Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

247%. 247% annually. Hands free and daily liquidity. Now add 20% cash yield annually. That’s what our Bitcoin Algorithm Arbitrage Strategy does for you each year. Huge stacks of Bitcoin, additional stacks of cash, buy on the dips, and sell at the top!

Arch Public has brought an institutional grade tool to retail. Harness the power of a long bias, arbitrage strategy. Let our team set it up for you, and you sit back and watch it work hourly, daily, weekly, monthly.

Try Arch Public now! You can even demo the platform, for free, to learn more.

In This Issue:

The Largest Crypto Liquidation Event In History

Bitcoin Thoughts And Analysis

Legacy Markets

You Still Have To be Careful of Scams!

World Liberty Financial Is Making Moves

Crypto Czar David Sacks Plans To Address Crypto Today!

MicroStrategy Did Not Buy Bitcoin Last Week

MASSIVE CRYPTO SELL-OFF: Bitcoin Collapses. Is The Worst Yet To Come? | Macro Monday

The Largest Crypto Liquidation Event In History

Let’s get this straight.

Crypto took a hit last week after a Chinese AI company rolled out a successful model at a fraction of the cost… then dropped again when the Fed held rates steady and hinted at slower cuts… and then yesterday, after Trump threatened and imposed tariffs on Mexico, Canada, and China, sparking trade war fears.

From that list, which of these actually justifies the biggest one-day liquidation in crypto history?

For record keeping:

BTC dropped to $91,500

ETH dropped to $2,150.

SOL dropped to $176.

BNB dropped to $504.

TRUMP dropped to $16.

XRP dropped to $1.76.

DOGE dropped to $0.20

One coin on this list is different from the others, but I’ll get to that in a bit.

Every major news outlet ran with the same headline: “Over $2 billion liquidated in just 24 hours.” I shared it too. Everyone noted that this surpassed the liquidations seen during COVID and FTX—$800 billion in market cap wiped out in mere hours.

This wasn’t just any ordinary drawdown; altcoin holders just had a nuclear bomb dropped on them. For better or worse, it was quick but brutal, with some larger alts crashing as much as 40% in the steepest moments, all within just 24 hours.

I’ve got a big “maybe” here, but could it be that the ETH/BTC ratio just bottomed at 0.0234? The pair just hit lows not seen since December 2020, when ETH ran from $600 to $4,800 over the course of a year. A bag holder can only hope, right?

Let’s get back on track to the main story though.

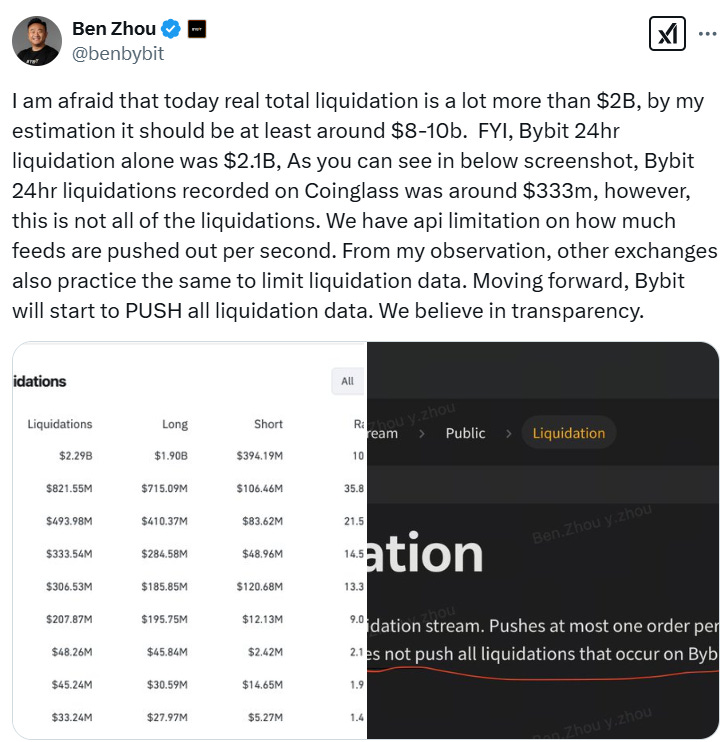

This post, from the CEO of Bybit, blew me away.

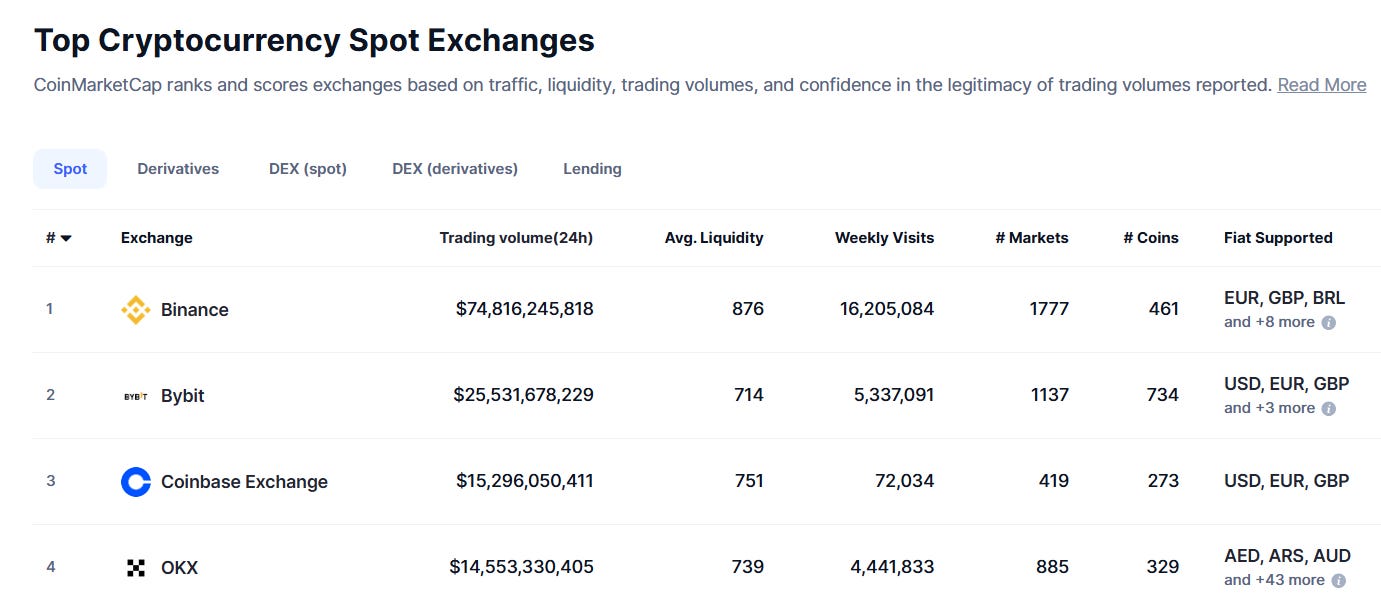

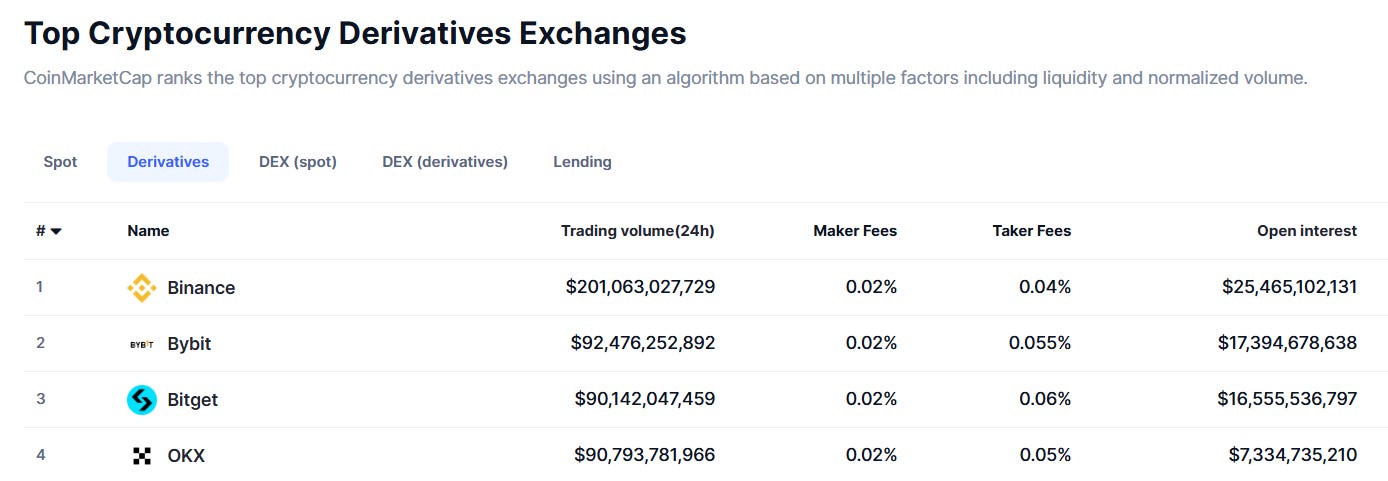

By spot and derivative rankings, ByBit is the second-largest exchange.

If $2 billion in liquidations is a nuclear bomb, then this was global thermonuclear war. Binance is about 3x the size of ByBit in spot trading volume and 2x the size in derivative trading volume, and that doesn't even account for Coinbase, OKX, and Bitget, each of which is a titan in its own right. All of these platforms likely had liquidations in roughly equal proportions to their size.

Taking Ben Zhou’s comment into account, this weekend looks more like $8b to $10b in liquidations, not just $2b. Speaking of liquidations, let’s make one thing crystal clear: Nobody should ever be liquidated. Liquidation is not a stop loss. There’s absolutely no reason to have an entire position cleared, whether it’s a trade you took over the weekend or a medium-sized position you set a few weeks ago.

Trading isn’t a game of poker where you should go all-in when the odds are on your side. This is real money, real assets, and real risk. Why would you ever give your entire stack back to the house? In trading, it’s about managing risk and protecting your position—not gambling everything on a single move. The goal is to preserve capital, not to chase after an all-or-nothing win.

You’re not Michael Saylor, George Soros, Cathie Wood, Stanley Druckenmiller, or Carl Icahn. You’re also not one of the quants they hired with access to billions of dollars worth of state-of-the-art tools and deep networks to make sophisticated decisions about the market’s direction. TA on TradingView and limit orders on Robinhood aren’t enough to outwit these players. We’re merely small fish in an ocean filled with apex predators.

Now that my rant about leverage is out of the way, let’s talk Bitcoin. Bitcoin dominance briefly spiked above 64% yesterday—levels we haven’t seen since February 2021, right before an epic alt-season took off. Meanwhile, Ethereum’s market dominance sank to 9.3%—yikes. It’s hard to imagine this not being the new bottom for ETH this cycle. But if it’s not, I might have to rethink my stance on holding this asset.

Bitcoin barely flinched yesterday, making this liquidation event unlike FTX, COVID, or the China mining ban. It didn’t go down with the ship—it jumped into its own luxury life raft, kicked back, and enjoyed a steak and wine dinner while everything else capsized. This weekend’s liquidations are just another piece of evidence in the growing mountain that this cycle is all about Bitcoin. A dip in BTC isn’t the same as a sale on ETH, SOL, or any other asset. It makes you wonder what will happen to alts vs. Bitcoin when the bear market finally hits.

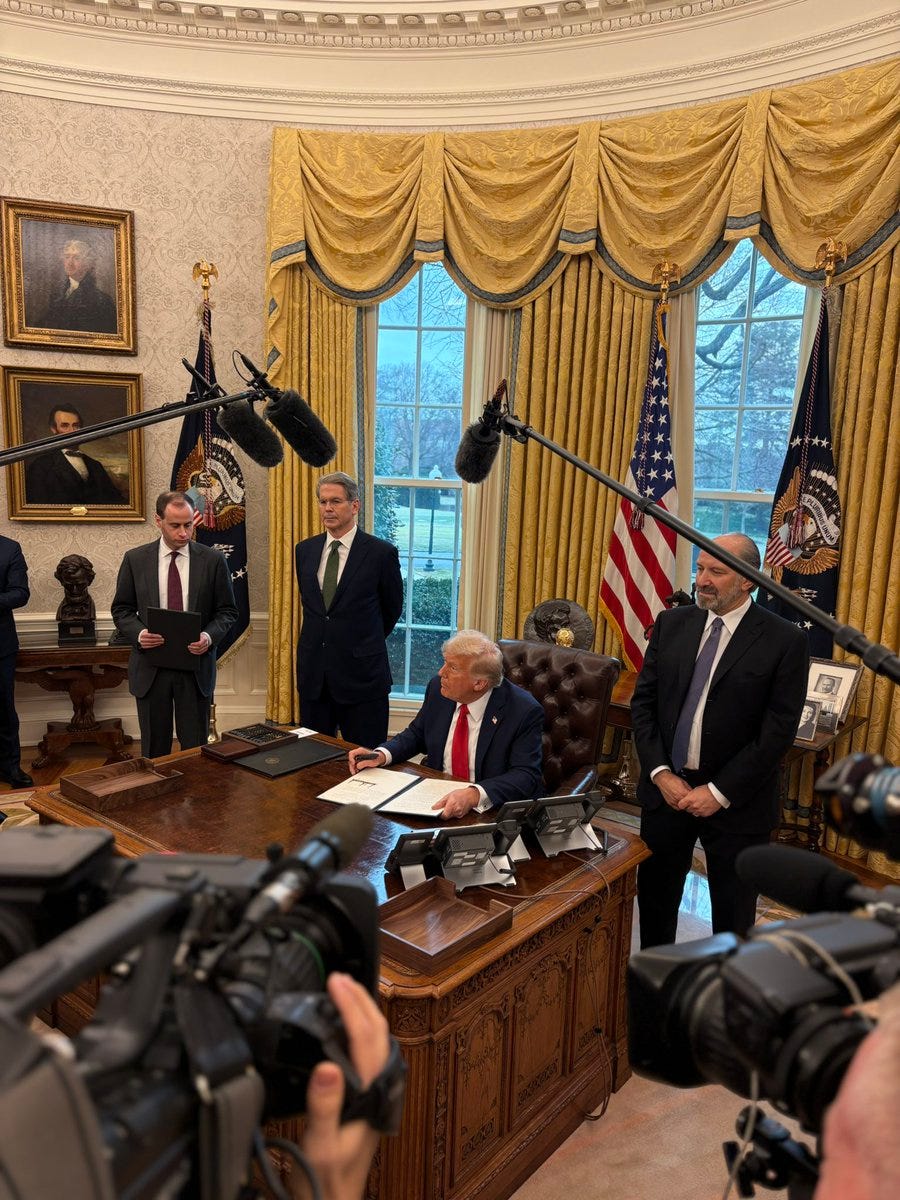

Also, this happened yesterday.

The image above shows Trump signing an executive order calling for the creation of a Sovereign Wealth Fund, a first in U.S. history. Standing to Trump's right is Scott Bessent, and to his left is Howard Lutnick. Lutnick, who spoke at the Bitcoin conference in Nashville, owns a 5% stake in Tether and previously held hundreds of millions in Bitcoin—though he pledged to divest within 90 days of confirmation. Bessent, who owned $500,000 of BTC, has expressed enthusiasm for the president’s embrace of crypto, stating that crypto is about freedom and that the crypto economy is here to stay.

Is there really a world where these three get together, have closed-door meetings and casual conversations, and Bitcoin isn’t brought up? Not a chance. They all like Bitcoin, they’re all dialed into asset prices just like we are, and they all know that if the U.S. buys Bitcoin, they would go down as heroes. Senator Cynthia Lummis had just one thing to say on the announcement:

For those that don’t know, a sovereign wealth fund (SWF) is a state-owned investment fund that manages a nation's reserves by investing in assets like stocks, real estate, and commodities for long-term growth. Unlike the U.S. Treasury, which primarily holds assets for liquidity and stability, an SWF actively seeks returns with a higher risk tolerance. If the U.S. were to establish one, it could mark a shift toward strategic investments, potentially including Bitcoin, rather than just holding traditional reserves for monetary policy.

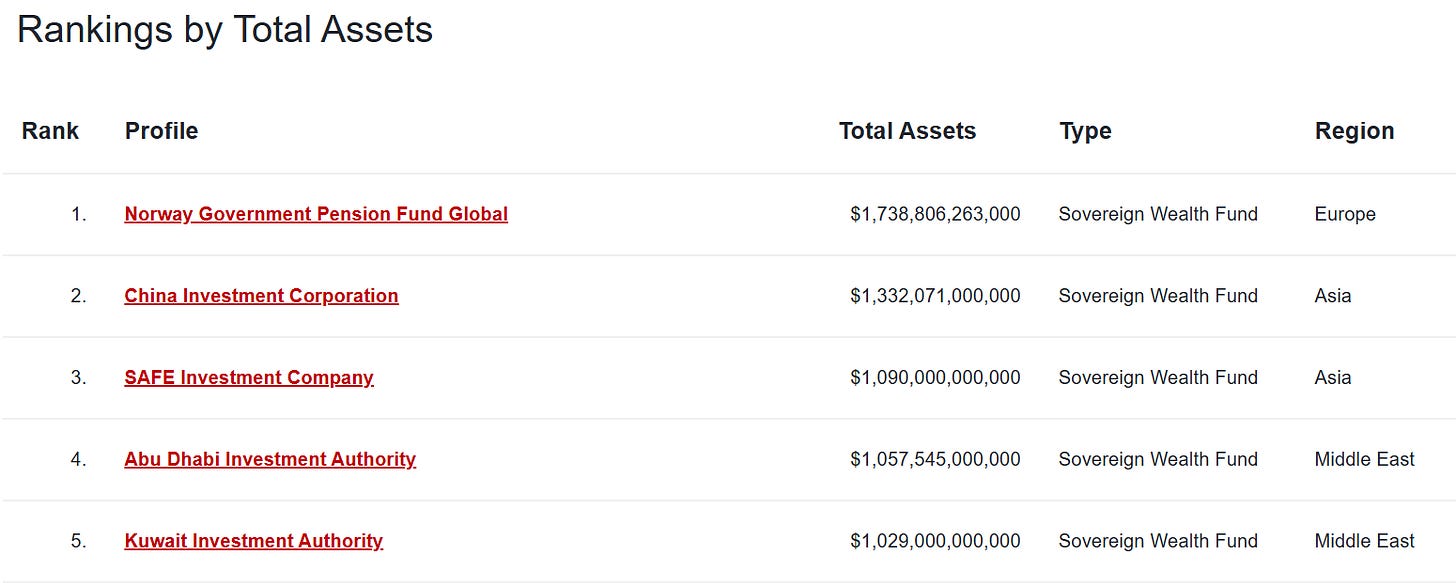

Below are the top 5 sovereign wealth funds:

Imagine the U.S. comes out swinging, announcing a fund even larger than Norway’s—whose sovereign wealth fund is currently worth the equivalent of approximately $325,000 per citizen. Obviously, the U.S. wouldn’t be able to match that with a larger proportional net worth per citizen, but Trump likes to be #1, especially in financial matters. I don’t see how a U.S. fund doesn’t either emerge near the top of this list or debut in first place.

This newsletter has turned progressively positive since the start, so I think I’ll end on one final strong note.

The president of the United States’ son is telling us it’s a good time to add ETH. Maybe he's just saying that because World Liberty Financial has a position, but it feels like he's implying something—like ETH being included in the digital asset stockpile or sovereign wealth fund, or perhaps ETH ETF staking is closer than we think. The former—ETH being included in a digital asset stockpile or sovereign wealth fund—would be a bigger deal than ETH staking, but it seems more aligned with his current focus and the people he works with. On the other hand, ETH ETF staking seems more achievable, but it’s not as closely tied to his immediate priorities.

If we learn that ETH is being included in either a digital asset stockpile or sovereign wealth fund alongside BTC, the days of ETH lagging will be over—immediately.

It was a VERY rocky start to the week, but things are likely to get smoother from here—fingers crossed. It seems Trump has successfully pressured Canada and Mexico to bend to his will, securing a 30-day delay on tariffs and meeting his list of demands. If you felt uneasy about your portfolio during this downturn, consider it a sign to reorganize your positions, reduce leverage, or consolidate into Bitcoin. You can’t go wrong with BTC for the rest of this cycle or over the next 10 years.

Shortly after posting, Eric Trump edited out the “You can thank me later” portion, almost certainly for legal reasons. As for the rumors that WLF was selling while Eric was posting, they appear to be false. I have more details on WLF and their activities in the news below, which you should check out, but based on what I’ve seen, there’s no evidence the team is selling.

Don’t get me wrong, it’s completely insane that the president’s son is bull posting about assets his family holds hundreds of millions in, but we have to take every bit of information we can get.

This is clearly a tough market, and this past weekend proved that again.

Bitcoin Thoughts And Analysis

Bitcoin's daily chart shows a significant recovery after yesterday’s steep drop. Price bounced strongly above the key support zone near 90,000, marking the bottom of the broader consolidation range. This rebound has allowed Bitcoin to regain the critical 99,860 level, which is now acting as a pivotal area to watch. The current candle is testing this level, and holding above it would be a bullish sign, while a failure could invite further downside.

The 50-day moving average is still in play and has provided dynamic support during this volatile period, reinforcing its importance. If Bitcoin can establish itself above 99,860, the next resistance to overcome is 106,099. A close above that level would be a bullish signal and open the door for a retest of the recent highs near 109,358.

On the downside, losing 99,860 again could trigger another test of the support zone near 90,000. Volume has been elevated during this corrective move, reflecting strong market activity, and further price action will likely be decisive in shaping Bitcoin’s next major direction.

Traders should monitor today’s close carefully to assess whether the bounce off support has enough momentum to maintain bullish continuation.

Legacy Markets

US stock futures dipped on Monday, hinting at a third consecutive day of losses for the S&P 500 due to concerns over escalating trade tensions. This market reaction followed President Trump's decision to delay tariffs on Mexico and Canada, providing a temporary relief but not alleviating worries about broader trade conflicts. China responded to the US tariffs with a relatively restrained approach, which somewhat calmed markets. However, the dollar weakened, and bond yields climbed, signaling potential stagflation risks.

The S&P 500 futures fell by 0.2%, and European stocks also experienced declines, though less severe than anticipated given the geopolitical developments. The dollar index dropped by 0.3%, reflecting some market relief that extreme scenarios were avoided.

Amid this backdrop, Palantir Technologies Inc. saw its shares surge in premarket trading due to a robust forecast driven by AI product demand. Investors are also bracing for earnings from major corporations like Alphabet, Merck, and Pfizer. In Europe, the Stoxx 600 index fluctuated with mixed corporate earnings results; however, the looming threat of US tariffs on Europe kept investors cautious. Notable individual stock movements included drops for UBS Group AG and Vodafone Group Plc, while BNP Paribas and Infineon Technologies AG saw gains due to strong financial performances.

Key events this week:

US factory orders, US durable goods, Tuesday

Alphabet earnings, Tuesday

Fed’s Raphael Bostic, Mary Daly, Philip Jefferson speak, Tuesday

China Caixin services PMI, Wednesday

Eurozone HCOB Services PMI, PPI, Wednesday

US trade, Wednesday

Fed’s Austan Goolsbee, Tom Barkin, Michelle Bowman, Philip Jefferson speak, Wednesday

Eurozone retail sales, Thursday

UK rate decision, Thursday

US initial jobless claims, Thursday

Fed’s Christopher Waller, Lorie Logan speak, Thursday

Amazon earnings, Thursday

US nonfarm payrolls, unemployment, University of Michigan consumer sentiment, Friday

Fed’s Michelle Bowman, Adriana Kugler speak, Friday

Stocks

S&P 500 futures fell 0.2% as of 5:42 a.m. New York time

Nasdaq 100 futures fell 0.1%

Futures on the Dow Jones Industrial Average fell 0.3%

The Stoxx Europe 600 fell 0.1%

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index fell 0.3%

The euro fell 0.2% to $1.0326

The British pound fell 0.3% to $1.2418

The Japanese yen fell 0.4% to 155.31 per dollar

Cryptocurrencies

Bitcoin fell 3% to $98,833.82

Ether fell 2.9% to $2,737.36

Bonds

The yield on 10-year Treasuries advanced two basis points to 4.57%

Germany’s 10-year yield advanced three basis points to 2.42%

Britain’s 10-year yield advanced five basis points to 4.54%

Commodities

West Texas Intermediate crude fell 1.7% to $71.91 a barrel

Spot gold was little changed

You Still Have To be Careful of Scams!

Remember all the hate Coinbase got a month or two ago about users being unable to immediate withdraw funds or temporarily losing access to their funds on Coinbase? Well, it’s been revealed that Coinbase has been under attack via a series of social engineering scams between December 2024 and January 2025, which led to at least $65 million in losses for its users, with total estimated losses exceeding $150 million in the past year.

These scams involve phishing emails, spoofed customer service calls, and fake websites that mimic Coinbase’s interface to trick users into transferring funds to scam wallets. Once stolen, the funds are quickly laundered, making recovery nearly impossible. Despite warnings from cybersecurity experts, Coinbase has struggled to implement effective measures to protect its users.

I have zero doubts that Coinbase isn't the only exchange under attack; it's just the most recognizable and widely used exchange in the U.S. That said, these scams aren't necessarily Coinbase's fault. Sure, Coinbase could improve its messaging around scams or add new features to help prevent theft, but the primary responsibility lies with users who aren't informed enough to recognize these threats.

If users understood that Coinbase will never call them, more than half of these scams wouldn’t exist. Additionally, if users whitelisted addresses, the number of victims would be cut in half again.

World Liberty Financial Is Making Moves

World Liberty Financial, the Trump-backed crypto platform, is reportedly offering “token swap” deals to various blockchain teams. According to sources, the platform is proposing that projects buy at least $10 million worth of WLFI tokens (with a 10% fee), in exchange for World Liberty Financial purchasing an equal amount of the project's native token. WLFI tokens would be transferred at a $1.5 billion fully diluted valuation (FDV), with the platform set to launch in Q3 at that valuation. Notably, the deal requires that none of the tokens be subject to a vesting period.

It remains to be seen who will be the main winner of this deal, but my gut tells me it very much favors World Liberty Financial. Teams who agree are paying a premium with a 10% fee and taking on the risk of a speculative $1.5B FDV for WLFI tokens. Additionally, the lack of a vesting period allows WLF to immediately sell the tokens they receive, creating potential downward pressure on the partner projects’ tokens while securing $10M upfront. Furthermore, a source in the original article revealed $10M was just the minimum; it would take $15M to receive “priority treatment.”

In other WLF news, there is this:

WLF is shaping up to be the MicroStrategy of Ethereum. Whether it's a group of crypto degens or a glimpse into Trump’s plans remains to be seen, it’s definitely an entity worth keeping a close eye on.

Crypto Czar David Sacks Plans To Address Crypto Today!

Trump’s appointed AI and crypto Czar, David Sacks, will be joined by the Senate Banking, Senate Agriculture, House Financial Services, and House Agriculture Committee Chairmen at 2:30 PM EST today to discuss U.S. digital asset strategy. According to press releases online, Sacks is expected to outline the White House’s approach, covering regulation, innovation incentives, and national security.

MicroStrategy Did Not Buy Bitcoin Last Week

For the first time in 12 weeks, MicroStrategy held off on buying Bitcoin. Maybe this will play to their advantage, giving them a chance to load up while prices are temporarily lower—time will tell. Granted, Bitcoin’s drop was only a fraction of the broader market’s decline, but a discount is a discount—and MicroStrategy has only one item on its shopping list.

MASSIVE CRYPTO SELL-OFF: Bitcoin Collapses. Is The Worst Yet To Come? | Macro Monday

Join Dave Weisberger, Mike McGlone, and James Lavish as we break down what's happening in macro and crypto!

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.