Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Arch Public focuses on two guiding principles: liquidity and performance. Our customers have access to their funds 24/7. Our hands-free algorithmic portfolios produce alternative asset level returns (138% and 171% respectively). Take a look below and put a hedge fund in your pocket.

Try Arch Public now! You can even demo the platform, for free, to learn more.

In This Issue:

Consensus Mechanisms

Bitcoin Thoughts And Analysis

Legacy Markets

I Have A Prediction

WisdomTree Files For An XRP ETF

Using Polymarket For Predicting Price

What If MicroStrategy Acquired 1 Million BTC?

Rumble Buys Bitcoin

Bitcoin To $140K? MicroStrategy's Bold Play & Crypto-Friendly Treasury Chief! | Macro Monday

Consensus Mechanisms

Casual crypto investors often justify their purchases with simple reasoning, such as: “Bitcoin is the most reliable cryptocurrency,” “Ethereum drives innovation,” or “I need Solana for buying memes.”

While having a reason is better than no reason, these investors often miss the bigger picture. They struggle to respond meaningfully to news and lack the knowledge to engage in even basic discussions about the technology behind their choices.

Today, I want to help readers move beyond the “casual phase” of crypto knowledge. We’re diving into what might seem like one of the most boring topics—consensus mechanisms—but I promise to make it interesting.

In one sentence, a consensus mechanism is the process a blockchain uses to verify transactions, secure the network, and maintain its integrity. It’s the foundation that ensures the transactions you send, the buy orders you place, and the trades you execute go through without failure.

Blah, blah—who cares about the inner workings of a blockchain, right? You’re just here for the next 100x memecoin. But here’s the thing: understanding how a blockchain works can help you spot the next big opportunity before everyone else.

Success in this space often depends on identifying projects with solid foundations that can go the distance. While hunting for that moonshot, knowing how consensus mechanisms work could give you the edge to make smarter decisions.

Let’s start with Bitcoin—the gold standard of cryptocurrencies. Even if you have no plans to buy Bitcoin, it’s crucial to measure every coin you’re considering against it. Whether it’s the technology or fundamentals, Bitcoin serves as the baseline. Using Bitcoin as a comparison point provides a clearer framework for evaluating the strengths and weaknesses of other projects.

Bitcoin uses Proof-of-Work (PoW) as its consensus mechanism, relying on miners to validate transactions and secure the network. Miners compete to solve complex mathematical puzzles, and the first to solve one earns the right to add a new block of transactions to the blockchain, receiving Bitcoin as a reward. This process demands significant computational power, making the network highly secure and resistant to attacks. PoW ensures decentralization by allowing anyone with the necessary hardware to participate, though it’s often criticized for its high energy consumption.

Proof-of-Work (PoW) mining facilities can be massive and are designed differently based on factors such as location, temperature, and access to energy. In colder climates, miners often use natural cooling to save on costs, while in hotter regions, advanced cooling systems or immersion cooling are necessary to prevent overheating. Facility design also depends on the source of power, with some built near hydroelectric plants or renewable energy sources to take advantage of cheaper, sustainable electricity.

I included the picture of the shipping crates above because many modern Bitcoin miners operate in what are essentially massive transport crates or shipping container-style units, commonly referred to as “modular mining units.” These units house racks of mining hardware (ASICs), along with cooling systems, power distribution setups, and networking equipment.

Now, let’s get a bit more specific. A Bitcoin miner solves for a cryptographic hash—a string of numbers and letters—that begins with a specific number of leading zeros. This is achieved by repeatedly hashing a block's data combined with a random number (nonce) until the output meets the network's difficulty target. If you forget this, no big deal. If you remember it, congratulations—you’re already ahead of the average investor when it comes to understanding mining.

Let’s shift to Proof-of-Stake (PoS), the consensus mechanism powering Ethereum, Solana, Cardano, Polkadot, Avalanche, and the vast majority of cryptocurrencies on the market today. If a coin doesn’t use PoS directly, it likely relies on a PoS-based blockchain like Ethereum for its infrastructure. This dominance makes PoS the backbone of most modern crypto ecosystems.

That said, there are exceptions. For example, XRP operates on its own unique consensus protocol, which is neither PoS nor PoW. Meanwhile, Dogecoin and Litecoin still use PoW, making them increasingly rare outliers in the space. Today, it’s uncommon to find a coin that doesn’t rely on either PoS or PoW in some form.

Unlike PoW, PoS doesn’t require physical infrastructure. PoW relies on energy-intensive mining rigs housed in massive facilities with expensive cooling systems. In contrast, PoS validators only need a reliable computer, stable internet connection, and the required cryptocurrency stake to participate. This allows PoS validators to operate virtually anywhere in the world, eliminating the need for industrial-scale setups.

PoS is also significantly more energy-efficient, avoiding the high physical and environmental costs associated with PoW mining. While validators may cluster in areas with reliable internet and favorable regulations, the overall physical footprint of PoS systems is minimal compared to PoW.

One immediate benefit of understanding PoS is staking. Popular exchanges have simplified the staking process, allowing investors to earn rewards by holding and delegating their assets. Yields can range from a few percentage points to double digits, depending on the specific cryptocurrency and market conditions.

However, staking comes with additional risks. The rewards, or APYs, are offered as an incentive, but higher APYs often correlate with a higher percentage of a coin’s supply being locked up, leading to increased emissions. In bear markets, this dynamic can create problems, as inflation from staking rewards isn’t balanced by sufficient demand, potentially putting additional downward pressure on prices.

If you’re bored, hang in there—you’re almost done. The final topic I want to discuss is the Blockchain Trilemma—the challenge of balancing decentralization, scalability, and security. Both PoW and PoS address these factors differently.

PoW (e.g., Bitcoin) prioritizes security and decentralization but struggles with scalability due to high energy costs and slower transaction speeds. During periods of high demand, this often leads to network congestion, limiting its scalability.

PoS focuses on scalability by enabling faster transaction speeds and lower energy consumption. However, it can face challenges with decentralization, as large holders with significant staked assets have more influence on the network’s validation process.

Ultimately, PoS tries to balance scalability and security, but true decentralization remains a challenge. The Blockchain Trilemma underscores the trade-offs in blockchain design and fuels ongoing debates between PoW and PoS.

My advice: Understand what your preferred investment optimizes for and where it struggles. Align your priorities with the assets you choose and research how each asset is addressing its weaknesses.

I know today’s topic wasn’t flashy, but it’s essential for making long-term decisions in crypto. There’s no point in opting out of a fiat standard for something worse. DYOR, and ensure that even in a bull market, you’re buying assets that are technologically sound. This will protect you from the inevitable downsides of the bear market.

Bitcoin Thoughts And Analysis

No surprises for those following closely. There's clear overbought bearish divergence with RSI across nearly every timeframe, so a correction was inevitable. I'll be watching for hidden bullish divergence, which occurs when price forms a higher low while RSI creates a lower low. This could happen anytime—all it takes is a green day to give RSI an upward "elbow."

For now, there’s no signal yet that the correction has ended.

Legacy Markets

U.S. equity futures and Treasuries stabilized after a volatile session spurred by President-elect Donald Trump’s announcement of new tariffs. Trump proposed an additional 10% tariff on Chinese imports and a 25% levy on goods from Mexico and Canada, citing concerns over border security and illegal drug flows. While the S&P 500 and Nasdaq 100 futures recovered earlier losses, global markets, including European and Asian stocks, fell amidst fears of economic fallout for U.S. exporters. The Mexican peso and Canadian dollar weakened in response. Traders are also closely monitoring FOMC minutes for insights on inflation expectations and Federal Reserve policy, though the minutes are unlikely to address the impact of the election. Meanwhile, market sentiment was further shaped by Trump’s nomination of hedge fund manager Scott Bessent as Treasury Secretary, who has expressed support for tariffs. In individual stocks, Eli Lilly gained on news of potential Medicare coverage for weight-loss drugs, while Leslie’s and Zoom fell on disappointing earnings reports.

Key events this week:

Fed minutes, US new home sales, consumer confidence, Tuesday

US PCE, initial jobless claims, GDP, Wednesday

Eurozone consumer confidence, Thursday

US Thanksgiving holiday. Markets closed, Thursday

Eurozone CPI, Friday

ECB releases consumer expectations survey for October, Friday

“Black Friday,” the traditional start of the US holiday shopping rush

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.2% as of 7:16 a.m. New York time

Nasdaq 100 futures rose 0.3%

Futures on the Dow Jones Industrial Average were little changed

The Stoxx Europe 600 fell 0.2%

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro rose 0.3% to $1.0529

The British pound rose 0.2% to $1.2593

The Japanese yen rose 0.7% to 153.21 per dollar

Cryptocurrencies

Bitcoin fell 1.2% to $92,549.29

Ether fell 3% to $3,334.43

Bonds

The yield on 10-year Treasuries was little changed at 4.28%

Germany’s 10-year yield declined one basis point to 2.20%

Britain’s 10-year yield advanced one basis point to 4.36%

Commodities

West Texas Intermediate crude rose 1% to $69.62 a barrel

Spot gold rose 0.4% to $2,634.42 an ounce

I Have A Prediction

With only a few days left in November—historically Bitcoin’s best month based on average returns—a 36.83% gain is looking very solid, especially considering the average is skewed by volatile early years like 2013’s massive +449%. That said, here’s the point of this segment: I believe Bitcoin is poised to break $100,000 in December.

Over the past nine years, December’s price action has consistently followed November’s trend. Eyeballing the chart, the percentage gains tend to align closely. It’s just a gut feeling, but I believe $120,000 is even possible for Bitcoin in December before a pullback in January. If you look at 2016 and 2020, the two most comparable years in the four year cycle, December was huge.

WisdomTree Files For An XRP ETF

WisdomTree has filed for an XRP Exchange-Traded Fund (ETF) in Delaware, becoming the fourth asset manager to do so, following Bitwise, Canary Capital, and 21Shares. With an imminent change in SEC leadership, there's speculation that these filings may receive approval.

Currently, the altcoins in the ETF race include Solana (SOL), XRP, Litecoin (LTC), and Hedera Hashgraph (HBAR). It's uncertain how Wall Street will respond to these offerings. There may be limited interest in XRP, LTC, and HBAR, with potentially more attention given to SOL. However, this is speculative, and actual outcomes may vary.

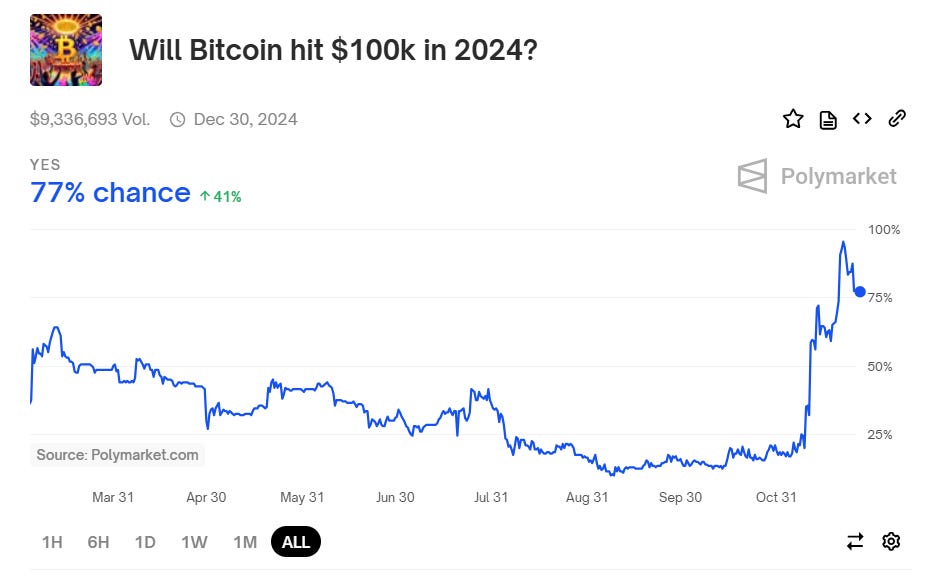

Using Polymarket For Predicting Price

With the presidential election no longer open for betting, Polymarket users are shifting their attention to other markets, such as the question, “Will Bitcoin hit $100K in 2024?” Based on the charts, the market seems to expect a run past $100,000 for Bitcoin in December. What I’m most excited about is a Bitcoin price prediction market for 2025, where we can see the wisdom of the crowd on where the next top might lie.

What If MicroStrategy Acquired 1 Million BTC?

MicroStrategy, under Michael Saylor's leadership, has significantly increased its Bitcoin holdings, now owning approximately 386,700 BTC. This represents about 38.67% of a potential goal of 1 million BTC. Saylor has expressed ambitions for MicroStrategy to evolve into a leading Bitcoin bank, aiming for a trillion-dollar valuation. Achieving 1 million BTC would require substantial capital, especially as Bitcoin's price rises. However, through strategic leveraging and consistent accumulation, this target could be attainable over time.

In other news…

Rumble Buys Bitcoin

Slowly, then all at once—that’s the motto. Rumble, a popular streaming platform for content creators with a market cap of $2 billion, has officially announced the establishment of a Bitcoin strategic reserve. The company plans to purchase $20 million worth of Bitcoin using its excess cash reserves.

According to Rumble’s CEO, “We believe that the world is still in the early stages of the adoption of Bitcoin, which has recently accelerated with the election of a crypto-friendly U.S. presidential administration and increased institutional adoption.”

Bitcoin To $140K? MicroStrategy's Bold Play & Crypto-Friendly Treasury Chief! | Macro Monday

Noelle Acheson is hosting Macro Monday! Join Dave Weisberger, Mike McGlone, and today’s special guest - Larry Lepard, as we break down what's happening in macro and crypto!

Subscribe to Noelle's Crypto Is Macro newsletter now: https://www.cryptoismacro.com/

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '30OFF' for a 30% Black Friday discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.

Thought the topic was great today, certainly not boring. Important stuff