Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Use my link HERE.

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 400 trading pairs, minimal fees, peer to peer trading, derivatives, up to 100x leverage.

Make sure to check if Phemex is available in your jurisdiction.

In This Issue:

The Executive Order

Bitcoin Thoughts And Analysis

Legacy Markets

This Paper Will Crush Your Models

Ohio Representative Proposes A Bitcoin Reserve Bill

The Largest Bank In Germany Is Developing An ETH Layer 2

The Fed Cut By A Quarter Of A Point

Bitcoin Is Crushing Gold: Here’s Why $250,000 BTC Is Closer Than You Think!

The Executive Order

In just 27 days—from today, December 19, to January 15—Trump will begin signing executive orders. One of these orders, which may land on his desk, is directly shaped by this very industry.

For a brief political primer for those unfamiliar with how the U.S. government operates: presidents have the authority under the U.S. Constitution to issue executive orders starting on their first day in office. These official directives carry the force of law and do not require Congressional approval.

Typically, a U.S. president signs anywhere from a handful to around 20 executive orders early in their term, establishing the administration’s policy priorities and outlining the direction for the nation. These orders garner global media attention and serve as a strategic roadmap for their party.

There’s no guarantee that the executive order I’m about to discuss will be among those awaiting Trump’s signature. However, given his sustained interest in this industry and the evidence I’ve shared daily, my expectation is that it will be—and that the creation of a Strategic Bitcoin Reserve will indeed take shape.

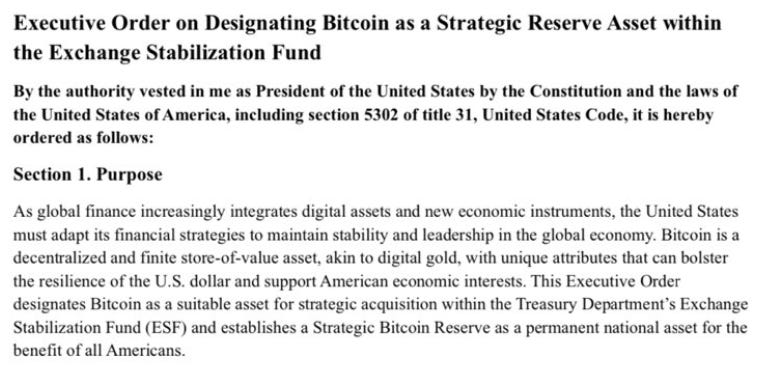

Let’s dive into the details of the Executive Order, drafted by the Bitcoin Policy Institute.

A few points stand out immediately:

“Bitcoin is a decentralized and finite store-of-value asset, akin to digital gold, with unique attributes that can bolster the resilience of the U.S. dollar and support economic interests.”

What more could we ask for in this opening section? Referring to Bitcoin as “akin to digital gold” and highlighting its potential to “bolster the resilience of the U.S. dollar” are straightforward yet compelling arguments. These points are framed in a way that even a 78-year-old admirer of the U.S. dollar could appreciate.

“This Executive Order designates Bitcoin as a suitable asset for strategic acquisition…”

This statement is intriguing because it frames Bitcoin as an option—specifically, a suitable one. It doesn’t mandate that the U.S. must purchase Bitcoin but instead leaves the door open for strategic consideration. The emphasis on suitability over obligation sets an interesting tone. Let’s see if this approach is consistent throughout the document.

This segment dictates that the Bitcoin the U.S. already holds shall not be sold and be transferred to the SBR.

Judging by this segment, I’d say this is a positive sign. By signing this order, Trump essentially directs the Secretary of the Treasury to implement a Bitcoin acquisition program within 60 days.

A couple of things stood out to me here:

First, at the end of the statement, it says, “This initial Acquisition Program shall be completed within 365 days of the date of this order.” I believe this refers to allocating at least $21 billion from the Exchange Stabilization Fund (ESF) to the Strategic Bitcoin Reserve (SBR). In other words, these initiatives are not designed to happen overnight; they will take time, largely due to bureaucratic processes.

Furthermore, you might be wondering why the text specifies, “The Secretary is hereby directed, in a manner consistent with obligations under the law, to allocate no less than $21 billion from the ESF for the strategic procurement of Bitcoin for the inclusion in the SBR…”

Here’s the context behind that figure:

$21 billion represents the current value of the Bitcoin already held by the U.S. government, totaling 198,109 BTC. A Twitter user questioned David Bailey, saying, “Just $21 billion? Less than 200k Bitcoins? I thought we were talking to get to 1 million BTC in the SBR.” His response was as follows:

Interesting…

For context, here’s what Cynthia Lummis said on stage immediately after Trump’s speech in Nashville:

“This Bitcoin Reserve will start with the 200,000 Bitcoin that President Trump just mentioned, pooled into a reserve stored in geographically diverse vaults. And that’s just the beginning. Over five years, the United States will assemble 1 million Bitcoin—5% of the world’s supply. It will be held for a minimum of 20 years and used for one purpose: to reduce our debt.”

And here is the official text for those keeping track of the Strategic Bitcoin Reserve Bill:

This suggests that, if you’ve been following along, there is indeed a Bitcoin Executive Order that will likely make it to Trump’s desk on day one and is expected to be signed (note the emphasis on “likely”—as anything can change). However, the order does not include specific instructions to purchase Bitcoin nor does it specify how much Bitcoin will be acquired.

In my view, the executive order serves as a foundational step. It lays the groundwork, while the accompanying bill will provide the detailed framework and legal authority necessary to move forward with the Strategic Bitcoin Reserve. This includes specific guidelines for acquisition and allocation. Once that is in place, the Treasury Secretary will have the full mandate to implement a Bitcoin acquisition strategy.

Could this happen in a week? Certainly.

Is it more likely to unfold over several months? Probably.

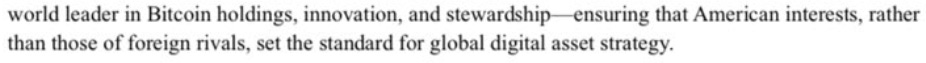

It’s worth noting that Polymarket predicts no Bitcoin purchases will occur within the first 100 days.

The rules for this market state:

“This market will resolve to 'Yes' if the US government holds any amount of Bitcoin in its reserves at any point between January 20, 2025, ET and April 29, 2025, 11:59 PM ET. Otherwise, this market will resolve to 'No.' Note that the US government confiscating Bitcoin does not count as holding Bitcoin reserves.”

Another critical detail in this story is the identity of the incoming Treasury Secretary. Spoiler alert—it’s not Janet Yellen. The role will be filled by Scott Bessent, someone unafraid to take risks and a vocal supporter of crypto.

“I have been excited about [Trump’s] embrace of crypto, and I think it fits very well with the Republican Party, the ethos of it. Crypto is about freedom, and the crypto economy is here to stay.”

“Crypto is bringing in young people, people who have not participated in markets.”

Here’s a brief paragraph I wrote about Bessent when his selection was announced:

If there’s ever going to be a Treasury Secretary to get the ball rolling with Bitcoin, it’s Scott Bessent. I’m quite optimistic, as you can probably tell, though I acknowledge the reality: for the Strategic Bitcoin Reserve (SBR) to become a reality, the executive order, the bill, and the Treasury’s actions all need to align seamlessly.

Of course, the plan could falter at any stage or face delays from foreseeable roadblocks like time, bureaucracy, or unpredictable challenges. However, at this moment, everything seems to be positioned exactly as it should be—especially considering Trump isn’t even in office yet.

Additionally, three U.S. states are quietly working in the background and might beat the federal government to the punch.

I see no reason to feel discouraged if the day-one executive order doesn’t mandate Bitcoin purchases or if the first 100 days pass without significant action. It’s easy to imagine a scenario where the market overreacts negatively because some investors bought into headlines without understanding the full context. But as a Bitcoiner, I couldn’t be more content. In fact, I welcome a more extended timeline, as it gives the process time to address bureaucratic hurdles and unfold smoothly.

David Bailey, Dennis Porter, Cynthia Lummis, and others working tirelessly behind the scenes are doing everything possible to bring Bitcoin into the U.S. government’s reserves. If a faster route existed, I’m confident they’d pursue it. However, they understand that this isn’t solely Trump’s decision—it starts with the American people and ends with lawmakers.

Before wrapping up, I want to share an alternative perspective I came across. Take it as you will—I’m presenting it in the spirit of balanced reporting. I suspect many of you can guess my stance. My advice is to use this viewpoint to reaffirm your conviction, identify any gaps in your reasoning, or, who knows, maybe even reconsider your position.

“If we are talking about a stockpile and holding the Bitcoin the U.S. government has already seized… I think we can reasonably expect that to happen. Trump has been clear on that front. If we are talking about Cynthia Lummis’ Bill, buying 1 million Bitcoin over 5 years, acquiring more Bitcoin, or potentially moving away from the existing dollar system to a Bitcoin-backed system. I don’t think that’s likely. I don’t see support in Congress for that. Congress would have to authorize that. I don’t believe that it would be prudent for the U.S. government to signal a move away from the dollar system to move to a commodity standard based on Bitcoin. Any other nation-state, it would make sense for them to acquire Bitcoin, and they are—Bhutan, El Salvador—that’s fine. The U.S. is the issuer of the global reserve currency. We shouldn’t do something that would call into question our own solvency… I don’t think it would benefit anyone if we were to shake confidence in global markets by implying the dollar is at risk.”

Interesting take… I disagree.

Also, I need to add this:

The Fed also doesn’t own gold, so this statement from Powell has no relevance to the likelihood of an SBR coming into play.

That concludes everything I wanted to share about the SBR. Given that the S&P 500 dropped 3% yesterday, I’m genuinely impressed with Bitcoin’s resilience. Markets cooling off from recent highs isn’t necessarily a bad thing. Let’s see if my prediction for a strong year-end finish plays out. A mere 10% move in Bitcoin would be enough to bring its price back—and then some.

Bitcoin Thoughts And Analysis

Bitcoin had a bad day. So did everything else. This was one of the worst days in recent memory for stocks, the Dow Jones is on a historic downturn and volatility rose dramatically.

And Bitcoin is still $102,000.

Think about that.

From a technical perspective, Bitcoin looks great. We now have more potential hidden bullish divergence with RSI, price bounced RIGHT at support and closed back above $100K.

Nothing here scares me, and the market’s first reaction to the FOMC or other news is usually wrong.

Legacy Markets

US stocks are poised to rebound on Thursday, recovering from a sharp selloff following the Federal Reserve's hawkish shift, which scaled back anticipated rate cuts for 2025. Futures for the S&P 500 and Nasdaq 100 showed modest gains, while European and Asian stocks adjusted to post-Fed moves in the U.S. The Fed’s decision to reduce expected rate cuts to two and emphasize the need for further inflation progress dampened this year's strong rally, driven by optimism around artificial intelligence and economic growth under Donald Trump. Despite the setback, some experts see the pullback as healthy for a resilient economy.

Treasury yields hit their highest levels since May, with long-duration bonds extending losses as markets anticipate prolonged high rates. The yen weakened amid unchanged policy from the Bank of Japan, while China reinforced its currency following Fed caution. In commodities, oil remained stable, and gold partially recovered after a sharp drop. While the market adjusts to the Fed's stance, analysts remain optimistic about continued growth in 2025, supported by stronger-than-expected profits and broader economic resilience.

Key events this week:

UK BOE rate decision

US revised GDP, Thursday

Japan CPI, Friday

China loan prime rates, Friday

Eurozone consumer confidence, Friday

US personal income, spending & PCE inflation, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.4% as of 6:15 a.m. New York time

Nasdaq 100 futures rose 0.3%

Futures on the Dow Jones Industrial Average rose 0.3%

The Stoxx Europe 600 fell 1.5%

The MSCI World Index fell 0.5%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro rose 0.5% to $1.0409

The British pound rose 0.5% to $1.2641

The Japanese yen fell 1.4% to 156.97 per dollar

Cryptocurrencies

Bitcoin rose 1.3% to $102,284.2

Ether rose 0.2% to $3,698.49

Bonds

The yield on 10-year Treasuries advanced two basis points to 4.53%

Germany’s 10-year yield advanced five basis points to 2.30%

Britain’s 10-year yield advanced five basis points to 4.61%

Commodities

West Texas Intermediate crude was little changed

Spot gold rose 1.4% to $2,621.66 an ounce

This Paper Will Crush Your Models

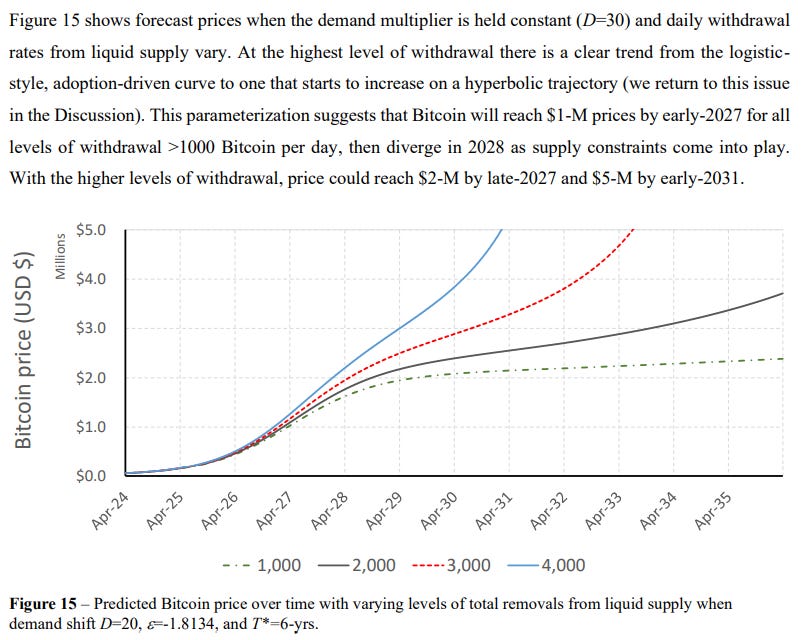

The images below are taken directly from “Forecasting Bitcoin price trajectories using a supply and demand framework,” which presents a bullish case for Bitcoin, factoring in aggressive institutional interest. If you plan to read this academic paper—and I encourage you to do so—expect it to be a challenging read. It’s geared toward more advanced investors with a strong background in statistics. Below, I’ve included a paragraph with spoilers that contains some big predictions.

Ohio Representative Proposes A Bitcoin Reserve Bill

Ohio is now the third U.S. state, behind Texas and Pennsylvania, to introduce a strategic Bitcoin reserve bill as part of the state’s treasury. Derek Merrin, an Ohio House Republican leader, introduced HB 703 on Dec. 17, titled “the Ohio Bitcoin Reserve Act,” which “authorizes the State Treasurer to purchase Bitcoin but does not require it.” Another important point to note is that the statement below mentions, “Merrin anticipated the incoming Trump administration will seek to establish a national bitcoin reserve, like Senator Cynthia Lummis’ (WY) proposal to help America’s balance sheet.”

Ohio's GDP for 2024 is projected at $706 billion, reflecting a 0.9% growth from 2023. Over the last five years, the state's GDP has increased at an annual average rate of 1.1%, placing it 39th among the 50 US states.

As for the specifics of the bill’s journey, Merrin expects the bill to serve as a framework for Ohio's next legislative session, as it was introduced shortly before the current session ends on Dec. 31. It will need to be reintroduced in the 136th General Assembly starting Jan. 6, 2025, since unpassed bills do not carry over between sessions.

The Largest Bank In Germany Is Developing An ETH Layer 2

Deutsche Bank, the largest bank by total assets in Germany, is reported to be developing its own L2 on Ethereum using ZKsync technology. For those who don’t know, ZKsync technology is essentially a layer 2 scaling solution that bundles multiple transactions off-chain and posts a single proof to Ethereum, making transactions faster, cheaper, and more secure. According to Cointelegraph, this would allow Deutsche Bank to “address compliance challenges associated with using public blockchains in regulated finance.” The goal is Deutsche Bank's project could inspire more financial institutions to embrace decentralized networks, but its 2025 launch depends on securing regulatory approval.

The Fed Cut By A Quarter Of A Point

As expected, Jerome Powell at the Federal Reserve lowered interest rates yesterday by a quarter percentage point to a range of 4.25% to 4.5%. What wasn’t expected was some of the hawkish language and the hint at a slower pace of rate cuts ahead, “It's kind of common sense that when the path is uncertain, you go a little bit slower. It's not unlike driving on a foggy night or walking into a dark room full of furniture. Today was a closer call but we decided it was the right call. We moved pretty quickly to get to here, and I think going forward obviously we’re moving slower.”

Bitcoin Is Crushing Gold: Here’s Why $250,000 BTC Is Closer Than You Think!

Markus Thielen, 10x Research, and James Butterfill, Head of Research at CoinShares, join me today to discuss the future of Bitcoin.

Chris Inks will join us in the second part to share some interesting trades in crypto and beyond.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform. MY LINK

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.