Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

2025 is starting off with some serious HEAT for Arch Public Concierge Program clients. Last week two of our algos crushed trades on Friday:

NQ: +15.98%

MNQ: +12.57%

In the past 120 days our Nasdaq algos have crushed the markets on behalf of clients:

NQ: +67.11%

MNQ: +61.07%

Hands free, daily liquidity, and tax advantaged. Join us!

Try Arch Public now! You can even demo the platform, for free, to learn more.

In This Issue:

$TRUMP

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Vitalik Is Ready For Change

Ten States Have Introduced Bitcoin Reserve Legislation

World Liberty Financial Bought More Ethereum

The Biggest Bull Market Ever - Can NFTs Explode? | Luca Schnetzler, Pudgy Penguins CEO

$TRUMP

I’m in shock right now.

It’s 1 a.m. Eastern on Friday night, and I’m sitting down to process what’s unfolding.

Billions of dollars are flooding into $TRUMP, and I still can’t tell if it’s real or fake.

In just a few paragraphs, I’ll break it all down for you. But as it was happening, I had to capture my real-time thoughts. The first thing I did was check Polymarket, where, just a few hours after launch, the market was pricing the odds of it being illegitimate between 6% and 8%.

It immediately reminded me of when Gary Gensler’s X (formerly Twitter) account was hacked at a pivotal moment leading up to the historic Bitcoin ETF launch. Ironically, that incident came right after he posted generic security tips for #CybersecurityAwarenessMonth. The timing couldn’t have been more uncanny.

As $TRUMP unfolded, the timeline was filled with mixed evidence, yet it consistently appeared to be mostly legitimate.

It was undeniably odd.

But this does seem legitimate.

Along with this.

And this of course.

Here’s what we know now that the chaos has settled:

$TRUMP is 100% real.

The Crypto Ball began at 8 p.m. EST. At 9:00 p.m., Trump posted on Truth Social, followed by a share on X at 9:44 p.m. This post set off a chain reaction. Moonshot, a crypto wallet specializing in meme coins, verified the token shortly afterward, unleashing a frenzy. Degens poured billions into $TRUMP, pushing its market cap to $15 billion within hours.

While I was drafting the first part of this newsletter, I watched the market cap lose billions in minutes, only to regain them just as quickly—a dizzying cycle of chaos.

By the next morning, $TRUMP shattered records:

$20 billion

$30 billion

$40 billion

$50 billion

$60 billion

And finally, $70 billion.

This wasn’t just another crypto launch—it was the fastest wealth creation event in history.

Now, let’s dissect the official website: gettrumpmemes.com

The site has a familiar vibe. It mirrors the over-the-top style Trump has used for past crypto products—complete with hyperbolic imagery, flashy headlines, and scattered disclaimers. It’s kitschy, absurd, and exactly what you’d expect from a Trump-branded meme coin rollout.

This statement caught a good amount of attention:

“Trump Memes are intended to function as an expression of support for, and engagement with, the ideals and beliefs embodied by the symbol “$TRUMP” and the associated artwork, and are not intended to be, or to be the subject of, an investment opportunity, investment contract, or security of any type. GetTrumpMemes.com is not political and has nothing to do with any political campaign or any political office or governmental agency. See Terms & Conditions Here, See Card Allocation Here.”

In other words, this screams: if you think this is an investment opportunity, contract, or security—it’s not! Gary Gensler must be losing his mind right now.

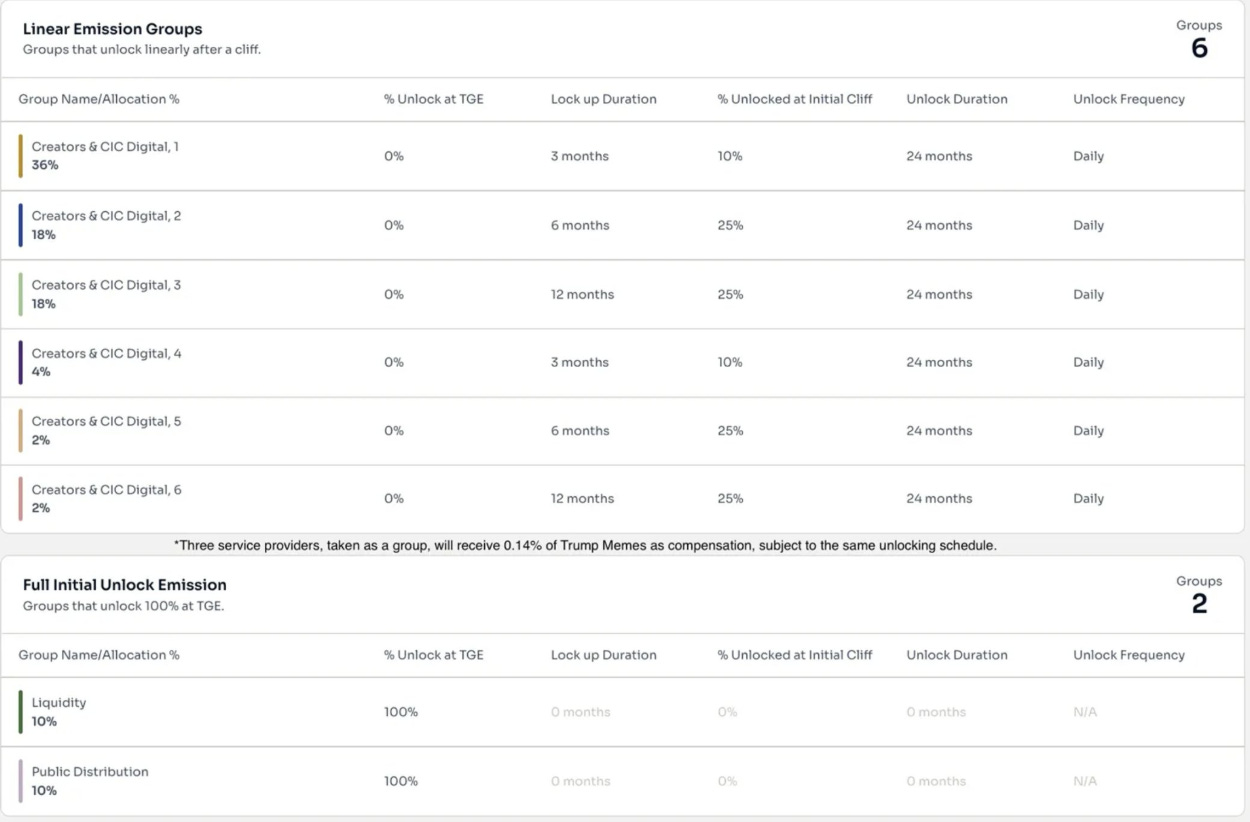

Now, let’s dive into the tokenomics of $TRUMP and see what’s under the hood.

Everyone online pointing out that 80% of the $TRUMP supply is owned by the team is absolutely correct. And they are underestimating. On this launch, it is clear that insiders with knowledge of the “surprise “launch were able to snipe huge positions from the offset - as is tradition.

The circulating $TRUMP token represents just 10% of the total supply, with another 10% allocated for liquidity. However, on-chain analysts have flagged some of that liquidity being shifted around—and even sold.

Now for the emission schedule.

Basically, what you need to know regarding when the tokens *can* be sold is below.

In just three months, some $TRUMP tokens will begin unlocking, with the entire supply unlocking over the next 24 months, occurring daily. Trump’s team has full control over the supply—they can hold it, burn it, slowly sell into the market, or dump it at their discretion.

Now, let’s get to the part everyone’s waiting for—my unfiltered opinions.

For the record, I don’t own $TRUMP. Maybe if I had jumped in during the first 15 minutes, I’d be deluded into thinking this is the greatest financial opportunity ever. I don’t think so. Or maybe, since I “missed out,” my perspective is clouded by regret. Either way, I’m here to give an honest breakdown, and you may not love it.

Spoiler - I think this is a massive grift and cash grab, and disgusting behavior, taking advantage of a brief moment between SEC Chairmen and before becoming President.

Here is a quick history lesson - according to the Emoluments Clauses in the Constitution, a President is unable to utilize the office to enrich themselves.

They had to get this done quickly, before inauguration day.

Moving on for now…

Let’s tackle the claim that ‘Trump has selected Solana.’ What people are implying is that Trump has officially endorsed Solana over other chains and that it’s now his chosen blockchain. While it’s possible Solana has risen in his favor—especially if his net worth just got a massive boost—we can’t ignore Trump’s history with other blockchains like Polygon, Bitcoin, and Ethereum.

Trump Digital Trading Cards were launched on Polygon.

Trump Bitcoin Digital Trading Cards were launched on Bitcoin.

World Liberty Financial ($WLFI) was launched on Ethereum.

It’s unclear how Trump profits from $TRUMP. His allocation and any associated fee or revenue structures remain a mystery.

Trump isn’t sticking to one blockchain. He’s been active across multiple platforms and shows no signs of stopping. While $TRUMP’s staggering performance might sway him to lean more heavily into Solana for now, it doesn’t mean he’ll abandon his ventures on Polygon, Bitcoin, or Ethereum. His earlier projects collectively amounted to a few hundred million dollars in value. Compare that to $TRUMP, now valued in the tens of billions—it’s easy to see why this project might dominate his attention for the time being.

Speaking of multiple projects, the website is called “gettrumpmemes.com.” Did we think that he would stop with just one? Of course not.

Enter $MELANIA.

Melania launched yesterday, because one grift and tens of billions in profit were clearly not enough to satisfy the team’s greed.

You read that right - they launched a SECOND meme token, one day before the inauguration.

$TRUMP immediately dumped from $73 to $40, as liquidity rushed for the exits, either in a panic or to grab the new token in an epic game of hot potato.

The audacity.

Even some of the most ardent supporters of Trump were forced to take a long look in the mirror. If you love the guy, it is still fair to admit that the optics of this are horrendous.

I love my kids - but sometimes they piss me off.

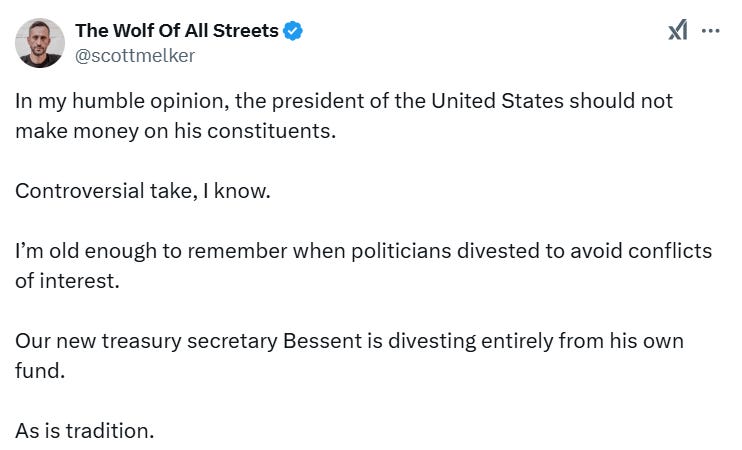

This is a decent take:

Did I mention that all of this caused Solana to go offline? And then crashed the entire crypto market, as disgusted enthusiasts ran (temporarily) for the exits? Maybe these are topics for another day…

As for the longevity of $TRUMP, it’s anyone’s guess. There’s a clear incentive for the team to keep the meme alive over the next four years. Obviously, the price won’t rise every day, but a steady increase in value over time would create far better optics than cashing out in a few months through relentless dumps. That said, serious corrections are inevitable—consider yourself warned!

Now, let’s talk about the team. On Friday, I outlined a list of “key voices influencing Trump—David Bailey, Cynthia Lummis, Dennis Porter, Paul Atkins, David Sacks, Tim Scott, J.D. Vance, Scott Bessent, Howard Lutnick, Tom Emmer, and Tulsi Gabbard.” After this weekend, I’m revising my stance. None of these individuals would have advised Trump to launch a memecoin on Solana—it likely never even crossed their minds. While they may hold influence over Trump at the policy level, it’s the behind-the-scenes team driving these decisions that’s really steering the ship.

Trump likely doesn’t know the first thing about launching a coin on Solana. He’s essentially handed this “team” full power and authority to leverage his name, brand, and likeness however they see fit—in whatever bold or downright degenerate way they choose.

The extent to which this team might decide to sell their tokens could be entirely beyond Trump’s control. Who’s running what and the terms of these arrangements remain deliberately opaque—and that’s no accident.

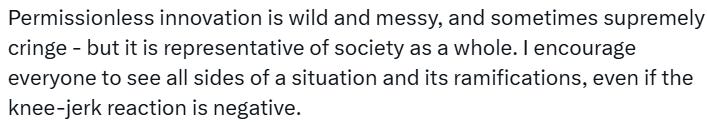

Perhaps the most controversial aspect of this entire spectacle is the ethical and moral debate it has sparked. There’s no denying that Trump launching a memecoin will bring new people into crypto. Memecoins, like it or not, have proven to be the most effective gateway for onboarding newcomers into this space. I’ve said this before and stand by it, even if I find this particular memecoin—and its implications—unsettling.

The nuance here is critical: newcomers won’t be navigating the complexities of acquiring SOL, downloading Moonshot, sending SOL to the wallet, and then swapping for $TRUMP. They’ll wait until it’s conveniently listed on Coinbase or Binance and buy it with a few clicks.

Moreover, the act of Trump launching a memecoin sends a loud and clear message to every American: Do whatever you want. If the President of the United States can launch a memecoin on Solana, then the perceived risks of prosecution or regulatory fallout in this industry are effectively diminished. It signals an unprecedented green light to push the boundaries of what’s possible in crypto. We need to start looking far beyond the immediate concerns of a SOL ETF or ETH staking approval because the landscape has fundamentally shifted.

Now for the negatives:

More than likely, this won’t end well. In an ideal scenario, the team sells only a small portion of the token supply, burns the majority, and uses any proceeds for public good—disaster relief, charitable causes, or even purchasing Bitcoin to benefit the public. But we don’t live in a perfect world. Instead, we live in a reality where tens of billions of dollars are printed out of thin air and controlled by anonymous players with the unchecked power to dump on retail investors in the coming months.

Let’s not gloss over the timing, either. Trump unveiled this memecoin during his Crypto Ball—a supposed celebration of sound policy, fresh leadership, and historic milestones. Three days before stepping into office as what many see as the most influential leader on the global stage, he’s launching a memecoin that, at its core, enriches himself at the public’s expense.

It’s a stark contradiction to the ideals of leadership, trust, and responsibility that his administration claims to champion.

To call this a conflict of interest is an insult to anyone who has ever genuinely committed one. I want to be wrong about this—I truly hope the proceeds are directed toward meaningful causes and that ethical decisions are made regarding the token’s supply and vesting schedule. But let’s be honest: I’m not holding my breath. Every step needed to set the stage for the largest grift in human history has been taken, and the only thing standing between this project and disaster are a handful of critical decisions.

As the token’s distribution widens and reaches more uninformed investors, how many of them will have any understanding of terms like “low float” or “high FDV”? Let’s not forget, there were undoubtedly insiders—those involved in the website’s creation, team members, and other contributors—who knew about this project before the public and capitalized the moment it launched. These aren’t just the degens who have notifications on for launches; these are people who had privileged access and likely walked away with life-changing profits.

If anyone still clings to the idea that this cycle might be different—that crypto will see steady, sustainable growth with shallow pullbacks—this should be your wake-up call. Trump’s actions just blew an entire lungful of hot air into the system, signaling he’s far from done. For those dismissing skepticism as mere PTSD from prior cycles, understand this: Trump’s moves are actively planting the seeds for cyclical behavior—times three. Giving every company, institution, and individual a green light to launch their own coin is a blueprint for anything but sustainable growth.

The more time that passes, the more I appreciate this take from Chris Burniske:

If this does turn out to be a pump-and-dump, all the libertarian freedom maxis will have some serious crow to eat. Until then, I’ll hold onto some cautious optimism. Speaking of hope, I’ve never been more convinced that the Strategic Bitcoin Reserve (SBR) is on the horizon. Beyond that, we may see other surprises like no capital gains on crypto, tailored tax treatments for specific coins (potentially bad news for Ethereum if Solana gains become tax-free), unexpected integrations of crypto into traditional finance, or even a $TRUMP ETF.

Solana is clearly dominating in terms of meme coins and cultural resonance. But this doesn’t make Bitcoin any less vital as the ultimate form of hard money, nor does it diminish Ethereum’s role as a trusted platform for tokenization and smart contracts. Don’t let the frenzy distract you from the bigger picture. Most people didn’t make life-changing profits from $TRUMP, and even if they did, it doesn’t change the underlying potential this industry holds.

The last time I felt this strongly about a moment was during the FTX collapse. This weekend feels like a pivotal turning point for the bull market—far more significant than ETF approvals. But don’t forget, nothing about this space is ever easy. If you’re feeling left out or holding what you think are the “wrong coins,” remember these emotions are universal. There’s so much more to this cycle than Solana and a Trump meme coin, and there are proactive steps you can take to prepare for what’s next.

For example, you could accumulate Bitcoin ahead of an SBR announcement, increase your exposure to Solana as it takes the lead this cycle, or go contrarian by betting on Ethereum as it catches up. Each strategy comes with its own risk/reward calculus, so as always, do your own research (DYOR). I may dive deeper into the “what should I do next” question soon, but for now, I’m letting the dust settle and gathering my thoughts before offering advice. One question I keep circling back to: what could possibly top this?

Can a meme coin launch ever surpass this? Or is the real question whether the likes of Taylor Swift, Mr. Beast, Ronaldo, Elon Musk, or even Putin are next? If they are—or aren’t—what does that mean for Solana’s trajectory this cycle and beyond? I’m not suggesting anyone fade Solana—it would be a death sentence right now—but it’s worth asking: how much higher can the ceiling go in terms of opportunity and growth?

At this point, I’ve practically written a novella, and even a few days doesn’t feel like enough time to fully process everything or articulate all the thoughts racing through my mind. That said, I’ll undoubtedly revisit this topic often, especially as more executive orders and breaking news unfold from this week’s chaos.

Thank you, as always, for taking the time to read these letters. Stories like this reignite my passion for both creative thinking and writing—two things I hold dear, second only to my love for this space. Let’s have an amazing week ahead!

Bitcoin Thoughts And Analysis

The Bitcoin weekly chart marks a historic milestone as the price has achieved a new all-time high today, surpassing previous highs to reach $108,388, which now serves as the immediate resistance level. This breakout above the critical $99,860 resistance, which has flipped into support, confirms the strength of the bullish momentum driving the market.

The move to this all-time high is accompanied by solid volume, underscoring strong buyer interest and confidence in the current trend. Bitcoin remains well above the rising 50-week moving average, which continues to act as a dynamic support and reinforces the long-term uptrend. The sustained green weekly candles and lack of significant bearish rejection reflect ongoing demand and healthy price action.

Moving forward, $108,388 is the key level to break, as flipping this resistance into support would likely signal continuation toward higher targets and into price discovery. On the downside, a retest of $99,860 could provide an opportunity for bulls to confirm the breakout's validity. With Bitcoin in price discovery mode, the market remains firmly bullish as it establishes new highs.

Altcoin Charts

Ethereum has reached a long-awaited key support level on the weekly ETH/BTC chart, around 0.03090 BTC. I am buying more - a lot more.

This level has been marked on my chart dating back to early 2021, and its retest is a crucial moment for the pair. This is where the liquidity lives. The recent price action shows Ethereum declining steadily to this region, suggesting a test of buyer strength.

The descending volume during this downtrend hints at decreasing selling pressure, a potential signal that a reversal or bounce may occur. However, if this support breaks decisively, the next logical support zone lies much lower, around 0.02750 BTC, making this level critical for bulls to defend.

For traders, this key level presents an attractive entry point for long-term accumulation, provided the support holds. Watching for bullish divergence on lower timeframes or a decisive weekly bounce with strong volume could confirm a reversal. Caution is warranted, as the ETH/BTC pair remains in a broader downtrend.

Trump’s team has aggressively been buying Ethereum the past few days.

Bitcoin dominance has broken above a descending trendline, currently sitting at 59.03%. This breakout suggests Bitcoin is beginning to absorb more market liquidity, a pattern often accompanied by altcoin underperformance. The next resistance lies near 59.92%, and a continuation above this level would confirm Bitcoin's growing market share. On the flip side, the breakout trendline near 58.5% now serves as immediate support. This shift in dominance reinforces Bitcoin's leading role in the market at the moment.

This is noteworthy considering the amount of liquidity that was sucked in the $TRUMP vortex. Altcoins are extra rekt for the moment.

Legacy Markets

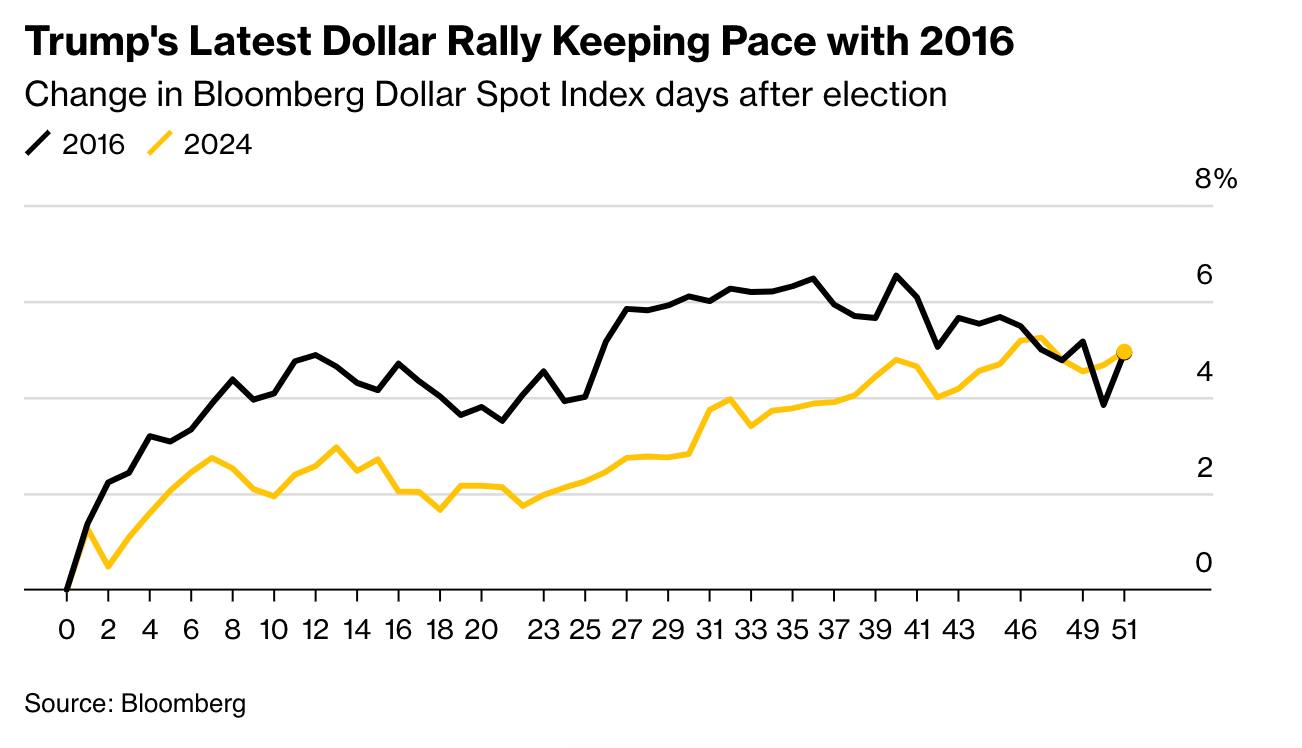

Markets were steady ahead of President-elect Donald Trump’s inauguration, with US equity futures trading in a narrow range and the dollar weakening. Bitcoin surged to a record, jumping 5.5%, boosted by news of Trump and Melania launching their own memecoins over the weekend. Trump's anticipated flurry of executive orders on energy, immigration, and trade is fueling both optimism about growth-focused policies and concerns over market volatility due to unpredictability.

Trump’s energy plans, emphasizing domestic fossil fuel production over renewables, pressured shares in Siemens Energy, Enel, and Vestas Wind Systems. Meanwhile, his conversation with Chinese President Xi Jinping boosted Asian markets as relations appeared to start on a positive note, with discussions on trade, TikTok, and fentanyl easing tensions. TikTok resumed US operations after a temporary reprieve from divestment requirements.

US Treasury yields remained elevated, with some analysts projecting a rise to 6% this year, driven by potential fiscal stimulus and growth-focused policies. However, the uncertainty surrounding abrupt policy changes could spark market volatility, especially as investors brace for potential inflation shocks and shifts in Federal Reserve policy.

In Europe, the Stoxx 600 steadied, while the dollar edged lower after a recent rally. Eyes are on the World Economic Forum in Davos, where Trump is set to address global leaders virtually. Additionally, the Bank of Japan’s policy decision on Friday, with a likely rate hike, will draw investor attention as markets navigate an environment marked by policy shifts and geopolitical developments.

Key events this week:

The annual World Economic Forum in Davos begins, Monday

Donald Trump to be sworn in as 47th president of US, Monday

UK jobless claims, unemployment, Tuesday

Canada CPI, Tuesday

New Zealand CPI, Wednesday

Malaysia CPI, rate decision, Wednesday

South Africa retail sales, CPI, Wednesday

ECB President Christine Lagarde and other officials speak at Davos, Wednesday

South Korea GDP, Thursday

Eurozone consumer confidence, Thursday

Turkey rate decision, Thursday

Norway rate decision, Thursday

Canada retail sales, Thursday

Trump will join the World Economic Forum for an online “dialogue”

Japan CPI, rate decision, Friday

India, euro area, UK PMIs, Friday

ECB President Christine Lagarde and BlackRock CEO Larry Fink speak at Davos, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures were little changed as of 5:55 a.m. New York time

Nasdaq 100 futures rose 0.2%

Futures on the Dow Jones Industrial Average were little changed

The Stoxx Europe 600 was little changed

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index fell 0.2%

The euro rose 0.4% to $1.0314

The British pound rose 0.2% to $1.2188

The Japanese yen was little changed at 156.40 per dollar

Cryptocurrencies

Bitcoin rose 4.2% to $107,931.17

Ether rose 3.9% to $3,355.01

Bonds

The yield on 10-year Treasuries was little changed at 4.63%

Germany’s 10-year yield was little changed at 2.54%

Britain’s 10-year yield advanced four basis points to 4.70%

Commodities

West Texas Intermediate crude fell 0.4% to $77.58 a barrel

Spot gold rose 0.2% to $2,708.24 an ounce

Vitalik Is Ready For Change

Here is the full statement:

“What we're trying to achieve is primarily the following goals:

Improve level of technical expertise within EF leadership

Improve two-way communications and ties between EF leadership and the ecosystem actors, old and new, that it is our role to support: users (individual and institutional), app devs, wallets, L2s

Bring in fresh talent, improve execution ability and speed

Become more actively supportive of app builders, and make sure important values and inalienable rights (esp privacy, open source, censorship resistance) are a reality for users including at the app layer

Continue to increase our use of decentralized and privacy tech and the Ethereum chain, including for payments and treasury management

Explicit *non-goals* are:

Execute some kind of ideological / vibez pivot from feminized wef soyboy mentality to bronze age mindset

Start aggressively lobbying regulators and powerful political figures (esp in USA, but really anywhere, especially large powerful countries), and risking compromising Ethereum's position as a global neutral platform

Become an arena for vested interests

Become a highly centralized org, or even more of a "main character" within Ethereum

These things aren't what EF does and this isn't going to change. People seeking a different vision are welcome to start their own orgs.”

When Vitalik speaks about non-goals, he’s laying out a clear framework of what the Ethereum Foundation intentionally avoids. These "non-goals" represent actions or principles that Vitalik believes would contradict Ethereum’s mission and values. Examples include:

No ideological pivots or alignment with specific cultural or political ideologies.

No lobbying or overt political engagement by the foundation.

Avoiding becoming a playground for vested interests.

Rejecting centralization in any form.

To clarify, his reference to rejecting a “feminized WEF soyboy mentality” underscores that Ethereum is not about leaning into extreme ideological stances—whether progressive or reactionary. The Ethereum Foundation’s focus remains on decentralization, inclusivity, and neutrality, aiming to uphold its principles of openness, privacy, and censorship resistance, free from divisive cultural or political agendas.

While this approach may not resonate with some U.S. investors who view lobbying or political alignment as vital for crypto’s success, Vitalik’s stance reflects Ethereum’s global nature. Crypto transcends borders and agendas, striving for worldwide adoption and innovation.

Importantly, nothing stops independent Ethereum organizations or communities from pursuing lobbying efforts or tackling ideological challenges if they believe it aligns with their vision. Vitalik’s ethos simply ensures that the Ethereum Foundation itself remains focused on its core mission.

Ten States Have Introduced Bitcoin Reserve Legislation

Here’s the growing list of states that have introduced Bitcoin legislation: Oklahoma, New Hampshire, North Dakota, Alabama, Pennsylvania, Texas, Ohio, Arizona, Massachusetts, and Wyoming. That makes 10 states so far, putting us at 20% of the way to all 50 states introducing their own versions or interpretations of an SBR.

What’s particularly noteworthy is Massachusetts, which has managed to secure bipartisan support—a promising development for broader adoption across diverse political landscapes.

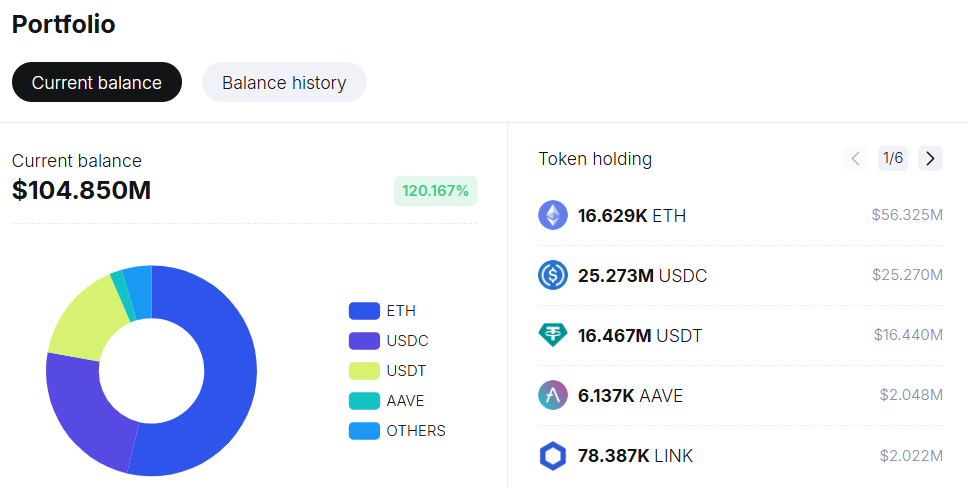

World Liberty Financial Bought More Ethereum

Ethereum remains intricately connected to the Trump ecosystem. Recently, World Liberty Financial made significant moves, transferring $61.4 million in ETH to a Coinbase Prime Wallet and following up with an additional $15 million purchase of ETH over the weekend. If you're looking to keep tabs on these transactions, click on either of the images below to dive into the portfolio trackers and explore the details.

In other ETH news, this is brewing:

Consensys becoming the next MicroStrategy would be an epic boost to Ethereum morale. It’s a plausible scenario for 2025.

The Biggest Bull Market Ever - Can NFTs Explode? | Luca Schnetzler, Pudgy Penguins CEO

Dive into this fun and inspiring episode of The Wolf of All Streets with Luca Schnetzler, the mastermind behind the incredible comeback of Pudgy Penguins! We explore how NFTs can thrive in a challenging market, the surprising success of physical products like Walmart toys, and what it takes to unite crypto communities.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.