Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Use my link HERE.

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 400 trading pairs, minimal fees, peer to peer trading, derivatives, up to 100x leverage.

Make sure to check if Phemex is available in your jurisdiction.

In This Issue:

Is Coinbase Sinking?

Bitcoin Thoughts And Analysis

Legacy Markets

El Salvador Alters Bitcoin Strategy For An IMF Loan

Saylor Will Never Stop Buying Bitcoin

The Microsoft Bitcoin Vote Is Today!

A Russian Deputy Is Arguing For A Strategic Bitcoin Reserve

Breaking: Bitcoin Closes Week Above $100,000! What Comes Next?

Is Coinbase Sinking?

Over the past week, I’ve been quietly observing a developing story from the sidelines, trying to piece together what’s happening with Coinbase and the issue of accounts being locked. I held off on commenting right away because I wanted to gather all the facts and ensure I fully understood the situation. While the story was unfolding, I didn’t feel it was urgent to share without a clear understanding. Now, I believe I have a solid grasp of what’s going on.

On November 30th, Brian Armstrong posted this on X in response to a broader discussion about the increasingly popular topic of debanking.

Below is what Armstrong was responding too:

The crypto community was quick to accept the possibility of this happening—anything perceived as anti-bank naturally reinforces the crypto thesis. However, I’ve also observed some dismissing the issue as a conspiracy, which doesn’t seem to align with the facts.

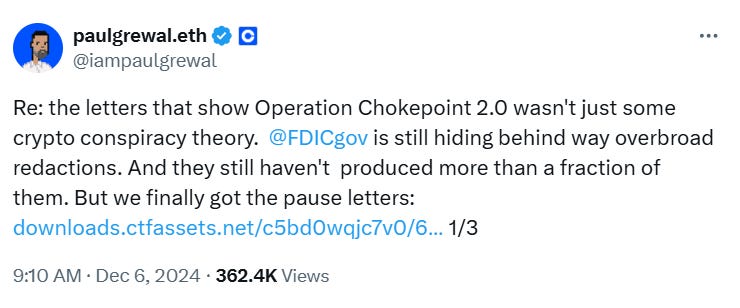

Coinbase’s Chief Legal Officer, Paul Grewal, stepped in and presented compelling evidence of the issue, uncovered through the Freedom of Information Act.

Skip over the redacted sections and focus on the sentence that states, “As a result, we respectfully ask that you pause all crypto asset-related activity.”

These letters only begin to scratch the surface—there is ample evidence that this has been happening for years.

Above is a clip of Marc Andreessen, cofounder and general partner at Andreessen Horowitz, on the Joe Rogan podcast, discussing Operation Chokepoint 2.0 and how the current administration has targeted tech founders, crypto founders, and political opponents.

This clip has, in many ways, reignited discussions about debanking and unfair financial practices. I’m fully convinced that none of this is mere conspiracy. Figures like Caitlin Long, Nic Carter, and the Winklevoss twins are among the many dedicated to exposing this story and working to end what can only be described as financial tyranny.

With that context in mind, let’s pivot back to Coinbase.

Eric Conner, founder of EthHub, posted the message above about a week ago, either at the perfect time—or perhaps the worst—amid the height of the debanking discussions. His post triggered a wave of others coming forward to share their own similar experiences.

To make matters worse, Coinbase responded to the account restriction FUD—only to be hit with a community note! Beneath their post, nearly every comment came from users complaining about their accounts being locked or restricted at some point.

It’s difficult to determine the full scope of this issue, but anyone objectively reviewing the facts can see that it’s real. That said, I can’t shake the feeling that some of the complaints may be from people who weren’t actually affected—more on that shortly.

One contributing factor to the account restrictions appears to be VPN usage. While the exact rules regarding VPNs remain unclear, Scott Shapiro, a product director at Coinbase, has advised against using them, as shown below.

According to the Coinbase Support thread, this is what is going on:

The comments are an absolute bloodbath.

On a serious note, this raises an important question: would you prefer your account be temporarily restricted due to heightened security measures, or would you rather Coinbase adopt a more relaxed approach, potentially exposing your account to risks like hacks or other vulnerabilities?

To be clear, I’m not excusing Coinbase—this is undeniably an issue. But let’s approach it fairly. Over the years, Coinbase has faced criticism for a wide range of reasons, many of which aren’t new. “Coinbase delisted XRP,” “Coinbase chose ETH over SOL,” “Coinbase is stealing international market share,” “Coinbase chose USDC over USDT,” “Coinbase preys on retail,” “Coinbase had an insider trader,” “Coinbase picks political favorites,” “Coinbase doesn’t engage in political activism,” “Coinbase is centralized,” “Coinbase shuts down during high demand,” “Coinbase has terrible support,” “Coinbase lists memecoins.” The complaints go on and on.

It took me just two seconds of scrolling to find a well-respected industry voice being critical of Coinbase.

To Chris' point, it’s likely a fair criticism. While I haven’t personally looked into this specific issue, I have no doubt that Coinbase has its flaws. That said, it’s important to acknowledge that Binance, Bybit, Kraken, Upbit, Bitget, and every other exchange also have areas in need of improvement. Anyone who has been using Coinbase since 2015, 2017, or even 2020 knows that the platform has come a long way, and its rise to the top wasn’t a matter of accident or luck.

Going back to the account restriction issue, I’m confident Coinbase isn’t doing this intentionally, nor do they want to restrict anyone’s access to their accounts. The root of the problem likely lies in their ambition to grow, build, and disrupt, which naturally leads to certain areas being neglected—particularly their customer support, a longstanding source of criticism that has come into sharper focus in recent days. In this case, it’s probably the straw that broke the camel's back.

Coinbase’s customer support has its challenges. Nobody enjoys dealing with a robotic system that takes you through endless prompts without solving the issue. Few things are more infuriating than being asked by an automated message if your problem is resolved without ever connecting to a human. To their credit, Coinbase has demonstrated in the past that, when it counts, their support team can escalate concerns quickly and resolve issues efficiently.

However, hiring enough support staff to handle every user question would be financially unsustainable for Coinbase. If you find that hard to believe, think back to your own early days in crypto—figuring out wallets, addresses, buy orders, or blockchain basics. The sheer volume of questions from users at that level of learning would be overwhelming for any organization.

Yes, Coinbase has areas to improve, but I’m not ready to pile on simply because it’s the popular thing to do. It’s important to remember how much Coinbase has contributed to the industry over the years. They operate with the same spirit many of us do—moving fast, breaking things, disrupting the status quo, and striving to replace TradFi.

Coinbase has been instrumental in supporting pro-crypto politicians, fighting Operation Chokepoint 2.0, challenging the SEC, and pushing for mainstream crypto adoption. They’ve championed Ethereum and DeFi, fostered open-source development, published extensive research, promoted NFTs, and delivered tools like Coinbase Wallet. They’ve consistently advocated for regulatory clarity, kept up with key listings, and provided a gateway for millions of people into crypto. Let’s not bite the hand that feeds us.

This is far from the beginning of Coinbase’s downfall—quite the opposite. Imagine the backlash they’d face if hackers breached their systems. The fact that they prioritize security, even at the expense of temporary inconveniences like account restrictions, demonstrates their commitment to safeguarding user assets. No crypto company has flawlessly secured its users or met every demand perfectly.

I’ll reserve harsher criticism for the day Coinbase stops caring about the industry, stops listening, and buries its head in the sand. But today is not that day. Personally, I haven’t been affected by the temporary account restrictions, but I primarily use a cold wallet—and I recommend anyone with concerns about exchanges do the same. Exchanges are a tool, but they’re not the end-all-be-all. The world isn’t ending while Coinbase addresses this issue.

That wraps up my thoughts on Coinbase. Meanwhile, the market seems to be cooling off, which is a good sign—it sets the stage for higher highs in the long run. Whether this dip lasts a day, a week, or a month, I’m not worried. Buy the dips if it aligns with your strategy, or just hold—it really is that simple.

Bitcoin Thoughts And Analysis

DAILY CHART

Not much to see here. Bitcoin did lose support around $100K for now, at least on the daily chart. Important to see where the week closes. For now, this is nothing but liquidations of massive leveraged positions. Easy money for whales to chop up longs and shorts.

Legacy Markets

Global equities paused on Tuesday as the boost from China’s stimulus pledge faded, and investors turned their attention to upcoming US inflation data. The Stoxx 600 index in Europe ended its eight-day winning streak, with miners and luxury stocks retreating after Monday's gains. In the US, futures for the S&P 500 and Nasdaq 100 remained steady, while Oracle dropped premarket after disappointing earnings and Nvidia faced additional losses due to a Chinese probe into alleged anti-monopoly violations. Meanwhile, Delivery Hero and Ashtead Group shares fell in Europe, with the latter announcing plans to move its primary listing to the US.

The US Consumer Price Index (CPI) report, due Wednesday, is critical as it represents the last major inflation metric before the Federal Reserve's upcoming policy meeting. Any sign of stalled progress on inflation could jeopardize expectations for a rate cut. European markets are also eyeing the European Central Bank, which is expected to reduce rates for the fourth time this year, alongside similar moves anticipated from the Swiss National Bank. Australia's central bank held rates steady, signaling progress toward inflation targets, while China's Central Economic Work Conference may announce further fiscal support.

Geopolitical tensions remain high, with Syrian rebel forces toppling Bashar al-Assad’s regime, though oil prices eased due to fears of a supply glut outweighing political risks. As the year-end approaches, markets appear to lack momentum, awaiting fresh catalysts to drive direction.

Key events this week:

US CPI, Wednesday

Canada rate decision, Wednesday

ECB rate decision, Thursday

US initial jobless claims, PPI, Thursday

Eurozone industrial production, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 fell 0.3% as of 10:23 a.m. London time

S&P 500 futures were little changed

Nasdaq 100 futures were little changed

Futures on the Dow Jones Industrial Average were little changed

The MSCI Asia Pacific Index fell 0.2%

The MSCI Emerging Markets Index fell 0.2%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro fell 0.2% to $1.0530

The Japanese yen fell 0.2% to 151.55 per dollar

The offshore yuan was little changed at 7.2617 per dollar

The British pound was little changed at $1.2758

Cryptocurrencies

Bitcoin rose 0.8% to $97,717.48

Ether rose 1.6% to $3,760.42

Bonds

The yield on 10-year Treasuries advanced one basis point to 4.21%

Germany’s 10-year yield was little changed at 2.13%

Britain’s 10-year yield advanced three basis points to 4.30%

Commodities

Brent crude fell 0.2% to $72 a barrel

Spot gold rose 0.3% to $2,667.31 an ounce

El Salvador Alters Bitcoin Strategy For An IMF Loan

El Salvador is scaling back some of its 2021 Bitcoin policies, specifically the requirement for businesses to accept Bitcoin as legal tender. This decision comes as part of a recent deal with the IMF to secure much-needed financial support. According to the Financial Times, this move will enable the country to access $3 billion in loans from the IMF, World Bank, and Inter-American Development Bank.

If you haven’t been following the story, El Salvador’s Bitcoin strategy initially faced significant criticism from the IMF, which withheld additional loans due to concerns about the adoption of Bitcoin as a national standard. To secure the IMF loan, El Salvador agreed to ease its Bitcoin mandate, reduce its budget deficit, implement an anti-corruption law, and bolster its financial reserves.

Saylor Will Never Stop Buying Bitcoin

Dave: “You’re the Michael Jordan of the analogy. You’re just buying forever? You’re never going to stop buying?”

Saylor: “I’m going to keep buying. You joke, is $100,000 too much? Look, Dave, I’ll be buying it at a million dollars a coin and I’ll probably be buying it at the rate of a billion dollars a day at a million dollars a coin because that’s what I do. Just like crap, Manhattan real state is really expensive in 1930. It’s a lot more expensive than 1830. Well, you know a hundred years later we’ll still be buying it and we will be paying a lot more. The only issue is can you hold it for that time period because people are going to want to buy it.”

I’m becoming more and more convinced that MicroStrategy will eventually obtain more than 1 million Bitcoin. Saylor is already 42.3% of the way there. Imagine the post below, but in a few years, it reads, ‘Saylor acquired 21,550 BTC for ~ 21.55 billion at $1,000,000 per #bitcoin.’

The Microsoft Bitcoin Vote Is Today!

I’ve covered this story extensively, and I’m not expecting Microsoft to adopt Bitcoin anytime soon. Would I be surprised if the vote comes back as a ‘yes’? Not particularly, but I’d guess we’re still a bit far from landing a catch that big. What’s more likely is that an increasing number of shareholders will continue advocating for this consideration, and over time, we’ll eventually reel one in. Even so, this is already a significant step forward for Bitcoin adoption at the corporate level.

A Russian Deputy Is Arguing For A Strategic Bitcoin Reserve

Anton Tkachev, a deputy in Russia’s State Duma—the legislative lower house—representing the “New People” party, has formally proposed the creation of a strategic Bitcoin reserve. In his appeal to Finance Minister Anton Siluanov, Tkachev emphasized the vulnerabilities of traditional reserves, citing their susceptibility to sanctions, inflation, and volatility, particularly during periods of geopolitical instability.

“I ask you, dear Anton Germanovich, to assess the feasibility of creating a strategic reserve of bitcoin in Russia by analogy with state reserves in traditional currencies. If this initiative is approved, I ask you to submit it to the Government of the Russian Federation for further implementation.”

“With limited access to traditional international payment systems for countries under sanctions, cryptocurrencies are becoming virtually the only tool for international trade. The Central Bank of Russia is already preparing to launch an experiment on cross-border payments in cryptocurrency.”

Breaking: Bitcoin Closes Week Above $100,000! What Comes Next?

Join Dave Weisberger, Mike McGlone, and James Lavish as we break down what's happening in macro and crypto!

My Recommended Platforms And Tools

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform. MY LINK

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.