Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

⚡️ Taking Back Financial Independence & Freedom ⚡

This week, the Bitcoin community takes one step closer to unlocking a new era of Bitcoin Powered Finance.

Peoples Reserve is on a mission to build financial tools that work for Bitcoiners - not against them.

Their products include things such as bitcoin bonds, bitcoin powered mortgages, home equity bitcoin line of credit, and more to come in the pipeline.

With their PRN loyalty token officially launching this Friday, the ecosystem enters the final phase before the platform officially launches.

In This Issue:

A Closer Look At Ethereum

Aptos Weekly Review

Bitcoin Thoughts And Analysis

Altcoin Charts

Markets Hold Steady As Jobs Report Looms, Bonds Rebound

An Honest Review Of Coinbase One

The SOL Staking ETF Is Live

Coinbase Acquires LiquiFi For Onchain Builders

Bitcoin To $160,000 This Cycle!

A Closer Look At Ethereum

I know I sound like a broken record talking about Ethereum.

Every now and then, I can’t help but rant about why ETH’s price has stayed muted compared to Bitcoin - throwing out theories like Bitcoin dominance, the Fed needing to cut rates, or the money printer needing to go brrrr.

I talk about this all the time - even in my new Telegram group (which, let’s be honest, 99% of you still haven’t joined). I know there’s been some confusion around how to join, especially among existing Blofin users and those a bit skeptical about signing up. But I promise, it’s simple - and it’s the most effective way to keep scammers out. I’ve gated access through an exchange, which is completely free to sign up for. It takes less than two minutes to create an account and share your UID with the Telegram bot to get in.

Okay, back to the subject.

Instead of just ranting or complaining, let’s take a clear, honest look at ETH’s metrics - starting with TVL.

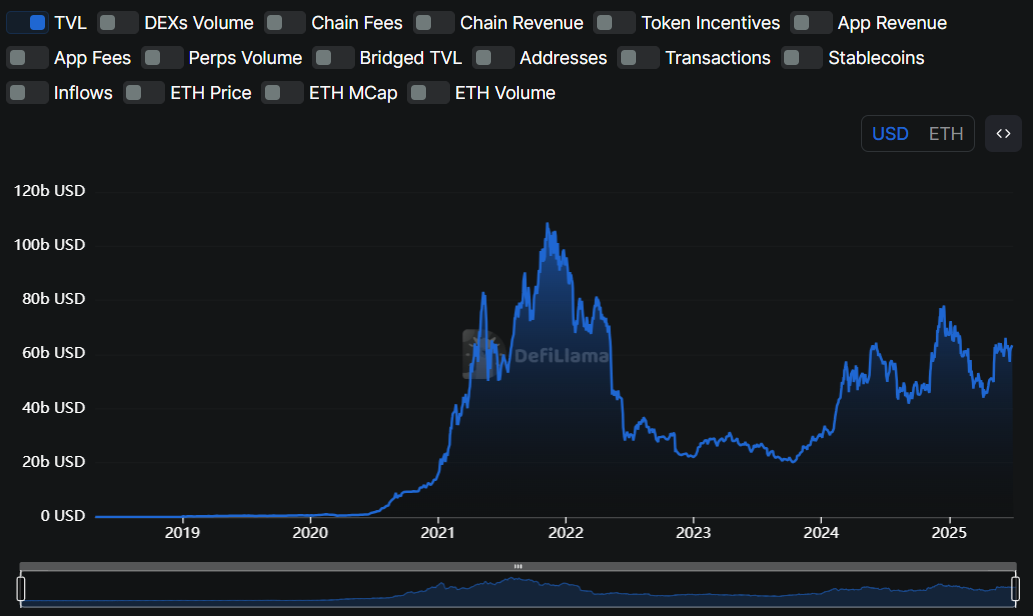

TVL In Terms Of USD:

In USD terms, ETH’s TVL mostly mirrors the price of ETH itself. But there’s a better way to assess whether TVL is truly growing.

TVL In Terms Of ETH:

This chart gives a clearer picture - not just because it’s near an all-time high. If ETH were trading at its price peak, the first chart would automatically be at its own ATH too. But with price still muted, the USD value of total value locked is being dragged down. In ETH terms, though, the metric is strong and on track to push into new highs in the coming months (or sooner) if this trajectory holds.

ETH Supply:

I’ll hold off on commenting until we have the full picture - just follow along with what I add in the next sequence. I did this intentionally, instead of showing everything all at once.

ETH Supply (with proof-of-work included):

Keep going.

ETH Supply (with proof-of-work and BTC included):

So, what I have here are two variations of ETH: PoS (the current economic model/consensus mechanism) and PoW (the old economic model/consensus mechanism). On one hand, we can see that since the merge, ETH has cut its supply growth by a factor of about 4.2. On the other hand, we can compare how both models stack up against BTC. In short, ETH went from underperforming BTC pre-merge to outperforming it post-merge. The caveat with ETH is that, unlike BTC, it doesn’t have a fixed supply schedule - but at its current rate, its flexible schedule is outperforming BTC’s.

Overview On Supply:

Here’s some more nuance to the discussion:

Ethereum’s supply metrics can appear contradictory at first glance, but the difference lies in whether you’re looking at gross issuance (this) or net supply growth (what we just did). The 3.5% figure represents how much ETH is issued annually through staking rewards, without factoring in the burn mechanism introduced by EIP-1559. In contrast, the 0.8% figure accounts for the ETH that's burned from transaction fees, showing the actual net change in supply. Both are accurate - they just reflect different sides of Ethereum’s monetary policy.

Let’s switch gears over to stablecoin metrics:

There’s a lot to digest here, so I am going to break it down:

The stablecoin market cap is $240B.

Ethereum accounts for $131B of the total.

Tron accounts for $78.8B.

There is more USDT on Tron ($78B) than USDT on Ethereum ($70B), but the gap is closing.

There is far more USDC on Ethereum ($40.7B) than USDC on Solana ($6.8B).

Here’s a look at tokenized treasuries:

In this category, too, ETH is the clear leader - making up $5.6B of the $7.36B total market.

Let’s look at staking statistics:

What you are looking at is about 29.4% of all eligible ETH is being staked - totaling 35.5 million ETH, or roughly $87.2B in value. This figure continues to gradually grow over time.

There's now an entry queue for validators again - something we haven’t seen since July of last year. This is a bullish sign - and it will stay that way unless an exit queue forms, which would suggest people are looking to sell.

Now I have a random assortment of charts from The Block.

Aside from the brief spike in 2021, active addresses are growing.

Transactions on the network are nearing all-time highs, already surpassing the spike from 2021 - and this is happening without a major price run. If ETH finally moves, both transactions and active addresses are likely to soar.

This chart isn’t too helpful, but it’s interesting. Right now, we’re squarely at 60%, which tells me that, at a minimum, 60% of ETH holders are annoyed with the performance of this asset - likely a lot more when you account for the time spent sitting on weak returns.

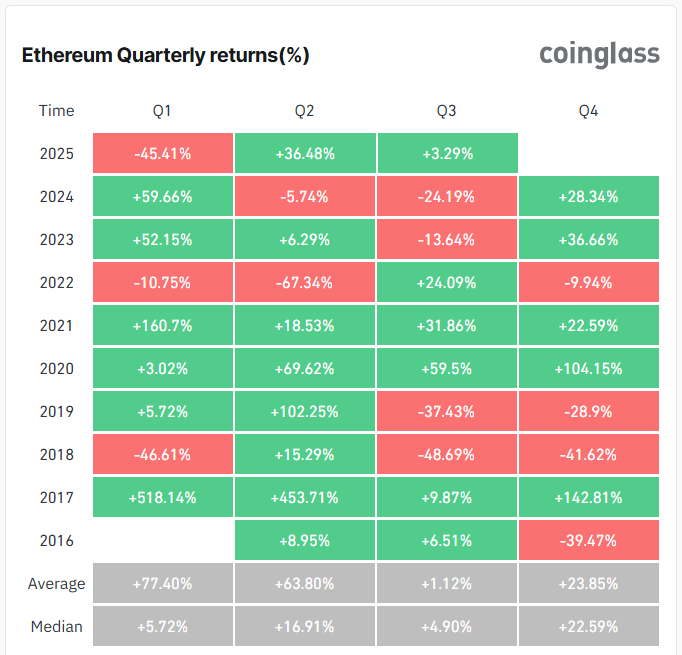

This chart isn’t exactly aligned with the original intent of this newsletter, but it felt right to include it. ETH finally had a decent quarter after a brutal 45% drop in Q1, which wiped out all the momentum it built at the end of last year. I used to look at this chart and try to draw some loose conclusions - like Q1 generally delivering solid returns and Q3 being relatively weak - but at this point, it’s time to throw that analysis out the window. ETH has consistently surprised to the downside, and that’s just the reality. If we were using this chart as even a loose guide for price action, ETH should’ve had a stronger Q4 and certainly not the abysmal Q1 we got.

At this point, all I can do is look at this table and think - after all the red we’ve endured and the underwhelming green - we might finally be due for some big green quarters. Especially considering we’re in a bull market and Bitcoin is moving like a champ.

Up next is the Altcoin Season Index. While it’s not a direct measure of ETH, when this chart finally flips, ETH is likely to be the primary benefactor. Aside from 2021, every year, for the past few years around early to mid-summertime, it has been Bitcoin season.

That wraps up everything I’m tracking for ETH, and hopefully it adds some context to the ongoing discussion about where price might be headed. The simple takeaway: if the metrics are at or near all-time highs and still trending upward, price should naturally follow.

If you enjoyed this newsletter - or know someone battling a bit of ETH depression - send it their way. It takes a couple of clicks to forward an email, and it helps me out a lot. Also, scroll up and join the Telegram group.

One last point - looks like Robinhood has some explaining to do…

Here’s Vlad’s response:

Just thought this was interesting.

Aptos Weekly Review

For those that don’t know, Aptos - one of the most exciting layer 1 blockchain competing with Solana and Ethereum - is an official sponsor of this newsletter! Over the past few months, I’ve had the chance to get to know the Aptos team, create content with them, and watch this project accomplish incredible things.

Each week, I provide an Aptos review, showcasing all the exciting announcements and milestones the network is achieving. This week, I want to start with this HUGE news that Avery Ching, the CEO and founder of Aptos Labs got accepted into the CFTC digital asset market subcommittee!

Avery Ching will join a growing list of crypto-native executives and traditional finance leaders on the CFTC’s Global Markets Advisory Committee (GMAC) Digital Asset Markets Subcommittee. Other notable members include Polygon Labs Head of Policy Rebecca Rettig, CoinFund President Christopher Perkins, Nasdaq Vice President Tony Sio, and Franklin Templeton Senior Vice President Sandy Kaul.

Ching steps in at a pivotal moment: the CFTC’s oversight of crypto is expanding, while several top agency officials are departing or planning to leave - potentially paving the way for more crypto-friendly commissioners, according to The Block.

Next, I want to give a quick shoutout to some of the hottest DeFi projects on Aptos right now. There are so many, so I’ll keep it brief and share a few quick highlights this week:

Finally, to close out this week’s segment, I want to zoom out and take a broader look at Aptos’s TVL:

January of last year, Aptos’s TVL was at $120m, today it’s over $1b with all-time highs over $1.2b. That’s insane growth. Anyways, that is all for this week, make sure to show Aptos some love - they’re a huge reason this newsletter remains free!

Bitcoin Thoughts And Analysis

The jobs report just dropped and was stronger than expected. That means the Fed has less reason to cut. That means less chance of immediate liquidity. Since we live in the upside down, apparently more jobs are bad for markets. And we generally see Bitcoin react first and then quickly go back to trading on its own.

All of that said, this is an interesting spot. Bitcoin broke out yesterday, before closing back below the resistance. The same is happening so far today, with a potentially ugly top candle if the day stays this way. But it is WAY too early to judge.

Altcoin Charts

Ethereum is battling the daily 50 MA on the ETH/BTC chart, a key area of resistance. If it beaks above, we could see a nice altcoin rally and Ethereum outperforming. If it gets rejected… more of the same.

Markets Hold Steady As Jobs Report Looms, Bonds Rebound

Markets remained calm ahead of Thursday’s closely watched U.S. payrolls report, with stocks steady and bonds rebounding from Wednesday’s global selloff. The 10-year Treasury yield dipped to 4.26%, while UK gilts rallied following political support for the new Chancellor's fiscal plans. The S&P 500 held near record highs, and futures were flat as traders weighed the potential for a Fed rate shift depending on the jobs data.

A weaker-than-expected report could bolster rate-cut hopes, while stronger numbers might complicate the Fed’s path forward. Strategists warn markets may be pricing in too much too soon, with fiscal concerns – especially the growing U.S. deficit – also looming large.

Meanwhile, semiconductor stocks surged after the U.S. lifted export license restrictions to China, and corporate headlines included BlackRock weighing a Saudi pipeline asset sale, Carlyle navigating a debt-fueled handover in Italy, and Alibaba launching a $1.5B exchangeable bond offering.

Markets close early for the July 4 holiday, but eyes remain on both macro data and mounting U.S. fiscal pressure.

Stocks

S&P 500 futures were little changed as of 7:37 a.m. New York time

Nasdaq 100 futures were little changed

Futures on the Dow Jones Industrial Average were little changed

The Stoxx Europe 600 rose 0.1%

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.1794

The British pound rose 0.2% to $1.3659

The Japanese yen fell 0.1% to 143.84 per dollar

Cryptocurrencies

Bitcoin rose 0.5% to $109,734.33

Ether was little changed at $2,592.66

Bonds

The yield on 10-year Treasuries declined two basis points to 4.26%

Germany’s 10-year yield declined five basis points to 2.62%

Britain’s 10-year yield declined eight basis points to 4.53%

Commodities

West Texas Intermediate crude fell 0.3% to $67.28 a barrel

Spot gold fell 0.3% to $3,347 an ounce

An Honest Review Of Coinbase One

I decided to give Coinbase One a try so I could share my thoughts with all of you here. Personally, I don’t think these types of products are ever worth it - unless you’re guaranteed to make your money back through trading, staking, or some other benefit. The current cheapest price is $30 a month or $300 a year.

Let’s look at the staking benefits received:

You’d need to hold and stake $90,000 in USDC on Coinbase for a year to earn enough from the 0.4% APY boost to break even on the $30/month Coinbase One membership.

You’d need to stake $180,000 worth of ETH on Coinbase for a year to make enough from the 0.2% APY boost to cover the $30/month Coinbase One membership.

You’d need to stake $72,000 worth of Solana on Coinbase for a year to earn enough from the 0.5% APY boost to offset the $30/month Coinbase One membership.

If your plan was to stake and trade to make up the difference, I wasn’t too impressed with how the trading benefits actually work. Coinbase One members get up to $10,000 in fee-free trading - but only on the standard Coinbase platform, not Coinbase Advanced. The catch is that trades on regular Coinbase include a wider spread, which can end up costing you more than the fees you’d pay on Advanced. And while Advanced does offer a fee rebate, it’s not that generous - just 25% back in USDC on spot trading fees, capped at $100 per month.

While there are additional perks - like sweepstakes entries, onchain benefits, and free wire transfers - I didn’t find any of them meaningful enough to make a difference for me.

The bottom line: unless you’re staking more than the breakeven threshold or trading enough to hit the rebate cap, this product isn’t worth it. I’m curious to see what the $5 month version will include when it releases - especially since it still gives access to the card - but for now, I’m not all that impressed. That said, if you’re staking more than the breakeven amount and don’t plan on moving it, Coinbase One becomes a no-brainer. Spending $30 a month to earn anything over the cost is a solid deal.

The SOL Staking ETF Is Live

SSK, the SOL ETF with staking, just wrapped up its first day of trading with over $33.9 million in volume. It had a strong start out of the gate, and with yesterday being a solid day for alts overall, the timing couldn’t have been better - making for an epic debut. By the time this newsletter goes out, we should have a clearer picture of day one inflows. I’ll revisit this asset after some time passes and compare its performance against its competitors.

In other crypto ETF news, I have some pretty cool stats screenshotted below:

Think about that for a second - BlackRock’s Bitcoin ETF has already generated more revenue than its S&P 500 ETF. There’s no reason to believe BlackRock won’t launch an ETH staking ETF - and others - once the market is ready. These products represent a massive revenue opportunity.

Here’s something to think about for ETH:

Given that now both Robinhood and Coinbase have selected ETH, all the metrics on this chain are going to accelerate.

Coinbase Acquires LiquiFi For Onchain Builders

Following Robinhood’s full day of announcements, Coinbase scored a small win of its own by announcing the acquisition of Liquifi - a platform that streamlines token management, vesting, and compliance for onchain projects. Teams like the Uniswap Foundation and Optimism already use Liquifi, and Coinbase plans to scale its capabilities even further. The goal is to eliminate the legal, regulatory, and operational hurdles that make launching a token complex. By integrating Liquifi into Coinbase Prime, the company aims to offer a seamless, end-to-end solution for builders, investors, and employees - making token launches as easy and global as issuing startup equity. This move supports Coinbase’s broader mission to accelerate onchain adoption and empower the next generation of crypto innovators.

Bitcoin To $160,000 This Cycle!

Hadley Stern, CCO of Marinade, predicts Bitcoin will peak at $160,000 this cycle - but warns that new U.S. legislation like the GENIUS Act could threaten decentralization in crypto. He shares concerns about the growing influence of centralized players like Circle and Coinbase. With ETF flows, corporate treasury demand, and policy shifts creating bullish momentum, is this the perfect storm for Bitcoin?

Chris Inks will join us in the second part to share some interesting trades in crypto and beyond.

My Platforms And Sponsors

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

The Wolf Pack - My new Telegram group where I share daily updates on everything I'm watching and chat directly with all of you. Completely free to join.

The Crypto Advisor - My weekly newsletter for registered investment advisors, combining macro trends, Wall Street insights, and crypto – all in one place..

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis!

Blofin - Blofin is offering our Telegram members a $30 Bonus + 50% Spot Discount when they sign up for The Wolf Pack.

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Peoples Reserve - Use Bitcoin as pristine collateral with Peoples Reserve - where wealth is built smarter through Bitcoin-powered finance.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.