The Wolf Den #1134 - Is The Trump Administration Following Through On Crypto?

What happened to the timeline?

Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

In This Issue:

Is The Trump Administration Following Through On Crypto?

Bitcoin Thoughts And Analysis

Altcoin Charts

Markets Hold Steady Amid Renewed Tariff Tensions

Trump Media Filed For A Crypto Index ETF

There Are Two More Crypto Treasury Companies To Track

Jack Dorsey Is Launching Bitchat

Bitcoin & Ethereum Treasury Stocks Rally: How Long Before It Collapses?

Is The Trump Administration Following Through On Crypto?

The crypto market could definitely use a morale boost right now.

Plenty of people are probably wondering – whatever happened to Trump’s executive order establishing the Strategic Bitcoin Reserve and U.S. Digital Asset Stockpile?

And what about the timeline laid out in his earlier crypto directive – Strengthening American Leadership in Digital Financial Technology?

Let’s revisit the timeline in question...

We’ve seen some encouraging signals from agencies like the SEC, which has been engaging with the crypto industry through periodic notices and updates. But here’s the thing – there’s still no public information showing that the President’s Working Group has submitted the required reports or policy recommendations. Neither the White House nor the key agencies have released any findings tied to the executive order’s reviews.

That kind of sucks. And since today is July 9th, it’s been 167 days since January 23rd. If we were on schedule, we’d be less than two weeks away from seeing those policy recommendations – for reviews we haven’t even heard about yet.

Bummer. But it’s not all bad.

It’s actually pretty common for agencies like Treasury, DOJ, and the SEC to lag a bit on public follow-ups – especially with something as complex and fast-moving as crypto. The executive order set firm timelines, but reality often means slower progress behind the scenes. Bureaucracy, interagency coordination, political chess – it all takes time.

That said, it’s not like we’ve gotten nothing. In fact, there’s been a steady drip of guidance, commentary, and action from these agencies.

And here’s what I think is happening: they’re still working – but they’re also watching. Next week’s “Crypto Week” in D.C. is a major focal point, and it wouldn’t be surprising if they’re waiting to coordinate messaging and avoid stepping on Congress’s toes. Why would Treasury drop a stablecoin framework right before the House votes on a stablecoin bill? Timing matters.

So no, we’re not totally off the rails – we’re just stuck in the usual D.C. crawl.

Extensions or informal delays are common — especially when more stakeholder input or legal reviews are needed. So the absence of visible updates doesn’t necessarily mean there’s no progress — more often, it reflects cautious, deliberate efforts that take time. The smart move? Watch for the subtle signals — like statements and scheduling hints — which makes “Crypto Week” a perfect focal point.

Now, when should we actually start getting worried?

A) If nothing passes during Crypto Week

B) If pro-crypto voices like Bo Hines, David Sacks, Eric Trump, Tim Scott, French Hill, Cynthia Lummis, John Boozman, and G.T. Thompson suddenly go quiet

C) If Trump ends his own crypto ventures with no explanation

D) If agencies go completely silent across the board

If those things happen, then yes — I’ll be concerned. But until then, we’re just fine.

A lot of the recent slowdown probably boils down to one thing: the GENIUS Act. That bill has clearly taken center stage, and its draft reflects deep engagement with industry experts, academics, and government stakeholders. There’s little doubt that agencies like the Treasury and FSOC have been contributing behind the scenes.

And let’s be honest — the SEC under Chairman Paul Atkins and Commissioner Hester Peirce is way ahead of the curve. While the broader Trump administration may still be catching up, the SEC has been moving quickly and decisively. They’re not waiting around.

Given all that, it’s hard to find much fault with the SEC right now. Especially considering their latest move: streamlining the process for crypto ETF filings — a massive signal for serious regulatory progress.

(Here’s the Reuters article on that, if you missed it.)

This is a speech delivered by Commissioner Mark Uyeda on tokenization.

Here, Hester Peirce outlined a non-exhaustive list of ten crypto priorities for the SEC’s Crypto Task Force in this statement.

Earlier this year, Staff Accounting Bulletin No. 122 (SAB 122) repealed SAB 121 by the SEC because it discouraged banks and custodians from holding crypto.

In the short to medium term, the questions are: will Congress get the job done during “Crypto Week,” and what’s to come after this week? Even if all goes according to plan - which should be very bullish for DeFi as a whole - the job is far from finished. The first ‘crypto chapter’ of Trump’s presidency ends when the U.S. starts buying Bitcoin.

Don’t be discouraged that the U.S. didn’t announce plans to acquire Bitcoin in a budget-neutral way - and then make it happen the following week. There are a lot of moving parts involved in pulling something like this off - and right now, it’s just not the number one priority on the president’s desk.

The good news is that the tariff tantrum has been slowing down – and eventually, it’ll come to a halt as final decisions are made. Getting this out of the way should free up some of Trump’s time. Plus, Trump is far too invested in this space’s infrastructure for the country he leads not to become as pro-crypto as possible (to fill his pockets, of course). Yes, it’s a conflict of interest – which brings its own set of challenges – but hopefully that doesn’t stop the U.S. from eventually buying Bitcoin.

If this stays intact, it’ll boost our cause:

All in all, if you're a crypto holder, you have to be pleased with the progress the U.S. has made so far under Trump’s administration. After all, we’re only about 12% of the way through his four-year presidency – give or take – and I’d say things are off to a hot start.

There are going to be plenty of future conversations about the U.S. acquiring Bitcoin through budget-neutral methods, along with commentary from the President’s Working Group. If the U.S. is strategic, it’ll wait to make major announcements until everything is in place – avoiding the risk of other countries jumping in first. But who knows – at this point, anything’s on the table.

The morale boost is coming. It won’t take much for this market to make a sharp move. Follow-through from the president should do it. We already saw a glimpse of this. That excitement the market had when Trump was elected and talking about crypto – it will come back, at least two-fold.

It just takes patience to get there.

If you enjoyed this, send it to a friend – or maybe someone who loves crypto but doesn’t realize the government is actually on our side.

Bitcoin Thoughts And Analysis

There is NOTHING new to see on the Bitcoin chart today.

Altcoin Charts

The ETH/BTC daily chart shows a prolonged consolidation phase following the explosive breakout in early May. Since then, price has been range-bound between approximately 0.022 and 0.026. We're currently sitting near the EQ (equilibrium) of the range – around 0.0240 – which often acts as a temporary magnet for price and a decision point for direction.

Importantly, ETH/BTC closed back above the 50-day moving average yesterday for the first time in weeks. This is a notable shift in short-term momentum and could be an early sign of bullish continuation, especially if the pair can push above the EQ and flip it into support. RSI is trending upward without being overbought, adding to the momentum argument.

However, until we get a breakout from this range – particularly a close above the 0.026 resistance – it’s still a game of chop. The return above the 50 MA is promising, but bulls need to defend it and push higher to regain control.

Markets Hold Steady Amid Renewed Tariff Tensions

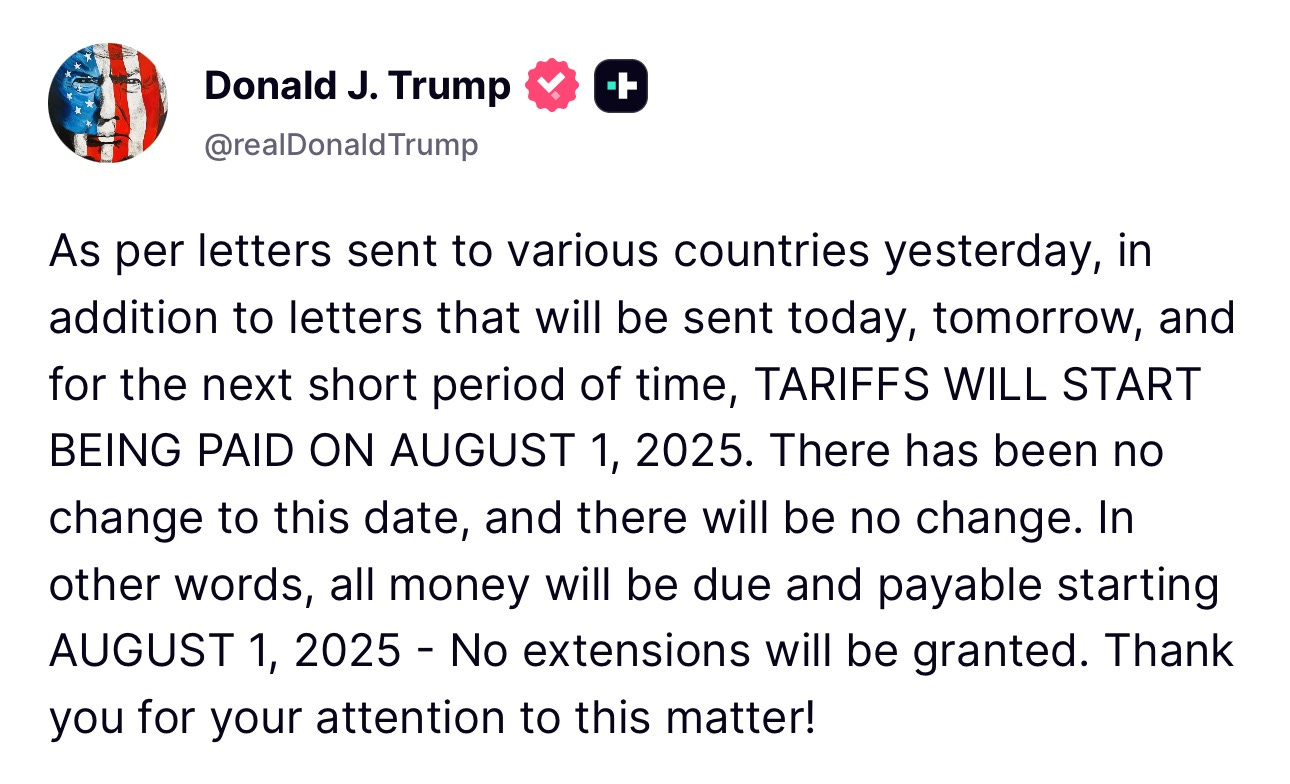

Global equities delivered a mixed performance as traders responded to a renewed wave of tariff threats from the White House. President Trump’s aggressive rhetoric targeting copper and pharmaceutical imports shifted market sentiment, despite earlier indications of a delayed tariff rollout. While U.S. stock futures barely moved, suggesting another muted session for the S&P 500, European equities climbed 0.7% to their highest level in nearly a month. Asian markets ticked lower.

Commodities weren’t spared from the volatility – LME copper plunged up to 2.4% after a massive 13% rally the day before. In New York, the metal closed down 2.8% as traders recalibrated expectations in response to Trump’s evolving stance.

While markets have become somewhat desensitized to Trump’s tariff brinkmanship, investors remain cautious. Eleva Capital’s Stéphane Deo noted that while reactions have been more measured lately, the administration’s trajectory suggests significantly higher tariffs this fall – a potential inflationary trigger.

U.S. Treasuries held their ground after five straight days of losses, with the 10-year yield steady at 4.40%. A $39 billion auction of 10-year notes is on deck, followed by $22 billion in 30-year bonds. Meanwhile, all eyes are on the Fed’s June meeting minutes for clues about the rate-cut timeline. Traders are nearly fully pricing in two quarter-point cuts by year-end, with a strong probability of a move in September.

Europe’s rally was fueled in part by a 7% surge in EssilorLuxottica after Meta took a minority stake in the eyewear giant. Bank stocks led the way, with SocGen hitting levels not seen since 2017. In U.S. premarket trading, Verona Pharma soared 20% following reports of a potential $10 billion acquisition by Merck.

Overall, investor caution remains high as inflation risks, trade policies, and Fed signals converge – with no clear resolution just yet.

Stocks

S&P 500 futures were little changed as of 6:07 a.m. New York time

Nasdaq 100 futures were little changed

Futures on the Dow Jones Industrial Average rose 0.1%

The Stoxx Europe 600 rose 0.7%

The MSCI World Index rose 0.2%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.1715

The British pound was little changed at $1.3598

The Japanese yen was unchanged at 146.58 per dollar

Cryptocurrencies

Bitcoin was little changed at $108,738.64

Ether rose 0.3% to $2,608.52

Bonds

The yield on 10-year Treasuries was little changed at 4.40%

Germany’s 10-year yield was little changed at 2.68%

Britain’s 10-year yield was little changed at 4.63%

Commodities

West Texas Intermediate crude rose 0.4% to $68.62 a barrel

Spot gold fell 0.3% to $3,291.43 an ounce

Trump Media Filed For A Crypto Index ETF

President Donald Trump’s media company is stepping further into crypto with plans for a new ETF that tracks BTC, ETH, SOL, XRP, and CRO. Trump Media & Technology Group – the parent of Truth Social – filed with the SEC to launch the “Crypto Blue Chip ETF” later this year. The fund would allocate 70% to Bitcoin, 15% to Ethereum, 8% to Solana, 5% to Ripple’s token, and 2% to Crypto.com’s coin – the latter also serving as the ETF’s digital custodian.

There are two key takeaways. First, this move follows an earlier plan by Trump Media to launch a simpler ETF holding only Bitcoin and Ethereum – though it’s unclear if that version is still in the works. The company hasn’t commented further. Second, it’s kind of wild to remember that earlier this year, people were panicking, thinking the president chose SOL over ETH. Now that we’ve seen more of what the president and his crypto team are doing, it’s clear the priority stack is BTC first, then ETH, then SOL – and that’s a good thing. Honestly, it’s the natural order of how this should go.

There Are Two More Crypto Treasury Companies To Track

Another day, another pair of crypto treasury firms stepping into the spotlight with bold plans and big money.

GameSquare Holdings (NASDAQ: GAME) just rolled out an Ethereum-focused treasury initiative designed to generate on-chain yields between 8–14%. The effort is backed by Dialectic and its AI-powered Medici platform, which will help guide allocation strategy. GameSquare has committed to investing up to $100 million in ETH over time and has already raised $8 million via a public offering to get the ball rolling.

Meanwhile, ReserveOne Inc. is getting ready to go public through a SPAC merger with M3-Brigade Acquisition V Corp. (NASDAQ: MBAV). The company aims to run a diversified crypto treasury with a strong Bitcoin foundation, rounded out by Ethereum, Solana, and others. Its strategy includes staking and lending to generate returns. If all goes to plan, the deal will raise over $1 billion and already has heavyweight backers like Galaxy Digital, Kraken, and Pantera Capital in its corner.

The crypto treasury wave isn’t slowing down – and these two moves signal growing confidence in long-term crypto yield strategies from institutional players.

Jack Dorsey Is Launching Bitchat

The new project created by Jack Dorsey – Block CEO and Twitter co-founder – is a decentralized peer-to-peer messaging app, inspired by Bitcoin and running entirely over Bluetooth.

Dorsey spent the weekend learning about Bluetooth mesh networks, relays, encryption, and store-and-forward models before unveiling Bitchat on X. He described the system as having “IRC vibes” – reminiscent of early internet chat platforms. According to its white paper, Bitchat operates on Bluetooth Low Energy (BLE) mesh networks, enabling users to send messages without relying on internet or cellular connections.

The one downside I saw some commenters discussing is the range being just 300 meters – which is just under three football fields or roughly the length of two city blocks.

Bitcoin & Ethereum Treasury Stocks Rally: How Long Before It Collapses?

Jeff Park, Head of Alpha Strategies at Bitwise, joins my friends Andrew Parish and Tillman Holloway from Arch Public to dive deep into the explosive Bitcoin & Ethereum treasury stocks rally. We'll also unpack what's driving the latest crypto headlines and discuss how far this market surge can realistically go.

My Platforms And Sponsors

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

The Wolf Pack - My new Telegram group where I share daily updates on everything I'm watching and chat directly with all of you. Completely free to join.

The Crypto Advisor - My weekly newsletter for registered investment advisors, combining macro trends, Wall Street insights, and crypto – all in one place..

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis!

Blofin - Blofin is offering our Telegram members a $30 Bonus + 50% Spot Discount when they sign up for The Wolf Pack.

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Peoples Reserve - Use Bitcoin as pristine collateral with Peoples Reserve - where wealth is built smarter through Bitcoin-powered finance.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.