Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Trading Alpha Released A Super Cool Product!

One of the partners of this newsletter, Trading Alpha, my trusted indicator and trading community, has launched their proprietary Indicator Search Engine for All Markets. This custom Indicator Screener scans crypto, stocks, and forex markets for Trading Alpha indicator setups, eliminating the need for time-consuming manual analysis. It can simultaneously screen for multiple indicators, enhancing confluence and providing advanced analysis capabilities across different markets. This is cutting-edge technology for serious traders.

Make sure to use my link HERE if you plan on giving it a try. Use code '10OFF' for a 10% discount.

In This Issue:

Is This The Future of Crypto ETFs?

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

FTX Repayments Are About To Begin

A Stablecoin Bill Is In The Works

The SEC Releases Top Priorities For The Crypto Task Force

VanEck Introduces “MAGA10” Index

Crypto Market Rebound & Big Day For Bitcoin | Here Is What Comes Next!

Is This The Future of Crypto ETFs?

A regular Bitcoin ETF simply tracks Bitcoin’s price, meaning investors experience both its gains and losses without any built-in protection. If Bitcoin drops 50%, your investment in IBIT, FBTC, GBTC or any other spot Bitcoin ETF drops 50%. If it rises 50%, you gain 50%—simple.

What if I told you there was a way to gain exposure to Bitcoin, through an ETF, with 100% downside protection? Impossible right? Nope, but there is a slight catch.

Calamos Investments is a U.S.-based asset management firm known for offering innovative investment strategies, including equity, fixed income, and alternative investments. They specialize in ETFs that provide downside protection while still allowing for upside participation.

On January 22, CBOJ launched as the world’s first 100% Protected Bitcoin ETF, offering upside potential to a cap with full downside protection over a one-year period. Following this, Calamos listed CBXJ and CBTJ yesterday, providing 90% and 80% downside protection, respectively, with higher upside cap rates.

Below are the details of each ETF:

“CBOJ with 100% downside protection and an estimated cap range of 10%-11.5%”

“CBXJ with 90% downside protection and an estimated cap range of 28%-31%”

“CBTJ with 80% downside protection and an estimated cap range of 50%-55%”

To clarify, 100% downside protection means no losses, 90% downside protection limits losses to a maximum of 10%, and 80% downside protection caps losses at 20%. Also important to know is that the cap range represents the maximum gain you can earn from the ETF over the specified period.

How is this possible? These ETFs use Treasuries and options on the CBOE Bitcoin US ETF Index to provide regulated, risk-managed Bitcoin exposure. They reset annually with a new upside cap and downside protection, and shares can be held indefinitely.

The catch? These ETFs can severely cap your upside potential—if Bitcoin surges, you miss out. Additionally, you’re relying on Calamos to successfully manage the Treasuries and options - we know that no investment is entirely risk-free. One advantage, however, is that these ETFs don’t rely on counterparties for guarantees, making them less risky than structured products with direct credit exposure, such as Bitcoin futures ETFs like BITO, XBTF, and BTF.

These ETFs appeal to risk-averse investors, conservative crypto enthusiasts, and institutional investors who want exposure to Bitcoin without being exposed to its extreme volatility. They’re ideal for first-time crypto investors who want to limit potential losses while still having a chance to capture gains, albeit with a capped upside. These ETFs offer a second set of options to the tried-and-true method of just allocating 1%, 2%, or 5% of a portfolio to spot products.

You could think of these products as a trial run before taking on spot exposure.

Draw investors in with Bitcoin’s historical success and sell them on safety—not bad.

I don’t expect these ETFs to move the needle like IBIT or FBTC do on a daily basis, but a wave of creative ETFs will definitely pull in new investors with all kinds of objections or unique preferences when it comes to their financial appetite. Now that Gensler is out, ETFs are going to fly through the approval process like there’s no tomorrow.

Just last week, the SEC approved the joint Bitcoin and Ethereum Bitwise ETF, joining Hashdex and Franklin Templeton’s similar offerings, which were approved in December. My hunch is that these combo ETFs and indexes will gradually grow, eventually becoming much larger as investors become more comfortable with the products they contain. Bitcoin and Ethereum are straightforward, but getting a grasp on 10 coins will take time. Investors love indexing and they'll definitely embrace it in crypto too given enough time.

In other crypto news, Crypto Twitter watched “Crypto Czar” David Sacks and lawmakers Tim Scott, French Hill, Glenn Thompson, and John Boozman circle jerk each other for 30 minutes yesterday, basically making an announcement of an announcement and saying nothing of substance until the last 10 seconds of the press conference. The whole point of the press conference was to “address crypto’s future,” but all we really heard was that they're working on a stablecoin bill and a market structure bill—and of course, they’re all super proud of the work they've done—bravo, bravo.

As for the last 10 seconds, we finally got something.

Question from the audience: “On the campaign trail, the president said he supported a Bitcoin reserve. I’m curious what the plans are for that at this point, and would the administration consider putting crypto into the sovereign wealth fund?”

David Sacks: “One of the things that the president instructed us to do was evaluate the idea for a Bitcoin Reserve. That's one of the first things we're going to look at as part of the internal working group of the administration. As soon as we get all that set up, we are still waiting for some cabinet secretaries who are on the working group to get confirmed, so we are still in the very early stages of this. That’s one of the first things we are going to look at: the feasibility of a Bitcoin Reserve. I think the concept of the sovereign wealth fund is separate… you’ll have to talk to Secretary Lutnick about that.”

Immediately following the press conference, David Sacks took an interview with CNBC where he added the following: “It's possible that the sovereign wealth fund could decide that they want to make Bitcoin or digital assets part of its portfolio.”

Our elected leaders are finally starting to get the language right. It was “Bitcoin” this time instead of “digital asset” and “reserve” instead of “stockpile” - that's progress. As for the strategic part, that was forgotten, but whatever. Also worth pointing out is that they're currently “evaluating the idea” of the Bitcoin reserve, which ties back to my earlier point that this is just a reiteration of things that have already been said.

Once I got the jokes out of my system on the timeline, I posted this and I’m sticking by it:

Even if BTC drops to the $70k or $80k range, I’m standing by my belief that there’s never been a better time in history to own Bitcoin, given the rate of global adoption happening right now. $250,000 is just as programmed as $500,000 or $1 million—it’s just a matter of stretching out the timeline.

A strategic Bitcoin reserve is coming, and a lot more is on the table too. Don’t get too caught up in the ‘Bitcoin has to hit $70k first’ mindset, or you’ll risk being left behind. Just hold or average in—that’s all you need to do.

Bitcoin Thoughts And Analysis

The Bitcoin daily chart indicates continued bearish pressure as the price remains below the 50-day moving average and the critical $99,860 support level. This marks a significant shift in market sentiment as Bitcoin struggles to regain its footing after recent declines.

The breakdown below $99,860 is notable and could pave the way for a move toward the broader support zone between $89,000 and $92,000, a region where significant demand has previously emerged. The 50-day moving average, now acting as resistance, adds further bearish confluence, and any attempt to reclaim this level will need strong volume and momentum to succeed.

To the upside, a recovery back above $99,860 is crucial for bulls to reestablish control and target the $106,099 resistance. For now, the chart reflects a bearish bias, and traders should remain cautious, especially if the price fails to regain key levels in the coming sessions.

Analyzing the Bitcoin daily chart with Bollinger Bands reveals key insights into the current market dynamics. The price is currently trading below the middle band (20-day moving average), which often serves as a dynamic resistance level in a downtrend. This signals a bearish bias, with the price unable to regain strength above this key level.

The lower Bollinger Band has widened, reflecting increased volatility during the recent sell-off. The price recently tested the lower band, indicating oversold conditions, but there was no significant rebound, suggesting that selling pressure remains strong and that buyers are hesitant to step in with confidence. This lack of a strong bounce near the lower band also highlights the bearish momentum in the market.

A move back toward the middle band would require a shift in sentiment and a recovery in buying interest. For now, the price is trading closer to the lower band, leaving room for further downside exploration, particularly if Bitcoin fails to break back above the middle band. This setup suggests traders should watch for a decisive close above or below the bands, which could signal the next major directional move.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

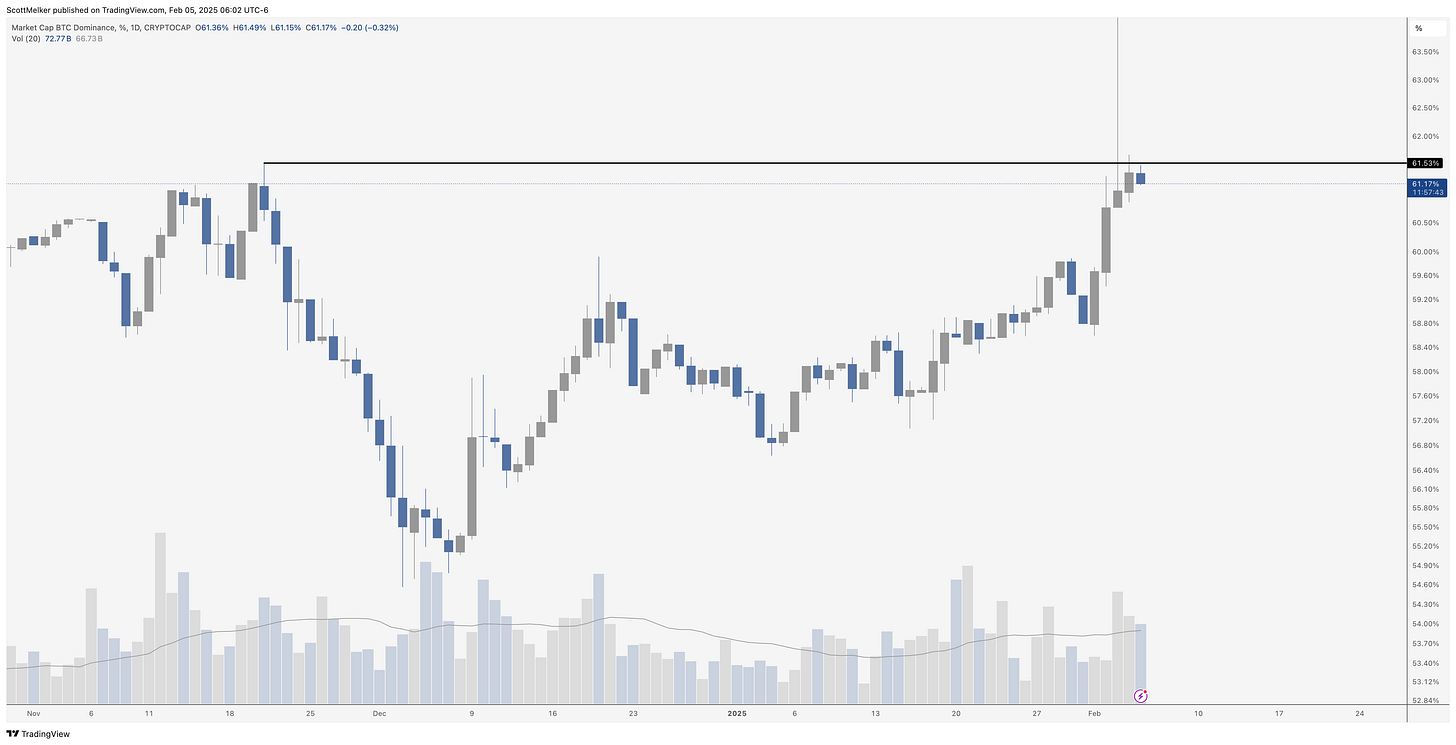

Bitcoin dominance is currently testing a critical resistance level near 61.5%, with multiple wicks poking above but no decisive breakout as of yet. While it's worth noting that Bitcoin dominance isn't a tradeable metric—there are no orders on the books—it can still serve as a valuable sentiment indicator for the broader crypto market, particularly in gauging the relative strength of altcoins versus Bitcoin.

Historically, dominance at resistance often signals a potential pause or reversal, suggesting that Bitcoin's outperformance against altcoins may face some challenges here. However, a confirmed breakout above this level could indicate further liquidity flowing into Bitcoin at the expense of altcoins. Traders should watch for either a strong rejection or a sustained breakout to glean insights into the next potential trend for altcoins in relation to Bitcoin.

Legacy Markets

US stock futures fell on Wednesday as trade tensions and disappointing earnings from major tech firms weighed on sentiment. Nasdaq 100 futures dropped 0.9% after Alphabet and AMD tumbled in premarket trading due to weak revenue and guidance. S&P 500 futures slipped 0.5%, raising concerns that Wall Street’s recent rebound may be short-lived. Amazon is set to report earnings on Thursday, with investors cautious amid uncertainty over US-China trade policies and economic growth.

The dollar weakened, while the yen and gold rallied on haven demand. Treasury yields dipped after US job openings fell more than expected to a three-month low, reinforcing speculation about the Federal Reserve’s future rate path. Alphabet's stock declined after its cloud business growth slowed, while AMD struggled to gain ground in the AI computing space against Nvidia. Apple also slipped in premarket trading amid reports that China’s antitrust regulators are investigating its policies.

In Europe, the Stoxx 600 fluctuated as tech losses were offset by gains in healthcare, led by Novo Nordisk’s upbeat guidance. Spanish lender Banco Santander surged after record profits and a €10 billion buyback, while GSK jumped on strong sales forecasts. Meanwhile, Renault dropped after reports that Nissan may pull out of a planned deal with Honda.

Amid rising trade tensions, the US Postal Service temporarily suspended inbound packages from China and Hong Kong following Trump’s revocation of a rule that previously allowed duty-free small shipments. Trump indicated he’s in no rush to speak with China’s Xi Jinping, leaving trade relations in limbo.

Oil prices declined as concerns over the economic impact of tariffs outweighed newly reinforced US sanctions on Iran. With markets bracing for further volatility, investors are closely watching upcoming earnings reports and economic data for clarity on growth and inflation risks.

Key events this week:

US trade, Wednesday

Fed’s Austan Goolsbee, Tom Barkin, Michelle Bowman, Philip Jefferson speak, Wednesday

Eurozone retail sales, Thursday

UK rate decision, Thursday

US initial jobless claims, Thursday

Fed’s Christopher Waller, Lorie Logan speak, Thursday

Amazon earnings, Thursday

US nonfarm payrolls, unemployment, University of Michigan consumer sentiment, Friday

Fed’s Michelle Bowman, Adriana Kugler speak, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures fell 0.5% as of 6:15 a.m. New York time

Nasdaq 100 futures fell 0.9%

Futures on the Dow Jones Industrial Average fell 0.2%

The Stoxx Europe 600 was little changed

The MSCI World Index rose 0.2%

Currencies

The Bloomberg Dollar Spot Index fell 0.4%

The euro rose 0.4% to $1.0418

The British pound rose 0.5% to $1.2538

The Japanese yen rose 1.1% to 152.70 per dollar

Cryptocurrencies

Bitcoin rose 1.7% to $98,127.48

Ether rose 5.9% to $2,796.57

Bonds

The yield on 10-year Treasuries declined four basis points to 4.47%

Germany’s 10-year yield declined four basis points to 2.36%

Britain’s 10-year yield declined six basis points to 4.46%

Commodities

West Texas Intermediate crude fell 0.8% to $72.13 a barrel

Spot gold rose 0.9% to $2,867.84 an ounce

FTX Repayments Are About To Begin

Starting February 18th, all FTX claims under $50,000 will be deposited into creditors' Bitgo and Kraken accounts. One of the most surprising aspects of the FTX collapse is that lawyers managed to recover an estimated $14.7 billion to $16.5 billion—enough to reimburse most customers at 119% of their account balances. However, this is mainly an illusion since creditors have essentially missed the entire bull run since November 2022. It’ll be interesting to see how this impacts the market—will returning investors stay away from crypto altogether, or will they use these funds to HODL and bid back in? We will find out in a couple of weeks.

A Stablecoin Bill Is In The Works

Sen. Bill Hagerty (R-TN) introduced a bill on Tuesday to establish a regulatory framework for stablecoins. Named the “Guiding and Establishing National Innovation for US Stablecoins,” the bill aims to create a “pro-growth regulatory structure,” requiring stablecoin issuers to back payments with “Treasury bills, U.S. dollars, and Federal Reserve notes,” while also mandating “monthly audited reports.” The bill, co-sponsored by pro-crypto Sens. Kirsten Gillibrand (D-NY), Tim Scott (R-SC), and Cynthia Lummis (R-WY), proposes “light-touch regulatory standards” and clarifies whether issuers would be regulated at the state or federal level.

The SEC Releases Top Priorities For The Crypto Task Force

Following the announcement of a crypto task force on Jan 21, the SEC has now released an official outline of its mission. Hester Peirce described it as “not exhaustive, nor is it presented in order of priority or expected completion.” Still, it provides a solid glimpse into the SEC’s focus. Below is a one-sentence summary for each initiative.

1. Security Status: Evaluating different types of crypto assets to determine their status under securities laws is key to resolving broader regulatory questions.

2. Scoping Out: No-action letter requests are welcomed to clarify areas outside the SEC’s jurisdiction and provide insights into its regulatory approach.

3. Coin and Token Offerings: A proposed framework could offer temporary relief for token issuers who provide disclosures and agree to SEC oversight, enabling secondary market trading without securities uncertainty.

4. Registered Offerings: Updates to Regulation A and crowdfunding rules are being considered to create viable registration pathways for token offerings.

5. Special Purpose Broker-Dealer: Potential updates to the no-action statement may allow broker-dealers to custody both crypto securities and non-securities, addressing current registration obstacles.

6. Custody Solutions for Investment Advisers: A regulatory framework is being developed to enable investment advisers to safely and legally custody crypto assets.

7. Crypto-Lending and Staking: Clarification is needed on whether lending and staking programs fall under securities laws and how they can be structured accordingly.

8. Crypto Exchange-Traded Products: Efforts are underway to clarify the SEC’s approach to approving and modifying crypto ETPs, including staking and in-kind redemptions.

9. Clearing Agencies and Transfer Agents: Work is being done to integrate blockchain technology into clearing and transfer agent rules to modernize financial markets.

10. Cross-Border Sandbox: Temporary regulatory frameworks for cross-border crypto experimentation are being explored, with the potential for long-term solutions.

VanEck Introduces MAGA10 Index

The MAGA10 index is 49% XRP, 23% SOL, and 6% or less allocated to other assets like LINK, AVAX, XLM, SUI and others. I get that there’s demand for U.S.-based cryptos given the current climate, but it’s unsettling to see XRP—considering its efforts to derail and disrupt the SBR—as a dominant share of the index. Then again, funds have to stay agnostic and provide the products their customers want.

Crypto Market Rebound & Big Day For Bitcoin | Here Is What Comes Next!

Joining me today are Matt Hougan, CIO at Bitwise, and my friends from Arch Public, Andrew Parish, and Tillman Holloway, who will provide an update on the $10K algorithmic portfolio.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.