Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Arch Public Concierge Program clients are already up big in January. A fantastic start to the year. Our algorithmic portfolios are up between +19.79 and +14.01% in less than twenty days.

Daily liquidity, stop loss protection, and diversified outcomes.

There’s a reason that you can only find positive reviews about our firm; we under promise and over deliver across the board. Join us!

Try Arch Public now! You can even demo the platform, for free, to learn more.

In This Issue:

Scott, Will You Manage My Money?

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Which Coins Are ‘Made In The USA’

Ripple Is Attacking The SBR

In-Kind Redemption Is Coming Soon

MicroStrategy Doesn’t Have A Tax Problem

Don’t Tell Anyone You Own Crypto

Traders Bet On Bitcoin Hitting $200,000! Crypto Options Are Booming | Luuk Strijers, CEO Of Deribit

Scott, Will You Manage My Money?

The crypto bull market will never be calm, but now that the executive order drama has settled and the new administration is beginning to function as intended, I finally feel like I can take a breather. Looking ahead, I expect a steady stream of positive news, interspersed with pullbacks, and occasional periods of intense excitement, much like what we experienced last week.

That said, I fully expect the unexpected as we move forward. By this, I mean don’t blindly follow influencers making arbitrary predictions about a market top in March, followed by a flat summer and a grand finale in Q4, just because someone else said so. While historical data suggests summer slowdowns are common, most crypto investors would be wise not to rely on these trends when making decisions.

Anything can happen at any time.

FOMO often sneaks in faster than investors can stick to their plans, and tax implications should not be overlooked when planning swing trades. If you can’t outperform the cost of short-term capital gains taxes and the time spent trading, it’s hard to justify trading during a bull market based on seasonal patterns.

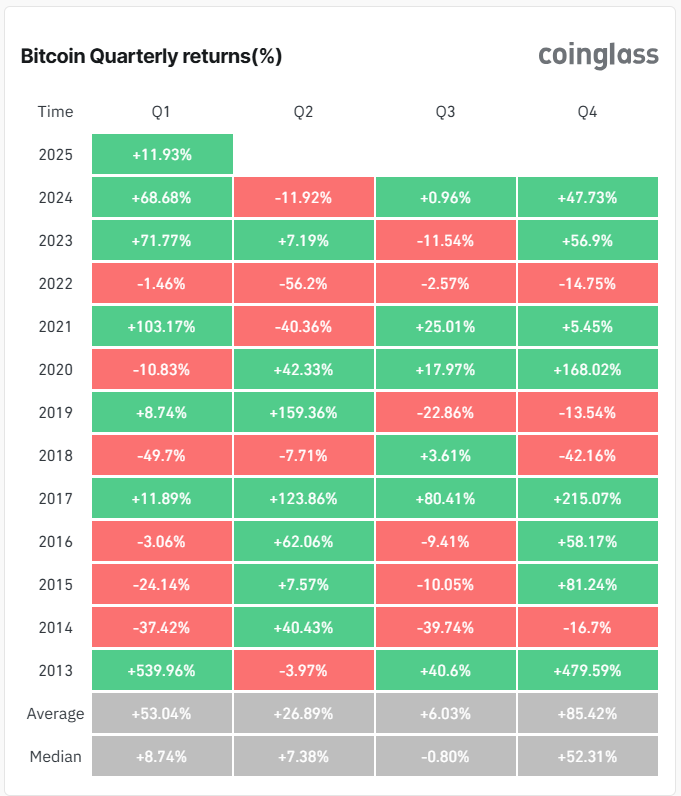

Two tables are especially crucial in understanding market behavior. I’ve covered them in detail in past discussions and may revisit them in a future issue, but for now, keep this in mind: Q4 and Q1 historically rank as Bitcoin’s best quarters. This pattern is the foundation of the theory about selling before summer.

Quarters broken down into months.

Aside from crunching numbers and dissecting historical data and charts, one of the key skills an investor should possess is the ability to gauge market sentiment and assess the prevailing hype. Crypto is especially susceptible to swings in investor psychology, where the pendulum swings wildly between excitement and fear, often dictating price movements.

With that in mind, I want to shed light on something that might fly under most people’s radar, yet could offer some perspective on where we stand in this cycle, along with my thoughts on it. Throughout both bull and bear markets, I've been pitched the idea of 'starting a fund.' Since I entered this space in 2017, friends, family, and even anonymous accounts have floated this notion. While it's a flattering vote of confidence that anyone would trust me to manage their money—it’s quite the compliment—I'll never take the bait. The only portfolio I'll manage is my own.

I know I'm not alone in getting these offers; I just saw a post on X last week about it.

I’ve spoken about this topic before, which might explain why I'm not bombarded with as many suggestions as larger entities like Blockworks, who perhaps have never tackled this head-on. That said, the idea of me starting a fund keeps cropping up in my casual chats—whether at conferences, in DMs, interviews, or anywhere else I roam in this space.

The reasoning behind these pitches is usually driven by a craving for someone who's both knowledgeable and trusted, someone actively swimming in the crypto currents, to navigate their investments. It's also fueled by the sheer overwhelm of volatility and the dread of missing out on potential gains that a savvy manager might catch. The deeper we venture into this cycle, the more investors bump into the bolded realities above.

Here's a little insider info: contrary to popular belief, the role of an investment manager isn't what you might think. It's tempting to paint them as crypto oracles, decoding every twist and turn of the market, but that's not the heart of their job. They're paid to manage investors, not just their money.

If this notion startles any investment managers reading this, let me clarify. I deeply respect the hurdles you jump through daily. My point is to illuminate that managing investments is an art form, one that requires navigating through a maze of human emotions, both your own and those of your clients. The raw truth is, people turn to advisors to offload their time, emotional baggage, and to bridge their own knowledge gaps. That’s the unfiltered reality of the investment game.

This quote from Meir Statman always resonates with me - “Good financial advisors are good financial physicians. Good advisors possess the knowledge of finance, as good physicians possess knowledge of medicine, and good advisors add to it the skills of good physicians: asking, listening, empathizing, educating, and prescribing.”

I genuinely believe the majority of my readers are more than equipped to construct a well-balanced crypto portfolio aimed at success, sans an advisor. There's a wealth of credible, insightful content out there, enabling most to sift through what's grounded in wisdom versus what's speculative, extractive, or downright deceitful.

However, I'm less confident these same investors can stick to their guns when executing their strategies, with emotions often being the Achilles' heel.

A meticulously crafted portfolio might survive market squalls, but it's worthless if the investor panics. The true strength of a portfolio is tied directly to an investor's emotional discipline. Similarly, an investment manager's portfolio thrives based on their prowess in managing client reactions.

I doubt those suggesting I start a fund are pondering these nuances, but this discussion underscores why it generally doesn't add up. It also frames the progress we're witnessing this cycle. I'll revisit this topic if there's a surge in fund-starting queries later on.

All things considered, I'm eager for the U.S. news cycle to calm down so we can adopt a more global lens on crypto. Crypto transcends U.S. executive orders and legislation. Sure, it's a big deal here, but venture to Singapore, Paris, London, Toronto, or Dubai, and you'll witness how expansive the space truly is. Or, just trust me—there's a vibrant crypto world out there, beyond our borders.

Bitcoin Thoughts And Analysis

Bitcoin's daily chart reflects a volatile session today, with a sharp crash attributed to the DeepSeek event and a broader tech sector wobble. Despite the sell-off, Bitcoin has demonstrated resilience, bouncing off its 50-day moving average (currently around $98,600) and key horizontal support at $99,860. This level continues to act as a critical line in the sand for bulls.

Today's low tested these support zones, but so far, price remains above them, indicating the market's willingness to defend these levels. However, with Bitcoin currently trading near $101,250, its ability to reclaim higher levels, particularly $106,099, will determine whether this dip will be viewed as a buying opportunity or a signal of further downside to come.

Volume has surged during this decline, which reflects strong participation in today's move. If Bitcoin closes above $99,860, it will signal that buyers stepped in to defend the uptrend, while a close below this level could open the door to deeper retracements toward the low 90s.

Traders will likely be closely monitoring the daily close to assess Bitcoin's short-term direction. The 50-day MA and $99,860 support remain crucial to maintaining bullish momentum. Reclaiming levels above $106,099 would signal a recovery, while failure to hold support could lead to increased bearish sentiment.

Altcoin Charts'

Just a quick reminder that ETH has returned to 2021 vs. BTC. Do with this information what you choose, I am buying Ethereum.

Legacy Markets

On January 27, 2025, Nasdaq futures briefly plummeted by over 5%, driven by concerns that DeepSeek, a cheaper AI model from China, could undermine the high valuations of U.S. tech companies. Nvidia Corp. saw a 12% drop in premarket trading, potentially setting a record for market capitalization loss, while the volume of Nasdaq 100 futures was significantly higher than average. The S&P 500 futures also fell by 3%, and Bitcoin dipped below $100,000. DeepSeek's model, offering performance comparable to top chatbots at a lower cost, has raised questions about the sustainability of the AI-driven market rally. This development has put pressure on tech valuations, with notable declines in shares of ASML Holding NV in Europe, impacting the Stoxx 600. The market's unease was compounded by President Donald Trump's brief tariff spat with Colombia, causing a drop in bond yields as investors moved towards safer assets. The tech sector remains a focal point this week, with major companies like Apple and Microsoft set to report earnings, which could be influenced by the ongoing concerns about AI competition and economic policies. Meanwhile, in China, AI-related stocks like Merit Interactive Co. benefited, with the Hang Seng Tech Index in Hong Kong rising before the Lunar New Year holidays.

Key events this week:

ECB President Christine Lagarde and others speak, Monday

US consumer confidence, durable goods, Tuesday

Chile rate decision, Tuesday

Australia CPI, Wednesday

BOE Governor Andrew Bailey speaks, Wednesday

US rate decision, Wednesday

Tesla, Microsoft, Meta, ASML earnings, Wednesday

Canada rate decision, Wednesday

Brazil rate decision, Wednesday

BOJ Deputy Governor Ryozo Himino speaks, Thursday

Eurozone consumer confidence, unemployment, GDP, Thursday

ECB rate decision, Thursday

South Africa rate decision, Thursday

US GDP, jobless claims, Thursday

Apple, Deutsche Bank, Shell earnings, Thursday

Japan unemployment, Tokyo CPI, Friday

US personal income & spending, PCE inflation, Friday

Colombia unemployment, rate decision, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures fell 2.2% as of 7:29 a.m. New York time

Nasdaq 100 futures fell 3.8%

Futures on the Dow Jones Industrial Average fell 0.9%

The Stoxx Europe 600 fell 0.5%

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index fell 0.1%

The euro rose 0.2% to $1.0515

The British pound rose 0.2% to $1.2504

The Japanese yen rose 1.2% to 154.18 per dollar

Cryptocurrencies

Bitcoin fell 5.4% to $98,955.64

Ether fell 7.3% to $3,055.67

Bonds

The yield on 10-year Treasuries declined 10 basis points to 4.52%

Germany’s 10-year yield declined six basis points to 2.51%

Britain’s 10-year yield declined five basis points to 4.57%

Commodities

West Texas Intermediate crude fell 0.8% to $74.06 a barrel

Spot gold fell 0.3% to $2,762.78 an ounce

Which Coins Are ‘Made In The USA’

Since Trump took office, a rumor has been circulating that coins ‘made in the USA’ will benefit from zero capital gains tax. This was recently confirmed by Trump’s son Eric, who stated that non-U.S.-based projects could face a tax rate of approximately 30%. As you can imagine, the news has caused widespread hysteria in the crypto space—I have my doubts. For one, it’s unclear whether Bitcoin would qualify as ‘made in the USA.’ Additionally, Trump’s DeFi platform, WLF, holds ETH as its largest position—nearly three times larger than any other holding—followed by WBTC.

For the record, Trump has never mentioned zero capital gains for ‘coins made in the USA.’ While he has talked about making the U.S. the “crypto capital of the world” and made other vague statements like the one below—which doesn’t entirely make sense—there’s been nothing from him to support the rumors currently circulating.

This rumor has prompted tons of major crypto companies to begin categorizing coins that are ‘made in the USA.’ CoinGecko has done it, along with CoinMarketCap, CryptoSlate, and probably a ton other.

Nothing surprises me anymore, but giving preferential treatment to cryptocurrencies made in the U.S.A. over equities, bonds, real estate or even small business doesn’t make a lot of sense. I’m not convinced Congress would go for this.

Ripple Is Attacking The SBR

I briefly mentioned on X and in last week’s newsletter that Ripple’s XRP is being considered for inclusion in the strategic stockpile. I don’t take these kinds of rumors lightly unless I have credible reasons to believe they could actually happen.

I don’t have all the details, but the video linked above adds further confirmation that something unusual is happening behind the scenes. In my opinion, Bitcoin should be the sole currency in the U.S. reserve for now. Over time, additional coins could potentially be considered, but at this stage, it should remain exclusively Bitcoin.

“Ripple is a for-profit company. It prints its own token in XRP and it’s asking the U.S. government to support its monopoly. I ask you this, why should the U.S. government back a privately owned currency. This is corporate lobbying disguised as innovation… Ripple created all of its currency, issued it to themselves, and relies on the public to buy it. This is not the money for the people. This is not in the best interest of the public; this is in the best interest of a private corporation. This is an economic announcement that would be like 2008, 1971, 1933... This is against the best interest of the United States of America.”

In-Kind Redemption Is Coming Soon

Nasdaq has filed a rule change with the SEC to allow in-kind creation and redemption for IBIT, enabling institutional investors to directly buy and redeem shares in Bitcoin rather than cash. This process is considered more efficient because it reduces friction and transaction costs, as there’s no need to convert Bitcoin to cash or vice versa. It also allows authorized participants to respond more quickly to shifts in demand for the ETF, helping to maintain tighter pricing and alignment with Bitcoin’s underlying value. An in-kind Bitcoin ETF also allows investors to directly deposit Bitcoin into the fund in exchange for shares, avoiding taxable events and reducing transaction costs.

MicroStrategy Doesn’t Have A Tax Problem

How could MicroStrategy have a tax problem if they aren’t selling? I’m not a tax professional, but this is basic accounting and reporting principles that anyone can understand. Unrealized capital gains aren’t taxed, and that law is unlikely to be passed under the current administration.

Don’t Tell Anyone You Own Crypto

This is truly a heartbreaking story, even though it ended with David Ballard and his wife being safely recovered. Ballard, a co-founder of Ledger, and his wife were kidnapped from their home in Central France on Tuesday and held at separate locations, with the kidnappers demanding a $100 million ransom from another Ledger co-founder. Thankfully, French elite police forces rescued the couple, but Ballard suffered injuries, including the mutilation of one hand, as part of the kidnappers' attempts to pressure associates into paying the ransom. Let this serve as a cautionary tale about the dangers of discussing your crypto holdings. While there’s nothing wrong with sharing your enthusiasm for Bitcoin, Solana, or other assets, disclosing how much you own is extremely risky and among the worst security practices you could follow.

Traders Bet On Bitcoin Hitting $200,000! Crypto Options Are Booming | Luuk Strijers, CEO Of Deribit

In this episode of The Wolf of All Streets, we dive deep with Luuk Strijers, CEO of Deribit, the leading crypto options platform. We uncover how Deribit dominates 85% of the global crypto options market, the strategies institutions use to hedge their positions, and why options are the key to Bitcoin's future growth. Whether you're a retail trader or an industry insider, this conversation is packed with actionable insights you won't want to miss!

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.