Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

“Arch Public has developed The Bitcoin Algorithm, a sophisticated tool for high net worth individuals seeking to optimize their cryptocurrency investments. As Bitcoin gains recognition in traditional finance and institutional circles, this algorithm provides an advanced, autonomous solution for managing spot Bitcoin holdings.”

I dive into more about this product in the ‘Education’ section below, and trust me, it’s a game changer. After seeing how well Arch has performed over the past few months, I couldn’t be more thrilled to see where this new launch takes them. Be sure to check it out when you can and show Arch Public some love on X, YouTube, and archpublic.com!

In This Issue:

The Underbelly of Chaos

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

The Bitcoin Algorithm!

Coinbase Now Offers USDC Yield

ETH Staking Will Happen In U.S. ETFs

MicroStrategy Is Setting Records

Bitwise Files For A Solana ETF

Bitcoin Gets A Massive Boost: Here Is Why The Bitcoin ETF Options Launch Is So Important

The Underbelly of Chaos

The crypto market is in a strange and chaotic state right now.

On one side, we have Bitcoin and MicroStrategy holders, euphoric as their dominant corner of the market continues to expand with no visible ceiling. They’re already planning their next five vacations. On the other, Solana holders—altcoin traders who have thrived on a mix of fundamentals, conviction, and luck—are basking in their success as Solana rallies on memes and Ethereum’s relative weakness.

Then there are Ethereum holders, struggling to understand why the second-largest ecosystem is underperforming. They debate their north star while clinging to promises of decentralization, utility, and Vitalik’s leadership. And finally, there’s the rest: a mixed bag of meme coins going wild, dead coins from 2017 catching surprise bids, and investors stuck in limbo, unsure of what to buy next.

It’s easy to think bull markets fix everything, but they’re just as messy as bear markets, albeit for different reasons. Today, I’m sharing scattered thoughts to lay out the chaos and help us all make sense of what’s happening.

**Winners and Losers**

There will be winners and losers across every category. Just because you’re thriving now doesn’t mean you’ll win throughout the bull market. Even Bitcoin and MicroStrategy holders—used to success—might only realize the party’s over when they’re 30% into the next bear market. Meanwhile, Bitcoiners will likely have to endure a proper alt season, watching everything they consider “trash” outperform their beloved coin.

**No Guarantees**

Nothing is guaranteed in this market. Maybe alt season doesn’t hit like it used to, and we see a Bitcoin-dominated cycle. Maybe Bitcoin tops at $100K, and max pain is realizing we were all positioned for higher targets. However, certain outcomes remain likely: Bitcoin will rise, and an alt season will come. Winning requires strategic positioning, even if value takes years—or a decade—to materialize.

If you’re new, there’s no shame in buying Bitcoin, Ethereum, and Solana, admitting you’re a beginner, and holding for five years. You’ll likely outperform many “experts” who never post their losses.

**The Tribalism Problem**

Tribalism thrives when coins don’t rise in perfect sync—and they never do. Bitcoin maxis want everything else to burn, often targeting Ethereum while propping up Solana as a tactical counterweight. If Solana overtakes Ethereum, it will become the next target, proving no chain is safe from scrutiny. Meanwhile, Ethereum holders are defensive, watching their ecosystem shrink relative to Bitcoin and Solana, and they cling to long-term visions of decentralization and innovation.

Solana holders enjoy being the cool kids for now, but their future depends on long-term catalysts, not just memes. Wall Street’s old ways may not align with Solana’s current image as a meme launchpad. The chain has potential, but sustaining growth over a decade will require more than its current momentum.

**Everyone Else**

For those not holding major assets, the reality is harsh. Dead chains may stay dead, meme coins are unsustainable, and altcoin holders must decide whether to hold steady or jump ship. Too many meme coins dilute market interest, and a pullback in memes could actually benefit the ecosystem, allowing capital to focus on impactful innovations.

** Preparing for Chaos**

Are you ready for a Bitcoin dip of 10%, 15%, or more? Spot Bitcoin holders may weather it, but those riding high on MSTR profits or altcoin gains might struggle to stomach the fallout. If Bitcoin corrects, altcoins are likely to drop even harder, potentially wiping out gains in the short term.

Bull markets are chaotic and won’t unfold harmoniously. As we approach the peak, everything remotely related to blockchain will pump, but until then, the market will remain turbulent.

The key is having conviction, patience, and a well-thought-out strategy. Ideally, this work was done long ago, but if not, now is the time to get to work. The market will reward both bold, strategic trades and those who remain steady and convicted in their beliefs.

The bear market prepared us for this turbulence. Be grateful you’re here—or on your way up. Godspeed to all your portfolios. Wolf out.

Bitcoin Thoughts And Analysis

98K all day.

Bitcoin is 2% away from $100,000, and it is still November. People thought that 100K price targets for the end of the year were insane - but here we are. Bitcoin has added $30,000 since election night and has double off of the August lows.

Enjoy the ride.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

There is no reason to spend much time on altcoins while Bitcoin is in price discovery. When Bitcoin calms down, there should be plenty of opportunity in the altcoin space.

For now, altcoins are taking an epic beating vs. Bitcoin and are struggling to even advance on their dollar pairs.

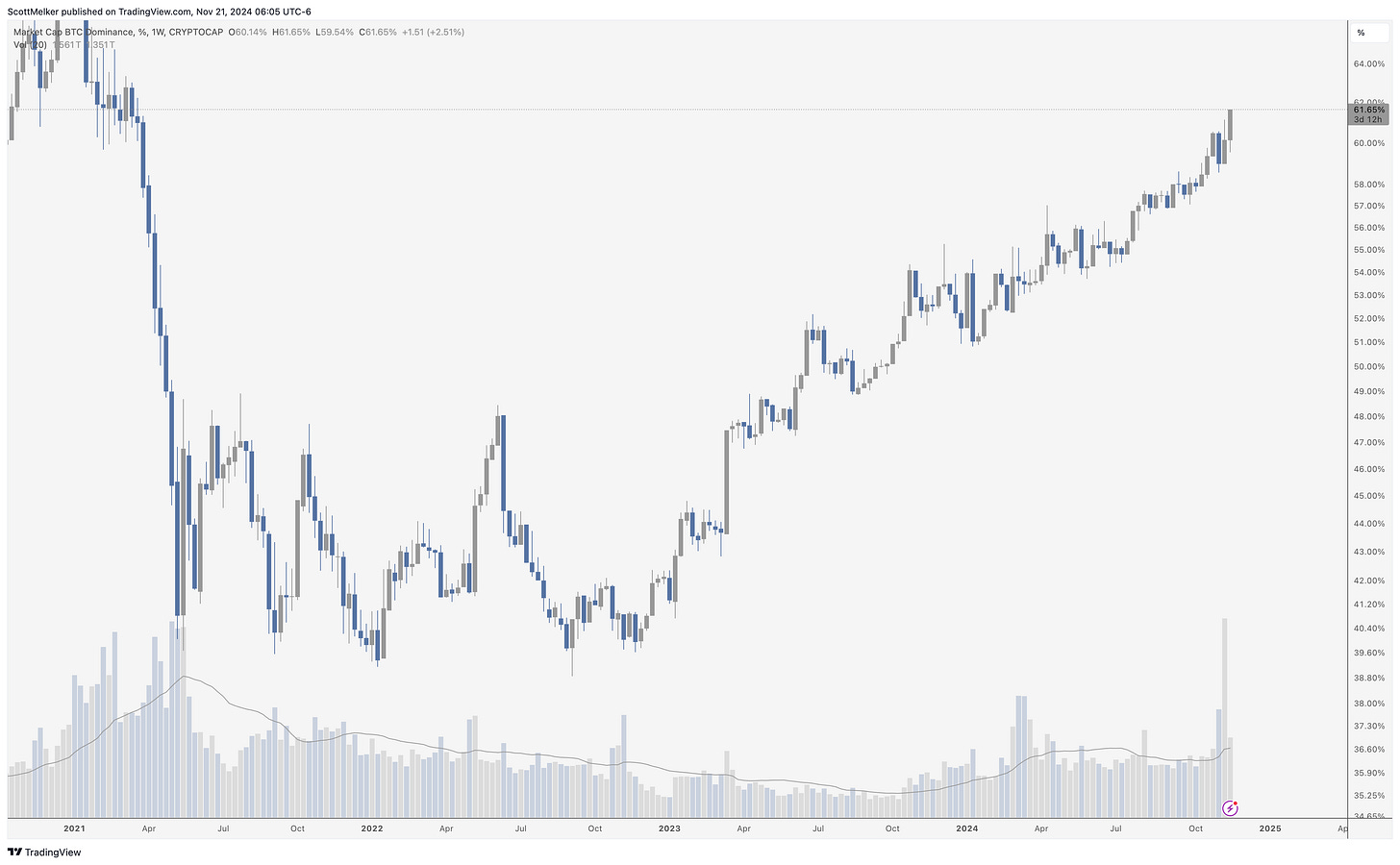

61.6% is yet another new cycle high for Bitcoin Dominance.

Legacy Markets

Key events this week:

Eurozone consumer confidence, Thursday

US existing home sales, initial jobless claims, Philadelphia Fed factory index, Thursday

Eurozone HCOB Manufacturing & Services PMI, Friday

US University of Michigan consumer sentiment, S&P Global Manufacturing & Services PMI, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures were little changed as of 6:50 a.m. New York time

Nasdaq 100 futures fell 0.1%

Futures on the Dow Jones Industrial Average rose 0.2%

The Stoxx Europe 600 was little changed

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro fell 0.2% to $1.0519

The British pound fell 0.1% to $1.2637

The Japanese yen rose 0.6% to 154.51 per dollar

Cryptocurrencies

Bitcoin rose 3.8% to $98,014.01

Ether rose 2.1% to $3,144.59

Bonds

The yield on 10-year Treasuries was little changed at 4.40%

Germany’s 10-year yield declined two basis points to 2.33%

Britain’s 10-year yield declined two basis points to 4.45%

Commodities

West Texas Intermediate crude rose 2% to $70.12 a barrel

Spot gold rose 0.8% to $2,670.73 an ounce

The Bitcoin Algorithm!

We're proud to announce the launch of The Bitcoin Algorithm, a sophisticated, easy-to-use Bitcoin acquisition algorithm designed for high-net-worth individuals and forward-thinking investors who recognize Bitcoin's growing role in the global financial system.

As nations adopt Bitcoin as legal tender and major institutions add it to their balance sheets, the need for professional-grade acquisition tools has never been greater. The Bitcoin Algorithm ensures you don't get left behind as institutional capital continues to flow into digital assets.

The Bitcoin Algorithm™️ offers both buy and sell algorithmic capabilities and multiple instances. It is a high level, hands off tool to capitalize on Bitcoin’s short and long term performance.

Coinbase Now Offers USDC Yield

Yield has permeated nearly every corner of the crypto market. If your portfolio isn’t entirely in spot positions, there’s little reason not to earn yield on your stablecoin holdings. Platforms like Coinbase now offer yield on USDC, Robinhood provides competitive rates, and staking presents an alternative for those without stablecoins.

That said, there’s no such thing as risk-free yield. Even platforms boasting FDIC insurance or reputations as "the most secure exchange in the world" carry some level of risk. It may be minimal, but it’s always present.

Before diving in, take the time to carefully weigh the risks and rewards of earning yield. A mindful approach beats mindlessly clicking “yes” every time.

ETH Staking Will Happen In U.S. ETFs

Switzerland’s 21Shares has rebranded its Ethereum Core ETP to the *Ethereum Core Staking ETP (ETHC)*, incorporating staking into the product, as the new name suggests. This is exciting because investors in ETHC are now earning a 3.2% yield—easily covering the 0.12% expense ratio.

This upgrade could also gradually increase the total supply of staked ETH as previously untapped capital begins contributing to the network. The ETP is listed on major European exchanges, including SIX Swiss Exchange, Euronext Amsterdam, and the London Stock Exchange, making it widely accessible to investors.

MicroStrategy Is Setting Records

Is it possible to look at the following chart and not fall backwards in your chair?

The fact that MSTR briefly outpaced industry giants like Nvidia, Microsoft, and Amazon while sitting at a $100 billion market cap is nothing short of extraordinary. Looking at this chart, it’s hard not to feel a sense of frothiness—but I’ll keep that thought to myself before the MSTR maxis come after me.

All jokes aside, MSTR is achieving something unprecedented, leaving the market scrambling to determine how to price it and react. While I’m not betting against the company, if you’ve made life-changing gains—or would be devastated to lose what you’ve built—it might be a good time to take a little off the table. Roll it into Bitcoin or another asset to maintain your position in the game, but above all, protect your wins.

Bitwise Files For A Solana ETF

There you have it—it was only a matter of time before Bitwise made a move on Solana. Not *that* type of move, you perv! I fully expect other major issuers to follow suit. Of course, this all depends on the appointment of a new SEC chair, but at this point, it’s almost a given that we’ll see someone who’s pro-crypto in the role.

Bitcoin Gets A Massive Boost: Here Is Why The Bitcoin ETF Options Launch Is So Important

I’m joined by James Seyffart, ETF Research Analyst at Bloomberg Intelligence, to dive into the successful launch of Bitcoin ETF options and explore why this milestone is crucial for the crypto market.

Chris Inks will join us in the second part to share some interesting trades in crypto and beyond.

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '30OFF' for a 30% Black Friday discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.