Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Trading Alpha Released A Super Cool Product!

One of the partners of this newsletter, Trading Alpha, my trusted indicator and trading community, has launched their proprietary Indicator Search Engine for All Markets. This custom Indicator Screener scans crypto, stocks, and forex markets for Trading Alpha indicator setups, eliminating the need for time-consuming manual analysis. It can simultaneously screen for multiple indicators, enhancing confluence and providing advanced analysis capabilities across different markets. This is cutting-edge technology for serious traders.

Make sure to use my link HERE if you plan on giving it a try. Use code '10OFF' for a 10% discount.

In This Issue:

Will SOL and XRP ETFs Soar?

Bitcoin Thoughts And Analysis

Legacy Markets

The Crypto Ball

IBIT Expands To Canada

Companies Buying Bitcoin Is An Overlooked Megatrend

Bitcoin: Is The Bottom In? $250,000 By The End Of 2025?

Will SOL and XRP ETFs Soar?

If there’s one lesson we’ve learned in crypto, it’s that nothing is official until it’s truly official. While there’s no absolute guarantee that a spot SOL or XRP ETF will ever gain approval in the U.S., I believe it’s highly likely. The new SEC chairman is pro-crypto, and Brad Garlinghouse, Ripple’s CEO, has been networking with Trump and is well-acquainted with the SEC—connections that could prove advantageous.

As for Solana, it has solidified its position as a top contender, competing with Ethereum as the industry’s second favorite asset. Since its late 2022 bottom, Solana has generated significant positive momentum. Both Solana’s and Ripple’s impressive comebacks make them well-deserving candidates for ETFs.

I’m focusing on these two assets today because a JPMorgan analyst has already issued bullish predictions ahead of their potential ETF approvals. It’s worth examining whether the current data supports these predictions as fact or fiction. Below is the headline that went viral yesterday.

Here’s the image that everyone’s been weighing in on:

Matthew Sigel from VanEck also shared his thoughts:

Before diving deeper, let’s set the stage for these two assets. For those curious, here’s a running list of who has filed for ETFs:

XRP Filers:

Canary Capital

Bitwise

21Shares

WisdomTree

SOL Filers:

VanEck

21Shares

Bitwise

Canary Capital

Grayscale

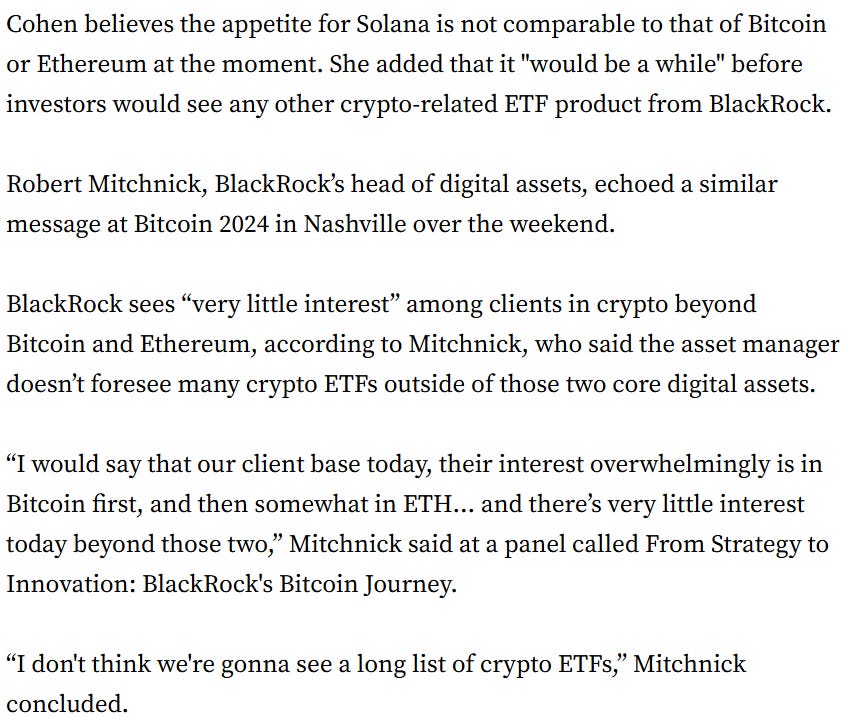

What stands out from these lists is the absence of BlackRock or Fidelity for either of these tokens, which raises the question: Do these two filers matter? I strongly believe the answer is yes, and here’s why. BlackRock and Fidelity are the undisputed leaders in the crypto ETF space—it’s not even close.

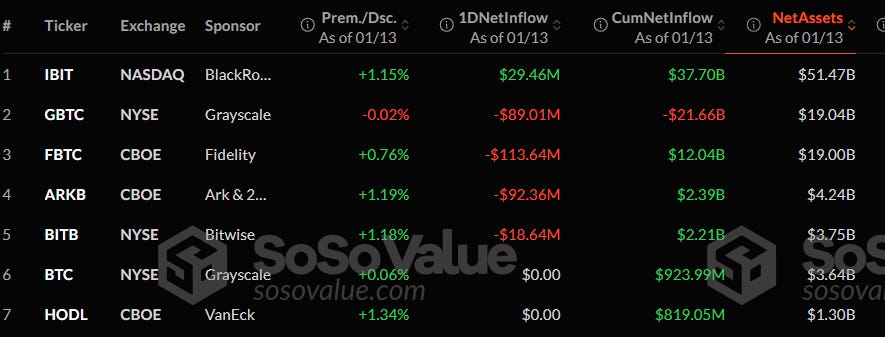

Below, I’ve included images showing cumulative net inflows and total net assets. Take a look at these figures:

For cumulative net inflows, IBIT leads with $37.7B, followed by Fidelity at $12.04B. The next largest, ARK, trails significantly with just $2.39B. Here’s a closer look, which essentially reinforces the same point: BlackRock and Fidelity are the ETF market.

The same holds true for Ethereum as well.

The success of BlackRock and Fidelity in capturing market share is no accident. Their networks, capital, and clientele far outstrip those of Bitwise, Grayscale, Canary, 21Shares, and the other filers combined. Institutional interest in Solana and XRP—or any other asset—largely hinges on BlackRock and Fidelity stepping in. Could Bitwise or another issuer step up if they don’t? Sure, it’s possible, but given the current dynamics, I’m not overly confident about that.

The reasons BlackRock and Fidelity haven’t filed for a spot XRP or SOL ETF likely boil down to several factors:

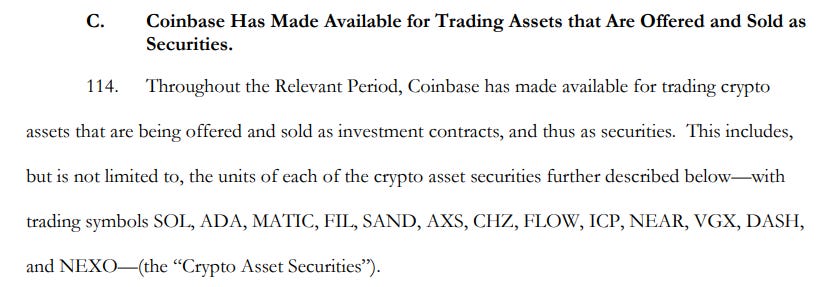

SOL’s classification as a security in the SEC’s Coinbase complaint.

Low client interest compared to Bitcoin and Ethereum.

Ethereum’s position as the bellwether, which is performing adequately but not exceptionally.

The current political and regulatory environment, which remains anti-crypto (though this is likely to shift soon).

Prioritization elsewhere as they focus on other crypto products or broader ETF strategies.

For reference, here’s a screenshot from the Coinbase lawsuit:

And here’s what we know from BlackRock:

Opinions can shift rapidly in this space, so it wouldn’t surprise me to see BlackRock move forward with a SOL or XRP ETF—or to see them pass on it for a while, or even indefinitely. If BlackRock does submit an application for either of these assets, it signals that they see significant potential for success—and success will almost certainly follow. BlackRock doesn’t lose.

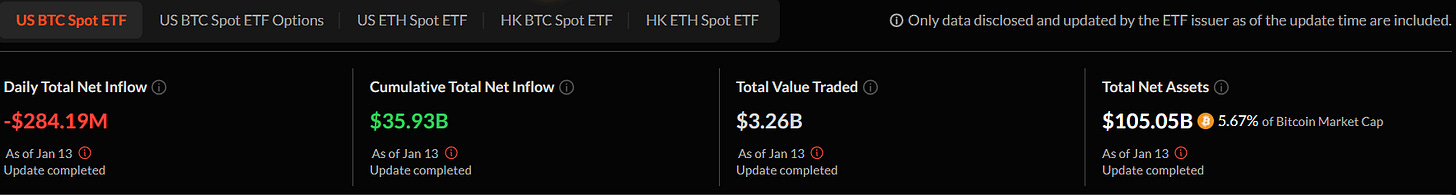

Let’s dive into the numbers. It’s important to distinguish between total net assets (TNA) and cumulative net inflows. SoSoValue provides a clear explanation:

Total Net Assets: “The total net value in US dollars of all assets held by all U.S. Bitcoin Spot ETFs at a specific point in time. This value is indicative of the total asset scale of the ETFs.”

Cumulative Total Net Inflow: “The cumulative sum of 1D Net Inflow of all U.S. Bitcoin spot ETFs since their listing. This value reflects the change in incremental funds brought to Bitcoin by the ETFs over time.”

For context:

Bitcoin

Cumulative Total Net Inflow: $35.93B

Total Net Assets: $105.05B (5.67% of BTC’s market cap)

Ethereum

Cumulative Total Net Inflow: $2.41B

Total Net Assets: $10.87B (2.92% of ETH’s market cap)

The difference between these figures arises because TNA includes both the actual capital invested and any changes in the value of the ETF’s holdings, while cumulative net inflows only account for new funds added. For Bitcoin ETFs, TNA can increase significantly due to Bitcoin’s price appreciation, even if inflows are relatively modest.

JPMorgan’s prediction centers on total net assets (TNA).

The U.S. Bitcoin spot ETF began trading on January 11, 2024, and the Ethereum spot ETF launched on July 23, 2024. Bitcoin has now been trading for 1 year and 4 days, while Ethereum has been active for about 6 months (5 months and 26 days).

Personally, I find it hard to imagine XRP and SOL achieving penetration between 3% and 6% of their market caps without the involvement of BlackRock and Fidelity. These two giants account for 67% of Bitcoin’s total net ETF assets and 42% of Ethereum’s total net ETF assets. Ethereum could potentially exceed 3% penetration if the market trends upward in the coming days before it hits the 6-month mark, but assuming XRP and SOL would automatically follow similar performance metrics feels like a stretch.

My take? ETH will underperform BTC in inflows, while XRP and SOL will underperform ETH. This is assuming BlackRock and Fidelity are in the mix. My opinion might shift if SOL continues to outperform ETH over the long term—think cycle to cycle. Yes, this view is controversial, so feel free to disagree.

Wall Street barely understands Ethereum as it stands, so adding two more ETFs into the mix doesn’t necessarily make decisions easier for institutional investors. Applying equivalent market cap penetration assumptions doesn’t make sense when ETH hasn’t mirrored Bitcoin’s level of penetration. While its ETF lifespan is only half as long as Bitcoin’s, ETH remains less understood, and staking isn’t yet available in an ETF format. Without BlackRock and Fidelity, the 3% to 6% penetration range feels like wishful thinking.

Don’t get me wrong—I’d love to see Bitwise or VanEck capture a disproportionately large market share of ETF inflows and assets, but I don’t see that happening.

For Solana, its strength this cycle has been its outperformance of ETH, which could help provide a boost in inflows when ETFs roll out. However, I’m not convinced that’s enough. Additionally, XRP is a polarizing asset in the crypto world, and that fact can’t be ignored. Solana does have the advantage of not managing large amounts of outflows like ETH did when it converted to an ETF, but that’s not exactly a celebratory point—it’s simply indicative of lower demand.

In other news, this happened yesterday:

The fund includes XRP and SOL.

The logic behind this ETF discussion is clear: if funds for XRP and SOL were approved, it would legitimize these assets and likely accelerate the timeline for additional approvals. Personally, I have zero doubt that both XRP and SOL will have ETFs in 2025. The real questions are whether BlackRock and Fidelity will file for them and if investors will have an appetite for these assets when they arrive.

Timing will also play a crucial role. Investors need to consider the time left in the current cycle and when these ETFs are likely to go live. While ETFs can drive significant inflows, they won’t shield XRP and SOL from the inevitable bear market that follows the bull market’s peak. Bitcoin and Ethereum’s ETFs have benefited from the current bull market momentum, but launching an ETF in the final stages of the cycle isn’t ideal for reaching the penetration levels JPMorgan predicts within a 6-month to 1-year timeframe.

Of course, anything can happen in crypto—it’s a market full of surprises. However, if XRP and SOL ETFs do achieve these penetration levels, I’d also expect significant strength for Ethereum this year. Investors aren’t likely to skip over ETH in favor of XRP and SOL, especially those with only a surface-level understanding of the space. For most, diversifying beyond Bitcoin into an Ethereum ETF is the logical next step.

When crypto indexes finally arrive, they’ll likely perform phenomenally, but launching late in a bull market only provides limited upside—similar to what I anticipate for XRP and SOL ETFs under such conditions.

I hope this gives you some perspective on what should be on your radar for 2025. It’s encouraging to see signs of life returning to the market. Sentiment-wise, Trump’s return feels fresh and exciting as a crypto investor, and I imagine many others feel the same. There’s a renewed sense of optimism—breathe it in.

Bitcoin Thoughts And Analysis

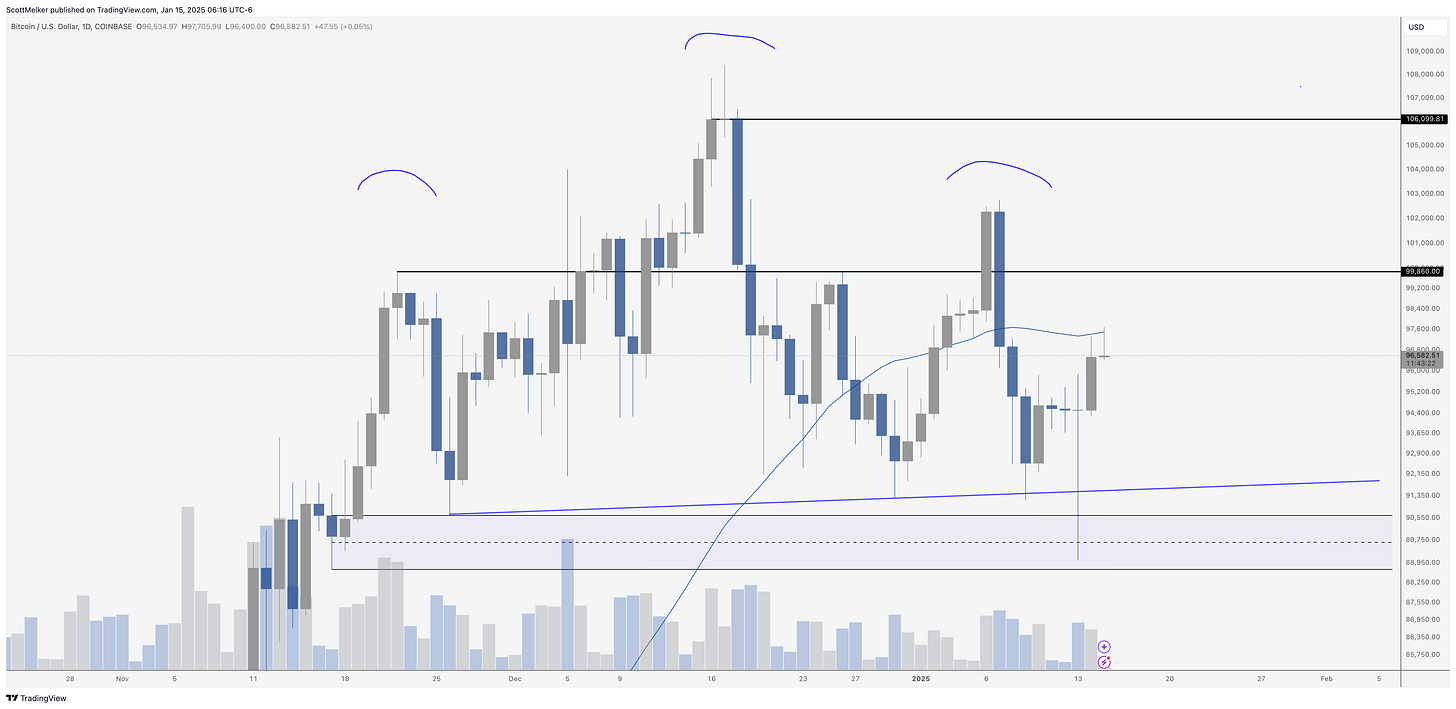

The Bitcoin daily chart continues to develop within a critical range, showing resilience and potential for short-term recovery but facing significant resistance. Yesterday's candle closed near the 50-day moving average (currently at $97,500), which has acted as dynamic resistance and support since early January. Today's price action reflects some indecision as the market grapples with this key level.

Notably, the price has yet to reclaim the $99,860 resistance zone. The potential head and shoulders pattern remains unconfirmed, as a decisive breakdown below $91,500 with volume would be needed to validate the bearish structure. Until then, this pattern should be viewed cautiously, as Bitcoin remains above key support zones.

Volume has been tapering during the recent recovery, indicating a lack of conviction among buyers. The recent bounce from the $88,800-$90,600 demand zone was supported by a long lower wick (indicative of strong buying pressure), but momentum has yet to follow through convincingly. RSI is neutral, leaving room for both upside and downside.

For bulls, a decisive close above the 50-day MA and $99,860 resistance would open the door to testing higher levels, potentially toward $106,099. For bears, failure to reclaim these levels could see Bitcoin revisit the demand zone, with increased risk of a breakdown.

Key levels to watch:

Resistance: $99,860 and $106,099.

Support: $91,300 (neckline) and the $88,800-$90,600 zone.

Market participants should remain vigilant for confirmation of either bullish continuation or a breakdown.

Legacy Markets

Global markets showed gains on Wednesday as investors awaited key US inflation data, hoping for signs of cooling price pressures after benign UK CPI readings and a lower-than-expected US wholesale price index earlier this week. Wall Street futures rose slightly, with Nasdaq 100 and S&P 500 contracts up 0.2%. BlackRock shares climbed in premarket trading following strong earnings and stable assets under management. Attention also turned to earnings reports from major banks, including Citigroup, JPMorgan, and Goldman Sachs, for insights into the US economy’s health.

Treasury yields edged lower, with the 10-year yield retreating from the critical 5% threshold, and the dollar extended its recent decline. Expectations for December CPI include a fifth consecutive monthly increase, with core CPI anticipated to rise by 0.3%. Analysts warn that an unexpectedly high inflation print could trigger renewed rate fears and volatility in equity markets.

European markets gained as UK CPI came in below forecasts, bolstering hopes for a Bank of England rate cut. The Stoxx 600 rose 0.6%, while the FTSE 350 surged 1.5%. UK gilt yields dropped nine basis points, easing pressure on a market recently hit by bond selloffs. Market strategists remain cautious, noting that elevated bond yields continue to challenge the sustainability of stock market rallies.

Key events this week:

Citigroup, JPMorgan, Goldman Sachs and Wells Fargo earnings, Wednesday

US CPI, Empire manufacturing, Wednesday

Fed’s John Williams, Tom Barkin, Austan Goolsbee and Neel Kashkari speak, Wednesday

TSMC earnings, Thursday

ECB releases account of December policy meeting, Thursday

Bank of America, Morgan Stanley earnings, Thursday

US initial jobless claims, retail sales, import prices, Thursday

China GDP, property prices, retail sales, industrial production, Friday

Eurozone CPI, Friday

US housing starts, industrial production, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.2% as of 6:33 a.m. New York time

Nasdaq 100 futures rose 0.3%

Futures on the Dow Jones Industrial Average rose 0.3%

The Stoxx Europe 600 rose 0.7%

The MSCI World Index rose 0.2%

Currencies

The Bloomberg Dollar Spot Index fell 0.2%

The euro was little changed at $1.0307

The British pound rose 0.1% to $1.2229

The Japanese yen rose 0.7% to 156.89 per dollar

Cryptocurrencies

Bitcoin rose 0.1% to $96,551.39

Ether fell 0.8% to $3,188.18

Bonds

The yield on 10-year Treasuries declined two basis points to 4.77%

Germany’s 10-year yield declined two basis points to 2.63%

Britain’s 10-year yield declined nine basis points to 4.80%

Commodities

West Texas Intermediate crude was little changed

Spot gold rose 0.3% to $2,686.73 an ounce

The Crypto Ball

Tickets to Trump’s inaugural ball are flying off the shelves, with the $2,500 Gold tickets already sold out. Remaining options include $5,000 Black tickets, a $100,000 package that grants access to the reception, or an ultra-exclusive $1 million opportunity for a future dinner with Trump himself.

The event, hosted by BTC INC.—the organization behind leading Bitcoin conferences—is co-hosted by Stand With Crypto, Exodus, Anchorage Digital, and Kraken. The sponsor lineup is equally impressive, featuring Coinbase, MicroStrategy, Robinhood, Solana, Uniswap, and MARA, which adds significant weight to the occasion. High-profile attendees such as Brian Armstrong and Michael Saylor are expected, potentially drawing in even more notable names.

What’s intriguing is whether this event will double as the stage for a major announcement—perhaps the much-anticipated Strategic Bitcoin Reserve (SBR)—or if it’s purely a celebration and spectacle. Also, let’s be honest: does this level of effort feel like something from someone who isn’t fully invested in this space?

IBIT Expands To Canada

2025 is shaping up to be an exciting year for Bitcoin enthusiasts in Canada. Pro-Bitcoin politician Pierre Poilievre is the clear frontrunner to become Canada’s next Prime Minister, with Polymarket giving him an 89% chance of victory. Adding to the momentum, BlackRock has launched its IBIT Bitcoin ETF in Canada, offering two versions: one trading under the ticker IBIT on Cboe Canada and a US dollar-denominated counterpart listed as IBIT.U.

“Investors increasingly seek crypto exposure through exchange-listed wrappers. Cboe is committed to meeting this demand by leveraging our global listings capabilities and derivatives expertise to expand market access and grow the crypto ecosystem with innovative products. We’re thrilled to collaborate with BlackRock and look forward to supporting their success globally through our extensive listings network,” said the Global Head of ETF Listings at Cboe.

With political leadership poised to turn more crypto-friendly and BlackRock's ETF further expanding access, Canada’s crypto ecosystem is entering a transformative phase.

Companies Buying Bitcoin Is An Overlooked Megatrend

“It’s not just MicroStrategy; it’s a bona fide megatrend, and it’s big enough to tilt the bitcoin market significantly upward this year.”

Matt Hougan’s latest piece argues that corporate Bitcoin adoption is far larger than most realize and predicts that hundreds of companies will add Bitcoin to their balance sheets over the next 12 to 18 months. To back up this thesis, Hougan outlines three key reasons:

Reason 1: MicroStrategy Alone Is Bigger Than You Think

“Last year, MicroStrategy bought ~257,000 bitcoin. Is that a lot? A little? Well, to put that number in perspective, it was more than all the bitcoin mined in 2024 (218,829 BTC). Let me say that again: A company the size of Chipotle bought more than 100% of the entire new supply of bitcoin in 2024.”

MicroStrategy’s purchases alone demonstrate how much impact one company can have on Bitcoin’s supply dynamics. It’s hard to ignore the implications when a single entity outpaces the entire annual production of new Bitcoin.

Reason 2: The Trend Is Already Bigger Than MicroStrategy

“Today, 70 publicly traded companies own bitcoin on their balance sheets, and many private companies do as well (including Bitwise, by the way). Together, these companies—excluding MicroStrategy—own 141,302 BTC. Private companies aren’t required to report their holdings, but the ones who have done so voluntarily (SpaceX, Block.one, etc.) own at least another 368,043 BTC, according to BitcoinTreasuries.com. That’s significant. It means that, even today, MicroStrategy is less than 50% of the corporate BTC market.”

Corporate adoption is already widespread, and the total holdings by public and private companies far exceed MicroStrategy’s. This illustrates the growing role of institutions in driving Bitcoin’s demand.

Reason 3: The Number of Companies Buying Bitcoin Is Poised to Explode

“Until the start of this year, two factors prevented companies from joining this trend. The first was reputational risk. But reputational risks have peeled back significantly in the past few months. But there’s a second, bigger factor at work. Starting in December, the Financial Accounting Standards Board (FASB)—which governs how publicly traded companies report financials—implemented a new rule called ASU 2023-08 that changes how bitcoin is accounted for in GAAP reporting. Now, if bitcoin’s price goes up, companies can mark the value to market and book a profit.”

With reputational risks receding and the introduction of favorable accounting rules under ASU 2023-08, publicly traded companies now have both fewer barriers and stronger incentives to add Bitcoin to their treasuries.

Hougan’s conclusion is clear: this is just the beginning. As Bitcoin becomes easier to account for and increasingly seen as a strategic asset, corporate adoption could accelerate to levels that significantly move the market. If this megatrend holds, the ripple effects on Bitcoin’s price and its adoption narrative could be transformative.

This wasn’t included in the memo, but below is a screenshot from BitcoinTreasuries.com.

Bitcoin: Is The Bottom In? $250,000 By The End Of 2025?

Joining me today are Jeff Park, Head of Alpha Strategies at Bitwise, and my friends from Arch Public, Andrew Parish, and Tillman Holloway, who will provide an update on the $10K algorithmic portfolio.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.