Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Use my link HERE.

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 400 trading pairs, minimal fees, peer to peer trading, derivatives, up to 100x leverage.

Make sure to check if Phemex is available in your jurisdiction.

In This Issue:

The Rule of 72

Bitcoin Thoughts And Analysis

Legacy Markets

Ondo Finance Unveils Ondo Global Markets

BlackRock’s BTC ETF Is Expanding To Europe and Inflows Are Rising!

MicroStrategy Rebrands To Strategy

These Bitcoin Predictions Are Massive

Bitcoin to $745,000?! This Billionaire Says It’s Inevitable!

The Rule of 72

Chances are you’ve come across the Rule of 72—whether it’s from scrolling on X, reading a textbook in college, or having your financial advisor repeat it every six months on a call. This rule dates back centuries and is believed to have first been documented in “Summa de arithmetica,” published in Venice, Italy, in 1494. It’s one of those timeless financial shortcuts that’s stuck around because it’s simple, effective, and surprisingly accurate for estimating how long it’ll take for your money to double at a fixed rate of return.

Here’s the earliest source I could find, translated directly from Latin to English: “In wanting to know of any capital, at a given yearly percentage, in how many years it will double adding the interest to the capital, keep as a rule [the number] 72 in mind, which you will always divide by the interest, and what results, in that many years it will be doubled. Example: When the interest is 6 percent per year, I say that one divides 72 by 6; 12 results, and in 12 years the capital will be doubled.”

Let’s make this a bit clearer…

The Rule of 72 is a simple way to estimate how long it will take for your investment to double based on a fixed annual rate of return. To use it, you just divide 72 by the rate of return you expect, and the result will give you the number of years it will take for your money to grow twofold. For example, if your investment grows at 6% per year, dividing 72 by 6 tells you it will take 12 years for your money to double. This rule is an easy shortcut that helps you get a rough idea of how your investments might grow over time.

For the math nerds out there, the number 72 is used in the Rule of 72 because it’s a convenient and close approximation of the formula needed to calculate compound growth over time. While technically 69.3 or 71.5 would be more precise (since they are closer to the value of ln(2)), 72 is easier to work with and still gives results that are fairly accurate for typical returns.

This formula—A = P × (1 + r) ^ t—describes how your money grows exponentially with compound interest. The reason 72 is a good fit is that it’s tied to the natural logarithm of 2 (approximately 0.693), a key value for determining how many times your money must compound to double.

Using the rule of 72, if we assume the average annual return of the S&P 500 is around 10%, we can quickly calculate that it will take approximately 7.2 years to double your money invested in the S&P 500. Dividing 72 by 10 equals 7.2 years.

What about Bitcoin? How long does it take to double your investment? This is a bit trickier to figure out because Bitcoin launched in 2009, but reliable pricing data didn’t emerge until mid-2010. In its early years, Bitcoin's price skyrocketed from $0.01 to $0.10, then to $1.00, and eventually hit $100 by November 2013. The extreme volatility during these formative years makes it more difficult to apply a simple formula like the Rule of 72 to Bitcoin’s price history.

But what about the later years?

Well, let’s look back on the price of Bitcoin at the start of each year going back to 2014

January 1st, 2014 - $754.97, January 1st, 2015 - $320.44, January 1st, 2016 - $430.72, January 1st, 2017 - $963.66, January 1st, 2018 - $14,112.20, January 1st, 2019 - $3,743.13, January 1st, 2020 - $7,212.63, January 1st, 2021 - $28,994.01, January 1st, 2022 - $47,738.59, January 1st, 2023 - $16,619.10, January 1st, 2024 - $44,500 and, January 1st, 2025 - $93,425.

This is a pretty unusual data set given the volatility and limited sample size, but I calculated the CAGR using the formula ((Ending Value / Beginning Value)^(1 / Number of Years) - 1) to be 54.8%, while the simple average of the yearly returns comes out to 187.58% (summing the year-over-year percentage changes and dividing by the number of years). A sharp eye will notice that this 187.58% is pretty close to the widely shared claim that Bitcoin appreciates 200% YoY. That claim is fun, but largely a result of growth in the early days before it was considered a meaningful asset, so it’s not very useful.

For our purposes, let’s stick with the CAGR figure of 54.8% but round it down to 50% and 40% to be more conservative. Bitcoin can’t sustain this level of appreciation forever, but for the next few years (or maybe a decade), 50% and 40% seem like reasonable estimates. Using the Rule of 72, at a 50% annual return, Bitcoin would double roughly every 1.44 years (72 ÷ 50), and at a 40% return, it would double about every 1.8 years (72 ÷ 40).

If we want to be extra conservative, a 30% CAGR would mean Bitcoin doubles roughly every 2.4 years (72 ÷ 30) according to the Rule of 72.

When we compare Bitcoin’s potential doubling times at 1.44 years, 1.8 years, and 2.4 years, respectively (50%, 40%, and 30%) — to the S&P 500's 7.2 years (10%), Bitcoin should be expected to move 5x, 4x, or 3x faster, depending on the rate you think it will take. Of course, the cost of taking the faster car (Bitcoin) is volatility—it will occasionally fly off the tracks—but if your goal is to double your money and you're willing to hold on, there's no faster and safer ride than Bitcoin.

The next time you’re considering an investment, I encourage you to apply the Rule of 72. Remember, the S&P 500 typically doubles every 7.2 years, while Bitcoin could double 3x, 4x, or even 5x faster. Then, ask yourself if the risk associated with the new asset is worth more than the potential returns from either of these two vehicles.

There is no better car than Bitcoin.

The week is almost over, and sentiment is still leaning pessimistic, though it’s severely split. Half of investors are expecting new lows, while the other half is convinced the bottom is in. But forget all of that and zoom out—there’s no denying that we’re in a bull cycle, and Bitcoin is set to go much higher eventually.

Bitcoin Thoughts And Analysis

The Bitcoin daily chart reveals an ongoing struggle at critical levels. The price is trading just below the 50-day moving average, which is acting as dynamic resistance around the $99,860 region. Yesterday's candle shows a strong rebound from the lows, indicating buyer interest near the support zone, but the price has yet to reclaim the key levels of $99,860 or the 50-day moving average for a more bullish outlook.

Volume on the bounce was slightly above average, which is encouraging, but follow-through will be key in determining whether this rebound has enough momentum to break above resistance.

For a bullish scenario, Bitcoin needs to establish a daily close above $99,860 and the 50-day moving average. A continuation above $106,099 would provide a more convincing signal of strength. On the other hand, a break below the recent lows could open the door to a retest of the demand zone in the $89,000–$90,000 range. Monitoring volume and price action near these key levels will be essential for confirming the next directional move.

Legacy Markets

US stock futures rose as Treasury Secretary Scott Bessent emphasized the Trump administration's focus on lowering Treasury yields, boosting investor sentiment. S&P 500 futures gained 0.2%, while 10-year yields hovered near their lowest levels since December. European stocks also rallied on strong earnings, with Societe Generale and AstraZeneca posting better-than-expected results. Shipping giant A.P. Moller-Maersk surged nearly 9% after announcing a $2 billion buyback.

Bessent reiterated that expanding energy supply would help curb inflation but avoided commenting on future Federal Reserve policy. Investors are also awaiting Amazon’s earnings report after market close. Analysts highlighted that despite trade concerns, falling bond yields and earnings growth remain positive for equities.

UK stocks outperformed, while the pound weakened as markets anticipated a Bank of England rate cut. Meanwhile, in US premarket trading, Qualcomm fell after disappointing earnings, with investors worried about slowing smartphone demand. Ford also declined after warning of profit risks from lower vehicle prices, new model costs, and potential Trump tariffs.

On the economic front, German factory orders surged in December, signaling a potential recovery in the struggling sector. Traders are also watching European retail sales and US jobless claims data ahead of Friday’s payroll report. Despite geopolitical uncertainties, easing bond yields and resilient earnings continue to support market optimism.

Key events this week:

Eurozone retail sales, Thursday

UK rate decision, Thursday

US initial jobless claims, Thursday

Fed’s Christopher Waller, Lorie Logan speak, Thursday

Amazon earnings, Thursday

US nonfarm payrolls, unemployment, University of Michigan consumer sentiment, Friday

Fed’s Michelle Bowman, Adriana Kugler speak, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 rose 0.7% as of 9:48 a.m. London time

S&P 500 futures rose 0.2%

Nasdaq 100 futures rose 0.2%

Futures on the Dow Jones Industrial Average rose 0.2%

The MSCI Asia Pacific Index rose 0.2%

The MSCI Emerging Markets Index rose 0.3%

Currencies

The Bloomberg Dollar Spot Index rose 0.3%

The euro fell 0.4% to $1.0363

The Japanese yen was little changed at 152.69 per dollar

The offshore yuan fell 0.2% to 7.2954 per dollar

The British pound fell 0.6% to $1.2434

Cryptocurrencies

Bitcoin rose 1.7% to $98,615.78

Ether rose 2.1% to $2,846.07

Bonds

The yield on 10-year Treasuries advanced two basis points to 4.44%

Germany’s 10-year yield advanced two basis points to 2.39%

Britain’s 10-year yield was little changed at 4.44%

Commodities

Brent crude rose 0.5% to $75.01 a barrel

Spot gold fell 0.3% to $2,858.56 an ounce

Ondo Finance Unveils Ondo Global Markets

Ondo Finance made headlines yesterday with the launch of Ondo Global Markets (Ondo GM), a platform bringing onchain exposure to U.S. public securities like stocks, bonds, and ETFs. In its press release, Ondo stated, “What stablecoins did for dollars, Ondo Global Markets will do for securities,” which, to me, signals the long-awaited move of securities onto the blockchain.

Similar to how stablecoins transformed dollars, Ondo GM aims to make securities more accessible, transparent, and efficient by leveraging blockchain technology. The platform currently offers exposure to 1,000+ securities from the NYSE and NASDAQ, including household names like Apple and Tesla stocks and fixed-income ETFs. Each tokenized asset will be backed 1:1 by an underlying security and freely transferable outside the U.S. Additionally, Ondo GM integrates issuer permissioning, allowing stakeholders to maintain control over distribution.

ETH holders should be happy regarding the news since Ondo primarily operates on Ethereum.

“By leveraging blockchain technology, we can bring institutional-grade financial markets onchain, making them more accessible, transparent, and efficient. That’s why, last year, we announced our intention to build what we call Ondo Global Markets, a tokenization platform designed to bring public securities onchain.”

“Behind this momentum, we reimagined the Ondo GM tokenization framework, which now will enable issuers to create tokens that are more freely transferable, similar to stablecoins—with permissioning built into the distribution layer (as needed or desired for participants’ compliance, security or commercial purposes).”

BlackRock’s BTC ETF Is Expanding To Europe and Inflows Are Rising!

Following the success of its U.S. launch, BlackRock is set to expand its crypto product lineup with the launch of a Bitcoin ETP in Europe. This new fund, expected to be based in Switzerland, will be BlackRock’s first crypto ETP in the European market and could debut as soon as this month according to a Bloomberg report.

Since its launch in January 2024, the iShares Bitcoin Trust (IBIT) has become one of the largest Bitcoin ETFs, accumulating $58 billion in Bitcoin assets as of February 4. The fund has also dominated the spot Bitcoin ETF market, attracting $934 million in net inflows since January 30, including $249 million in a single day.

I can imagine this also means ETH will likely receive similar treatment once the new Bitcoin ETP is underway. Speaking of ETH, ETH ETFs recorded their third-highest single-day inflow in history, bringing in $307.8 million—trailing only $332.92 million in November and $428.44 million in December, both single-day records. You can see the full stats in the images below.

When ETH ETF staking goes live, which is one of the new priorities for the SEC’s crypto Task Force to establish clarity, there are going to be much larger days than $300m. From the SEC, “We need to provide clarity about whether crypto-lending and staking programs are covered by the securities laws and, if so, how. We plan to work to help address how such programs can be structured consistent with the law.”

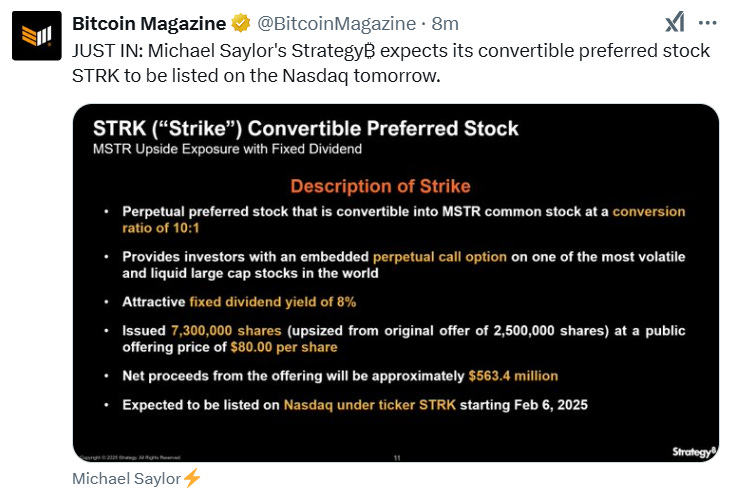

MicroStrategy Rebrands To Strategy

This one's going to take some time to adjust to. MicroStrategy is now Strategy, rebranding not just its name but its entire image and digital footprint. The core of Strategy’s business will stay the same as the software company it’s always been, but Bitcoin is now a more prominent part of the business.

“We provide cloud-native, AI-powered enterprise analytics software to thousands of global customers, and leverage 35+ years of software expertise to explore innovation in Bitcoin applications. We believe the combination of our operating structure, Bitcoin strategy, and focus on technology innovation provides a unique opportunity for value creation.”

In other Strategy news, there is this:

These Bitcoin Predictions Are Massive

I have two Bitcoin predictions to cover briefly. Above is Dan Morehead, CEO of Pantera Capital, which had over $5 billion in AUM as of mid-2024, reaffirming his $745,000 prediction.

Dan Morehead: “I used to tell people it could definitely go to zero to be conservative, but I don't think that's possible anymore. Fifteen million people in the U.S. own it, and 300 million globally. BlackRock and Fidelity are selling it. It really has reached escape velocity.”

Interviewer: “Your $745,000 prediction? I heard $13 million from Michael Saylor the other day.”

Dan Morehead: “It’s already increased three orders of magnitude since we launched our fund. I think it can go up a fourth, which would put it at a $15 trillion market cap—still relatively small compared to the $500 trillion in financial assets.”

Below is Standard Chartered’s Bitcoin forecast, predicting $200,000 this year and $500,000 by 2028. Their year-by-year projections are:

2025 – $200,000

2026 – $300,000

2027 – $400,000

2028 – $500,000

Bitcoin to $745,000?! This Billionaire Says It’s Inevitable!

I am joined by Joshua Frank, Co-Founder & CEO at The Tie, the leading information services provider for digital assets, to discuss the latest in crypto!

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.