The Wolf Den #1134 - Tokenizing RWAs: The Financial Revolution Is Underway

Ondo Is Breaking Barriers

Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Everyone should own Bitcoin. To that end, The Bitcoin Algorithm is now free. Yes, free forever.

Use our Arbitrage Strategy and create your personal Bitcoin Strategic Reserve!

247% annualized returns.

never lend or leverage your Bitcoin.

20% annual cash yield.

87% profitable trades.

We mean it. Sign up today, it’s free! Try Arch Public now!

In This Issue:

Tokenizing RWAs: The Financial Revolution Is Underway

Aptos Weekly Review

Bitcoin Thoughts And Analysis

Legacy Markets

Is Ethereum Made In The U.S.?

Trump Media Is Launching ETFs!?

Companies Will Go Public This Year

Massive Bull Run Ahead: Bitcoin To Skyrocket To $500K By 2028!

Tokenizing RWAs: The Financial Revolution Is Underway

Lately, one narrative has captured my attention more than most: the rise of real-world assets in crypto. When evaluating any emerging trend, I focus on three key factors—staying power, real-world utility, and growing demand. Hype alone isn’t enough; without all three, a narrative won’t translate into real financial impact.

Real-world assets (RWAs), as the name suggests, are tangible or traditional financial assets—real estate, commodities, government bonds—being brought on-chain through tokenization. This process makes them more accessible, liquid, and efficient to trade.

Imagine owning a fractional share of a high-value property—a golf club, an amusement park, or even a blockbuster film’s royalties. Picture investing in gold without the headache of storage. Tokenization makes these possibilities seamless, bridging the gap between traditional finance and crypto. It’s the shift from the old world to the modern one: analog to digital, physical to programmable.

That’s the promise of real-world assets.

For those who’ve been following my thoughts on this, you know I’ve been waiting for the moment when equities move on-chain—it’s an obvious first step, a total layup. I called this back in June of last year, and even earlier than that. So yeah, I’ve been on this one for a while now.

Last January, BlackRock CEO Larry Fink made a bold statement: “ETFs are step one in the technological revolution in financial markets. Step two will be the tokenization of every financial asset.” Unlike fleeting, retail-driven hype cycles, this narrative addresses a real and complex problem—one that requires time, innovation, and institutional adoption to fully materialize.

That’s where Ondo comes in. Over the past year, this U.S.-based tech company has emerged as a powerhouse in the RWA space, tokenizing and issuing products that solve real investor problems. This isn’t about cartoon NFTs or gimmicky meme coins that never found meaningful adoption—it’s about tangible financial innovation with real-world applications.

Serious investors tracking the RWA sector have taken note, especially because of Ondo’s two flagship offerings:

OUSG: Provides on-chain access to BlackRock’s iShares Short Treasury Bond ETF, giving accredited investors exposure to U.S. Treasuries with the efficiency of blockchain.

USDY: An interest-bearing stablecoin backed by short-term U.S. Treasuries and bank demand deposits, combining the stability of the U.S. dollar with a yield-generating mechanism.

According to RWA.xyz, Ondo ranks #2 in market share for tokenized treasuries and leads in the number of issued tokens. In a space where execution matters, they’re delivering.

Ondo takes the top spot in today’s newsletter for good reason. Over the past few days, they hosted their first-ever Summit in New York—the heart of traditional finance—and singlehandedly thrust the RWA narrative back into the spotlight.

Their first major announcement, which I covered yesterday, was the launch of Ondo Global Markets. The press release described it as, “What stablecoins did for dollars, Ondo Global Markets will do for securities.” In short, it will offer tokenized exposure to widely traded stocks like Apple and Tesla. Finally, the tokenization of equities is happening.

Unfortunately, Ondo Global Markets isn’t available in the U.S.—yet. But with the SEC’s Tokenization Task Force already adding it to their agenda, it’s likely only a matter of time. Ondo followed up with another major announcement: Ondo Chain, which they call “The Omnichain Network for RWAs.” Let’s break down what this means for the future of real-world asset development.

For the record, Ondo didn’t request or compensate me for this write-up. My interest is purely organic, with the sole goal of bringing you value.

Ondo Chain is a Layer 1 proof-of-stake blockchain designed to accelerate the creation of institutional-grade financial markets on-chain. It will natively support tokenized RWAs, including assets issued by Ondo Global Markets, ensuring seamless integration within its ecosystem. These tokens will play a crucial role in securing the network, powering oracles, and bridging assets, with validator nodes verifying collateral.

For Ethereum and Solana investors, it’s important to note that Ondo isn’t abandoning these networks. Nothing in the press releases suggests a departure. In fact, Ondo Chain complements Ethereum and Solana by specializing in tokenized RWAs and institutional finance. While Ethereum and Solana dominate general-purpose smart contracts and DeFi, Ondo Chain is carving out its own niche—offering enhanced security, cross-chain asset issuance, and greater capital efficiency for institutional players.

My guess? Ondo wants its products to trade across the entire crypto ecosystem, creating a win-win for everyone.

Ondo still relies heavily on Ethereum and Solana. OUSG is available on Ethereum, Solana, and Polygon, while USDY is supported on these networks along with Aptos, Mantle, Sui, Noble, and Arbitrum. In the long run, competition only fuels innovation—even if it means your favorite chain now has to fight for its share of the pie.

As far as narratives go, RWAs check every box for long-term potential. Tokenizing assets isn’t some speculative gimmick—it’s a real solution to a real problem. The inefficiencies of traditional finance demand modernization, and tokenization provides the answer.

Apparently, Trump’s World Liberty Financial team sees it the same way. Yesterday, when Ondo Chain was announced, they went on a buying spree. Six months ago, who would have predicted an elected U.S. president with a crypto-focused team actively buying various tokens—just like us? Not me. Not in a million years.

As you can see above, World Liberty Financial bought $470,000 of Ondo.

Regardless of your short-term market bias, now is not the time to lose interest or faith in this sector. It’s still in its infancy. Trillions—yes, trillions with a ‘T’—will flood on-chain once the technology is fully developed and the world wakes up to it. You can either sit back and watch it unfold or position yourself ahead of the curve. The choice is yours.

Aptos Weekly Review

For those that don’t know, Aptos—tone of the most exciting layer 1 blockchain competing with Solana and Ethereum—is now an official sponsor of this newsletter! Over the past few months, I’ve had the chance to get to know the Aptos team, create content with them, and watch this project accomplish incredible things.

Each week, I’ll provide an Aptos review, showcasing all the exciting announcements and milestones the network is achieving. This week let’s focus on the epic announcement of shardines!

“Today, we are excited to unveil Shardines, the next evolution of blockchain execution engines designed to achieve horizontal scalability. With Shardines, we can achieve near-linear throughput scaling, surpassing 1 million TPS on our 30-machine cluster. This milestone is not the end but a critical step forward, showcasing a blockchain architecture ready to support global-scale applications and the evolving demands of Web3.”

Scalability has been a major challenge for blockchains as Web3 adoption grows. Traditional blockchains, such as Ethereum, face bottlenecks in throughput, causing high latency and gas costs. Ethereum's single-threaded execution model limits it to 15 transactions per second (TPS), creating a bottleneck. To address this, newer blockchains like Aptos and Solana have adopted parallel execution models, aiming to improve scalability and transaction speed.

Here’s Avery’s take on the announcement, the CEO of Aptos.

You can read more HERE.

This truly is a paradigm shift in the future of blockchain technology, the impossible becoming possible. That is all for this week, make sure to show Aptos some love—they’re a huge reason this newsletter remains free!

Bitcoin Thoughts And Analysis

The Bitcoin daily chart remains largely unchanged, with price continuing to hover below the $99,860 resistance and the 50-day moving average. Yesterday's candle showed modest buying, but the lack of significant volume indicates hesitation among participants. Support around $96,500 is still holding, but a clear reclaim of $99,860 is needed to signal bullish momentum. Until then, the chart suggests continued consolidation within this range.

Legacy Markets

Markets remained steady as investors awaited the critical US jobs report, which is expected to show a cooling labor market with 175,000 new jobs added in January. S&P 500 futures were little changed, with the index set for a 0.7% weekly gain, while 10-year Treasury yields held at 4.43%. European stocks extended their longest weekly winning streak since last March.

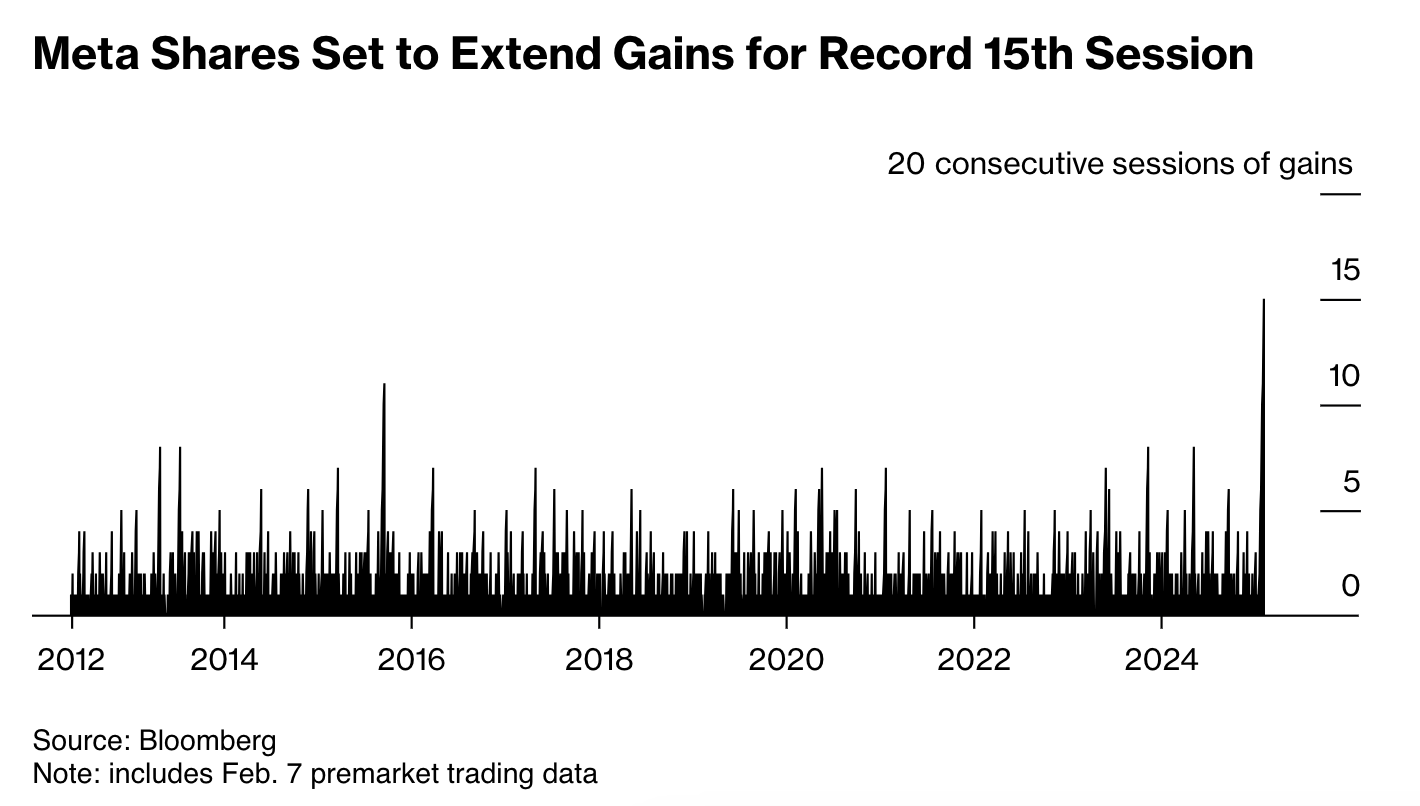

Amazon shares fell 3% in premarket trading after the company warned of capacity constraints in its cloud computing business despite plans to invest $100 billion this year. Meanwhile, Expedia surged over 10% following stronger-than-expected earnings, and Meta Platforms was set to extend its record-breaking rally for a 15th straight session as enthusiasm over its AI strategy continued.

Treasury Secretary Scott Bessent reaffirmed the administration’s commitment to a strong dollar, countering concerns that President Trump’s trade policies could weaken the currency. He emphasized that the US does not intend to manipulate the dollar but will resist efforts by other nations to weaken their currencies for trade advantages.

With a lukewarm earnings season nearing its end, Wall Street is looking to the jobs report for clues on the Federal Reserve’s next move. A softer-than-expected report could boost equities by reinforcing the case for rate cuts, while a stronger number could stoke inflation fears. Investors remain on edge as they assess the data’s implications for monetary policy and economic growth.

Key events this week:

US nonfarm payrolls, unemployment, University of Michigan consumer sentiment, Friday

Fed’s Michelle Bowman, Adriana Kugler speak, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures were little changed as of 7:58 a.m. New York time

Nasdaq 100 futures were little changed

Futures on the Dow Jones Industrial Average were little changed

The Stoxx Europe 600 was little changed

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index rose 0.1%

The euro was little changed at $1.0376

The British pound was little changed at $1.2447

The Japanese yen fell 0.4% to 151.99 per dollar

Cryptocurrencies

Bitcoin rose 1.2% to $97,945.25

Ether rose 1.8% to $2,757.74

Bonds

The yield on 10-year Treasuries was little changed at 4.43%

Germany’s 10-year yield declined one basis point to 2.37%

Britain’s 10-year yield declined three basis points to 4.45%

Commodities

West Texas Intermediate crude rose 0.5% to $70.99 a barrel

Spot gold rose 0.3% to $2,864.46 an ounce

Is Ethereum Made In The U.S.?

The answer isn’t as clear-cut as you might think. Ethereum was created by Vitalik Buterin, a Canadian-Russian developer who worked on it while living in Canada. But much of Ethereum’s early development, marketing, and growth had deep ties to the United States. The Ethereum Foundation, which supports the network, is based in Switzerland, but key co-founders like Gavin Wood (UK) and Joseph Lubin (US) were instrumental in its development. Lubin, in particular, played a major role in Ethereum’s expansion through his company, ConsenSys, headquartered in Brooklyn, New York.

So while Ethereum was a global effort, a significant part of its foundation and early growth was rooted in the U.S. That said, VanEck’s recent “MAGA10” release didn’t include ETH, which suggests that those making the call don’t view Ethereum as a U.S.-based project. Ultimately, Ethereum’s long-term success won’t depend on where it was created—after all, we still don’t even know where Bitcoin came from.

Trump Media Is Launching ETFs!?

That was the face I made when I read this news. Donald Trump is now the first president to issue an ETF—scratch that, a crypto ETF—and he’s doing it during his presidency. You can’t make this up. Ethics aside, the details are that Trump’s media company, Trump Media and Technology Group (TMTG), is planning to launch ETFs and other products under Trump’s Truth.Fi brand. While there haven’t been any filings yet, we do know some details surrounding the trademarks. “We’re exploring a range of ways to differentiate our products, including strategies related to bitcoin,” said TMTG CEO and Chairman Devin Nunes.

The trademark clarifies that there will be a focus on “Made in America” projects like XRP, SOL, LINK, AVAX, and others. Also, I'm not sure what to make of “Bitcoin Plus”—whether it's just another way of describing Bitcoin or Bitcoin ‘plus’ something else. Outside of this, I don’t anticipate any of Trump’s ETFs competing with Fidelity’s or BlackRock’s. While this may boost the publicity and credibility of crypto, at the end of the day, investors will put their money behind the brands they trust most, regardless of political loyalties.

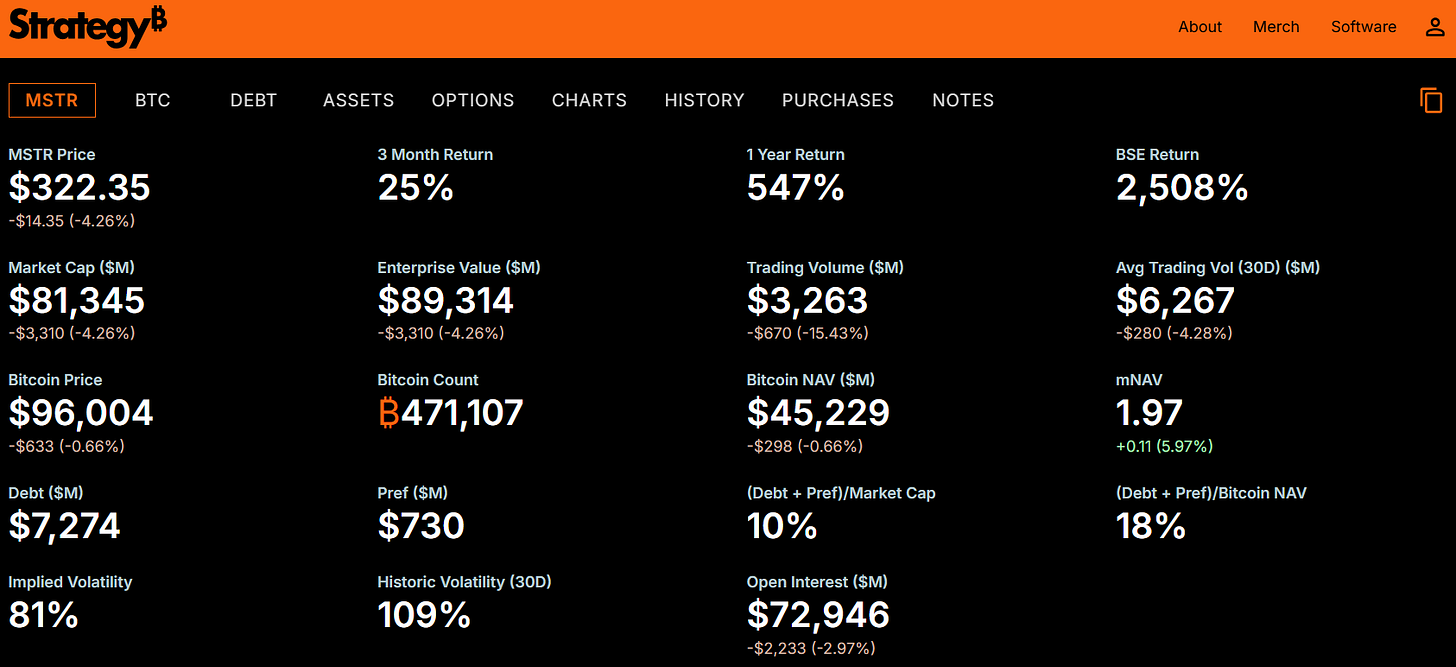

Visit The Bitcoin Tab On Strategy.com

Strategy’s (formerly MicroStrategy) new Bitcoin page is seriously impressive—you should check it out right now. It’s packed with valuable information across nine separate tabs, covering everything from Strategy’s Bitcoin history to key performance data like Bitcoin NAV, open interest, BTC yield, and MSTR’s returns compared to major stocks and indices. Even better, it finally includes a properly organized textual breakdown of all Bitcoin acquisitions, along with useful notes on the structure of Strategy and MSTR.

Companies Will Go Public This Year

There’s really no good reason for most major crypto companies not to go public—it’s the natural next step in their growth. Kraken, Gemini, ConsenSys, Uniswap—take your pick. A wave of crypto firms is heading for the public markets this year and next.

Massive Bull Run Ahead: Bitcoin To Skyrocket To $500K By 2028!

Where's Scott?! Edan Yago, Core Contributor at Bitcoin OS, and Tom Dunleavy, Partner at MV Global, take over The Wolf of All Streets! We’re diving deep into crypto and Bitcoin, of course! Stay tuned!

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.