Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Arch Public Concierge Program clients started 2025 the right way! Another winning trade closed on Friday.

Both our NQ and MNQ algos extended their hot streaks:

NQ: +4.02%

MNQ: +3.2%

The last seven trades taken by our Nasdaq algos (Atlas) have crushed:

NQ: +33.56% in December.

MNQ: +26.25% in December.

Liquidity. Risk mitigation. Performance. Hands free. Join us and let our algos do ALL the work for you.

Try Arch Public now! You can even demo the platform, for free, to learn more.

In This Issue:

Cheers To The New Year

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

IRS Delays Crypto Tax Reporting Rules

AI16Z Is Considering Launching An L1

Marathon Is Collecting Bitcoin Yield

Happy Birthday, Bitcoin

The Hottest Crypto Trends To Watch In 2025, Straight From Coinbase | Hoolie Tejwani

Cheers To The New Year!

Welcome to the New Year!

2024 is in the rearview mirror, and 2025 is upon us—let’s get to it.

I have an undeniably good feeling about this year. And no, it’s not some whimsical gut instinct or fleeting hunch. It’s rooted in a long list of bullish variables that are setting the stage for a truly unprecedented backdrop. If you’ve been following along for at least a month, you already know what I’m getting at. But for those who need a quick recap, here’s my list of 2025 expectations—the ones that have me most excited (in no particular order and with the disclaimer that nothing is ever guaranteed):

ETF flows and new products (hello, SOL ETF)

A stablecoin boom

A pro-crypto U.S. president (Trump) and the potential for a Strategic Bitcoin Reserve

U.S. states going pro-Bitcoin while nation-states prepare to join the game

Tokenization of treasuries, equities, and real-world assets

A new SEC commissioner and Treasury Secretary shaking up the landscape

Wall Street diving headfirst into crypto companies

MicroStrategy surpassing a mind-boggling 500,000 BTC

The convergence of AI and crypto

The triumphant return of NFTs and DeFi

A parade of all-time highs (ATHs)

For those of you following me on Twitter, you may have noticed my absence. The truth? The Melker family needed a break, and I desperately needed a drink.

Cheers to catching our breath before what promises to be a wild ride ahead.

I returned eager to tackle the inevitable mountain of news that usually piles up during a break. But for the first time in ages, it feels like I didn’t miss much at all. Typically, even a short pause leaves me sifting through enough news to fill multiple newsletters, with plenty of stories worth revisiting. Not this time.

I’ve pulled together a few noteworthy headlines in the news section below to help us all get back up to speed. But let me be blunt—there’s not a lot to write home about, and I think I know why.

Maybe I’m too focused on one angle, but it seems like investors worldwide are holding their breath, waiting to see what Trump does on day one in office. With the inauguration just two weeks away, the specifics of his first executive order remain a mystery. There’s evidence to suggest it could be pro-Bitcoin, but the real question is: How far will he go?

So far, it’s been all talk and no action—the game hasn’t even started. A day-one executive order that completely ignores Bitcoin would be a bad look. A neutral outcome might involve some vague language about prioritizing crypto, which markets have arguably priced in already. But the real fireworks would come from an explicit commitment to buying Bitcoin, turning speculation into reality and giving the bulls all the fuel they need.

Stay tuned—the next few weeks might set the tone for an extraordinary year.

Polymarket isn’t exactly brimming with optimism—though, to be fair, the market is relatively small, and this prediction is limited to the first 100 days of Trump’s presidency. The market resolves to "yes" only if the U.S. actually buys Bitcoin within that time, not merely if plans are set in motion.

My anticipation for Bitcoin is building as inauguration day approaches, with a lot riding on the language and details of any potential executive order (assuming there is one). Since mid-December, Bitcoin has been teetering between pushing back toward $100,000 and shaking out more leverage. The clock is ticking. With the right signals, we could see a strong move higher, but if the plans remain vague, the market may hesitate, waiting for clarity.

Before diving into a couple of standout stories, let’s take a moment to talk about the psychology of price—setting fundamentals aside for a moment.

Crossing $100,000 was, without question, the most significant psychological barrier Bitcoin has ever faced. There won’t be another quite like it for a long time. Before we even hit that milestone, I theorized that breaking $100k would be like lighting the bat signal over Gotham City—the world would sit up and take notice, and the price itself would act as an irresistible advertisement to buy.

That didn’t exactly play out as I had envisioned, but I’m not abandoning the theory just yet. The world didn’t have enough time to let $100,000 sink in. Frankly, the lack of a major reaction when it happened suggests to me that the market’s gas tank still has plenty of fuel.

$110,000 → $120,000 → $150,000—these levels are going to arrive sooner than most anticipate. And here’s the kicker: they’ll likely be driven by the very crowd that once dismissed $100,000 as impossible. As always, everyone buys at the price they deserve.

Now, onto a couple of standout stories:

This post was made on X…

And Jesse Pollak, the creator of Base and Head of Protocols at Coinbase responded with the following:

For as long as I can remember, I’ve argued that the most obvious candidate for tokenization is COIN. Think about it—it has the perfect name, it’s issued by a crypto company, and it has the technology to make tokenization a reality. If every asset in the world is destined to end up on Base, it only makes sense for COIN to lead the charge.

I have a few more clarifications on this story from Pollak:

“Also just to be clear, you can already access $COIN on @base if you are a non-US citizen via products like @BackedFi. We need regulatory clarity and improvements that embrace on-chain as an open platform to unlock this for everyone.”

“And to clarify even further: there are no concrete plans right now. We are in an exploratory phase and working to understand what needs to be unlocked from a regulatory perspective to bring assets like $COIN to @base in a safe, compliant, future-looking way. Still day one.”

Now imagine this: MicroStrategy tokenized next, followed by mining stocks, Coinbase’s competitors, and even random tech companies jumping into the mix. If this happens in 2025, Ethereum could surge well beyond the bulls’ expectations—and COIN wouldn’t be far behind.

The other story worth mentioning is Galaxy Digital’s release of their "Crypto Predictions for 2025." Here are a few highlights:

“Bitcoin will cross $150k in Q1 and test or best $185k in Q4 2025.”

“The U.S. spot Bitcoin ETPs will collectively cross $250bn AUM in 2025.”

“Bitcoin will again be among the top performers on a risk-adjusted basis among global assets in 2025.”

“Five Nasdaq 100 companies and five nation-states will announce they have added Bitcoin to their balance sheets or sovereign wealth funds.”

“Ether will trade above $5500 in 2025.”

“Ethereum staking rate will exceed 50%.”

“The ETH/BTC ratio will trade below 0.03 and also above 0.045 in 2025.”

“Total stablecoin supply will double to exceed $400bn in 2025.”

“The U.S. government will not purchase Bitcoin in 2025.”

“Dogecoin will finally hit $1, with the world’s largest and oldest memecoin touching a $100bn market cap.”

There’s a blend of bullish, bearish, and neutral takes in this report. Personally, I’m not sold on the idea of flat-out predicting that the U.S. won’t buy Bitcoin in 2025 or that Ethereum will only hit $5,500. Galaxy also sidestepped key topics like AI, the performance of the ETH ETF, and the upcoming SOL ETF—factors I consider pretty significant. Overall, I’d rate the report a 6.5/10. Feel free to check it out HERE and form your own opinion.

Let’s finish this first newsletter of 2025 with a broader perspective on price.

Bitcoin just wrapped up an impressive Q4, posting a 47.73% gain in what is historically its strongest quarter, with an average return of 85.42% since 2013. Now, as we move into Q1—the second-best quarter historically, with an average return of +52.45%—I expect Bitcoin to stay true to form and deliver another strong performance.

If history holds, this could mean a robust Q1, followed by a larger shift into altcoins, led by ETH, as the year progresses. By summer, Bitcoin is likely to experience slower growth and start losing market share, setting the stage for a potential market stall.

At that point, the cycle could go one of two ways: either it comes to an end, or it takes an extended breather before a finale later in the year. The outcome will largely depend on the progress of U.S. Bitcoin adoption, nation-state involvement, and just how stretched prices get earlier in the year.

Ethereum delivered a modest Q4 performance with a +28.34% gain, bouncing back from a -5.74% dip in Q2 2024 and a sharper -24.19% decline in Q3. Now, it’s entering its historically strongest quarter, which boasts an average gain of 83.41%, followed closely by Q2 with an average gain of 66.84%.

With so many factors working in Ethereum’s favor for 2025—like incoming staking approvals for ETFs, Trump-backed WLF holding ETH, a new SEC chair, increased tokenization, rising ETH inflows, a DeFi resurgence, and the return of NFTs—a +100% quarter wouldn’t shock me. Such a move would echo historic runs like Q4 2017’s massive +518.14% gain or Q1 2021’s +160.7% rally.

All in all, it feels like ETH’s time has finally come. Given the doubt it has faced throughout this cycle, I’m expecting it to shine and perform exceptionally well.

There, I said it! It’s on the record now. I doubt I’ll get any credit for calling this ahead of time when it happens—but that’s beside the point. ETH investors will have their moment, as will Solana investors—and just about anything with a pulse, meme potential, or the promise of utility.

Don’t let FOMO take the wheel. You’ve made it to 2025, and now it’s about letting the cycle play out. Selling will be tough—it always is—but I don’t believe now is the time to exit simply because the market has had a good run. We’ll cross that bridge when we get to it.

Cheers to the new year, and a heartfelt thank you to every single one of you who joined me on this journey through 2024 and the years before. Your feedback, your engagement, and your commitment to showing up every day mean the world to me. It’s why I write these letters—it’s all for you.

Nothing about being an investor is easy, and crypto takes that challenge to another level entirely. The volatility, the noise, the FUD, the never-ending stream of conflicting opinions—it’s all designed to test your resolve. This space moves faster, hits harder, and demands more patience and resilience than most are willing to give.

But you’ve stayed the course, and you deserve the reward. Beyond that, you’re part of something much bigger. You’re not just reshaping your own financial future—you’re playing a role in redefining the entire financial system.

2025 is our year, and I couldn’t be more excited to share it with all of you. So, congratulations one last time—let’s kick some serious New Year ass!

Bitcoin Thoughts And Analysis

Bitcoin is trading near $99,210, successfully reclaiming the 50-day SMA (~$97,000) as support, signaling renewed bullish momentum. However, it is now facing strong resistance at $99,860, a level that has acted as a significant barrier in recent weeks.

A daily close above $99,860 could trigger a move toward the next major resistance at $106,099, representing a critical bullish breakout. Conversely, failure to break above this resistance may result in a pullback, with the 50-day SMA as immediate support. Below that, the $88,000-$90,000 demand zone remains a crucial area to monitor.

Volume has been moderate, indicating some buyer activity, but a stronger confirmation will require increased volume. The RSI remains neutral, allowing room for further upside if resistance is broken decisively. Bitcoin is at a pivotal point, with $99,860 as the key level to determine the next major move.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

Solana (SOL) is trading at $217, consolidating just below the 50-day SMA (~$219) after a break and retest of descending resistance. This breakout indicates potential bullish continuation, but the lack of significant volume suggests that buyer conviction is still weak. Volume confirmation will be key to validating any sustained upward move.

The $259.50 level, representing the previous cycle’s all-time high that was briefly broken in November, remains the major resistance to watch. A clean break above this level with increased volume could open the door to new highs, signaling stronger bullish momentum.

On the downside, the $203 level serves as critical support, as it aligns with the retest of the descending resistance turned support. Maintaining this level is essential to preserve the bullish structure. If the price falls below $203, it could lead to a deeper correction, potentially testing the 200-day SMA near $171.

In summary, while Solana's technical setup leans bullish, confirmation through volume and a reclaim of the 50-day SMA will be critical for a move toward the $259.50 resistance. Until then, the market remains in a cautious consolidation phase.

Legacy Markets

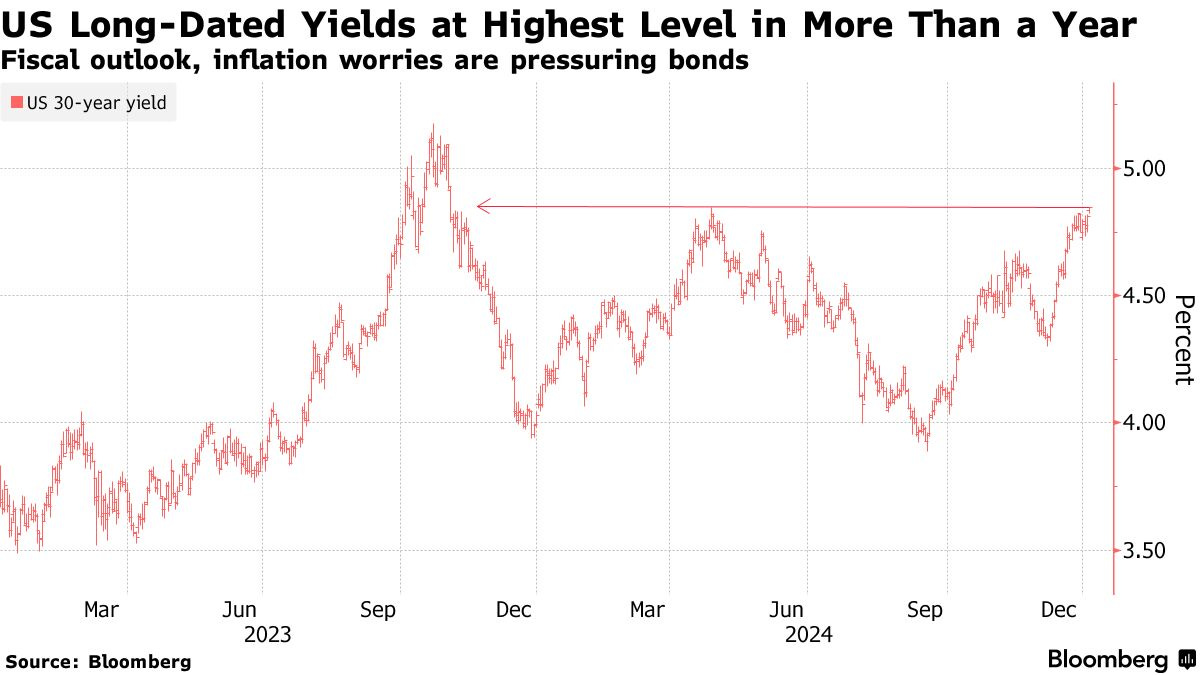

Technology stocks surged on Monday, bolstered by optimism around artificial intelligence and a sharp drop in the dollar, marking its steepest decline since November. Nasdaq 100 futures rose 1%, driven by gains in Nvidia and AMD, while Microsoft’s $80 billion investment in data centers spurred fresh confidence in AI demand. European markets followed suit, with the Stoxx 600 rising on strong performance by ASML Holding. Meanwhile, the dollar’s decline was fueled by reports that the incoming Trump administration is considering targeted tariff plans, which could ease global trade tensions and inflationary pressures. US Treasury yields fluctuated, with the 10-year yield reaching 4.6%, reflecting concerns about inflation’s impact on Federal Reserve policy. Rising yields may challenge equities, as analysts warn of potential headwinds for stocks in early 2025. China’s economic indicators showed resilience, with strong service sector growth, while oil steadied near a three-month high amid tight supply. Gold prices dipped as Goldman Sachs revised its $3,000-per-ounce forecast to mid-2026 due to reduced expectations for Fed rate cuts.

Key events this week:

US factory orders, S&P Global services and composite PMI, Monday

Fed Governor Lisa Cook speaks, Monday

Eurozone CPI, unemployment, Tuesday

US job openings, trade, ISM services, Tuesday

Richmond Fed President Thomas Barkin speaks, Tuesday

Eurozone PPI, consumer confidence, Wednesday

FOMC minutes, Wednesday

Fed Governor Christopher Waller speaks, Wednesday

ECB Governing Council member Francois Villeroy de Galhau speaks, Wednesday

China CPI, PPI, Thursday

Eurozone retail sales, Thursday

BOE Deputy Governor Sarah Breeden speaks, Thursday

Japan household spending, leading index, Friday

US nonfarm payrolls, unemployment, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.7% as of 7:11 a.m. New York time

Nasdaq 100 futures rose 1%

Futures on the Dow Jones Industrial Average rose 0.4%

The Stoxx Europe 600 rose 0.8%

The MSCI World Index rose 0.3%

Currencies

The Bloomberg Dollar Spot Index fell 0.8%

The euro rose 1% to $1.0414

The British pound rose 1% to $1.2542

The Japanese yen rose 0.1% to 157.09 per dollar

Cryptocurrencies

Bitcoin rose 0.9% to $99,382.28

Ether rose 0.1% to $3,650.41

Bonds

The yield on 10-year Treasuries was little changed at 4.60%

Germany’s 10-year yield advanced two basis points to 2.44%

Britain’s 10-year yield was little changed at 4.60%

Commodities

West Texas Intermediate crude rose 0.4% to $74.22 a barrel

Spot gold rose 0.2% to $2,644.94 an ounce

IRS Delays Crypto Tax Reporting Rules

I have seen mixed opinions on this from accountants I trust, but for now this seems to be the case…

Do you remember the closely watched IRS reporting rules for crypto, which would have required centralized exchange users to default to the FIFO (First In, First Out) accounting method for capital gains unless they proactively chose another method? Originally slated to take effect at the beginning of this year, the IRS has now postponed the rule until January 1, 2026.

Critics argued that the FIFO method could result in higher tax liabilities during market upswings by prioritizing the sale of older, lower-cost-basis assets. For most investors, however, this delay is likely a welcome reprieve.

The postponement is largely positive, as it provides investors with more time to adapt and gives brokers the chance to upgrade systems to support alternative methods like HIFO (Highest In, First Out) and Specific Identification. On top of that, the Blockchain Association and the Texas Blockchain Council are challenging related IRS broker reporting rules set to take effect in 2027, arguing that these rules violate constitutional rights.

AI16Z Is Considering Launching An L1

This news dropped about a week ago, propelling AI16Z into all-time high territory. While the AI x crypto space has cooled off in the past few days, the update is still worth discussing. If you recall my deep dive into the AI x crypto crossover, AI16Z stands out as one of the most intriguing and established plays in this space. The token enables investors to engage with the first venture capital firm led entirely by AI agents—a groundbreaking concept in itself.

As for the latest development, an update was recently posted on the AI16Z governance forum, exploring the feasibility and potential launch of its own Layer 1 blockchain, with AI16Z as the native currency. While this is still in the proposal stage and nothing has been confirmed, the announcement could serve as a major catalyst for the token if it materializes. As interest in this sector resurges, the move could generate significant attention and growth for AI16Z.

Below are key excerpts from the official announcement:

“Making $ai16z the base currency for agent-to-agent transactions and an ‘App Store’ for agent services. Positioning ai16z as an L1 blockchain for AI.”

“Long-term, position ai16z as an L1 for AI to cement its status and value. Development should be open-source with node incentives.”

“There is excitement about ai16z's long-term potential to become an L1 for AI if the tokenomics and ecosystem are done right. But also a recognition that moves need to be carefully considered in light of regulatory scrutiny.”

“ai16z tokens being used for agent-to-agent (a2a) transactions. Seen as a good potential source of demand/utility for ai16z token. Could allow ai16z to become the base currency for an ‘L1 for AI agents.’”

I remain fairly bullish on the AI x crypto space, especially considering its current total market cap is under or around $10 billion. This is a drop in the bucket compared to the heights reached during previous crypto market manias. For context, it’s not even a tenth of what other sectors like NFTs, memes, ICOs, and DeFi achieved at their peaks.

This space has massive room for growth, and AI16Z could very well lead the charge.

Marathon Is Collecting Bitcoin Yield

It’s no secret that mining is a cut-throat business and as a result of that, Marathon Digital has found a new way to take on risk and bring in more profits. Here’s what we learned from Marathon’s most recent production update, “In 2024, we acquired 22,065 BTC at an average price of $87,205 and mined an additional 9,457 BTC. Our year-end BTC yield per diluted share was 62.7%. Overall, we now own a total of 44,893 BTC, valued at $4.2 billion based on a spot price of $93,354 per BTC. Of note, as of December 31, 2024, we had 7,377 BTC loaned to third parties generating additional return for our stakeholders.”

Following some buzz on the announcement, vice president of investor relations, Robert Samuels added the following to the discussion.

I think investors can be optimistic about the announcement. Sure, it adds some risk for MARA holders, but the market is in a healthy state, and the time to seek risk is now, especially with contagion entirely wiped away

Happy Birthday, Bitcoin

Cheers to the greatest financial asset the world has ever known.

The hardest asset humanity has ever created.

A financial apex predator.

The spark of a revolution.

The end of fiat debasement.

A game-changer for the global economy.

The cornerstone of true financial freedom.

A beacon of hope.

The embodiment of true decentralization.

The definition of honest scarcity.

And history in the making.

Happy Birthday, Bitcoin.

The Hottest Crypto Trends To Watch In 2025, Straight From Coinbase | Hoolie Tejwani

Join us on The Wolf Of All Streets as we dive into an inspiring conversation with Hoolie Tejwani, Head of Coinbase Ventures. We discuss the future of crypto and AI, stablecoins, decentralized finance (DeFi), and the intersection of traditional finance and blockchain. Discover how Coinbase Ventures is fostering innovation and pushing boundaries to bring billions of users and trillions in assets on-chain. Don't miss this deep dive into the long-term vision for the crypto economy!

My Recommended Platforms And Tools

Phemex - Exclusive for new user, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Trading Alpha - My new go-to indicator site and trading community. Use my link to sign up and get 25% off. Make sure to use code “25OFF”

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

The Daily Close - Brand New Newsletter! Institutional grade indicators and data are delivered directly to your inbox every day, at the daily close. Trade like the big boys

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.