Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Yes, our algorithms make losing trades. In the past two weeks our MES Strategy (my 10K Portfolio) lost two trades: -1.32% and -3.96%.

In total, the $10K portfolio is up 41.5% over the past seven months. 6.1% monthly returns since we started tracking and publishing returns on Scott’s show. Hands free, unemotional, programmatic.

Try Arch Public now! You can even demo the platform, for free, to learn more.

In This Issue:

2% Isn’t Nearly Enough

Bitcoin Thoughts And Analysis

Legacy Markets

Can The Two-Week Streak Continue?

Trump Appoints A Crypto Czar

Solana ETFs To Be Rejected At First

Cardano’s X Page Was Compromised

Plan B Predicts $1M Bitcoin – Is It Happening This Cycle?

2% Isn’t Nearly Enough

Simple question for all of you: What percentage of your net worth is in Bitcoin, and what percentage would you recommend to someone interested in Bitcoin?

I know this is a delicate question because, legally, I—along with most of you—can’t actually give a recommendation, aside from sharing our opinions for educational and entertainment purposes. However, with the holidays approaching, many of you will inevitably have conversations about Bitcoin and end up suggesting allocations anyway.

My suspicion is that many of you likely have 10%, 25%, or maybe even over 50% of your net worth in Bitcoin, or other assets like Ethereum or Solana. At the same time, I anticipate that many of my well-educated readers, who take these conversations seriously, will eloquently explain all the right reasons to own Bitcoin but ultimately suggest a cautious 2% allocation.

Is that the safe thing to do? I would say so.

Does it make a whole lot of sense? Eh, maybe not.

The situation I’m describing actually happened—it’s the reason I chose this topic—between Michael Saylor and Anthony Scaramucci. I had to share it with all of you because it provides just the right mix of humor, honesty, and deeper insights into how we approach Bitcoin allocation.

If you haven’t seen the video I’m about to transcribe, make sure to come back up HERE after you finish reading and watch it! Saylor knows how to deliver a proper speech.

Saylor: “Anthony wrote a book, ‘The Little Book of Bitcoin,’ and he contacted me and said, ‘Would you write the foreword?’ I said, ‘Anthony, I need to read the book.’ So, it’s a good book. I got to the end, though, and in the end, after writing the entire book and explaining all the benefits of Bitcoin...”

Anthony: “This gets bad for me at this moment.”

Saylor: “Okay, Anthony loves Bitcoin. He’s devoted all of his time to Bitcoin. He’s told me why it’s great. He’s told me about all the great, insanely brilliant people and their journey to Bitcoin. And he gets to the end, and he says, ‘And Bitcoin, that’s why I recommend people consider allocating 1 to 2% of their portfolios to it.’”

Scaramucci: “We did change that, by the way.”

Saylor: So, I got to the 1 to 2%. I found it wanting. So, I called him on the phone, and I said, ‘Anthony, do you have 49 other books in you?’ ‘No, this is my book.’ ‘Do you have 50 good ideas, this good?’ ‘No.’ So, you’ve given people a 2% solution. What are they supposed to do with the other 98% of their money?" Then I said, ‘Anthony, how much of your net worth is in Bitcoin?’ He goes, ‘substantially more than 2%, more than 50%.’”

Scaramucci: “Higher now, Michael.”

Saylor: “So, why are you telling everybody, if they got to the end of the book, why are you telling people 2%? Can you just at least add a little paragraph that says, ‘There are certain Bitcoin maximalists, like Michael Saylor, who believe in an allocation greater than 2%. 25%, 50%, even 75%.’”

“I started with a $250 million investment, and I think I’m just about to hit $25 billion. The trick is to figure out how to go more than 100%. I said, can you just make it more? Give them a range. So, he goes, and to his credit, ‘Yeah, I guess you have a good point.’ So, I made him rewrite the book, and I agreed to write the foreword. And I highly recommend everybody pick up a copy.”

Saylor’s conviction in Bitcoin is unparalleled—literally unmatched by anyone else on the planet. I’m not sure it ever will be matched. Yet, the lesson here is that many of us share a similarly strong conviction but still hold back, handicapping the advice we give to others.

Conservative and conventional wisdom tells us to allocate small percentages to individual assets—but let’s be honest, we’ve clearly ignored that advice ourselves. Of course, I’m not about to tell my neighbors, friends, and family that I recommend (for educational and entertainment purposes) a 50% allocation to Bitcoin. But perhaps it’s time we collectively move on from the outdated 2% narrative. Maybe we take a bold step and start suggesting 5% or even 10% allocations—aligning our advice with the confidence we hold in our own decisions.

When the big players on Wall Street finally figure out Bitcoin, they’re not going to be generous enough to recommend more than a 1% to 2% allocation until they’ve secured their own positions. That advice will only come after they’ve bought in bulk. By then, sticking with a 1% to 2% allocation will likely mean falling behind on the risk curve, exposing yourself to the very risks you were trying to avoid in the first place. Time is ticking.

I went ahead and pre-ordered, “The Little Book of Bitcoin: What You Need to Know that Wall Street Has Already Figured Out, Scaramucci, Anthony,” and suggest you do as well. FYI, the title will be released on January 9th, 2025.

In other major Bitcoin news, this just happened yesterday…

The shareholder proposal for Amazon closely mirrors the one presented at Microsoft, with the primary differences being the company names and some specific data points used to tailor the proposals. Consistency is ideal here.

How epic would it be if Saylor got the opportunity to pitch Bitcoin to every major tech company? Who else would we trust more for that role?

As I mentioned last week, if Microsoft doesn’t take the orange pill, other companies will. I wouldn’t be surprised if a major player steps in soon—perhaps Amazon, Meta, NVIDIA, Alphabet, or Apple. Who knows?

In the meantime, Bitcoin is holding strong, and Ethereum looks poised to break through significant resistance. It’s shaping up to be a good week.

Bitcoin Thoughts And Analysis

Bitcoin closed it’s first daily and weekly candle above $100K - ever. That was yesterday.

Today, we are back below, but the day is not over yet.

You can see that we have a clear level at $99,860 (we can call it 100K) from the late November all time high. This level has acted as resistance and support for the last 3 daily candles, almost to the dollar. I would like to see today close back above that.

Legacy Markets

Global markets showed mixed performance as investors balanced optimism from China’s signals of looser monetary policy with heightened geopolitical risks and upcoming central bank decisions. US equity futures gave up early gains, with Nasdaq 100 and S&P 500 contracts slightly declining after China announced plans for a "moderately loose" policy next year, which initially buoyed Asian markets and sectors tied to China, such as European miners and consumer goods. Meanwhile, geopolitical tensions escalated following the ousting of Bashar al-Assad in Syria, unsettling the Middle East and driving up crude oil and gold prices. South Korea's political uncertainty also weighed on its markets and currency.

Attention is now shifting to central bank meetings across Europe, Canada, and Switzerland, with the European Central Bank expected to cut rates amidst broader economic concerns. In the US, upcoming inflation data will be critical in determining if the Federal Reserve proceeds with another rate cut during its Dec. 18 meeting, with markets pricing in an 87% chance of a 25-basis-point reduction—pending CPI figures. Individual stock movements reflected these dynamics, with gains in Turkish construction firms tied to Syria’s reconstruction and US companies joining the S&P 500, while Nvidia faced premarket declines amid an antitrust probe in China.

Key events this week:

Mexico CPI, Monday

Australia rate decision, Tuesday

Germany CPI, Tuesday

Brazil CPI, Tuesday

Japan PPI, Wednesday

Chinese leaders expected to hold annual Central Economic Work Conference, beginning Wednesday through Dec. 12

RBA Deputy Governor Andrew Hauser speaks, Wednesday

US CPI, Wednesday

Canada rate decision, Wednesday

Brazil rate decision, Wednesday

Australia unemployment, Thursday

India CPI, Thursday

Eurozone ECB rate decision, Thursday

Switzerland rate decision, Thursday

France CPI, Friday

Eurozone industrial production, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 was little changed as of 11:56 a.m. London time

S&P 500 futures were little changed

Nasdaq 100 futures fell 0.2%

Futures on the Dow Jones Industrial Average were little changed

The MSCI Asia Pacific Index rose 0.4%

The MSCI Emerging Markets Index rose 0.6%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0569

The Japanese yen fell 0.3% to 150.45 per dollar

The offshore yuan rose 0.1% to 7.2735 per dollar

The British pound rose 0.2% to $1.2768

Cryptocurrencies

Bitcoin fell 2% to $98,129.36

Ether fell 3.5% to $3,855.33

Bonds

The yield on 10-year Treasuries advanced one basis point to 4.17%

Germany’s 10-year yield was little changed at 2.10%

Britain’s 10-year yield declined two basis points to 4.26%

Commodities

Brent crude rose 1.1% to $71.91 a barrel

Spot gold rose 0.8% to $2,655.53 an ounce

Can The Two Week Streak Continue?

Spot Ethereum ETFs in the U.S. have recorded ten consecutive days of positive inflows, marking their longest streak since launching in July. On Friday alone, the funds saw $83.8 million in inflows, following $428.5 million, $167.7 million, and $132.6 million on the preceding days. Total trading volume on Friday reached $992 million, the fourth-highest day since their debut. Weekly inflows hit a record $836.7 million, up 62% from the previous high, driven largely by BlackRock’s ETHA ($520 million) and Fidelity’s FETH ($276 million).

I’ve got a few thoughts on what’s happening here. Remember how even Bitcoin bulls underestimated the performance of Bitcoin’s ETF, which is now on a historic run this year? I think Ethereum is on a similar trajectory. Of course, market caps need to be taken into account, but take a look at the images below.

Bitcoin has amassed $33.43 billion in net inflows, while Ethereum sits at just $1.41 billion. Sure, Bitcoin had a head start with its ETF launch, but over time, I expect Ethereum’s cumulative net inflows to reach about 25% of Bitcoin’s total (based on their respective market caps). This would bring Ethereum up to around $8 billion at the current valuation.

And let’s not forget—Ethereum ETFs will eventually incorporate staking, which could push that inflow figure closer to 30% of Bitcoin’s total. I’m anticipating that Ethereum’s ETF will outperform Bitcoin’s on a relative basis in the coming months, helping to close the gap.

This chart is a beauty. ETH ETFs barely moved for about three months, and then BAM—it’s alive. If you recall, Bitcoin took its time too. Wall Street isn’t going to ape into ETFs like we do shitcoins in this space. The education and dissemination of information takes time, especially among older folks.

Trump Appoints A Crypto Czar

For anyone unclear about the term "czar," in U.S. government it refers to an unofficial, high-level position created to oversee a specific policy area or emerging issue. While not an official title, it signifies the importance and centralized responsibility of the role. These positions are typically appointed without Senate confirmation, enabling quicker action in implementing policies compared to the traditional bureaucratic processes.

In recent news, President-elect Donald Trump announced his intention to appoint David Sacks, former PayPal COO, as his “White House A.I. & Crypto Czar.” Below is Trump’s statement regarding the appointment:

Solana ETFs To Be Rejected At First

Before diving into the details, I want to reaffirm my prediction: Solana will likely get an ETF once the current SEC leadership is replaced. Whether that happens on day one or a few months into the new regime is anyone’s guess. However, there are still lawsuits labeling SOL as a security, which should theoretically block ETF approval—unless the SEC takes an aggressive pro-crypto stance and approves the ETF to counter those claims. Honestly, I wouldn’t be surprised either way.

Here’s the news: Eleanor Terret’s image above lays it all out. Gary Gensler is set to step down on January 15, and the SOL filers include VanEck, 21Shares, Canary Capital, Bitwise, and Grayscale. At this stage, the rejected applicants either need to make some adjustments or simply wait, depending on the feedback they received—if any. If Gensler’s approach was to approve all ETFs simultaneously to maintain fairness, I’d expect Paul Atkins to take a similar path. My prediction? We’ll see a SOL ETF approved within one to two months after Atkins takes over.

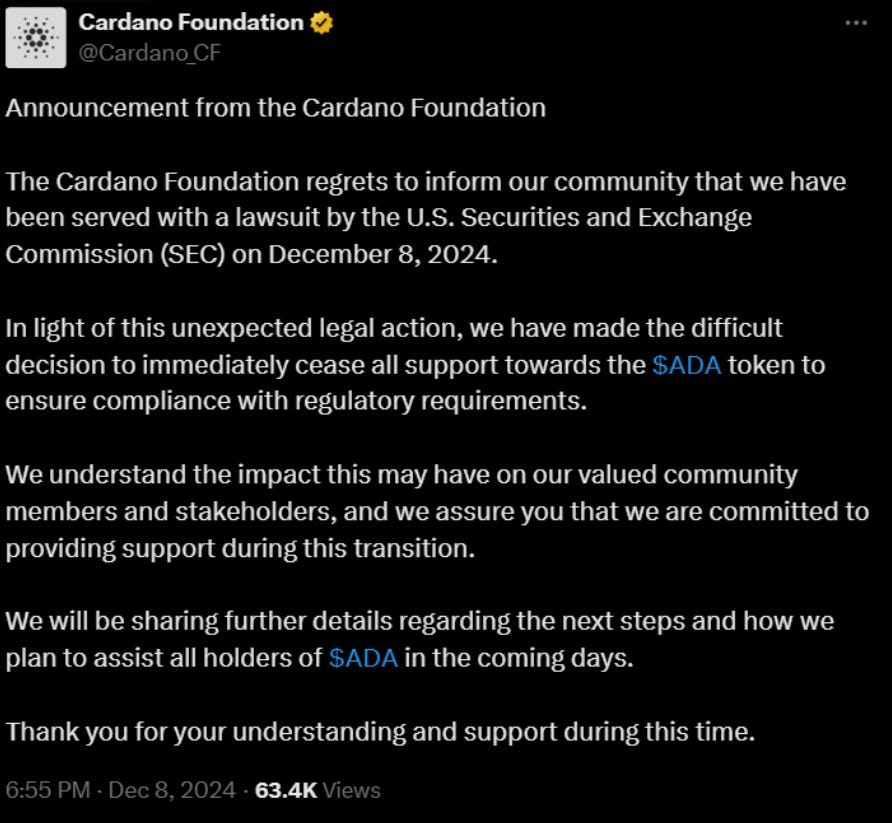

Cardano’s X Page Was Compromised

This scam was more elaborate than it initially seemed. The Cardano Foundation’s X account was hacked, and the scammers wasted no time posting fake messages to lure people into trading a fraudulent token called $ADASOL. Below is a screenshot of the scam, clearly marked with “FAKE,” so no one mistakenly engages with these scammers.

Fortunately, the Cardano team acted quickly and issued the following statement:

“The Cardano Foundation X account @Cardano_CF has been compromised. Please ignore any posts from the account at this time while we address this.”

Don’t believe everything you see on X, especially if it seems too good to be true.

Plan B Predicts $1M Bitcoin – Is It Happening This Cycle?

Join us on The Wolf Of All Streets podcast as we sit down with Plan B, the anonymous legend behind the stock-to-flow model, to discuss his jaw-dropping predictions for Bitcoin’s future. From $250,000 to $1 million Bitcoin targets, he shares insights into market cycles, institutional adoption, and the changing global economy. Don’t miss this engaging conversation packed with actionable insights and bold forecasts!

My Recommended Platforms And Tools

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform. MY LINK

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.