The Wolf Den #1122 - Ethereum’s Existential Crisis: What’s at Stake?

Is ETH dead? I don't think so...

Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Trading Alpha Released A Super Cool Product!

One of the partners of this newsletter, Trading Alpha, my trusted indicator and trading community, has launched their proprietary Indicator Search Engine for All Markets. This custom Indicator Screener scans crypto, stocks, and forex markets for Trading Alpha indicator setups, eliminating the need for time-consuming manual analysis. It can simultaneously screen for multiple indicators, enhancing confluence and providing advanced analysis capabilities across different markets. This is cutting-edge technology for serious traders.

Make sure to use my link HERE if you plan on giving it a try. Use code '10OFF' for a 10% discount.

In This Issue:

Ethereum’s Existential Crisis: What’s at Stake?

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Donald Trump Frees Ross Ulbricht

Circle Makes 3 Big Announcements

Power Has Shifted In The SEC

MicroStrategy Is 46.1% Away From 1M Bitcoin

Is Bitcoin The Ultimate Winner? USA Hits $36 Trillion Debt Bomb!

Ethereum’s Existential Crisis: What’s at Stake?

“I happily played World of Warcraft during 2007-2010, but one day Blizzard removed the damage component from my beloved warlock’s Siphon Life spell. I cried myself to sleep, and on that day I realized what horrors centralized services can bring. I soon decided to quit.”

That quote, both amusing and poignant, comes from none other than Vitalik Buterin, reflecting on his younger self and how a seemingly trivial change in a video game planted the seed that would eventually grow into Ethereum.

What many might not know about Vitalik is that he didn’t simply appear out of thin air to revolutionize crypto with Ethereum. He began his journey as an OG Bitcoiner, cutting his teeth in the space by writing for a publication called Bitcoin Weekly. That gig eventually led him to co-found Bitcoin Magazine, where he became the lead writer, shaping some of the earliest narratives in the crypto ecosystem.

Below is Vitalik’s first publication with Bitcoin Magazine—a fascinating relic of crypto history and a reminder of how far both he and the space have come.

Vitalik Buterin was deeply embedded in the Bitcoin community, even dedicating six months to a global roadshow where he connected with developers and shared his perspectives as an early advocate. His passion for Bitcoin was undeniable, but what many might not realize is that his groundbreaking ideas—like implementing smart contracts—created friction within the Bitcoin community. These concepts clashed with Bitcoin's core ethos of simplicity and immutability, ultimately leading Vitalik to forge his own path. The result? Ethereum.

How the name ‘Ethereum’ came to be:

“I was browsing a list of elements from science fiction on Wikipedia when I came across the name. I suppose it was the fact that [it] sounded nice and it had the word ‘ether,’ referring to the hypothetical invisible medium that permeates the universe and allows light to travel.”

On where Bitcoin fell short:

“I went around the world, explored many crypto projects, and finally realized that they were all too concerned about specific applications and not being sufficiently general. Hence the birth of Ethereum, which has been taking up my life ever since.”

And from the original Ethereum white paper:

Ethereum needs no introduction—its story is well-known from this point onward. As the second-largest cryptocurrency, Ethereum dominates other blockchains in areas such as versatility, trust, network strength, developer adoption, programmability, decentralization, and more. Its legendary 2017 bull run solidified its position as an industry titan. But Ethereum’s path hasn’t always been smooth sailing.

Right now, Ethereum faces an identity crisis. Unlike Bitcoin, which thrives without a centralized leader, official foundation, or ICO funds driving its growth and development, Ethereum’s structured governance is under scrutiny. Questions about its ultimate purpose and direction are recurring themes in the community. From the DAO hack and subsequent controversial hard fork to the seismic shift from proof-of-work to proof-of-stake, Ethereum’s history is a testament to the challenges of steering a decentralized ecosystem through uncharted waters.

Ethereum’s community has often been divided by debates over ethics, financial losses, historical precedents, and ideological differences. These aren’t unique problems, but Ethereum’s prominence magnifies them, making internal debates a matter of public interest with implications for the entire crypto space. The sheer scale of Ethereum ensures that its challenges reverberate far beyond its own community.

Vitalik Buterin, Ethereum’s founder, occupies a unique role—not a CEO like Paolo Ardoino of USDT, Brad Garlinghouse of XRP, Justin Sun of TRON, or Richard Teng of BNB. This ambiguity leaves people questioning where the real power lies. Is Vitalik’s informal influence still the driving force? Is it the Ethereum Foundation, the broader community, or some other, less visible group? As someone who’s followed Ethereum closely for years, I’d argue it’s likely a healthy mix of the first three, and anything beyond that veers into conspiracy.

Recently, the Ethereum Foundation (EF) has faced criticism. For the record, I doubt these concerns would exist if Ethereum were outperforming competitors like Solana (SOL), but that’s not the case. Price shapes perception, and Ethereum’s recent underperformance has prompted tough questions. If Ethereum were gaining on Bitcoin and the “flippening” became a serious conversation again, I imagine Bitcoiners would face their own existential reckoning.

Adding to the friction is the shifting political landscape in the United States. Ethereum, and by extension the EF, has garnered a reputation—rightly or wrongly—of being “soft,” “quirky,” “left-leaning,” “woke,” or even “anti-winning.” While there’s undoubtedly evidence to challenge these perceptions, they persist. And in Trump’s America, where success is framed as a zero-sum game, such branding doesn’t play well. The United States remains the global epicenter of influence, and Ethereum’s ability to thrive here carries immense stakes.

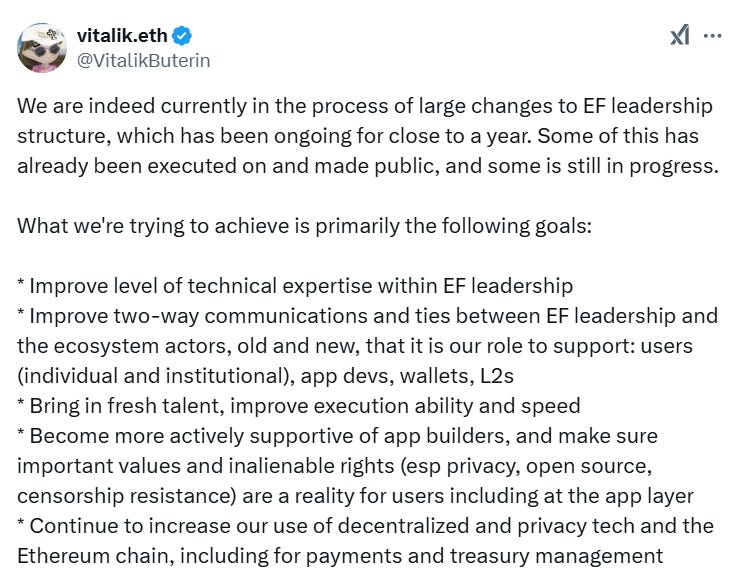

Against this backdrop of criticism, Vitalik has weighed in. He acknowledged that changes in leadership are on the horizon but simultaneously reignited debates with his thoughts on the Ethereum Foundation’s core values:

Under growing pressure to fire the executive director of the Ethereum Foundation…

Vitalik responded with this:

In response to a growing wave of disgruntled community members, Vitalik has adopted a cryptic, yet oddly humorous, way of replying: “Milady.” It’s reminiscent of Binance’s CZ casually dismissing FUD by simply posting “4.” Both approaches reflect a certain confidence—or defiance—in the face of criticism, though Vitalik’s quirkier style seems more aligned with Ethereum’s unique culture.

Love Ethereum or hate Ethereum, Vitalik is not the Type-A, polished, ambitious leader some might hope for—and he likely never will be. Investors need to individually assess the long-term impact of Vitalik’s leadership on Ethereum’s success. To some, he may fall short; to others, he may excel; and for many, his influence might not matter much at all.

This past week, Vitalik stepped out of his usual shell, passionately pushing back against critics, while the Ethereum Foundation made a bold move, allocating 50,000 ETH to actively participate in the ecosystem they support. Perhaps this frustration from Vitalik and the EF will act as a catalyst for positive change—or it could be exposing deeper issues within the Ethereum ecosystem. The verdict ultimately lies with each of you.

Here’s a diverse range of opinions for you to sift through, presented in no particular order.

I encourage everyone to explore these ideas and stay informed about the evolving narrative. While I believe many of these concerns would fade if ETH surged to $4,000, being aware of the challenges and opportunities can help investors navigate the news cycle and make informed decisions about their portfolios.

Personally, I’m not overly worried about Ethereum. That said, I don’t love everything I’m seeing. I wish the Ethereum Foundation showed more urgency in focusing on success, particularly with a stronger emphasis on winning in the U.S., even if it means compromising some political neutrality. Vitalik, in my view, thrives as a backseat driver—philosophical and visionary—rather than a front-seat operator embodying pragmatism and relatability. It’s perplexing that the Ethereum Foundation is only now starting to financially engage with its ecosystem. And yes, Ethereum does seem to be navigating an identity crisis.

A single massive green candle could erase many of these concerns, but until then, this is the reality. Investors should stay aware of these dynamics. There’s still plenty of hope for Ethereum, with numerous potential solutions available—provided the right people step up. Paths to victory include: a major public company buying Ethereum, the establishment of a political advocacy group lobbying for Ethereum, or a renewed sense of urgency and active leadership from Vitalik and the Ethereum Foundation.

On a brighter note, the market seems to be pricing in the potential impact of Trump’s administration on the crypto space. Remember, today is only day three.

Yesterday, reports surfaced that Cynthia Lummis met with Eric Trump at the Capitol to discuss the creation of a Strategic Bitcoin Reserve. Brian Armstrong also went on air, stating, “Trump is excited about it (the SBR), and he really wants to be the first Bitcoin president.” Meanwhile, political advocates are flooding D.C. at this pivotal moment.

In even better news, we learned yesterday that Hester Peirce—one of the most respected legal minds in crypto—will now lead the SEC’s new crypto task force. This signals the end of the “regulation by enforcement” era. What we’re seeing now is just the beginning, with the new administration and its officials finally taking a structured and proactive approach.

If XRP—arguably one of the most controversial and divisive assets in crypto—can stage a face-melting rally, then Ethereum can too. Seriously, don’t overthink it.

Switching gears for a moment, it seems increasingly obvious that the $TRUMP token isn’t directly tied to Trump himself but rather to his team. The distinction is important and telling. While Trump’s name might carry the project, the execution and decisions likely lie with the individuals behind the scenes.

Trump didn’t choose Solana; it’s clear his team opted to launch a memecoin on Solana because it has established itself as the go-to chain for memecoins.

Bitcoin Thoughts And Analysis

Bitcoin's daily chart shows that after hitting a new all-time high of $109,358 two days ago, the price has struggled to hold above the key resistance level of $106,099. Despite briefly trading above it, Bitcoin has not managed a daily candle close above this level, reinforcing it as a key resistance to watch.

On the downside, Bitcoin has consistently held the $99,860 support level over the past several days. This level remains critical for maintaining the bullish structure. Below this, the next significant support aligns with the 50-day moving average, currently sitting around $98,600, which provides another layer of potential buying interest.

For bullish momentum to resume, a daily close above $106,099 is essential. Such a move could reinitiate a challenge of the recent all-time high at $109,358. Conversely, losing $99,860 would signal a potential shift toward a test of the 50-day moving average at $98,600.

Legacy Markets

US equity futures pointed to continued market gains as investors grew optimistic that President Donald Trump’s protectionist policies might be less aggressive than initially feared. Nasdaq 100 futures rose 0.9%, driven by significant premarket jumps in Netflix and Oracle shares. Netflix surged over 15% on better-than-expected fourth-quarter results, setting the stock up for a potential all-time high and its biggest rally since October 2023. Oracle gained 9% following the announcement of a $100 billion AI joint venture with SoftBank and OpenAI.

The dollar touched its lowest level in a month as relief spread that Trump’s early days in office did not include the harsh tariffs investors anticipated. While Trump reiterated his consideration of a 10% tariff on Chinese imports and a 25% tariff on Canadian and Mexican goods by February, his actions so far have been limited to ordering a review of trade practices, providing a window for negotiation until April 1.

European markets also advanced, with the Stoxx Europe 600 hitting new highs, supported by gains in tech stocks. Treasury yields remained steady, reflecting tempered inflation concerns despite ongoing tariff threats. Analysts noted that while investor nervousness persists about the long-term impact of Trump’s policies, the focus has shifted to pro-business measures and the outperformance of big tech stocks like Netflix and Oracle, which continue to dominate bullish bets.

Key events this week:

US Conference Board leading index, Wednesday

Samsung Galaxy “Unpacked 2025” event, expected to reveal new flagship phone models, Wednesday

Eurozone consumer confidence, Thursday

US jobless claims, Thursday

Bank of Japan policy meeting, Friday

Eurozone HCOB Manufacturing & Services PMI, Friday

US University of Michigan consumer sentiment, existing home sales, S&P Global Manufacturing & Services PMI, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.4% as of 6:35 a.m. New York time

Nasdaq 100 futures rose 0.9%

Futures on the Dow Jones Industrial Average rose 0.1%

The Stoxx Europe 600 rose 0.7%

The MSCI World Index rose 0.2%

Currencies

The Bloomberg Dollar Spot Index fell 0.1%

The euro rose 0.2% to $1.0445

The British pound was little changed at $1.2357

The Japanese yen fell 0.2% to 155.86 per dollar

Cryptocurrencies

Bitcoin fell 1.8% to $104,902.9

Ether fell 0.7% to $3,309.7

Bonds

The yield on 10-year Treasuries was little changed at 4.57%

Germany’s 10-year yield was little changed at 2.51%

Britain’s 10-year yield was little changed at 4.60%

Commodities

West Texas Intermediate crude rose 0.4% to $76.12 a barrel

Spot gold rose 0.5% to $2,757.25 an ounce

Donald Trump Frees Ross Ulbricht

President Donald Trump fulfilled a significant campaign promise by pardoning Ross Ulbricht, the founder of Silk Road, a decision widely celebrated by Bitcoiners and advocates for justice reform. Ulbricht, who had been serving a double life sentence plus 40 years without parole for charges including conspiracy to traffic narcotics, became a symbol of excessive sentencing and government overreach in the digital age. Supporters have long argued his punishment was disproportionate and that he has shown genuine remorse. This pardon is seen as a win for the cryptocurrency community, which has rallied around Ulbricht for years, highlighting the broader implications for innovation, freedom, and reform.

Circle Makes 3 Big Announcements

Circle made three significant announcements: the acquisition of Hashnote, a partnership with DRW, and the launch of USDC and USYC on the Canton Network. Here's a concise breakdown:

Acquisition of Hashnote: Circle now owns Hashnote, the issuer of USYC, the largest tokenized treasury and money market fund globally. As of January 21, $1.25 billion has been deployed into USYC. For context, USYC (US Yield Coin) is an on-chain representation of Hashnote's Short Duration Yield Fund (SDYF), which invests in short-term U.S. Treasury Bills.

Partnership with DRW: Circle has partnered with DRW, a global trading firm, to enhance liquidity for USDC and USYC. This collaboration aims to scale these products effectively and broaden their market reach.

USDC and USYC on the Canton Network: Circle announced plans to deploy USDC on the Canton blockchain, which boasts over $3.6 trillion in real-world assets (RWA) issued. Canton has gained trust from top-tier traditional banks, trading firms, asset managers, and exchanges, solidifying its role as a leading platform for integrating RWAs with blockchain technology.

Power Has Shifted In The SEC

The SEC is in an unusual position, with only three commissioners remaining after the confirmed departures of anti-crypto Gary Gensler and Jaime Lizárraga, as reflected on the official SEC website. This current composition creates a 2-1 majority favoring pro-crypto policies.

While it would have been ideal for Trump to appoint Hester Peirce as interim chairwoman, this isn’t a significant setback. The remaining commissioners have the authority to vote and take action until Paul Atkins is confirmed and begins his tenure. Though I’m not expecting sweeping changes during this brief period, the encouraging news is that as the remaining chairs are filled, the majority is likely to remain pro-crypto.

And who knows? Perhaps the fifth chair, expected to be a Democrat, will shock everyone and also lean pro-crypto.

MicroStrategy Is 46.1% Away From 1M Bitcoin

Following the purchase of 11,000 BTC, MicroStrategy is now 46.1% of the way to reaching 1 million Bitcoin. Inch by inch, week by week. That’s how we win.

Is Bitcoin The Ultimate Winner? USA Hits $36 Trillion Debt Bomb!

Joining me today are Paget Stanco, Principal at Gemini Institutional, and my friends from Arch Public, Andrew Parish, and Tillman Holloway, who will provide an update on the $10K algorithmic portfolio

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.