Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Arch Public has added an additional exchange to our roster: Kraken. We are excited to partner with Kraken to offer our algorithmic strategies for BTC, ETH, SOL, XRP and now SUI!

Adding additional symbols across exchanges will be a theme for us throughout the summer. Come talk to us and find out how you can accumulate, arbitrage, and trade crypto TAX FREE on Kraken!!

In This Issue:

Crypto News Is Booming!

Bitcoin Thoughts And Analysis

Altcoin Charts

Stocks Slip After Records As Traders Eye Fed And Trade Risks

Circle Applies For A Banking Charter

Tokenized Stocks Are Now On Kraken And Solana

This Major German Bank Is Saying Yes To Crypto

Bitcoin Booms, Altcoins Die - Is China Back in Crypto? | Macro Monday

Crypto News Is Booming!

Yesterday brought a downpour of meaningful crypto updates – more than we can reasonably unpack in the news section below – so I’ve pulled the most important ones together right here. Whether you're into Bitcoin, Ethereum, Solana, or even traditional equities, chances are something in your portfolio just got a little more interesting. Let’s dive in.

For the Bitcoin holders:

Strategy’s 12-week Bitcoin buying spree continues, with just 2,675 BTC to go before hitting a massive 600,000 BTC total.

MSTR is everywhere – it’s only a matter of time until S&P 500 inclusion. That would be huge for both MSTR holders and BTC holders.

Metaplanet, once a budget hotel operator, now holds the fifth-largest Bitcoin treasury among public companies. While it still trails MARA by a wide margin, there’s a real chance it could catch up – after all, its target is a bold 210,000 BTC.

For the Solana holders:

Somehow, someway, Solana just crossed the staking ETF finish line right alongside Ethereum. While the filing highlighted above only mentions SOL, both Rex Shares and Osprey submitted applications for staking ETFs tied to both SOL and ETH. I doubt the initial inflows will move markets, but approval could accelerate a wave of similar filings – and maybe even push BlackRock to file for an ETH staking ETF. Robert Mitchnick has already said these products work better with staking. If BlackRock enters the game – for ETH, or even Solana – that changes everything.

Now, for Ethereum holders:

Check out this headline – “Wall Street strategist Tom Lee is aiming to create the MicroStrategy of Ethereum.” But before we get to that, here’s a quick recap of two major ETH treasury moves: Nasdaq-listed BitDigital ditched Bitcoin to accumulate ETH and ramp up staking, and SharpLink Gaming just partnered with Consensys to become the largest publicly traded ETH treasury in the world. ETH isn’t missing out on the treasury narrative – it's gaining momentum.

Now, back to Tom Lee...

Fundstrat’s Tom Lee has joined BitMine Immersion Technologies as chairman, as the little-known Bitcoin miner rolls out big plans to become the largest publicly traded holder of Ethereum. The company just announced a $250 million private placement to begin accumulating ETH as its primary treasury asset – all while continuing its Bitcoin mining operations.

From Tom Lee: “The financial services industry and crypto are converging and it really started with stablecoins, which is the ChatGPT of crypto because it’s viral adoption by consumers, business banks and now even Visa. Underneath the stablecoin industry is Ethereum – that is really the backbone and architecture of stablecoins so it’s important to create a project that accumulates Ethereum to essentially protect and have some influence on the network.”

In other words, Lee is putting his money where his mouth is – backing his belief that Ethereum will be the biggest beneficiary of stablecoin growth.

You can watch Tom Lee explain the news by clicking HERE.

For the Robinhood holders:

Robinhood dropped a year’s worth of updates in a single day – and it’s the main reason I decided to bring the news section up top today.

The staking announcement only scratches the surface, but it’s a huge win – not just for users, but also for the underlying chains and the companies’ shareholders. Staking on trusted platforms, in my view, is a no-brainer. Of course, DYOR and make your own decisions – there are risks – but if you’re going to stake, doing it through Robinhood or Coinbase is about as safe as it gets.

Up next was this – and it still wasn’t the major announcement…

Robinhood announcing the launch of perpetual futures this summer is a big deal – it marks a clear shift toward serving more sophisticated crypto traders and signals the company’s intent to compete with global derivatives giants like Binance and Bybit. It opens the door to deeper liquidity, 24/7 trading, and more advanced strategies on a platform historically built for retail.

That said, perpetual futures are not for beginners. They carry serious risks – including leverage and liquidation exposure – and are best suited for experienced traders who truly understand how they work. If you’re new to crypto or derivatives, take the time to educate yourself before jumping in – this isn’t a feature to casually explore.

And here’s the big one:

Robinhood has launched tokenized U.S. stocks and ETFs in the EU, giving eligible users access to U.S. equities through its European app – now upgraded from crypto-only to a full investment platform. These stock tokens come with zero commission or added spreads from Robinhood, support dividends, and offer 24/5 trading access. At launch, more than 200 stock and ETF tokens will be available, issued on Arbitrum, with plans to migrate to Robinhood’s own Layer 2 blockchain optimized for tokenized real-world assets, seamless bridging, and self-custody.

This is insane.

Also, if you want to see Vitalik’s panel at the event, click HERE.

Robinhood just gave everyday European investors access to U.S. stocks – and they did it using Ethereum, Arbitrum, and the announcement of their own Layer 2 blockchain. Following the flood of updates, HOOD had a monster day, closing at $93.63 – an all-time high.

(It pushed even higher after hours.)

For the Coinbase holders:

I think Coinbase saw Robinhood making moves and thought, “oh sh*t – we better respond.” To be honest, Robinhood tends to move faster than Coinbase. Sure, Coinbase has done more on the DeFi front, but I find myself giving Robinhood twice the coverage simply because they’re often ahead of the curve. That said, Coinbase is paying close attention – and there’s no chance they’ll let Robinhood run away with the lead.

Kraken rolled out tokenized stocks in the EU yesterday (details in the news segment below), and I wouldn’t be surprised if Coinbase follows with its own announcement soon.

For all crypto holders:

I suspect many people don’t know who Ric Edelman is, so let me quickly introduce him. Edelman is one of the most prominent financial advisors in the U.S. – founder of Edelman Financial Services, which manages around $300 billion. In recent years, he’s shifted his focus to educating financial professionals about crypto, founding the Digital Assets Council of Financial Professionals (DACFP).

Here’s what he thinks:

Ric Edelman is literally saying that if you’re an aggressive crypto investor, he recommends a 40% allocation. While many of you are already 80–100% in, this is coming from a legacy finance OG – most of whom are still stuck recommending 3–5%. That’s one hell of an endorsement.

All in all, yesterday was a pretty historic day in terms of sheer news volume. Now we just need the price action to match – maybe a 10% move in Bitcoin and 30% in alts, and we’ll all be high-fiving. I’m not holding my breath, but I’m confident Bitcoin’s headed higher, and quality alts will follow. Once we’re through the summer doldrums, it’s clear skies ahead.

Congrats to HOOD holders – it’s always a good time to be hitting new all-time highs.

Also, we now have over 100 members in the Wolf Pack on Telegram. Those who have joined have been having a blast.

Bitcoin Thoughts And Analysis

Bitcoin is currently consolidating just below a clear descending trendline, showing a series of lower highs since its recent local top near $112,000. Price is hovering around $106,300, holding just above key horizontal support at ~$105,800. This level coincides with the 50-day moving average (blue), which is currently acting as dynamic support.

So far, Bitcoin has respected the ~$100,700 level as major support after the mid-June shakeout. As long as price remains above that zone and holds the 50 MA, the bullish structure remains intact despite the short-term lower highs. But the more price compresses beneath the descending resistance, the more likely we see a breakout (or breakdown) soon.

The 200-day moving average (red) is well below current price action, hovering near $95,000. That’s a long way down and would likely only be tested if broader market conditions deteriorate significantly.

Volume is tapering, suggesting traders are waiting for a decisive move. A break above the descending trendline and reclaim of $110,000+ would invalidate the current short-term downtrend and likely bring $112,000 and new highs into view. A loss of $105,800, on the other hand, puts $100,700 back in play – and below that, things could get ugly quickly.

For now, the trend is neutral within a broader uptrend. The bulls are holding the line – but just barely

Altcoin Charts

I am currently seeing almost nothing of interest in the altcoin market. It is hard to post many charts right now in the newsletter - if I see something in real time, I will post it to Telegram HERE.

Stocks Slip After Records As Traders Eye Fed And Trade Risks

U.S. stock futures slipped Tuesday morning following two straight record closes for the S&P 500, as investors shifted their attention to mounting geopolitical and fiscal uncertainties. The pullback comes after a stellar quarter – the S&P’s best since 2023 – but concerns are growing over the outcome of U.S. trade negotiations, a looming July 9 deadline, and the political gridlock surrounding President Trump’s proposed tax bill, which could add more than $3 trillion to the national deficit over the next decade.

Tesla led early declines, falling more than 4% in premarket trading after Trump once again threatened to withdraw subsidies from Elon Musk’s companies. European equities also dipped modestly, and sentiment remains fragile as the market digests headlines out of Washington and the Middle East. Despite recent bullish momentum, investors are treading cautiously ahead of earnings season, with analysts warning that continued gains will require more than just narrative – they’ll need actual performance.

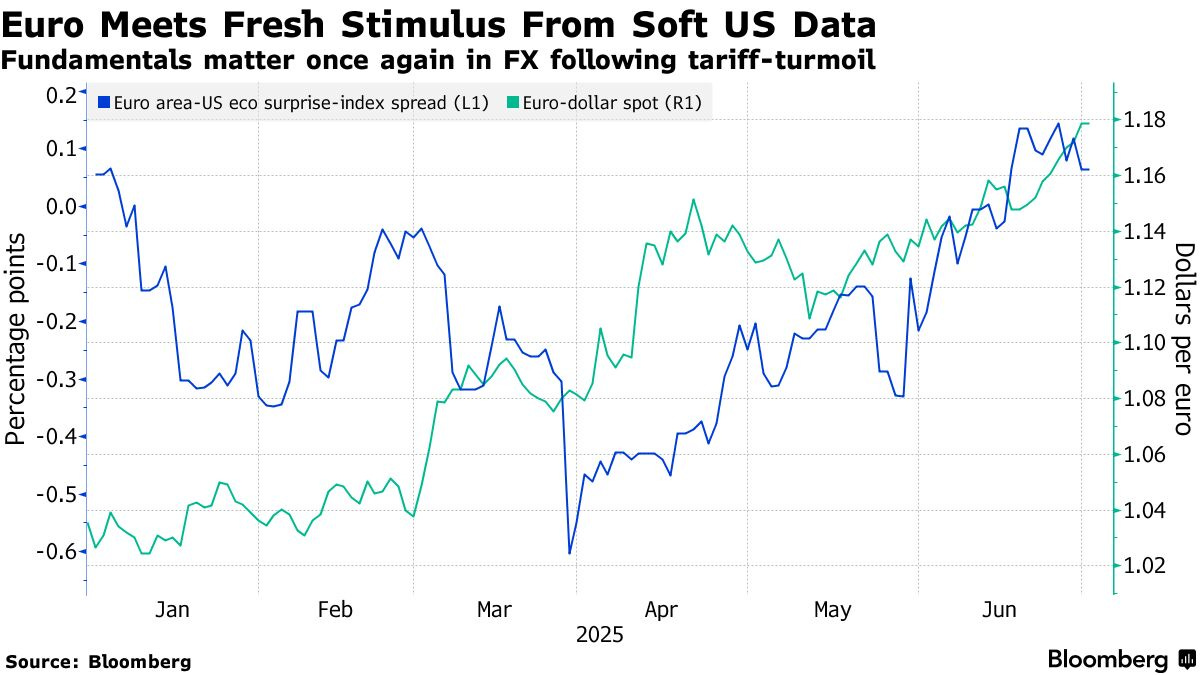

Meanwhile, U.S. Treasuries extended Monday’s rally, pushing the 10-year yield down to 4.19%, as traders increase bets on rate cuts by the Federal Reserve. Two Fed governors have recently diverged from Chair Jerome Powell’s cautious stance, signaling support for a possible reduction as early as July. Swaps markets now price in at least two quarter-point cuts by year-end, with a 65% chance of a third – pressuring the dollar, which dropped 0.3% on Tuesday. Analysts say the rising likelihood of July action is limiting the dollar’s upside and fueling appetite for risk assets.

The euro, in contrast, is nearing its longest winning streak against the greenback since 2004, gaining as much as 0.4% to $1.1829. Investors are closely watching central bank commentary from the European Central Bank’s annual retreat in Portugal, where Powell and other key policymakers are scheduled to speak. A wave of economic data, including PMI readings and the U.S. job openings report, will also shape sentiment ahead of Thursday’s crucial nonfarm payrolls release.

Strategists remain cautiously constructive on risk assets. Jefferies' Mohit Kumar noted that while market positioning has turned increasingly long, expectations for rate cuts and easing inflation pressures may support a slow, steady grind higher. Still, volatility is likely to remain elevated as headlines on trade, fiscal policy, and inflation continue to roll in.

On the corporate front, U.S. auto sales took a hit in June as Trump’s tariffs on car imports weighed on demand, while Apple is reportedly exploring partnerships with OpenAI and Anthropic to power a more advanced version of Siri. Standard Chartered faces a $2.7 billion lawsuit over its alleged role in the 1MDB scandal, and Netflix investors are wrestling with whether the stock’s strong recent performance can be sustained given lofty expectations. Meanwhile, UK-based Southern Water secured a $1.7 billion equity lifeline that could stave off a credit downgrade.

Key events this week:

📅 Tuesday, July 1

S&P Global U.S. Manufacturing PMI (June Final)

A measure of performance in the manufacturing sector.ISM Manufacturing PMI (June)

A widely followed indicator for national manufacturing health.Construction Spending (May)

Tracks total dollar value of construction activity, reflecting economic momentum.JOLTS – Job Openings and Labor Turnover Survey (May)

Provides data on job openings, hires, and separations—key labor market dynamics.Auto Sales (June)

Measures vehicle sales and is a useful proxy for consumer spending.

📅 Wednesday, July 2

Challenger Job Cuts Report (June)

Offers data on planned corporate layoffs.ADP National Employment Report (June)

Gives a snapshot of private sector employment trends.

📅 Thursday, July 3

Initial Jobless Claims (week ending June 28)

Measures weekly filings for unemployment benefits.Nonfarm Payrolls Report (June)

A critical employment report showing monthly job additions or losses.Unemployment Rate (June)

Indicates the percentage of the labor force that is unemployed.

📅 Friday, July 4

Independence Day (Market Holiday)

U.S. financial markets closed in observance of the national holiday.

Some of the main moves in markets:

Stocks

S&P 500 futures fell 0.2% as of 6:23 a.m. New York time

Nasdaq 100 futures fell 0.3%

Futures on the Dow Jones Industrial Average were little changed

The Stoxx Europe 600 fell 0.3%

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index fell 0.3%

The euro rose 0.2% to $1.1813

The British pound rose 0.4% to $1.3782

The Japanese yen rose 0.8% to 142.93 per dollar

Cryptocurrencies

Bitcoin fell 1% to $106,563.18

Ether fell 1.7% to $2,460.27

Bonds

The yield on 10-year Treasuries declined three basis points to 4.19%

Germany’s 10-year yield declined six basis points to 2.55%

Britain’s 10-year yield declined six basis points to 4.43%

Commodities

West Texas Intermediate crude was little changed

Spot gold rose 1.3% to $3,347.48 an ounce

Circle Applies For A Banking Charter

Circle has applied for a national trust bank charter as it looks to further integrate stablecoins into the traditional financial system. If approved, it will establish the First National Digital Currency Bank and gain the ability to offer custody services for tokenized assets like stocks and bonds. The move follows a strong IPO and a 484% surge in share price during June, positioning Circle to align with the new regulatory framework introduced by the GENIUS Act.

From Circle’s CEO Jeremy Allaire:

“Establishing a national digital currency trust bank of this kind marks a significant milestone in our goal to build an internet financial system that is transparent, efficient and accessible. By applying for a national trust charter, Circle is taking proactive steps to further strengthen our USDC infrastructure.”

“Further, we will align with emerging U.S. regulation for the issuance and operation of dollar-denominated payment stablecoins, which we believe can enhance the reach and resilience of the U.S. dollar, and support the development of crucial, market neutral infrastructure for the world’s leading institutions to build on.”

Tokenized Stocks Are Now On Kraken And Solana

I could have included this news up top, but it would’ve made things too cluttered. Kraken is also launching tokenized U.S. stocks and ETFs for eligible non-U.S. users, offering seamless access to major equities through its platform. Powered by Backed’s xStocks, the initial rollout includes 60 tokenized assets that can be traded 24/5 and withdrawn to self-custody wallets – enabling onchain use and DeFi integration far beyond what traditional stocks allow. At this point, it’s safe to say Europe has officially beaten the U.S. on this front, with American companies almost exclusively launching these products overseas.

This Major German Bank Is Saying Yes To Crypto

Germany’s largest banking group, Sparkassen, is reversing its stance on crypto and plans to offer Bitcoin and digital asset trading to retail clients by 2026. The move, confirmed by the German Savings Banks and Giro Association, will give 50 million customers access to crypto directly through their existing banking apps via DekaBank.

Bitcoin Booms, Altcoins Die - Is China Back in Crypto? | Macro Monday

Bitcoin is pulling ahead as altcoins slowly lose steam - and China might be preparing a big move back into crypto. I’m joined by Dave Weisberger, Mike McGlone, and Larry Lepard to break down the macro forces shaping markets, from Fed policy and inflation to Trump’s push for lower rates. Don’t miss this high-stakes Macro Monday - like, subscribe, and stay ahead of the next big shift!

My Platforms And Sponsors

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

The Wolf Pack - My new Telegram group where I share daily updates on everything I'm watching and chat directly with all of you. Completely free to join.

The Crypto Advisor - My weekly newsletter for registered investment advisors, combining macro trends, Wall Street insights, and crypto – all in one place..

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis!

Blofin - Blofin is offering our Telegram members a $30 Bonus + 50% Spot Discount when they sign up for The Wolf Pack.

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Peoples Reserve - Use Bitcoin as pristine collateral with Peoples Reserve - where wealth is built smarter through Bitcoin-powered finance.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.