Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

⚡️Taking Back Financial Independence & Freedom - Sponsored By Peoples Reserve⚡️

Peoples Reserve just launched a brand-new corporate website. The new site elaborates on all their different product offerings, including their newly announced Real World Asset Property Claims.

With their platform already built, Peoples Reserve is now one step closer to being able to offer Bitcoiner’s the power to Earn and Borrow against their Bitcoin without ever having to sell.

In This Issue:

We Made It To The Club

Aptos Weekly Review

Bitcoin Thoughts And Analysis

Fidelity Wrote Bullish Report On Ethereum

Treasury Withdraws IRS Rule Targeting DeFi, Marking Win for Crypto Industry

The Ethereum Foundation Releases An Ecosystem Development Plan

Bitcoin Price Just Set Another All-Time High, What's Next For Crypto?

We Made It To The Club

Nineteen months ago, I wrote a newsletter I’ve been patiently waiting to follow up on.

The title was, “This Is The Pre-Game.”

The opening of that intro was iconic.

Analysts love breaking the crypto cycle into neat little phases – and there’s no shortage of frameworks to choose from. Baseball innings, the four seasons (hello, crypto winter), the classic “Psychology of a Market Cycle” chart, the Innovation Adoption Life Cycle, the Gartner Hype Cycle – they all try to map market mood to some deeper truth. Venture investors talk product-market fit through scaling, while Bitcoin purists see everything through pre- and post-halving lenses. But ultimately, they’re all chasing the same question: where are we now – and what’s next?

I love exploring Bitcoin through all these perspectives, but sometimes, it’s better to just trust your gut. And today, I feel it – the pre-game is over. Bitcoin took the Uber, skipped the line, and walked straight to its table. The music’s already loud, the headlining DJ hits the stage in 30 minutes, and the bottles are inbound. That’s where we are in the cycle – not the beginning of the night, but the opening act of the main event.

I know that doesn’t sound very academic – and it’s not meant to be. Sometimes markets have a rhythm that no chart can explain. It’s a momentum thing, an energy shift you just sense. That feeling, paired with data, is what I trust most.

When I wrote that pre-game intro, Bitcoin was topping out around $44,265. That might sound laughable now, but at the time, it was a breakout moment – we’d climbed from sub-$20K lows and smashed through the $30K wall. For the first time in a long while, Bitcoin had a real tailwind.

Since then, Bitcoin is up 162% – and it’s got a whole new lift beneath it. This isn’t just about Trump, ETF flows, macro fears, or Michael Saylor. It’s a shift in atmosphere. A collective buzz that something real – something much bigger – is on the table.

Now, sure, this could all come crashing down. Bitcoin lives to catch people off guard. But eventually, it has to deliver. Because the sidelines are still packed with skeptics and outsiders – and at some point, they’ll be forced in, often at the worst possible time for them.

Anyway, back to the club. Bitcoin isn’t just in – it’s the VIP. There are other tables, sure – Ethereum, Solana, BNB, Doge – but none of them have the same view or bottle service. Still, the other tables will fill, and trust me, they’ll be fun too.

Most alts haven’t even made it inside yet. Some are still at the pre-game. Some are stuck in traffic. A few are waiting in line, watching Bitcoin get all the attention. Ethereum feels like the VIP waiting at the rope – definitely getting in, but still on hold. Solana? Bouncer’s checking ID, making sure everyone’s dressed for entry.

The club won’t last as long as the pre-game – and that dragged for 19 months – but this phase is going to be wild. Dopamine levels will spike. The lights will flash. And for a brief moment, nothing else will matter. It won’t last forever – but while it does, it’ll be unforgettable.

Bitcoin will have its peak, no doubt – but the party doesn’t really reach max energy until the alts are seated and the bottle parade starts rolling. That’s when headlines go insane. Countries buying BTC. DeFi going nuclear. Retail chasing the next 100x.

But for now, we’re just vibing.

Eventually, Bitcoin will leave the club first – it showed up first, after all. It’ll head to the afters, where things get weird and messy. That’s probably where price peaks – somewhere deep in those hours. Once Bitcoin exits, the spotlight shifts. Capital rotates. The alts become the main event. Same lights. Same music. But new stars.

They’ll get their own sloppy after-party too. Every asset that made it inside will. That’s when everyone’s drunk on gains, blind to risk, and sure the high will last forever.

Then comes the hangover – but we’re not there yet. No need to stress. We just stepped in. It’s early.

The question is – how does Bitcoin pace itself? Is it slamming bottles or taking it slow? And when do the others show up? ETH and SOL still aren’t close to all-time highs – they’re not in yet. Doesn’t mean they won’t be – just means they’ve got more to prove.

Best case from here? Bitcoin enjoys the night without burning out, and the alts arrive right on cue. A packed club, every table full, energy peaking – that’s the dream.

If you’re a Bitcoiner, it feels damn good right now. If you’ve been holding alts from the lows, vibes are solid too. The night is young. The music’s building. This moment feels right.

It’s about to be lit.

And if you liked this newsletter – from Pump.fun’s final rug to regulators cracking down, tokenization trends, ‘thin air’ debates, and the wild return of Bitcoin ICOs – send it to a friend. The cycle’s pushing forward fast – and the window to get in cheap is closing.

Also, so many of you aren’t yet part of the Wolf Pack - my brand-new Telegram group. We’ve just crossed 200 members, but I know once we hit 1,000+, hitting all-time highs will be a lot more fun. Come join us! We’re talking about everything crypto and want to hear from you. Best of all, it’s completely free.

Aptos Weekly Review

For those that don’t know, Aptos - one of the most exciting layer 1 blockchain competing with Solana and Ethereum - is an official sponsor of this newsletter! Over the past few months, I’ve had the chance to get to know the Aptos team, create content with them, and watch this project accomplish incredible things.

Each week, I provide an Aptos review, showcasing all the exciting announcements and milestones the network is achieving. This week, I want to start with this epic news:

Look at this monster of a chart:

And the same goes for total stablecoin marketcap:

Aptos is killing it:

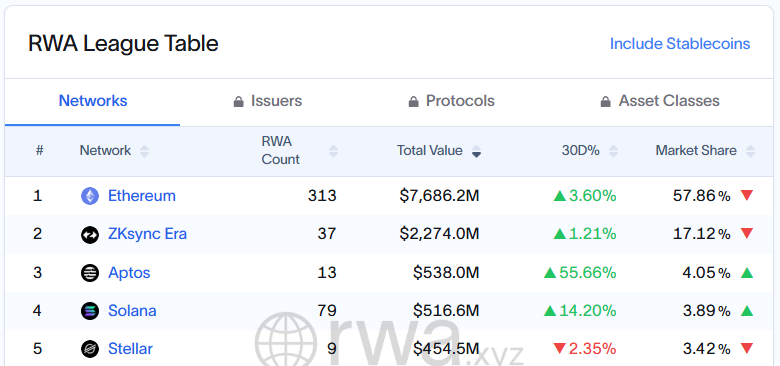

Also, if you visit RWA.xyz - my go-to platform for tracking real-world assets in crypto - you can see which chains are actually leading, not just talking a big game. And guess who's in third place, right behind Ethereum and zkSync Era? It’s not Solana, not Ripple, not even Chainlink. It’s Aptos.

Aptos says it best:

Anyways, that is all for this week, make sure to show Aptos some love - they’re a huge reason this newsletter remains free!

Bitcoin Thoughts And Analysis

DAILY CHART

Blue skies. See you on the moon. What else is there to say? Bitcoin is back in price discovery.

Fidelity Wrote Bullish Report On Ethereum

Fidelity recently published a research report titled “Blockchains as Emerging Economies” exploring Ethereum’s growing role in digital finance and its potential to reshape traditional finance. I pulled a few key highlights, but I’d recommend circling back to read the full report - it’s clear Wall Street is finally starting to get it.

“Tokenization is the blockchain equivalent process of moving an offshore asset to be recognized for investment and trading in the local market, as seen in the overview of the U.S. and Ethereum economies in Exhibit 2.”

“Exhibit 5 illustrates the growth in users within the Ethereum ecosystem, as measured by active wallets and associated transactions, according to data tracked by Artemis.”

“The native currency plays a significant role in the applications hosted on the blockchain. Ether is the dominant trading pair on exchanges and serves as a primary asset to borrow against, as depicted in Exhibit 9.6”

Treasury Withdraws IRS Rule Targeting DeFi, Marking Win for Crypto Industry

The U.S. Treasury has officially withdrawn a controversial IRS rule that would have required decentralized crypto platforms to report user transactions, following a Congressional repeal and mounting industry pushback. Originally introduced under the 2021 Infrastructure Act, the rule sought to classify both centralized and decentralized exchanges as brokers for tax reporting purposes. Critics argued the mandate was unworkable for DeFi platforms and threatened innovation. The reversal - backed by bipartisan support in Congress and signed into law by President Trump in April - signals that broker reporting will apply only to custodial platforms for now, though future rules tailored to DeFi remain on the table.

The Ethereum Foundation Releases An Ecosystem Development Plan

The Ethereum Foundation key goals:

Ecosystem Amplification:

Long-Term Ecosystem Unblocking:

It’s great to see the Ethereum Foundation continuing to take community feedback seriously and pushing for meaningful improvements. The first two core goals - maximizing user adoption and strengthening the resilience of Ethereum’s infrastructure, both technically and socially - signal a clear long-term vision. If you’re an ETH investor, this should be encouraging: they’re essentially saying, we want the ecosystem to grow - and be strong enough to sustain that growth as the price climbs.

Nobody can complain about that.

The next set of goals is broad, but what stands out is the emphasis on driving Ethereum adoption and supporting the right actors. Ethereum has long needed well-intentioned champions - and it’s finally getting them, not just from corporate players on Wall Street, but from within the Foundation itself. In my view, this asset is finally back on track and just starting to pick up speed.

Bitcoin Price Just Set Another All-Time High, What's Next For Crypto?

Bitcoin just hit a fresh all-time high above $112,000, but Markus Thielen says it’s just getting started - with a $133K target for September. Traders may be underexposed as ETF demand surges and altcoins continue to underperform, driving Bitcoin dominance back to 62%. I’m joined by Markus Thielen, the CEO of 10x Research and Edan Yago, Core Contributor to BitcoinOS to break down the bullish signals, ETF flows, and what’s coming next for crypto markets.

In the second part of the show, Dan from The Chart Guys will share his market analysis and some trades.

My Platforms And Sponsors

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

The Wolf Pack - My new Telegram group where I share daily updates on everything I'm watching and chat directly with all of you. Completely free to join.

The Crypto Advisor - My weekly newsletter for registered investment advisors, combining macro trends, Wall Street insights, and crypto – all in one place..

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis!

Blofin - Blofin is offering our Telegram members a $30 Bonus + 50% Spot Discount when they sign up for The Wolf Pack.

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Peoples Reserve - Use Bitcoin as pristine collateral with Peoples Reserve - where wealth is built smarter through Bitcoin-powered finance.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.

Love your opening to today’s newsletter. More than fitting to where we are and where we will possibly go.

Good way of putting it