Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Acquire. Trade. Arbitrage. The Bitcoin Algorithm is an Institutional grade tool available to retail investors. Arch Public and Gemini have partnered together to automate thousands of buy/sell strategies. Bitcoin Alpha is at your fingertips.

Try Arch Public now! You can even demo the platform, for free, to learn more.

In This Issue:

One Hundred Thousand United States Dollars

The Wolf Den Has A New Sponsor - Aptos!

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

An Open Letter To Peter Schiff

Beware Of Pumps and Dumps

Germany Failed The Bitcoin Test

Bitcoin About To Hit $100K! Altcoins Are Skyrocketing! | Trading Alpha

One Hundred Thousand United States Dollars

As I noted in my previous newsletter, by the time Bitcoin skyrocketed past $100,000 at 9:40 PM EST on December 4th, I had already completed writing yesterday’s introduction.

If you have a minute after reading this letter, I encourage you to scroll back up here and watch the video below. Click HERE to watch.

If the video left you scratching your head, here’s a quick breakdown: When someone mentions that the $100,000 sell wall has been overtaken, they’re essentially saying that the cumulative buy orders in the order book have absorbed all the sell orders at that price. A sell wall is a significant cluster of limit sell orders at a particular level, acting as a formidable barrier to upward price movement. For the market to breach $100,000, buyers had to place enough market orders to consume the entire wall, effectively purchasing all the Bitcoin offered at that level.

Once this resistance was cleared, several key dynamics came into play, driving Bitcoin’s price to $103,500 and fueling expectations of a continued surge. The removal of heavy sell-side liquidity at $100,000 likely triggered a wave of additional buying, as traders who were cautious about entering near the resistance now felt confident. At the same time, short sellers rushed to close positions to avoid mounting losses, adding more fuel to the rally. Automated trading systems further compounded the effect, interpreting the breach as a bullish signal and ramping up buying activity. These factors combined to create a rapid price jump, and it’s reasonable to anticipate that this could pave the way for a dramatic upward price movement as the market adjusts to the shifting supply-demand landscape.

Now, a brief message from Donald J. Trump:

The soon-to-be president of the United States congratulating Bitcoiners on reaching $100,000—and even taking partial credit for it—truly highlights the surreal times we’re living in.

Here’s my perspective on what this milestone means for the industry and my long-term portfolio. Crossing $100,000 is undeniably historic, but its significance varies depending on who you ask. For dedicated Bitcoiners, it was an inevitability. Bitcoin reaching $100,000 wasn’t a question of "if," but "when." This moment serves as a precursor to what many believe is the eventual flipping of gold and the start of Bitcoin’s ascent toward $1 million. While some might see this price point as extraordinary, Bitcoin believers view it as another milestone in the realization of its ultimate potential as a global asset.

Moreover, for the true HODLers, this isn’t the time to cash out. It’s a moment of validation. It reaffirms their conviction and commitment to holding through volatility, reinforcing that their long-term vision is steadily unfolding as expected. For them, $100,000 isn’t the endgame—it’s a stepping stone.

Bitcoin’s rise to $100,000 is a watershed moment that reverberates across the entire financial ecosystem, impacting everyone from altcoin holders to institutional investors. For altcoin holders, it forces a critical reassessment of their portfolios as Bitcoin’s growing dominance could overshadow smaller assets in the short term. Macro traders, on the other hand, are likely dissecting what this milestone means for Bitcoin’s famed 4-year cycle and its broader implications for market trends. Swing traders, ever opportunistic, are analyzing price action closely, searching for ideal entry and exit points amidst Bitcoin’s momentum.

Institutional investors may be the most energized by this achievement. The psychological barrier of $100,000 serves as a powerful signal of Bitcoin’s legitimacy as an asset class, likely encouraging a surge in capital inflow. For many in this group, the milestone represents not just a door of opportunity but a grand unveiling of Bitcoin’s potential. Here’s the secret, though: the door has always been there—and it’s always been open.

Now, let’s talk about the skeptics, doubters, and those who are only just discovering Bitcoin. While I’m not part of this camp, I’ve spoken with enough friends and family to understand their perspective. If I were a skeptic, hearing that Bitcoin had surpassed $100,000 might make me pause. For some, this milestone could serve as a tipping point, prompting them to question their doubts and explore Bitcoin’s potential. They might consider the global shifts underway—from adoption in countries like El Salvador to policy discussions in the U.S., to increasing interest from the largest financial institutions.

Yet for others, $100,000 may simply solidify their belief that Bitcoin is a bubble, a ticking time bomb. The divide is fascinating: for believers, $100,000 is a step toward inevitability; for skeptics, it’s a test of resilience that Bitcoin must still prove. Either way, one thing is clear—Bitcoin’s journey to $100,000 is not just a market milestone; it’s a cultural one.

Above is the line of thinking we want people to escape.

Below is the line of thinking we want to help people enter.

Truthfully, I feel sympathy for this third group, but I’ll continue striving to educate them as effectively as possible. After all, the journey to $1 million per Bitcoin isn’t about convincing the first two groups—the believers and early adopters—that Bitcoin is a good investment. Their contributions move the needle, but only incrementally. Reaching $1 million requires a collective shift in mindset from group three—the doubters, non-believers, and skeptics. Their awakening is what will propel Bitcoin to multiply its value by $100,000 nine more times. Eventually, this shift will happen; I have no doubt about that. But the pace of this transformation is up to us.

Do we mock those who didn’t buy in earlier? Ridicule them and boast about their missed opportunity as Bitcoin climbs beyond $100,000? Or do we take the opportunity to explain why the price is just one facet of the story? Bitcoin is more than a speculative asset—it’s a superior form of gold, a hedge against inflation, the ultimate savings account, and a pathway out of the fiat tyranny that has shaped global finance for decades.

How quickly we reach $1 million is, in many ways, a choice we hold the power to influence.

Also, take a look at the Bitcoin Rainbow chart from the Blockchaincenter.net below.

HODL: Right now, we’re in the light-yellow category, sitting squarely in the middle of the fear and greed spectrum. That’s likely why many of you aren’t feeling euphoric about this milestone—and honestly, I think that’s a good thing.

That wraps up my thoughts on $100,000. I’m glad we’ve reached this point—it’s a relief, but truthfully, not much changes for me. There was no grand epiphany when the price hit $100,000, no sudden realizations, or bursts of renewed passion. I called a few friends to share congratulations, they congratulated me back, and then we talked about how this is just the first 10% of the journey to $1 million.

Let that sink in—we’re only 10% of the way there. That’s where my focus is now.

If I could, I’d call each and every one of you personally to say this: ‘Congratulations and thank you for sticking with me on this journey.’ You’ve earned this moment, and I’m grateful to have shared it with you.

Now, let’s begin the march to $1 million.

The Wolf Den Has A New Sponsor - Aptos!

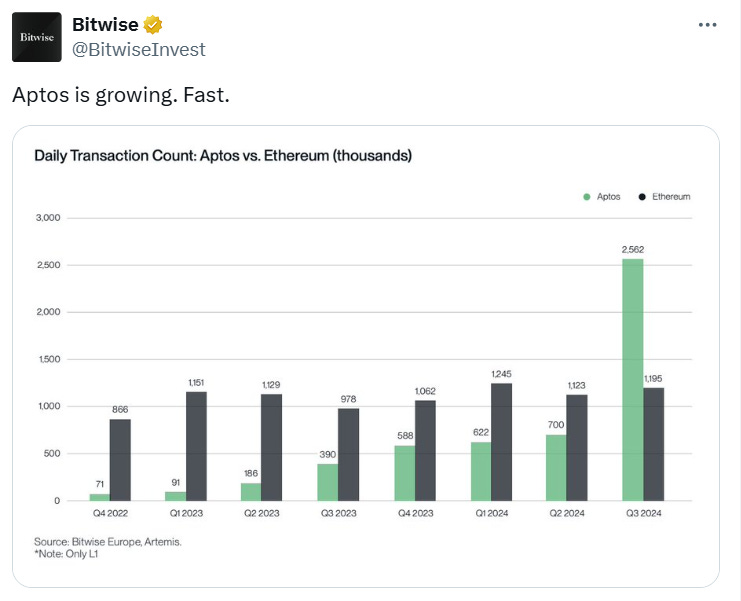

I’m really excited to announce that Aptos—the most exciting layer 1 blockchain competing with Solana and Ethereum—is now an official sponsor of this newsletter! Over the past few months, I’ve had the chance to get to know the Aptos team, create content with them, and interview their CEO and co-founder, Mo Shaikh. Let me tell you, Mo is easily one of the best guests I’ve ever had on the podcast.

For those that don’t know about Aptos, here’s the first paragraph of the Aptos vision from the official white paper, “The Aptos vision is to deliver a blockchain that can bring mainstream adoption to web3 and empower an ecosystem of decentralized applications to solve real-world user problems. Our mission is to advance the state-of-the-art in blockchain reliability, safety, and performance by providing a flexible and modular blockchain architecture. This architecture should support frequent upgrades, fast adoption of the latest technology advancements, and first-class support for new and emerging use cases.”

Below are some of Aptos’s partners:

Aptos is the real deal.

My plan with this sponsorship moving forward is to highlight key news stories once a week, keeping you all updated on the exciting things Aptos is doing in the space. The news below just dropped yesterday, and it’s a pretty big deal!

And Bitwise shared this earlier this week about Aptos:

There’s so much more to share, so keep an eye out for weekly updates on Aptos—and don’t forget to show them some love! Aptos is the reason this newsletter remains free, and I couldn’t be more grateful for their support. I’m genuinely excited to see all they accomplish this year!

Bitcoin Thoughts And Analysis

Are you not entertained?

For those who doubted that Bitcoin would remain volatile, I think we have our answer.

Yesterday’s candle had roughly a $12,000 spread on Coinbase - almost $14,000 on leveraged exchanges. This represents roughly 12% - 14% of movement in a matter of hours. At these prices, those are huge moves. Apparently over $2.5B was liquidated from the market, proving once again that using leverage is a very dangerous game.

Things still look good - just a huge leverage flush.

Altcoin Charts

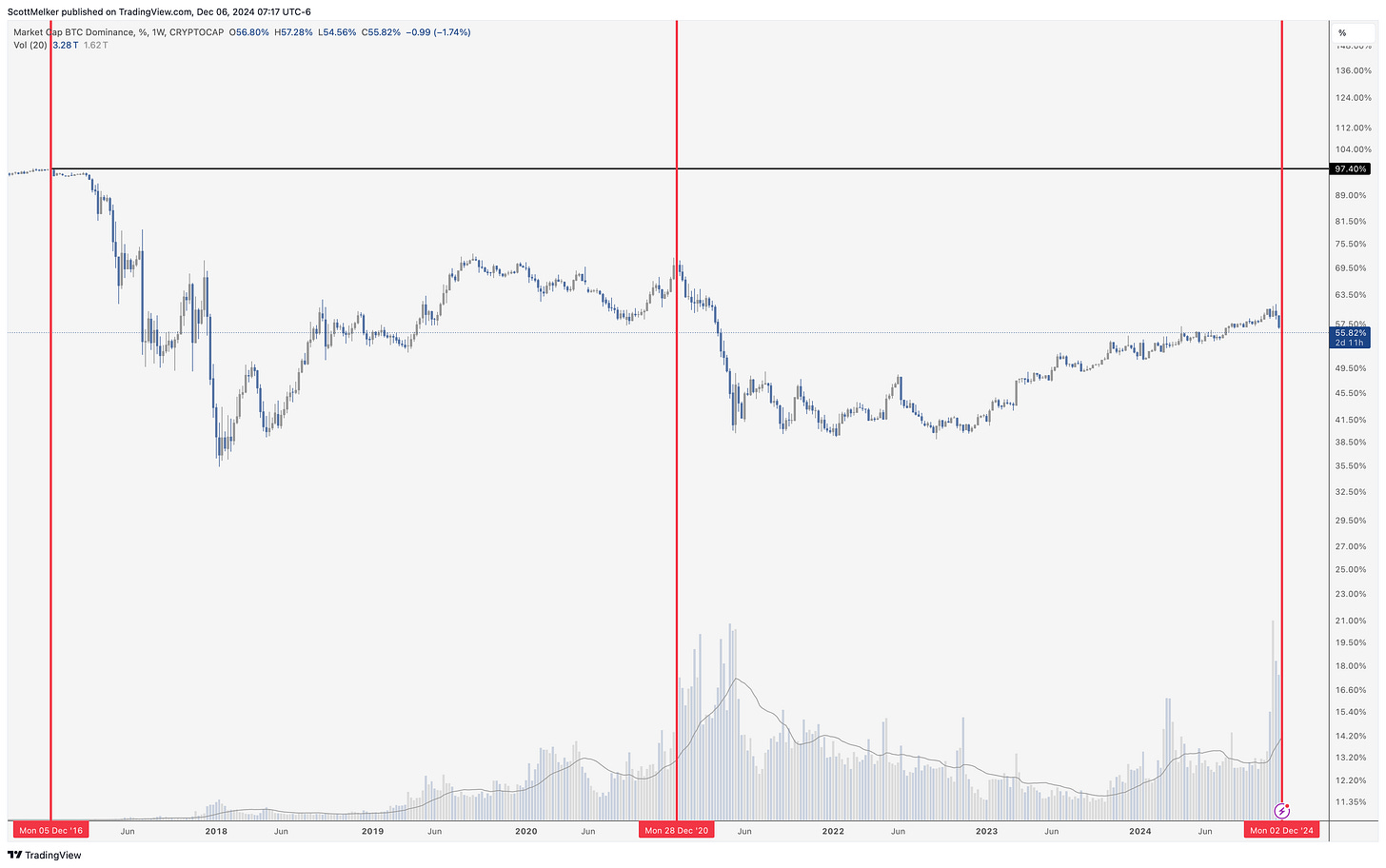

Altcoins have held up exceptionally well, even amongst extreme Bitcoin volatility. This is a good sign. Bitcoin Dominance continues to drop, now sitting below 56%.

Safe to say that there is real money playing in the altcoin market and that is likely to continue.

Legacy Markets

Markets adopted a cautious tone ahead of the U.S. jobs report, which is expected to show a rebound with 220,000 jobs added in November after weather-related disruptions in October. This data could influence the Federal Reserve’s policy, with markets currently pricing a 65% chance of a quarter-point rate cut this month. U.S. equity futures were steady, the dollar extended its strength for the ninth week out of ten, and Treasury yields edged higher. Meanwhile, oil prices declined for the third consecutive day, and Bitcoin retreated from its record high of over $103,000, falling as much as 7%.

In Europe, French markets rallied despite a politically tumultuous week, with bonds outperforming and the CAC 40 index rising for the seventh consecutive day—its longest winning streak in nearly 10 months. Bank of America’s Michael Hartnett highlighted concerns over frothy valuations in U.S. stocks and cryptocurrencies, noting the S&P 500’s price-to-book ratio is nearing levels last seen during the dot-com bubble. The S&P 500, up 27% this year, has been fueled by AI excitement and optimism about President-elect Donald Trump’s economic policies.

Globally, Asian markets showed mixed results. Chinese stocks rose on hopes for economic support measures, while South Korea experienced volatility before assurances that martial law would not be imposed. In commodities, oil prices continued to slide as concerns over an impending supply surplus outweighed OPEC+’s decision to delay production increases.

On the corporate front, Lululemon raised its full-year outlook due to strong international sales, while Aviva announced plans to acquire Direct Line Insurance for $4.6 billion, creating the UK’s largest motor insurer. Hewlett Packard Enterprise reported strong AI-related server sales, but Puig Brands saw shares drop after a Charlotte Tilbury product recall. Holcim confirmed plans to spin off its North American business by mid-2025.

Overall, the markets remain dynamic and uncertain, with critical developments in policy, valuations, and corporate performance shaping the landscape.

Key events this week:

US jobs report, consumer sentiment, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures were little changed as of 7:42 a.m. New York time

Nasdaq 100 futures were little changed

Futures on the Dow Jones Industrial Average were little changed

The Stoxx Europe 600 rose 0.3%

The MSCI World Index was unchanged

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0584

The British pound rose 0.1% to $1.2772

The Japanese yen fell 0.2% to 150.44 per dollar

Cryptocurrencies

Bitcoin fell 1% to $98,079.73

Ether rose 0.5% to $3,878.71

Bonds

The yield on 10-year Treasuries was little changed at 4.18%

Germany’s 10-year yield advanced one basis point to 2.12%

Britain’s 10-year yield was little changed at 4.29%

Commodities

West Texas Intermediate crude fell 0.7% to $67.81 a barrel

Spot gold rose 0.4% to $2,640.92 an ounce

An Open Letter To Peter Schiff

I came across this letter being shared yesterday on X. Erik Voorhees wrote it to Peter Schiff back in 2013 when Bitcoin had just reached $1,000. The letter serves as a defense of Bitcoin, highlighting its utility as a payment network and addressing common criticisms about its value and scarcity. Erik clearly distinguishes between Bitcoin (the network) and bitcoins (the currency units), making the case that the network’s utility underpins the market price of its currency.

He refutes claims that Bitcoin is a Ponzi scheme, critiques the limitations of gold-backed currencies in terms of scalability, and proposes that Bitcoin and gold can coexist to promote free-market money and individual liberty. A decade later, Jerome Powell essentially affirmed this view, further solidifying Bitcoin’s role in the financial system.

Honestly, it’s astonishing that Peter Schiff had the privilege of reading this back in 2013 and still remains staunchly anti-Bitcoin today.

“When my grandparents ask me how to protect their wealth, I don’t tell them to buy bitcoins. I tell them to buy precious metals. When they ask me how to transfer value across distance, I don’t tell them to ship gold. I tell them to use Bitcoin. My hope in writing this letter is simply this – that perhaps you’ll come to see Bitcoin and gold as beautiful compliments and important tools in the advancement of free-market money – one long-standing, conservative, and physical, the other new, technologically and politically disruptive, and digital. One will not replace the other, but I believe both will come to replace fiat, and good riddance to that stuff.”

Beware Of Pumps and Dumps

I won’t spend much time on this, but here are the facts: Hailey Welch, the viral “Hawk Tuah” girl, launched $HAWK coin on Solana. It skyrocketed to a $500 million market cap almost instantly, only to crash below $60 million.

The takeaway?

A) Don’t waste your money chasing worthless projects like this.

B) Even with a new SEC chair incoming, behavior like this likely won’t hold up in court.

Someone’s probably getting into trouble. Law firms are already stepping up to represent victims, and it’s been revealed that the team behind the launch held nearly all the coins. The entire saga is an embarrassing blemish on the industry.

Germany Failed The Bitcoin Test

There’s not much to this story beyond Germany making the colossal mistake of letting go of its Bitcoin. For Germany’s sake, I hope the takeaway isn’t as naive as, “How could we have known it would go up.” While someone might attempt that as a defense, the truth is clear—someone needs to be held accountable for missing out on $2.4 billion in profits.

Let this be a lesson for other countries: as Trump famously said, “You never sell your Bitcoin.”

Bitcoin About To Hit $100K! Altcoins Are Skyrocketing! | Trading Alpha

Massive sale! 30% off both the Alpha Bundle and the Alpha Screener!

Trading Alpha is a show with John Wick, an anonymous options trader, where we analyze the market and give setups. Make sure to check out Trading Alpha for elite-level trading tools and indicators. Use code '30OFF' for a 30% discount.

My Recommended Platforms And Tools

Phemex - Join me on Phemex and unlock up to 30,000 USDT in exclusive rewards! Phemex is the most efficient crypto trading and investment platform. MY LINK

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.