Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Last week all Arch Public Concierge Program clients received a remarkable holiday gift!! Two massive winning trades to close out the year!

MNQ: +10.33%

NQ: +12.49%

And in Q4 our Nasdaq Algorithms put the hammer down:

MNQ QTD: +35.19%

MNQ MTD: +21.4%

Try Arch Public now! You can even demo the platform, for free, to learn more.

In This Issue:

AI Agents

Aptos Weekly Review

Bitcoin Thoughts And Analysis

Legacy Markets

Bitcoin is The Best Performing Asset In 11 Of The Last 14 Year

MicroStrategy Is Issuing A LOT More Shares

Base Has Captured Virtuals

Bitcoin To Hit $180K In The Next 3 Months

AI Agents

*This will be the last newsletter of 2024! I am taking off next week to spend time with my family… so Happy New Year and let’s crush it in 2025!

Let’s get a disclaimer out of the way.

Today’s newsletter takes a detour from my usual focus. Typically, I emphasize the importance of sticking to timeless principles: resisting the urge to chase fleeting trends, focusing on major assets, staying within the top 100 coins by market capitalization, and steering clear of speculative altcoins. These are the bedrock strategies for sustainable success cycle-to-cycle.

If you’re not a disciplined trader or investor with strong self-control, skipping today’s newsletter might actually save you money. The topics below delve into a highly speculative, cutting-edge sector of the crypto space—where 99.99% of projects are likely to trend toward zero over time. As always, this is not financial advice; it’s purely for educational and entertainment purposes only.

Now that I can’t be sued, let’s discuss AI and crypto.

For starters, AI has never been an area of expertise for me. So, if you’re expecting a groundbreaking opinion on AI from this newsletter, you might be disappointed. However, for some time now, I’ve been wondering when crypto would intersect meaningfully with AI, and I finally feel like we’re nearing that point. After doing some research, I wouldn’t say I’m the first to spot this, but we’re still a long way from the mainstream catching on to this trend.

The way I feel about AI right now reminds me of how NFTs were back in early 2020—something cool and exciting for those of us in the crypto space, but completely under the radar for everyone else.

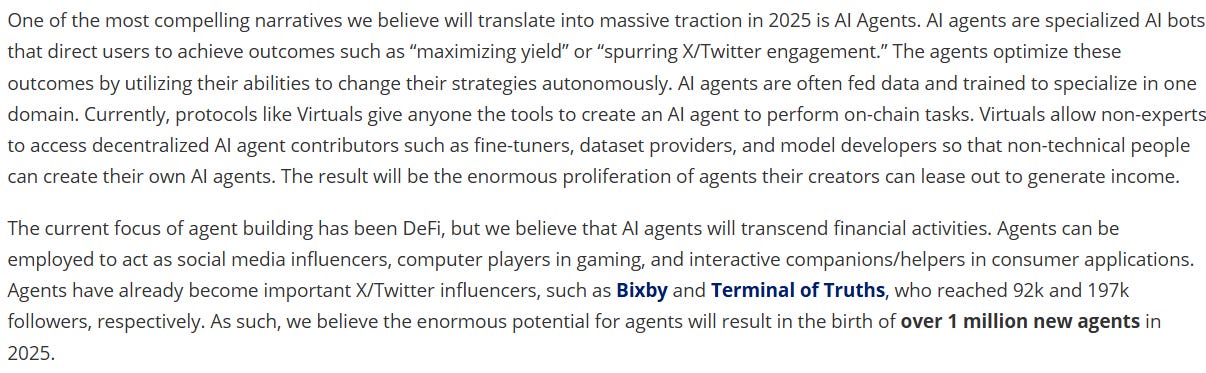

I’ve heard talk about AI crossing over with crypto memes, and while that might make some people rich, the real-world use case just wasn’t there, so I didn’t pay much attention. However, the conversations around AI agents have been different. There's a growing sense that this could have a much more significant and practical impact—both VanEck and Bitwise have very bullish predictions on this crossover.

From VanEck, “AI agents’ onchain activity surpasses 1 million agents.”

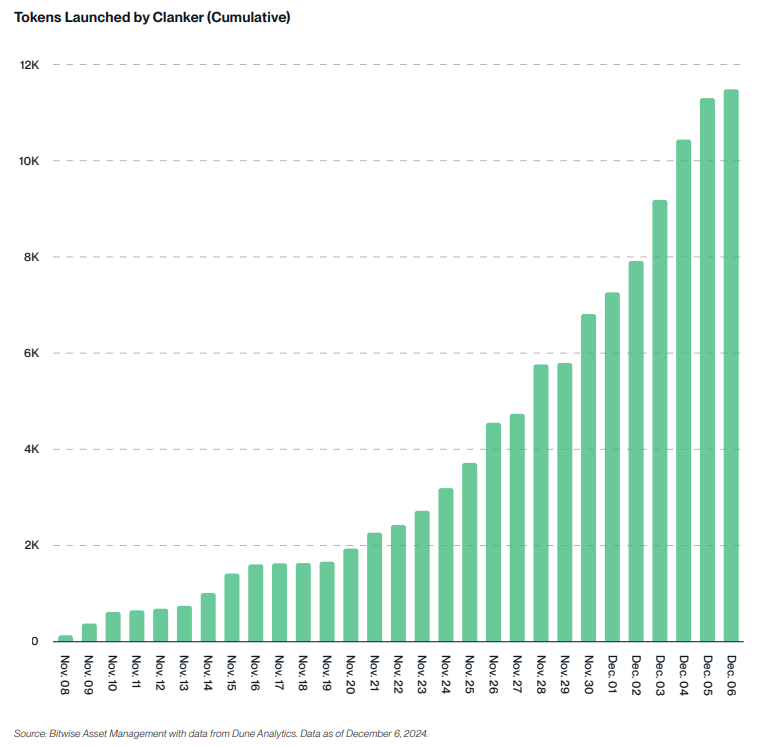

From Bitwise, “Tokens launched by AI agents will spearhead a memecoin mania even bigger than in 2024.”

So, what exactly are AI agents?

AI agents are advanced, autonomous programs designed to carry out a wide range of tasks with minimal human intervention. These tasks can range from simple activities like curating and sharing content on social platforms, to much more intricate processes such as managing entire investment funds, optimizing trading strategies, or fine-tuning yield farming approaches. What sets AI agents apart from traditional bots is their ability to learn, adapt, and evolve over time, making decisions based on dynamic data and real-time conditions.

AI agents can continuously refine their strategies and discover innovative approaches to achieving their goals—whether that’s maximizing profits or executing complex crypto operations. Essentially, they act as self-guided, intelligent participants in the digital economy, capable of navigating and executing tasks in ways that humans might not foresee. For instance, it would be impossible for a human to analyze every new DeFi project or team and then invest in them, but training an AI agent to process data a million times faster, while learning and adapting along the way, is a groundbreaking development.

Some of the AI agents I’m keeping an eye on are Virtuals Protocol and AI16Z. Before you rush to check them out on CoinMarketCap and throw all your money into these coins, here are some key stats you should know. Virtuals Protocol is currently ranked #45, with a market cap of $3.2 billion and a circulating supply of 1 billion tokens. AI16Z, on the other hand, is just outside the top 100, but it could be in there by the time you read this as market cap rankings get updated. At the time of writing, AI16Z’s market cap is $1.01 billion, with a total supply of 1.1 billion tokens.

I chose these coins because both have reached a significant size, not to downplay their risk, but to highlight the credibility they’ve gained by moving beyond the noise. They’ve managed to push past the realm of low-quality projects and are now focused on building out their own established networks, which suggests some level of legitimacy and long-term potential.

Let’s start with AI16Z.

If you haven't figured it out already, AI16Z is a play on ‘A16Z,’ the renowned venture capital firm Andreessen Horowitz. While the two are not affiliated in any way, AI16Z is inspired by A16Z and famously aims to outperform it, using AI-driven investment strategies instead of traditional human-managed funds.

The interesting part is that the DAO functions like a hedge fund, where members invest their money, which is then managed by an AI agent named ‘Marc AIndreessen.’ This AI agent makes investment decisions to grow the fund's assets. Unlike traditional venture funds, where only accredited investors can participate and fund managers charge fees, AI16Z allows anyone to invest via the token, with AI agents handling the management, bypassing the need for human fund managers.

Will the SEC crack down on this at some point? Possibly. Could the code fail? Absolutely. Could North Korean hackers target its security? Definitely. Could Marc AIndreessen make bad investment decisions and turn against us? Without a doubt; a lot could go wrong. Holding the token grants you voting rights within the DAO, allowing you to participate in key decisions regarding the fund's direction and management. Buying the token is kind of like becoming a partner at a VC firm, in a very crypto-esque way.

If you click the image below, you'll be able to see all the holdings of AI16Z, and it's open to the public—pretty cool.

Now for Virtuals Protocol, which I’ll quote the official white paper to explain:

“Virtuals Protocol is building the co-ownership layer for AI agents in gaming and entertainment. We believe AI agents are the revenue-generating assets of the future. These agents can operate across a wide range of applications and games, significantly expanding their revenue surface area. Like any other productive asset, we enable these AI agents to be tokenized and co-owned via blockchain.”

“Our technological innovations have given VIRTUAL AI Agents unique capabilities: they are autonomous in their planning and goal achievement, multimodal (able to communicate via text, speech, and 3D animation), and capable of interacting with their environments—whether it’s picking up a sword in Roblox or collecting gifts in TikTok, and even using on-chain wallets! Imagine a fully-AI influencer who also functions as a gaming NPC, seamlessly existing across multiple platforms like Roblox, Telegram games, and more. These agents maintain memory across applications, allowing users to form deeper, lasting connections—ultimately increasing ARPU (Average Revenue Per User).”

If you’re looking for a comprehensive overview of Virtuals, I can’t recommend this video enough. Jansen Teng, the co-founder of Virtuals, does an excellent job explaining the technology using simple, relatable analogies. He compares Virtuals to a country, with the different AI agents acting as citizens who function as autonomous entrepreneurs.

Given the complexity of AI agents, especially when they intersect with crypto, I think Virtuals does a great job of effectively breaking down what they are and how they work. This straightforward approach is likely a key reason why the coin has broken into the top 50 by market cap. After all, marketing is half the battle—if not more—especially when the underlying technology is as intricate as this.

For those considering an allocation to this sector, I always recommend starting with the larger, more established coins and building from there. It’s similar to introducing someone to crypto for the first time—you start with Bitcoin to establish the basics, then gradually explore other options. If a coin has a weak chart, it’s best to cross it off your list. When it comes to AI tokens, focus on projects with innovative ideas that haven’t faded out from the last cycle. From there, if you’re comfortable taking on higher risk, explore smaller market-cap coins that are built on or interact with the established protocols. Solid projects in this space may trade with higher volatility, offering greater upside potential compared to the main coins.

While researching AI16Z, I found that the DAO’s largest holding is ELIZA, with Eliza Labs being the team behind AI16Z. ELIZA's market cap is approximately 1/20th the size of AI16Z’s. As for Virtuals, several coins have been launched within its ecosystem, including LUNA, GAME, VADER, and AIXBT. If any of this piques your interest, I recommend checking out the respective white papers to assess whether the teams behind these projects are ones you’d trust with your money. While most crypto AI coins, whether utility or meme-based, will ultimately fail, some have the potential to exceed multi-billion-dollar market caps, and their betas could make early investors very wealthy.

Here’s my advice to anyone who’s about to rush out and start buying AI coins after reading this: don’t just throw shit at the wall and hope it sticks. Diversify across chains like SOL and BASE, and pick a few coins from each that you actually believe in. I don’t recommend buying 100 different coins because you won’t be able to make informed decisions when you need to. Keep it focused and smart.

I don’t personally own any of them… yet.

Remember, Bitcoin is the most important asset in this space and should always be your reference point for risk/reward. If you’re putting money into this space, whether it's $20 or $20,000, Bitcoin, along with the majors like Ethereum and Solana, should make up the bulk of your holdings. Anything you invest outside of these three should be treated as lost money until you’ve sold it and the cash is back in your bank account.

Happy Holidays and Happy New Year! Enjoy the time with your family and don’t stress too much about crypto—2025 is going to be our year.

Aptos Weekly Review

I’m really excited to announce that Aptos—the most exciting layer 1 blockchain competing with Solana and Ethereum—is now an official sponsor of this newsletter! Over the past few months, I’ve had the chance to get to know the Aptos team, create content with them, and interview their previous CEO and co-founder, Mo Shaikh. Stick around because I have a lot of great content to share about Aptos.

Let’s start with the elephant in the room, Mo Shaikh.

In case you missed it, Aptos CEO Mo Shaikh has stepped down from his position. While this news came as a surprise to many, including myself, it’s certainly not a reason to lose faith in Aptos or the innovative technology the team is building. Comparing this to Ethereum and Vitalik Buterin isn’t quite accurate—Vitalik was never a CEO, and Ethereum has never had one. However, Mo stepping down doesn’t mean he’s abandoning Aptos. Like Vitalik, Mo can continue to be a thought leader for Aptos and play an influential role in guiding the project’s vision and future development.

Aptos is just as strong as it has always been.

The Aptos vision is to deliver a blockchain that can bring mainstream adoption to web3 and empower an ecosystem of decentralized applications to solve real-world user problems. Our mission is to advance the state-of-the-art in blockchain reliability, safety, and performance by providing a flexible and modular blockchain architecture. This architecture should support frequent upgrades, fast adoption of the latest technology advancements, and first-class support for new and emerging use cases.

Bitcoin Thoughts And Analysis

Bitcoin is trading at $96,769, holding above the 50-day SMA (~$95,000), which is acting as immediate support, with additional support around $94,000. Resistance remains strong at $99,860, with the price repeatedly failing to reclaim this level. Volume is low, reflecting indecision, and RSI is neutral around 45-50, indicating balanced momentum. A breakout above $99,860 could target $108,000 (recent highs), while a breakdown below $94,000 may lead to further downside toward $89,000. The next move depends on a decisive breakout or breakdown, confirmed by increased volume.

Legacy Markets

U.S. equity futures declined after a subdued session on Wall Street, while European stocks rose, with the Stoxx Europe 600 gaining 0.4% amid light holiday trading. Asian markets extended gains, with the MSCI Asia Pacific Index climbing for a fifth consecutive day, driven by Tokyo stocks after the yen fell to a five-month low against the dollar. The dollar remained on track for its best year since 2015, while 10-year Treasury yields hovered near a seven-month high. Investors are closely watching President-elect Donald Trump’s upcoming inauguration and its potential impact on inflation, amid concerns over tariffs and tax cuts influencing Federal Reserve policy. In commodities, Bitcoin edged higher after a recent slowdown, while iron ore dropped to its lowest in over five weeks, oil slipped, and gold remained steady. Japan’s economic data showed accelerating inflation and strong retail sales, suggesting potential for tighter monetary policy in the coming months.

Key events this week:

US goods trade, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures fell 0.4% as of 5:25 a.m. New York time

Nasdaq 100 futures fell 0.4%

Futures on the Dow Jones Industrial Average fell 0.3%

The Stoxx Europe 600 rose 0.4%

The MSCI World Index rose 0.2%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0415

The British pound was little changed at $1.2513

The Japanese yen rose 0.1% to 157.79 per dollar

Cryptocurrencies

Bitcoin rose 0.9% to $96,556.67

Ether rose 2.1% to $3,404.8

Bonds

The yield on 10-year Treasuries advanced two basis points to 4.61%

Germany’s 10-year yield advanced seven basis points to 2.39%

Britain’s 10-year yield advanced six basis points to 4.64%

Commodities

West Texas Intermediate crude rose 0.5% to $69.96 a barrel

Spot gold fell 0.3% to $2,625.66 an ounce

Bitcoin is The Best Performing Asset In 11 Of The Last 14 Years

This chart remains a masterpiece every time I reference it. While this version is a variation from Bloomberg, it delivers the same insights as any chart tracking global assets. Since 2011, Bitcoin has consistently ranked as the #1 performing asset, outperforming major benchmarks such as the S&P 500, the dollar index, U.S. Treasuries, emerging market equities, emerging market debt, and more.

In the three years when Bitcoin didn’t claim the top spot, it fell to the bottom of the list with substantial losses. Yet, it has always rebounded, regaining its position as the #1 performing asset. This year is no different—Bitcoin is back at the top once again.

MicroStrategy Is Issuing A LOT More Shares

Do you remember the big announcement from October when Saylor unveiled his ambitious three-year “21/21 Plan”? The plan aimed to raise $21 billion through equity sales and $21 billion via fixed-income securities to acquire $42 billion worth of Bitcoin. Remarkably, that goal was achieved in just a few months. The company now holds $43.77 billion in Bitcoin, equivalent to 444,262 BTC.

Building on this success, Saylor has raised the stakes with a new plan: if the latest SEC filing is approved, the company intends to issue 10.3 billion shares, up from the current 330 million. Yes, you are reading this correctly, Saylor is looking to issue 10 billion shares, with a ‘B.’

And here’s where it gets even more intriguing. If this proposal fails to pass a shareholder vote, MicroStrategy’s ability to continue buying Bitcoin will effectively come to a halt. However, Saylor holds approximately 46.8% of the voting power, so he only needs about 4% more support for the proposal to be approved. Given that the business had been in decline for nearly a decade before its Bitcoin strategy, this seems like a no-brainer. Not only has Bitcoin turned the company around, but it’s also showcasing a groundbreaking strategy for corporations worldwide.

Bitcoin Isn’t A Bad Gift

Christmas may have already passed, but it’s never too late to gift someone you care about some Bitcoin. Just keep in mind that Bitcoin might not be the only gift they’re expecting, so pair it with something thoughtful to ensure it’s well-received.

Base Has Captured Virtuals

Having completed the full write-up on AI agents, I can now share relevant news on the topic. As previously mentioned, Virtuals is one of the most prominent AI crypto platforms currently in the market. Operating exclusively on Base, Virtuals and its entire network of projects are driving significant volume and activity to the Layer 2 platform—a substantial win for Base. This dynamic is expected to provide a major narrative boost for Base in 2025.

What many might not know is that Jansen Teng, the co-founder of Virtuals, revealed in the podcast linked above that the team was once fully prepared to deploy on Solana while maintaining operations on Base. However, in a last-minute decision, they chose to focus on achieving greater success on Base before exploring expansion. While the technology remains ready for deployment on Solana, it’s possible the move may never materialize.

Bitcoin To Hit $180K In The Next 3 Months

Mike Alfred joins me for one of the final shows of this pivotal year for crypto with some bold predictions for Bitcoin!

In the second part of the show, Dan from The Chart Guys will share his market analysis and some trades.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform. MY LINK

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.

مرسی