Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Trading Alpha Released A Super Cool Product!

One of the partners of this newsletter, Trading Alpha, my trusted indicator and trading community, has launched their proprietary Indicator Search Engine for All Markets. This custom Indicator Screener scans crypto, stocks, and forex markets for Trading Alpha indicator setups, eliminating the need for time-consuming manual analysis. It can simultaneously screen for multiple indicators, enhancing confluence and providing advanced analysis capabilities across different markets. This is cutting-edge technology for serious traders.

Make sure to use my link HERE if you plan on giving it a try. Use code '10OFF' for a 10% discount.

In This Issue:

Not Everyone Is Bullish

Bitcoin Thoughts And Analysis

Legacy Markets

Roger Ver Is Asking For A Trump Pardon

Pudgy Penguin Ecosystem Suffers After A Big Launch

You Can Now Bet On The Possibility Of A National Ethereum Reserve

And They Say, ‘Blockchain Has No Use’

I Own Bitcoin, You Should Own Bitcoin, Bitcoin Is Great!

Not Everyone Is Bullish

I’ll be the first to admit that this newsletter leans perpetually bullish. My reasoning is simple: I believe Bitcoin and the entire crypto market are set for long-term growth. Fighting that trend—especially in a bull market—just doesn’t make sense.

During bear markets, I try to keep this optimism alive by emphasizing themes like conviction and the power of dollar-cost averaging. Sure, there have been moments—like the China ban or the FTX collapse—when I expected further downside, but I never lose sight of the fact that, for most investors, simply holding through all conditions is the best strategy.

This bias isn’t a secret; it’s exactly how I operate. On rare occasions, I’ve taken profits when the charts made it painfully obvious to do so, but at my core, I’m a HODLer—just like many of you. And that’s part of what makes this newsletter unique: we’re in this together, navigating the market with a shared mindset and long-term vision.

With that in mind, I want to turn the spotlight on someone I’ve long followed in this space—someone who has recently shifted from a bullish stance to a much more bearish outlook. This individual is one of the sharpest minds in the industry, and his insights have influenced my own approach over the years.

Without further ado—Arthur Hayes.

As an aside, I interviewed Arthur yesterday for The Street. The entire convo will be available this weekend on my channels.

But I digress.

Hayes’ latest blog post, “The Ugly,” is the first in a three-part series. Next up will be “The Good,” covering the rise of political memecoins, followed by “The Bad,” which will focus on how U.S. crypto holders could get blindsided by the Trump administration’s approach to regulation.

For now, though, we have “The Ugly.”

Here’s the premise:

For those unfamiliar with Hayes’ style, he’s an extremely technical writer who delves deep into global monetary policy as the foundation for his market outlook. I’m not on his level, but I’ll break down some of his key points so we can all understand why he’s flipped bearish.

Hayes starts by analyzing the 10-year Treasury and its role in his newfound bearish outlook. His argument hinges on the idea that the USD is the world’s dominant currency, and U.S. Treasury debt is considered the safest way to store dollars while earning a return. Financial institutions treat treasuries as risk-free assets, but if their value drops sharply, economic instability follows. The 10-year Treasury yield is particularly critical because it influences rates on mortgages and loans.

With the U.S. constantly printing money to navigate financial crises, systemic leverage has been growing for over a century, making financial collapse more probable if interest rates rise too high. Currently, U.S. debt has soared past $36 trillion, but key buyers—such as the Fed, U.S. banks, and foreign nations—are scaling back their purchases, raising red flags about the sustainability of the debt.

Hayes’ second point revolves around Trump’s relationship with the Federal Reserve. Trump has historically pushed for lower interest rates to support his “Make America Great Again” agenda, while Powell insists the Fed is “data dependent,” meaning they’ll act based on economic conditions and justify decisions with complex theories. Hayes predicts that to align the Fed with his vision, Trump might allow a mini-financial crisis by running massive deficits, forcing the Treasury to issue more debt. This could escalate into a debt ceiling standoff, driving the 10-year Treasury yield above 5%.

From there, Hayes expands on the monetary policies underpinning the Yen and Yuan, arguing that their current trajectories are not favorable for fiat financial asset appreciation.

Here’s the high-level summary:

“In the long term, Bitcoin is uncorrelated with stock prices, but it can be very correlated in the short term. Here is the 30-day correlation between Bitcoin and the Nasdaq 100. It’s high and rising. This is not good for the short-term price prognosis if stocks get smoked due to the rising 10-year yield.”

“Another belief I hold is that Bitcoin is the only truly global free market in existence. It is extremely sensitive to global fiat liquidity conditions; therefore, if a fiat liquidity crunch is forthcoming, its price will break down before that of stocks and will be the leading indicator of financial stress. If it is a leading indicator, then Bitcoin will bottom before stocks, thus predicting a re-opening of the fiat money printing spigots.”

Like any good trader, Hayes has defined a clear point at which he will admit his theory is wrong and jump back into the action. He lays it out plainly:

“How do I know when I’m wrong? You never truly know, but in my mind, if Bitcoin trades through $110,000 (the level reached during the height of the $TRUMP memecoin mania) on strong volume with an expanding perp open interest, then I’ll throw in the towel and buy back risk higher.”

Here’s the math Hayes presents:

What I want to emphasize are a few key takeaways that might resonate more with the average trader who isn’t living inside the mind of a genius.

First, both Arthur, I, and most crypto investors believe that Bitcoin and the broader market will trend upward over time. That’s the baseline.

Second, Arthur assigns a 60% chance to a 30% correction—which is very different from predicting a 70% chance of a 40% correction or an 80% chance of a 50% correction. All things considered, he’s working with just a -14% EV if he holds his positions. Yes, if his thesis plays out exactly as planned, he could massively increase his holdings. But it’s no easy task. If most traders tried to follow this strategy, they’d likely miss the bottom, sell too soon, or get liquidated chasing the perfect entry.

I would never advise this approach to the average HODLer, and I won’t be using it myself. I know that simply being patient, buying dips when possible, and holding for higher prices—whether that takes 1 month, 3 months, or 1 year—is the far better strategy. The gains will still be substantial, and in my mind, this path is as close to a sure thing as you can get in markets.

Hayes’ blogs are wildly popular because they offer a window into the mind of one of crypto’s best fundamental traders, but they’re not meant to be copied by 99% of people. I’m pretty sure even Hayes would agree with that.

"The shitcoin space will face Armageddon if Bitcoin dumps, and that’s where I really want to play. As mentioned at the outset, Maelstrom has many liquid shitcoin positions due to various early-stage investments and advisory allocations. We dumped most of them. The stuff of the highest quality will sell off >50% if Bitcoin drops by 30%. The final mega liquidation candle on Bitcoin will tell me when it’s time to back up the truck and go shopping for crypto dung."

At the end of the day, there can only be one Maelstrom. If his success could be replicated just by reading his blogs, trust me, I’d have launched "Wolfstrom" yesterday. But the reality is, as much as I’d love to execute the trades Hayes and his team make, it’s just not realistic for me—or for most of us.

"Let me repeat: if I’m wrong, my downside is that we took profit early and sold a bit of Bitcoin we purchased using profits from prior shitcoin investments. But if I’m right, then we have the cash ready to quickly double or triple our money on quality shitcoins that got the stick in a general crypto market selloff."

My reason for sharing this blog is to offer a completely different perspective from my usual outlook and, hopefully, remind everyone not to be blindly bullish—even in a bull market. There’s always someone out there with a different approach and deeper insights, and sometimes, they’ll be right.

Eventually, this bull cycle will peak. By looking for early signs now, we’ll be better prepared to spot them when the EV shifts enough to warrant a complete change in strategy.

For now, I’m content.

Bitcoin Thoughts And Analysis

Bitcoin's daily chart is displaying a continuation of consolidation within a well-defined range, with critical support at $99,860 and key resistance at $106,099. The price is currently trading around $102,730, indicating a slight recovery after recent volatility.

Yesterday's candle showed indecision, as evidenced by the narrow body and long wicks, suggesting a balance between buyers and sellers. The 50-day moving average near $99,860 continues to act as a crucial support level, and the repeated bounces from this area highlight strong buying interest at this level.

For the bullish scenario to gain momentum, Bitcoin must reclaim $106,099 and secure a daily close above this level, which would pave the way for a potential retest of the $109,358 all-time high. Failure to break above resistance could lead to continued range-bound movement or a retest of support at $99,860.

Volume remains moderate, indicating that traders are waiting for a decisive move out of this range. A loss of support at $99,860 would likely lead to a deeper correction toward the next significant demand zone around $94,000. For now, bulls will want to see continued higher lows and a sustained push toward resistance for confirmation of renewed upward momentum.

Legacy Markets

US stock futures showed gains as the market recovered from an earlier AI-driven downturn, with attention turning to major tech earnings and the Federal Reserve's upcoming interest-rate decision. Nasdaq 100 futures rose 0.4%, while S&P 500 futures also edged up. In Europe, the Stoxx 600 index increased by 0.7%, led by a significant 11% surge in ASML Holding NV after its order bookings exceeded expectations, boosting semiconductor stocks. The tech sector is under scrutiny as investors await earnings from giants like Microsoft, Meta, and Tesla, particularly after concerns from Chinese AI startup DeepSeek's market impact.

The Fed is anticipated to keep rates unchanged, with investors keen to hear from Chair Jerome Powell on potential inflationary pressures from new trade policies by President Donald Trump. U.S. Treasuries saw slight gains amid expectations of a possible rate cut in March. Meanwhile, global central banks seem to be leaning towards easing, with the Bank of Canada expected to cut rates and similar moves anticipated from the European Central Bank.

In corporate news, Apple is reportedly enhancing its iPhone with SpaceX's Starlink support, Novo Nordisk's Ozempic got a new approval in the U.S., Sony announced a new CEO, and SEB AB experienced a stock drop due to disappointing dividend announcements. The market sentiment remains cautiously optimistic, with investors still leaning towards buying during dips.

Key events this week:

US Fed rate decision, Wednesday

Tesla, Microsoft, Meta, ASML earnings, Wednesday

Canada rate decision, Wednesday

Eurozone ECB rate decision, consumer confidence, unemployment, GDP, Thursday

US GDP, jobless claims, Thursday

Apple, Deutsche Bank earnings, Thursday

US personal income & spending, PCE inflation, employment cost index, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures were little changed as of 6:36 a.m. New York time

Nasdaq 100 futures rose 0.3%

Futures on the Dow Jones Industrial Average were little changed

The Stoxx Europe 600 rose 0.7%

The MSCI World Index rose 0.1%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro fell 0.2% to $1.0405

The British pound fell 0.2% to $1.2422

The Japanese yen was little changed at 155.45 per dollar

Cryptocurrencies

Bitcoin rose 2.3% to $102,543.92

Ether rose 2.8% to $3,136.68

Bonds

The yield on 10-year Treasuries was little changed at 4.53%

Germany’s 10-year yield declined two basis points to 2.55%

Britain’s 10-year yield declined three basis points to 4.58%

Commodities

West Texas Intermediate crude fell 0.7% to $73.23 a barrel

Spot gold fell 0.2% to $2,758.82 an ounce

Roger Ver Is Asking For A Trump Pardon

For those who haven't been following, Roger Ver, an early Bitcoin investor turned Bitcoin Cash advocate, was arrested in Spain in April at the request of the U.S. Department of Justice. He’s facing charges of mail fraud, tax evasion, and filing false tax returns. Despite renouncing his U.S. citizenship in 2014 after obtaining citizenship in Saint Kitts and Nevis, authorities claim he failed to report capital gains and the fair market value of his global assets, including Bitcoin.

Elon Musk weighed in on the situation, saying, “Roger Ver gave up his US citizenship. No pardon for Ver.”

For a little background, Ver was the leading figure in the Bitcoin Blocksize War, advocating for larger BTC blocks to allow faster, cheaper transactions. His stance clashed with “small blockers” like Blockstream CEO Adam Back, who argued that the 1MB block size was necessary to preserve Bitcoin's decentralization. Ver later claimed that propaganda—possibly spread by U.S. intelligence agencies—misled people into supporting smaller block sizes, which is a pretty far-fetched theory.

During the fork war, Ver isolated a lot of people, and now, when he needs public support the most, that might come back to haunt him.

I interviewed him on Twitter Spaces on Monday.

Pudgy Penguin Ecosystem Suffers After A Big Launch

Igloo Inc., the parent company of the popular Pudgy Penguins NFT collection, has launched Abstract, an Ethereum Layer 2 chain, on the mainnet. Built using ZKsync’s ZK stack, Abstract leverages zero-knowledge rollups to provide low transaction fees and high scalability for on-chain applications. Alongside the launch, Igloo introduced The Portal, a consumer blockchain platform that enables users to create wallets and access its ecosystem of dapps instantly using just an email address.

Ironically, despite the positive developments, Pudgy Penguins NFTs and PENGU—the Solana token tied to the ecosystem—have seen sharp declines following the Abstract launch. PENGU has dropped 24% in the last 24 hours and 49% over the past month, hitting a low of $0.0173 and falling out of the top 100 crypto assets by market cap. Similarly, Pudgy Penguins NFTs on Ethereum fell nearly 20% in the last day and 39% over the past week, now priced at $37,950 (11.94 ETH).

DeepSeek’s emergence may have contributed to broader sell pressure across the ecosystem, but there’s more at play. If the Abstract launch had included immediate incentives for token or NFT holders, the market reaction would likely have been much more positive. So far, XP multipliers are the only reward offered to holders, though the Abstract team has clarified that additional benefits are on the way. Ultimately, this underscores how much of a project’s valuation is driven by expectations rather than immediate utility.

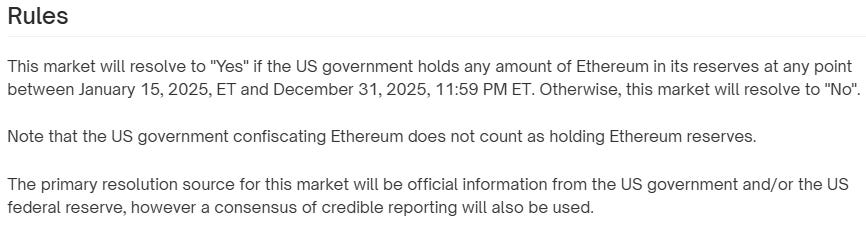

You Can Now Bet On The Possibility Of A National Ethereum Reserve

The equivalent market to “the US national Bitcoin reserve in 2025?” with the same rules outlined below is currently sitting at 56% odds and has a volume of $529,541. Honestly, when I first saw a market for Ethereum, I wasn’t expecting it to be sitting at just 24%. There’s also a market for XRP at 18% and Solana at 19%.

Trump remains a wild card, but these numbers should put the “Trump has chosen Solana” rumor to rest. It’s clear that Trump hasn’t “chosen Solana” any more than he has Ethereum.

And They Say, ‘Blockchain Has No Use’

Elon Musk, appointed by Trump to lead the new Department of Government Efficiency (DOGE), has proposed using blockchain technology to track federal spending, secure data, manage payments, and oversee infrastructure. The department was created in response to the U.S. government’s staggering $6.7 trillion spending in fiscal 2024, with the goal of reducing it to $2 trillion. Musk’s plan aligns with Trump’s push for crypto-friendly policies, and several representatives from public blockchains have already met with DOGE affiliates.

I Own Bitcoin, You Should Own Bitcoin, Bitcoin Is Great!

Joining me today are Jeff Park, Head of Alpha Strategies at Bitwise, and my friends from Arch Public, Andrew Parish, and Tillman Holloway, who will provide an update on the $10K algorithmic portfolio.

Unleash algorithmic trading with Arch Public.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.