Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Arch Public has added an additional exchange to our roster: Kraken. We are excited to partner with Kraken to offer our algorithmic strategies for BTC, ETH, SOL, XRP and now SUI!

Adding additional symbols across exchanges will be a theme for us throughout the summer. Come talk to us and find out how you can accumulate, arbitrage, and trade crypto TAX FREE on Kraken!!

In This Issue:

Bitcoin ICOs

Bitcoin Thoughts And Analysis

Stocks Waiver As Tariff Deadline Approaches

Get Ready For “Crypto Week”

Every U.S. Child Will Be Given $1,000

North Korea Accounts For Most Of Crypto’s Hacks

Bitcoin Treasury Stocks Are A Scam - Ran Neuner Warns Of A Massive Collapse!

Bitcoin ICOs

Right now, I’m guessing every reader falls into one of two camps:

You’re either looking at the title thinking, “Wait, that’s an oxymoron – Bitcoin has nothing to do with ICOs,” or you nodded quietly, already sensing exactly where this is headed… and maybe feeling a little uneasy that things are starting to spin out of control.

This cycle is being driven by some incredibly powerful narratives:

The U.S. might start buying Bitcoin. Tokenization is set to devour the entire financial system. And crypto stocks – the dark horse of this bull run – are turning into Pandora’s Box, as public companies start loading up on crypto assets with leverage like there’s no tomorrow.

Before we go any further, let me be clear:

A) I’m not a bear, and I’m not here to target any one company or individual.

B) I’m not claiming to be an expert – you should absolutely do your own research.

C) I don’t have hundreds of hours to do a full deep dive – this is a broad overview.

D) don’t shoot the messenger. I’m simply laying out a few things for you to consider. Take it or leave it.

Alright, let’s jump right into the thick of it.

If you haven’t seen this video yet, pause what you’re doing, click the link, and then come back. On the left is David Bailey – chairman of Bitcoin Magazine and founder of Nakamoto. In the center, Udi Wertheimer – a well-known and polarizing figure in Bitcoin circles. And on the right is threadguy – one of the most prominent voices in DeFi and the trenches of degen trading and investing.

For the record, I’ve got no beef with any of them. I actually like all three. They’re each sharp in their own way and great at what they do. But the conversation they had about Bitcoin treasury companies? It’s… bizarre.

David Bailey: “We made like a hundred million on a million bucks, in like a month. We’re up like - uh - our investments range, like our worst investment we’ve made is up like 3x, and our best investment we have made is up like 200-something x, and then everything else is somewhere in between - 20x, 50x, 100x.”

threadguy: “Wait, so first of all, that’s like disgusting. It’s on size too - it’s not like you hit a 10x on 10 SOL. So basically, every company that’s like, ‘We’re going to be a Bitcoin treasury company, we are going to raise a bunch of money to buy Bitcoin’ - you’re just investing in?”

David Bailey: “Yeah, and we’re helping structure, and we’re bringing our partners. It’s kind of like early days ICOs, where you have a posse of people you bring into that token. We have a posse of people that we are bringing into the treasury companies. We have the best practices nailed down on how to do it. We have done like ten of these - we have done like twelve of these. I don’t remember how many we have in the pipeline that are coming to market soon - like six or seven more.

Our goal is to do one of these in every capital market on the planet: Saudi Arabia, UAE, Turkey, South Africa, Germany, France, UK, Netherlands, Brazil, Thailand tomorrow, Taiwan, South Korea, Hong Kong, Singapore, Vietnam, Malaysia, Indonesia...”

threadguy: “Jesus, dude.”

Udi: “Bro’s just reading out the map.”

threadguy: “He’s got a f***ing globe next to him. You’re going to make like a billion dollars on this.”

David Bailey: “Yeah, no - we’re going to make more than that. We’re going to make a lot more than that.”

I can’t watch this video without thinking – how is this not the making of a bubble? These three together... maybe they had a “we got a little carried away” moment (it happens) – or maybe this is actually starting to get a bit out of control. Comparing this to the ICO craze is telling: a period that ended with countless projects collapsing or being exposed as scams. So when I hear “best practices” tossed around alongside aggressive expansion, it feels more like an attempt to sound buttoned-up than a safeguard against inevitable chaos.

Again, maybe this is just excitement spilling over after a few big wins. I’ll let you decide as we go.

Let’s take a step back. The first Bitcoin treasury company to do it was MicroStrategy – now Strategy. Since then, we’ve seen these companies pop up left and right. In no particular order: Metaplanet, Riot, Bitmine, GameStop, XXI, Nakamoto, Marathon, Galaxy Digital, and Semler Scientific – just to name a few of the Bitcoin-focused ones.

The distinction that matters when evaluating these companies is simple: some have sustainable businesses and are allocating profits into Bitcoin. Others are using their tickers to access cheap capital in public markets – and levering up to buy BTC. My goal today is to help you spot that difference and figure out where the line is being crossed.

Right now, because of the momentum behind Strategy – and the hype around its clones – there’s probably more capital flowing in than is reasonably justified. That’s distorting valuations across the board. The spillover is real – and it’s touching everything from legitimate companies to new entrants now exploring ETH, SOL, and XRP. And no, I haven’t forgotten about those three. The same rules apply.

Speaking of Strategy – it deserves some credit for doing things differently, and in many ways, doing them right.

I’d argue that Saylor and Strategy get a pass here because they’ve spent a lot of time laying out what Bitcoin can enable in the future:

“If the Bitcoin network is $10 trillion, why couldn’t there be a $500 billion or $1 trillion finance company that strips the risk, volatility, and performance out of crude capital? What did John D. Rockefeller do? Rockefeller took crude oil and gave you kerosene, gasoline, and diesel. How big can the business get? Pretty big. I think there’s room for a $1 trillion company that securitizes every flavor of capital. I’m talking about the transformation of capital markets.”

I’ve covered this vision in past newsletters – but I don’t see the same long-term thinking from most of the newer Bitcoin treasury companies. Maybe they’re still in phase one – accumulate BTC and figure the rest out later. After all, you can’t be a bank without a balance sheet. But maybe this is something else entirely – ICOs in new clothes. Same playbook. Different cycle.

And how ironic would it be if Bitcoin became the bubble this time? Not the asset itself – but the ecosystem around it. Driven by the very people who spent years mocking everything else as a scam. The same voices who proudly declared: there is no second best.

Let’s zoom out even further. Is there a historical precedent for this kind of thing? Not in crypto – but kind of, yeah.

During the gold rush eras – both in the late 1800s and again in the 1970s – companies emerged just to hold, mine, or speculate on gold. Many were created for investors who didn’t want to deal with physical gold. But almost none were built purely as gold treasury vehicles.

Then came the dot-com bubble in the late ’90s. Companies rebranded with “.com” in their names just to attract capital. Narrative over substance. Sound familiar?

You could also point to old-school holding companies like Berkshire Hathaway or SoftBank – but those businesses actively manage massive portfolios. Bitcoin treasury firms tend to be passive. No real strategy beyond “buy and hold.”

And of course, there’s the SPAC boom of 2020–2021 – blank-check companies raising money with no product, just a promise. Today’s BTC treasury companies feel like their spiritual successors: raise capital, buy Bitcoin, and hope the ticker rides the narrative.

Which brings us back to today. I just had a great conversation with Ran Neuner about all of this – the rise of crypto treasury companies, the real opportunities, and the risks hiding in plain sight. It’s linked below in the podcast segment, and I’ve included the relevant part of our conversation here.

Me: “So I definitely understand, in your theory - which is correct - that if these treasury companies have to buy these assets, then that is the buyer. But the price of these treasury companies is not commensurate to the amount they're buying or the rise. It’s the hype, right? So…”

Ran: “95% of these treasury companies are a scam, and I'm going to explain to you how.”

Me: “Correct. That’s where I was trying to go.”

Ran: “Okay, so let me explain to you - and I know this, and I can only tell you this because I've been approached by a few of these companies to actually become a seed investor.”

Me: “I had probably 30 of them pitched to me in Vegas, by the way.”

Ran: “Okay, so let me explain to you the model and how it works. Joe Luben announced the announcement of the fact that he was going to start this - is it called Sharplink Gaming or whatever it is, right? Yeah. And they made - let me try and find this announcement for you, because I think it's the SharpLink announcement. I just want to find it because I want to show you where the scam is, because I think it'll really protect your community, right?”

Me: “I was just having a conversation with someone today who's a pretty well-known Bitcoin maxi, who said - and listen, I know nothing about this - who said his belief was that Joe Luben at least was kind of behind all the Ethereum treasury companies. I don't necessarily think that's a bad thing.”

Ran: “No, that's right. So, you've got it. You've nailed it spot on. Okay, so let's just read this announcement. And it says - it basically says - SharpLink announces a $425 million private placement to initiate an ETH treasury strategy. And you read further down the line here, and you say Consensys Software acted as lead investor, and the offering included participation from Parafi Capital, Electric Capital, Pantera Capital, Arrington Capital, Galaxy Digital, Ondo, blah blah blah blah.

What do all these companies have in common? They all had ETH before the treasury company. So what did they do? They go to Scott Melker, who has a million dollars’ worth of ETH, and they say, ‘Scott, listen. We're going to start this treasury company. You give us a million dollars’ worth of ETH, and you get a million dollars’ worth of our shares. But as soon as we make the announcement, the market's going to give us such a premium to net asset value that your original million worth of ETH is going to be worth $10 million.’

And you go, hold on. So, are you saying that I put a million dollars’ worth of ETH, I get shares worth a million dollars at net asset value, but this company is going to trade above net asset value, and therefore I'm going to be 10x-ing my original investment?

So now, just let's understand the logic here. Consensys has a shit ton of ETH. What did they do? They put their ETH into this thing at a 1:1 ratio at NAV. And as soon as they made the announcement, the thing spiked above NAV, and therefore they multiplied - they took something that they had, and they multiplied it by 12. I know for a fact that every single one of these companies held huge ETH on their balance sheets. It's not a coincidence that these guys all funded this thing.

Do you remember the deal that was announced with Tether, right?... First announcement was they raised three or four billion dollars' worth. They're coming onto the market with three or four billion worth of Bitcoin. Couple of weeks later, Tether, who's already holding Bitcoin, transfers the Bitcoin into Twenty-One. So, oh, of course, they raised it. They took it from the initial investors. Initial investors got in at net asset value. Every other investor got in at a premium to net asset value. It's a simple thing. Take your Bitcoin, give it to Twenty One in the beginning, and you'll get X times your Bitcoin back - multiples on your Bitcoin back - in shares, which you can sell immediately and buy. No brainer. Yeah. And by brainer. It's a way for you to leverage.”

Me: “In the pitches you saw, what were the vesting terms for a lot of it? Because a few of them I’ve seen - as you point - you’re immediately liquid.”

Ran: “Zero. Zero vesting. Immediately liquid. You can sell on day one.”

Me: “How is this okay?”

And that’s just it – how is this okay? I genuinely want to ask that question to some of the founders behind these companies and hear their answers. Maybe I’m missing something. Maybe some of you out there know things I don’t. Maybe this all turns out fine. But I can’t shake the voice in the back of my head whispering… this isn’t okay.

It’s a catch-22, because I hold the same assets these companies are buying. And as Ran pointed out, in some cases they’re just moving money around. But assuming some of them are actually acquiring with fiat, that does push the value of my holdings higher. Still, at some point, there has to be an unwind – if our understanding of how this works is even close to correct.

Maybe that’s when the dust clears and we’re left with a new class of responsible Bitcoin companies – the ones with real businesses or those that legitimately become Bitcoin-native banks. Maybe they’ll serve a real purpose beyond just accumulating BTC. But eventually, the tide always goes back out. And when it does, we’ll find out who’s been swimming naked. That’s just how global finance works.

I’m not here to tell any of you to stop trading or speculating if you know what you’re doing. Find your edge. Use it. But if you’re not truly confident, here’s the simple play: buy the assets these companies are speculating on – primarily Bitcoin. Forget the 20x, the 50x, the 100x dreams. Buy Bitcoin. It’s still going to $1 million even if the entire treasury narrative blows up in our faces.

That’s the game plan I’m sticking with – and it’s the one I think more people need to seriously consider.

Best of luck out there. Let’s make it a killer week. It’s good to be back.

By the way, my brand-new Telegram Group is still below 200 members, which tells me A LOT of you have not signed up. This is an example of some of the awesome content shared in this group.

This is free alpha a lot of you are leaving on the table. Signing up is very easy, just click HERE.

Bitcoin Thoughts And Analysis

Bitcoin is quietly grinding higher, holding above the key $105,787 level after reclaiming it with authority. Price is consolidating just under $112,000 resistance, pressing against the top of the range while riding the 50-day moving average like a support rail.

The dip to $100,716 was a trap. Buyers stepped in hard, and price hasn’t looked back. But without a decisive close above $112K, this remains a waiting game. A breakout sends us flying. A rejection brings $105K and $100K back into view. No need to guess - just let the levels speak.

Stocks Waiver As Tariff Deadline Approaches

Markets kicked off the week in the red as investors braced for renewed trade tensions ahead of President Trump’s July 9 tariff deadline. S&P 500 futures fell 0.5% after the holiday weekend, while Asian stocks dropped and European markets stayed flat. Tesla tumbled over 7% premarket as Trump publicly criticized Elon Musk’s move to form a new political party, fueling investor concern.

The return of tariff fears has shaken markets just weeks after equities rallied back to record highs. Trump is expected to impose unilateral tariffs on dozens of countries, with some receiving short extensions to negotiate. The potential impact has analysts warning that markets may be underestimating the risk.

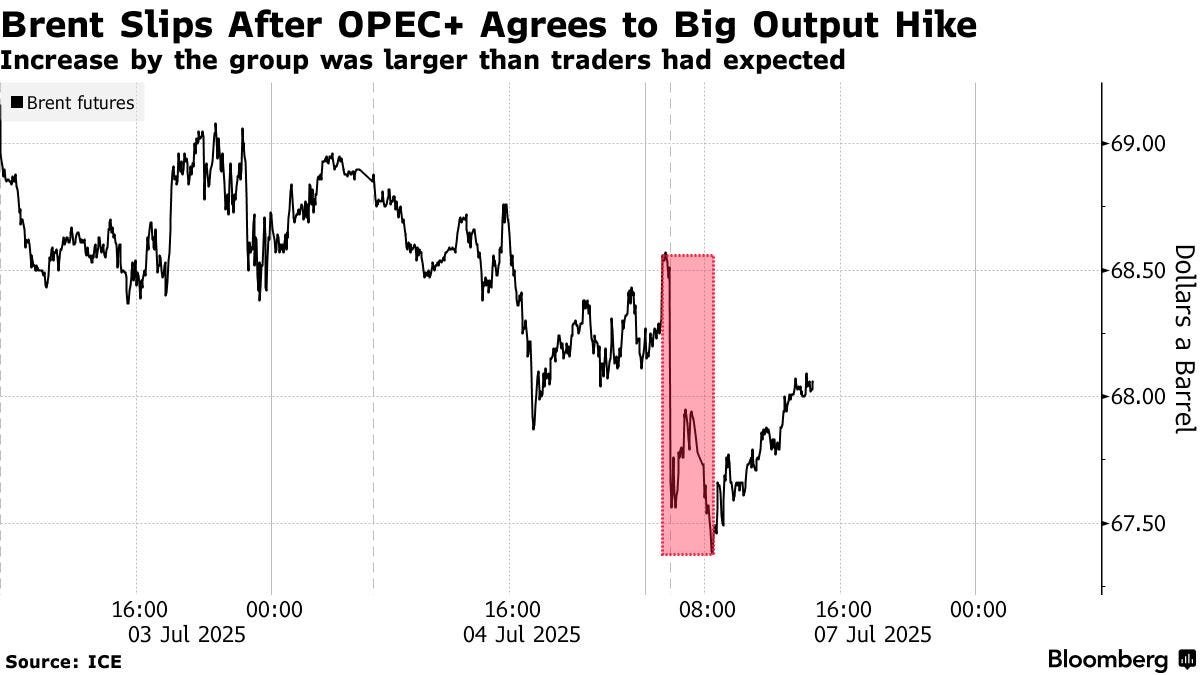

Elsewhere, Trump threatened an additional 10% levy on countries aligning with the BRICS bloc (Brazil, Russia, India, China, South Africa), sending metals lower and the yuan down, while the dollar climbed 0.4%. Oil also continued its slide after OPEC+ agreed to a larger-than-expected production hike.

Corporate highlights:

Trump’s feud with Elon Musk escalates, rattling Tesla investors

Shell warns of sharply lower Q2 results in oil and gas trading

Nissan plans a $5B debt sale to support turnaround efforts

Capgemini to acquire WNS Holdings for $3.3B to boost AI capabilities

Richard Li’s FWD Group jumps in Hong Kong trading debut after $442M IPO

Tensions are rising fast, and with just days left before the deadline, volatility could be just getting started.

Stocks

The Stoxx Europe 600 was little changed as of 9:30 a.m. London time

S&P 500 futures fell 0.5%

Nasdaq 100 futures fell 0.6%

Futures on the Dow Jones Industrial Average fell 0.2%

The MSCI Asia Pacific Index fell 0.7%

The MSCI Emerging Markets Index fell 0.5%

Currencies

The Bloomberg Dollar Spot Index rose 0.4%

The euro fell 0.3% to $1.1738

The Japanese yen fell 0.5% to 145.16 per dollar

The offshore yuan fell 0.2% to 7.1781 per dollar

The British pound fell 0.4% to $1.3591

Cryptocurrencies

Bitcoin rose 0.2% to $108,925.25

Ether rose 1.1% to $2,575.36

Bonds

The yield on 10-year Treasuries was little changed at 4.34%

Germany’s 10-year yield was little changed at 2.61%

Britain’s 10-year yield declined two basis points to 4.53%

Commodities

Brent crude fell 0.6% to $67.92 a barrel

Spot gold fell 0.8% to $3,310.61 an ounce

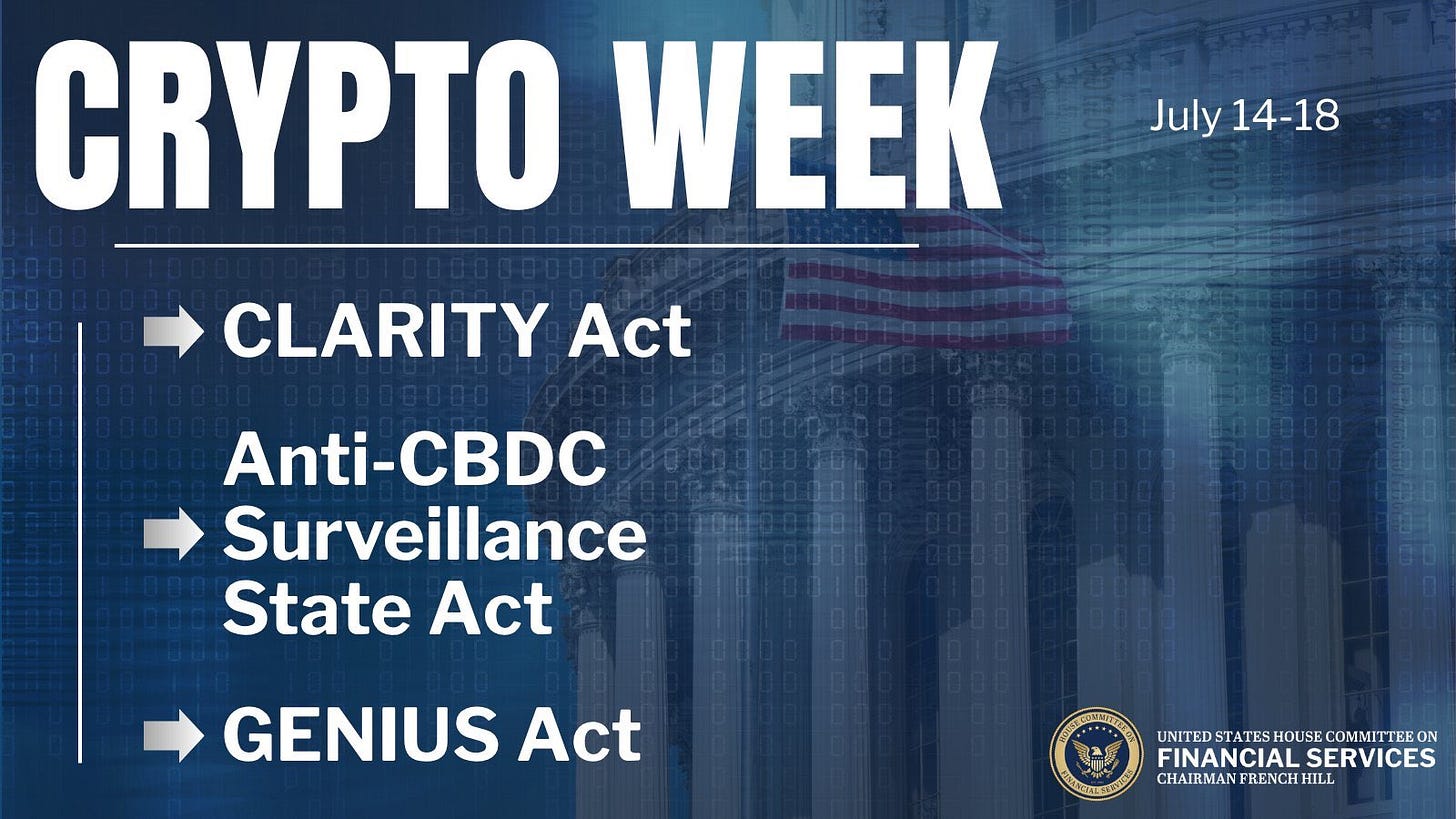

Get Ready For “Crypto Week!”

Never in a million years would the previous administration have called something “Crypto Week” unless it was a week dedicated to destroying everything we care about. Here’s the official commentary: “Today, House Committee on Financial Services Chairman French Hill (AR-02), House Committee on Agriculture Chairman GT Thompson (PA-15), and House Leadership announced that the week of July 14th will be ‘Crypto Week.’ The House of Representatives looks forward to considering the CLARITY Act, the Anti-CBDC Surveillance State Act, and the Senate’s GENIUS Act as part of Congress’ efforts to make America the crypto capital of the world.”

Here’s what some of the members had to say:

“This is a historic opportunity for the United States. After years of work, American innovators are one step closer to having the clarity they need to build here at home while ensuring the future of the digital economy reflects our values of privacy, individual sovereignty, and free-market competitiveness,” said Majority Whip Tom Emmer (MN-06). “By sending these three pieces of legislation to President Trump’s desk, we will protect Americans’ right to financial privacy and deliver on our promise to make the United States the crypto capital of the world. A new day for American excellence has finally arrived, and now it’s time to get the job done.”

“2025 is set to be a pivotal year for digital asset legislation, and next week marks a pivotal milestone in this agenda. I commend Chairman Hill, Chairman Steil, and the rest of my colleagues in the House for moving at pace next week to pass these three critical bills. These pieces of legislation are vital to ensuring America is at the forefront of innovation in the digital asset space. I look forwarding to enacting the GENIUS act into law, and to working with my colleagues to move the CLARITY act through the Senate in short order,” stated Senator Bill Hagerty (R-TN).

“For the first time in U.S. history, we have a president who sees the value in embracing digital assets, and already we are working to capitalize on that,” said Senator Cynthia Lummis (R-WY). “In Wyoming, we have worked for nearly a decade to embrace digital assets, and it is exciting to see the federal government beginning to follow in the Cowboy State’s footsteps. As we celebrate crypto week, I am thrilled to partner with Chairman Hill and Chairman Thompson to pass comprehensive stablecoin legislation, establish clear market structure rules, and ensure that any central bank digital currency respects Americans’ privacy and financial freedom. Together, we are going to maintain America’s competitive edge and ensure the United States remains the global leader in financial technology while preserving the principles that make our economy the strongest in the world.”

In other major news related to U.S. lawmakers, take a look at this…

Is it possible that crypto taxes are reduced? We are inching closer and closer to some really strong pro-crypto policy.

Every U.S. Child Will Be Given $1,000

The Invest America Act, recently passed by Congress, gives every American child a $1,000 investment account at birth, aiming to promote long-term savings habits and financial literacy from an early age. It's part of a broader Republican-led legislative push to stimulate economic growth, alongside tax reforms like immediate write-offs for business spending and permanent tax cuts on tips and overtime income. These combined measures are designed to support workers, encourage investment, and strengthen the economy, with the Invest America Act specifically focused on improving the financial future of the next generation.

This One Country Accounts For Most Of Crypto’s Hacks

North Korea is dominating the world of crypto crime, responsible for 61% of all crypto theft in 2024 (key word being ‘theft’), stealing $1.34 billion - more than every other group combined. Their attacks are becoming more frequent and sophisticated, relying heavily on private key theft and laundering funds through mixers like Sinbad after Tornado Cash was sanctioned.

One major 2025 breach saw the Lazarus Group allegedly steal $1.5 billion in ETH from Bybit via a vulnerable multisig bridge. But North Korea isn't alone - crypto crime is expanding. In total, $9.9 billion was taken through scams in 2024, many involving AI-generated profiles, deepfake video calls, and elaborate fake apps or trading platforms.

DeFi isn’t immune either: over $2.5 billion in trading volume was fake, driven by wash trading bots, and nearly 4% of new tokens in 2024 showed signs of pump-and-dump schemes, often collapsing within a day. As a whole, the broader crypto crime ecosystem is growing more complex, coordinated, and difficult to track.

Bitcoin Treasury Stocks Are A Scam - Ran Neuner Warns Of A Massive Collapse!

I sat down with Ran Neuner for one of the most eye-opening conversations I’ve had all cycle. We talked about how the new wave of Bitcoin treasury companies is creating a dangerous leverage bubble, why this altcoin cycle might be different, and how we’re both thinking long-term about network effects over hype. This episode of The Wolf Of All Streets could completely change the way you think about this market.

My Platforms And Sponsors

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

The Wolf Pack - My new Telegram group where I share daily updates on everything I'm watching and chat directly with all of you. Completely free to join.

The Crypto Advisor - My weekly newsletter for registered investment advisors, combining macro trends, Wall Street insights, and crypto – all in one place..

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis!

Blofin - Blofin is offering our Telegram members a $30 Bonus + 50% Spot Discount when they sign up for The Wolf Pack.

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Peoples Reserve - Use Bitcoin as pristine collateral with Peoples Reserve - where wealth is built smarter through Bitcoin-powered finance.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.