Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Trading Alpha Has A Black Friday Sale!

Trading Alpha, my go-to indicator site and trading community is having a massive Black Friday sale! 30% off both the Alpha Bundle and the Alpha Screener! If you have been thinking about gaining access to the proprietary Indicator Search Engine for All Markets, now is the time. This custom Indicator Screener scans crypto, stocks, and forex markets for Trading Alpha indicator setups, eliminating the need for time-consuming manual analysis.

Use code '30OFF' entered during checkout on left hand side for a 30% discount!

In This Issue:

Welcome Back, China

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

#FIREGARYGENSLER Worked

Trump's Is Assembling A Powerful Team

The Solana ETF Is Making Progress

Charles Schwab CEO “Feels Silly”

URGENT: Bitcoin About To Hit $100,000 | But Get Ready For A Pullback

Welcome Back, China

欢迎回到中国

Welcome back, China—we missed you!

In case you haven’t been keeping up, here’s what went down yesterday...

This, my friends, is a big deal. But to truly appreciate the significance of this news, we need to understand this first...

In May 2021, China dropped the hammer on the entire crypto market, right in the middle of a bull run. The government banned financial institutions and payment companies from offering services related to cryptocurrency transactions. This effectively outlawed activities like trading, registration, clearing, and settlement of cryptocurrencies within the country. And just like that, the infamous 'China Crackdown' was born.

Those two massive red candles I circled? Yeah, that was China’s doing. And those big red candles in September of the same year, just as Bitcoin was trying to recover? Also courtesy of China, doubling down with a stricter blanket ban on all transactions and mining.

I truly believe that if China hadn’t rained—honestly, *“shit”* might be the better word—on our parade mid-bull run, that six-month trough could’ve inverted, and we might have seen Bitcoin top out around $100,000, maybe even more. Who knows? It’s all speculation now, but the past is the past.

To grasp how severe these bans were, let’s talk numbers. Before China went dark with its mining operations, it was responsible for an estimated 65–75% of the global Bitcoin hash rate. When the crackdown hit, the network took a major blow. Between May and July 2021, Bitcoin’s hash rate nosedived from about 180 million TH/s to 87.6 million TH/s—a jaw-dropping 51.3% drop in just two months.

A good chunk of those miners never came back online, and many rigs were likely scrapped for parts. But the hash rate resurgence in the months that followed was nothing short of inspiring. New mining hubs popped up in Kazakhstan, the U.S., and Canada, spreading out the previously centralized mining operations in China. Looking back, China’s ban was almost a blessing in disguise. It addressed the longstanding issue of mining centralization and forced the network to decentralize further. Plus, I genuinely think the muted nature of the last cycle might pave the way for something much bigger this time. Time will tell, but I’m optimistic.

Before we dive into today’s news, let’s zoom out for one last point. China got into crypto early, leveraging its access to cheap electricity, particularly hydroelectric power. This gave them a massive edge in Bitcoin mining, and by 2017, they controlled a staggering 70% of the global hash rate. This mining dominance naturally opened the door to DeFi experimentation, with Chinese investors going full degen on ICOs and fueling the boom with huge investments in projects like Filecoin, Tezos, VeChain, and QTUM. Of course, it all came crashing down later in 2017 with more regulatory crackdowns.

The point is, no matter the bans, regulations, or crackdowns, crypto always finds a way back. And when it comes to crypto, China knows how to play ball when given the chance.

Anyone who has been around for a while knows that this cycle of bans and resurgences has become almost meme worthy… but we are now back on the better side of that cycle.

I recently came across a segment outlining some of the creative ways Chinese investors have managed to access Bitcoin despite the restrictions—it’s fascinating stuff and could easily lead you down a rabbit hole of its own.

China is primed for Bitcoin. With a population of 1.4 billion and a GDP of $17.8 trillion in 2023, it’s the second-largest economy globally. Even with a struggling economy, China remains a financial powerhouse. Its stock market capitalization stood at $10.89 trillion as of December 2023, with the Shanghai Stock Exchange accounting for $6.52 trillion of that. Historically, China has had the power to either spark a crypto bull market or crush one—and thankfully, it now seems to be on the right side of history.

Now for today’s news.

China is officially back in the crypto conversation thanks to a ruling from the Shanghai Songjiang People’s Court. Earlier this week, the court clarified that owning cryptocurrencies is not illegal in China. It recognized digital assets as having “property attributes” under Chinese law, limited to personal ownership, and banned as legal tender or investment tools. Businesses are still prohibited from engaging in crypto activities like trading or token issuance. While this ruling doesn’t drastically change the current landscape, it signals a softening rather than a neutral stance.

Isn’t it interesting that this clarity from China coincides with Bitcoin nearing $100,000 and the U.S. edging closer to establishing a strategic reserve? To me, this suggests China is positioning itself to be a key player in crypto and is closely monitoring global developments.

I’m cautiously optimistic about China’s return to the crypto space and hope game theory plays out favorably. Ideally, Chinese citizens will be able to buy Bitcoin freely without fear, setting a precedent for other nations with unclear regulations. As Chinese citizens accumulate Bitcoin, the government may be incentivized to adopt more favorable policies. This momentum could even push Trump’s team to accelerate the reserve process, potentially sparking a global race for Bitcoin accumulation.

Of course, there’s a risk China’s involvement could send mixed signals or trigger unintended reactions, but I’m hopeful Trump’s team is seeking advice from the right people to navigate this carefully.

Bitcoin is for everyone, no matter the price tag. Whether it’s $100,000, $500,000, or somewhere in between, it’s essentially a call option on a vastly improved financial future. Closing out this week with Bitcoin inches away from $100,000 feels surreal, but truly, this is just the beginning.

欢迎回到中国—Welcome back China.

Bitcoin Thoughts And Analysis

99K all day.

Is there anything else to say?

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

Altcoins continue to underperform Bitcoin writ large, and Ethereum continues to generally be beaten down.

Good.

As you can see, the demand zone below price is currently being front run, which I discussed as a likely possibility a few days ago. As Bitcoin hit $99,000, liquidity moved VERY quickly into Ethereum, which bounced hard.

RSI is oversold, with likely bullish divergence on basically every single time frame. Ethereum is EXACTLY where it should be at this point in the cycle, but general consensus it that is is “dead.” Maybe? But usually that is the best buy signal there is.

And another reminder… let’s take a quick look at Bitcoin Dominance, which usually can give us information as to when “alt season” is likely.

Do you see those huge red lines? Those are the “tops” for Bitcoin Dominance in the 4 year cycles, which came right before a MAJOR alt season.

The first red line is December, 2016. The second red line is December, 2020.

I’m not great at math, but in a few weeks it will be December 2024… I believe that is 4 years after the last dominance top… again.

Maybe alts have a bit more pain to come before dominance finally tops, Ethereum included. We will see.

Patience.

Legacy Markets

US equity futures fell on Friday as investors shifted focus to other regions offering better value after a strong rally in US stocks this month. Contracts for the S&P 500 dropped 0.3%, and Nasdaq 100 futures fell 0.4%. Nvidia shares also declined following mixed reactions to its recent outlook.

Meanwhile, Bitcoin edged closer to the $100,000 milestone, fueled by optimism over President-elect Donald Trump’s pro-crypto stance and expectations of a more favorable regulatory environment. The resignation of SEC Chair Gary Gensler, scheduled for January, is anticipated to ease enforcement actions against the industry.

Globally, European and Japanese equities gained, while Asia saw its first back-to-back monthly losses of the year, pressured by the strong US dollar and concerns over the Chinese economy. The dollar continued its upward march, on track for its eighth consecutive weekly gain, buoyed by safe-haven flows amid geopolitical tensions.

In Europe, weak economic data raised expectations of rate cuts from the European Central Bank, while sovereign bonds rallied. Bank of America strategists cautioned that the Nasdaq 100 is nearing levels that could trigger profit-taking relative to the S&P 500.

Bitcoin’s record-breaking performance and shifts in global equity markets set the stage for an exciting close to the week.

Key events this week:

US University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures fell 0.3% as of 6:39 a.m. New York time

Nasdaq 100 futures fell 0.4%

Futures on the Dow Jones Industrial Average fell 0.2%

The Stoxx Europe 600 rose 0.3%

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index rose 0.3%

The euro fell 0.5% to $1.0420

The British pound fell 0.6% to $1.2516

The Japanese yen rose 0.1% to 154.36 per dollar

Cryptocurrencies

Bitcoin rose 0.8% to $98,903.43

Ether fell 0.2% to $3,340.62

Bonds

The yield on 10-year Treasuries declined three basis points to 4.39%

Germany’s 10-year yield declined seven basis points to 2.25%

Britain’s 10-year yield declined six basis points to 4.39%

Commodities

West Texas Intermediate crude was little changed

Spot gold rose 1.1% to $2,698.33 an ounce

#FIREGARYGENSLER Worked

I don’t think many people actually read the rest of Gary Gensler’s post. Here’s the deal: in less than two months, Gary is out, and someone new will take the reins at the SEC. Honestly, he might go down as one of the most disliked and ineffective SEC chairs in history.

The bull market is far from over, and I’m expecting some major changes once Gary’s out the door. If you’ve been holding off on popping champagne for this milestone—go for it. Now’s as good a time as any to celebrate.

Trump's Is Assembling A Powerful Team

I have to say, I’m genuinely impressed with how well Trump has been handling things so far. Winning the presidency was a major victory for the crypto space, but it could have easily derailed if he had tried to control the industry himself without fully understanding it—or if he’d been guided by the wrong people. Thankfully, neither of those things has happened. Instead, he’s reaching out to the right experts for advice.

I still remember walking away from Trump’s speech at the Bitcoin conference thinking, “he doesn’t quite get it.” But here’s the thing: he doesn’t need to. All he has to do is put the right people in charge. Honestly, I’m not sure if he fully understands crypto any better now than he did back then, but what matters is that he’s surrounding himself with qualified individuals. That gives me real hope for what can be accomplished. Trump doesn’t need to be the expert; he just needs to delegate power effectively.

Speaking of the crypto council, David Bailey (CEO of Bitcoin Magazine) recently said, “It’s being fleshed out, but I anticipate the leading executives from America’s bitcoin and crypto firms to be represented.” Apparently, candidates are currently being vetted for the role of “tsar” to lead the council. There are so many great names being mentioned that I won’t even bother being picky.

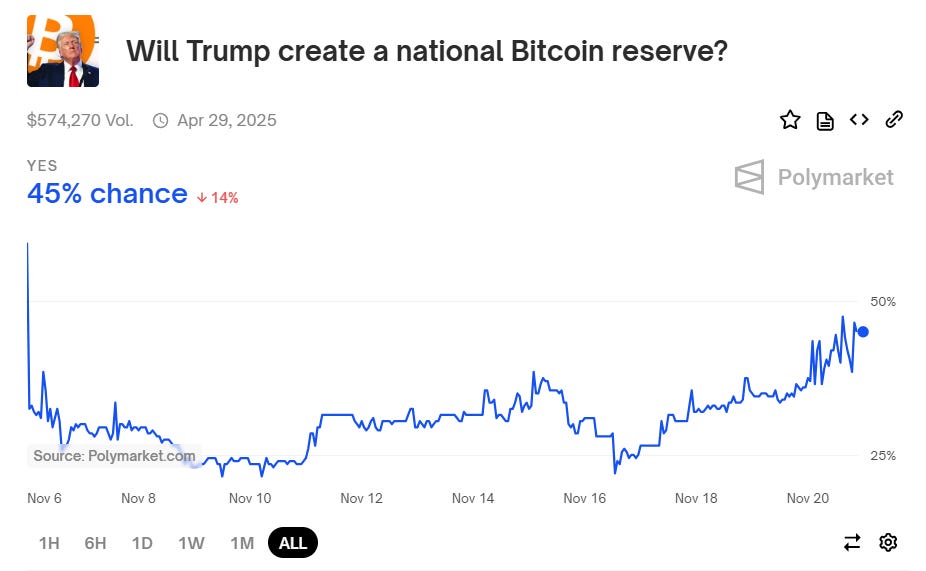

The council itself is expected to operate under the White House’s National Economic Council or a similar executive branch group. Its responsibilities will likely include advising on digital asset policies, collaborating with Congress on crypto legislation, helping establish Trump’s proposed Bitcoin reserve, and coordinating efforts among key agencies like the SEC, CFTC, and Treasury. It may also involve enforcement representatives and former policymakers to ensure a well-rounded and comprehensive approach.

This feels like a promising step forward for the crypto industry. If the right people are put in the right places, the potential for real progress is massive.

Leaving this here without comment.

The Solana ETF Is Making Progress

In this segment, I’ll share two key pieces: first, the remainder of Eleanor’s post to provide context, and second, some insights I uncovered about the approval process that could help us estimate the timeline for Solana’s potential approval.

Quick disclaimer: I’m not a lawyer or financial advisor—always DYOR (Do Your Own Research)!

“Right now @vaneck_us, @21Shares and, @CanaryFunds have all filed S-1’s for a Solana ETF, while @BitwiseInvest announced its intent to file an S-1 yesterday. The 19b4 forms would be filed by the exchanges such as the @CBOE on behalf of issuers, asking the SEC to allow them to list the prospective ETFs. Once the SEC acknowledges receipt of the filing, a 240-day window opens for it to either approve or deny the products.

The filing of the 19b4’s does not guarantee an approval by the SEC. Indeed, previous 19b4 filings from VanEck and 21Shares were taken down from the CBOE’s website in August with some industry participants speculating the reason was that the agency under @GaryGensler was not inclined to approve such listings.

Now, issuers have indicated that recent engagement from staff, coupled with the incoming pro-crypto administration is sparking a renewed sense of optimism that a Solana ETF could be approved sometime in 2025.”

Now, let’s switch gears and break down the timeline for IBIT’s approval process. IBIT, along with several other spot Bitcoin ETFs, received approval on January 10, 2024, and started trading the very next day. To understand the timeline, I looked through the SEC’s EDGAR database and found that the first S-1 for IBIT was submitted on June 15, 2023.

Bitcoin ETFs took much longer to get approved since they were the first of their kind and required ironing out numerous regulatory details. In comparison, Ethereum’s spot ETF followed a slightly faster path—the SEC received its first S-1 on November 16, 2023, and trading began on July 23, 2024.

It’s reasonable to assume the process might continue to speed up with each subsequent asset, but there are still variables to consider—especially since we don’t yet know who the new SEC chair will be. For Solana, two key hurdles remain: the ongoing lawsuits labeling Solana a security must be resolved, and the SEC needs to officially acknowledge the filings.

If the SEC acknowledges these filings, the final resolution deadline is August 2025. However, I suspect we’ll see everything wrapped up much sooner, assuming no major roadblocks arise.

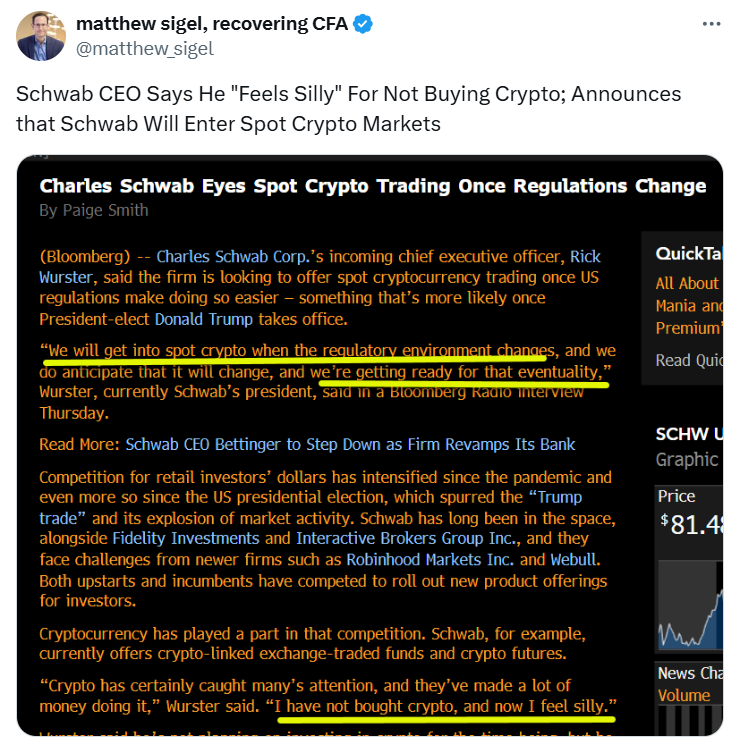

Charles Schwab CEO “Feels Silly”

The words, “I have not bought crypto, and now I feel silly,” aren’t exactly groundbreaking—they echo the sentiment of countless others who were too caught up in their own hubris to admit they’ve been on the wrong side of history. Credit where it’s due, though: Charles Schwab’s incoming CEO at least had the courage to say the embarrassing part out loud.

I won’t hold anything against anyone who took their time warming up to Bitcoin or even changed their stance on it. But if you’re still dunking on it in 2024, you’ve earned every bit of criticism that comes your way.

URGENT: Bitcoin About To Hit $100,000 | But Get Ready For A Pullback

I’m thrilled to welcome back one of my favorite guests, Noelle Acheson, author of the Crypto is Macro Now newsletter. Together, we dive into the wild developments in the crypto space and celebrate Bitcoin’s remarkable ascent to a major milestone.

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '30OFF' for a 30% Black Friday discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.