Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Arch Public has added an additional exchange to our roster: Kraken. We are excited to partner with Kraken to offer our algorithmic strategies for BTC, ETH, SOL, XRP and now SUI!

Adding additional symbols across exchanges will be a theme for us throughout the summer. Come talk to us and find out how you can accumulate, arbitrage, and trade crypto TAX FREE on Kraken!!

In This Issue:

Abolish The Bell

Bitcoin Thoughts And Analysis

US Stock Futures Hold Steady Ahead Of Jobs Data, Trade Talks In Focus

Bitwise Updates Its 2025 Predictions

The SEC May Streamline Crypto ETF Submissions

Polymarket Goes Wild On SOL ETF

The Senate Passed The Big Beautiful Bill

Bitcoin Inflows Explode | Welcome American Bitcoin!

Abolish The Bell

What happens when the stock market never closes?

To traditional investors, this sounds absurd – maybe even reckless. But in crypto, it feels more like a matter of “when,” not “if.” The idea of a closing bell is starting to feel like a relic from another era.

Take Monday night: Robinhood ($HOOD) closed at an all-time high during regular hours. Then it kept pushing higher in after-hours trading – thin liquidity, fewer participants, but momentum didn’t care. That kind of move outside the “official” trading window suggests there’s still untapped demand.

So what if the market hadn’t closed at all? Would HOOD have kept climbing? Possibly. But instead, everyone had to pause – every algo, trading desk, and retail investor forced to sleep on it. Traditional markets impose artificial breaks that can stall hot trades and interrupt price discovery.

Crypto doesn’t have that problem. It moves whenever it wants – including weekends, which have become prime time for volatility.

Bitcoin’s biggest surges often happen when legacy markets are offline. At first, it felt like a cheeky rebellion against Wall Street. Now, it just feels inefficient. The real issue? Traditional investors can’t respond in real-time, especially if they’re using ETFs. That leads to annoying chart gaps when crypto pumps (or dumps) over the weekend, but ETFs don’t reflect it until Monday’s open.

Some of the biggest moments in crypto happened when Wall Street was asleep:

Ethereum’s Bellatrix and Paris upgrades – weekend of Sept 10–12, 2022

FTX bankruptcy – weekend of Nov 11–13, 2022

Binance.US halting withdrawals – weekend of Sept 17–18, 2022

Bitcoin’s brutal COVID drop – March 7–8, 2020 (–30%)

Coinbase earnings volatility – sometimes spills into weekends

Solana x FTX partnership – announced over a weekend in Dec 2021

Polygon x Google Cloud – revealed on a weekend in May 2021

The takeaway: it’s not just that crypto never sleeps. It’s that the rest of the world will eventually have to catch up. The sooner markets go 24/7, the better price discovery becomes – and the fewer opportunities get left behind because a bell told you to stop trading.

Vlad Tenev, the CEO of Robinhood, laid out the broker’s plans for the coming months on a chalkboard during this week’s “To Catch a Token” event. It was pretty epic.

The Introduction:

“Stock tokens may not be the easiest product to understand at first blush, so I'm wondering - if you're curious about how all this works behind the scenes, I can show you, if you'll bear with me. I find the whole process behind what Song showed you fascinating.

I'll also share a little bit about how it will evolve in the near future and potentially scale to pretty much any asset…”

Phase One:

“Okay, so here you are - our European customer. There’s your mobile phone, and let’s say you wanted to buy some Apple stock. What happens is that order is transmitted to our backend, and then it’s transmitted to a U.S. broker. Now, this is a registered TradFi broker-dealer that will buy a traditional share from what I’ll call a TradFi market. Now, this could be a market maker or an exchange like the NYSE or the NASDAQ.

Then, that share is transmitted back to the U.S. broker. It’s custodied in traditional form and it gets sent to what we call our tokenization engine. Now, this is where the magic really happens.

So for every share that’s being purchased from the TradFi market, one token is being minted. This represents the exposure to the share. And then that token gets transmitted back to you.

So what this means is: right now, every time you place a trade, an actual traditional share is being purchased from the market, held in custody, and a fresh token is minted. Then, similarly, when you want to sell these shares, the process goes in reverse. Robinhood instructs the introducing broker to sell the underlying share in the open market.

Then we burn the token, give you the proceeds, and this is all available 24 hours a day, 5 days a week. So I’ll call this Phase One.”

Phase Two:

“Okay, and let’s talk about what happens in Phase Two, which hopefully will be rolling out to customers in the next few months. So in Phase Two, we see the introduction of Bitstamp by Robinhood.

Now, what happens with Bitstamp is it’s put alongside the TradFi market, and the tokenized instruments would be listed there - just like normal cryptos like Bitcoin and ETH. And we now have the choice. So let’s say the TradFi market is closed, like it is on weekends and holidays - we can send your orders to Bitstamp.

But if it’s open, then we can send it to the TradFi market and benefit from the centuries of liquidity that’s been building on these traditional markets.

So, you really would get the best of both worlds. And then, this unlocks 24/7 trading, which is very cool. But that’s not all.”

Phase Three:

“Phase Three is when things really start to cook - also a few months away. This is when the possibilities really start to multiply. Okay, now if you bear with me - with my schematic - we should probably do that.

So, in Phase Three, you're integrating directly with the blockchain. We're working on unlocking the ability for you to take these kinds of tokens outside of our walled garden and into your wallet - into the world of DeFi.

How would you feel about self-custodying your stock tokens? It's cool, right? Well, it just might be available soon in your Robinhood wallet. So what this means: you could take your stock tokens off of Robinhood, control your keys, integrate directly with the blockchain, and take advantage of all the amazing utilities that developers - including many of you here - are building.

This could mean collateralized lending and borrowing, swapping - really, self-custody in its very pure form. Now, the beauty of this process is that it transfers pretty easily to any type of asset. So you can kind of circumscribe this part here, and you could replace this U.S. stock broker with, say, an art broker or real estate broker - swap out the appropriate market or exchange.

Outside of the token stuff, everything is pretty fungible and, uh, interchangeable. So we look forward to expanding your trading options with the assets that you care about most.”

Assuming you made it this far – and I hope you did – you now know that Robinhood doesn’t just plan to roll out tokenized assets globally, but also aims to complete Phases 2 and 3 in the coming months. Everything is moving toward being tokenized and untethered from the constraints of closing bells, sleeping hours, time zones, and arbitrary holidays.

That’s why I expect we’ll see an announcement from Coinbase soon. It’s hard to imagine they’d just hand over the entire opportunity to Robinhood – especially when they already have the perfect asset to lead with: COIN.

Tokenization is no longer a whiteboard sketch or futuristic theory – it’s here, and it’s scaling fast. The big question for investors now is: how do you capture the value this shift is creating? Is the move to own HOOD and COIN (assuming Coinbase steps in)? Or will Ethereum finally emerge as the real winner?

I don’t pretend to know the answer, which is why I’m playing both sides – allocating across ETH and SOL, while also holding crypto equities like HOOD and COIN – aiming to capture as much upside as possible.

This Friday, the banks are closed and the market is too, thanks to the Fourth of July. I love the holiday – but why do assets need to stop trading? I’d love to pull out my phone, make a few trades while having a beer with my family, and keep my portfolio moving. With crypto, I can. With everything else, I have to wait until Monday morning.

That’s 89.5 hours between Thursday’s close and Monday’s open. Almost four full days of forced silence. Is that not absurd?

My guess? By next Fourth of July – 2026 – that won’t be the case.

That’s all for today. If you enjoyed this issue, do me a favor and forward it to a friend. It only takes a few seconds, and it helps this free newsletter grow. I truly believe it can help a lot of people – and I want to reach as many of them as possible.

Bitcoin Thoughts And Analysis

Bitcoin just pulled off a clean bounce off support, landing perfectly on the 50-day moving average around $105,800 – a level that’s repeatedly proven its importance. The move came with a solid +2% daily candle, reclaiming lost ground and putting the bulls back in control for now. Price is still trapped under the descending trendline just below $112,000, which has capped every breakout attempt over the past month, but momentum is shifting. As long as BTC stays above that support zone and keeps printing higher lows, the structure looks bullish. A breakout above that trendline would likely send us flying – but fall back below $105,800, and we’re probably retesting $100,700. For now, the bounce looks strong, the trend is intact, and the ball’s back in the bulls’ court.

US Stock Futures Hold Steady Ahead Of Jobs Data, Trade Talks In Focus

U.S. stock futures remained steady as investors awaited Thursday’s June payrolls report and monitored ongoing trade negotiations ahead of the Trump administration’s July 9 tariff deadline. S&P 500 futures inched up 0.1% following a brief pause in the index’s rally, while Nasdaq 100 futures were flat. European stocks gained 0.4%, while Asian markets dipped slightly.

Despite renewed pressure from President Trump on Japan and other trade partners, equities continue to hover near record highs, suggesting reduced investor anxiety compared to earlier in the year. Economic data this week has reinforced the strength of the U.S. economy despite tariff threats, with job openings unexpectedly climbing to their highest level since November.

Treasury yields rose, with the 10-year climbing to 4.28% as rate-cut expectations softened. Swaps now price in roughly 63 basis points of easing by year-end, down slightly from earlier projections.

Notable Corporate Developments:

Banco Santander is acquiring Banco Sabadell’s UK unit for $3.64B, potentially becoming the UK’s third-largest lender.

Stellantis posted a 10% drop in U.S. deliveries in Q2, though Jeep and Ram brands showed improvement.

KKR agreed to buy Spectris Plc for $5.6B, topping a previous bid.

Worldline SA is conducting an internal review amid fraud concerns.

SoftBank’s $6.5B acquisition of Ampere Computing faces a potential U.S. regulatory probe.

Domino’s Pizza Enterprises plunged up to 26% after its CEO announced his resignation.

Greggs Plc warned of a possible profit decline due to reduced foot traffic during June’s heatwave.

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 rose 0.4% as of 10 a.m. London time

S&P 500 futures rose 0.1%

Nasdaq 100 futures were little changed

Futures on the Dow Jones Industrial Average rose 0.1%

The MSCI Asia Pacific Index fell 0.1%

The MSCI Emerging Markets Index was little changed

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro fell 0.3% to $1.1776

The Japanese yen fell 0.4% to 143.96 per dollar

The offshore yuan was little changed at 7.1663 per dollar

The British pound fell 0.3% to $1.3699

Cryptocurrencies

Bitcoin rose 1.7% to $107,796.7

Ether rose 1.4% to $2,450.68

Bonds

The yield on 10-year Treasuries advanced four basis points to 4.28%

Germany’s 10-year yield advanced six basis points to 2.64%

Britain’s 10-year yield advanced four basis points to 4.50%

Commodities

Brent crude rose 0.2% to $67.26 a barrel

Spot gold fell 0.2% to $3,333.49 an ounce

Bitwise Updates Its 2025 Predictions

The full Bitwise memo is summarized below – so if you want to give it a fresh read, skip ahead. I recommend checking out the original. It offers important context behind each prediction that’s worth digesting.

What stood out most: Bitwise is holding firm on its bold $200,000 end-of-year Bitcoin target – but they’re “less confident in ETH and SOL.”

Too Soon To Call:

Prediction 1: Bitcoin, Ethereum, and Solana will hit new all-time highs, with BTC trading above $200,000

Prediction 2: Bitcoin ETFs will attract more flows in 2025 than they did in 2024

Prediction 9: Stablecoin assets will double to $400 billion as the U.S. passes long-awaited stablecoin legislation

Looks Unlikely:

Prediction 3: Coinbase will surpass Charles Schwab as the most valuable brokerage, with COIN topping $700

Prediction 6: The number of countries holding bitcoin will double, from 9 to 18

Highly Unlikely:

Prediction 5: Tokens launched by AI agents will ignite a memecoin mania even bigger than 2024

Looking Good:

Prediction 10: The value of tokenized real-world assets (RWAs) will surpass $50 billion as Wall Street’s crypto pivot gains momentum

Almost Guaranteed:

Prediction 4: 2025 will be the “Year of the Crypto IPO,” with at least five U.S. crypto unicorns going public

We Nailed It:

Prediction 7: Coinbase joins the S&P 500 and MicroStrategy enters the Nasdaq-100 – giving nearly every U.S. investor indirect crypto exposure

Prediction 8: The U.S. Department of Labor relaxes its stance on crypto in 401(k)s, opening the door for billions in new inflows

The SEC May Streamline Crypto ETF Submissions

Here’s the remainder of Eleanor’s post:

“The thinking, I’m told, is that if a token meets the criteria, issuers could skip the 19b-4 process, file an S-1, wait 75 days, and the exchange could list it. This approach could save both issuers and the SEC a lot of paperwork and back-and-forth on comments.

What those listing standards would be is still unclear, but some are speculating market cap, trading volume and liquidity are all under consideration.

Through a spokesperson, the SEC declined to comment.”

Overall, I think this would be great news if the SEC came up with a cookie-cutter process to decide on and push through ETF applications, but the downside is that if it’s based on market cap, trading volume, and liquidity, alts may not make it through, depending on where those lines are drawn.

While we’re on the subject, let’s check where the Bloomberg Bros stand on approval odds. Keep in mind, this came out before Eleanor’s post.

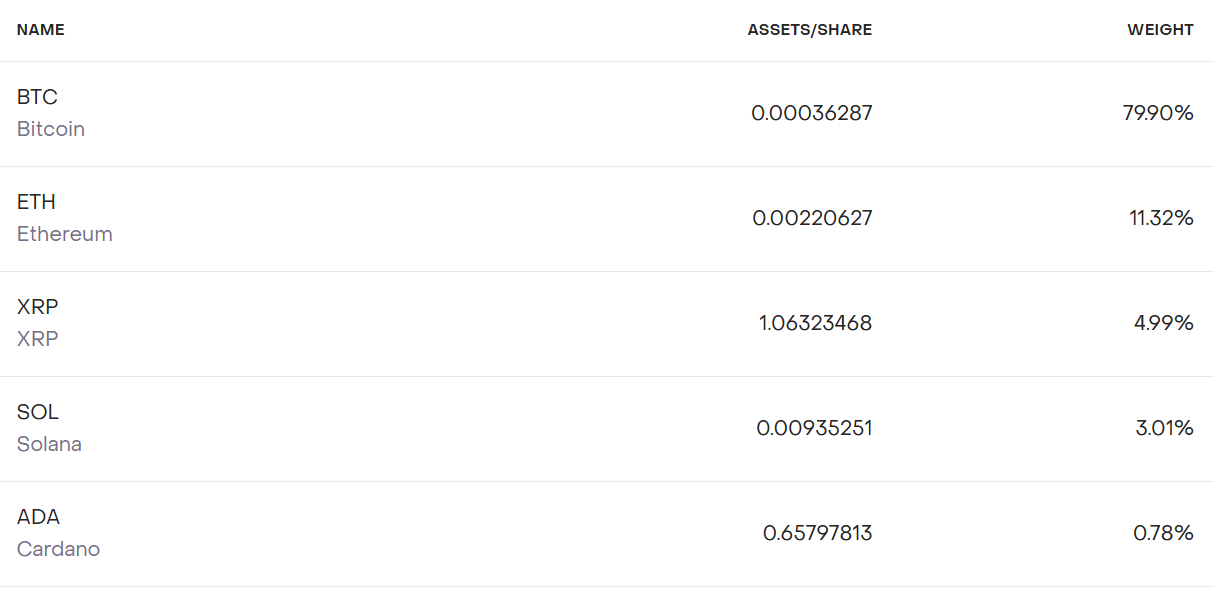

One last point on the crypto ETF front: Grayscale’s $GDLC has been approved for conversion into an ETF. GDLC is their Digital Large Cap Fund, holding Bitcoin, Ethereum, Solana, XRP, and Cardano. It’s a strong win for investors seeking index-style exposure to leading altcoins and should generate decent inflows.

The asset weighting is below:

Polymarket Goes Wild On SOL ETF

This Polymarket prediction was trending downward, with odds of a July 31st ETF approval falling to around 10% – until everything flipped. After the Rex Solana ETF received approval through an unexpected SEC pathway, the odds spiked to nearly 100%.

What changed? Rex pulled off a rare regulatory maneuver by structuring the ETF as a C-corp under the ’40 Act, sidestepping the usual 19b-4 process. It’s a creative and unconventional route the SEC has historically resisted – but now appears willing to accept. That signals a surprising openness to novel ETF designs and may pave the way for others.

Naturally, this triggered chaos on Polymarket. Some participants are ecstatic, others are furious, all because the market had to interpret an unforeseen outcome. And that’s the thing about Polymarket – it’s not structured like a financial market. It’s gambling. High-stakes, entertaining, and completely vulnerable to the fine print.

The Senate Passed The Big Beautiful Bill

Politics aside, the Senate passing this bill is likely good news if you hold assets or stand to benefit from a looser fiscal environment. It includes a proposed $4 trillion debt ceiling increase (cue the money printer), eliminates taxes on tips, provides tax breaks on Social Security benefits, and more. You can read the full breakdown here: “Myth vs. Fact: The One Big Beautiful Bill.”

Bitcoin Inflows Explode | Welcome American Bitcoin!

Discover Bitcoin Yield HERE.

Bitcoin ETFs have pulled in nearly $5 billion in just 15 trading days – and BlackRock's IBIT is leading the charge. Meanwhile, Trump-backed American Bitcoin raised $220 million to accumulate BTC and mining equipment, signaling a new wave of U.S. political and institutional adoption. I’m joined by Andrew Parish from Arch Public to break it all down on The Wolf Of All Streets.

My Platforms And Sponsors

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

The Wolf Pack - My new Telegram group where I share daily updates on everything I'm watching and chat directly with all of you. Completely free to join.

The Crypto Advisor - My weekly newsletter for registered investment advisors, combining macro trends, Wall Street insights, and crypto – all in one place..

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis!

Blofin - Blofin is offering our Telegram members a $30 Bonus + 50% Spot Discount when they sign up for The Wolf Pack.

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Peoples Reserve - Use Bitcoin as pristine collateral with Peoples Reserve - where wealth is built smarter through Bitcoin-powered finance.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.