The Wolf Den #1119 - Trump, Reserves, and Rumors: Separating Fact from Fiction

I don't think we are getting a memecoin strategic reserve...

Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Next week Arch Public will be releasing an update to our Bitcoin Algorithm. Specifically an Arbitrage strategy that is extraordinarily powerful. How powerful you might ask:

234% annualized returns.

11% annual cash flow.

You’re reading that correctly. Our Bitcoin Algorithm Arbitrage strategy will generate cash flow, while also producing exceptional annual returns that are 4.5X buy and hold Bitcoin returns.

Most of you reading this believe in Bitcoin, and so do we. Employing a strategy that generates cash flow, protects downside risk, and aggressively buys dips (completely hands free!) is about to be available to you.

Try Arch Public now! You can even demo the platform, for free, to learn more.

In This Issue:

Trump, Reserves, and Rumors: Separating Fact from Fiction

Aptos Weekly Review

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Coinbase Introduces Bitcoin-Backed Loans

Litecoin May Beat XRP And SOL To An ETF

VanEck Files For A New Kind of Crypto ETF

Bitcoin Ready To Explode As Trump Era Is Officially Coming

Trump, Reserves, and Rumors: Separating Fact from Fiction

Rumors were flying off the shelves yesterday—and at a steep discount, no less.

If you believed everything you read online, you’d think Solana, Ripple, and USDC are set to become Trump’s new BFFs as strategic reserve assets. Why? Because—cue dramatic drum roll—they were founded in the U.S.

Buhhh… Buhhhh… Buhhhhh… Bullllllshittt.

Here’s the context straight from the New York Post: “Crypto crowd ready for blue skies under Trump administration: Four-year ‘harassment’ is over.” Let’s dive in.

Let me be clear: it’s not entirely impossible for this to happen. After all, Trump is nothing if not unpredictable. But let’s not kid ourselves—rumors like this are par for the course in crypto. Shocking, I know.

That said, I’m not buying it. In this newsletter, I’ll break down exactly why this idea doesn’t hold water—and where the truth might actually lie.

Trump is not exclusively tethered to Bitcoin. If there’s enough interest or incentive, he wouldn’t hesitate to show up at an Ethereum or Solana event. Trump’s ability to follow the trail of money, votes, and popularity is unmatched, and he leans into opportunities that serve his brand and goals.

And let’s not overlook his indirect involvement with crypto beyond Bitcoin. Trump essentially has his own token. World Liberty Financial, a project reportedly “inspired” by Trump, lists him as a significant benefactor. The details and connections are outlined below, but it’s clear Trump’s crypto narrative extends beyond just Bitcoin maximalism.

“DT Marks DEFI LLC and its affiliates, including Donald Trump, may receive approximately 22.5 billion $WLFI tokens and are entitled to 75% of the net protocol revenues as specified in a services agreement. Importantly, World Liberty Financial and $WLFI are not politically affiliated and are not part of any political campaign.”

Trump also has his own NFTs:

Trump will always do what suits Trump. But let’s be real—SOL, XRP, and USDC don’t seem like his first picks, at least not initially.

Remember the buzz a while back about Ethereum potentially being included in a strategic reserve? The reasoning? Trump’s World Liberty Financial team had reportedly been buying Ethereum. Fun fact: they still hold that Ethereum. The rumors may have faded, but the holdings haven’t gone anywhere.

The Post might as well have run a headline claiming Ethereum was being considered for a strategic reserve because World Liberty Financial owns some, and therefore, Trump must be a fan. The "evidence" in the original article is just as thin as this entirely fictional scenario I just made up.

There’s a lot of financial incentive to keep rumors like these circulating. While I’d love to see a reserve strategy that includes BTC, ETH, and SOL, I can’t, in good faith, give this particular idea any credibility based on the facts we have so far. Investors with a financial motive will often say anything to gain an edge.

The Post is right about one thing: Trump wants America to lead. When I revisited his Bitcoin speech in Nashville, he mentioned "America" an impressive 41 times. But that doesn’t mean his vision for "America First" translates to a strategic reserve featuring Solana, Ripple, or USDC.

Here’s the quote that stands out:

“The reason I've come to address the Bitcoin community today can be summed up in two very simple words: America First.”

“If crypto is going to define the future, I want it to be mined, minted, and made in the USA. It's going to be...it's not going to be made anywhere else. And if Bitcoin is going to the moon, as we say...it's gone to the moon. I want America to be the nation that leads the way.”

It’s clear Trump values U.S.-based companies and wants to bring crypto business back to the U.S., reversing the hostile stance of the current administration:

“The Biden-Harris administration's repression of crypto and Bitcoin is wrong, and it's very bad for our country. It's really quite un-American.”

But let’s not jump the gun here. It’s a massive leap to go from Trump wanting U.S. leadership in crypto to Solana, Ripple, and USDC landing on America’s balance sheet. Trump hasn’t even explicitly committed to buying Bitcoin yet.

Furthermore, the key voices influencing Trump—David Bailey, Cynthia Lummis, Dennis Porter, Paul Atkins, David Sacks, Tim Scott, J.D. Vance, Scott Bessent, Howard Lutnick, Tom Emmer, and Tulsi Gabbard—are all firmly in the pro-Bitcoin or general pro-crypto camp. None of them have championed the inclusion of SOL, XRP, or USDC. The only individuals who might advocate for these assets are Brad Garlinghouse and Anatoly Yakovenko—and it's unclear if the latter has even met Trump.

The right move for America at this time is Bitcoin, and those around Trump should be reinforcing that message.

Now, here’s the nail in the coffin: Ripple has a track record of controversial decisions, and if there’s one thing Trump loves, it’s holding onto receipts. For instance, consider this:

Granted, it wasn’t officially a Ripple donation, but it made waves, sparking a wide range of opinions. Ripple CEO Brad Garlinghouse defended his co-founder’s move, saying:

“Obviously, Trump came out early and very aggressively… and said he’s the crypto president. Kamala and Team Harris have been more nuanced.”

Nuanced? Let’s call it what it is: a complete lack of action. Kamala has done nothing positive for this industry over the past four years. She didn’t even show up to the Bitcoin conference, likely because she knew it would be a PR disaster. Staying silent on crypto isn’t just bad optics—it’s tacit approval of an administration actively working against it.

And let’s be honest—Biden wasn’t calling the shots here. His administration's anti-crypto stance came from others pushing their own agendas, turning policymaking into a kangaroo court. Kamala had every opportunity to stand up for this industry and its potential, but she chose not to engage.

It gets worse.

Chris Larsen, Ripple’s co-founder and the man behind the donation to Kamala, also funded Greenpeace a few years back. On the surface, Greenpeace appears to be a noble “save the environment” organization. In reality, it spearheaded one of the most misguided anti-Bitcoin campaigns in history, spreading fear, uncertainty, and doubt (FUD) against Bitcoin mining and the institutions that support it.

Greenpeace’s campaign, with its laughable slogan, “Change the Code. Not the Climate,” pretended to offer a genuine solution while taking direct aim at Bitcoin. But it wasn’t about the miners or environmental impact—it was about carving out space for XRP. From the beginning, it was obvious the campaign was more about opportunism than ecological integrity.

Calling Bitcoin “climate-destroying” seemed absurd even then, but Greenpeace was pushing this narrative during the depths of the bear market—when Bitcoin had dropped to around $20,000 from its nearly $70,000 peak.

Did you notice there’s no mention of PayPal here? That’s because Greenpeace accepts donations through PayPal—a company with Bitcoin-friendly policies. Convenient, isn’t it?

Attacking Bitcoin was trendy at the time, and getting paid to do so was a significant win for Greenpeace. What they conveniently fail to mention is that Bitcoin miners can purchase excess renewable energy from the grid, helping to balance supply and demand. They ignore the role Bitcoin plays in mitigating gas flaring emissions and the fact that most mining operations now rely on renewable energy. They also omit how a new wave of investors has been inspired to create environmentally conscious infrastructure to optimize energy use and capture. Lastly, they overlook how miners contribute to securing and stabilizing the energy grid.

Greenpeace was Ripple’s tool to stir up drama and sow division. There’s no way they genuinely believe they can change Bitcoin’s consensus mechanism. Bitcoin’s code will never change, and its supporters will never bow to misinformed climate activists or Ripple’s underhanded tactics. While Trump may not be aware of this, the individuals he’s chosen to guide him in the crypto space likely have some understanding of what’s been happening. Greenpeace, which actively opposes what Trump aims to achieve, is fundamentally un-American—and Ripple is their top backer.

That said, nothing would truly surprise me at this point. However, based on the evidence available, it’s highly unlikely Solana, Ripple, or USDC (a stablecoin) will find their way into a strategic reserve before Ethereum. This year, Trump’s focus will remain on Bitcoin. Finalizing the SBR and purchasing Bitcoin will require significant effort, and anything else should be seen as a distraction until those goals are achieved.

Well said, David Bailey.

If Trump makes any comments about these assets, I’ll cover it here immediately. Until then, let’s stay focused on the SBR and approach it step by step. On that note, take a look at this:

Solana investors should focus on addressing the SEC’s classification of SOL as a security and pushing for ETF application approvals. Ethereum investors, on the other hand, should prioritize staking approval and staying competitive in an increasingly crowded Layer 1 landscape. Optimism is great, but baseless speculation only misleads newcomers.

To XRP holders: congratulations—I genuinely mean it. Nothing make me happier than seeing a beaten down community finally get their win. You all deserve it for being steadfast and holding so long.

The goal here isn’t to dampen enthusiasm but to cut through speculation and provide clarity. Let’s gear up for what could be an exciting week, where we might finally uncover the details of a crypto executive order!

Aptos Weekly Review

For those that don’t know, Aptos—the most exciting layer 1 blockchain competing with Solana and Ethereum—is now an official sponsor of this newsletter! Over the past few months, I’ve had the chance to get to know the Aptos team, create content with them, and watch this project accomplish incredible things.

Each week, I’ll provide an Aptos review, showcasing all the exciting announcements and milestones the network is achieving. This week let’s kick things off with this epic chart depicting Aptos’s active address growth.

Ande these impressive growth metrics:

Next, I want to highlight Aave’s integration with Aptos, which is being unveiled today, Friday, January 17, 2024, on Spaces at 4 PM UTC. Aptos will dive into Aave’s groundbreaking launch on Aptos—its first non-EVM deployment! The Space will share why this is a DeFi game-changer and what it unlocks on both platforms

Lastly, I want to share something I find interesting about Aptos that you might not be aware of. With AI being such a hot topic right now, Aptos is actively collaborating with Microsoft in this space.

“The partnership between Aptos Labs and Microsoft will work to provide a more seamless adoption of web3 by combining Microsoft’s AI expertise and high-tech infrastructure with Aptos Labs’ technical team and cutting-edge blockchain. Together on Aptos, and with the right partners, AI and blockchain make a powerful team. AI can decode blockchain’s complexities and make building on-chain accessible, while blockchain provides the security and transparency needed to solve AI’s perception problem. The result is a clear path to a user-first, decentralized online ecosystem.”

Make sure to show Aptos some love—they’re a huge reason this newsletter remains free!

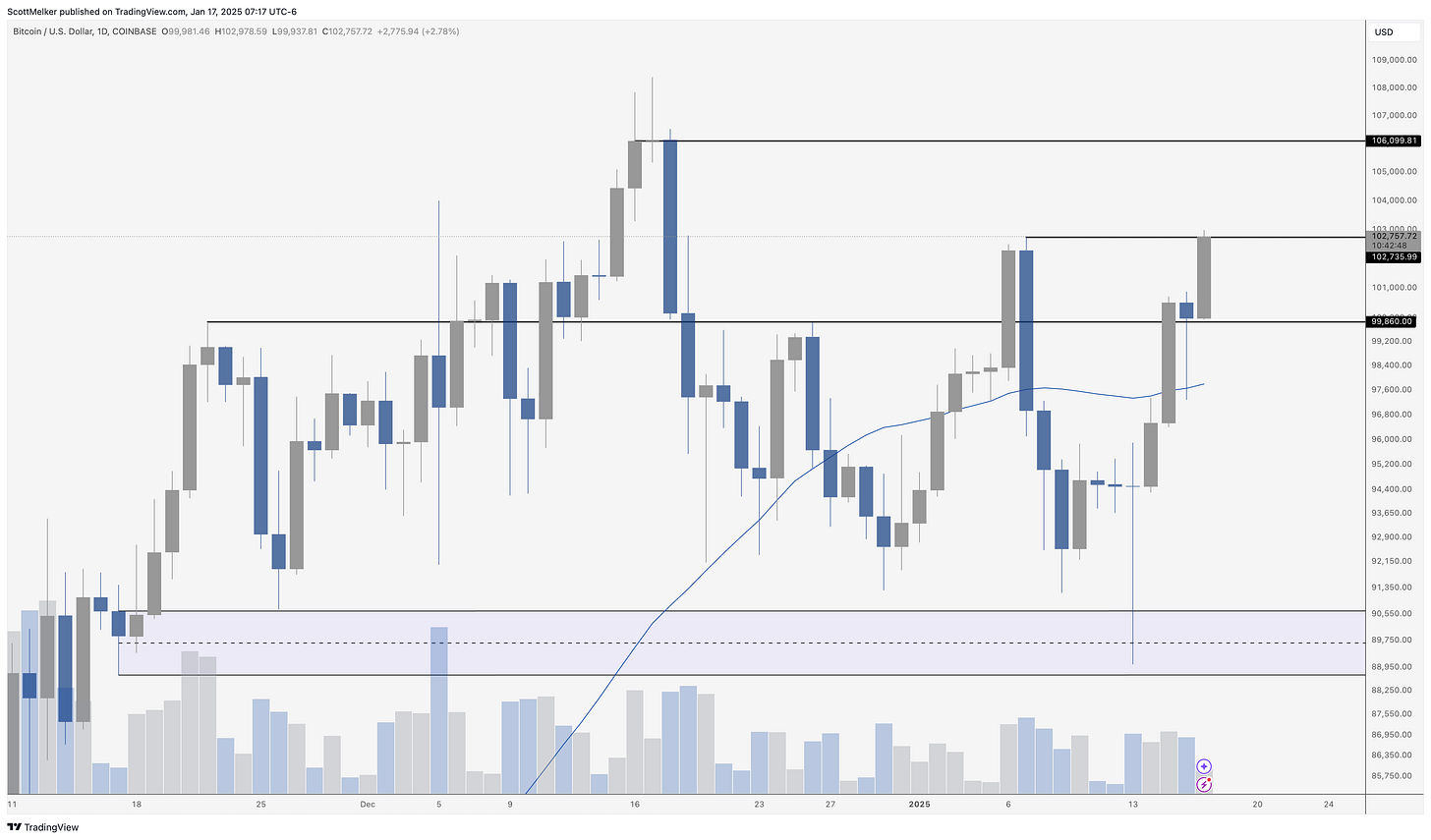

Bitcoin Thoughts And Analysis

Bitcoin is showing exceptional strength on the daily chart today, confirming the bullish momentum we have been tracking. As anticipated, Bitcoin retested the 50-day moving average around $97,600 yesterday, providing a textbook bounce and reaffirming this level as solid support. This successful retest aligns with the analysis shared yesterday, where we highlighted this as a critical area to watch for buyers to step in.

Now, Bitcoin is decisively above the key $99,860 resistance level, with a strong daily candle pushing through and blasting toward a new local high of $102,735. This breakout above resistance signifies a critical bullish confirmation and opens the door for a potential run toward the next major resistance at $106,099.

Volume is also picking up, adding validity to the breakout, while Bitcoin's structure continues to look constructive. Holding above $99,860 solidifies the case for further upside, and the retest of the 50-day moving average now provides a clearly defined support level for traders to watch. As Bitcoin pushes toward new local highs, the chart remains in a strong position, with the bulls firmly in control.

Altcoin Charts

The Solana daily chart is demonstrating strong bullish momentum, with the price rallying significantly off key support at $175, a level that also aligned with the 200-day moving average. Notably, I purchased more Solana live on YouTube at this support level on Monday, confident in the confluence of technical factors. The subsequent move upward has been impressive, as Solana now approaches the next resistance at $223.18.

Traders may want to approach this level with caution, as it represents a key area of interest. A breakout and retest of $223.18 as support could provide confirmation for further upside and present an opportunity to enter a long position. Alternatively, for those waiting for a potential pullback, watching for a retest of the 50-day moving average around $209 could offer a favorable entry point.

The chart structure remains constructive, and Solana's ability to hold above these key levels will be critical in determining whether this rally has more room to run. Volume is increasing, adding conviction to the recent price action, but the response at resistance will ultimately set the tone for the next move.

Legacy Markets

US stocks were set to rise on Friday as expectations of Federal Reserve rate cuts gained momentum, driving Treasury yields lower. S&P 500 futures climbed 0.4%, while Nasdaq 100 futures rose 0.5%, positioning US markets for their strongest weekly gain since November. Swap markets now anticipate 40 basis points in Fed rate cuts this year, reversing earlier skepticism about policy easing. Ten-year Treasury yields retreated further from recent highs, reflecting confidence that the US economy is not overheating.

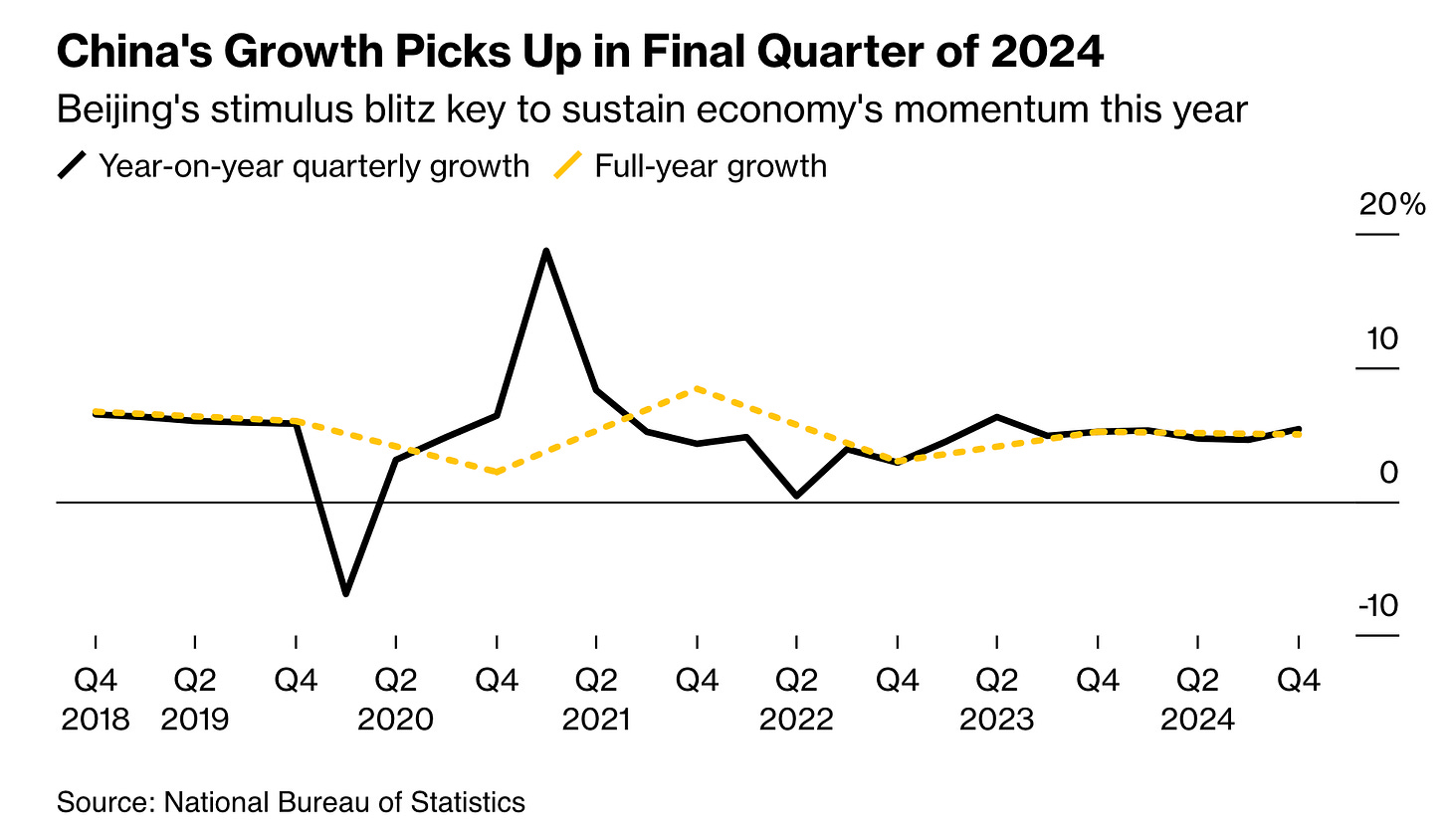

European stocks also advanced, with the Stoxx 600 on track for its best week since September, led by mining shares after news of preliminary merger talks between Glencore and Rio Tinto. London’s FTSE 100 hit a record high, supported by a weaker pound and strong basic resource stocks. Sectors tied to China’s economy, such as retail and autos, gained on signs that Beijing’s stimulus measures are bolstering growth.

In currency markets, the US dollar edged higher, while the pound slipped to its weakest level since November 2023 after UK retail sales unexpectedly fell, adding to concerns about the British economy. Meanwhile, Asian equities ended a three-day winning streak despite China’s economy growing at its fastest pace in six quarters, as looming US tariffs on Chinese exports weighed on sentiment.

Attention now shifts to President-elect Donald Trump’s inauguration on Monday, with investors closely watching his initial policy moves, including potential tariff hikes, tax cuts, and executive orders. Market participants remain cautious about whether Trump will act decisively or continue his rhetoric without immediate implementation.

Key events this week:

Eurozone CPI, Friday

US housing starts, industrial production, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.4% as of 6:36 a.m. New York time

Nasdaq 100 futures rose 0.5%

Futures on the Dow Jones Industrial Average rose 0.4%

The Stoxx Europe 600 rose 0.7%

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0304

The British pound fell 0.2% to $1.2211

The Japanese yen fell 0.3% to 155.68 per dollar

Cryptocurrencies

Bitcoin rose 2.1% to $102,240.7

Ether rose 3.3% to $3,428.81

Bonds

The yield on 10-year Treasuries declined two basis points to 4.59%

Germany’s 10-year yield declined two basis points to 2.52%

Britain’s 10-year yield declined five basis points to 4.63%

Commodities

West Texas Intermediate crude rose 0.4% to $79.02 a barrel

Spot gold fell 0.3% to $2,705.90 an ounce

Coinbase Introduces Bitcoin-Backed Loans

Ah, we’ve reached that familiar point in the cycle where leverage slowly piles up—until it doesn’t. Let’s hope we don’t revisit that scenario. If there’s one company I trust to handle crypto loans responsibly, it’s Coinbase. Sure, crypto loans were the domino that toppled many exchanges last cycle, but Bitcoin-backed loans, when done right, make sense. I’ve been waiting for their comeback, this time with a safer, more thoughtful approach.

This product is bound to attract attention, especially since borrowers can earn a 4% yield on USDC while holding the cash. That said, the 4% yield likely won’t fully offset the borrowing costs or mitigate the risks. From the demo, we saw a variable interest rate of 7.6% APR and a loan-to-value ratio of 50%. Once the feature launches on the web version, I’ll dive in and provide a more detailed breakdown.

A few key points stand out:

Variable interest rates – These are dynamically calculated by Morpho, adjusting in real-time based on market conditions with every block created on the Base blockchain.

Borrowing limits – Coinbase has set a maximum borrowing cap of $100,000.

I’ll be keeping a close eye on this one.

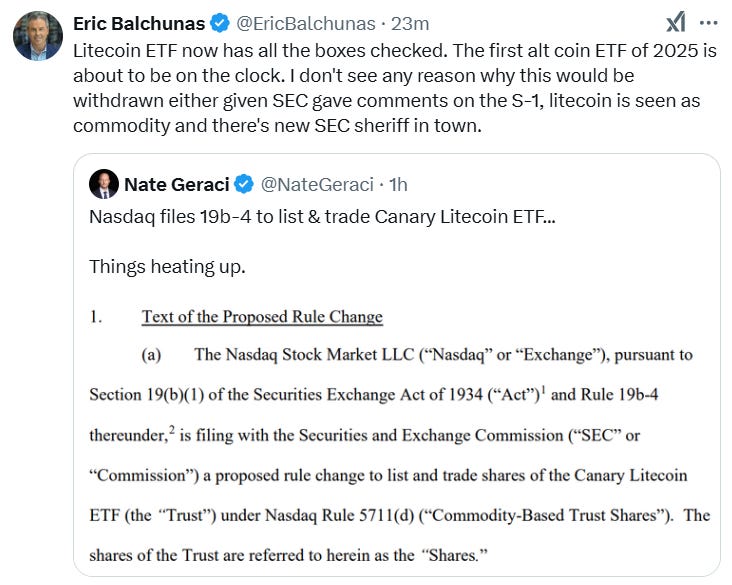

Litecoin May Beat XRP And SOL To An ETF

Rumors are circulating that Litecoin ETF filer Canary Capital has received feedback from the SEC on its application. If true, this could potentially position Litecoin ahead of XRP and SOL in the race for the next ETF approval. Adding to the momentum, Nasdaq has filed a 19b-4 form with the SEC on behalf of Canary Capital for the “Canary Litecoin ETF,” signaling progress in the approval process following the submission of an amended S-1 form.

According to the filing, Coinbase Custody will handle the ETF’s Litecoin storage, U.S. Bancorp Fund Services will act as the administrator, and U.S. Bank N.A. will manage cash custody.

What remains to be seen is whether the SEC’s new leadership will choose to approve these assets collectively or take a staggered, asset-by-asset approach over time.

VanEck Files For A New Kind of Crypto ETF

Dubbed the “Onchain Economy ETF,” this fund won’t directly invest in digital assets or commodities. Instead, it plans to allocate “at least 80% of its net assets to digital transformation companies and/or digital asset instruments,” according to its SEC filing. The fund’s investments will include crypto exchanges, miners, payment platforms, and commodity futures contracts.

While VanEck recently closed its Ethereum futures ETF, it’s encouraging to see the firm continuing to innovate with products aimed at bridging the gap between legacy capital and the digital asset ecosystem.

Bitcoin Ready To Explode As Trump Era Is Officially Coming

Trump's inauguration could push Bitcoin to a new all-time high—will it happen? And what if Moody's downgrades the U.S.? How would that impact the economy and crypto? Join me as I dive into these topics and more with Matthew Sigel, Head of Digital Assets Research at VanEck.

In the second part of the show, Dan from The Chart Guys will share his market analysis and some trades.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.