Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

The Wolf Den Has A New Sponsor - Aptos!

I’m really excited to announce that Aptos—the most exciting layer 1 blockchain competing with Solana and Ethereum—is now an official sponsor of this newsletter! Over the past few months, I’ve had the chance to get to know the Aptos team, create content with them, and interview their CEO and co-founder, Mo Shaikh. Stick around because I have a lot more to share about Aptos below the intro.

Aptos is the blockchain network with everything you need to build your big idea.

Let’s Move.

In This Issue:

Considerations For A Model Portfolio

Aptos Weekly Roundup

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Texas Files A Bill To Establish A Strategic Bitcoin Reserve

Trump Is Ready To Make Crypto Great Again

BlackRock Only Recommends A 2% Bitcoin Allocation

USDe Flips DAI

Is Bitcoin About To Skyrocket? The Parabolic Move Everyone Is Waiting For!

Considerations For A Model Portfolio

Seasoned crypto investors understand the power of long-term holdings. This wisdom is partly rooted in the harsh reality that many short-term traders get shaken out of the market before they can benefit from the next cycle, leaving only the most resilient to thrive. In the world of investing, just as in nature, survival of the fittest prevails—those who endure the volatility are the ones who ultimately succeed.

For the diversified crypto investor, however, merely surviving isn’t enough to achieve optimal success. Eventually, key decisions must be made—particularly around managing long-term capital gains and rebalancing the portfolio to stay aligned with shifting goals and market dynamics. A general truth to consider is that minimizing risk reduces the frequency and complexity of decisions, while maximizing risk amplifies them, requiring greater attention and strategy.

Bitcoin maximalists enjoy the luxury of minimal decision-making, as their sole focus on Bitcoin allows for a more passive approach with few portfolio adjustments required over time.

In contrast, vanilla crypto investors—those with a portfolio consisting of Bitcoin, Ethereum (ETH), and Solana (SOL)—have a handful of decisions to make. They need to assess market conditions, manage risk, and periodically rebalance their portfolios based on performance and shifting goals. However, compared to more diversified portfolios, these decisions are relatively straightforward.

A third category of investors, the most diversified, includes those who hold a wide range of assets across various sectors, such as DeFi tokens, NFTs, and altcoins. These investors face a greater volume of decisions, navigating complex market trends and the unique dynamics of each asset class while continually rebalancing to maintain a cohesive strategy.

Interestingly, the third group tends to have the widest distribution of skill levels, with the highest concentration of beginners. Meanwhile, the Bitcoin-only group has a larger median of high-skill investors. Yeah, I said it. Don’t get me wrong—there’s money to be made in all three groups. The key is staying in the lane that suits you best.

Since most of my readers likely fall into groups two and three—and most of you should probably be in two—I want to walk through an example portfolio reflecting group two and highlight some of the decisions long-term holders in that category might face.

A Sample Portfolio

Imagine a portfolio consisting of:

Bitcoin (BTC): 60%

Ethereum (ETH): 15%

Solana (SOL): 10%

Altcoins & Memecoins: 15%

For simplicity, assume the portfolio is valued at $10,000:

Bitcoin: $6,000

Ethereum: $1,500

Solana: $1,000

Altcoins & Memecoins: $1,500

Now, let’s imagine some time has passed, and the portfolio experiences growth. Bitcoin, Ethereum, and Solana have grown by 10%, 20%, and 30%, respectively. Meanwhile, the altcoins and memecoins category has surged by 500%, creating an imbalance in the portfolio.

A Good Problem to Have

Here’s the new portfolio breakdown:

Bitcoin: $6,600

Ethereum: $1,800

Solana: $1,300

Altcoins & Memecoins: $9,000

Total Portfolio Value: $18,700 (+87%)

This sudden imbalance presents a dilemma: Should the investor continue holding these high-risk, high-reward assets, hoping the rally continues? Or should they reallocate some gains into more stable holdings like Bitcoin, Ethereum, and Solana to restore balance and reduce overall risk?

Questions to Consider

Once the euphoria fades, the investor should ask:

What has fundamentally changed in the altcoins/memecoins category?

Are there lagging assets that should be sold?

What are the tax implications of selling and reallocating gains?

Do Bitcoin, Ethereum, or Solana align with long-term goals and risk tolerance?

Should adjustments be gradual or immediate?

What psychological biases might influence decision-making?

Timing and Taxes

Let’s assume today is December 13, 2024. The investor must decide whether to sell gains now, incurring 2024 taxes, or wait until 2025, delaying taxes but risking volatility in altcoins and memecoins. Tax-loss harvesting might be an option, but the investor needs to weigh the risks and align actions with long-term goals.

My Approach

If I were in this investor’s shoes, here’s how I’d approach the situation (not financial advice):

Rebalancing: I’d reduce the altcoin portion back to its original 15% allocation. Staying true to the initial plan minimizes risk and ensures consistency.

Tax Planning: I’d secure funds owed for taxes in a stablecoin earning interest or in Bitcoin. For profits beyond taxes, I’d assess underperforming assets and rebalance accordingly.

Timing: Since we’re in a crucial bull cycle, I’d aim to re-enter positions within two weeks. If no clear entries appear, I’d dollar-cost average daily.

Once rebalanced, my focus would shift to staying informed. Unless there’s a significant market move or fundamental shift, I’d stick to the plan, leveraging the power of doing nothing while letting the portfolio grow.

The complexity of investing increases with diversification, but the principles of rebalancing, risk management, and aligning with long-term goals remain universal. As your portfolio grows, stay true to your strategy and risk tolerance.

It’s exciting to see Bitcoin over $100,000 and other key developments. Make sure to check out the Aptos weekly roundup below, and thank you for being part of this journey. Writing this newsletter daily is a privilege, and I’m grateful for your support.

Aptos Weekly Roundup

Messari did a full writeup on the Aptos ecosystem!

Messari puts out some of the best research in the space. I highly recommend reading this report to get a clear picture of what Aptos has been working on and where this L1 is really making moves.

Aptos was named in the CoinDesk Most Influential 2024.

This what CoinDesk said about the selection, “The layer-1 blockchain, a descendant of Facebook's discontinued Libra (later Diem) project, landed integrations with such TradFi players as Stripe, Franklin Templeton and BlackRock. Aptos also released a new version of its smart contract programming language, Move, which is finding usage outside the project's own ecosystem: the language was used to create Movement, a layer-2 network running on top of Ethereum.”

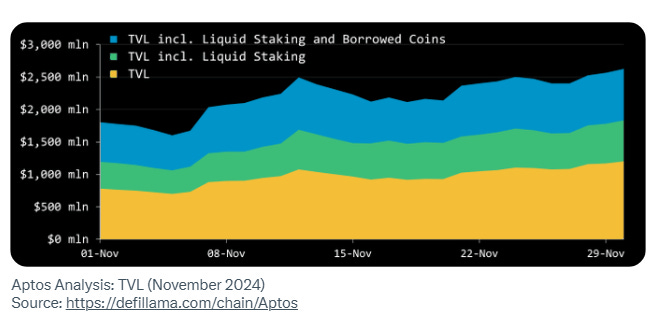

Aptos has some really impressive growth metrics.

You can read the full report HERE.

“Between November 1st and November 30th, Aptos' base TVL increased by 54%, or $420 million, reaching $1.20 billion. When including liquid staking, Aptos' TVL rose by 53%, or $639 million, to a total of $1.83 billion. The most substantial growth was observed in TVL that includes both liquid staking and borrowed coins, which grew by 45%, or $820 million, to reach $2.63 billion.”

Bitcoin Thoughts And Analysis

DAILY CHART

Here’s a detailed analysis of the Bitcoin daily chart:

Key Observations:

Price Action:

Bitcoin has had a parabolic move, breaking above the previous key resistance at $73,835, which is now acting as support.

The price appears to be consolidating in a range between $98,000–$102,000, following the explosive rally. This is healthy after such a strong upward move.

RSI Analysis:

The RSI shows exaggerated bearish divergence (equal highs on price, lower high on RSI) mixed with hidden bullish divergence : While price has been making higher highs, RSI has been making lower highs, indicating weakening momentum. This is a potential warning sign for a pullback or consolidation. The hidden bullish divergence is not the most recent, so the exaggerated bearish divergence still plays. Still, we have clear indecision using this indicator.

Current RSI levels are trending down but remain above 50, suggesting Bitcoin is still in bullish territory despite the divergence.

Moving Averages:

The 50-day SMA (blue line) is trending upward and currently sits near $87,000, providing immediate dynamic support.

The 200-day SMA (red line) is far below at $69,000, showing the long-term trend is strongly bullish.

Volume:

Volume has tapered off during the consolidation phase, indicating indecision or exhaustion among buyers at these levels. A breakout in either direction should be accompanied by a volume spike.

Support and Resistance Levels:

Support:

Immediate support is at the $98,000–$100,000 psychological zone.

Below that, $73,835 serves as a critical level, as it was the previous resistance that Bitcoin broke through.

Resistance:

The key resistance level to watch is around $102,000–$105,000. A breakout above this level could trigger another leg higher, targeting $110,000–$120,000.

Market Context:

Bitcoin remains in a bull market, and this consolidation phase is typical after a parabolic move.

The bearish divergence on RSI warrants caution, as it could lead to a deeper pullback. However, the overall structure remains bullish as long as the price stays above the 50-day SMA and critical support levels.

Strategy:

Bullish Case:

A breakout above $105,000 with strong volume could signal continuation to higher targets, such as $110,000 and $120,000.

Bearish Case:

If the RSI divergence plays out, expect a pullback toward $87,000 (50-day SMA) or even $73,835, which would still maintain the bullish structure.

Summary:

Bitcoin is consolidating after a strong rally, with bearish divergence on RSI hinting at potential short-term weakness. However, the broader trend remains bullish, and pullbacks should be viewed as opportunities to buy at support levels. Watching the volume and reaction at key levels will provide clarity on the next move.

Let me know if you'd like to focus further on specific scenarios or deeper insights!

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

This is the total market cap of crypto, excluding Bitcoin and Ethereum. While charting something like this is speculative since it is not a traded asset, analyzing its movements can provide insights into the potential for altseason. Last week, Total3 reached its all-time high, touching the peak from November 2021 at 1.13T, before being rejected.

Currently, total market cap, including Bitcoin and Ethereum, is already breaking new highs, indicating that Bitcoin has been leading the charge, with its price appreciation driving overall market cap growth.

Take note of the left side of this chart—December 2020 marks the equivalent point in the previous 4-year cycle.

The potential here is significant: if we break to a new all-time high, altcoins could go parabolic in 2025.

Let’s hope history repeats itself.

To be more clear:

Analysis of the Total Crypto Market Cap (Excluding Bitcoin and Ethereum):

This chart provides significant insight into the state of the altcoin market as a whole, especially when viewed through the lens of the 4-year crypto cycle.

Key Observations:

Overall Trend:

The market is in a strong recovery phase, with a clear breakout above previous consolidation patterns (the triangle marked on the chart).

Altcoin market cap has rallied sharply in recent months and is approaching the previous cycle’s key resistance zone around $1.13T, the level where altcoins peaked during the last bull market.

4-Year Cycle Context:

Historically, the altcoin market lags behind Bitcoin in the early stages of a bull market, but significant gains typically follow Bitcoin's lead.

The chart suggests we are in the early to mid-stage of an altcoin bull run, similar to the phase marked "WE ARE HERE" in the previous cycle (2020-2021).

Moving Averages:

50-week SMA (blue line): Strong upward slope, acting as dynamic support during the rally. The market cap is well above this level, showing strong bullish momentum.

200-week SMA (red line): The long-term support is also sloping upwards, confirming a shift to a bullish market structure.

Volume:

Volume has increased significantly during the breakout, confirming the strength of the upward move. This suggests sustained interest and confidence in the altcoin market.

Resistance and Support Levels:

Resistance: The key resistance is around $1.13T, representing the previous cycle’s high. A breakout above this level would likely signal altcoin season, with significant upside potential.

Support:

Immediate support at the breakout zone near $850B–$900B (aligned with the triangle breakout).

Major support lies near $650B–$700B, around the 50-week SMA.

Conclusions:

Altcoin Market Outlook:

If the market cap breaks above $1.13T, this could mark the start of altcoin season, where altcoins outperform both Bitcoin and Ethereum.

If the resistance holds, a retracement to $850B–$900B or even $700B is possible, providing a re-entry opportunity before further upside.

4-Year Cycle Perspective:

The current market position aligns well with the mid-cycle phase of the 4-year crypto cycle, where Bitcoin leads first, followed by Ethereum, and then altcoins.

The chart suggests that altcoins may soon begin their parabolic phase, echoing the explosive growth seen in late 2020 and early 2021.

Actionable Takeaways:

Monitor the $1.13T resistance closely. A breakout with high volume would confirm further upside.

Be cautious of a potential retracement toward $850B–$900B, as this would still preserve the bullish market structure.

Rotations from Bitcoin into altcoins may already be underway, signaling opportunities for significant gains in the broader altcoin market.

Legacy Markets

Wall Street's rally paused on Thursday as traders awaited the Federal Reserve's policy meeting next week, with expectations of a third consecutive rate cut following similar actions by the ECB and Swiss National Bank. Tech stocks, including Broadcom Inc., saw mixed results, with Broadcom gaining 5% in after-hours trading due to strong AI-driven profits. During the day, the S&P 500 and Nasdaq fell as jobless claims surpassed expectations, though inflation data signaled a potential Fed rate cut. The dollar strengthened for the fifth session, while Treasury yields climbed, highlighting uncertainty about economic policy despite diminished recession fears. Concerns grew about the narrow breadth of the market rally, with a few major companies like Nvidia and Apple driving gains while most S&P 500 stocks lagged. Globally, central banks showed dovish tendencies, with the Swiss franc tumbling after a steep rate cut. In commodities, oil pared losses amid a projected supply glut, while gold experienced its largest drop in two weeks. Corporate highlights included Riot Platforms' stock jump due to activist investor interest, Adobe's decline on AI competition fears, and ServiceTitan's IPO surge.

Key events this week:

Eurozone industrial production, Friday

Some of the main moves in markets:

Stocks

The S&P 500 fell 0.5% as of 4:01 p.m. New York time

The Nasdaq 100 fell 0.7%

The Dow Jones Industrial Average fell 0.5%

The MSCI World Index fell 0.5%

Currencies

The Bloomberg Dollar Spot Index rose 0.3%

The euro fell 0.3% to $1.0466

The British pound fell 0.7% to $1.2667

The Japanese yen fell 0.1% to 152.67 per dollar

Cryptocurrencies

Bitcoin fell 1.5% to $100,098.25

Ether rose 1.4% to $3,886.63

Bonds

The yield on 10-year Treasuries advanced six basis points to 4.33%

Germany’s 10-year yield advanced eight basis points to 2.20%

Britain’s 10-year yield advanced five basis points to 4.36%

Commodities

West Texas Intermediate crude fell 0.2% to $70.16 a barrel

Spot gold fell 1.4% to $2,680.15 an ounce

Texas Files A Bill To Establish A Strategic Bitcoin Reserve

Yesterday, Texas State Representative Giovanni Capriglione filed a Strategic Bitcoin Reserve bill during Dennis Porter’s X Space, which effectively does the following for the state:

See Texas buy and hold bitcoin as a strategic reserve asset.

Securely store the BTC in cold storage for at least five years.

Allow Texas residents to donate bitcoin to the reserve.

Ensure transparency via yearly reports and audits.

Allow state agencies to accept cryptocurrencies, and convert them to bitcoin.

Establish rules for security, donations, and management.

If you’re thinking, ‘Oh, this is just one state in the U.S.,’ think again. Texas boasts the second-largest GDP in the U.S. and ranks as the 8th largest globally. In 2023, its GDP was valued at $2.6 trillion—positioning it between France at $3.1 trillion and Italy at $2.3 trillion. It’s true that everything is bigger in Texas.

I like this quote from Capriglione, “My goal is to make this bill as big and as broad as possible. This initial step is to allow some optionality and flexibility on it, but if I am able to get support from other legislators, we will make it even stronger.” So far, we have Texas and Pennsylvania on the scoreboard, but here's the big caveat: the bills still need to pass to become law. It's not a guarantee, and we don’t yet know how much Bitcoin would be purchased if they do pass. We're still very much in the early stages.

Trump Is Ready To Make Crypto Great Again

I’ve got two quick Trump stories for you: First, Trump rang the bell at the NYSE yesterday morning and mentioned crypto while he was there. He said, “We're going to do something great with crypto because we don't want China or anybody else, not just China but others, embracing it—we want to be the head.” Second, Trump’s DeFi project, World Liberty Financial, has been buying up crypto non-stop.

As for World Liberty Financial, take a look below at what the wallet holds:

For all the posts on X claiming that Trump bought another $5 million worth of ETH, that’s a bit misleading. A more accurate statement would be: “Trump’s DeFi project, World Liberty Financial, has been purchasing ETH.” My guess is that Trump isn’t heavily involved in the project’s decision-making—it’s likely low on his radar at the moment. Nonetheless, this is a positive sign, as Trump now has a personal incentive to see ETH prices rise.

BlackRock Only Recommends A 2% Bitcoin Allocation

A recent BlackRock report recommends allocating 1% to 2% of a portfolio to Bitcoin, mirroring the influence of the ‘Magnificent Seven’ tech stocks in a traditional 60/40 portfolio. According to the Bloomberg Bros, this guidance was likely issued in response to the growing number of inquiries about Bitcoin’s role in diversification. While BlackRock highlights Bitcoin’s low correlation to other assets as a diversification benefit, their conservative recommendation seems cautious. It’s not hard to imagine that as the asset matures they may eventually advocate for higher allocations, perhaps in the 3% to 5% range.

USDe Flips DAI

DeFi protocol Ethena's stablecoin, USDe, has overtaken Sky’s Dai (DAI) in market capitalization, becoming the third-largest stablecoin after USDT and USDC according to DefiLlama and Coinmarketcap. Despite this, USDe's market cap is still under $6 billion, far behind USDT’s $140 billion and USDC's $40 billion. Meanwhile, DAI's market cap has dropped from over $7 billion in 2022 to around $4.5 billion. The total market cap of all stablecoins now exceeds $200 billion.

Here’s a brief description of Ethena from Coinmarketcap:

“Ethena is a synthetic dollar protocol built on Ethereum that will provide a crypto-native solution for money not reliant on traditional banking system infrastructure, alongside a globally accessible dollar denominated savings instrument - the 'Internet Bond'.

Ethena's synthetic dollar, USDe, will provide the first censorship resistant, scalable and stable crypto-native solution for money achieved by delta-hedging staked Ethereum collateral. USDe will be fully backed transparently onchain and free to compose throughout DeFi.”

Is Bitcoin About To Skyrocket? The Parabolic Move Everyone Is Waiting For!

Join me and Alex Miller, Founder of Hiro, as we dive into the hottest topics in crypto: Why are billionaires urging investments in Bitcoin? Why are companies stacking Bitcoin on their balance sheets? And what does it all mean for Bitcoin's price trajectory? Is the next parabolic move just around the corner?

In the second part of the show, Dan from The Chart Guys will share his market analysis and some trades.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform. MY LINK

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.