Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Arch Public algos have been on fire in Q2. Both our Futures and Crypto algos have been absolutely printing returns for clients.

Our Futures products have produced positive returns 27 of the past 31 trades. Exceptional executions.

Our crypto algos are now available on both Kraken and Gemini all over the globe. Yield. CAGR. Total Return. $BTC $SOL $ETH $XRP $SUI. Join us and find out what all the FREE hype is about; you won’t be disappointed.

In This Issue:

The Final Scam

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Hester Peirce Speaks On Tokenization

Justin Sun Loves $TRUMP

The Final Scam

This weekend is going to be a circus.

Half of crypto will be jacked up on Red Bull, eyes bloodshot, trading Pump.fun’s ICO like their lives depend on it – while the other half suits up to cover the first-ever “Crypto Week” in Congress like it’s a presidential summit. If your dopamine receptors are fried, this weekend might just jolt them back to life – at least a little.

Yesterday, I covered the boring professional stuff. Today? Let’s get into the fun, the degenerate side of crypto that may very well produce a supernova of chaos and brilliance.

And before anyone comes for the title or my opinions, a quick disclaimer: this newsletter has always been educational and entertaining, with a healthy dose of satire.

If you think Pump.fun is the most secure, legitimate place to park your hard-earned dollars, I salute you. I’m just here to share a few spicy thoughts. Take what resonates, and toss the rest.

This is coming from Pump.fun’s co-founder, not me, I think anything goes at this point.

Let’s break down what’s going down.

“Kill Facebook, TikTok, and Twitch. On Solana.” Yeah… I’ll have whatever they’re smoking. I guess there’s no such thing as a trailblazer who sounds sane - and there’s also no such thing as Pump.fun missing one last exit pump (their words, not mine).

Let’s continue through the thread.

“since launching in January 2024, pump fun sought to become a household name by allowing anyone, anywhere to create & trade tokens

pump fun quickly became the fastest growing company in history, reaching $100m, $300m & $500m in revenue faster than any other company in the world”

Okay, pause. The lack of grammar? That was Pump.fun’s stylistic choice - bear with it. Second, Pump.fun did have a commendable run, and I can’t deny them that. But being a company that keeps growing is way cooler than one that falls off a cliff… and then another few cliffs. More on this later.

“but that was just the beginning

we're building pump fun to replace existing social platforms with one that gives instead of takes

whether you’re a trader, creator, startup founder, or anyone else, pump fun will allow you to tap into a global network of instant money & attention

to unlock further growth, we decided to launch $PUMP - the official native token of the http://pump.fun protocols

$PUMP will grow the http://pump.fun ecosystem by delivering value to its community and incentivizing the ecosystem that continues helping the platform succeed

while the token will be fully functional at launch, we’re giving thorough consideration to utility mechanisms like fee rebates, token buybacks, or other incentives and promotions”

Pause again. Pump’s idea isn’t all that bad. The current revenue model for streamers definitely could use an update. I’d bet even the streamers cashing in big every month would agree with me. Twitch, for example, the largest streaming platform, uses their own proprietary currency (Bits) - I’m being generous calling it a ‘currency’ - that viewers purchase to then support their favorite streamers. Outside of Twitch, a Bit is useless. Imagine if it was replaced with something like Sats, or just crypto in general. It would make a lot more sense.

Pump.fun’s idea is correct, the execution… well… we will see.

The thread continued:

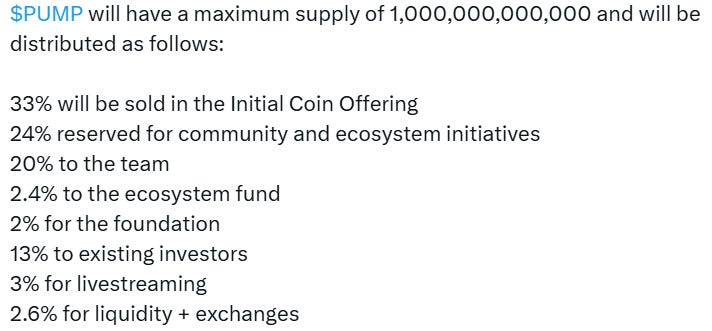

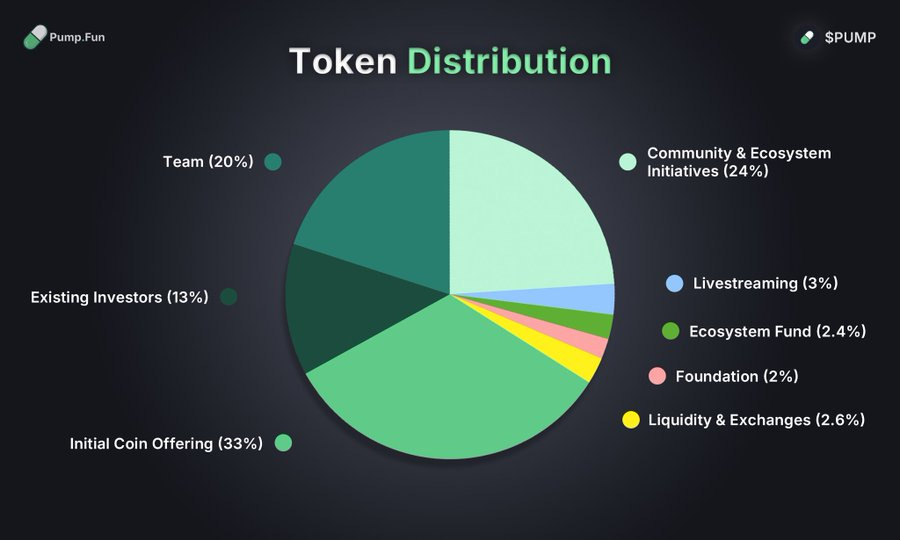

That large number is 1 trillion by the way.

Here’s how I am reading this chart:

Insiders: Team (20%) + Existing Investors (13%) + Community & Ecosystem Initiatives ((extra cash for the team) (24%)) + Foundation (2%)

ICO: Will the 33% truly have a fair launch? At least the supporting platforms have been announced ahead of time.

The community that matters: Livestreaming (3%)

Back to the thread:

“$PUMP will be launched through an Initial Coin Offering (ICO)

in the ICO, 33% of the token supply is being sold: 18% in a private sale for institutional purchasers and 15% in a public sale. both private sale and public sale purchasers are on the exact same terms

- each token will be sold at a price of $0.004

- all tokens sold as a part of the ICO will be fully unlocked on day 1 of the token becoming tradeable

- the private sale has already been fully allocated”

Well, that answers our question about the ICO. This means there will actually be even fewer tokens available at launch, and private investors locked in their price comfortably at $0.004 - meaning they won’t have to spam the buy button to get in on the action.

The rest of the thread explains where to buy the token and how the sale will work, which we can skip. But - and this is a big but - there’s one detail you absolutely need to know about this sale.

“the public token sale will take place until all 150,000,000,000 tokens are sold or at 14:00 UTC on Tuesday, July 15th, whichever comes first

shortly after the public sale ends, token sale participants will receive their tokens. tokens will initially be non-transferable, meaning that they cannot be traded

48-72 hours after the token sale ends, tokens will become transferable”

At some unknown time, these tokens will become sellable. What this means is you won’t know exactly when that happens - but insiders probably will. They might even know which exchange will list the tokens first. And while these platforms are legitimate exchanges, that doesn’t stop leaks of information that shouldn’t be shared.

I can assure you: there are traders out there with way bigger bags who know more than you - and quants who aren’t insiders, but have bots scraping every platform, ready to act against your best interest the moment this thing goes live.

I’m not going to make price predictions because it’s pointless but just know you’re gambling if you participate - which is exactly why I’m sitting this one out.

Since I told you we would look at Pump.fun’s run, let’s do that now.

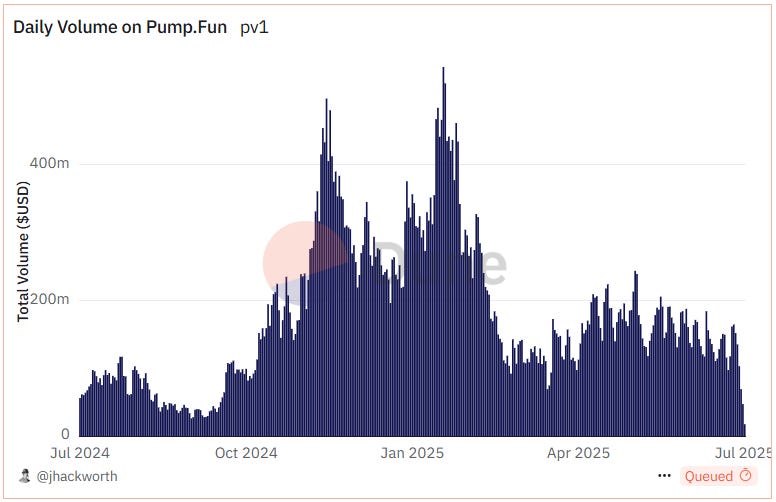

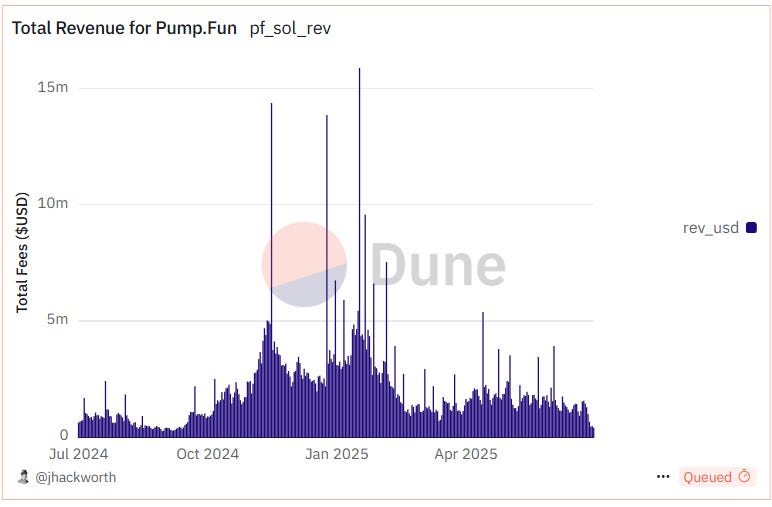

I have to admit - my intuition on this platform’s performance was slightly off. Pump.fun has fallen off, but not as hard as I initially thought. Sure, the chart looks like the typical lifespan of a shitcoin, but there’s still some life left in it. The team probably realized it’s now or never for one last home run.

Also, Pump.fun had some good (but brief) periods in late 2024 and early 2025, and even had some stellar moments. But the revenue and daily volume spikes were short-lived.

All the charts tell the same story. And there’s a reason SOL took such a hard hit right after hitting an all-time high earlier this year - and it rhymes with Dump.run. SOL will be fine without Pump.fun injecting gambler capital, but let’s be honest: meme success on Solana is a major boost to the ecosystem.

Also, this market as a whole is extremely saturated, competitors are plentiful, constantly trying to steal everyone else’s lunch.

This isn’t the kind of stat you want to see right before a major announcement, but the show goes on.

If you plan on trading this coin this weekend, please be careful. Nearly 60% of the supply will be unlocked immediately, which means even more volatility - and likely some instant selling from early investors.

Here’s what some of the community is saying.

Alright, I’m done. Good luck out there and please, be safe. 99.99% of you are better off just sticking with Bitcoin. And yes, I absolutely include myself in that stat line.

By the way - new all-time highs for Bitcoin. Feels good, right? The Wolf Pack Telegram group would be even more lit if the 99.99% of you who aren't in it yet decided to join. It’s completely free and a lot of fun.

Bitcoin Thoughts And Analysis

Bitcoin briefly made a new all-time high yesterday, tagging $112,000 before pulling back slightly. The breakout came after a multi-week consolidation that formed higher lows and built pressure just below resistance. Price is now hovering just under that key $112K level, which has become the short-term line in the sand for bulls. A daily close above would confirm the breakout and likely bring strong continuation, but for now BTC remains in a tight battle between buyers and sellers.

The 50-day moving average continues to trend upward and is providing dynamic support, while the recent surge in volume suggests traders are positioning for a larger move. If price fails to break cleanly above $112K, we could see a short-term retest of the $105,787 area – the previous breakout level – before any further upside. Overall, Bitcoin remains in a strong uptrend, with the path of least resistance clearly higher if bulls can secure a decisive close above all-time highs.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

Yesterday I took a look at ETH/BTC, which is clearly still rising. Today, let’s take a look at ETH/USD.

Ethereum is making a strong weekly push into resistance around $2,817 – a key level that acted as support throughout 2023 before flipping to resistance in early 2024. Price is now testing this zone after a steady string of higher lows, and the move is backed by increasing volume, signaling genuine momentum. ETH has already reclaimed its 200-week moving average and is now challenging the 50-week MA from below. A weekly close above both would mark a major technical shift, suggesting the end of a long consolidation phase and the potential start of a sustained uptrend. If bulls can push decisively above this level, the next major target sits near $4,093. For now, all eyes remain on whether Ethereum can reclaim this final resistance before the path higher opens up.

Legacy Markets

U.S. stock futures slipped slightly Thursday as traders digested the Trump administration’s escalating tariff agenda and awaited a new catalyst to push markets higher. S&P 500 futures dipped 0.1% after the index closed just shy of a record high, while European and Asian equities extended gains. Despite lingering trade uncertainties - including Trump’s newly announced 50% tariffs on Brazilian imports and copper - confidence in corporate earnings, especially in tech, and AI optimism continue to fuel market strength.

Copper rebounded sharply, up over 11% this week. Nvidia and Tesla rose in premarket trading, with Nvidia’s valuation briefly hitting $4 trillion. Meanwhile, Blackstone inked a $20 billion private credit deal with Legal & General, and Ferrero is reportedly close to acquiring WK Kellogg for $3 billion. WPP also tapped Microsoft’s Cindy Rose as its new CEO.

Strategists remain bullish: dips may be buying opportunities, with tariffs seen as noise rather than long-term headwinds.

Stocks

The Stoxx Europe 600 rose 0.6% as of 9:44 a.m. London time

S&P 500 futures fell 0.1%

Nasdaq 100 futures were little changed

Futures on the Dow Jones Industrial Average fell 0.2%

The MSCI Asia Pacific Index rose 0.2%

The MSCI Emerging Markets Index rose 0.3%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.1728

The Japanese yen was little changed at 146.39 per dollar

The offshore yuan was little changed at 7.1799 per dollar

The British pound rose 0.1% to $1.3606

Cryptocurrencies

Bitcoin rose 0.6% to $111,423.79

Ether rose 2% to $2,793.3

Bonds

The yield on 10-year Treasuries advanced one basis point to 4.35%

Germany’s 10-year yield was little changed at 2.67%

Britain’s 10-year yield declined two basis points to 4.59%

Commodities

Brent crude fell 0.3% to $69.98 a barrel

Spot gold rose 0.4% to $3,325.35 an ounce

Hester Peirce Speaks On Tokenization

I want to share the first paragraph, which is her main premise, and the law.

“Blockchain technology has unlocked novel models for distributing and trading securities in a “tokenized” format. Tokenization may facilitate capital formation and enhance investors’ ability to use their assets as collateral. Enchanted by these possibilities, new entrants and many traditional firms are embracing onchain products. As powerful as blockchain technology is, it does not have magical abilities to transform the nature of the underlying asset. Tokenized securities are still securities. Accordingly, market participants must consider - and adhere to - the federal securities laws when transacting in these instruments.”

I’m glad statements like these are being made because they legitimize those who are honestly applying the law and delegitimize those who think they can skirt the law just because this is crypto and ‘anything goes.’

Justin Sun Loves $TRUMP

Please don’t let there be a Strategic TRUMP Reserve coming soon. At this point, with $100 million already in play, there kind of already is one.

I can only imagine that Justin Sun’s ties to Trump-aligned crypto projects might actually help his legal case – not hurt it – as he works to resolve issues in the U.S. The newly crypto-friendly SEC under Trump seems far more open to settling.

In a recent court filing, both Sun’s legal team and the SEC jointly requested a pause in the case involving past charges over unregistered token sales of TRX and BTT.

Does Coinbase Hold Strategy’s Bitcoin?

Michael Saylor has repeatedly declined to reveal proof of reserves for Strategy’s nearly 600,000 BTC. Despite this, Coinbase CEO Brian Armstrong publicly shared the likely location of those coins. Armstrong dismissed Saylor’s worries that revealing the location could increase risks like social engineering or wrench attacks. In his tweet, Armstrong also boasted about Coinbase’s “institutional team” and revealed that eight of the top ten public companies holding BTC use Coinbase Prime, strongly suggesting Strategy’s bitcoins are stored there.

My Platforms And Sponsors

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

The Wolf Pack - My new Telegram group where I share daily updates on everything I'm watching and chat directly with all of you. Completely free to join.

The Crypto Advisor - My weekly newsletter for registered investment advisors, combining macro trends, Wall Street insights, and crypto – all in one place..

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis!

Blofin - Blofin is offering our Telegram members a $30 Bonus + 50% Spot Discount when they sign up for The Wolf Pack.

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Peoples Reserve - Use Bitcoin as pristine collateral with Peoples Reserve - where wealth is built smarter through Bitcoin-powered finance.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.