The Wolf Den #1100 - The Truth About Net Worth, Part 2.0

Net worth is still less important than self worth.

Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Use my link HERE.

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 400 trading pairs, minimal fees, peer to peer trading, derivatives, up to 100x leverage.

Make sure to check if Phemex is available in your jurisdiction.

In This Issue:

The Truth About Net Worth, Part 2.0

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Quantum Computing Threats Are As Old As Bitcoin

Circle Partners With Binance

Coinbase Volumes Are Pumping

Microsoft Wasn’t Remotely Close To Buying Bitcoin

Invest In Bitcoin! Why Billionaire Ray Dalio is Betting Big on Bitcoin

The Truth About Net Worth, Part 2.0

One month ago, I wrote a newsletter titled, “The Truth About Net Worth.” Here’s how it opened:

When I wrote this newsletter, BTC was trading at approximately $72,300, ETH at $2,660, SOL at $175, and XRP at $0.52. If only we had spent less time debating net worth and instead gone "giga long" on XRP! Over the past 30 days, BTC has surged by 38%, ETH by 42%, SOL by 30%, and XRP by an astounding 361%. For those of you with substantial portions of your net worth in crypto, I imagine this translated to a remarkable boost in your wealth.

Congratulations—you’ve earned it! And there’s likely more growth to come in the months ahead.

On that note, I’d like to continue our discussion on net worth, adding new insights and details. This time, I’ve come armed with data to deepen the conversation. Let’s unpack it together.

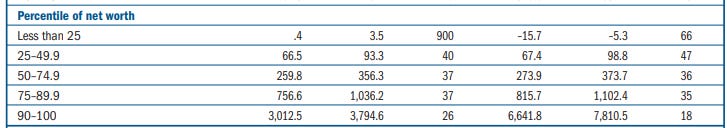

The table above is sourced from a 2023 Federal Reserve Board publication titled “Changes in U.S. Family Finances from 2019 to 2022.” I’d love to share the official data from 2024 with you, but unfortunately, the U.S. government doesn’t operate at that pace.

At the top of the table, some bolded figures stand out:

In 2019, the median net worth of American families was $141,140.

By 2022, the median net worth had risen to $192,900—a 37% increase.

For comparison, I asked ChatGPT how much the S&P 500 grew between the start of 2019 and the start of 2022. The answer? A 48.7% increase.

In 2019, the mean net worth of American families was $868,000.

By 2022, the mean net worth climbed to $1,063,700—a 23% increase.

Yes, all of these figures are adjusted for inflation.

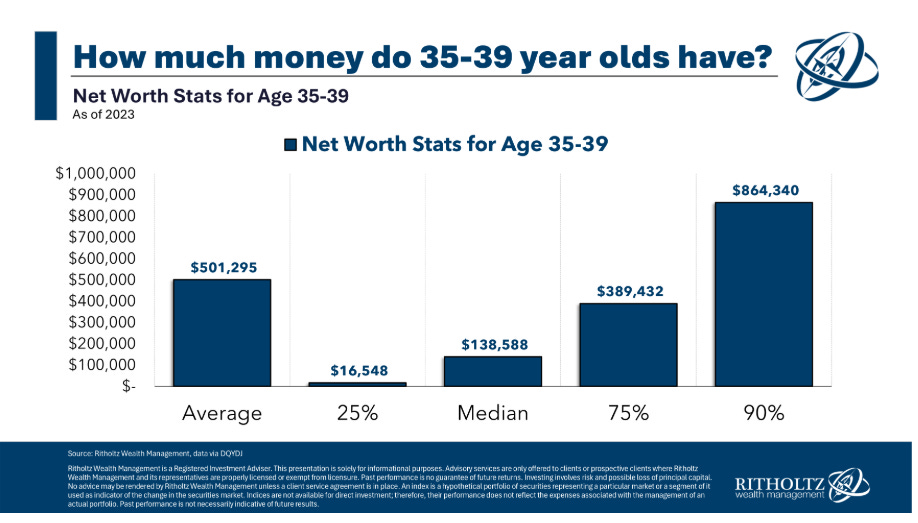

Now, I have some helpful charts to provide perspective on where you might stand based on your age. Keep in mind, these reflect U.S. standards—more on that shortly.

Keep in mind that the average of any sample set is often skewed by higher values—in this case, wealthier households. The median, however, provides a more accurate reflection of what is typical for most households.

To all my readers in their late 30s…

And now, for all my readers: if your age isn’t on this chart (those of you under 20 or over 80), give yourself a pat on the back—thank you for being here!

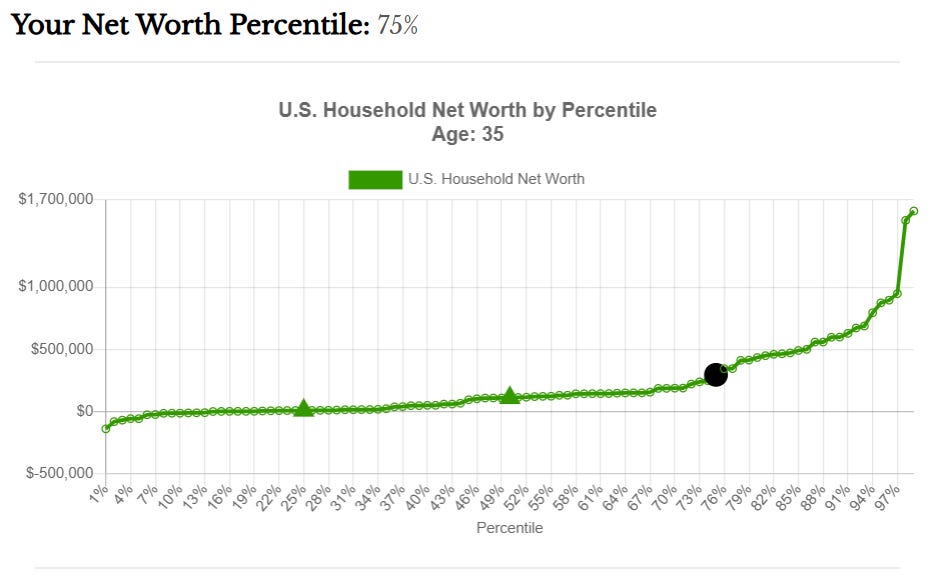

Last but not least, click the image below to enter your age and household net worth into the calculator to see where you stand. I’ve also included a few examples for reference.

For example, a 35-year-old with a net worth of $300,000 falls into the 75th percentile.

Here’s an example: a 55-year-old with a net worth of $750,000.

By now, I hope you have a clear sense of where you stand with your net worth. However, remember that this can vary significantly based on where you live. For instance, earning a modest salary by U.S. standards might place you in the upper echelons of society in countries like Thailand, Vietnam, Portugal, Panama, or Colombia. The takeaway is to be thankful for what you have and recognize how different your situation might be in other parts of the world.

That said, while these numbers are interesting to analyze, they shouldn’t become your sole focus. What truly matters is how you use this information to make smarter financial decisions and build long-term wealth. Understanding where you are can help you gauge how seriously to focus on annual savings or assess your risk appetite, but it’s just one piece of a much larger puzzle.

When I covered this topic last month, I shared four key pieces of crypto-related advice:

Everyone’s net worth and crypto journey is unique, shaped by their individual experiences and perspectives.

Measuring one asset’s performance against another shouldn’t be glorified; the only scoreboard that truly matters is innovation.

Crypto investors should give themselves credit for taking on risk and resist the urge to chase the fastest horse.

Success as an investor shouldn’t be defined solely by gains but by a commitment to learning and staying within your circle of competence in this uncharted space.

Today, I want to expand on that discussion with four new insights about net worth and crypto investing, especially as the market picks up speed.

1. Embrace the risk inherent in crypto.

Crypto comes with volatility. Bitcoin fluctuates, and the landscape includes countless competing layer-1s, utility tokens, L2 solutions, memecoins, and obscure altcoins—most of which won’t survive. As your net worth grows, remember that significant drawdowns, whether temporary or permanent, are part of the journey. For instance, a 30% drop on $1,000 is manageable at $300, but a 30% drop on $1,000,000 means losing $300,000—a very different experience. Always consider what those dollar losses once represented to you and make decisions to avoid giving it all back.

2. Decide whether you’re here for the cycle or the long haul.

If you’re a crypto tourist (no judgment), prioritize learning and consider taking profits sooner, as there may be gaps in your understanding of the market that need addressing. For those in it for decades, shift your focus away from short-term net worth fluctuations and toward two primary goals: holding through the long term and accumulating more. While taking profits isn’t discouraged, ask yourself—if you believe Bitcoin is heading to $1 million, do you want to cash out at $100,000?

3. Diversify your net worth beyond crypto.

Especially for older readers, diversification is essential. Consider your broader financial picture: Is your Roth IRA on track? Do you have a 401(k) or social security to rely on? Have you set aside enough emergency cash for unexpected health concerns or other surprises? A diversified strategy protects you from overexposure to crypto’s inherent volatility. For younger readers, take the time to explore opportunities outside crypto. Weigh the risks and rewards of alternative investments as part of a well-rounded approach to building your financial future.

4. Assess Bitcoin’s role as a savings account.

Finally, let’s revisit an ongoing question: Is Bitcoin the greatest savings account on Earth?

The answer—so far—is yes. Allocating a significant portion of your net worth to Bitcoin has consistently been one of the best financial decisions over the past decade, and I suspect this trend will hold true for the decade ahead. Michael Saylor has demonstrated that even with more than 100% exposure to Bitcoin, success is possible. While this extreme approach should never be replicated, it serves as compelling evidence that increasing Bitcoin allocations might be reasonable for those already invested. For instance, moving from 2% to 5% or from 10% to 15% could be a prudent adjustment. It won’t be easy, but the coming decade will likely reward those who remain the furthest from zero.

In the months and years ahead, many lives will be transformed—hopefully for the better. Reflect on the principles that have guided you so far. If this is your first cycle, temper your expectations and proceed cautiously—this group is most at risk of losing it all without understanding how or why. If you’re in your second cycle, prepare for tough lessons—this is when real learning begins. For those in their third cycle or beyond, it’s time to leverage your hard-earned wisdom and make it count.

Net worth is a long game, played over a lifetime, not confined to a single 4-year Bitcoin cycle. Always prioritize your health, relationships, and overall well-being above financial growth. Let the gains you achieve enhance your life in meaningful ways rather than detract from what truly matters.

It’s thrilling to see Bitcoin back above $100,000. Whether this marks a true recovery or just another clever shakeout, only time will tell. That said, my intuition suggests we’ll witness strong price action as the year draws to a close.

Bitcoin Thoughts And Analysis

Want to see something cool? I entered the above chart into ChatGPT with no further information. My lines are drawn, so it clearly identified those as key levels in its analysis, but I did not offer anything else.

Here’s a technical analysis of the Bitcoin (BTC/USD) daily chart provided:

Key Observations:

All-Time High Retest Zone:

The price has broken above significant resistance near $100,000, which was a key psychological level. This breakout signals strong bullish momentum.

Bitcoin is currently consolidating just above this zone, suggesting a potential retest of support at $99,860.

Trend Confirmation:

Bitcoin is in a strong uptrend, as indicated by the series of higher highs and higher lows. Both the 50-day SMA (blue) and the 200-day SMA (red) are sloping upwards, confirming bullish momentum.

The price is well above both moving averages, indicating strong support and an extended bullish structure.

Volume Analysis:

Volume increased significantly during the initial breakout above $100,000, validating the move.

Recent volume levels during consolidation are slightly lower, which is typical during a pause after a breakout.

Support and Resistance Levels:

Immediate Support: The key level to watch is $99,860, where prior resistance is now expected to act as support.

Major Support: The next critical support lies near $73,835, the previous breakout level.

Resistance: While Bitcoin is trading in uncharted territory, potential resistance could form near psychological levels such as $105,000 and $110,000.

Momentum Indicators:

Momentum remains strong, with no immediate signs of bearish divergence. The absence of a pullback after such a significant rally indicates sustained buying pressure.

Potential Scenarios:

Bullish Continuation:

A daily close above $100,000, followed by a retest and successful hold of this level, could lead to further upside.

Potential targets include $105,000 and $110,000 in the near term.

Consolidation:

Bitcoin may consolidate between $99,860 and $102,000, allowing the market to absorb gains before the next move higher.

This would allow the moving averages to catch up and provide additional support.

Bearish Reversal:

A failure to hold $99,860 could trigger a retracement toward the 50-day SMA (~$85,000) or even the major support level near $73,835.

Strategy Recommendations:

For Bullish Traders:

Look for confirmation of a breakout above $102,000 for long entries, targeting $105,000 and beyond.

Use $99,860 as a stop-loss level to manage downside risk (I disgree with this, I would put it lower below support, not on support!)

For Bearish Traders:

Consider short positions if Bitcoin closes below $99,860 with increasing volume, targeting the 50-day SMA or $73,835 for a pullback.

Neutral Traders:

Monitor the consolidation near $100,000. A breakout or breakdown will provide better clarity on the next major move.

Conclusion:

Bitcoin’s daily chart shows strong bullish momentum, with the price breaking above the key $100,000 level. As long as $99,860 holds as support, the uptrend remains intact, with potential for further upside to psychological levels like $105,000 and $110,000. However, a failure to maintain this level could lead to a retracement, offering opportunities for both bulls and bears depending on the direction of the next move.

Not bad, ChatGPT, not bad. Not exactly my analysis, but cool to see.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

Another all-time high for SUI! If you followed my briefly existing website, you may recall the videos I made about this when it was trading below a dollar and forming a massive bull flag. That pattern hit its target at $2.18… and then kept climbing.

SUI is once again breaking into uncharted territory, poised to continue leading the market. To confirm this momentum, we’ll want to see the daily close hold above $4.49 to avoid a potential fake out.

Legacy Markets

European stocks remained steady while the euro gained ahead of the European Central Bank's (ECB) expected 25-basis-point rate cut, marking its fourth reduction this year. The Swiss National Bank surprised markets earlier with a 50-basis-point rate cut, boosting Swiss stocks and bonds, while Canada also cut its policy rate by half a point. Traders are closely watching the ECB's post-decision commentary for insights on future monetary policy, amid divisions within the Governing Council. Meanwhile, U.S. futures edged lower following Wednesday's stock rally, with inflation data aligning with expectations and reinforcing the likelihood of a Federal Reserve rate cut next week.

Luxury stocks, including Brunello Cucinelli, rose alongside China-exposed sectors after Beijing signaled openness to U.S. trade talks. However, Adobe shares dropped over 10% in premarket trading on a weaker-than-expected forecast, while Uber gained from positive management remarks. Asian equities rebounded on hopes for additional growth measures from Beijing, as the Central Economic Work Conference maps out next year’s policies. In commodities, oil prices stabilized after recent gains fueled by potential supply restrictions on Russian and Iranian crude.

Key events this week:

ECB rate decision, Thursday

US initial jobless claims, PPI, Thursday

Eurozone industrial production, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 fell 0.1% as of 10:12 a.m. London time

S&P 500 futures fell 0.2%

Nasdaq 100 futures fell 0.3%

Futures on the Dow Jones Industrial Average fell 0.2%

The MSCI Asia Pacific Index rose 0.7%

The MSCI Emerging Markets Index rose 0.6%

Currencies

The Bloomberg Dollar Spot Index fell 0.1%

The euro rose 0.2% to $1.0512

The Japanese yen was little changed at 152.51 per dollar

The offshore yuan rose 0.1% to 7.2683 per dollar

The British pound was little changed at $1.2762

Cryptocurrencies

Bitcoin fell 1% to $100,552.76

Ether rose 1.7% to $3,895.89

Bonds

The yield on 10-year Treasuries advanced three basis points to 4.30%

Germany’s 10-year yield advanced four basis points to 2.16%

Britain’s 10-year yield advanced five basis points to 4.36%

Commodities

Brent crude rose 0.4% to $73.78 a barrel

Spot gold fell 0.2% to $2,712.75 an ounce

Quantum Computing Threats Are As Old As Bitcoin

I’m not diving into the quantum computing debate—it’s far beyond my area of expertise. What I will say, however, is that this debate is nothing new for Bitcoin. For those unfamiliar, Satoshi even addressed this in the original mailing list, and it resurfaces every cycle as part of the usual FUD. Let’s be honest: if computers capable of breaking current encryption methods truly existed, would Bitcoin really be the primary concern? I’m not convinced.

Circle Partners With Binance

Jeremy Allaire, co-founder and CEO of Circle, joined Richard Teng, CEO of Binance, on stage at Abu Dhabi Finance Week to unveil a strategic partnership between their companies. This collaboration aims to accelerate USDC adoption and strengthen the global digital-asset ecosystem. Binance plans to integrate USDC across its products and services, making it available to over 240 million users for trading, saving, and payments. Furthermore, Binance will adopt USDC as a core stablecoin in its corporate treasury, signaling a major shift toward on-chain financial operations.

Meanwhile, as this story unfolds, guess what Tether is up to?

Currently, USDC's market cap stands at $40.9 billion, which is approximately 29.48% of USDT's $138.7 billion market cap.

Coinbase Volumes Are Pumping

This news is straightforward: trading volumes on Coinbase International (not available in the U.S.) are surging, reaching record levels in daily notional trading. The first two charts below highlight this growth on Coinbase International, while the third provides a broader view of Coinbase overall. December is off to a strong start for derivatives volumes, though it has yet to surpass November’s spot trading levels. The final chart reveals that current volumes remain significantly lower than the peaks of 2021, which were double today’s levels. To me, this signals clear evidence that the cycle isn’t over and still has substantial room to grow.

Derivative Daily Volume

Spot Daily Volume

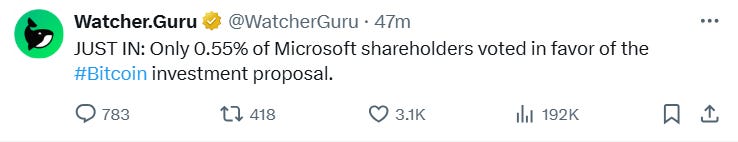

Microsoft Wasn’t Remotely Close To Buying Bitcoin

Yikes. I’m not sure if this was because the Bitcoiners didn’t show up to vote or shareholders just don’t want Microsoft to buy Bitcoin. I don’t know, but it tells me we are still very early. In other Microsoft news, there is this:

The word Ethereum wasn’t explicitly mentioned in the image above, but terms like “asset class,” “crypto,” “liquidity,” and “generating income” were. These align with where Matthew Sigel was headed with his comment on ETH ETF staking.

Invest In Bitcoin! Why Billionaire Ray Dalio is Betting Big on Bitcoin

Join me as I sit down with Nate Geraci, President of the ETF Store, to break down the latest in the crypto world. We explore MicroStrategy's bold Bitcoin purchases, the potential for inclusion in the Nasdaq, and Ray Dalio's intriguing shift toward Bitcoin and gold.

Chris Inks will join us in the second part to share some interesting trades in crypto and beyond.

My Recommended Platforms And Tools

Aptos - The blockchain network with everything you need to build your big idea. Unrivaled Speed, Unprecedented Trust, and an Unstoppable Community on Aptos.

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform. MY LINK

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.

Thank you from Iran in Middle East