Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Use my link HERE.

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 400 trading pairs, minimal fees, peer to peer trading, derivatives, up to 100x leverage.

Make sure to check if Phemex is available in your jurisdiction.

In This Issue:

Things Are About To Get Crazy

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Oklahoma Introduces SBR Bill

An SEC Overhaul Is Coming

U.S. Crypto Policy is Getting Better and Better

CoinMarketCap Fooled Its Users

CPI’s Shockwave: Bitcoin Skyrockets! Plus, The RWA Takeover

Things Are About To Get Crazy

Cynthia Lummis is the Senator who introduced the Strategic Bitcoin Reserve bill immediately after Trump’s speech at Bitcoin 2024 in Nashville, TN, seen below.

Well, she is now saying this…

AND THIS…

For those who don't know, Cynthia Lummis, a Senator from Wyoming since 2021, has been a pioneer in the crypto space for years. She bought her first Bitcoin in 2013 on her son-in-law's advice and has since earned the title of Congress’s “Crypto Queen” for her tireless efforts to pass sensible, responsible, and clear legislation for the industry. Most people in crypto today recognize her name from co-sponsoring the “Lummis-Gillibrand Responsible Financial Innovation Act.” However, her most significant contribution to the space is her leadership behind the “S.4912 - BITCOIN Act of 2024,” also known as the SBR.

Her hints about “things getting crazy” and “starting on the SBR in 6 days” should be taken seriously.

On that note, I wanted to take today to share my personal tier list for gathering credible crypto information to help keep us grounded. If things are about to get crazy, as I suspect they will in the coming months, it’s going to become even harder to make sure the information we’re consuming is accurate and reliable. While useful insights can sometimes come from less reputable sources, the general rule of thumb is that the closer you are to the source, the more trustworthy the information tends to be.

Disclaimer:

The tier ranking below is subjective and based on my personal opinion. You might have a different ranking or additional sources not listed here. Use this as a starting point and adjust it based on your preferences. If you already have a reliable system, stick with it—continuous improvement is the key.

My grading system starts with S-tier (superior) and ends with D-tier (dumps).

S-Tier: The Most Reliable Sources

These are considered the gold standard for accurate and insightful crypto information. They often provide detailed, in-depth analyses and are usually primary sources.

Institutional-grade trading platforms

Academic research papers

Legal precedents, documents, and reports

Academic and official certificate programs

On-chain analytics tools

For example, when discussing the Bitcoin bill mentioned earlier, the bill itself (available on Congress.gov) is the most reliable source to refer to for accurate information.

A-Tier: High-Quality but Not Perfect

S-tier information is present here but in lesser quantities. These sources are generally reliable and informative but may not have the same prestige or trustworthiness as S-tier. Mistakes are rare but do occur.

Whitepapers and roadmaps: Be wary of exaggerated claims.

CoinMarketCap/CoinGecko: They lack perfect real-time accuracy and miss some details.

GitHub: Useful but not immune to censorship or centralization concerns.

Twitter (depending on who you follow): Echo chambers and limited direct sourcing can be an issue.

Crypto news outlets (e.g., CoinDesk, Cointelegraph, Bloomberg, Reuters): Occasionally get things wrong but are still valuable.

Cryptocurrency exchanges: Exchanges have limitations—2022 taught us to be cautious.

Politicians: More on this below.

Incoming President Donald Trump and Senator Cynthia Lummis fall into this category. While what they say is likely S-tier in terms of significance, politics is inherently unpredictable, and narratives can evolve quickly.

B-Tier: Decent but Requires Vetting

These sources provide useful insights but often require additional research to verify accuracy. Hidden gems exist here, but so does misinformation.

Medium

Reddit

Podcasts

Crypto newsletters

Crypto courses

YouTube

These platforms are content-rich but vary significantly in credibility depending on the creators. The risk/reward ratio is higher, but with careful vetting, they can provide valuable insights.

C-Tier: Proceed with Caution

These sources are less established and often riddled with biases or inaccuracies. Use them sparingly and verify everything.

Conferences, events, and meetups: Some are great, but many come with strong biases.

Facebook groups: Generally disconnected from reality—avoid unless necessary.

Telegram/Discord/Slack: These are scam-prone, but there are occasional gems.

D-Tier: Avoid

These sources are unreliable and often misleading. They add unnecessary risk and rarely provide worthwhile rewards.

TikTok

Regulators (not all): Many lack deep understanding of the space.

Celebrities

Pop culture references

Context and Exceptions

Any source can contain information that varies in quality. For instance:

Twitter has plenty of D-tier accounts, but some are S-tier.

Telegram and Discord are rife with scams but also house some high-quality discussion groups.

For the B-tier, the issue lies in interpretation. Podcasts, newsletters, and YouTube channels often provide commentary on S-tier and A-tier content. While this can make complex material more digestible, it also opens the door to biases and misinterpretations. That’s why these sources fall a notch below.

As for whitepapers and roadmaps, while they are primary sources, their quality can range drastically. Compare reading Bitcoin’s whitepaper to skimming the roadmap of a speculative NFT project with anonymous founders—there’s no contest.

Why This Matters

Take time to evaluate your information sources now. As the cycle progresses, the market will reach a point of information overload. Sorting the credible insights from the noise will become increasingly challenging. Doing this work now will pay dividends later.

Improving the quality of the information you consume can significantly impact your decision-making and earnings. While D-tier sources are tempting, they carry enormous risks. As you move up the tier list, the confidence you can have in your insights increases dramatically.

In Other News:

The crypto space is buzzing with activity. Dubai is reportedly constructing a 17-story Crypto Tower in the Dubai Multi Commodities Centre (DMCC). The project, offering 150,000 square feet of leasable space for Web3 projects, is yet another sign of the UAE’s determination to compete with the U.S. for blockchain dominance. Typical bull market news—but still, wow.

We are 100% in a bull market.

Bitcoin Thoughts And Analysis

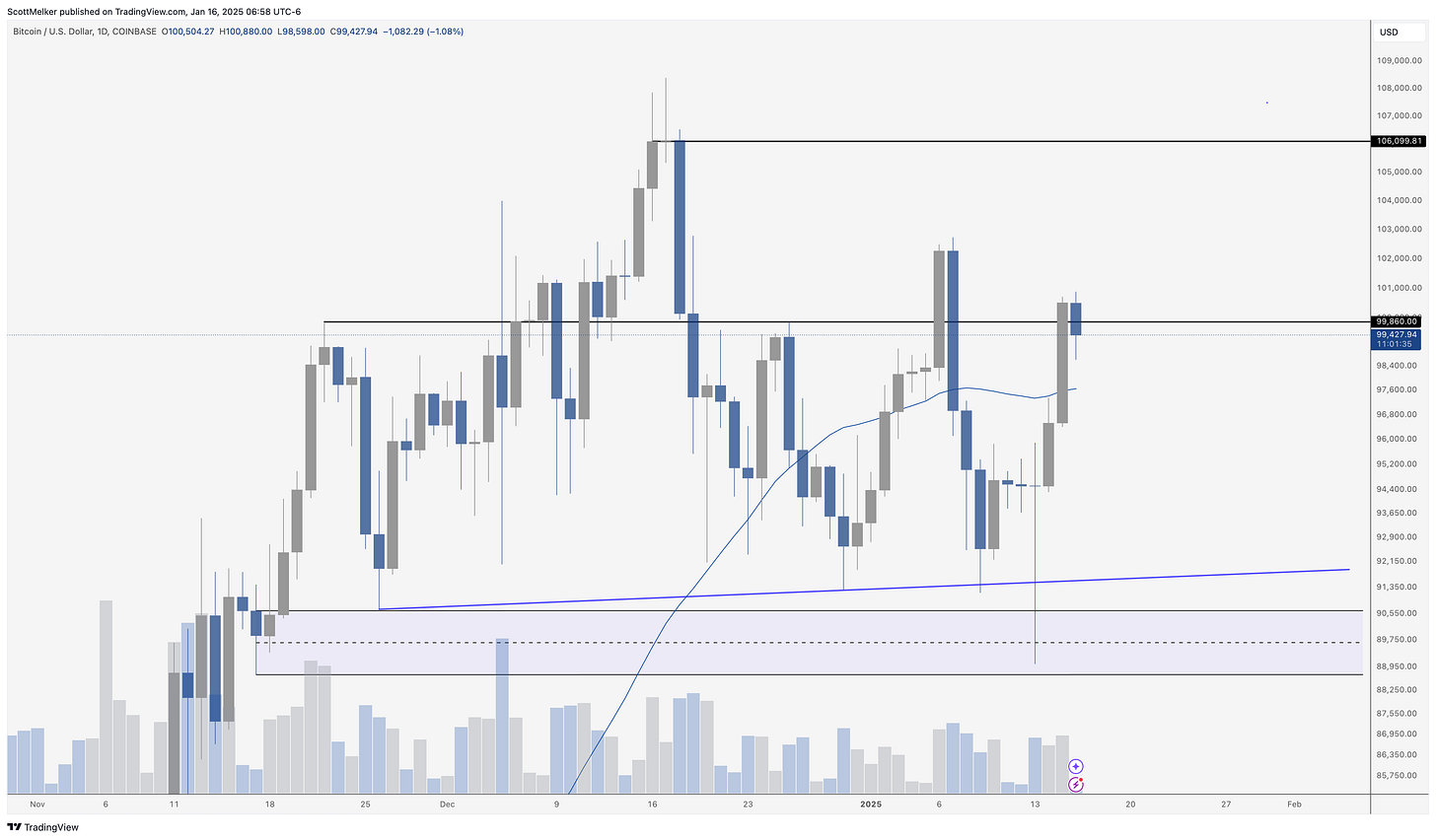

Bitcoin achieved a pivotal daily close above the key $99,860 resistance level, marking a significant bullish development. This close not only solidifies the reclaim of this critical level but also signals the potential for further upside momentum in the near term. The break above $99,860 had been a crucial hurdle for bulls, and this close now shifts the focus toward the next major resistance at $106,099. That said, we are trading below it today and need to hold. Today’s close is meaningful.

Adding to the bullish case, Bitcoin remains well above the 50-day moving average, currently around $97,600, which has now established itself as solid support. The daily candle demonstrated clear strength, indicating that buyers are stepping in with confidence. This level will be a critical area for bulls to defend moving forward to sustain the breakout.

With Bitcoin back above $99,860, the immediate outlook leans bullish, with the potential for a move toward $106,099 if momentum continues. However, it’s important to monitor volume closely, as stronger participation would further validate this breakout. Any pullbacks should find support at the 50-day moving average, providing an area of interest for buyers.

For now, the daily close above resistance is a key win for the bulls, setting the stage for potentially more upward momentum in the days ahead.

Altcoin Charts

Altcoins look good. They outperformed Bitcoin on this bounce, as can be seen below on Bitcoin Dominance, which is dropping fast.

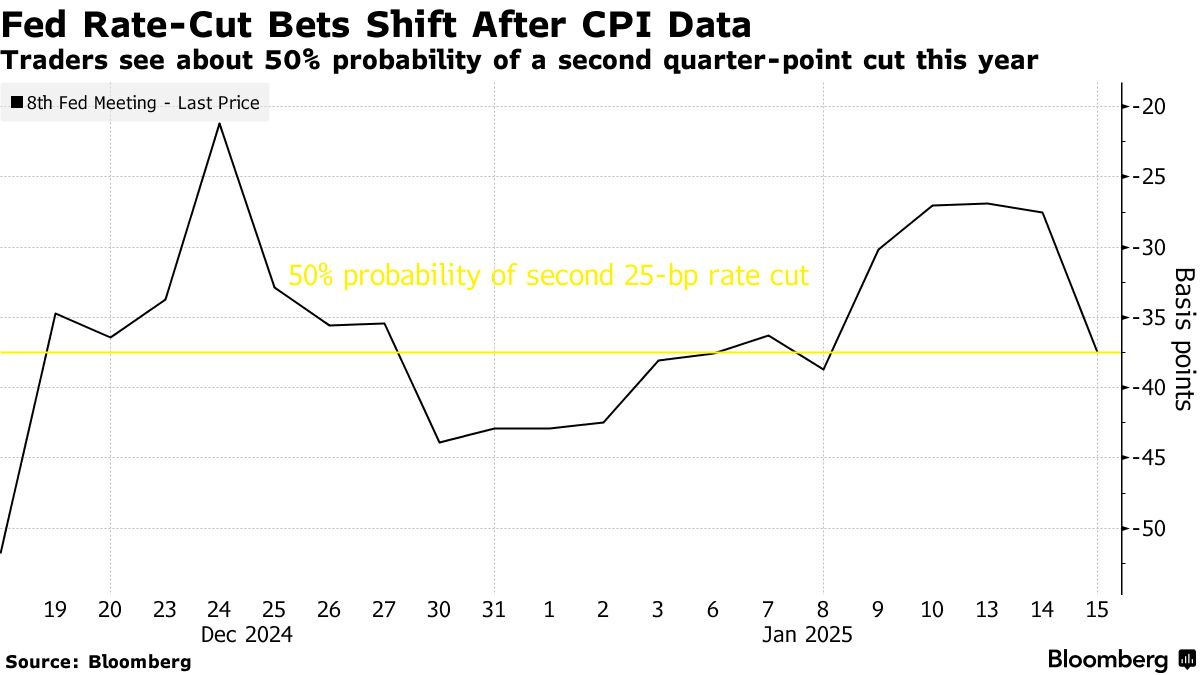

With the news that the SEC will likely pause or drop enforcement actions when the new administration comes in, renewed confidence in markets after CPI, and people once again believing the bull market is back, I am feeling very positive about alt season returning, as it should in the coming phase of the cycle.

As you know, I bought BTC and Solana on the dip on Monday, live on YouTube. The follow through the past few days gives me even more confidence.

Here’s another one that I shared on twitter on Monday…

Here is is now.

Pay attention to the altcoins that outperform on the dips - they are likely to be the winners this cycle.

Legacy Markets

Key events this week:

ECB releases account of December policy meeting, Thursday

Morgan Stanley earnings, Thursday

US initial jobless claims, retail sales, import prices, Thursday

China GDP, property prices, retail sales, industrial production, Friday

Eurozone CPI, Friday

US housing starts, industrial production, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.2% as of 7:05 a.m. New York time

Nasdaq 100 futures rose 0.4%

Futures on the Dow Jones Industrial Average fell 0.2%

The Stoxx Europe 600 rose 0.7%

The MSCI World Index rose 0.1%

Currencies

The Bloomberg Dollar Spot Index rose 0.1%

The euro was little changed at $1.0288

The British pound fell 0.3% to $1.2210

The Japanese yen rose 0.4% to 155.87 per dollar

Cryptocurrencies

Bitcoin fell 0.8% to $98,913.14

Ether fell 2.6% to $3,342.84

Bonds

The yield on 10-year Treasuries advanced one basis point to 4.66%

Germany’s 10-year yield advanced one basis point to 2.57%

Britain’s 10-year yield declined two basis points to 4.71%

Commodities

West Texas Intermediate crude fell 1.1% to $79.16 a barrel

Spot gold rose 0.4% to $2,706.74 an ounce

Oklahoma Introduces SBR Bill

There are moments when I scroll through X and feel an immense sense of pride in being part of this community. Yet another U.S. state, Oklahoma, has introduced an SBR bill, making it the sixth state to do so, joining New Hampshire, North Dakota, Alabama, Florida, Pennsylvania, Texas, and Ohio. While the contents of the bill haven’t been made public yet, Rep. Cody Maynard (R-Durant), the driving force behind the bill, has left no doubt about his stance on Bitcoin.

“Bitcoin represents freedom from bureaucrats printing away our purchasing power. As a decentralized form of money, Bitcoin cannot be manipulated or created by government entities. It is the ultimate store of value for those who believe in financial freedom and sound money principles. This bill is about protecting the hard-earned money of Oklahoma’s citizens. By diversifying our state’s savings and pension funds into digital assets, we are not only securing a stronger financial future for our state but also demonstrating Oklahoma’s leadership in adopting innovative fiscal policies.”

The proposed legislation, HB1203, is set to be considered in the upcoming legislative session beginning Feb. 3, with an effective date of Nov. 1, should it pass.

The second half of this post is a much-deserved shoutout to House Majority Whip Representative Tom Emmer (R-MN, 6th District). I can’t say enough positive things about Rep. Emmer. His tireless efforts to push forward meaningful crypto legislation have earned him well-deserved recognition, and his recent selection as Vice Chairman of the Subcommittee on Digital Assets is a testament to his leadership.

It’s not just a win for Rep. Emmer—it’s a huge win for all of us. Let’s hope this momentum continues to build.

An SEC Overhaul Is Coming

A Reuters article that made waves yesterday reported that top Republican officials at the SEC are gearing up to reshape the agency's cryptocurrency policies as soon as next week, coinciding with President-elect Donald Trump’s inauguration. This comes from “three people familiar with the matter.” While the timing remains uncertain until Paul Atkins is confirmed by the Senate, Commissioners Hester Peirce and Mark Uyeda will hold the majority. Notably, anti-crypto Commissioner Crenshaw’s renomination vote was postponed, making her continuation at the SEC increasingly unlikely.

What adds a layer of optimism is the strong connection between Peirce, Uyeda, and Atkins. Both Peirce and Uyeda served as aides to Atkins during his tenure at the SEC from 2002 to 2008, and the three have maintained a strong working relationship since.

This line from the article drew the most attention:

“In the first few days of the new administration, the SEC is expected to begin a review of those court cases and potentially freeze some litigation that does not involve allegations of fraud, said two of the sources. Some of those cases could eventually be withdrawn.”

If this plays out, it could mark a significant shift in the SEC’s approach to crypto, especially in terms of enforcement actions that have stifled growth in the sector. The best-case scenario? Rapid SEC movement on pressing crypto issues, clearing the path to tackle other priorities like the Solana ETF and Ethereum ETF staking.

It’s looking more likely by the day that we’ll see meaningful progress sooner rather than later.

U.S. Crypto Policy is Getting Better and Better

It’s not just the SEC making strides in crypto regulation in 2025. Republican Senator Tim Scott, the new chair of the U.S. Senate Banking Committee, has made establishing a regulatory framework for digital assets a top priority for the 119th Congress. His agenda for the 119th Congress dedicates an entire segment to crypto, emphasizing its significance. What makes this development even more striking is the stark contrast with the previous chair, Sherrod Brown, who received an ‘F’ rating on StandWithCrypto.org, while his successor, Senator Scott, has earned an ‘A.’

Developing a Framework for Digital Assets

“Under Chair Gensler, the SEC refused to provide clarity to the cryptocurrency industry, which has forced projects overseas. Moving forward, the committee will work to build a regulatory framework that establishes a tailored pathway for the trading and custody of digital assets.”

CoinMarketCap Fooled Its Followers

Earlier yesterday, CoinMarketCap pulled a wholesome prank on its followers via posting a token contract address on its X account, raising concerns it had been compromised to promote a scam token. The post, which stayed up for over 50 minutes, initially sparked fears of a hack. However, Coinmarketcap clarified that the post was a warning to users that it has no official token and will not promote one with a direct link. The platform confirmed it hadn't lost access to its account but instead used the post to alert its community about potential malicious links. For those who looked carefully, the contract address that read, “1xCh3ck0utTh32o2425CmcY3Ar8o0kR1gHtn0w2vpump” actually says, ‘Check out the 2024/25 CMC Yearbook Right Now.’ We got trolled.

CPI’s Shockwave: Bitcoin Skyrockets! Plus, The RWA Takeover

I am joined by Sid Powell, Co-Founder of Maple Finance, DeFi’s Institutional Lender. We are discussing the upcoming CPI report and it's impact on Bitcoin and of course the RWAs boom!

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.