Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Trading Alpha Released A Brand New Product!

One of the partners of this newsletter, Trading Alpha, my trusted indicator and trading community, has launched their proprietary Indicator Search Engine for All Markets. This custom Indicator Screener scans crypto, stocks, and forex markets for Trading Alpha indicator setups, eliminating the need for time-consuming manual analysis. It can simultaneously screen for multiple indicators, enhancing confluence and providing advanced analysis capabilities across different markets. This is cutting-edge technology for serious traders.

Make sure to use my link HERE if you plan on giving it a try.

In This Issue:

'Tis The Season of Predictions

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Highlights From Eric Trump’s Speech

Ripple’s Stablecoin Earns Final Approval

Microsoft Voted ‘No’ on Bitcoin

Asset Managers Are Waiting For Trump’s Green Light

'Tis The Season Of Predictions

It’s that magical time of year again—the season of predictions.

This is the time when the crypto community unites to share their most ambitious forecasts for the year ahead. Yet, how ironic would it be if Bitcoin and the broader market encountered a prolonged correction during this hopeful season?

With that in mind, I couldn’t think of a better institution than Bitwise to lead the charge. Their predictions, which went viral yesterday, sparked a wave of thoughts about the future direction of the industry.

In the coming weeks, I plan to share more of my own predictions, but for now, I want to focus on Bitwise’s insights. I trust their expertise and have added a few of my personal reflections along the way.

Please remember, everything you’re about to read is purely speculative. Predictions offer no guarantees, and you should never make decisions based solely on what is shared here. The following could turn out to be entirely inaccurate.

Now, let’s dive into what you came for:

“The Year Ahead: 10 Crypto Predictions for 2025”

Bitwise’s report begins with ten bold predictions:

Bitcoin, Ethereum, and Solana will reach new all-time highs, with Bitcoin surpassing $200,000.

Bitcoin ETFs will attract more capital in 2025 than they did in 2024.

Coinbase will surpass Charles Schwab to become the most valuable brokerage globally, with its stock exceeding $700 per share.

2025 will be the “Year of the Crypto IPO,” with at least five crypto unicorns going public in the U.S.

Tokens created by AI agents will ignite a memecoin mania even larger than 2024’s frenzy.

The number of countries holding Bitcoin will double.

Coinbase will join the S&P 500, and MicroStrategy will enter the Nasdaq-100, incorporating crypto exposure into nearly every U.S. investor’s portfolio.

The U.S. Department of Labor will relax its restrictions on crypto in 401(k) plans, unlocking billions of dollars in new investments.

Stablecoin assets will double to $400 billion, spurred by the U.S. passing long-awaited stablecoin legislation.

The value of tokenized real-world assets (RWAs) will exceed $50 billion as Wall Street deepens its engagement with crypto.

Bonus: By 2029, Bitcoin will surpass the $18 trillion gold market and trade above $1 million per bitcoin.

From here, my plan is to delve deeper into these predictions, sharing insights from Bitwise along with my own perspectives. Stay tuned as we explore what the future may hold for crypto.

Prediction 1: “Bitcoin, Ethereum, and Solana will hit new all-time highs, with Bitcoin trading above $200,000.”

Bitwise is predicting Bitcoin to reach $200,000, Ethereum to reach $7,000, and Solana to reach $750. This would represent a 2.9x increase for BTC from its previous ATH, a 1.46x increase for ETH, and a 2.69x increase for SOL. Personally, I like where Bitwise is at for BTC and SOL, but I don’t quite agree with ETH only reaching a 1.46x. This puts the ETH/BTC ratio at 0.035, compared to its current ratio of 0.037. I don’t see how this ratio wouldn’t increase, especially considering ETH typically outperforms in Q1.

Prediction 2: “Bitcoin ETFs will attract more flows in 2025 than they did in 2024.”

Just to add to this prediction, I expect ETH to outperform in flows relative to its market cap in 2025, along with a wave of ETFs being approved, creating an abundance of diverse options for traditional investors. The endgame is the proliferation of crypto index funds, making crypto more accessible and streamlined for the broader investment community.

Prediction 3: “Coinbase will surpass Charles Schwab as the most valuable brokerage in the world, and its stock will top $700 per share.”

Here’s some supplemental text: “Our prediction: Coinbase stock will trade above $700 per share in 2025 (more than doubling today’s price). That would make Coinbase the most valuable brokerage in the world, surpassing Charles Schwab.” Reading this suggests that Bitwise is anticipating the stock to trade above that level. I’ve long said that $1,000 is possible for COIN, but I’m going to err on the side of caution and predict $800—just a gut feeling. If Bitcoin doubles in 2025, COIN should too, and considering COIN will likely have a higher beta, I’m thinking it does a little more than double.

Prediction 4: “2025 will be the ‘Year of the Crypto IPO,’ with at least five crypto unicorns going public in the U.S.”

Some companies I could see going public are Binance, Ledger, Blockchain.com, Ripple Labs, BlockFi, and Gemini. Here’s what Bitwise predicted, “five likely candidates for IPOs in 2025: Circle, Figure, Kraken, Anchorage Digital, and Chainanalysis.”

Prediction 5: “Tokens launched by AI agents will spearhead a memecoin mania even bigger than in 2024.”

I'm not on the front lines of what's happening with memes, but I know anything is possible. The success of memes seems to be divided between the old guard and the new guard, with AI emerging as a likely catalyst for innovation in this space.

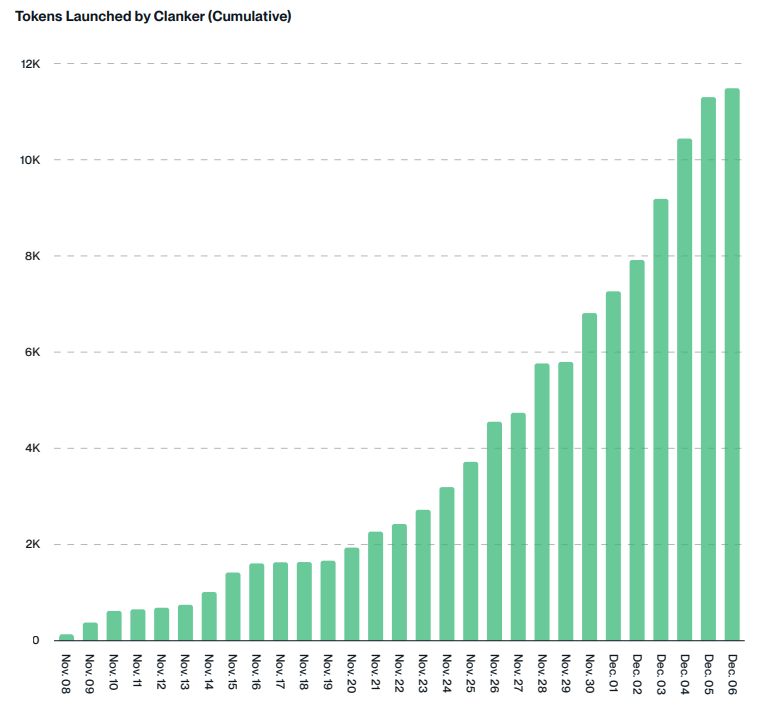

“But the breakthrough we’re most excited about is Clanker, an AI agent designed to deploy tokens autonomously on Coinbase’s Layer 2 scaling solution, Base. Users simply tag Clanker in a post on Farcaster telling the AI agent to launch a token with a given name and image, and it automatically deploys the token.”

Prediction 6: “The number of countries holding bitcoin will double.”

“According to BitcoinTreasuries.net, there are currently nine countries with bitcoin holdings (led by the United States). We expect this to double in 2025.”

These are the countries currently holding Bitcoin: the United States, El Salvador, Venezuela, the United Kingdom, Ukraine, Finland, Georgia, Bhutan, and China. In my view, Polymarket is mispricing the odds of Bitcoin becoming a reserve asset. When it does happen, my prediction is that many countries will follow the U.S. in adopting it. Furthermore, it won’t just be countries with small GDPs; we’ll see some larger ones in the mix as well.

Prediction 7: “Coinbase will enter the S&P 500 and MicroStrategy will enter the Nasdaq-100, adding crypto exposure to (nearly) every U.S. investor’s portfolio.”

The inclusion of crypto-related companies in major indexes will mark a historic moment that the space has yet to witness. I expect that by 2025, with more IPOs, the growing list of companies joining major indexes will extend beyond just Coinbase and MicroStrategy.

“Up until now, however, these indexes excluded the largest publicly traded crypto companies, Coinbase and MicroStrategy. We expect that to change as early as this month, at the next major reconstitution of the two indexes. This could have a big impact.”

“Consider: $10 trillion in assets directly tracks the S&P 500, and another $6 trillion is ‘benchmarked’ to the index. If Coinbase enters the index, we expect funds will have to buy around $15 billion of the stock. If the funds benchmarked to the index add Coinbase, that’s another $9 billion of buying.”

“The expected impact on MicroStrategy is smaller, given the relative size of the funds that track the Nasdaq-100, but still significant.”

It turns out Bitwise published their prediction just in the nick of time, because this news dropped yesterday afternoon.

Prediction 8: “The U.S. Department of Labor will relax its guidance against crypto in 401(k) plans, enabling billions of dollars to flow into crypto assets.”

A pro-crypto administration doesn’t just mean the administration itself is pro-crypto; it means that all government agencies will be forced to reevaluate their positions on the asset class and walk back some of the guidance they’ve issued over the past four years.

“With a new administration in D.C., we expect the Department to soften that guidance. Why should you care? There are (at least) 80 billion reasons.”

“401(k) plans in the U.S. hold $8 trillion in assets. Every week, more capital funnels into these funds. If crypto captures 1% of 401(k) assets, that’s $80 billion of new capital entering the space, with a steady flow thereafter. A 3% capture would be $240 billion.”

Prediction 9: “Stablecoin assets will double to $400 billion as the U.S. passes long-awaited stablecoin legislation.”

I grabbed some data from RWA.xyz

Since November 6th, Tether has printed $20 billion!

“A 2025 stablecoin boom will send the market cap of stablecoins to $400 billion or higher. Four catalysts will fuel the growth: stablecoin legislation, global trade and remittances, fintech integration, and bull market growth.”

This prediction is pretty spot on. If Tether continues at its current rate, reaching $400 billion will be an easy target.

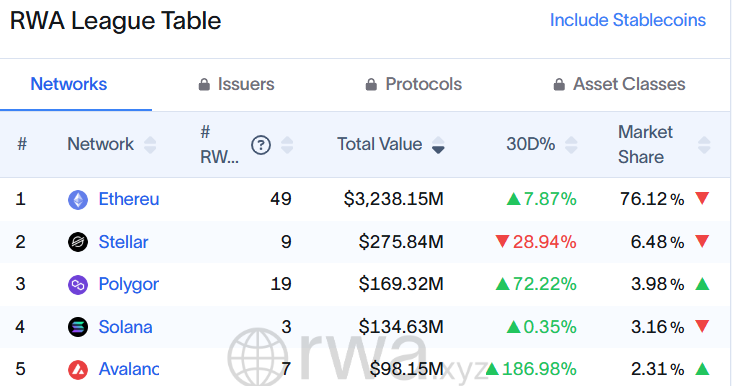

Prediction 10: “The value of tokenized real-world assets (RWAs) will surpass $50 billion as Wall Street’s embrace of crypto intensifies.”

“What explains the massive growth? And why tokenize RWAs—that is, represent real assets on a blockchain—in the first place? Simply put: Tokenization is better. It offers instantaneous settlement, significantly lower costs than traditional securitization, and 24/7/365 liquidity—all while bringing transparency and access to nearly every asset class.”

“That’s why BlackRock CEO Larry Fink, the onetime bitcoin skeptic turned tokenization maximalist, has said that ‘the next generation for markets will be tokenization of securities.’ It bears emphasizing: These words are from the leader of the largest asset manager in the world.”

I’m fully on board with the $50 billion prediction and will defer to Bitwise on this. That said, how is it possible for tokenization to achieve a 3.65x increase in 2025, while ETH only sees a 1.46x rise? The math doesn’t add up.

Tokenization, in its current form, is primarily happening on ETH. And if Larry Fink’s statement about ‘tokenizing securities’ proves to be true, it’s likely that tokenization will continue to be centered around ETH.

Bonus: “In 2029, Bitcoin will overtake the $18 trillion gold market and trade above $1 million per bitcoin.”

“Why 2029? Bitcoin has historically moved in four-year cycles. While there’s no guarantee that will persist, 2029 would mark the top of the next cycle (as well as the 20th anniversary of bitcoin’s creation). Topping gold within 20 years of launching would be quite an achievement, but we think bitcoin can do it.”

“(Note: If the U.S. announces it is buying 1 million bitcoins for a strategic bitcoin reserve, we could get to $1 million per bitcoin a lot faster.)”

Here’s my final thoughts:

Bitwise operates in the asset management business, meaning they bear the highest responsibility to deliver accurate insights for their paying clients. In an ideal world, anyone making predictions would strive to hit every mark perfectly. However, in reality, predictions often fall short, either overshooting or undershooting the mark. To mitigate this, professional-grade forecasts tend to lean toward more conservative adjustments.

I’m not saying Bitwise took this approach, but I do think they may have underestimated the possibility of Trump aggressively buying Bitcoin once he takes office. The more I consider it, while Trump has made plenty of promises, he hasn’t outright declared that the U.S. will be purchasing Bitcoin. Perhaps this leans into tinfoil hat territory, but it would be a savvy strategy to keep prices suppressed—though, realistically, the U.S.'s immense buying power would render this point moot.

I think these odds are too low:

Given everything, we know, I think a fair assessment for where the odds should be right now is between 40% to 50%. Keep in mind, the rules state, “This market will resolve to ‘Yes’ if the US government holds any amount of Bitcoin in its reserves at any point between January 20, 2025, ET and April 29, 2025, 11:59 PM ET. Otherwise, this market will resolve to ‘No’. Note that the US government confiscating Bitcoin does not count as holding Bitcoin reserves.”

I agree with Bitwise’s view that, “If the U.S. announces it is buying 1 million bitcoins for a strategic reserve, we could see Bitcoin reach $1 million per coin a lot faster.” If that happens, all predictions across the board would need to be reevaluated. Bitcoin wouldn’t be the only beneficiary—every category of predictions would likely rise by 1 to 2 additional magnitudes, at the very least.

My thesis for 2025 is simple: Trump loves money and America. He will want the price of Bitcoin to rise and will make sure it’s known that America is to thank for it.

That wraps up everything for the intro. If you're holding spot, don't panic. Check prices in a week or two if you can—I believe we'll see a strong finish to the year.

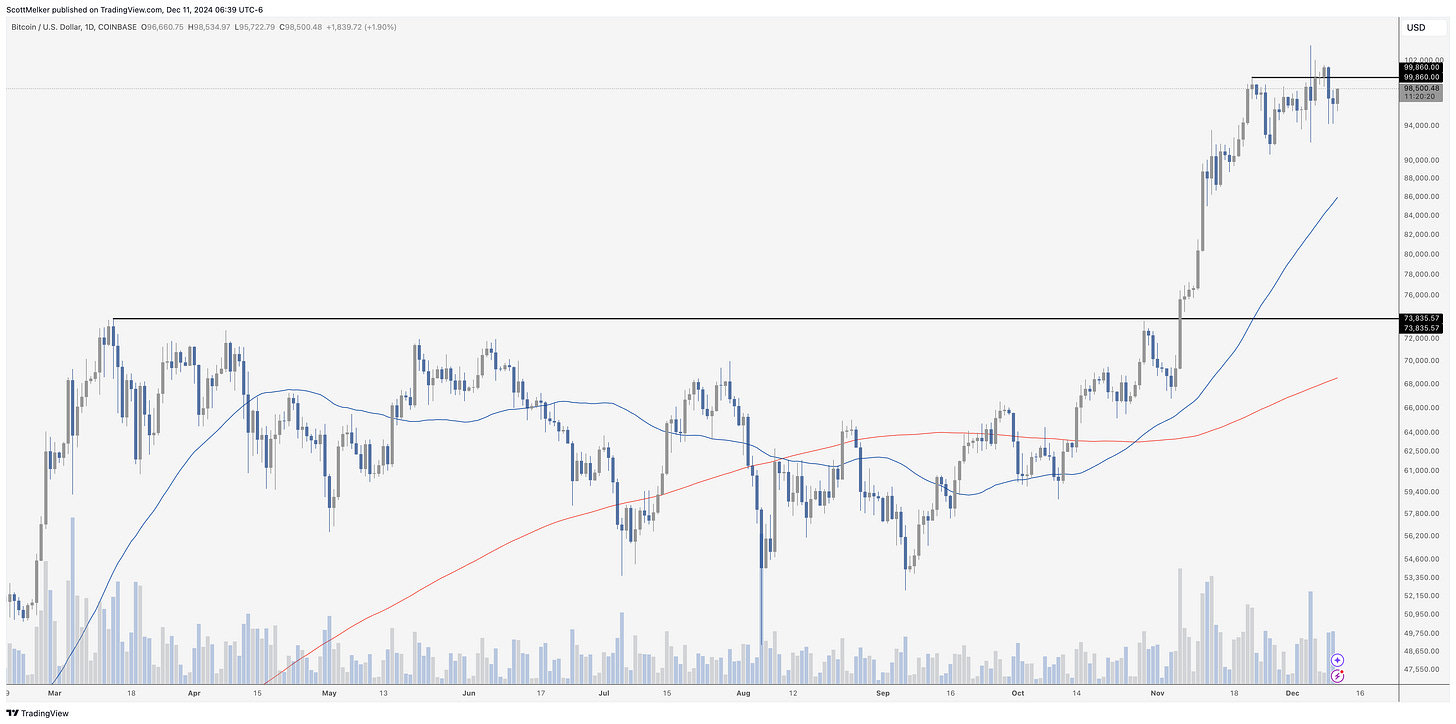

Bitcoin Thoughts And Analysis

There is very little to see here. Bitcoin can correct as low as $74,000 with it being a non event. That would be in line with previous bull market corrections. I am NOT expecting that, to be clear, but Bitcoin consolidating in the 90Ks is nothing to be concerned about.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

I do not have a specific chart to share. I will just note that I believe that dips on your favorite alts are generally for buying, knowing that they can still continue further down if bitcoin continues to correct. A 20-30% drop in a day is a gift long term… even if you don’t end up with the perfect entry. Slowly entering your positions when they are down is generally a winning strategy for bull markets.

Legacy Markets

The dollar strengthened following a Reuters report that Chinese leaders may allow the yuan to weaken in response to anticipated higher tariffs under a second Trump presidency. This news sent the offshore yuan down 0.5% and lifted the Bloomberg dollar index by 0.3%, reaching a two-week high. The ripple effects impacted global markets, weakening currencies like the Australian and New Zealand dollars and emerging-market currencies such as the South African rand. Equity markets were mixed, with US futures slightly higher and Europe’s Stoxx 600 flat. Analysts suggest the yuan’s potential depreciation echoes strategies from the prior trade war, with the dollar's current strength attributed to tariff concerns and expectations of delayed Federal Reserve rate cuts. Meanwhile, individual stock movements saw Walgreens decline on doubts about a Sycamore Partners deal and GameStop rise on a surprise profit. Brent crude gained as the Biden administration mulled new sanctions on Russia’s oil trade, while the Canadian dollar hit a multi-year low ahead of anticipated rate cuts by the Bank of Canada. Central banks in Europe and China are also expected to signal policy easing this week, highlighting diverging monetary strategies worldwide.

Key events this week:

US CPI, Wednesday

Canada rate decision, Wednesday

ECB rate decision, Thursday

US initial jobless claims, PPI, Thursday

Eurozone industrial production, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.1% as of 6:41 a.m. New York time

Nasdaq 100 futures rose 0.2%

Futures on the Dow Jones Industrial Average were little changed

The Stoxx Europe 600 was little changed

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index rose 0.2%

The euro fell 0.3% to $1.0500

The British pound fell 0.3% to $1.2735

The Japanese yen fell 0.4% to 152.55 per dollar

Cryptocurrencies

Bitcoin rose 1.4% to $98,249.23

Ether rose 2.1% to $3,716.5

Bonds

The yield on 10-year Treasuries advanced one basis point to 4.24%

Germany’s 10-year yield was little changed at 2.11%

Britain’s 10-year yield advanced one basis point to 4.34%

Commodities

West Texas Intermediate crude rose 0.9% to $69.23 a barrel

Spot gold was little changed

Highlights From The Eric Trump Speech

I took the time to watch Eric’s speech about Trump at Bitcoin MENA 2024, knowing it could provide valuable insight into his stance on Bitcoin. Understanding where Eric stands seemed crucial, as his perspective is likely to influence his father’s views on the subject. I must admit, I am very impressed. In his speech, Eric demonstrates a comprehensive understanding of Bitcoin’s significance—what it means for the future, his father’s administration, and global investors. It’s clear: Eric is on our side. I compiled a list of all the highlights of the speech for you to read below. If you want to watch the speech, you can do so here, “THE #BITCOIN MENA 2024 DAY 2 LIVESTREAM,” and navigate to the timestamps 5:28:55–5:54:20.

The highlights:

“Here’s your transcription with grammatical corrections while keeping Eric’s exact words intact:

I believe in Bitcoin. I absolutely love Bitcoin; it has a special place in my heart.

He’s (Trump) going to make America the crypto capital of the world.

The reason I am here is I really believe this is the future of finance. I can say with great pride now that he has won, you’re going to have the most pro-crypto president in the history of America. I can honestly say America will lead the way in the digital revolution.

A person (Trump) who has pledged to make crypto tax-free.

I’m not paid to be on this stage; I truly believe this is the future—the beginning of a financial revolution, not just in America but around the world.

Bitcoin is a fundamental shift in how we think about money, wealth, and the future.

It’s a way I think about how I want to safeguard the treasury in our company.

I can tell you a lot of eyes were opened when Bitcoin hit $100,000, and I can tell you a hell of a lot more eyes are going to be opened when Bitcoin hits $1 million—and I’m confident it’s going to hit $1 million.

For the first time, there is another asset that has energy—a new digital asset that is revolutionary, one that consumes energy and has life. One that has the potential to be more powerful than anything we have ever seen before.

The traditional banking system is rigid and vulnerable to manipulation. It’s failed the modern world. It’s failed to adapt. It’s failed to keep up with the modern world. It’s failed the needs of the modern world. That’s where crypto emerges.

Bitcoin is not just an investment. It’s a global asset, a store of value, a hedge against inflation, a hedge against political turmoil, political instability, acts of God—hurricanes, fires, floods, tornadoes. That’s what makes it so powerful.

There’s no question the institutions are petrified.

We, as a family, and my father in office, are going to lead the charge doing this.”

Ripple’s Stablecoin Earns Final Approval

Ripple’s RLUSD stablecoin has received final approval from the New York State Department of Financial Services, according to CEO Brad Garlinghouse. Designed as a 1:1 US dollar-backed stablecoin, RLUSD will challenge Circle’s USDC in the U.S. market, targeting large institutional players and preparing for listing on major crypto exchanges.

Tested earlier this year on the XRP Ledger and Ethereum, RLUSD's launch comes at just the right time as XRP has pulled off 400% returns, climbing its way to the 4th largest cryptocurrency by market cap. Ripple aims to enhance cross-border payment solutions by integrating RLUSD with XRP.

Microsoft Voted ‘NO’ on Bitcoin

No shocker here—the key takeaway is that Microsoft held a vote to adopt Bitcoin. If that doesn’t make you bullish, I’m not sure what will. I’m already anticipating the posts in a few years saying, ‘Had Microsoft voted yes, they’d be up by this percentage.’

Asset Managers Are Waiting For Trump’s Green Light

Goldman Sachs CEO David Solomon stated that the firm would consider entering Bitcoin and Ethereum markets if U.S. regulations evolve. Speaking at the Reuters Next conference, Solomon emphasized that current regulations limit Goldman Sachs' ability to engage in crypto trading. Along with Goldman, other notable firms not in this space yet include Morgan Stanley, Merrill Lynch, Bank of America, and Wells Fargo.

“I do think that these technologies are addressing, and they're getting a lot of attention at the moment because there's a view that the regulatory framework is going to evolve as we go forward differently than it seemed like it was evolving under the last administration.” When asked about making Bitcoin or Ethereum markets, Solomon said, “If the regulatory structure changes, we would evaluate that, but at the moment we're not permitted to.”

My Recommended Platforms And Tools

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform. MY LINK

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.