Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Aptos!

For those that don’t know, Aptos—the most exciting layer 1 blockchain competing with Solana and Ethereum—is now an official sponsor of this newsletter! Over the past few months, I’ve had the chance to get to know the Aptos team, create content with them, and watch this project accomplish incredible things.

Stick around until after the intro to learn more about Aptos!

In This Issue:

The Crypto Executive Order

Aptos Review

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

The SEC Rescinds SAB121

Etherealize Will Reshape Ethereum

The Current Cycle Closely Mirrors 2017

Huge Opportunity For Bitcoin Traders Is Coming!

The Crypto Executive Order

How many times have you watched a movie and, as the credits roll, you’re left thinking, "What the hell did I just watch?" Your options? Endure a detailed explanation from your wife or friend (less fun), or dive into the internet for a theory that conveniently matches your fuzzy understanding of the plot (much better).

Well, yesterday’s X timeline was exactly that—a cinematic masterpiece of chaos. So, grab your popcorn and soda because we’re about to relive the drama, fill in the gaps, and make sense of it all.

Cue the opening credits: Cynthia Lummis pumps Bitcoin.

The assumption? The announcement of a strategic bitcoin reserve. Anything short of that would be a letdown with this much hype.

Scene 1: The Stage Is Set – An Important Vote Announced

Not a strategic reserve. A letdown.

Bitcoin teleported up +$3,000 leading up to 10 AM EST, but when 10 AM EST passed and nothing happened, it fell back down. Perhaps something was actually supposed to happen at 10 AM MST, which is 12 PM EST.

Scene 2: Everyone is confused about time zones.

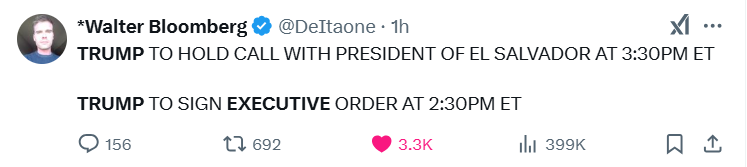

Scene 3: Meanwhile, this bombshell hits the timeline…

Scene 4: At 10:44 a.m. EST, Senator Cynthia Lummis was officially voted in as the Committee Chair of a historic panel focused entirely on digital assets.

Scene 5: In response to the news, CZ shared the following.

Scene 6: Less than an hour after all this unfolded, Trump finally mentioned crypto for the first time since taking office. He didn’t say “Bitcoin,” but the timeline went absolutely bananas.

Scene 7: His quote was, “The U.S. will be the world capital of artificial intelligence and crypto.”

Scene 8: Senator Cynthia Lummis chimed in with more commentary, adding fuel to the already blazing timeline.

Scene 9: Bitcoin Magazine starts playing Cynthia Lummis's July speech on repeat, turning it into the anthem of the timeline.

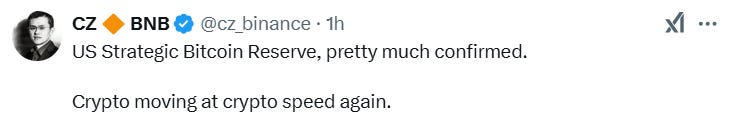

The Final Scene Pt 1: The details of the crypto executive order emerge.

The Final Scene Pt. 2: The language of the Executive Order has been released! (I’ll dive into all the details soon.) For now, let’s focus on where the conversation is heating up.

End Credit Scene: You can read the EO HERE.

The market has been on edge, anxiously awaiting updates from Trump on Bitcoin, crypto, the SBR, executive orders, his acknowledgment of his meme coin, or even Ross (which, fortunately, we got). Despite yesterday’s whirlwind of news, I expect this tension to persist until the U.S. formally begins purchasing Bitcoin (unlikely) and the process is codified into law, providing clarity on what to expect.

The market is laser-focused on the specific language Trump uses—terms like “crypto” versus “Bitcoin” or “stockpile” versus “reserve.” These distinctions matter. Referring to a “strategic Bitcoin reserve” signals a Bitcoin-centric approach, while a “crypto stockpile” implies a more diversified portfolio of digital assets. To go further, “stockpile” could suggest maintaining what the U.S. already holds, while “reserve” implies actively acquiring more.

This choice of words will be critical when it comes time for a Congressional vote. The phrasing proposed by the Working Group and the intentions behind it could determine how much resistance such legislation faces. For now, it seems the focus is on preserving the assets the U.S. already owns while laying the groundwork for a Strategic Bitcoin Reserve—an effort spearheaded by Cynthia Lummis and her allies.

Some speculate there’s tension between Lummis and Trump over “stockpile” versus “reserve,” but that seems far-fetched. The Republican Party has shown unity on this issue, and any internal conflict over language is unlikely. It was always improbable that legislation to purchase Bitcoin for the U.S. balance sheet would bypass Congress. Starting with maintaining existing holdings is a logical first step before advancing to larger initiatives.

It’s worth noting that Trump never explicitly stated he plans to create an SBR to eliminate U.S. debt through Bitcoin acquisitions. That narrative came from those around him—industry leaders and his family, including Eric Trump—who have championed the idea. Trump’s mention of a “stockpile” left the details vague until now. While I still fully expect an SBR, as envisioned by Lummis following the Nashville speech, it will be a gradual rollout requiring Congressional approval rather than a unilateral move.

Bitcoin price action yesterday was a rollercoaster. It surged on the Lummis announcement fake-out, dipped due to a time zone misunderstanding, rose again on the executive order news, fell when 2:30 ET passed without developments, climbed again after the confirmation of a crypto-focused executive order, and dropped once more when it became clear the order referred to “digital assets” broadly, not Bitcoin specifically.

Traders in this market should have anticipated heightened volatility at the start of this political season, and now it’s here in full force. The problem with volatility is its tendency to create self-fulfilling cycles: small rumors fuel price surges, which then amplify further speculation, only for the market to unravel as the news proves premature or overhyped. Yesterday’s movements reflected traders hoping for an outright announcement that the U.S. is buying Bitcoin—something that was never likely to happen without proper legislative groundwork.

By the way, did anyone take the time to read the press releases on www.lummis.senate.gov? The subcommittee has two key areas of focus.

I’ll make this more readable (the capitalization and bolding are my touch).

1) Passing bipartisan digital asset legislation that promotes responsible innovation and protects consumers, including market structure, stablecoins AND A STRATEGIC BITCOIN RESERVE.

2) Conducting robust oversight over Federal financial regulators to ensure those agencies are following the law, including by ENSURING OPERATION CHOKEPOINT 2.0 NEVER HAPPENS AGAIN.

The Strategic Bitcoin Reserve will be spearheaded by Cynthia Lummis and take shape as a Congressional initiative. If it passes, I have no doubt Trump will sign off on it, but it’s unlikely he’ll directly declare, “We are establishing a Strategic Bitcoin Reserve.”

Now, let’s get into some rumors.

and this:

Trump is a wildcard, and Ripple has been strategically building connections with his administration. No one anticipated $TRUMP, so it wouldn’t be shocking if XRP somehow finds its way into the stockpile. I’ll continue to keep you updated in real time and sift through the rumors to focus on those with a real shot of materializing (based on what I’m hearing). For now, it seems Trump’s headline domination may wind down as the spotlight shifts to the Working Group's proposals, agency rulings, and Lummis officially presenting the Strategic Bitcoin Reserve bill to Congress.

It’s been one hell of a ride.

P.S. I hit 1 million followers on X, and I owe it all to you. The number itself might not matter, but symbolically, it represents your trust in me. This is my way of expressing gratitude. I wish I could shake hands, give hugs, and pop champagne with each of you. The craziness of this cycle is just beginning, but we’re in it together. Have a fantastic weekend. All of this news is incredibly bullish.

Post-Credit Scene: Every good movie sneaks in a teaser.

End movie.

Aptos Weekly Review

Each week, I’ll provide an Aptos review, showcasing all the exciting announcements and milestones the network is achieving. This week let’s kick things off with this epic announcement: the launch of Zaptos.

From the co-founder and CEO of Aptos, “In 2022, @Aptos revolutionized blockchain design with a pipelined architecture. Today, Zaptos takes it further—introducing shadow execution, state certification, and optimized storage to unlock unmatched speed and scalability. Imagine on-chain trading as instant as Robinhood- real-time, seamless, and built for Internet-scale. Developers can now scale massive dApps without sacrificing user experience.”

Want to know how fast Zaptos is? The answer is 20,000 tps with sub-second latency.

Over in the AI Agent world, Aptos is keeping pace with the rapid acceleration, offering guidance to help users build their own AI Agent. Developers, this one's for you! Before you get started, there are a few prerequisites to be aware of:

Basic understanding of terminal/command line usage

Familiarity with Python (helpful but not required)

Mac or Linux environment (Windows users will need to modify some commands)

OpenAI API key (we'll help you get this)

Last and certainly not least, LayerZero V2 is live on Aptos.

From layerzero.network, “LayerZero is a technology that enables applications to move data across blockchains, uniquely supporting censorship-resistant messages and permissionless development through immutable smart contracts.”

“Before LayerZero, developers had to choose a single blockchain for their applications, limiting their reach and functionality. Existing cross-chain solutions frequently rely on centralized intermediaries or fragmented bridges, introducing security risks, a poor user experience, and fragmented liquidity. LayerZero solves these problems by providing a secure, efficient, and user-friendly way to build truly omnichain applications.”

That is all for this week, make sure to show Aptos some love—they’re a huge reason this newsletter remains free!

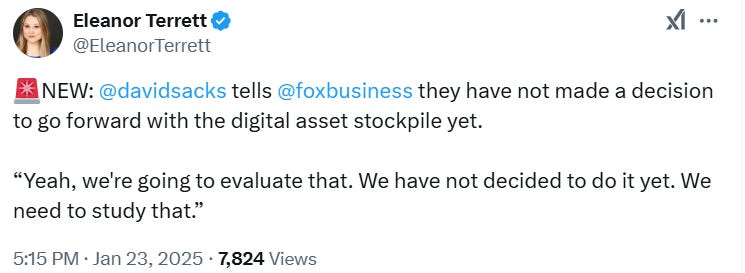

Bitcoin Thoughts And Analysis

The Bitcoin daily chart remains constructive as price consolidates within the range established by the $106,099 resistance level and the strong support at $99,860. After the temporary all-time high at $109,358, Bitcoin experienced a pullback, but key support levels have continued to hold.

Currently, price is hovering just below the $106,099 resistance, and no daily candle close has confirmed a breakout above this level yet. This zone remains the key level for bulls to overcome in order to challenge the recent all-time high and potentially push toward $108,388 and higher.

The 50-day moving average, currently around $98,600, has continued to trend upward and acts as dynamic support below the range. Price holding well above this moving average signals that the bullish structure remains intact.

Volume has been relatively moderate during this consolidation phase, suggesting that market participants are waiting for a decisive move either above resistance or a retest of support levels. A breakout above $106,099 on a daily close would likely attract more buyers, whereas a loss of $99,860 could lead to a deeper retracement toward the next major support area near $94,000–$96,000.

Traders will be closely watching the daily closes to determine whether Bitcoin can gain momentum for another leg up or if a deeper pullback is on the horizon.

Altcoin Charts

The SEI weekly chart exhibits a textbook bounce from the key support level at 0.3304, which has held firm and demonstrated buyer interest in this zone. This bounce off support is a bullish signal, with price showing early signs of recovery.

The first target to the upside appears to be 0.4786, representing a key resistance level and potential inflection point for further price action. A sustained move above this resistance could open the door for SEI to test higher levels, with significant room for growth if bullish momentum continues.

Volume appears to support the bounce, suggesting that market participants are stepping in at this critical support level. Traders may look for follow-through confirmation this week to validate the strength of the move and track price action as it approaches resistance.

Easy invalidation below support for traders.

Legacy Markets

Global stocks soared to record highs as President Donald Trump signaled a softer stance on tariffs, stating he would "rather not" impose levies on China and holding back on measures against Europe, though he maintained threats toward Canada and Mexico. This perceived openness to negotiation lifted investor sentiment, driving gains across equities, currencies, and bonds globally. The Stoxx Europe 600 hit a new peak, marking its fifth consecutive weekly advance, while emerging-market currencies achieved their best performance since July 2023.

US equity futures dipped 0.2% after the S&P 500 reached a fresh high. The dollar fell to a one-month low as investors sought higher-yielding assets, while the yen strengthened following the Bank of Japan’s first rate hike since July. Positive data, including signs of easing inflation and strong corporate earnings, further boosted markets. Burberry Group shares surged on better-than-expected sales, while Banca Monte dei Paschi di Siena’s takeover bid for Mediobanca caused mixed reactions in Italian banking stocks.

Adding to the optimism, the eurozone’s private sector showed unexpected growth in January, with the Composite PMI rising above expectations to 50.2, signaling expansion. Analysts noted that Trump’s moderated trade rhetoric, combined with improving macroeconomic conditions, is sustaining the rally and encouraging investors to stay engaged in riskier assets.

Key events this week:

US University of Michigan consumer sentiment, existing home sales, S&P Global Manufacturing & Services PMI, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures fell 0.2% as of 6:24 a.m. New York time

Nasdaq 100 futures fell 0.2%

Futures on the Dow Jones Industrial Average fell 0.1%

The Stoxx Europe 600 rose 0.3%

The MSCI World Index rose 0.2%

Currencies

The Bloomberg Dollar Spot Index fell 0.5%

The euro rose 0.7% to $1.0488

The British pound rose 0.6% to $1.2421

The Japanese yen was little changed at 156.03 per dollar

Cryptocurrencies

Bitcoin rose 2.2% to $105,432.33

Ether rose 4.7% to $3,402.77

Bonds

The yield on 10-year Treasuries was little changed at 4.64%

Germany’s 10-year yield advanced two basis points to 2.57%

Britain’s 10-year yield advanced two basis points to 4.66%

Commodities

West Texas Intermediate crude rose 0.5% to $75.03 a barrel

Spot gold rose 0.8% to $2,776.17 an ounce

The SEC Rescinds SAB121

The SEC is on fire! SAB121 has officially been rescinded, marking a huge win for the crypto industry. Here’s why this matters:

SAB121, introduced in 2022, required publicly traded banks to include digital assets on their balance sheets. This ran counter to the long-standing principle of bank custody, where assets held by banks were kept off the balance sheet. The rule effectively sidelined banks, excluding them from the crypto market and making it harder—and less secure—for Americans to engage with digital assets.

This misguided rule created a chilling effect on the industry, fueling apprehension and uncertainty. Now, with SAB121 gone, a major barrier has been lifted, clearing the way for greater institutional involvement and enhanced security for the crypto space.

Etherealize Will Reshape Ethereum

Frustration and disappointment with the Ethereum Foundation (EF) and Vitalik are already driving tangible, positive changes. Since the EF refuses to engage in lobbying for institutional involvement, the community has stepped up with Etherealize. The initiative’s polished website and clear, effective strategy make it hard not to be a fan.

Here’s the plan for Etherealize:

Content Hub: Etherealize is positioning itself as the go-to resource for TradFi, ETF issuers, and the general public to learn about the Ethereum economy.

Product Suite for Institutions: To address Ethereum’s need for more institutional-grade applications, Etherealize has developed tools tailored for corporate use.

Tokenization of High-Value Assets: Etherealize is committed to ensuring that all high-value assets are tokenized and traded on the most secure blockchain: Ethereum.

Wall Street Partnerships: The initiative is actively working with financial institutions to make Ethereum the backbone of tokenized assets.

Advocacy for Ethereum: Growth won’t happen without vocal proponents. Etherealize is stepping up to advocate for Ethereum and $ETH where it counts.

The roadmap emphasizes a dual-track approach to corporate and policy adoption. After all, the EF can’t—and arguably shouldn’t—do everything on its own.

One standout feature is the dashboard Etherealize has developed. It’s nothing short of a 10/10, designed for institutions to seamlessly integrate Ethereum into their frameworks and as a compelling selling point for clients. It’s exactly the kind of initiative Ethereum needs right now.

Also, tokenization is a major focus for the platform—one of Ethereum’s strongest narratives that deserves more attention.

I’ll just leave this here:

BlackRock has clearly chosen Ethereum, it’s only a matter of time until tokenization takes the world by storm.

The Current Cycle Closely Mirrors 2017

The Block wrote an interesting article making the case Bitcoin is closely following what I call the ‘2017 cycle’ and they call it the “2015-2018 cycle.” Regardless, data to back the claim comes from GlassNode, simply overlaying the cycles on each other logarithmically to see what resembles similarity.

Orange = Genesis to 2011

Red = 2011 to 2015

Blue = 2015 to 2018

Green = 2018 to 2022

Black = Current cycle

I zoomed in for you:

Our black line is almost perfectly aligned with the blue line, and if this trajectory holds, it implies we have about nine months left in the cycle. What’s fascinating is that we’ve already surpassed the genesis cycle peak, overtaken the 2015 peak by a couple of months, and are now closing in on the 2022 peak. This raises an intriguing possibility: are the cycles lengthening?

The previous cycle didn’t provide confirmation of this theory, largely due to the China ban abruptly cutting the bull market short. If this cycle manages to extend another nine months (or longer), it would be monumental—but, as always, nothing is guaranteed. For now, all we can do is sit back, observe, and wait to see how it unfolds.

Huge Opportunity For Bitcoin Traders Is Coming!

I am joined by Edan Yago, CEO at BTC OS & Core Contributor to BitcoinOS, and one of my favorite guests and my co-host for Thursdays starting this week! We are talking everything crypto and specifically - Bitcoin!

In the second part of the show, Dan from The Chart Guys will share his market analysis and some trades.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.