Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

247%. 247% annually. Hands free and daily liquidity. Now add 20% cash yield annually. That’s what our Bitcoin Algorithm Arbitrage Strategy does for you each year. Huge stacks of Bitcoin, additional stacks of cash, buy on the dips, and sell at the top!

Arch Public has brought an institutional grade tool to retail. Harness the power of a long bias, arbitrage strategy. Let our team set it up for you, and you sit back and watch it work hourly, daily, weekly, monthly.

Try Arch Public now! You can even demo the platform, for free, to learn more.

In This Issue:

Not Everyone Wants Bitcoin To Succeed

Aptos Weekly Review

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Norway’s Central Bank Holds $500M of MicroStrategy!

Michael Saylor Makes The Cover of Forbes

Tether Launches USDT On Bitcoin

HUGE Bitcoin News: The Fed Just Gave BTC The Green Light!

Not Everyone Wants Bitcoin To Succeed

“First they ignore you, then they laugh at you, then they fight you, then you win.”

Yesterday, I covered the breaking story that the Czech central bank was set to vote on allocating up to 5% of its reserves to Bitcoin. Out of nowhere, a $360 billion economy essentially declared to the world, “we like Bitcoin,” and “we want to buy Bitcoin.” It was a bold and unexpected move. Well, the plot just thickened—the vote was held, and the outcome was a resounding “yes.” The Czech National Bank has officially committed to analyzing Bitcoin as part of its broader strategy for reserve diversification.

This story gets better.

There’s a crucial detail I left out yesterday: The Czech Republic recently passed a law that exempts Bitcoin and other digital assets from capital gains tax if held for over three years. Parliament approved it on December 6, and it officially took effect on January 1. The law also grants tax exemptions for individuals with annual crypto transaction income under CZK 100,000 ($4,000).

Now, imagine if the U.S. did that. BOOM—Bitcoin jumps $10,000 instantly, no hesitation.

In less than a month, the Czech Republic has gone from a relatively quiet player in the crypto space to one of its loudest advocates—and in the best way possible. But, of course, this didn’t go unnoticed by a certain central bank loyalist and fiat maximalist. European Central Bank President Christine Lagarde, one of the most powerful figures in global banking, wasted no time inserting herself into the conversation with a statement so out of touch it will be remembered as one of Europe’s biggest self-inflicted wounds in recent financial history.

Here’s what she said…

“On the matter you referred to, regarding whether the reserves of central banks should or could include Bitcoin, I think there is a view around the table of the governing council—and most likely the general council as well—that reserves must be liquid, secure, and safe. They should not be associated with the suspicion of money laundering or other criminal activities. As a result, I am confident that Bitcoin will not enter the reserves of any central bank within the General Council. I had a good conversation with my colleague from the Czech Republic, and I leave it to him to make any announcements he wishes. However, I am confident that he, like all of us, is convinced of the necessity for liquid, secure, and safe reserves.”

I’m no expert in psychology or body language, but when she smirks and holds back a laugh right at the “I’m confident” part—while shaking her head like she’s saying ‘no’—it’s as obvious as it gets. This is peak “I’m definitely NOT confident and I absolutely don’t believe what I’m saying.” It’s like watching someone try to convince you they didn’t eat the last cookie—while they’ve got crumbs all over their face.

If you haven’t seen the video, do yourself a favor and watch it. It’s as lousy and disingenuous as it gets.

But I’ve got more dirt on Lagarde. No anti-Bitcoin deed goes unpunished in The Wolf Den.

Did you hear about Christine Lagarde’s son and his little crypto adventure? Yeah, in late 2023, her adult son—who’s in his mid-30s, by the way—decided to dip his toes into crypto... and promptly lost a good chunk of it. She shared this little nugget during a speech to students in Frankfurt, perhaps hoping it would give her some street cred with the younger generation.

“He ignored me royally, which is his privilege. And he lost almost all the money that he had invested. It wasn't a lot but he lost it all, he lost about 60% of it. So, when I then had another talk with him about it, he reluctantly accepted that I was right.”

Wow. Stellar parenting move, Ms. Lagarde. You let your son make a financial decision, waited for him to fail, and then gloated about it in public. Impressive.

In all seriousness, Lagarde has spent years seizing every opportunity to bash crypto while simultaneously pushing for a European Central Bank Digital Currency. Makes sense, right? She wants to be remembered as the hero who ushered in the digital euro—by centralizing even more power. Unfortunately for her, history won’t be so kind. Many European countries, along with hundreds of millions of people, will be set back because of her anti-crypto stance.

Let’s take a look at some of her greatest hits:

“I have, as you can tell, a very low opinion of cryptos. People are free to invest their money where they want, people are free to speculate as much as they want, (but) people should not be free to participate in criminally sanctioned trade and businesses.”

“My very humble assessment is that it is worth nothing, it is based on nothing, there is no underlying asset to act as an anchor of safety.”

“The day when we have the central bank digital currency out, any digital euro, I will guarantee—so the central bank will be behind it, and I think it’s vastly different than many of those things.”

“My feeling is when you regulate it so you couldn't engage in money laundering and all these other crimes, there will be no demand for bitcoin.”

As it stands, Europe’s anti-Bitcoin, power-hungry bureaucrats are running out of time in the laughing at you phase before they enter fighting you territory. And I can’t help but wonder—where would Lagarde’s son’s portfolio be now if he hadn’t panic sold near the bottom?

It’s blatantly obvious she has a personal agenda against decentralized digital assets. Their success undermines the lies she’s told herself throughout her career and threatens the power she has consolidated. The silver lining? Countries within the EU—like the Czech Republic—are starting to go their own way, telling her and her cronies to piss off.

Bitcoin is highly liquid, secure, and safe. And if they choose to fight us, that only means we’re one step closer to winning. Bitcoin is the ultimate tool for reinvention—whether through national reserves or everyday savings. It’s taken countless trials and tribulations to get here, but it’s never been more obvious that we’re winning. And there’s still plenty more winning ahead.

“First they ignore you, then they laugh at you, then they fight you, then you win.”

Aptos Weekly Review

Each week, I’ll provide an Aptos review, showcasing all the exciting announcements and milestones the network is achieving. This week let’s kick things off with this epic announcement: Native USDC is LIVE on Aptos!

USDC has officially gone live natively on the Aptos blockchain, following Circle's earlier announcement in November 2024. This launch marks the integration of both the native USD Coin and Circle’s cross-chain transfer protocol on Aptos. With native availability, users and developers can now directly use USDC on the Move-based layer-1 blockchain, eliminating the need for cross-chain bridges. This integration allows financial institutions and the broader Aptos community to access USDC liquidity for various applications, such as decentralized finance, peer-to-peer payments, remittances, and gaming.

USDC is powering these innovative use cases:

Build secure apps for peer-to-peer payments, cross-border remittances, RWA settlement, gaming, and more

Supercharge DeFi with deep liquidity for digital asset trading and financial services

Empower merchants with global, instant, low-cost payment solutions that settle 24/7

With this integration complete, users can now seamlessly transfer USDC between Aptos and 9 others major blockchains—including Arbitrum, Base, Ethereum, and Solana—thanks to Circle’s Cross-Chain Transfer Protocol.

For the second half of this segment, I want to cover the following:

1. Unrivaled Speed and Security

“These innate advantages of Aptos helped the network to achieve an industry record for daily transactions across any Layer-1 blockchain—with 325M transactions recorded over a four-day period thanks to the clicker game Tapos.”

2. Modular Architecture That Scales

“Thanks to Aptos’ parallel execution engine Block-STM, innovative AptosBFT consensus mechanism and Raptr, Aptos’ fully paralleled and pipelined architecture is able to provide sub-second latency with high throughput.”

3. Evolving Ecosystem

“In 2024, Aptos set new user acquisition records, solidifying its technical capabilities and ability support massive growth. The Aptos ecosystem expanded to over 330 projects, while monthly active users surged to over 13 million—up from 10 million at the end of 2024.”

4. A Powerful Developer Language

“Move, the programming language at the core of Aptos, offers a critical advantage for builders. And builders are about to see a huge upgrade with Move 2—an extension that offers new features and a major upgrade of the MoveVM to enhance cross-chain compatibility with ecosystems like Ethereum and Bitcoin.”

5. Unique Features

“Aptos is the only blockchain that offers features like aggregators for parallel execution, privacy solutions and Aptos’ Fungible and Digital Asset standards.”

To read the full blog from the Aptos Foundation, click HERE.

That is all for this week, make sure to show Aptos some love—they’re a huge reason this newsletter remains free!

Bitcoin Thoughts And Analysis

The Bitcoin daily chart remains within a consolidation phase after a failed breakout above key resistance at 106,099. Price is currently trading just below this level, showing indecision with several wicks on both sides of the candles, signaling market uncertainty.

The descending trendline from the recent all-time high was broken last week, and price has held above it, which suggests that the overall structure remains bullish. Support at 99,860 continues to act as a strong floor, aligning closely with the 50-day moving average, which has been steadily trending upward.

Volume has been relatively muted over the past few sessions, indicating a lack of conviction from both bulls and bears. A daily close above resistance at 106,099 would likely confirm bullish continuation and could open the door for a retest of the all-time high at 109,358. Conversely, a breakdown below 99,860 could test the 50-day moving average and lead to a broader pullback.

Traders should watch for a decisive move in either direction, as the current range-bound action indicates the market is building energy for the next significant move.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

ETH/USDT + ETH/BTC

ETH has underperformed this cycle. Historically, ETH lags behind Bitcoin, and that pattern has held. My conviction on ETH has been high—and while it has performed well in absolute terms, it hasn’t kept pace with BTC and Solana.

I’ve been pushing this narrative hard since ETH was trading below $1,000 during the depths of the bear market. Was it a bad investment? No. It has simply underperformed a few other assets. I’m happy with the gains and still have strong conviction that ETH is a great buy at these levels. I could be wrong—but I’m betting I’m not.

Take a quick look at the weekly chart vs. USDT. We’ve now had three consecutive weekly candles testing the 50 MA, with a textbook reversal candle forming. Volume has been steadily increasing since September 2023, culminating in capitulation-level selling two weeks ago—the largest volume candle on the chart. Despite the massive sell pressure, bears failed to push lower, leaving a long wick down. Classic exhaustion move.

Now onto the ETH/BTC chart, which I’ve shared multiple times over the past few weeks. We’ve got three weekly candles testing the most significant support and demand zone on the chart—going all the way back to 2021. Each of these candles has a wick down, signaling strong buying interest. RSI is now oversold on the weekly for only the fifth time in history. Three of the last four instances marked major bottoms. On top of that, we’re seeing clear bullish divergence.

Throw in the overwhelming FUD, endless claims that ETH is "dead," and the usual doomsday narratives—this is exactly when I’m buying.

Legacy Markets

European stocks surged, with the Stoxx 600 index set for its best month in two years, climbing 6.5% in January. Strong corporate earnings, European Central Bank easing, and optimism about avoiding US tariffs bolstered investor sentiment. Nasdaq 100 futures advanced 0.8%, while S&P 500 futures also gained, helped by premarket rallies in Apple and Intel. The tech sector rebounded after concerns over China’s DeepSeek AI disruption rattled markets earlier in the week.

Investors are shifting focus toward European equities, with Bank of America’s Michael Hartnett advising diversification away from US big tech, which dominated last year’s market outperformance. Meanwhile, President Donald Trump is expected to announce tariffs on Canada and Mexico this Saturday, driving volatility in the Canadian dollar to its highest level since October 2022. Traders are bracing for potential trade-related inflation, pushing 10-year Treasury yields lower and boosting gold, which is on track for its best month since March.

Commodity markets remain tense as speculation grows that US sanctions could target key Canadian imports, including oil. Crude prices fluctuated ahead of the weekend tariff decision. On the economic front, attention turns to the US core price index (PCE), the Fed’s preferred inflation measure, which is expected to show a slight increase for December.

Despite early-week concerns about AI competition from China, strong US tech earnings have reassured investors. Nasdaq-100 companies reporting this season have delivered an average 6% earnings beat, reversing initial worries and supporting the broader stock market recovery.

Key events this week:

US personal income & spending, PCE inflation, employment cost index, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.5% as of 7:22 a.m. New York time

Nasdaq 100 futures rose 0.8%

Futures on the Dow Jones Industrial Average rose 0.3%

The Stoxx Europe 600 rose 0.5%

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index rose 0.2%

The euro was little changed at $1.0382

The British pound was unchanged at $1.2419

The Japanese yen fell 0.3% to 154.79 per dollar

Cryptocurrencies

Bitcoin fell 0.2% to $104,821.03

Ether rose 3.1% to $3,346.57

Bonds

The yield on 10-year Treasuries advanced one basis point to 4.53%

Germany’s 10-year yield declined four basis points to 2.48%

Britain’s 10-year yield declined two basis points to 4.54%

Commodities

West Texas Intermediate crude fell 0.2% to $72.61 a barrel

Spot gold rose 0.4% to $2,805.22 an ounce

Norway’s Central Bank Holds $500M of MicroStrategy!

Upon hearing the news, I immediately fired off a post on X: “This is about as close as you can get to ‘Bitcoin on the balance sheet.’” In hindsight, I was spot on. Technically, the balance sheet isn’t holding Bitcoin itself, but in terms of exposure, this is essentially leveraged Bitcoin. MSTR has always been the equivalent of holding more than 100% BTC—probably closer to 150% on average.

It’s impressive that Norway’s sovereign wealth fund has increased its indirect Bitcoin exposure by 153% year-over-year, reaching 3,821 BTC ($400 million) as of Dec. 31, 2024. This exposure comes through investments in Bitcoin-heavy companies like MicroStrategy, Riot, MARA, and Coinbase, according to K33’s Vetle Lunde.

The fund, known as the Government Pension Fund Global (GPFG), is controlled by Norway’s central bank but managed by a subsidiary, Norges Bank Investment Management (NBIM). NBIM operates independently within the central bank under the Ministry of Finance, overseeing over $1.5 trillion in assets across global equities, bonds, and real estate.

Norway’s move is yet another example of Bitcoin’s silent march into institutional balance sheets—whether directly or through proxy plays. The tide is rising, and the skeptics are running out of excuses.

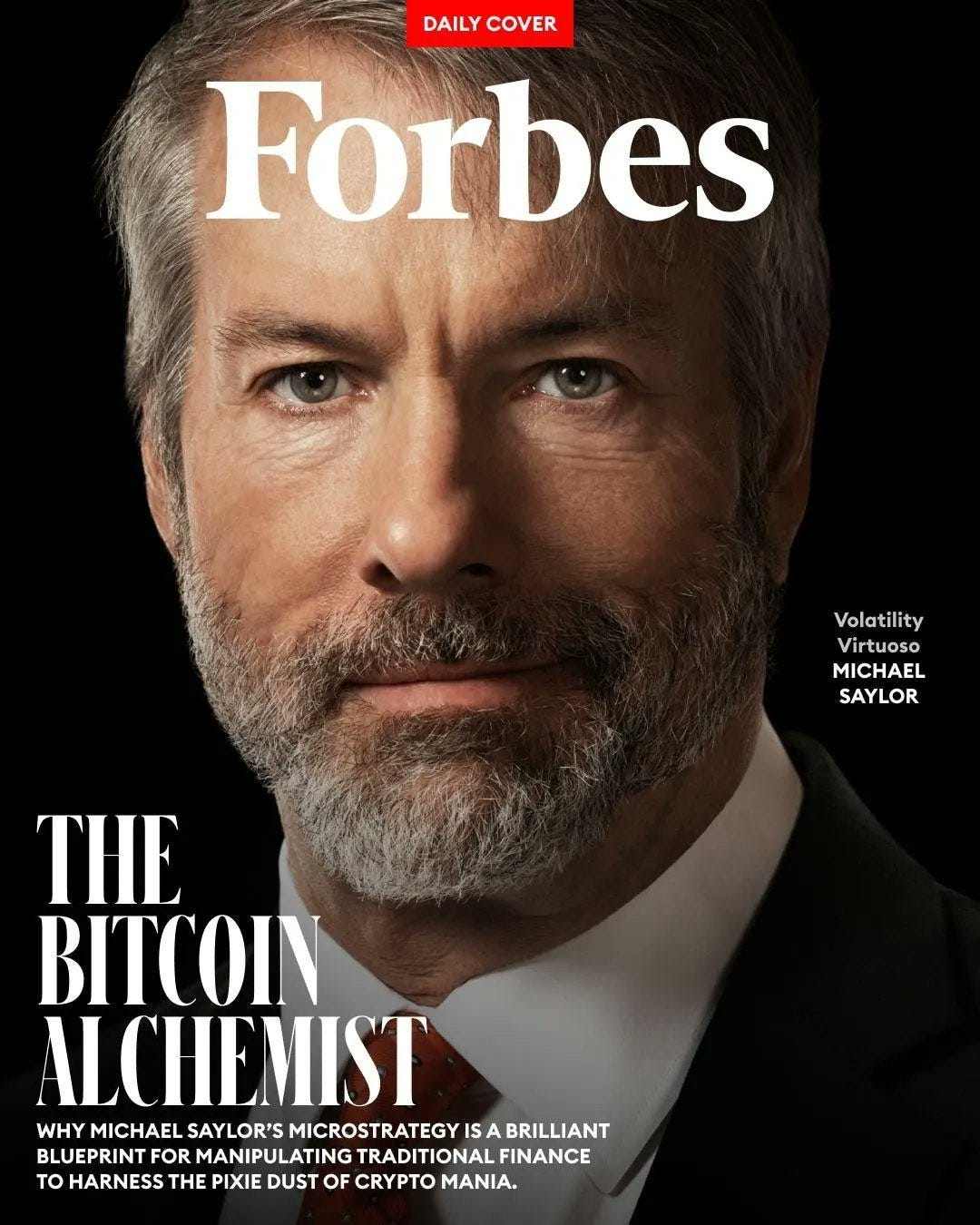

Michael Saylor Makes The Cover of Forbes

The timeline yesterday was flooded with jokes about this being the top—because, let’s be honest, anytime someone lands on the cover of Forbes or TIME, things tend to go south. And sure, there might be some truth to that, but it’s also a bit ridiculous. Look back at any past Forbes or TIME cover featuring crypto and check Bitcoin’s price at the time—chances are, you’d wish you had bought more.

The article is behind a paywall, so I can’t share the details, but I’ve heard good things. That said, you’re probably not missing much—just listen to a Saylor podcast. Study the man, and you’ll get everything you need to know.

Tether Launches USDT On Bitcoin

Tether is bringing its $140 billion USDT stablecoin to Bitcoin and the Lightning Network using Taproot Assets, a protocol that enables asset issuance and fast, low-cost transactions on Bitcoin. While stablecoin adoption has surged, most of the activity still happens on smart contract platforms like Ethereum, Tron, and Solana. This integration is a significant step toward expanding Bitcoin’s role in the stablecoin market, particularly for payments and remittances in emerging economies.

What I’m most eager to see is how Bitcoin’s activity stacks up against Ethereum and Solana in six months. My expectation? The existing rails will continue to dominate—but I’m open to being surprised.

HUGE Bitcoin News: The Fed Just Gave BTC The Green Light!

I am joined by Edan Yago, CEO at BTC OS & Core Contributor to BitcoinOS, and one of my favorite guests and my co-host for Thursdays starting this week! We are talking everything crypto and specifically - Bitcoin!

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.