberate on the part of the Fed with respect to digital asset policy. The Constitution says Congress is your boss, but somehow, your staff has not gotten that message. So, Chairman Powell, do you commit, on behalf of yourself and the Federal Reserve staff, to comply fully with all document demands issued by this committee in a timely manner? “

Powell: “Sure.”

Lummis: “Will you instruct your staff to be complete in their responses and not obstruct the oversight functions of this committee?”

Powell: “We always work with the committee to be responsive to your requests. Sometimes, they are beyond our capacity to respond to, and we work with committee staff to do that, but we are always responsive to committee requests.”

Lummis: “And I’ll look forward to engaging with you when you feel our requests are outside the scope of the oversight that we have over the Fed. Do you commit to disciplining or removing any staff that have been found to have engaged in debanking activity, furthering Operation Chokepoint 2.0, or other misconduct?”

Powell: “I can’t make an open-ended commitment to remove anybody, but I am struck, and my colleagues are struck, by the growing number of cases of what appears to be debanking, and we are determined to take a fresh look at that.”

Bitcoin Frenzy: Buy Before It Skyrockets Or End Up Digging Through The Trash!

Joining me today to discuss all the latest Bitcoin and crypto news are Alex Miller, CEO at Hiro Systems, and my friends from Arch Public, Andrew Parish, and Tillman Holloway, who will provide an update on the $10K algorithmic portfolio.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.