Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Use my link HERE.

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 400 trading pairs, minimal fees, peer to peer trading, derivatives, up to 100x leverage.

Make sure to check if Phemex is available in your jurisdiction.

In This Issue:

Ethereum's Short Squeeze: The Perfect Storm?

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Trumps’s WLF Buys MOVE And Stakes ETH

Strategy Buys Bitcoin!

The Bloomberg Bros Release Their ETF Odds

British Man Wants To Buy Garbage Site To Recover Bitcoin

Will Trump DESTROY Bitcoin Or TRIGGER A Massive Bull Run? | Macro Monday

Ethereum's Short Squeeze: The Perfect Storm?

Ethereum’s price action is balancing on the brink of a make-or-break moment.

The opener was meant to hook you—yeah, a bit dramatic, I’ll admit. But credit where it’s due: The Kobeissi Letter got me thinking, so today’s newsletter is all about Ethereum. The current buildup of shorts on this asset is a site to behold.

To read the official thread by The Kobeissi Letter, click HERE. I’ll be sharing the full thread while adding supplemental data, key facts, and my own insights along the way. Let’s dive in.

This image has been featured in countless articles referencing the thread. It tracks an exponential short buildup dating back to March 2020, with positions digging deeper day by day.

Kobeissi points out, “We saw the effects of this extreme positioning on February 2nd. Ethereum fell -37% in 60 hours as the trade war headlines emerged. It felt almost like the flash crash seen in stocks in 2010, but with no headlines. More than $1 trillion was erased in crypto in HOURS.”

Ethereum—the #2 asset by market cap and nearly every other meaningful metric—dropped like a shitcoin outside the top 500 on the recent tariff scare. For comparison, Ethereum’s top competitor, Solana, fell about 19%, while Bitcoin dropped roughly 9.27% in the same 24-hour window. To be fair, my calculation of Ethereum’s 24-hour drop came in at 31.6%—but still, that kind of move is anything but normal for an asset of this caliber.

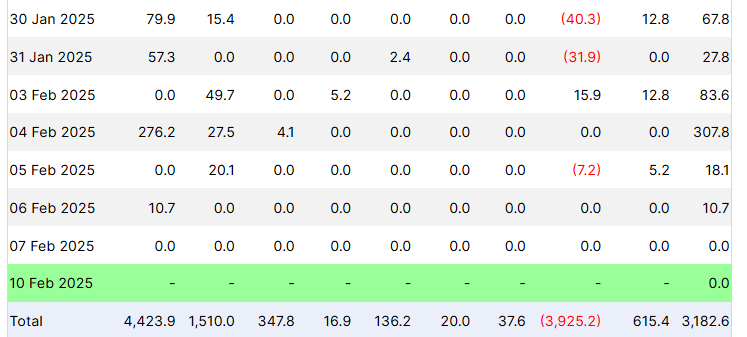

“Interestingly, even as short exposure was ramping up in December 2024, Ethereum inflows were HIGH. In just 3 weeks, ETH saw +$2 billion of new funds with a record breaking weekly inflow of +$854 million. However, hedge funds are betting ETH's surge and limiting breakouts.”

The right-hand side displays the inflow totals, highlighting six consecutive days of positive flows, including a massive $307 million inflow immediately after the epic sell-off—a strong response from TradFi and Wall Street.

“Furthermore, volume has been strong in ETH generally speaking. We saw large spikes in volume on January 21st after Inauguration Day. We also saw large spikes in volume around the February 3rd crash. Price action has failed to recover the gap lower even as one week has passed.”

This is where the crux of the discussion lies, The Kobeissi Letter nails it, “In fact, even as Bitcoin and other major cryptocurrencies have broken out, ETH is stuck. ETH is currently trading a whopping ~45% below its record high set in November 2021. This brings the next question. Why are hedge funds so dedicated to shorting Ethereum?”

“For years, there was fear of ETH being classified as a security by the SEC. However, with the new SEC under the Trump Admin this seems unlikely. In fact, Eric Trump recently posted ‘it’s a great time to add ETH’ and prices briefly surged. So why is ETH so widely hated?”

At this point, the odds of the SEC targeting Ethereum as a security are virtually zero. Since Ethereum’s transition to proof-of-stake in September 2022 and the Shanghai upgrade in April 2023, which enabled withdrawals, staking has remained secure and functioned without major issues. Plus, Coinbase—a publicly traded company—has built on top of Ethereum, spot ETFs are thriving, the Ethereum Foundation and ConsenSys aren’t under investigation, and there’s never been a better time to push the envelope on what’s considered ‘legally grey’ in America.

Originally, it read, “In my opinion, it’s a great time to add $ETH. You can thank me later.”

“There is a lot of debate over the answer to this question. Potential reasons range from market manipulation, to harmless crypto hedges, to bearish outlook on Ethereum itself. However, this is rather strange as the Trump Administration and new regulators have favored ETH.”

I have some thoughts on this:

First, there’s not enough attention given to “harmless crypto hedges.” If there’s one thing we should all understand by now, it’s that Wall Street, whales, and hedge funds—whatever label you prefer—love toying with crypto investors for their own financial gain. A prime example? XRP’s explosive move from $0.50 to $3.40 in just two months, with most of the rally happening in under a month.

The recent XRP rally has nothing to do with a stablecoin launch or Brad Garlinghouse rubbing shoulders with Trump’s team. This is a classic whale-driven play, tapping into an older wave of retail investors who got swept up in the momentum. If ETH were given the same treatment as XRP, every criticism would vanish overnight, and the narrative would instantly shift back to 'ultra-sound money,' 'programmable money,' 'digital oil,' and 'the ultimate tokenization platform.'

“Largely due to this extreme positioning, Ethereum has significantly underperformed Bitcoin. Bitcoin is now 6 times larger than Ethereum in one of its largest caps since 2020. Could Ethereum be setting up for a short squeeze?”

“This extreme positioning means big swings like the one on February 3rd will be more common. Since the start of 2024, Bitcoin is up ~12 TIMES as much as Ethereum. Is a short squeeze set to close this gap?”

That wraps up the thread. Ethereum’s performance is both puzzling and, in some ways, straightforward. Sentiment is hanging by a thread due to lackluster price action, though the exact reasons remain unclear.

The Ethereum Foundation has faced sustained criticism from both inside and outside the community. For what it’s worth, I doubt these concerns would even exist if Ethereum were outperforming competitors like Solana—but that’s not the case. Price dictates perception, and Ethereum’s recent underperformance has raised tough questions. Some critics want Vitalik to step away from decision-making at the EF, while others argue he should take a more active, centralized role to benefit the ecosystem. One massive green candle would silence most of these concerns and restore the harmony ETH holders are desperate for.

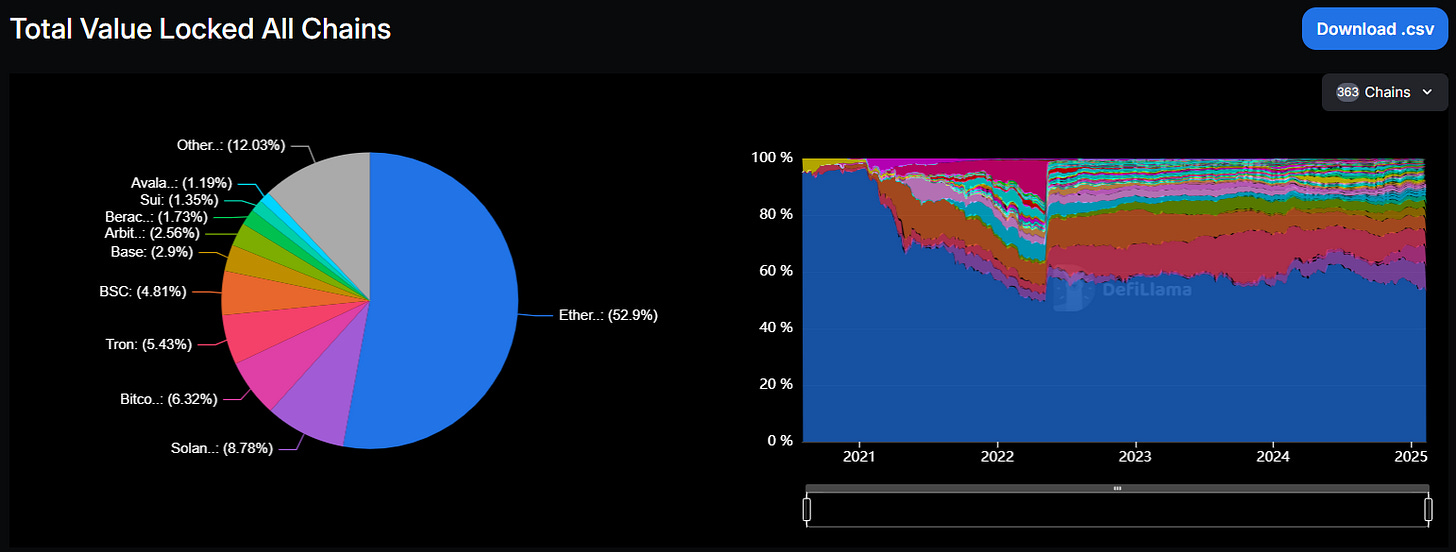

On a more analytical note, Ethereum’s competition isn’t slowing down, but it still holds a significant lead—especially over Solana, which, for now, has mostly captured meme-driven speculation.

Ethereum’s TVL remains dominant.

Most stablecoins are issued on Ethereum.

Tokenization is almost exclusively happening on Ethereum.

Most developers are on Ethereum, Base is on Ethereum, NFTs are on Ethereum, and the majority of DeFi—essentially all of this and more—still runs on Ethereum. You could argue that none of this directly impacts price, but I’d disagree. It’s far easier to make the case that these factors will drive price higher than to argue the opposite. The one thing Ethereum has missed out on is memes, but I think most rational investors can look past that.

Ethereum’s price action doesn’t have to make perfect sense—crypto is confusing and full of plot twists. But what I do know is that when the crypto gods decide they’re done toying with Ethereum, an epic squeeze should be the result (though nothing is guaranteed). Even if it never happens in dramatic fashion, Ethereum remains a solid investment alongside Bitcoin and Solana. If you believe in the decentralization of finance, then rooting for Ethereum is in your best interest.

As always, this is not financial advice—purely educational and for entertainment only. Invest at your own risk, and accept the reality that you could lose everything.

Bitcoin Thoughts And Analysis

Bitcoin is doing nothing at the moment. Altcoins are doing less.

I will share more charts when there’s something to see.

Legacy Markets

US stock futures fell as traders reacted to President Donald Trump’s newly announced tariffs on steel and aluminum imports, while also bracing for Federal Reserve Chair Jerome Powell’s testimony and key inflation data later this week. The S&P 500 and Nasdaq 100 futures declined, with market sentiment dampened by escalating trade tensions. The European Union vowed to impose countermeasures in response, heightening the risk of a transatlantic trade dispute.

Gold hit a fresh record above $2,940 an ounce before paring gains, reinforcing its appeal as a haven asset amid economic uncertainty. Treasury yields edged higher, with the 10-year yield rising to 4.52%, as investors reassessed risks ahead of the US Consumer Price Index (CPI) report. Analysts warned that any upside inflation surprise could pressure credit markets and delay Fed rate cuts.

In corporate news, BP pledged strategic changes after reporting a sharp drop in profits, while UniCredit’s plans to return more capital failed to impress investors. Kering shares rose after better-than-expected profits and stabilization at Gucci. Robinhood announced plans to expand its options trading platform to the UK.

Meanwhile, oil prices rebounded from near-year lows as shrinking Russian production eased concerns about an oversupply. The pound weakened after Bank of England rate-setter Catherine Mann, previously seen as hawkish, pushed for a sharper rate cut. With trade uncertainty, monetary policy shifts, and key economic data ahead, investors are navigating a volatile and complex market landscape.

Key events this week:

Fed Chair Jerome Powell gives semiannual testimony to Senate Banking Committee, Tuesday

Fed’s Beth Hammack, John Williams, Michelle Bowman speak, Tuesday

US CPI, Wednesday

Fed Chair Jerome Powell testifies to House Financial Services panel, Wednesday

Fed’s Raphael Bostic and Christopher Waller speak, Wednesday

Eurozone industrial production, Thursday

US initial jobless claims, PPI, Thursday

Eurozone GDP, Friday

US retail sales, industrial production, business inventories, Friday

Fed’s Lorie Logan speaks, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures fell 0.3% as of 5:43 a.m. New York time

Nasdaq 100 futures fell 0.5%

Futures on the Dow Jones Industrial Average fell 0.2%

The Stoxx Europe 600 was little changed

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0316

The British pound was little changed at $1.2358

The Japanese yen was little changed at 152.10 per dollar

Cryptocurrencies

Bitcoin rose 0.6% to $97,998.32

Ether rose 1.2% to $2,696.37

Bonds

The yield on 10-year Treasuries advanced two basis points to 4.52%

Germany’s 10-year yield advanced four basis points to 2.40%

Britain’s 10-year yield advanced two basis points to 4.48%

Commodities

West Texas Intermediate crude rose 1.1% to $73.15 a barrel

Spot gold fell 0.2% to $2,902.54 an ounce

Trumps’s WLF Buys MOVE And Stakes ETH

Trump’s World Liberty Financial is buying more Movement (MOVE) tokens for the first time since January and has also become an Ethereum staker, locking up 913.5 ETH. The fund is reorganizing its portfolio, adding 803K MOVE tokens across three transactions via CowSwap, bringing its total holdings to $447.3K. MOVE was previously reduced to zero after a series of large purchases. This new buying round follows prior outflows from the fund’s transparent wallets. Despite being an early investor, World Liberty Fi’s moves haven’t significantly impacted MOVE’s price action.

Strategy Buys Bitcoin!

This is the same story we’ve seen play out week after week—except this time, it wasn’t MicroStrategy buying Bitcoin, it was Strategy. Strategy acquired 7,633 BTC for ~$742.4 million at an average price of ~$97,255 per Bitcoin, bringing its total holdings to 478,740 BTC, purchased for ~$31.1 billion at an average price of ~$65,033 per Bitcoin.

The Bloomberg Bros Release Their ETF Odds

From James Seyffart: “We’re putting out relatively high odds of approval across the board, mainly focused on Litecoin, Solana, XRP, and Dogecoin for now.” I appreciate their attention to detail and the real values they've assigned to their predictions, but unless something major changes, I expect approval for all of these assets. What’s really worth watching is if BlackRock or Fidelity file applications for ETFs on these assets. Without their involvement, the flows into these products will likely be minimal.

British Man Wants To Buy Garbage Site To Recover Bitcoin

Remember the story of the man whose crazy ex-girlfriend threw away his hard drive with Bitcoin on it? James Howell, a U.K.-based computer engineer, is still on his mission to recover it—this time by trying to buy the entire landfill where he believes the drive, containing 8,000 BTC (~$784 million), is buried.

Howell claims his ex “accidentally” discarded the drive in 2013 when Bitcoin was trading between $50 and $246, meaning his lost fortune was initially worth between $400,000 and $2 million. Earlier this year, he lost a lawsuit against the local council, which denied him access to the site or a $646 million compensation claim. The landfill, located at Newport’s Docks Way, is scheduled to close by 2025/26 and will be repurposed for a solar plant.

Will Trump DESTROY Bitcoin Or TRIGGER A Massive Bull Run? | Macro Monday

Join Dave Weisberger, Mike McGlone, and James Lavish as we break down what's happening in macro and crypto!

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.