Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

In This Issue:

‘Out Of Thin Air’

Bitcoin Thoughts And Analysis

Altcoin Charts

Stock Futures Hold Steady As Tariff Jitters Ease

Robinhood Offers Higher Staking Yield Than Coinbase

This Ethereum Treasury Company Sold All Of Its BTC

The SEC Is Working Toward Streamlined ETF Approval

Elon Musk Files For His Own Political Party

“America” Will Support Bitcoin, Fiat Is Hopeless | Macro Monday

‘Out Of Thin Air’

Grab a chair or a cup of coffee, it’s story time.

Three newsletters ago, I ended on a cliffhanger - this…

OpenAI, the company Vlad Tenev (CEO of Robinhood) proudly touted as newly accessible to European retail investors via tokenization, was quick to distance itself. Not only did it clarify that it doesn’t endorse the effort, it also issued a warning to users: “please be careful,” as if something might go wrong.

You can practically picture the moment Robinhood caught wind of OpenAI’s response - PR and compliance teams scrambling into an emergency meeting to figure out how to contain the fallout.

Vlad’s response was thoughtful, professional, and fast – it took just three hours.

But who’s actually in the right here? And is Robinhood doing something it maybe shouldn’t?

Before we get into that, let’s be clear: this is not legal or financial advice. It’s for educational and entertainment purposes only. Always do your own research and consult a licensed professional before making any decisions.

Now, let’s break down what tokenization actually means, how crypto ‘equity’ compares, and what traditional equity looks like – using Strategy as a simple example.

Strategy bought Bitcoin, then issued shares that people could purchase. Those shares represent ownership in the business and its balance sheet. If you own 100% of the shares, you own 100% of the company. Own 1%, and you own 1% of the assets, profits, liabilities, and future upside.

This isn’t just a piece of paper or a digital token – it’s a legal claim. Shareholders get voting rights, a say in major decisions, and a claim on earnings and the company’s residual value if it’s ever sold or liquidated.

So what happens when a company offers tokenized ‘equity’ on a blockchain? What do those tokens actually represent? Are they legally recognized shares with the same rights? Or are they just digital placeholders – promises without protection?

Tokenization today often means creating a digital asset that represents something, rather than conferring actual ownership. It can improve liquidity, speed up transfers, and lower barriers to entry – but that doesn’t make it the same as holding real equity.

So does tokenized equity create value out of thin air?

Not exactly.

Traditional equity is backed by business fundamentals – products, profits, assets, and growth. A share of Strategy gives you a slice of a functioning business with legal protections and economic value behind it.

Yes, market prices swing with hype and macro noise. But underneath the volatility, traditional equity is grounded in real-world activity and structure.

Tokenized assets, on the other hand, often live in a gray area. Without clear legal frameworks, governance, or shareholder rights, these tokens might behave more like derivatives or IOUs – attractive in theory, but risky in practice.

Which brings us back to Robinhood and OpenAI. The problem? The tokens don’t represent actual ownership. They just offer price exposure – no voting rights, no dividends, no seat at the table. That subtle but critical distinction caused the confusion on X.

And that’s how we got here.

I’m going to assume there was at least some sarcasm in that post – but let’s break it down anyway.

Robinhood did issue tokens linked to OpenAI, but these tokens aren’t “fake” in the sense of being worthless – they simply don’t represent traditional equity or legal ownership rights. Also, OpenAI isn’t strictly a non-profit trying to convert into a for-profit. It operates under a unique capped-profit model through its OpenAI LP entity, blending non-profit goals with commercial ambitions. So while the tokens don’t grant actual ownership or profit-sharing, calling them fake oversimplifies the nuanced reality of what these digital assets are intended to be.

Here’s a good question: if someone creates a token that mirrors the value of a real asset – but doesn’t actually confer ownership – isn’t that like conjuring value out of thin air? Doesn’t that inflate the amount of ‘money’ sloshing around in the system?

The answer: creating a token that represents something doesn’t create new intrinsic value – it creates a derivative, like a synthetic version. But yes, if people start trading it as if it’s real equity, it can behave in markets like real capital – which is where the illusion kicks in.

Think of it like this: if I issue poker chips to my friends and say, “Each chip is worth $100 of Microsoft stock,” but you can’t redeem the chip for actual stock or dividends, then the chip only has value if someone else agrees to buy or sell it – even though nothing new was created on Microsoft’s balance sheet. A market may then start trading around a proxy that isn’t anchored by actual ownership. It’s not new capital in the system, but it feels like it.

Value isn’t created out of thin air – it’s merely repackaged. The token doesn’t inject capital into OpenAI, nor does it expand the company’s balance sheet or redistribute ownership. But from the outside, it can look like more value exists, because now there’s a new asset trading in parallel to the real one. This creates a kind of financial mirage: two markets – one real, one synthetic – both reacting to the same narrative, but only one with actual rights, governance, and legal weight.

The danger comes when that distinction gets lost. When retail investors mistake exposure for ownership, or believe access means entitlement, the line between innovation and misrepresentation starts to blur – and that’s exactly what made this Robinhood episode so controversial.

That said, I think Robinhood’s going to be fine here. I don’t think the SEC is coming down with the hammer – for one, they aren’t even offering these products in the U.S.

For my fine print lovers: go crazy.

Here’s another good point:

Here’s Vlad giving some more detail from the “To Catch A Token” event. The key part I want you to notice is highlighted below:

“This could mean collateralized lending and borrowing, swapping – really, self-custody in its very pure form. Now, the beauty of this process is that it transfers pretty easily to any type of asset. So you can kind of circumscribe this part here, and you could replace this U.S. stock broker with, say, an art broker or real estate broker – swap out the appropriate market or exchange.

Outside of the token stuff, everything is pretty fungible and, uh, interchangeable. So we look forward to expanding your trading options with the assets that you care about most.”

Tokenization isn’t going to stop just because OpenAI – or any other company – doesn’t like it. The tech is compelling, and the momentum is clearly spreading. Robinhood didn’t just tokenize OpenAI – they’ve issued over 200 tokenized stocks, and as far as I can tell, OpenAI is the only one that publicly pushed back.

Frankly, most companies would probably welcome the visibility and demand that comes from their equity – or even a proxy for it – becoming accessible to a wider investor base. While OpenAI might have valid concerns around branding, control, or legal clarity, there’s a strong case that tokenized exposure to its valuation is a sign of relevance, not a threat to integrity.

Everything is going to be tokenized – whether companies like it or not.

If there’s one key takeaway from this story, it’s this: the innovation here isn’t about conjuring value out of thin air – it’s about access. These tokens may not offer real ownership, but for everyday investors, they offer exposure to companies they never would have been able to reach. In that sense, it’s less about financial engineering and more about making the inaccessible feel suddenly possible – almost like magic.

I know I talk about tokenization a lot – but that’s because I genuinely believe it’s going to be MASSIVE. Not just a trend, but a transformation measured in trillions.

If you enjoyed this newsletter – or know someone who’s still wrapping their head around tokenization – forward it to them. It only takes a second, and if they subscribe, it helps me out more than you know.

Bitcoin Thoughts And Analysis

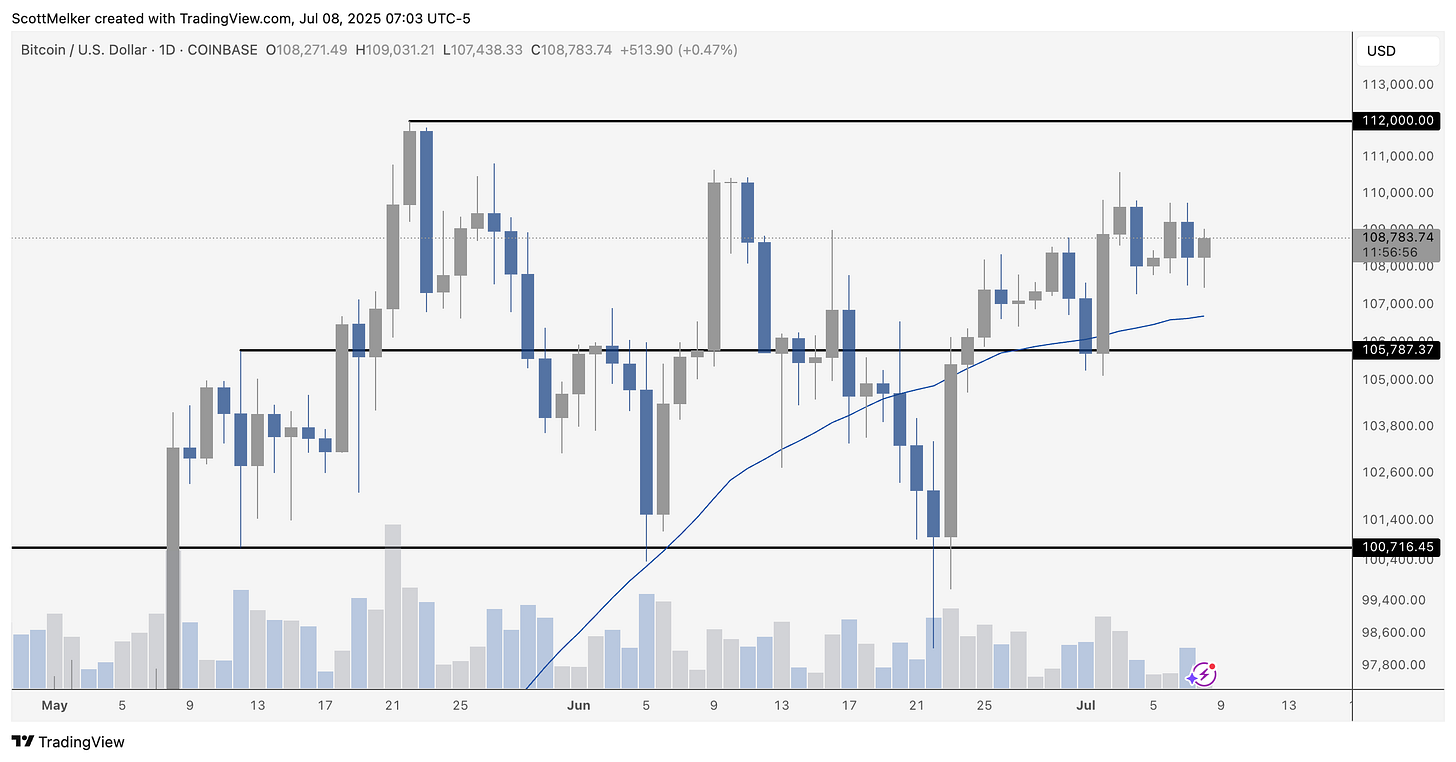

Bitcoin continues to hold strong just below resistance at $112K after a clean reclaim of the $105,787 support zone and the 50-day moving average. Price is consolidating in a tight range, printing higher lows and showing signs of strength as it flirts with a potential breakout.

Volume has tapered off slightly during this sideways action, which is typical in a coiling pattern before a move. If bulls can finally push through $112K with conviction, we’re likely headed for a fresh leg higher. On the flip side, a drop back below the 50 MA and $105K would invalidate the short-term bullish structure.

Until then, it’s just a waiting game inside this range – but the bias leans bullish.

Altcoin Charts

There is so little to say about altcoins - even when I spot a good chart, it’s hard to justify buying it rather than simply buying Bitcoin. This could change, but for now, it’s not really worth the time to try to find a needle in a haystack.

Stock Futures Hold Steady As Tariff Jitters Ease

Markets took a collective breath Tuesday as U.S. stock futures stabilized and fears over impending tariffs began to ease. The S&P 500 inched up 0.1% after retreating from record highs last session, while Tesla bounced 1% in early trading. Meanwhile, U.S. Treasury yields continued climbing – the 10-year at 4.41% and the 30-year nearing 5% – amid a global selloff in longer-dated bonds.

The driver? Hopes that Trump’s trade war rhetoric will once again end in compromise. The White House extended its July 9 deadline for new tariffs – now eyeing August 1. That news helped steady investor nerves and buoy optimism for a deal, especially in Europe, where leaders are rushing to finalize a framework with the U.S. that could cap tariffs at 10% while a permanent agreement is hammered out.

Currency markets liked the progress too. The euro jumped 0.5% after a Politico report claimed the U.S. is offering exemptions for sensitive European sectors in exchange for tariff commitments. Still, analysts warned that the “default to higher tariffs” posture adds long-term uncertainty and could weigh on U.S. growth and the dollar.

Despite the geopolitical tension, the U.S. economy continues to show resilience – job growth is solid, and the S&P 500 recently hit an all-time high. But not everyone is convinced the good times will last. Persistent debt concerns, policy unpredictability, and trade risks could eventually force a market reckoning.

As Tikehau Capital’s Raphael Thuin put it, investors betting on the TACO trade – tech, AI, crypto, and oil – might be in for a reality check if tariffs become a permanent fiscal tool rather than just political leverage.

Stocks

S&P 500 futures rose 0.1% as of 7:17 a.m. New York time

Nasdaq 100 futures rose 0.2%

Futures on the Dow Jones Industrial Average were little changed

The Stoxx Europe 600 was little changed

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro rose 0.2% to $1.1735

The British pound fell 0.1% to $1.3584

The Japanese yen fell 0.2% to 146.37 per dollar

Cryptocurrencies

Bitcoin rose 0.9% to $108,912.92

Ether rose 1.7% to $2,576.72

Bonds

The yield on 10-year Treasuries advanced three basis points to 4.41%

Germany’s 10-year yield advanced five basis points to 2.69%

Britain’s 10-year yield advanced four basis points to 4.63%

Commodities

West Texas Intermediate crude fell 0.2% to $67.77 a barrel

Spot gold fell 0.3% to $3,326.26 an ounce

Robinhood Offers Higher Staking Yield Than Coinbase

I have screenshots on the APY’s from Robinhood and Coinbase below:

Here are the boosted and standard APYs from Coinbase. To earn the higher rate, you need to pay $30 a month, which is quite expensive to justify solely through staking rewards.

Robinhood outperforms Coinbase on staking APYs, offering 2.39% higher returns on Solana compared to Coinbase’s standard rate and 1.89% more than Coinbase One. It also beats Coinbase by 0.62% on Ethereum’s regular APY and 0.42% over Coinbase One.

This Ethereum Treasury Company Sold All Of Its BTC

I have a couple of updates here: First, BitDigital has completed its transition to an ETH treasury by selling its entire BTC stack along with raising $172 million in capital. According to the press release, the capital was used to purchase ETH - meaning BitDigital might be one of the treasury companies doing this ethically. That is, they're not just acquiring ETH from outside investors and then selling shares of the company at a premium while insiders dump the shares they acquired at NAV (as I discussed yesterday).

“We believe Ethereum has the ability to rewrite the entire financial system. Ethereum's programmable nature, growing adoption, and staking yield model represent the future of digital assets,” said Sam Tabar, Chief Executive Officer of Bit Digital. “Bit Digital is aligning itself with Ethereum's long-term potential and positioning itself as a focused Ethereum treasury platform in the public markets. We are starting with exposure to over 100K ETH for now but we intend to aggressively add more so we become the preeminent ETH holding company in the world.”

Second, according to the Strategic ETH Reserve platform, all of the companies currently holding ETH - which is likely an underestimate given that World Liberty Financial isn’t even listed - collectively hold just 1% of the total ETH supply. I think that number could easily jump to 3%, and here’s why. Strategy alone holds 2.8% of the 21m total BTC supply (this isn’t accounting for lost coins or Satoshi’s holdings). Granted, Strategy has been aggressively accumulating for a long time, but the fact of the matter is ETH is cheaper to acquire and represents a new frontier. While it doesn’t yet draw the same level of attention as BTC, I believe a few strong voices - namely Joe Lubin and Thomas Lee - could significantly influence how much ETH these companies begin to accumulate. What we want to see though is ETH being purchased on the open market, not just transferred from one entity to another and then packaged into public shares.

The SEC Is Working Toward Streamlined ETF Approval

The SEC is currently developing its most comprehensive guidance yet for crypto exchange-traded products - a move industry experts see as a pivotal shift in the agency’s stance and approval process. Rather than blocking crypto ETFs as it has in the past or undergoing lengthy back-and-forth filing periods, the SEC appears to be laying the groundwork for rules around broader approvals, including funds tied to major altcoins like Solana and XRP, and even politically themed meme coins. According to sources, the SEC is working on a universal ETF listing rule that would replace the current 19b-4 process - a bureaucratic hurdle that can delay approvals by up to 240 days. The new framework, being developed with input from exchanges like Nasdaq and Cboe, could reduce that timeline to just 75 days, streamlining the path for future crypto ETF listings.

Elon Musk Files For His Own Political Party

It seems like Elon is just being Elon, but the detail I want to highlight is this exchange on X.

So far, I don’t see this party going anywhere. But what I do see is the world’s richest man - and one of the most powerful - supporting Bitcoin. That’s a win.

“America” Will Support Bitcoin, Fiat Is Hopeless | Macro Monday

Join Dave Weisberger, Mike McGlone, and James Lavish as we break down what's happening in macro and crypto!

My Platforms And Sponsors

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

The Wolf Pack - My new Telegram group where I share daily updates on everything I'm watching and chat directly with all of you. Completely free to join.

The Crypto Advisor - My weekly newsletter for registered investment advisors, combining macro trends, Wall Street insights, and crypto – all in one place..

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis!

Blofin - Blofin is offering our Telegram members a $30 Bonus + 50% Spot Discount when they sign up for The Wolf Pack.

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Peoples Reserve - Use Bitcoin as pristine collateral with Peoples Reserve - where wealth is built smarter through Bitcoin-powered finance.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.