Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

At Arch Public we’ve talked about our suite of algorithms being the equivalent to having a ‘hedge fund in your pocket’. That remains true with a couple of benefits that hedge funds don’t offer their clients.

One benefit is liquidity. Your capital (every single cent) is available to you at all times. No matter what our algos are doing on any given day, your money is your money.

Another benefit is cost and fees. Hedge funds charge annual fees that are substantial. Our Concierge Program is a one time, lifetime fee only.

Yes, our strategies produce incredible performance monthly and annually; but additional benefits versus other alternative assets are core to our values as well.”

2024 Arch Public Returns:

ES: 46.4%

MES: 44.9%

NQ: 53.3%

MNQ: 89.77%

Try Arch Public now! You can even demo the platform, for free, to learn more.

In This Issue:

Bitcoin Vs. The DOJ: Unpacking The FUD

Aptos Weekly Review

Bitcoin Thoughts And Analysis

Legacy Markets

Linear vs Logarithmic Charts

Polymarket’s Controversial Bets: Profiting from Tragedy or Providing Insight?

Block May Join The S&P 500 Before MicroStrategy

Crypto Dump: The Perfect Time To Buy Bitcoin & Altcoins?

Bitcoin Vs. The DOJ: Unpacking The FUD

Okay, I admit the title was a bit clickbaity—trust me, the DOJ hasn’t rugged anyone.

I’m honestly baffled at how quickly sentiment turns pessimistic over a dip into the low 90s. It’s wild to hear people question whether the cycle is already over. While I can’t predict the exact end of this cycle, there’s no reasonable evidence suggesting we’re there yet.

We haven’t even hit the fun part.

It feels like the market is still carrying collective PTSD from FTX and the last cycle, overreacting to every minor jump scare and panicking at a moment’s notice. At some point, excess caution will be justified—but not right now. I’m holding strong, and the contents of this newsletter will remain bullish for this cycle.

One last point: I don’t gain anything from sharing this opinion. Frankly, I’d probably be better off staying quiet and “just covering the news.” But if there’s even a small chance I can help some of you keep perspective, I’ll do it. There’s more left in this cycle, even if we see a deeper pullback. Now, let’s move on to the news.

The FUD of the week is the claim that the DOJ is planning to dump Bitcoin just before Trump takes office. I briefly touched on this during my YouTube show, but let’s dive deeper. Honestly, this feels like noise—something already priced in when you consider the bigger picture. In short, it’s not a big deal.

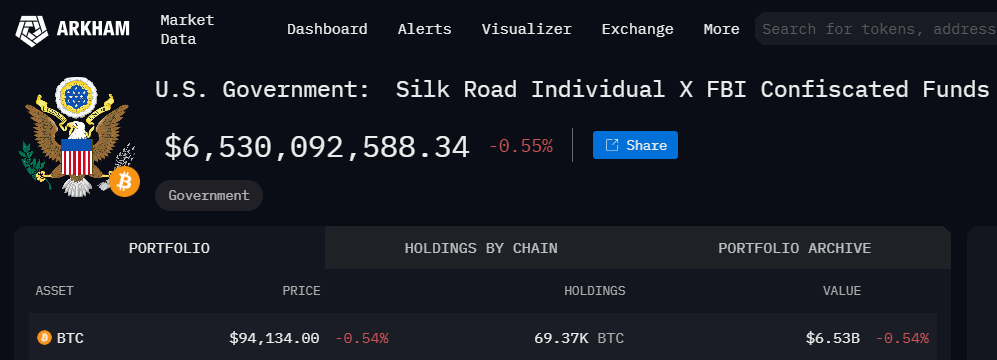

The DOJ has been cleared to sell 69,370 BTC, worth roughly $6.5 billion. Are we seriously worried the market can’t absorb this? If this were happening in the depths of the bear market a couple of years ago, it might sting. But let’s not forget, back in November, Saylor made a $5.4 billion purchase of 55,500 BTC and followed that with several billion-dollar acquisitions in the weeks after. More recently, on January 6, 2025, we saw $1.1 billion in inflows into Bitcoin and Ethereum ETFs in a single day. The market has far more liquidity and resilience than people give it credit for.

Let’s take a quick look back at Monday. The price jump was driven primarily by spot and institutional buying, not leverage—this is clear from the data. Then came macro news that should have been objectively positive but somehow elicited a negative market reaction. Finally, the DOJ news dropped at the perfect moment to amplify the FUD.

Here’s the thing: the DOJ’s mandate to sell seized Bitcoin isn’t new. This specific case has been public knowledge all along. While it wasn’t front and center in most investors’ minds, the idea that the DOJ would sell these holdings once cleared is no surprise.

In short, it’s noise—don’t let it shake your conviction.

Do I want to go so far as to suggest the Biden administration is doing this as an “F U” to Trump before he takes office? I’d say it’s just as likely as it is unlikely. The DOJ’s policy doesn’t require an immediate sale, so they could theoretically hold off and see if a day-one executive order comes through. But let’s be real—that would mean waiting for 10 days, which might not be their style.

What seems more plausible is that Trump and his pro-Bitcoin appointees will absolutely take note of this move. I can already imagine Trump criticizing the decision, potentially blaming Kamala and Biden, and using it as political leverage if Bitcoin performs well after the fact. That said, I doubt this will significantly alter Trump’s stance on Bitcoin. Chances are, he already has a clear plan regarding a Strategic Bitcoin Reserve (SBR) and will reveal it when the timing suits him.

There are plenty of plausible theories floating around, but here’s the bottom line: this is not the end of the cycle, nor is it a reason to panic. Even if Bitcoin dips into the 80s or even the 70s, it could simply be building momentum for a stronger move higher. Let’s not forget—if Bitcoin hits those levels, Saylor would likely jump at the chance to buy more, and honestly, so would I.

Here’s the wallet for tracking the Bitcoin in question:

If the DOJ manages to sell the Bitcoin before Trump takes office, I suspect it won’t age well over time. The wayward state in Germany offers a prime recent example—selling seized Bitcoin early, only to watch its value skyrocket afterward. History tends to look unkindly on such short-sighted decisions, especially when it comes to an appreciating asset like Bitcoin.

As for the United States' entire crypto wallet, it can be viewed HERE.

I did the math: the 69,370 BTC represents 35% of the U.S. holdings. The more I think about it, the more it feels like a calculated jab at Trump if it’s sold within this narrow window—especially given his promise not to sell. Perhaps this will be the spark that pushes him to take the leap and buy Bitcoin. Conspiracy theories are always more fun when they align with outcomes that work in your favor.

In all seriousness, I didn’t get a chance to share this earlier in the week, but ZeroHedge released a brief article highlighting the urgency for U.S. policymakers to adopt financial tools like Bitcoin and digital currencies to maintain an edge over China and Russia. It’s a compelling argument worth considering.

I have the highlights below:

This line hits the nail on the head: “in our rapidly digitizing world, the absence of a native digital asset in this portfolio is becoming increasingly conspicuous.”

I won’t keep reiterating the same point—you get it.

The spectacle of it all is that when you break down the concept of an SBR (Strategic Bitcoin Reserve), it just makes sense. Anyone who takes the time to truly understand Bitcoin usually ends up supporting it. Almost everyone wants to see Bitcoin succeed once they grasp its potential, and the SBR benefits both the people and the government equally. It’s rare to find someone who studies Bitcoin deeply and walks away thinking it’s a bad idea. The SBR is logical, and over time, politicians will come to see that.

By the way, if you’re reading this on Friday morning, don’t miss the X space linked below!

I have no idea what the announcement is, so I am as eager to hear as you are.

Aptos Weekly Review

For those that don’t know, Aptos—the most exciting layer 1 blockchain competing with Solana and Ethereum—is now an official sponsor of this newsletter! Over the past few months, I’ve had the chance to get to know the Aptos team, create content with them, and watch this project accomplish incredible things.

Each week, I’ll provide an Aptos review, showcasing all the exciting announcements and milestones the network is achieving. This week, let’s kick things off with Aptos’ partnership with Chainlink!

“Aptos Network Adopts the Chainlink Standard for Verifiable Data”

Aptos made a cool announcement yesterday that they're adopting the Chainlink standard for high-quality, tamper-proof data, providing seamless access to reliable off-chain data and computation services for developers on the network. This integration enhances the development of secure, decentralized applications by leveraging Chainlink's proven infrastructure, which is trusted by leading DeFi protocols. Key features of Chainlink Data Feeds include high-quality data aggregation, reliable and decentralized oracle nodes, and transparent performance monitoring. This move aligns with Aptos' focus on scalability, security, and innovation, providing developers with the tools to build secure Web3 applications.

Here’s a quick one! After many months of hard work, Aave Labs is excited to present a working implementation of Aave V3 on Aptos testnet. We invite the community to test it out as we continue development.

Now for my favorite update this week, a yearly review of Aptos!

Network Stats

Monthly active users: 9.5M+

Total unique users: 38.5M+ (+336% YoY)

Total transactions: 2B+ (+416% YoY)

Validator nodes: 152

Network Milestones

Surpassed 1B in TVL

Broke 4 daily transaction records (including 326M done in a single day)

1M NFTs minted in ~4 hours

Ecosystem Stats

330+ projects

160+ AptosCollective members

Community Highlights

Ecosystem Summit in Palo Alto

DeFi Days in Hong Kong

Aptos Experience in Seoul

Make sure to show Aptos some love—they’re a huge reason this newsletter remains free!

Bitcoin Thoughts And Analysis

Bitcoin's daily chart continues to show critical developments, with price action hovering just above the key support zone between $88,800 and $90,600. Today’s bounce has slightly alleviated immediate selling pressure, but the overall trend remains fragile. The potential head-and-shoulders pattern remains intact, with the neckline now near $91,300. Price bounced right at the neckline.

This level remains a key threshold; a break below it, especially on higher volume, could confirm the bearish pattern and suggest further downside.

The 50-day moving average, currently at $97,700, has firmly flipped to resistance after being lost earlier this week. Bitcoin attempted a recovery but was rejected before reclaiming it. Bulls will need to regain this level to shift momentum back in their favor.

RSI is still not oversold on the daily timeframe, which means there could be room for further downward movement. However, shorter time frames, such as the 4-hour chart, are approaching oversold territory, which could provide some temporary relief. Look for bullish divergence on these lower time frames to signal a potential bottom.

Volume remains muted on today’s bounce, suggesting that buyers are not yet stepping in with conviction. A decisive close above $99,860 would invalidate some of the bearish concerns and could open the door for a retest of higher resistance levels. Conversely, a loss of the neckline or the support zone below it could accelerate selling pressure, making the $73,835 level the next major target. For now, caution is warranted as Bitcoin navigates this critical zone.

Legacy Markets

Global markets retreated on Friday as investors braced for the release of US nonfarm payrolls data, which is expected to provide insight into the labor market and its impact on Federal Reserve policy. S&P 500 and Nasdaq 100 futures dipped 0.2%, while European stocks were largely flat, and a Chinese benchmark approached bear market territory. US Treasuries were stable, but UK gilts remained under pressure, with 10-year yields hovering near their highest levels since 2008.

Markets are grappling with concerns over persistent inflation, limited scope for rate cuts, and uncertainty surrounding the incoming US administration's trade policies. Friday’s jobs report is projected to show 165,000 new jobs in December, a steady 4.2% unemployment rate, and slightly cooler wage growth. Analysts suggest soft data could provoke a stronger market reaction than robust figures, given recent hawkish signals from the Fed.

In the UK, the pound neared its weakest level since late 2023, and bond yields surged more than 20 basis points this week amid concerns over inflation and strained public finances. Comparisons were drawn to the market turmoil two years ago that ended Liz Truss’ premiership. Elsewhere, oil climbed to a three-month high, supported by reduced US crude stockpiles due to winter weather, signaling tighter global markets.

Some of the main moves in markets:

Stocks

S&P 500 futures fell 0.2% as of 6:13 a.m. New York time

Nasdaq 100 futures fell 0.2%

Futures on the Dow Jones Industrial Average were little changed

The Stoxx Europe 600 was little changed

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0301

The British pound fell 0.1% to $1.2291

The Japanese yen was little changed at 158.13 per dollar

Cryptocurrencies

Bitcoin rose 3.1% to $94,980.93

Ether rose 3.2% to $3,312.21

Bonds

The yield on 10-year Treasuries advanced one basis point to 4.70%

Germany’s 10-year yield advanced two basis points to 2.58%

Britain’s 10-year yield advanced three basis points to 4.84%

Commodities

West Texas Intermediate crude rose 2.5% to $75.80 a barrel

Spot gold rose 0.6% to $2,682.06 an ounce

Linear Vs. Logarithmic Charts

You’ve probably noticed that Bitcoin price charts can look drastically different depending on whether they use a log scale or a linear scale. Here’s a quick breakdown of the key differences:

A logarithmic chart is crucial for analyzing Bitcoin because it emphasizes percentage changes rather than absolute price movements, making it ideal for assets experiencing exponential growth. Bitcoin’s price has ranged from a few cents to tens of thousands of dollars, and linear charts simply can’t capture this range without distorting the data. By using a log scale, price movements are smoothed out, ensuring that both early and recent price action is represented proportionally and meaningfully.

Your favorite price prediction chart? Almost certainly in log scale.

This perspective reveals that Bitcoin's substantial growth phases aren’t just anomalies—they’re part of a consistent pattern established since its early days. By filtering out the noise of short-term volatility, a log chart emphasizes the broader trends that define Bitcoin's long-term trajectory. This approach helps investors better understand its historical performance and potential future growth, providing a clear, data-driven view of Bitcoin's enduring narrative.

Polymarket’s Controversial Bets: Profiting from Tragedy or Providing Insight?

Polymarket has come under fire for offering betting markets on sensitive events, including the Palisades fire in California. As of January 8, 2025, the platform allowed users to wager on aspects such as the fire's containment status, acres burned, and its potential reach. For those familiar with Polymarket, this isn’t the first time the platform has faced backlash over controversial markets. In December 2024, it offered markets predicting the likelihood of Israeli military action in Syria and the fate of those aboard the tragic OceanGate submersible.

The criticism is straightforward: by allowing these markets, Polymarket is seen as capitalizing on human suffering and disaster, turning tragic events into a form of speculation and entertainment. Additionally, Polymarket profits, at least indirectly, from these markets, further fueling outrage.

The counterargument, particularly in the case of the fire, is that Polymarket’s markets provide real-time data on evolving situations, offering insights that could help keep people informed. However, there’s a darker flip side—these markets could be exploited, creating perverse incentives for bad actors to manipulate events for personal gain.

This is a growing ethical dilemma for prediction platforms, and unless properly addressed, it’s a problem that’s likely to escalate.

Block May Join The S&P 500 Before MicroStrategy

Fintech company Block, founded by Twitter co-founder Jack Dorsey, could become the first publicly listed company with Bitcoin in its treasury to join the S&P 500 Index within the next 21 months. Following a strong Q1 2024 earnings report, Block now meets the key criteria for inclusion, including a market cap exceeding $18 billion and positive GAAP earnings.

However, inclusion ultimately hinges on the S&P Index Committee’s decision. The process typically takes 3 to 21 months, though there have been exceptions, like Lululemon’s 65-month wait.

Matthew Siegel from VanEck has the scoop:

(Also worth noting: Tesla technically owns Bitcoin, but they don’t have a defined Bitcoin strategy.)

“Sector diversification is one of the Index Committee’s considerations, in that they aim to maintain a sector composition that is generally in line with the economy. ‘In line with the economy’ is undefined, so use the S&P Total Market Index as a proxy: Financials currently make up 13.9% of the S&P 500, compared to 14.6% in the broader index, suggesting that there is room for a Financials addition.”

In the long-run, MicroStrategy, Coinbase, Block, and probably a major Bitcoin mining company will all be included at some point. I could see at least one being approved in 2025.

Crypto Dump: The Perfect Time To Buy Bitcoin & Altcoins?

Bitcoin and broad crypto markets are going through a massive sell-off. What caused it and when is the best time to buy crypto? I am joined by Aya Kantorovich, Co-Founder & Co-CEO of August, institutional grade platform for crypto.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform.

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.