Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Use my link HERE.

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 400 trading pairs, minimal fees, peer to peer trading, derivatives, up to 100x leverage.

Make sure to check if Phemex is available in your jurisdiction.

In This Issue:

There’s Never Been A Better Time To Invest

Bitcoin Thoughts And Analysis

Legacy Markets

Polymarket Vs. Kalshi: Diverging Odds On The SBR

Larry Fink Is Very Bullish

Tornado Cash Sanctions Have Been Reversed

Jeremy Allaire Anticipates More Executive Orders

Investors Are Confused by CME Adding XRP and SOL Futures

Additional News You Might Have Missed

Trump Becomes Crypto Billionaire Overnight, AI To Drive Massive Bitcoin Bull Market

There’s Never Been A Better Time To Invest

Here are some stats you should be aware of:

On January 20, 2017, the day Donald Trump was inaugurated as the 45th President of the United States for his first term, the S&P 500 closed at 2,263.69. On January 20, 2021, the day Donald Trump left office, the S&P 500 closed at 3,851.85. During his first term, the S&P 500 increased by approximately 70.16%.

On January 20, 2017, the NASDAQ-100 Index closed at 4,717.02. On January 20, 2021, it closed at 13,197.18. Over this four-year period, the NASDAQ-100 increased by approximately 179.5%.

On January 20, 2017, the Dow Jones Industrial Average (DJIA) closed at 19,827.25. On January 20, 2021, it closed at 31,188.38. Over this four-year period, the DJIA increased by approximately 57.6%.

On January 20, 2017, the price of Bitcoin was approximately $915.91. On January 20, 2021, the price of Bitcoin had risen to $33,114.00. Over this four-year period, Bitcoin saw an increase of approximately 3,515.42%.

On January 20, 2017, the price of Apple was approximately $30.00. On January 20, 2021, the price of Apple had risen to $143.00. Over this four-year period, Apple saw an increase of approximately 376.67%.

On January 20, 2017, the price of 1 ounce of gold was approximately $1,204.90. On January 20, 2021, the price of 1 ounce of gold had risen to $1,866.30. Over this four-year period, gold saw an increase of approximately 54.89%.

There’s no denying that Trump’s first term saw significant market gains. However, there’s a catch…

In Biden’s four-year term, this is the performance of the same assets.

S&P 500: +56.1%

NASDAQ-100: +59.3%

DJIA: +39.4%

Bitcoin: +204.1%

Apple: 77.7%

Gold: 44.8%

Comparing the two, under Trump, the S&P 500 gained an additional 14.1%, the NASDAQ-100 outperformed by 120.2%, Bitcoin skyrocketed 3,311.3% more, Apple surged an extra 298.97%, and gold edged out Biden’s term by 10.1%. These numbers are fascinating and worth a deeper dive on their own, but the broader takeaway is clear: 4-year periods are generally favorable for markets, regardless of which party is in power.

These time frames consistently provide a "sweet spot" where positive returns are the norm. While Trump’s term delivered stronger performance across these metrics, the larger narrative is that most presidential terms end with markets significantly higher than where they started, often outpacing inflation.

Obama:

Trump:

Biden:

The last time the S&P 500 ended a presidency lower than it began was under George W. Bush, a period defined by the dot-com bust, 9/11, the Iraq War, and the Global Financial Crisis. Such occurrences are rare, happening only a handful of times in history. The takeaway is simple: invest in the market and hold. It remains the most reliable way to outpace inflation and build wealth, especially as wage growth struggles to keep up.

No matter your political stance, American investors have plenty of reasons to be optimistic about the next four years—not just the next few months. While Trump will undoubtedly take credit for Bitcoin’s rise, S&P 500 gains, and anything else he can point to, the market’s natural trajectory should be upward barring any major disruptions. History shows that as long as there aren’t catastrophic crashes at the start or end of a term, market performance tends to reflect positive growth.

However, inflation looms as a persistent challenge, potentially reaching between 10% and 20% over the next four years. While I’m confident in the market’s ability to deliver strong returns, I’m less optimistic about inflation easing anytime soon. This means investors need to carefully consider how they allocate cash in their portfolios. Holding too much cash could result in a significant loss of purchasing power—10% to 20% erosion over four years is no small thing.

Ultimately, the message is clear: widen your time horizon. While everyone is laser-focused on whether the U.S. will implement a Strategic Bitcoin Reserve (SBR), it’s vital to think about the long-term implications. What will the SBR look like after 1 year, 5 years, or even 10 years? How will it influence competing nations, major corporations, banks, hedge funds, pensions, and sovereign wealth funds? What ripple effects will it have on individuals who currently hold no Bitcoin at all? This is the kind of catalyst that could propel Bitcoin to over $1,000,000 within four years.

As the week winds down, the sheer volume of news has been overwhelming. I found it difficult to pick and choose what to share because so much is happening, and all of it feels important. The Trump administration is just getting started, the bull market clock has plenty of time left, and there has never been a better time to be a crypto investor.

Bitcoin Thoughts And Analysis

Bitcoin's daily chart shows a continued pullback from the recent new all-time high of $109,358, with price currently trading around $101,634. The key resistance at $106,099, which Bitcoin briefly surpassed last week, has proven difficult to hold above, marking it as a critical level for bulls to reclaim for a renewed upward push.

On the downside, Bitcoin has so far maintained support near $99,860, a level that has held firm for several days, aligning with strong market structure. Below this, the 50-day moving average at approximately $98,600 represents the next layer of potential support, where buyers may step in if the current price action continues to weaken.

Volume has been declining slightly during this pullback, suggesting the retracement lacks aggressive selling pressure, which may indicate consolidation rather than a major trend reversal. However, for bullish momentum to resume, Bitcoin must break and close above $106,099, paving the way for a retest of $108,388 and ultimately $109,358. Failure to hold the $99,860 support could lead to further downside pressure toward the 50-day moving average. For now, Bitcoin remains in a critical range between these key levels.

Legacy Markets

Stocks paused on Thursday after a three-day rally that brought US and European markets close to record highs. Futures for the S&P 500 and Nasdaq 100 dipped 0.2% and 0.5%, respectively, as investors reassessed recent gains driven by optimism over artificial intelligence and strong corporate earnings. While the S&P 500 has risen about 5% since Donald Trump’s election, concerns over potential tariffs on major trading partners continued to weigh on sentiment.

Markets shifted focus to US jobless claims data, Trump’s upcoming address at the World Economic Forum in Davos, and earnings reports from companies like General Electric and Texas Instruments. In premarket trading, American Airlines fell 8% after forecasting a first-quarter loss, diverging from competitors benefiting from strong winter demand, while Alaska Air projected a smaller-than-expected loss.

European markets also cooled, with tech stocks in the Stoxx Europe 600 dropping more than 1%, erasing much of the prior session's gains. Puma SE tumbled after missing earnings estimates. Meanwhile, 10-year Treasury yields rose slightly to 4.64%, and the dollar edged higher.

Despite the pause, analysts believe US equities may still have room for growth due to ongoing economic momentum, though concerns persist about high valuations, particularly in tech. Investors remain cautious as markets react to Trump’s headlines and potential trade policy shifts.

Key events this week:

Eurozone consumer confidence, Thursday

US jobless claims, Thursday

Bank of Japan policy meeting, Friday

Eurozone HCOB Manufacturing & Services PMI, Friday

US University of Michigan consumer sentiment, existing home sales, S&P Global Manufacturing & Services PMI, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures fell 0.2% as of 7:13 a.m. New York time

Nasdaq 100 futures fell 0.5%

Futures on the Dow Jones Industrial Average were little changed

The Stoxx Europe 600 was little changed

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index rose 0.1%

The euro fell 0.1% to $1.0395

The British pound fell 0.1% to $1.2301

The Japanese yen was little changed at 156.59 per dollar

Cryptocurrencies

Bitcoin fell 2.2% to $101,765.51

Ether fell 1.8% to $3,201.33

Bonds

The yield on 10-year Treasuries advanced three basis points to 4.64%

Germany’s 10-year yield advanced one basis point to 2.54%

Britain’s 10-year yield advanced one basis point to 4.65%

Commodities

West Texas Intermediate crude rose 0.4% to $75.73 a barrel

Spot gold fell 0.3% to $2,747.02 an ounce

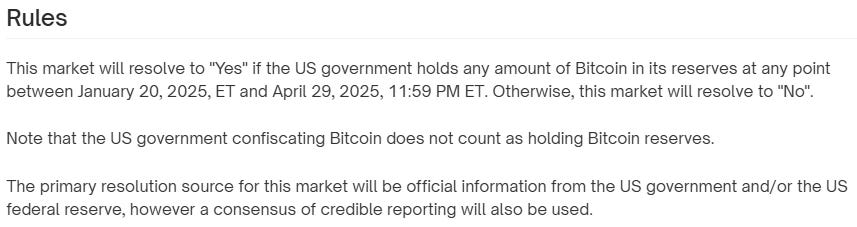

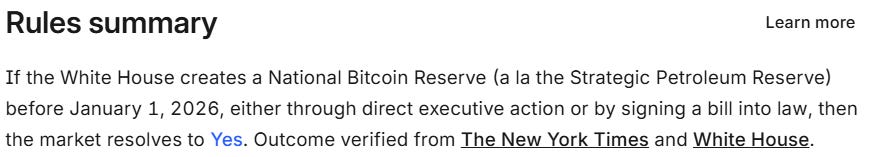

Polymarket Vs. Kalshi: Diverging Odds On The SBR

Now that the initial wave of executive orders has settled, the odds of Trump establishing an SBR within the first 100 days have dropped significantly on Polymarket, while remaining above 60% on Kalshi. The key difference lies in the market criteria: Polymarket's market requires the U.S. government to buy Bitcoin—not confiscate it—within 100 days, whereas Kalshi's market only stipulates the creation of a reserve, with no mention of Bitcoin purchases.

Due to the market rules, Kalshi presents a much safer option for gamblers. Moreover, Polymarket odds are likely to gradually decline toward zero as time progresses, whereas the Kalshi market could remain stable or even trend upward under specific conditions.

Larry Fink Is Very Bullish

It’s not just Bitcoin that Larry Fink seems bullish on. In the second segment, it’s hard to believe he’s not referencing—or at least considering—Ethereum.

“If you’re frightened of the debasement of your currency or the economic or political stability of your country, you can have an internationally based instrument called Bitcoin that will overcome those local fears. I’m a big believer in the utilization of that as an instrument. And so, if that becomes true and we see that it can be a proper hedge against hope securities or equities, the question is: could you see a 2% or 5% allocation? I was with a sovereign wealth fund during this week, and that was the conversation: should we have a 2% allocation, a 5% allocation? If everyone had that conversation, then it would be $500k, $600k, $700k for Bitcoin.”

“My God, if we can tokenize bonds and stocks tomorrow... it would democratize investing in all ways we can't imagine.”

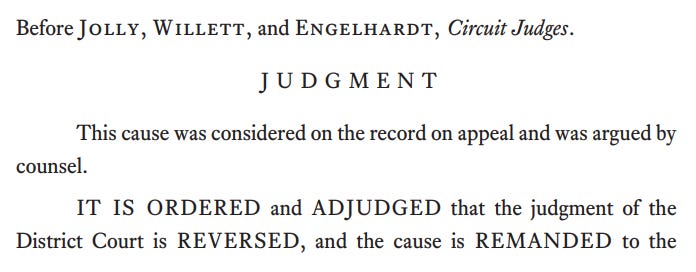

Tornado Cash Sanctions Have Been Reversed

In just 24 hours, two monumental wins shook the crypto world: Ross Ulbricht received a presidential pardon, and a U.S. court overturned OFAC's sanctions on the Tornado Cash cryptocurrency mixing protocol. The sanctions, initially imposed in 2022, accused Tornado Cash of facilitating over $455 million in money laundering tied to the North Korean Lazarus Group.

However, the court’s decision doesn’t erase the controversy. Tornado Cash developer Alexey Pertsev was convicted in the Netherlands for laundering $1.2 billion through the platform and sentenced to over five years in prison. Meanwhile, co-founders Roman Storm and Roman Semenov remain entangled in legal troubles—Storm was arrested in 2023 and is awaiting trial, while Semenov remains sanctioned by the U.S. These developments highlight the ongoing tension between technological innovation and legal accountability in the crypto space.

Jeremy Allaire Anticipates More Executive Orders

Don’t just take my word for it—take it from the CEO of Circle, a $51 billion stablecoin issuer, who seems confident that President Trump will take meaningful action for the crypto space in the days, weeks, and months ahead.

Interviewer: “Are you concerned at all that, given what we saw in the last 24 hours, this isn’t necessarily much of a priority for the president as many had thought?”

Jeremy Allaire: “Not at all. I expect to see executive orders, and I expect to see key agenda items here. There’s a lot to do, and I expect the Trump administration to be in the limelight with a lot of action. Obviously, we are going to start seeing action from the regulatory agencies, Congress, and the White House as well.”

“It was in the policy platform for President Trump, and it’s a major issue for the industry and broader Republican leadership. My expectation is that we will see that [SAB 121] repealed, whether it’s by executive order or legality. Just as you heard from the CEO of State Street, Ron O'Hanley, banks need this clarity, and corporations need this clarity so they can hold crypto assets on their balance sheets, provide custody, and do other things without it being punitive. SAB 121 has been punitive in many respects and is a huge headache for public companies. Making this all more capital market-friendly, custodian-friendly, and financial institution-friendly will take place.”

Investors Are Confused by CME Adding XRP and SOL Futures

CME reportedly announced that futures contracts for XRP and SOL are set to go live on February 10, pending regulatory approval, according to a now-deleted page from their "staging subdomain." Following the report, XRP and SOL prices spiked by up to 3%. While the page is no longer accessible, analysts, including Bloomberg's James Seyffart, have speculated that this move could align with forthcoming ETF filings for XRP and SOL futures. CME has yet to issue a comment on the matter.

Additional News You Might Have Missed

I have some rapid-fire stories to cover:

What you’re looking at above are 33 crypto ETFs currently filed with the SEC. This list has doubled since Gensler left office late last week. We’re on the brink of a Cambrian ETF explosion. More options = more investors.

Rumors of a second Ethereum Foundation, called “Second Foundation,” are growing. It is believed that Konstantin Lomashuk, the founder of the Lido staking protocol, is behind the account and is considering building out a second foundation. So far, only two posts have been made.

Coinbase has faced a good deal of criticism for its lack of support for Solana, which intensified this past weekend following the surge of interest in using the chain to purchase $TRUMP. I can imagine Coinbase wants to see Base succeed over Solana, but Brian Armstrong gave a fair response and clarification here.

Trump Becomes Crypto Billionaire Overnight, AI To Drive Massive Bitcoin Bull Market

Sponsored by Aptos, check it out here: https://aptosfoundation.org/

I’m joined by Dr. Sujit Roy, CEO and CSO of BrainAlive AI, and to explore the exciting intersection of cryptocurrency and artificial intelligence. We’ll discuss how AI-powered projects are set to shape the next bull market and drive innovation across the crypto space.

Dr. Sujit Roy: https://x.com/the_sujitroy

Gaurav Dubey: https://x.com/GauravDubeyLive

Chris Inks will join us in the second part to share some interesting trades in crypto and beyond.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.