Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Trading Alpha Released A Brand New Product!

One of the partners of this newsletter, Trading Alpha, my trusted indicator and trading community, has launched their proprietary Indicator Search Engine for All Markets. This custom Indicator Screener scans crypto, stocks, and forex markets for Trading Alpha indicator setups, eliminating the need for time-consuming manual analysis. It can simultaneously screen for multiple indicators, enhancing confluence and providing advanced analysis capabilities across different markets. This is cutting-edge technology for serious traders.

Make sure to use my link HERE if you plan on giving it a try.

In This Issue:

The Next SEC Chair

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

VPNs Don’t Work Well With Coinbase

Martial Law In South Korea Triggers A Flash Crash

Marathon Is Ramping Up Its Bitcoin Strategy

Grayscale Files For A Solana ETF

Bitcoin Gets A Massive Boost: Here Is What To Expect From Crypto In 2025

The Next SEC Chair

There you have it, folks—the next SEC Chairman is most likely going to be Paul Atkins.

To err on the side of caution, it’s worth noting that Trump hasn’t officially made the announcement yet. However, based on the information circulating and the signals I’m picking up, it’s safe to assume this is the pick, and he’s likely to accept.

Researching Paul Atkins’ background for this introduction was a welcome departure from the seemingly endless discourse on Gary Gensler. To my readers: while this might not be the flashiest topic, if you’re based in the U.S. and are serious about crypto, this is a conversation worth your attention. Let’s get into it.

Paul S. Atkins currently serves as the CEO of Patomak Global Partners LLC, a consulting firm that specializes in navigating the complexities of the financial services industry—particularly in regulatory compliance, risk management, and litigation support. The firm’s motto, prominently displayed on their website, encapsulates their mission: “From Wall Street to Silicon Valley to board rooms worldwide, our unrivaled roster of advisors helps you navigate challenges and seize opportunities.” While exploring their site, I also came across a compelling image from their “Clients We Serve” page—a succinct visual representation of their broad impact.

Atkins has an impressive and extensive resume, so I’ll focus on parsing through the material most relevant to us. Let’s begin with an overview:

What stands out from this timeline is that Paul Atkins is no stranger to the SEC. As a former commissioner of the U.S. Securities and Exchange Commission (2002–2008), he played a pivotal role in corporate governance reforms, enhancing shareholder communication, and resolving the Bennett Funding Group Ponzi scheme. His efforts significantly recovered value for investors. A fun fact: Atkins was responsible for hiring current commissioners Hester Peirce and Mark Uyeda.

After his tenure at the SEC, Atkins founded Patomak Global Partners, which I mentioned earlier, and co-chaired the Token Alliance at the Digital Chamber of Commerce. According to the Token Alliance website, “Any asset, tangible or intangible, can be tokenized (represented in token form), recorded, tracked and traded on a blockchain. This enables many transactions to be faster, cheaper, and more efficient than ever before.”

Additionally, the Token Alliance describes itself as follows:

“The Token Alliance is an industry-led initiative of the Chamber of Digital Commerce developed to be a key resource for tokenized networks and applications. Comprised of 400+ industry thought leaders, technologists, and innovators, the Token Alliance has developed a series of tools and resources for industry and policymakers to make informed decisions when engaging in the token economy.”

Long story short: Atkins understands crypto. While his resume might not be overflowing with crypto-specific roles, that’s not necessarily a requirement for the SEC Chair. What we need is someone who grasps the broader regulatory landscape and doesn’t hyper-fixate on crypto, as Gary Gensler did.

In my research, I came across an interview Atkins did on the Kibbe on Liberty show, hosted on the Free the People YouTube channel. The show’s description reads: “Honest conversations with interesting people from libertarian Matt Kibbe. He’ll never tell you what to think, he just wants you to think for yourself and rise above the noise.”

The episode premiered on February 22, 2023. Here are the key highlights:

Matt Kibbe: “You were a commissioner for the Securities and Exchange Commission, and you were like the free market guy on the commission. Is that an accurate way to—”

Paul Atkins: “I was. So, I believe in free markets, and uh, Milton Friedman is, I think, uh, was a great guy and it, you know, still misses not being here. But uh, but anyway, he obviously plowed great ground—yeah—during his time.”

Paul Atkins: “I mean, it's been a really interesting time to see the whole blockchain area kind of thrive, and obviously we've come into a rough patch here, to say the least, in the last few years.”

Matt Kibbe: “Would you call it the crypto winter?”

Paul Atkins: “Uh, yeah, and there's been one before. And then we'll have more in the future as well. But, uh, it's certainly a crypto winter, and maybe even, if you talk about FTX and whatnot, the crypto earthquake or, uh, you know, tornado as well. But still, we’re seeing with our clients, people who are, um, pushing forward with their ventures, there is still a lot of confidence in the technology, in, uh, the marketplace, and in the ability for digital assets to meet the needs of, uh, not just financial services but of other sorts of, uh, firms as well and other sorts of needs in the market. Um, it's really an exciting niche.”

Matt Kibbe: “It strikes me that the FTX scandal is not a crypto scandal at all—it's just a typical case of fraudulent behavior. Is that accurate, or does that not tell the whole story?”

Paul Atkins: “It happened to occur in the crypto space, but when you peel back the various layers, it's the same thing that's happened elsewhere—somebody without proper controls, without proper internal governance of the corporation, uses other people's money to do things without any accountability. And, unfortunately, it's similar to what happened with Madoff.”

Paul Atkins: “I do think there is enough control for regulators to accommodate the particular technology we're talking about. Hester Peirce, who's a commissioner at the Securities and Exchange Commission now, has come up with some proposals for a Safe Harbor, for example, to allow new technology to develop and to make accommodations for digital assets. Mark Uyeda, another commissioner, also has made proposals. Both of them actually worked in my office back when I was a commissioner, and I think they're doing a stellar job. But unfortunately, even though they've made these proposals about how the SEC can accommodate this, it hasn’t happened yet.”

Paul Atkins: “If the government, particularly the SEC, were more accommodating and dealt straightforwardly with these various firms, I think it would be much better to have developments happen here in the United States rather than outside.”

Paul Atkins: “To have something that isn't controlled by any particular entity, isn't centralized, and operates as a trustless product—where you have different miners or validators confirming transactions and appending them to the blockchain—makes a lot of sense. Obviously, Ethereum has taken a different approach with its consensus changes, but we'll see how all of this shakes out.”

Paul Atkins: “I think there’s a lot of innovation out there, and people aren’t throwing in the towel. They’re continuing to push forward.”

Paul Atkins is pro-crypto—plain and simple. He wouldn’t have founded a firm offering services like “Strategy & Advisory, Risk Management & Compliance, Litigation Support & Enforcement” for the industry or co-chaired the Token Alliance if he weren’t. His praise for the work of Hester Peirce and Mark Uyeda, coupled with his support for those continuing to push forward despite the SEC’s current mishandling, makes his stance crystal clear. And let’s not overlook that his wife is a libertarian—so you can bet those nightly conversations at home have some influence on his decision-making.

This is a significant development for the industry. My take? Hester Peirce is likely about to gain far more freedom to act as she sees fit. From what I can gather, Atkins understands crypto, though probably not as deeply as Peirce. If he hands her the reins, nothing is off the table for crypto in the U.S.

Solana ETF? Done.

ETH staking yield? Done.

Coinbase lawsuit dropped? Done.

Restrictions on self-custody? No more.

Aggressive enforcement actions? Over.

Lack of clarity on staking and custodial services? Resolved.

Overreaching enforcement on wallet providers? A relic of the past.

Whatever has been frustrating you about the SEC—whether it’s the lack of clarity, roadblocks, or flat-out negligence—could very well be addressed in the coming months. The future looks bright. Now we just need an official statement from Trump’s team, which could be released by the time you read this, and we’ll cross our fingers that Gary hasn’t messed things up so badly that Atkins decides to say ‘no.’

Below is the commentary from CoinDesk regarding the hesitation:

Fingers crossed we get Paul Atkins—if we do, it’s clear that crypto assets have yet to fully price this in.

Bitcoin Thoughts And Analysis

This is not rocket science. Bitcoin stopped rising just under $100K and is now consolidating. The longer it stays in this area, the better altcoins will perform and the larger the future breakout.

The market is doing exactly what it always does in the cycle.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

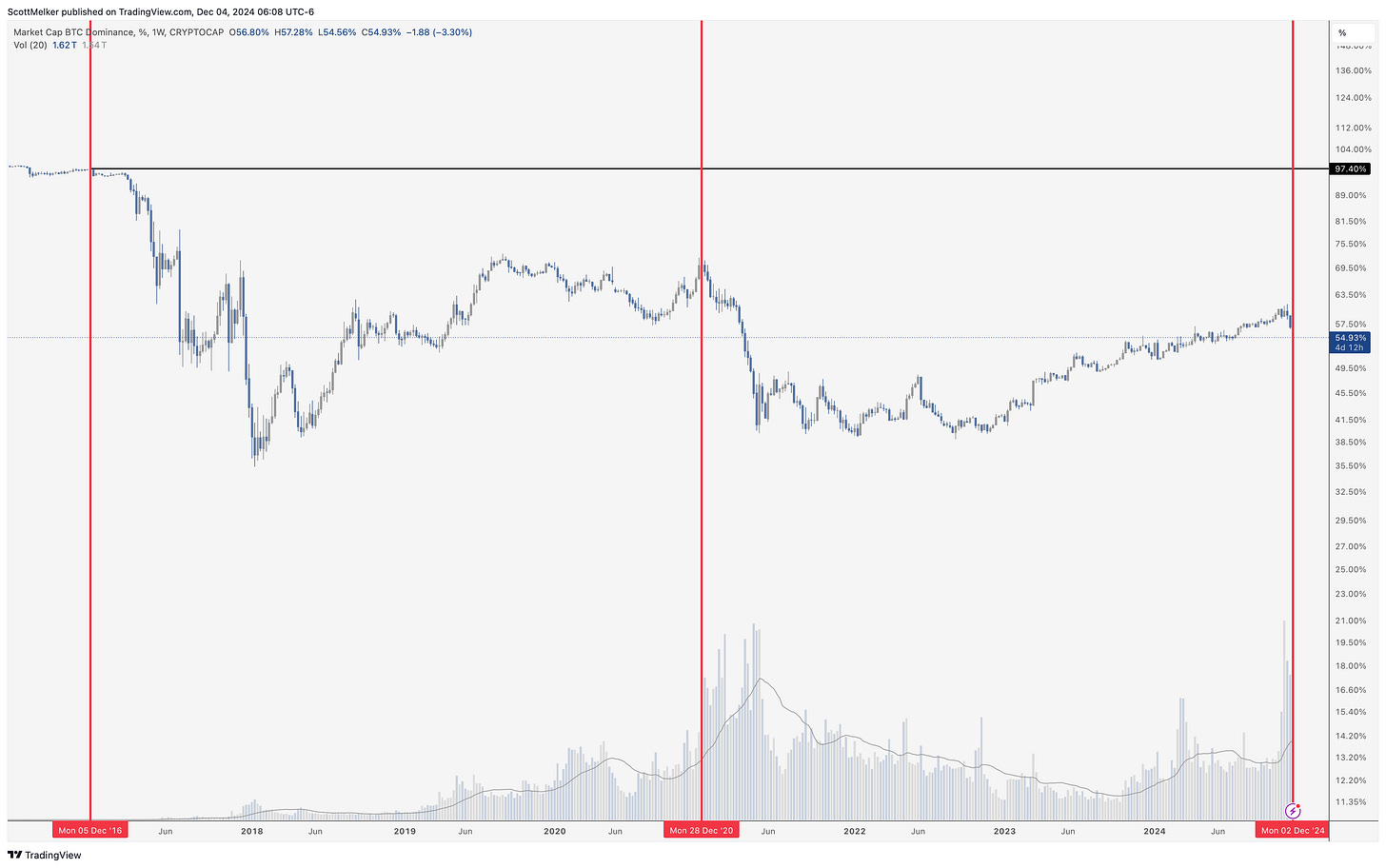

Dominance is falling off of a cliff, as expected. The 4-year cycle remains almost perfectly intact, which is quite astounding. Bitcoin makes a move 6-8 months after the halving, consolidates, and altcoins go crazy. As you can see, we are back in December… 2016, 2020 and now 2024. In these years (so far) Bitcoin Dominance has topped and fallen… hard. It seems to be happening again, with Dominance at below 55% after topping at almost 62% just a week and a half ago.

Have fun trading altcoins while it lasts!

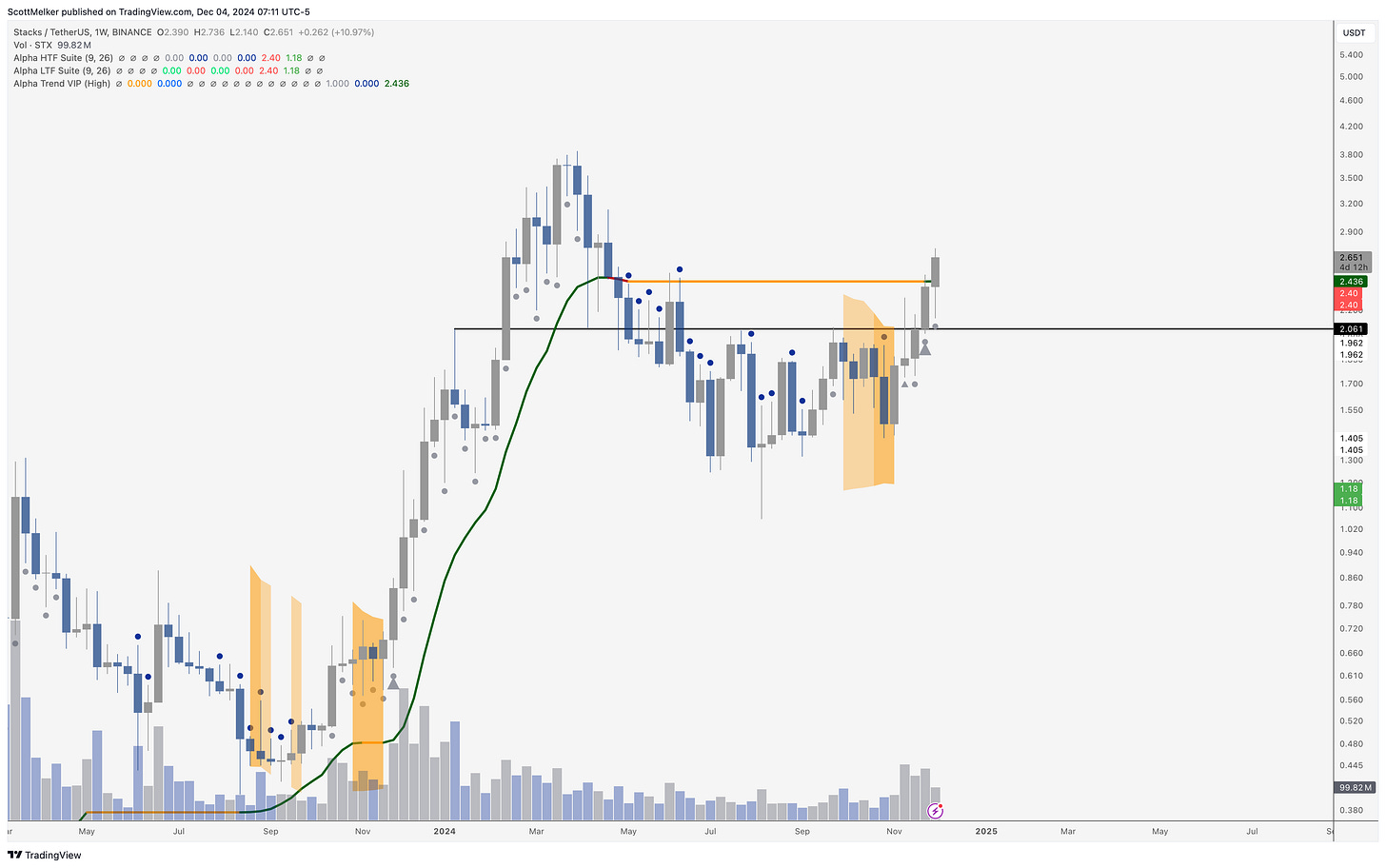

I shared this one before on X, and wanted to follow up. As you can see, price broke resistance at $2.06 and has retested it as support. This should easily target the recent $3.85 highs from March, assuming alts continue to boom.

Trading Alpha is showing a big grey arrow, a break above the trackline and grey dots here on the weekly. A lot to love.

Legacy Markets

Tech stocks led a rise in U.S. equity futures, with Nasdaq 100 contracts climbing 0.6% on positive earnings, and S&P 500 contracts also edging higher following the index's 55th record high this year. The dollar strengthened alongside 10-year Treasury yields. Investors are focused on Federal Reserve Chair Jerome Powell's upcoming remarks for guidance on interest rates, as well as key U.S. economic data ahead of Friday’s labor market report. Fed official Mary Daly noted a December rate cut isn’t guaranteed but remains a possibility.

French markets were steady ahead of a no-confidence vote threatening the government, with the CAC 40 slightly outperforming the Stoxx 600. Meanwhile, South Korea’s won rebounded after President Yoon Suk Yeol reversed his surprise declaration of martial law, though political uncertainty lingers with impeachment threats from the opposition. The Bank of Korea pledged measures to maintain market stability.

Strategists at Barclays see continued strength in U.S. equities into 2025, citing economic resilience and market "exceptionalism." Oil steadied after recent gains, while gold remained stable following a haven-driven rise amid political turmoil in South Korea and France.

Key events this week:

S&P Global Eurozone Services PMI, PPI, Wednesday

US factory orders, US durable goods, Wednesday

Fed’s Jerome Powell and Alberto Musalem speak, Wednesday

Fed’s Beige Book, Wednesday

Eurozone retail sales, Thursday

US initial jobless claims, Thursday

Eurozone GDP, Friday

US jobs report, consumer sentiment, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.3% as of 6:26 a.m. New York time

Nasdaq 100 futures rose 0.6%

Futures on the Dow Jones Industrial Average rose 0.4%

The Stoxx Europe 600 rose 0.2%

The MSCI World Index fell 0.1%

Currencies

The Bloomberg Dollar Spot Index rose 0.1%

The euro was little changed at $1.0502

The British pound was little changed at $1.2669

The Japanese yen fell 0.9% to 150.99 per dollar

Cryptocurrencies

Bitcoin rose 0.4% to $96,436.92

Ether rose 3.3% to $3,735.05

Bonds

The yield on 10-year Treasuries advanced three basis points to 4.25%

Germany’s 10-year yield advanced three basis points to 2.09%

Britain’s 10-year yield advanced three basis points to 4.27%

Commodities

West Texas Intermediate crude rose 0.3% to $70.14 a barrel

Spot gold was little changed

VPNs Don’t Work Well With Coinbase

Coinbase is under fire on social media after EthHub co-founder Eric Conner revealed that his account was locked when he tried to send $25,000 in USDC while using a VPN. The incident triggered a wave of similar complaints from other users, amplifying concerns over Coinbase’s practices. Kraken’s Chief Security Officer weighed in with sharp criticism, stating, “You are making some of your users choose between financial freedom and physical safety.”

The timing of this controversy couldn’t be worse, as it overlaps with broader debates about debanking and financial access. While some have defended Coinbase’s actions as necessary to protect users from hackers, Coinbase product designer Scott Shapiro offered an explanation: “Attackers always use VPNs, so our risk models take that as a negative sign even if you’re legitimately using your own account.” Coinbase CEO Brian Armstrong has also shared his perspective on the issue.

Martial Law In South Korea Triggers A Flash Crash

South Korean President Yoon Suk Yeol’s declaration of emergency martial law sent shockwaves through the crypto market, causing Bitcoin to plummet by as much as 33% in Korean won terms on Upbit before partially recovering. The announcement, reportedly in response to threats from North Korea, anti-state activities, and impeachment attempts by the Democratic Party, also led to sharp declines in Ethereum and Ripple, which dropped 35% and 51%, respectively.

Major domestic exchanges, including Upbit and Bithumb, faced temporary outages as the market reacted to the news. Since then, Bitcoin has recovered to approximately $88,600 on Upbit at the time of writing.

Marathon Is Ramping Up Its Bitcoin Strategy

Marathon, the largest Bitcoin miner by market cap at $8.11 billion—nearly double Core Scientific’s $4.65 billion (the second-largest miner)—has significantly ramped up its Bitcoin acquisition strategy, mirroring MicroStrategy. Over the past two months, Marathon has spent $600 million on Bitcoin purchases. Despite this aggressive accumulation, the company still holds only about one-tenth of MicroStrategy’s Bitcoin stash but ranks as the second-largest corporate Bitcoin holder.

On December 2nd, Marathon announced:

“MARA Holdings today announced that it intends to offer, subject to market conditions and other factors, $700 million aggregate principal amount of 0.00% convertible senior notes due 2031 (the ‘notes’) in a private offering. Proceeds to be used primarily to acquire Bitcoin and repurchase existing convertible notes due 2026.”

Grayscale Files For A Solana ETF

Grayscale has joined Bitwise, VanEck, 21Shares, and Canary Capital in seeking approval for a Solana ETF. The approval timeline will depend on the new SEC chair's approach to crypto and the resolution of existing lawsuits that classify Solana as a security, which may be impeding progress. Notably, Grayscale's Solana Trust (GSOL) manages approximately $134.2 million in assets under management (AUM). While this modest AUM could mitigate the risk of a large sell-off, it might also pose challenges in attracting significant interest from Wall Street. The outcome remains to be seen.

Bitcoin Gets A Massive Boost: Here Is What To Expect From Crypto In 2025

My friends from Arch Public, Andrew Parish, and Tillman Holloway, are joining in the second part of the stream to provide an update on the $10K algorithmic portfolio.

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.