Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Diversified outcomes were the name of the game this past week for Arch Public. Our MNQ Algorithm returned +12.52%. Our MES Algorithm returned -11.9%. A net result of +.6% for the week. Our Concierge Program clients benefit from multiple algorithmic outcomes that flatten the performance curve and produce a diversity of results. While one algorithm may produce a negative result, another may be positive. And some weeks, both (or all!) are positive.

Try Arch Public now! You can even demo the platform, for free, to learn more.

In This Issue:

Predictions Are Pouring In

Bitcoin Thoughts And Analysis

Legacy Markets

Will There Be An Ethereum Strategic Reserve?

FASB Fair Value Accounting Has Finally Begun

MSTR Joins The Nasdaq 100

Are Solana Unlocks Coming?

Liquid Restaking Growth Is Rapidly Rising

Bitcoin Will Skyrocket, But Crypto Casinos Are The Next Big Thing! | Nigel Eccles

Predictions Are Pouring In

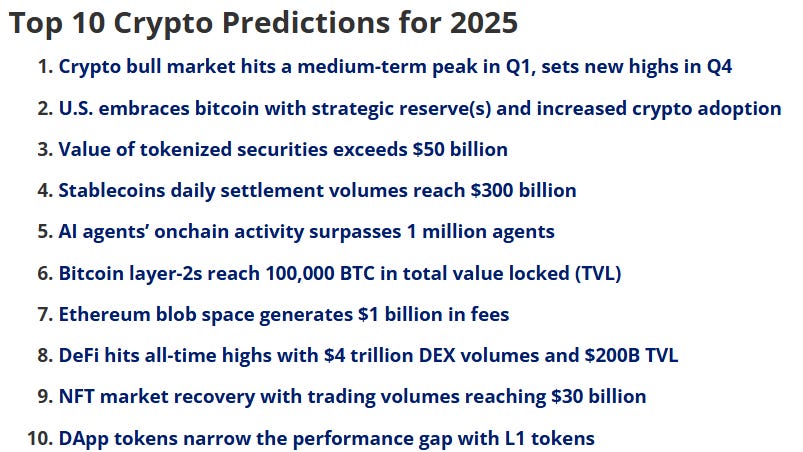

Let’s get straight to it—here’s the scorecard for some of the major crypto predictions (we have so far) heading into 2025:

Bitwise

Bitcoin: $200,000

Ethereum: $7,000

Solana: $750

(Note: If the U.S. government follows through on proposals to establish a 1 million bitcoin strategic reserve, $200,000 becomes $500,000 or more.)

VanEck

Bitcoin: $180,000

Ethereum: $6,000

Solana: $500

(Bitcoin to be valued at around $180,000, with Ethereum trading above $6,000. Other prominent projects, such as Solana and Sui, could exceed $500 and $10, respectively.)

Matrixport

Bitcoin: $160,000

The dichotomy of the crypto space is fascinating. Matrixport, a crypto company, is recommending a 1.55% allocation for “optimal diversification,” while BlackRock, a non-crypto company, was comfortable going up to 2%. Meanwhile, you have Saylor relentlessly looking for ways to push MicroStrategy’s Bitcoin exposure beyond 100%.

Anyway, today I want to dive into VanEck’s 10 Crypto Predictions for 2025. Matthew Sigel, head of digital assets research, has been releasing some of the most insightful and alpha-packed reports on the asset class for quite some time now. So, on that note, let’s take a closer look at what he’s forecasting for the year ahead.

To keep this newsletter fresh, I’m not going to cover every prediction like I did with Bitwise. Instead, I’ll highlight my favorite ones and dive a bit deeper into those.

“Crypto bull market hits a medium-term peak in Q1, sets new highs in Q4.”

I’ve covered some of this prediction above, but there’s more to unpack. The five key metrics that VanEck will be measuring to determine when the market is “nearing its top” include: sustained high funding rates, excessive unrealized profits, overvalued market cap relative to realized value, declining Bitcoin dominance, and mainstream speculation.

This one is interesting, “Overvalued Market Cap Relative to Realized Value: When MVRV (market value to realized value) scores exceed 5, it shows BTC prices are far above average purchase prices, often signaling overheated conditions.” Currently, with the price of Bitcoin surpassing $100,000, the MVRV (Market Value to Realized Value) score stands at 2.95, according to Coinglass.

“Mainstream Speculation: A flood of texts from non-crypto-savvy friends asking about questionable projects is a reliable signal of speculative mania near the top.”

This one’s funny, and there’s definitely some truth to it, but don’t measure it in isolation. I’ve been getting a steady stream of ridiculous texts about all sorts of memecoins, scams, and random projects, on and off. I do expect this to ramp up further down the line, and I’ll be keeping an eye on it, but for now, this is definitely the wildcard and most subjective of the group.

“Declining Bitcoin Dominance: If Bitcoin’s share of the total crypto market drops below 40%, it implies a speculative shift into riskier altcoins, a classic late-cycle behavior.”

A 15% drop in Bitcoin dominance implies an epic altcoin season. If we ever experience an altcoin season that far surpasses anything we've seen before, I highly encourage profit-taking if you don’t want to hold onto your positions for another 2 to 4 years.

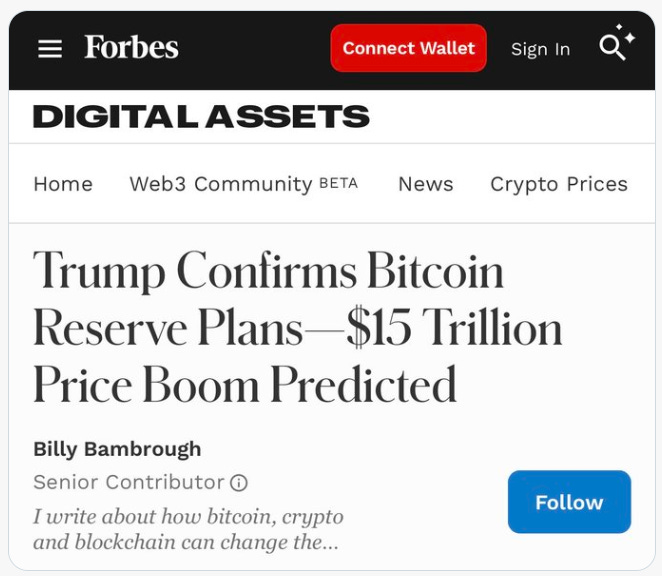

“U.S. embraces bitcoin with strategic reserve(s) and increased crypto adoption.”

Let’s see what VanEck has to say about this first:

“We predict that by 2025, either the federal government or at least one U.S. state—likely Pennsylvania, Florida, or Texas—will establish a Bitcoin reserve. Federally, this is more likely to occur through an executive order utilizing the Treasury’s Exchange Stabilization Fund (ESF), though bipartisan legislation remains a wildcard. Simultaneously, state governments may act independently, viewing Bitcoin as a hedge against fiscal uncertainty or a tool to attract crypto investment and innovation.”

To build on VanEck’s prediction, my expectations are that by 2025, at least a handful of states will adopt Bitcoin as part of their reserve strategy and Trump will in fact sign a federal Bitcoin reserve into law—either through an executive order or bipartisan legislation. The evidence is overwhelming for both of these events to happen and yet institutions, understandably, are taking the cautious and conservative route.

Up next, the following prediction came from the segment on tokenized securities: “As a wildcard bet, we forecast that Coinbase will take the unprecedented step of tokenizing COIN stock and deploying it to its BASE blockchain.” We’ve never seen anything like this, but I can imagine it being bullish for COIN and marking the beginning of a narrative that hasn’t really materialized yet (tokenized equities). COIN is also a very fitting name for the first ever tokenized stock—poetic.

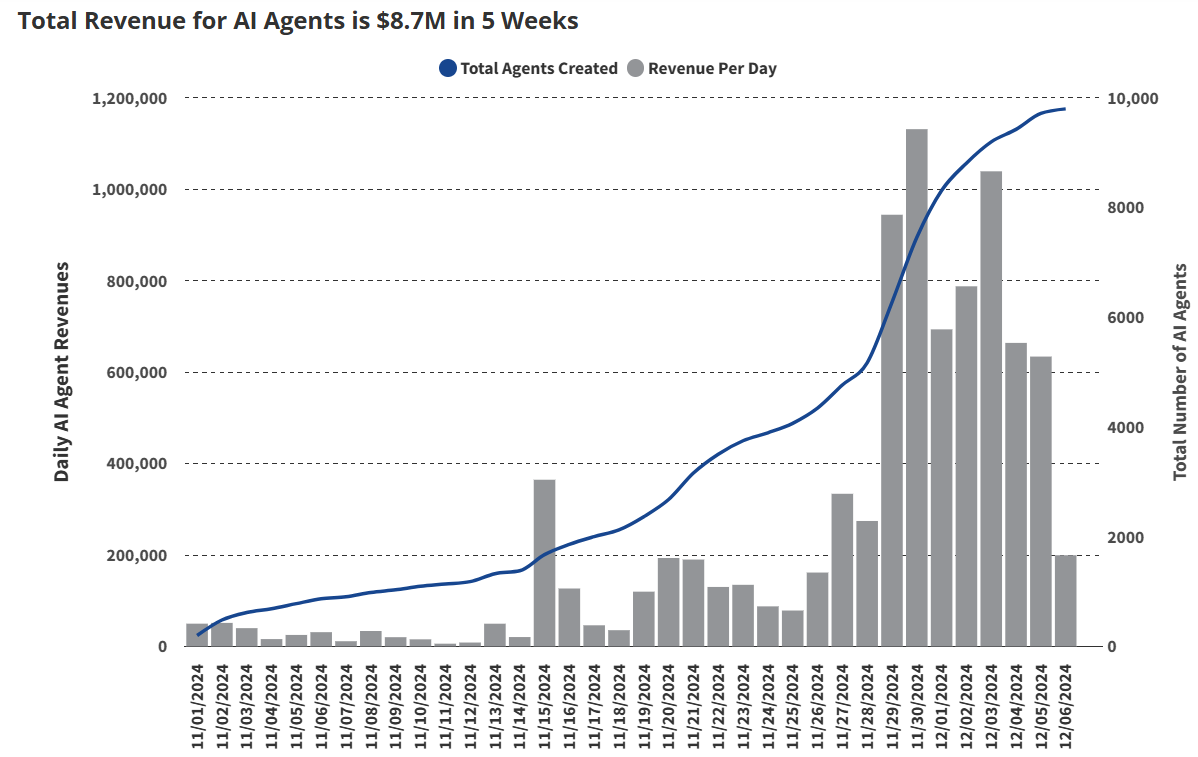

5. “AI agents’ onchain activity surpasses 1 million agents.”

This prediction is out of my wheelhouse, which means I am going to defer entirely to VanEck on this one:

“One of the most compelling narratives we believe will translate into massive traction in 2025 is AI Agents. AI agents are specialized AI bots that direct users to achieve outcomes such as “maximizing yield” or “spurring X/Twitter engagement.” The agents optimize these outcomes by utilizing their abilities to change their strategies autonomously. AI agents are often fed data and trained to specialize in one domain. Currently, protocols like Virtuals give anyone the tools to create an AI agent to perform on-chain tasks. Virtuals allow non-experts to access decentralized AI agent contributors such as fine-tuners, dataset providers, and model developers so that non-technical people can create their own AI agents. The result will be the enormous proliferation of agents their creators can lease out to generate income.”

For investors on the hunt for the ‘next big thing,’ this seems like a promising starting point. We’re still early in the game—mainstream discussions around AI agents are noticeably absent for now. In the meantime, I’ll dig deeper into this narrative to stay ahead. Remember, no matter the narrative, it almost always sounds ridiculous at first—and AI agents are no exception.

Here’s a quick bonus from the seventh prediction: “By the end of 2025, we project that Blob Space fees will exceed $1 billion, up from negligible levels today. This growth will cement Ethereum’s role as the ultimate settlement layer for decentralized applications while reinforcing its ability to capture value from its rapidly expanding L2 ecosystem.”

9. “NFT market recovery with trading volumes reaching $30 billion.”

Pudgy Penguins are absolutely dominating right now. And if you take a closer look at the top 10 NFTs over the past 30 days, you’ll notice something interesting—they’re all Ethereum-based. The same holds true for the top 10 of all time. To those who believed SOL NFTs would overtake ETH NFTs, I’m sorry, but that simply didn’t pan out. Now that the market is picking back up and favoring Ethereum, I think it’s clear that ETH has solidified its position as the dominant NFT platform.

“For instance, Pudgy Penguins have successfully transitioned into a consumer brand through collectible toys, while Miladys have gained cultural prominence within the realm of sardonic internet culture. Similarly, the Bored Ape Yacht Club (BAYC) has continued to evolve as a dominant cultural force, attracting widespread attention from brands, celebrities, and mainstream media.”

“Ethereum continues to dominate the NFT space, hosting the majority of significant collections. In 2024, it accounts for 71% of NFT trading, a figure we project to rise to 85% by 2025. This dominance is reflected in market capitalization rankings, where Ethereum-based NFTs occupy the entire top 10 and 16 of the top 20 positions, underscoring the blockchain's central role in the NFT ecosystem.”

“Although NFT trading volumes may not revisit the euphoric highs of previous cycles, we think a $30 billion annual turnover is doable, approximately 55% of the 2021 peak, as the market shifts toward sustainability and cultural relevance over speculative hype.”

That wraps up the VanEck report, which wasn’t too different from Bitwise’s 2025 predictions. However, the standout game-changer on this list remains the prospect of the U.S. buying Bitcoin and its implications for everything else. Market optimism is already high, fueled by the spillover of Bitcoin profits into other areas of the sector.

But imagine what happens if the U.S. starts purchasing Bitcoin in excessive amounts, causing the price to effortlessly blow past $160K, $180K, or even $200K predictions.

At that point, we’re looking at an unprecedented explosion of wealth creation and growth. The trickle-down effects would be massive—impacting COIN stock, Pudgy Penguins, the SOL ETF, TVL, and even AI agents (something I admittedly don’t fully understand yet) as they skyrocket to the upside. Everything and anything will moon.

If the U.S. quickly buys Bitcoin and game theory amongst competing governments begins to play out, all tides rise, and all bets are off—every one of these predictions will fall way short. Bitwise put it perfectly, as I mentioned above and will reiterate again: “(Note: If the U.S. government follows through on proposals to establish a 1 million bitcoin strategic reserve, $200,000 becomes $500,000 or more.)”

As I continue to cover these institutional predictions, keep in mind that most of them, if not all, will likely be on the conservative side. Let’s have a great week! I continue to anticipate a run in Bitcoin and the stronger assets into the year-end. Time will tell.

Bitcoin Thoughts And Analysis

In past bull markets, especially 2017, I remember that we used to joke that the market always pumped on Sunday and then dumped on Monday.

We seem to have temporarily recaptured that trend.

But the day is not done, and Bitcoin hit $106K yesterday… hard to be anything but mega bullish.

Legacy Markets

US Stock Optimism Builds Amid Central Bank Rate Decisions

US equity futures pointed to further gains on Monday, driven by optimism ahead of key central bank rate decisions this week. Nasdaq 100 futures rose 0.3%, signaling potential new highs after the index reached a record close on Friday. Meanwhile, S&P 500 futures gained 0.2%, with MicroStrategy advancing over 6% in premarket trading following its upcoming inclusion in the tech-heavy index, reflecting its transformation into a Bitcoin-focused company. These gains came despite weaker performances in Asia and Europe, where disappointing Chinese retail data and euro-area private sector contractions dampened sentiment.

Expectations of a quarter-point rate cut from the Federal Reserve on Wednesday are adding to the bullish outlook for US markets. The S&P 500 has surged 27% in 2024, with analysts attributing the rally to strong earnings and optimism surrounding economic policies under President-elect Donald Trump. According to Marija Veitmane, a senior strategist at State Street Global Equities, the focus will now shift to earnings growth, where the US continues to show solid potential. Following the Fed’s decision, other central banks, including those in Japan, the UK, and Nordic countries, are set to announce policy updates later in the week.

Dollar Weakness and China's Struggles

The Bloomberg Dollar Index remained steady after six days of gains, but sell-side analysts predict the dollar will peak by mid-2025, driven by Trump’s policies and the Fed’s rate cuts. Meanwhile, in China, retail sales data disappointed, growing only 3% in November compared to the 5% forecast. Analysts criticized Beijing’s vague stimulus efforts, citing the need for more concrete measures to counter persistent economic challenges.

European Strains and Bitcoin's Rise

In Europe, markets were pressured by political instability and economic challenges. France faced fallout from a Moody’s credit rating downgrade, while Germany’s Chancellor Olaf Scholz braced for a no-confidence vote that could trigger new elections during a period of economic decline. Strategists noted that fiscal support in Germany could be delayed by political uncertainty, leaving the European Central Bank to provide interim relief.

Bitcoin surged past $106,000 on Monday, gaining over 3% on news of Trump’s support for digital assets, which also lifted sentiment across the broader crypto market. As traders brace for pivotal decisions from the Fed and other central banks, the optimism in US markets contrasts with the broader uncertainty in global economies.

Key events this week:

UK jobless claims, unemployment, Tuesday

UK CPI, Wednesday

Eurozone CPI, Wednesday

US rate decision, Wednesday

Japan rate decision, Thursday

UK BOE rate decision

US revised GDP, Thursday

Japan CPI, Friday

China loan prime rates, Friday

Eurozone consumer confidence, Friday

US personal income, spending & PCE inflation, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.2% as of 6:41 a.m. New York time

Nasdaq 100 futures rose 0.3%

Futures on the Dow Jones Industrial Average rose 0.1%

The Stoxx Europe 600 fell 0.3%

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro fell 0.1% to $1.0490

The British pound rose 0.2% to $1.2647

The Japanese yen fell 0.1% to 153.82 per dollar

Cryptocurrencies

Bitcoin rose 1.3% to $104,167.17

Ether rose 1.8% to $3,924.89

Bonds

The yield on 10-year Treasuries declined two basis points to 4.38%

Germany’s 10-year yield declined two basis points to 2.24%

Britain’s 10-year yield declined two basis points to 4.39%

Commodities

West Texas Intermediate crude fell 1.2% to $70.44 a barrel

Spot gold rose 0.5% to $2,661.55 an ounce

Will There Be An Ethereum Strategic Reserve?

Would I love to see the U.S. purchase ETH to establish a strategic Ethereum reserve? Absolutely. Do I think it will happen in 2025? Almost certainly not. The excitement around the idea of a reserve beyond Bitcoin stems partly from Trump’s DeFi project, World Liberty Financial. The team behind it is buying ETH, and Trump has mentioned crypto broadly—not just Bitcoin.

However, the current push for a strategic Bitcoin reserve is almost entirely driven by the industry and politicians focused exclusively on Bitcoin. I doubt Trump would stick his neck out for Ethereum or advocate for the U.S. to buy it anytime soon. If the Bitcoin reserve succeeds and Trump leans further into “crypto,” this idea might gain some traction. For now, though, I’d place the odds at squarely at less than 5%.

FASB Fair Value Accounting Has Finally Begun

The Financial Accounting Standards Board (FASB) sets U.S. accounting standards, known as GAAP, to ensure consistency and transparency in financial reporting. One key rule involves the treatment of ‘long-lived intangible assets,’ such as patents or, controversially, Bitcoin. Critics argue that this classification overlooks Bitcoin’s unique nature as a highly liquid asset that trades 24/7/365, suggesting it should instead be treated like a commodity.

Under FASB’s classification, companies must record Bitcoin at its purchase price and write it down if its value drops (impairment) but cannot adjust the value upward if the price recovers unless it’s sold. This creates a disconnect between Bitcoin’s market value and how it’s represented on financial statements, impacting companies like MicroStrategy that hold significant amounts. Treating Bitcoin as a commodity would allow fair value reporting, better reflecting its liquidity and real-time trading activity.

Companies holding Bitcoin, such as MicroStrategy or Coinbase, now benefit from updated FASB guidelines that allow them to report Bitcoin at its fair market value on their financial statements. Instead of being required to write down Bitcoin’s value during price drops and unable to recognize gains unless sold, these companies can now adjust the value of their Bitcoin holdings to reflect real-time market prices—both upward and downward.

MSTR Joins The Nasdaq 100

After months of speculation, MicroStrategy has officially joined major household names like Apple, Nvidia, Microsoft, Amazon, Broadcom, Meta, Tesla, and Costco in the Nasdaq-100 Index. Commenting on the news, Eric Balchunas noted, “Likely a 0.47% weight (40th biggest holding). There’s $550B of ETFs tracking the index. S&P 500 add next year prob.”

This development not only adds credibility to the idea of MicroStrategy eventually joining the SPDR S&P 500 Trust (SPY) but also raises questions about how it might impact Michael Saylor’s ability to accumulate more Bitcoin. While difficult to quantify, the inclusion in QQQ effectively means that institutional investors and retirees writing checks to index funds are indirectly funding Saylor’s Bitcoin strategy, giving them exposure to Bitcoin through MicroStrategy.

The rebalancing of the QQQ is scheduled to take effect on December 23rd.

Are Solana Unlocks Coming?

Yes, Solana unlocks are coming, but frankly, they don’t really matter. Also, it’ not like unlock are a surprise—there were always part of the unlock schedule. The only reason Crypto Twitter is making a fuss now is because Solana has been underperforming compared to other alt-L1s and Ethereum over the past month. The unlocks are more of a convenient narrative for negativity than a legit fundamental issue. The real story is that Solana has been on an incredible run for over a year. While the hype and meme-fueled momentum have cooled recently, the criticisms Solana is facing now are no different from the ones Ethereum has dealt with in the past. It’s all par for the course.

Liquid Restaking Growth Is Rapidly Rising

Ethereum liquid restaking protocols have experienced explosive growth in 2024, with TVL surging nearly 6,000% from $284 million on January 1 to $17.26 billion by December 15, driven by increasing demand for staked asset utility. For a little bit of historical context, restaking first gained attention as a concept after Vitalik Buterin proposed it in his May 2023 post, “Restaking and Rebuilding Trust in Stake Systems.”

The idea behind restaking is that it enhances the utility of staked assets by enabling them to secure additional networks or perform other functions without compromising Ethereum’s security. Liquid restaking builds on liquid staking by providing derivative tokens that stakers can use in DeFi activities while maintaining liquidity. Ether.fi leads the liquid restaking market, controlling over 50% of TVL with $9.17 billion in restaked assets, according to DefiLlama.

Bitcoin Will Skyrocket, But Crypto Casinos Are The Next Big Thing! | Nigel Eccles

Join me on The Wolf Of All Streets as I sit down chat with Nigel Eccles, the visionary founder of FanDuel, now taking his expertise to the crypto space. Learn how his battle with regulators in the fantasy sports industry is shaping his innovative crypto casino, BetHog. From political prediction markets to building social gaming experiences with blockchain, this conversation is packed with insights, controversies, and the future of crypto gambling. Don't miss it!

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform. MY LINK

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.